Flow Chemistry Market | Acumen Research and Consulting

Flow Chemistry Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format : ![]()

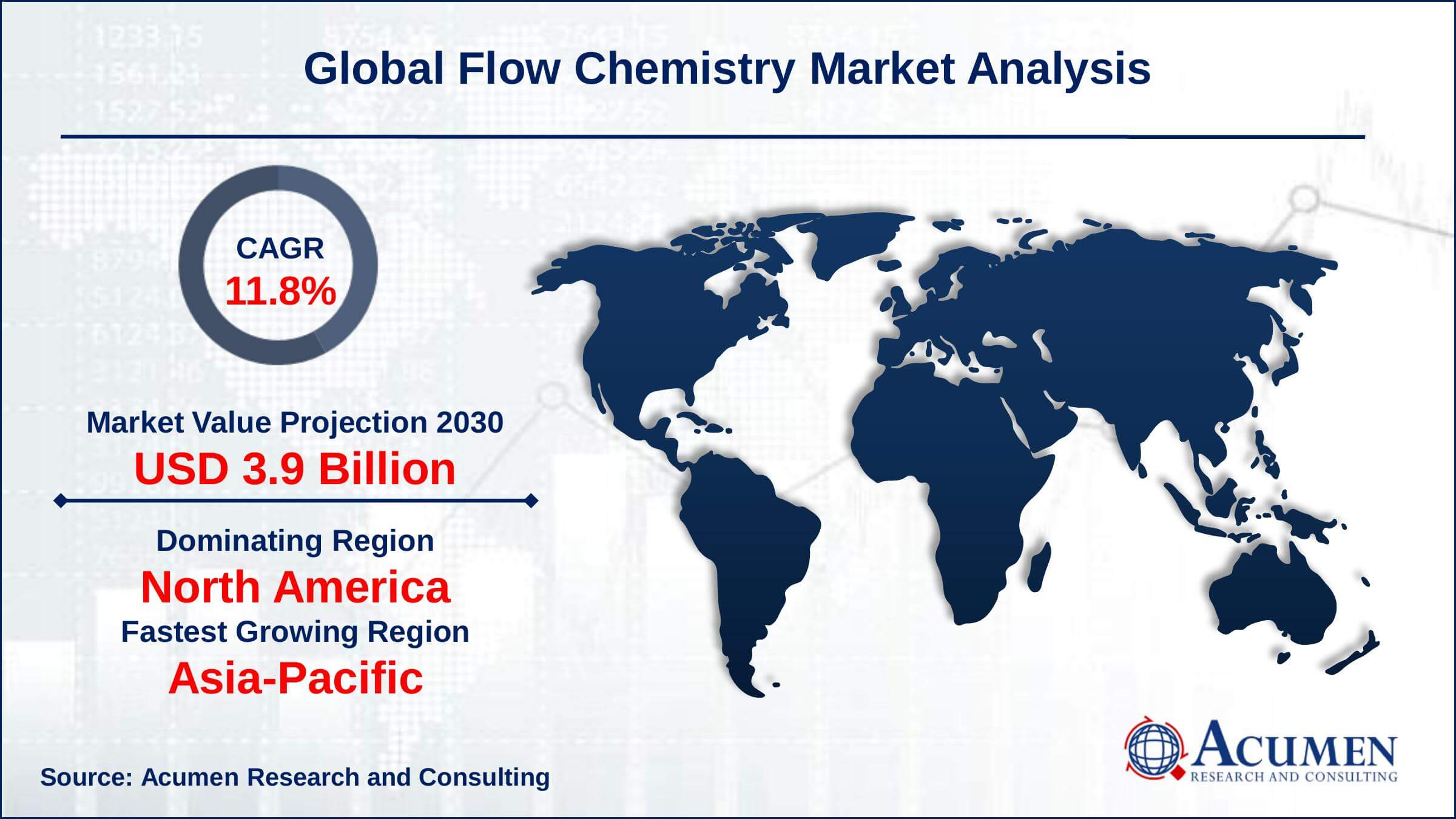

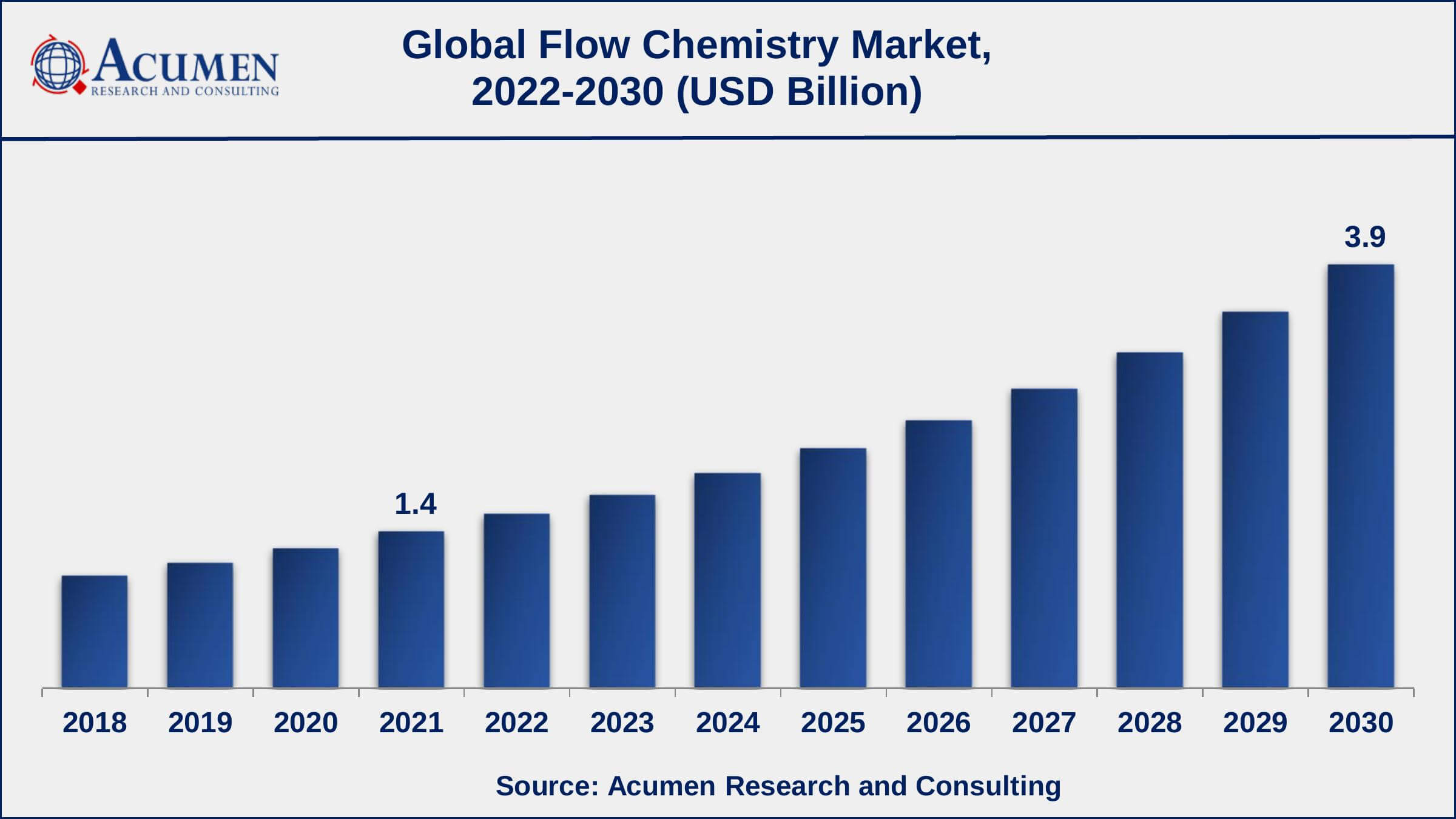

The Global Flow Chemistry Market Size accounted for USD 1.4 Billion in 2021 and is projected to occupy a market size of USD 3.9 Billion by 2030 growing at a CAGR of 11.8% from 2022 to 2030.

Flow chemistry refers to a broad range of chemical processes that take place in a continuously flowing stream, typically in a reactor zone. The major benefit of this new concept is that molecules enter, react, and leave the system, avoiding prolonged exposure to conditions that would eventually result in side reactions, by-products, or impurities formation, and so on.

Flow Chemistry Market Report Statistics

- Global flow chemistry market revenue is projected to reach USD 3.9 Billion by 2030 with a CAGR of 11.8% from 2022 to 2030

- North America flow chemistry market share generated over 36% shares in 2021

- Asia-Pacific flow chemistry market growth will record noteworthy CAGR of over 12% from 2022 to 2030

- Based on reactor type, CSTR recorded 38% of the overall market share in 2021

- Among applications, chemicals accounted for USD 547 million in 2021

- Growing adoption of environmentally-friendly chemicals is a popular flow chemistry market trend that fuels the industry demand

