Floor Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Floor Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Floor Coatings Market Size accounted for USD 3.37 Billion in 2023 and is estimated to achieve a market size of USD 6.25 Billion by 2032 growing at a CAGR of 7.2% from 2024 to 2032.

Floor Coatings Market Highlights

- The global floor coatings market is expected to reach USD 6.25 billion by 2032, with a CAGR of 7.2% from 2024 to 2032

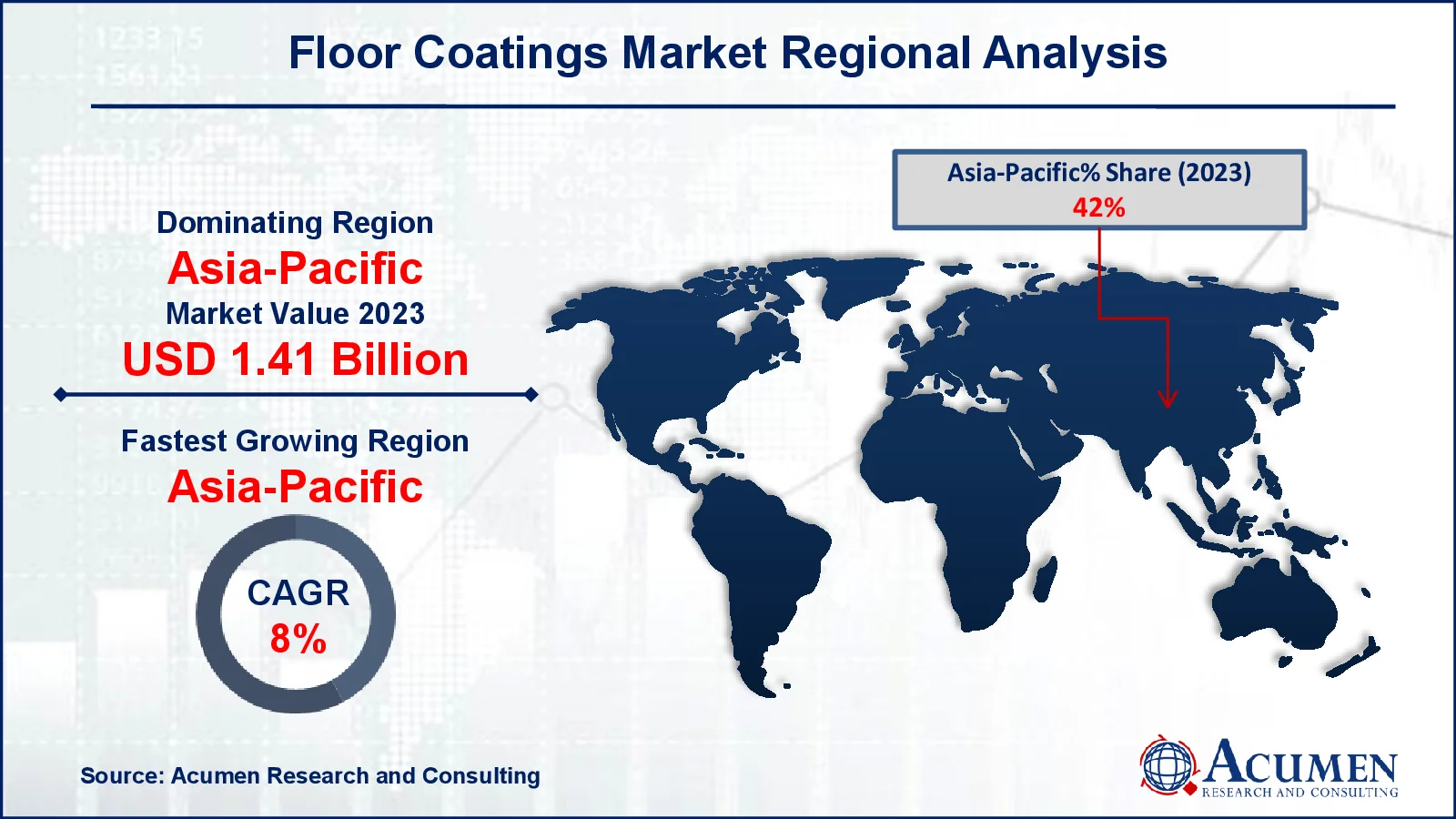

- In 2023, the Asia-Pacific floor coatings market was valued at approximately USD 1.41 billion

- Asia-Pacific is projected to grow at a CAGR exceeding 8% from 2024 to 2032

- The epoxy product segment accounted for 41% of the market share in 2023

- The single-component segment held a 48% market share in 2023

- The industrial end-user segment captured 44% of the market share in 2023

- Rising advancements in quick-curing and low-VOC (volatile organic compound) technologies is the floor coatings market trend that fuels the industry demand

