Floating Liquefied Natural GAS Market | Acumen Research and Consulting

Floating Liquefied Natural GAS Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

The Global Floating Liquefied Natural GAS Market Size accounted for USD 21.8 Billion in 2023 and is estimated to achieve a market size of USD 54.6 Billion by 2032 growing at a CAGR of 10.9% from 2024 to 2032.

Floating Liquefied Natural GAS (FLNG) Market Highlights

- Global floating liquefied natural gas (FLNG) market revenue is poised to garner USD 54.6 billion by 2032 with a CAGR of 10.9% from 2024 to 2032

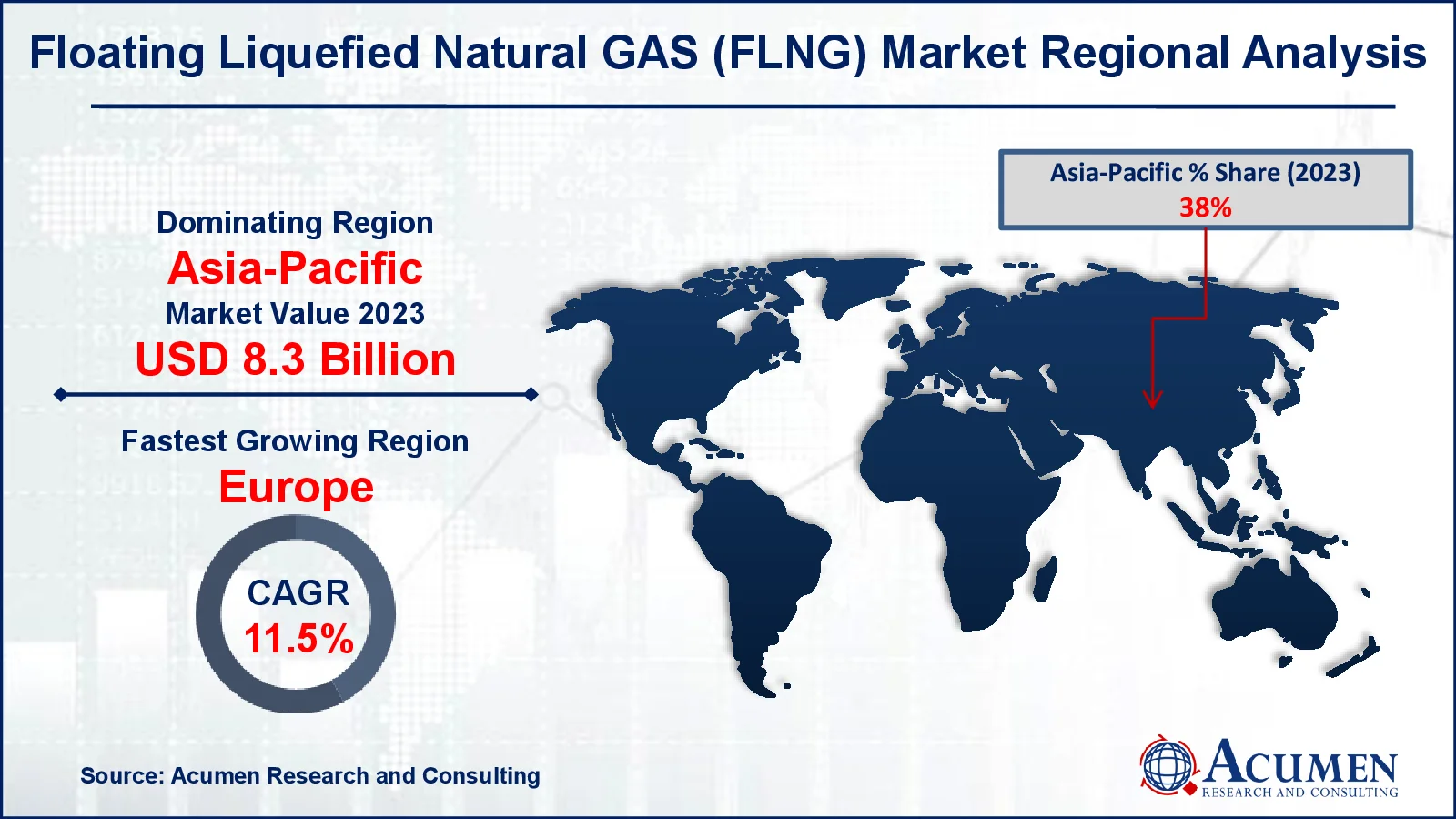

- Asia-Pacific floating liquefied natural gas (FLNG) market value occupied around USD 8.3 billion in 2023

- Europe floating liquefied natural gas (FLNG) market growth will record a CAGR of more than 11.5% from 2024 to 2032

- Among technology, the FSRU sub-segment generated 55% of the floating LNG market share in 2023

- Increasing adoption of FLNG technology to tap into remote and stranded gas fields economically is the floating liquefied natural gas market trend that fuels the industry demand

Floating liquefied natural gas (FLNG) is an offshore facility that extracts, liquefies, stores, and transports natural gas straight from undersea fields. FLNG units reduce the need for costly onshore infrastructure because they operate entirely at sea, making isolated and stranded gas fields economically viable. These facilities have innovative processing methods for converting natural gas into liquefied natural gas (LNG), which is easier to transport.