Global Flow Chemistry Market Dynamics

Market Drivers

- Increasing demand for petrochemicals in the world

- Rapidly growing chemical industry

- Rising trend due to sustainable characteristics

Market Restraints

- Concerns about scaling up technology for commercialization

- Issues handling highly active stable catalysts

Market Opportunities

- Increasing demand in biodiesel manufacturing

- Regulatory permissions for the development of APIs

Flow Chemistry Market Report Coverage

| Market | Flow Chemistry Market |

| Flow Chemistry Market Size 2021 | USD 1.4 Billion |

| Flow Chemistry Market Forecast 2030 | USD 3.9 Billion |

| Flow Chemistry Market CAGR During 2022 - 2030 | 11.8% |

| Flow Chemistry Market Analysis Period | 2018 - 2030 |

| Flow Chemistry Market Base Year | 2021 |

| Flow Chemistry Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Reactor Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Parr Instrument Company, Am Technology, PDC Machines Inc., CEM Corporation, Cambridge Reactor Design Ltd., Milestone Srl, Corning Incorporated, Biotage AB, Future Chemistry Holding BV, Syrris Ltd., EhrfeldMikrotechnik BTS, Vapourtec Ltd., Chemtrix BV, ThalesNano Inc., and Hel Group, Uniqsis Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Flow Chemistry Market Growth Factors

Factors, for example, equipment size, diminished waste, minimal effort, and turn-around time to market for new medications are anticipated to drive the development. Rising need in the application business by reactor producers and end clients are relied upon to drive the development. Various advantages of flow chemistry reactors over cluster reactors are foreseen to enhance development over the forecasted time period.

Flow chemistry conveys essentially high return while decreasing the energy and dissolvable waste by over 90%. This has prompted expanded acknowledgment of the innovation for various applications. Administrative bodies including the U.S. Nourishment and Drug Administration (FDA) and the European Commission bolster the utilization of flow chemistry for assembling Active Pharmaceutical Ingredients (APIs) and synthetic compounds. This innovation pursues the quality by design efforts of the U.S. FDA which is relied upon to expand its usage in these businesses.

Flow Chemistry Market Segmentation

The global flow chemistry market is segmented based on reactor type, application, and geography.