The floor is most often the area of the house that receives the most wear, necessitating additional upkeep. Floor coatings offer safety, an increased level of abrasion, chemical safety, decorative features, impact resistance, a low price, and ease of usage. Floor coatings are often applied as a protective layer on the floor surface. There are various varieties of floor covering to choose from, each with its own set of features for a certain environment. The key concern with floor coverings is their long-term durability and protection measures such as corrosion resistance. Floor coatings are classified according to their environmental and functional requirements. Businesses, for example, may make their premises professional and visually appealing in order to impress clients who visit the location on a frequent basis. In these cases, ornamental floor coatings are acceptable for a variety of external and interior situations.

Global Floor Coatings Market Dynamics

Market Drivers

- Growing construction activities globally, particularly in residential and commercial sectors

- Increasing demand for durable and aesthetic flooring solutions in industrial applications

- Advancements in eco-friendly and low-VOC coating technologies

Market Restraints

- High cost of raw materials impacting product pricing

- Stringent environmental regulations on chemical-based coatings

- Limited awareness and adoption in developing economies

Market Opportunities

- Rising demand for sustainable and green building materials

- Expanding industrial base in emerging markets

- Innovations in fast-curing and UV-resistant coating solutions

Floor Coatings Market Report Coverage

| Market | Floor Coatings Market |

| Floor Coatings Market Size 2022 |

USD 3.37 Billion |

| Floor Coatings Market Forecast 2032 | USD 6.25 Billion |

| Floor Coatings Market CAGR During 2023 - 2032 | 7.2% |

| Floor Coatings Market Analysis Period | 2020 - 2032 |

| Floor Coatings Market Base Year |

2022 |

| Floor Coatings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Component, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M, Kansai Paint Co., Ltd., Grand Polycoats, Michelman, Inc., Hempel A/S, BASF SE, Chugoku Marine Paints, Ltd., Asian Paints Limited, Stonhard, Axalta Coating Systems Ltd., Flowcrete Group Ltd., Terrazzo & Marble Supply, Nippon Paint Holdings Co., Ltd., Florock Polymer Flooring, Koninklijke DSM N.V., and CPC Floor Coatings. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Floor Coatings Market Insights

The increasing development and use of coatings in commercial, industrial, and residential applications promotes market growth. Coating protects floors from moisture, stains, and cracks while providing a high-efficiency, soft, and durable surface that can withstand heavy loads. Warehouses, hospitals, production and industrial plants, showrooms, retail and commercial stores, garages, and aircraft sheds are among the areas where floor coatings are used. Globally, the expansion of building activities has considerably increased demand for floor coverings.

The growing population, combined with increased industrialization, prompted governments in many countries to expand and accelerate construction spending. The United States, China, India, Indonesia, the United Kingdom, Saudi Arabia, and the UAE are among the countries that have made the most significant contributions to the global construction industry's development. As a result, rising worldwide building costs are expected to drive up demand for floor coverings in the coming years.

The building sector has had positive growth in recent years as a result of increased infrastructure development in the United States. Floor coatings are increasingly being used for commercial and industrial purposes in the building industry. In the United States, the construction sector is expected to grow due to new import taxes, changes in trade agreements, and a strong economy, the spread of mega-projects, intelligent towns, and family formation.

In the future, many other building projects are likely to offer profitable growth opportunities for the North American business, including the JKF International Airport Restructuring and Expansion, the Atlanta Chattanooga High Speed Rail Transportation Project, and others. However, there will be a rising danger of replacement products such as furniture, carpet, and bamboo floors over the predicted period. Tile flooring is becoming increasingly popular in both residential and commercial settings due to its benefits such as water, stain, odor, and bacterial resistance. Tiles are typically made with basic materials such as glass, sand, and clay. Floor tiles are favored over floor coverings in a variety of residential settings, including flats, apartments, homes, and single-family homes.

Floor Coatings Market Segmentation

The worldwide market for floor coatings is split based on product, component, application, end-user, and geography.

Floor Coating Market By Product

- Acrylic

- Epoxy

- Polyurethane

- Polyaspartic

- Methyl Methacrylate

According to the floor coatings industry analysis, epoxy is dominant product sector in 2023 and its dominance over the forecast period is expected to continue. Epoxy surface coaters in various industrial and commercial applications are commonly used for concrete floors such as commercial & retail shops, warehouses, showrooms, factories, garages, hospitals, aircraft hangars and more. These coatings provide high-gloss ornamental finishing and are accessible in a range of colours. Epoxy floor coverings are used for decoration on terrazzo floors, chip floors, and colored floors. The lacquers give a solution that is simple to wash and chemical resistant and can be straight applied to fresh and old floors. In addition, the advantages fueling product needs for industrial and commercial applications include characteristics such as oil resistance & water, great abrasion, low VOCs and less fragrance during the assembly process.