FLNG can be used to extract natural gas from deepwater or remote offshore deposits, produce LNG, and store it for worldwide export. FLNG vessels also contribute significantly to decreasing environmental impacts by limiting onshore footprints. Furthermore, they are employed to address energy demands in areas without large gas pipeline networks.

Global Floating Liquefied Natural GAS Market Dynamics

Market Drivers

- Growing demand for LNG as a cleaner energy alternative to coal and oil

- Advancements in offshore exploration technologies for stranded gas fields

- Rising energy consumption in emerging economies, particularly in Asia-Pacific

Market Restraints

- High initial capital investment and operational costs of FLNG projects

- Technical challenges associated with operating in deepwater and harsh offshore environments

- Regulatory complexities and environmental concerns around offshore gas extraction

Market Opportunities

- Expansion of FLNG operations in untapped gas reserves in Africa and the Middle East

- Integration of FLNG technology with renewable energy for hybrid energy solutions

- Increasing investments in newbuild FLNG vessels with cutting-edge storage and processing systems

Floating Liquefied Natural GAS (FLNG) Market Report Coverage

| Market | Floating Liquefied Natural GAS (FLNG) Market |

| Floating Liquefied Natural GAS (FLNG) Market Size 2022 |

USD 21.8 Billion |

| Floating Liquefied Natural GAS (FLNG) Market Forecast 2032 | USD 54.6 Billion |

| Floating Liquefied Natural GAS (FLNG) Market CAGR During 2023 - 2032 | 10.9% |

| Floating Liquefied Natural GAS (FLNG) Market Analysis Period | 2020 - 2032 |

| Floating Liquefied Natural GAS (FLNG) Market Base Year |

2023 |

| Floating Liquefied Natural GAS (FLNG) Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Vessel Type, By Technology, By Capacity, By Storage, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Chiyoda Corporation, TotalEnergies SE, Shell plc, Baker Hughes Company, JGC Holdings Corporation, BP Plc, Linde Plc, Golar LNG Limited, Technip Energies N.V., Excelerate Energy, Petroliam Nasional Berhad, ABB Limited, and Black & Veatch. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Floating Liquefied Natural GAS (FLNG) Market Insights

Rising energy needs and cleaner alternatives to coal and oil drive floating LNG market adoption. For instance, according to International Institute of Sustainable Development, India is also establishing itself as a leader in the expanding global value chain of clean energy technology by encouraging domestic production of high-efficiency solar photovoltaic modules and advanced batteries, as well as green hydrogen. Governments should direct their resources toward measures that better serve the people they represent, such as cash transfers or energy access via clean technology. This includes energy solutions that reduce greenhouse gas emissions and environmental harm while providing reliable access to power.

Increased need for clean fuel technology and a greater emphasis on sustainable energy blends will drive FLNG market expansion. The rapid depletion of fossil fuels, along with continued carbon footprint reductions, will promote positive corporate growth. Global demand for natural gas is increasing at a stronger rate in 2024 than in the previous two years, which were heavily affected by the turmoil of the global energy crisis. According to the most recent edition of the IEA's annual Global Gas Security Review, global gas demand is predicted to climb by more than 2.5% in 2024, followed by a similar increase in 2025. The United States and China are the leading contributors to the increase in oil manufacturing, accounting for more than half of the total increase.

The capacity to speed gas procurement, as well as a growth in the number of natural gas-fired plants will help to grow the FLNG industry. For instance, new natural gas-fired capacity additions expected to total 8.6 gigawatts in 2023. October 16, 2023, during 2022 and 2023, a total of 13 new CCGT plants with a combined capacity of 12.4 GW will have entered service. The average output for each of the 13 CCGT plants is 0.9 GW of electric generating capacity. Many experts are skeptical of the future FLNG market due to the recent decline in gas prices. Industry experts debated whether gas supply would generate the necessary momentum for FLNG initiatives to take off.

Furthermore, the government initiated a program to build gas-fired power plants and update LNG import infrastructure to meet new electrification targets. The growing number of such government activities around the world has primarily influenced the development of the FLNG market.

Floating Liquefied Natural GAS (FLNG) Market Segmentation

The worldwide market for floating liquefied natural gas (FLNG) is split based on vessel type, technology, capacity, storage, and geography.

Floating Liquefied Natural GAS Market By Vessel Type

- Converted LNG Carriers

- Newbuild (Purpose-built) FLNG Vessels

According to the floating liquefied natural gas (FLNG) industry analysis, the conversions utilize existing LNG carriers, reducing capital expenditure while repurposing older fleets. However, newbuild FLNG vessels are gaining traction for their advanced technology and optimized design, tailored to meet specific operational needs. For instance, Mitsui O.S.K., Ltd has inked a long-term charter deal for a newbuild LNG carrier with a vessel operation management business sponsored by Jeera Co., Inc. Through this long-term charter contract, MOL will contribute to the development of a stable supply of LNG in partnership with Jeera.