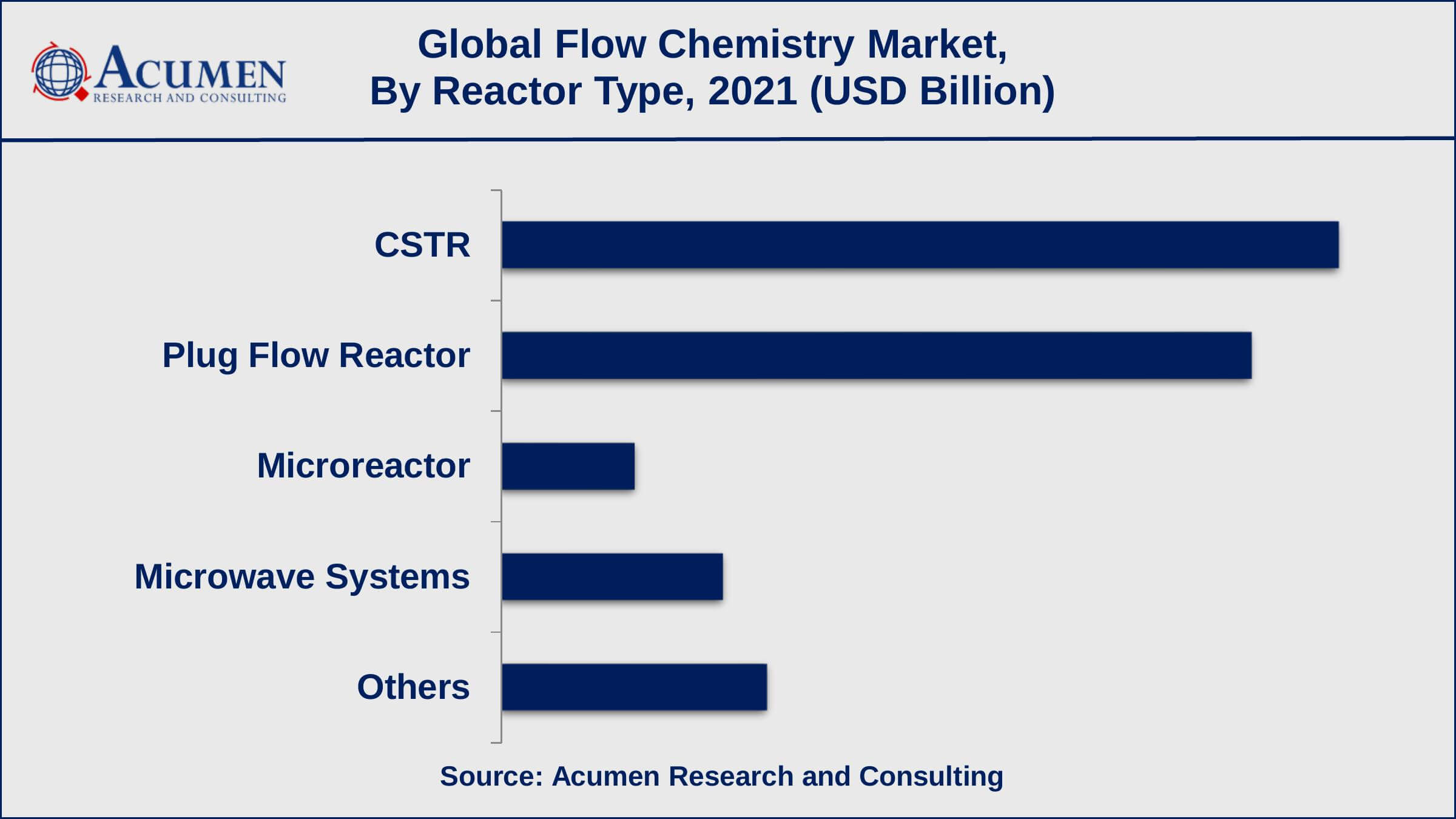

Flow Chemistry Market By Reactor Type

- CSTR

- Plug Flow Reactor

- Microreactor

- Microwave Systems

- Others

According to our flow chemistry industry analysis, the CSTR sub-segment occupied more than 38% shares in 2021 and is expected to maintain this trend throughout the projected years. Plug Flow (PF) and Continuous Stirred Tank (CST) are the most usually accepted reactors in this market. Continuous Stirred Tank reactor systems necessitate limited human intervention to function thus experiencing low labor costs related with its adoption. Moreover, both reactor technologies have a high output rate, which is resulting in low manufacturing costs.