Floor Coating Market By Component

- Triple

- Double

- Single

- Others

According to the floor coatings industry analysis, the single component is a largest segment, accounting for more than 48 percent of total sales. Growth in the housing industry is predicted to increase demand for single component coatings, particularly for infrastructure projects such as indoor playgrounds, sidewalks, and other areas. Floor coverings with a single element have excellent adhesiveness to the surface of the concrete and are inexpensive, simple to apply, and unobtrusive. These features enable the cover to be employed in a variety of settings, including vehicle parks, industrial facilities, warehouses, basements, aviation hangars, and so on.

Floor Coating Market By Application

- Terrazzo

- Wood

- Concrete

- Others

According to the floor coatings market forecast, concrete is projected to be the largest application segment in 2023. Beton floor coverings are used in a variety of applications to improve the appearance of bare concrete surfaces. Concrete floor coating applications are subject to a number of specific color regulations and legislation in various industries. There are several sorts of coverings available for different uses, such as a concrete sealant, which requires the least amount of labor prior to application. Sealers are used to prevent food stains and chemical spills on concrete surfaces while also making cleaning easier.

Floor Coating Market By End-User

- Commercial

- Industrial

- Residential

According to the floor coatings market forecast, the primary end-user segments of the market are residential, commercial, and industrial. Industrial is the largest segment in 2023. During the same year, the company generated more than 44% of its sales. Demand for floor coverings in the industrial sector is increasing, particularly in the burgeoning food, chemical processing, and manufacturing industries. Rapid industrialization and investment-boosting infrastructure and manufacturing sector expansion are likely to have a positive impact on the industrial ground surface layer market during the forecast period, both in the private and public sectors.

Floor Coatings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Floor Coatings Market Regional Analysis

For several reasons, Asia-Pacific accounted for more than 42% of total income in floor coatings market. Given the rising demand for products from the residential, commercial, and industrial industries, the region is likely to account for a sizable share of the global market throughout the projection period. China led the Asia-Pacific market in terms of both quantity and income. Green demand is expected to generate significant market growth opportunities over the projection period in countries such as Australia, India, China, and New Zealand. The Asia-Pacific region's floor coatings market is expanding rapidly, owing to increased urbanization and infrastructure development in emerging economies. Additionally, in March 2023, BASF SE begins manufacturing of Sovermol, the first bio-based polyol designed for uses such as flooring coatings, waterpipe coatings, adhesives, and putty. The manufacturing facility, located in Mangalore, India, intends to meet the growing demand for floor coatings in the Asia-Pacific area.

Floor Coatings Market Players

Some of the top floor coatings companies offered in our report include 3M, Kansai Paint Co., Ltd., Grand Polycoats, Michelman, Inc., Hempel A/S, BASF SE, Chugoku Marine Paints, Ltd., Asian Paints Limited, Stonhard, Axalta Coating Systems Ltd., Flowcrete Group Ltd., Terrazzo & Marble Supply, Nippon Paint Holdings Co., Ltd., Florock Polymer Flooring, Koninklijke DSM N.V., and CPC Floor Coatings.

Frequently Asked Questions

How big is the floor coatings market?

The floor coatings market size was valued at USD 3.37 billion in 2023.

What is the CAGR of the global floor coatings market from 2024 to 2032?

The CAGR of floor coatings is 7.2% during the analysis period of 2024 to 2032.

Which are the key players in the floor coatings market?

The key players operating in the global market are including 3M, Kansai Paint Co., Ltd., Grand Polycoats, Michelman, Inc., Hempel A/S, BASF SE, Chugoku Marine Paints, Ltd., Asian Paints Limited, Stonhard, Axalta Coating Systems Ltd., Flowcrete Group Ltd., Terrazzo & Marble Supply, Nippon Paint Holdings Co., Ltd., Florock Polymer Flooring, Koninklijke DSM N.V., and CPC Floor Coatings.

Which region dominated the global floor coatings market share?

Asia-Pacific held the dominating position in floor coatings industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of floor coatings during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global floor coatings industry?

The current trends and dynamics in the floor coatings industry include growing construction activities globally, particularly in residential and commercial sectors, increasing demand for durable and aesthetic flooring solutions in industrial applications, and advancements in eco-friendly and low-VOC coating technologies.

Which product held the maximum share in 2023?

The epoxy product held the maximum share of the floor coatings industry.