Floating Liquefied Natural GAS Market By Technology

- LNG FPSO

- FSRU

- Others

According to the floating LNG market analysis, low capital costs, more flexibility, and fast track execution are the primary factors driving FSRU demand. Facilities uncover widespread implementation across numerous nations that lack national energy resources. A floating storage regasification system is an LNG storage ship equipped with a regasification plant that converts LNG into gas and transfers it directly to the gas network. Technological innovation to create high-performance, secure floating infrastructure has increased Australia's share of the FLNG market.

Floating Liquefied Natural GAS Market By Capacity

- Small Scale

- Mid Scale

- Large Scale

According to the floating liquefied natural gas market forecast, the LNG business will grow as demand for natural gas rises, particularly in large scale regions such as Asia-Pacific and the Middle East. Compared to onshore liquefaction crops, cost efficiency, the ability to migrate to many sites, and versatility to function in a variety of well depths are just a few of the key advantages that will boost brand acceptability. These vessels can employ marginal gas fields and allied offshore gas assets for shipping, regeneration, storage, and a variety of other applications. Small / mid-scale capability vessels have rapid deployment because to low investment costs and a short implementation timeline. The installations are typically conducted in stranded stocks that are economically impractical for other units.

Floating Liquefied Natural GAS Market By Storage

- Onboard Storage Tanks

- Membrane-Type Storage Systems

- Moss-Type Storage Systems

- Other Storage Type

According to the floating LNG market forecast, membrane-type storage systemss expected to growing due to their space-efficient design and ability to maximize storage capacity within the vessel’s hull. These systems use flexible, thin membranes that enable more LNG storage compared to Moss-type spherical tanks. They are particularly preferred for large-scale operations, where optimizing capacity and minimizing structural weight are critical. Additionally, their adaptability and integration with modern FLNG designs make them a favored choice in the industry.

Floating Liquefied Natural GAS (FLNG) Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Floating Liquefied Natural GAS (FLNG) Market Regional Analysis

For several reasons, Asia-Pacific FLNG market is set to expand due to accelerating investment in infrastructure growth along with significant public assistance. The Government of India is trying to increase NG's share of the main power blend from the prevalent 6% to 15%, leading to stable development of the oil industry by 2030, with LNG being the biggest contributor.

Africa's FLNG market will experience substantial growth due to continuing public projects along with important economic assistance for the region-wide development of stranded oil deposits. Increasing energy demand and increasing amount of initiatives across Mozambique will improve company perspective.

Floating Liquefied Natural GAS (FLNG) market experts predict that investors will shift their focus from Australasia to Africa and Asia. Increasing economic growth and electricity consumption in Asia's emerging markets have piqued the interest of various industry titans to invest in these sectors. Asia will represent one-third of the overall FLNG industry. Africa and Asia are the primary development regions for aggressive agreements and financing.

Floating Liquefied Natural GAS (FLNG) Market Players

Some of the top floating liquefied natural gas (FLNG) companies offered in our report include BASF SE, Chiyoda Corporation, TotalEnergies SE, Shell plc, Baker Hughes Company, JGC Holdings Corporation, BP Plc, Linde Plc, Golar LNG Limited, Technip Energies N.V., Excelerate Energy, Petroliam Nasional Berhad, ABB Limited, and Black & Veatch.

Frequently Asked Questions

How big is the Floating Liquefied Natural GAS (FLNG) market?

The floating liquefied natural gas (FLNG) market size was valued at USD 21.8 Billion in 2023.

What is the CAGR of the global Floating Liquefied Natural GAS (FLNG) market from 2024 to 2032?

The CAGR of floating liquefied natural gas (FLNG) is 10.9% during the analysis period of 2024 to 2032.

Which are the key players in the Floating Liquefied Natural GAS (FLNG) market?

The key players operating in the global market are including BASF SE, Chiyoda Corporation, TotalEnergies SE, Shell plc, Baker Hughes Company, JGC Holdings Corporation, BP Plc, Linde Plc, Golar LNG Limited, Technip Energies N.V., Excelerate Energy, Petroliam Nasional Berhad, ABB Limited, and Black & Veatch.

Which region dominated the global Floating Liquefied Natural GAS (FLNG) market share?

Asia-Pacific held the dominating position in floating liquefied natural gas (FLNG) industry during the analysis period of 2024 to 2032.

Which region registered fastest growing Type CAGR from 2024 to 2032?

Europe exhibited fastest growing CAGR for market of floating liquefied natural gas (FLNG) during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Floating Liquefied Natural GAS (FLNG) industry?

The current trends and dynamics in the floating liquefied natural gas (FLNG) industry include growing demand for LNG as a cleaner energy alternative to coal and oil, advancements in offshore exploration technologies for stranded gas fields, and rising energy consumption in emerging economies, particularly in Asia-Pacific.

Which technology held the maximum share in 2023?

The FSRU technology held the maximum share of the floating liquefied natural gas (FLNG) industry.