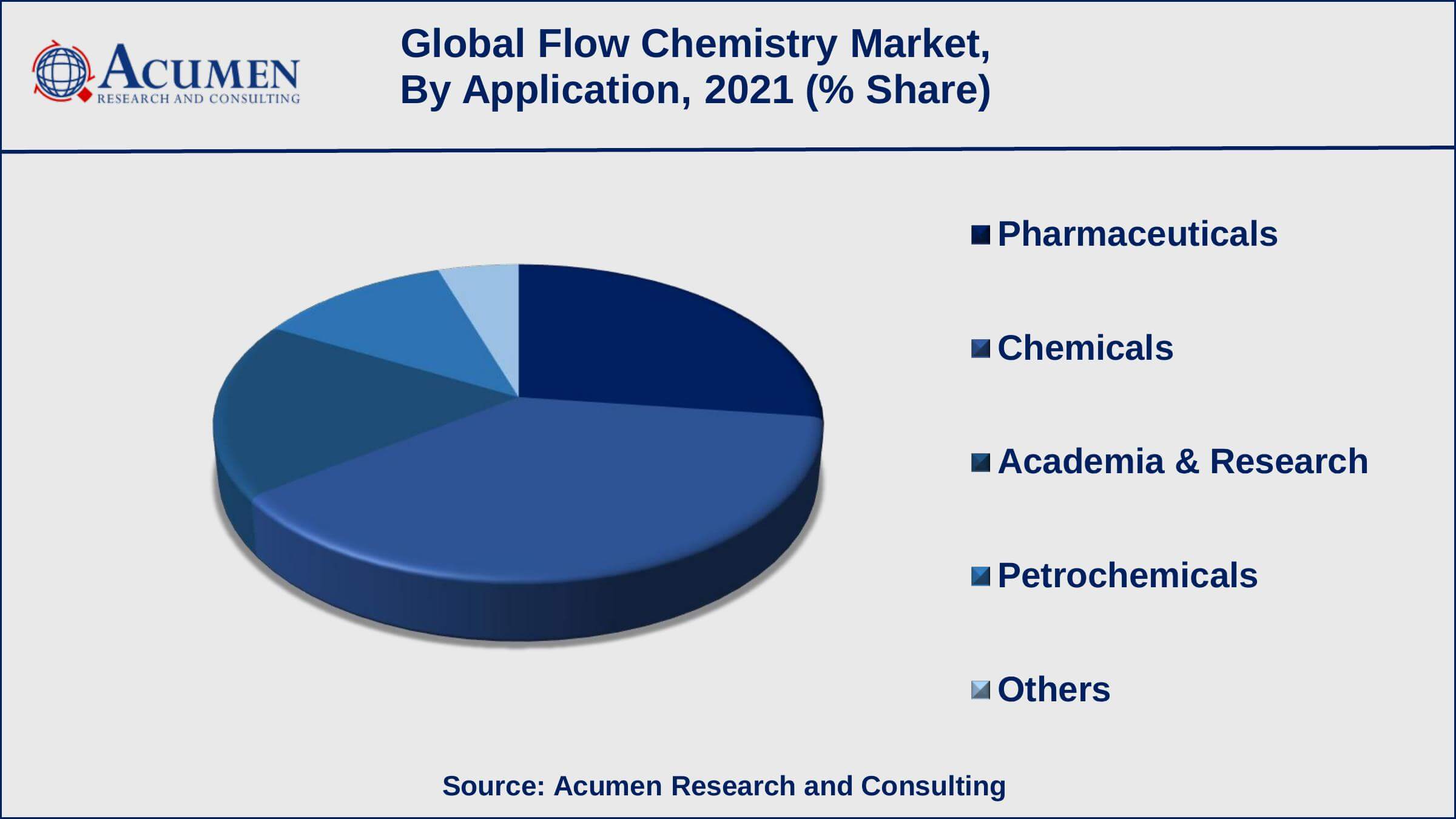

Flow Chemistry Market By Application

- Pharmaceuticals

- Chemicals

- Academia & Research

- Petrochemicals

- Others

According to our flow chemistry market forecast, chemicals application is likely to hold maximum share from 2022 to 2030. The use of flow chemistry in the pharmaceutical business is foreseen to observe the quickest development in continuous separations, conducting reactions, and continuous crystallization. In 2021, pharmaceuticals segment was esteemed at USD 388.8 million and is anticipated to contribute over USD 1.05 billion by 2030. Petrochemicals is foreseen to enlist a CAGR of 11.4% from 2022 to 2030, attributable to the expanding requirement for increasing high return with low energy and material utilization and staggering expense sparing.

Flow Chemistry Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Flow Chemistry Market Regional Analysis

North America held the leading market share of 36% in 2021. The presence of a substantial number of chemical manufacturers combined with technological innovation is required to increase the demand for new innovations incorporating flow chemistry in the region. Asia-Pacific is anticipated to lead the worldwide market by 2030 attributable to the expanding provincial demand for nonexclusive medications. China, India, and Japan are foreseen to decidedly impact the worldwide demand during the prediction period. Europe is one of the quickest developing regions, representing a market share of 24% in 2021, attributable to extreme demand from a few noteworthy end-clients incorporate chemicals and petrochemicals.

U.S. is the biggest market for flow chemistry in North America. High chemical and pharmaceutical assembling combined with expanding venture by the petrochemical makers is required to assume a key job in driving the territorial demand in the last years. Stringent government arrangements in regards to environmental pollution are normal fuel usage of effective and green innovations in the economy.

Flow Chemistry Market Players

Some of the key players Parr Instrument Company, Am Technology, PDC Machines Inc., CEM Corporation, Cambridge Reactor Design Ltd., Milestone Srl, Corning Incorporated, Biotage AB, Future Chemistry Holding BV, Syrris Ltd., EhrfeldMikrotechnik BTS, Vapourtec Ltd., Chemtrix BV, ThalesNano Inc., and Hel Group,Uniqsis Ltd. are significant players operating in the wide-reaching flow chemistry market.

Frequently Asked Questions

What is the size of global FLOW CHEMISTRY market in 2021?

The market size of flow chemistry market in 2021 was accounted to be USD 1.4 Billion.

What is the CAGR of global flow chemistry market during forecast period of 2022 to 2030?

The projected CAGR of flow chemistry market during the analysis period of 2022 to 2030 is 11.8%.

Which are the key players operating in the market?

The prominent players of the global flow chemistry market include Parr Instrument Company, Am Technology, PDC Machines Inc., CEM Corporation, Cambridge Reactor Design Ltd., Milestone Srl, Corning Incorporated, Biotage AB, Future Chemistry Holding BV, Syrris Ltd., EhrfeldMikrotechnik BTS, Vapourtec Ltd., Chemtrix BV, ThalesNano Inc., Hel Group, and Uniqsis Ltd.

Which region held the dominating position in the global flow chemistry market?

Asia-Pacific held the dominating flow chemistry during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for flow chemistry during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global flow chemistry market?

Increasing demand for petrochemicals in the world, rapidly growing chemical industry, and rising trend due to sustainable characteristics drives the growth of global Flow Chemistry market.

Which reactor type held the maximum share in 2021?

Based on reactor type, CSTR segment is expected to hold the maximum share of the flow chemistry market.