Flavors and Fragrances Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Flavors and Fragrances Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

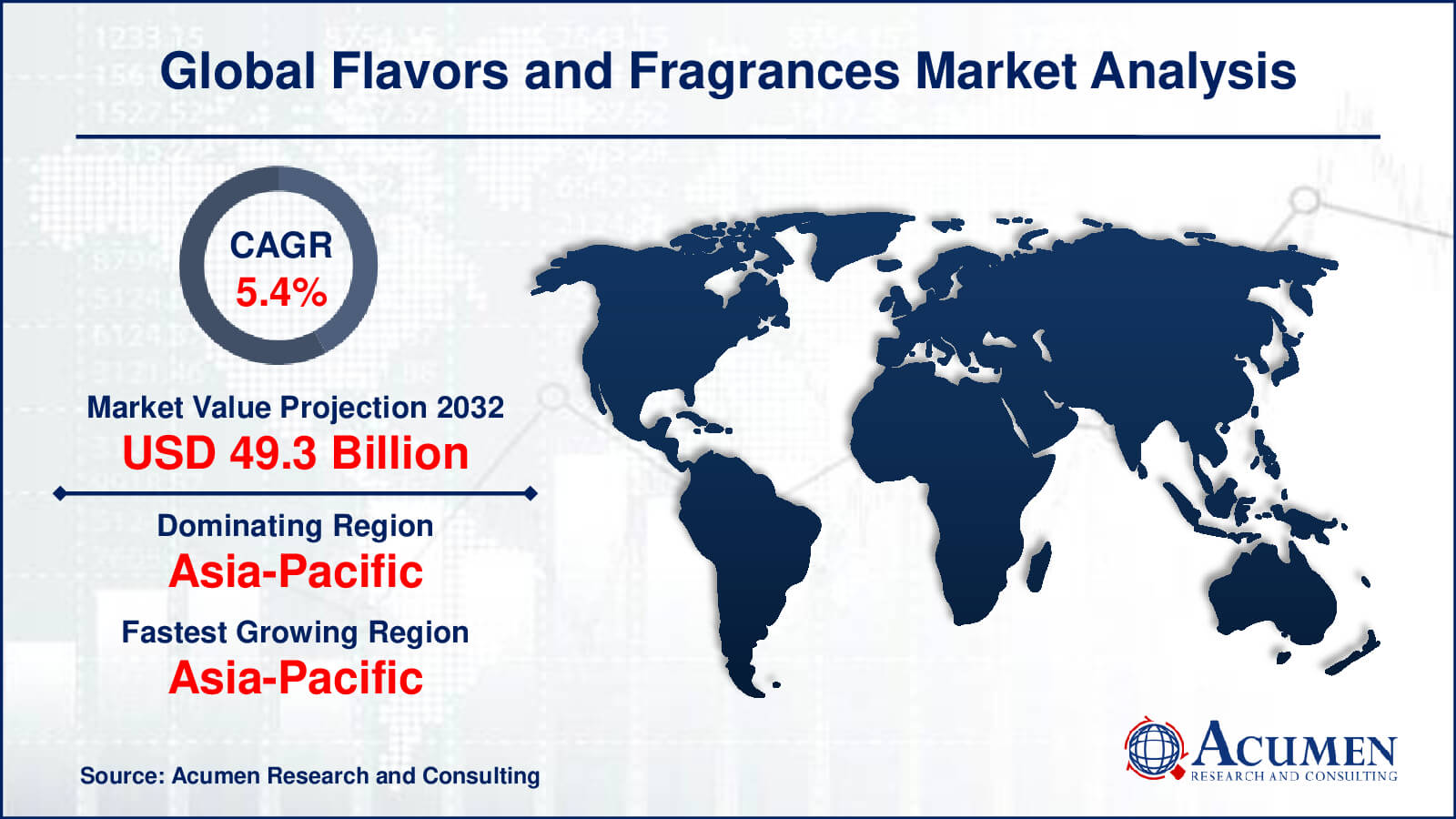

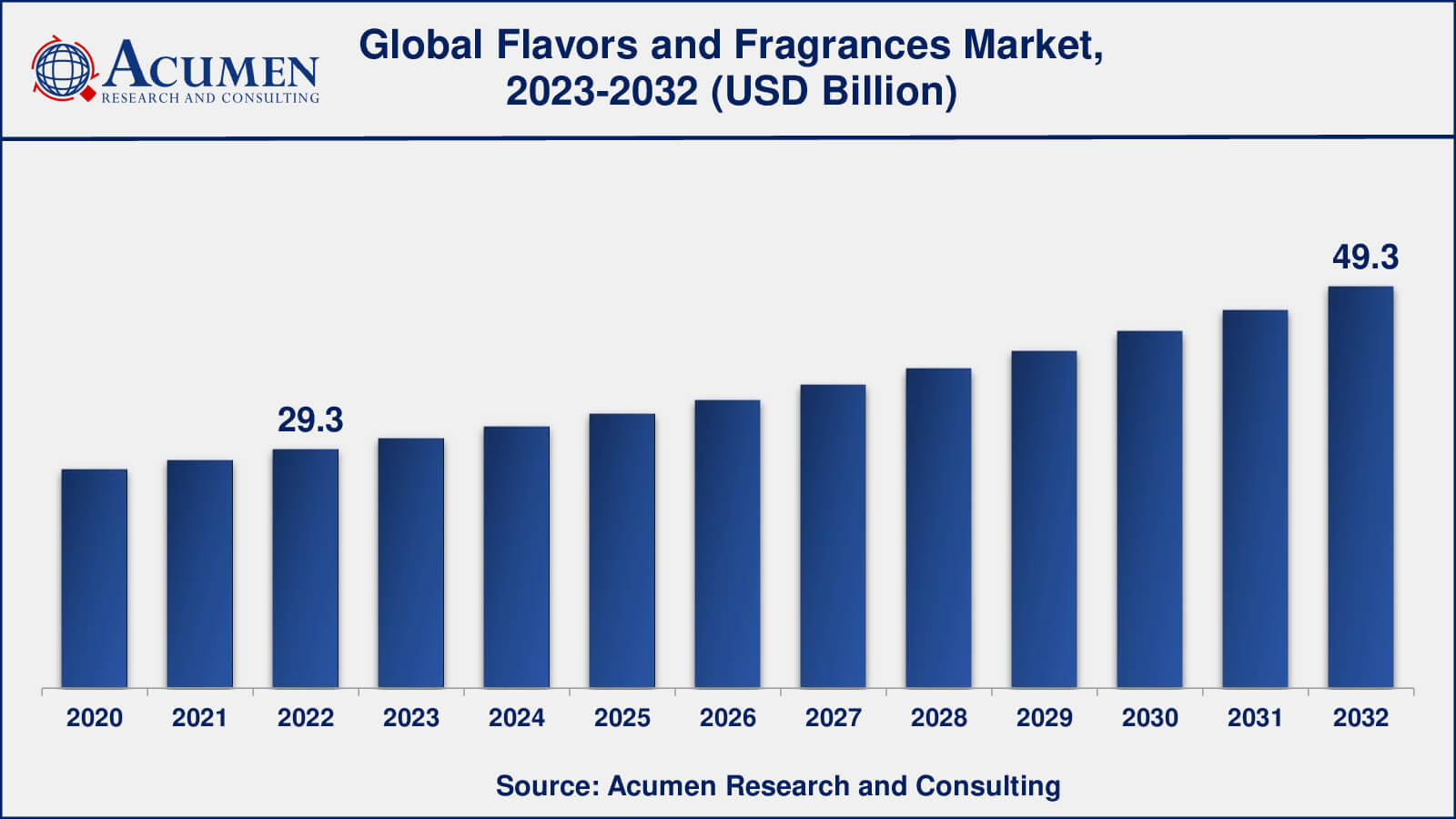

The Global Flavors and Fragrances Market Size accounted for USD 29.3 Billion in 2022 and is estimated to achieve a market size of USD 49.3 Billion by 2032 growing at a CAGR of 5.4% from 2023 to 2032.

Flavors and Fragrances Market Key Highlights

- Global flavors and fragrances market revenue is poised to garner USD 49.3 billion by 2032 with a CAGR of 5.4% from 2023 to 2032

- Asia-Pacific flavors and fragrances market value occupied more than USD 9.4 billion in 2022

- Asia-Pacific flavors and fragrances market growth will record a CAGR of around 6% from 2023 to 2032

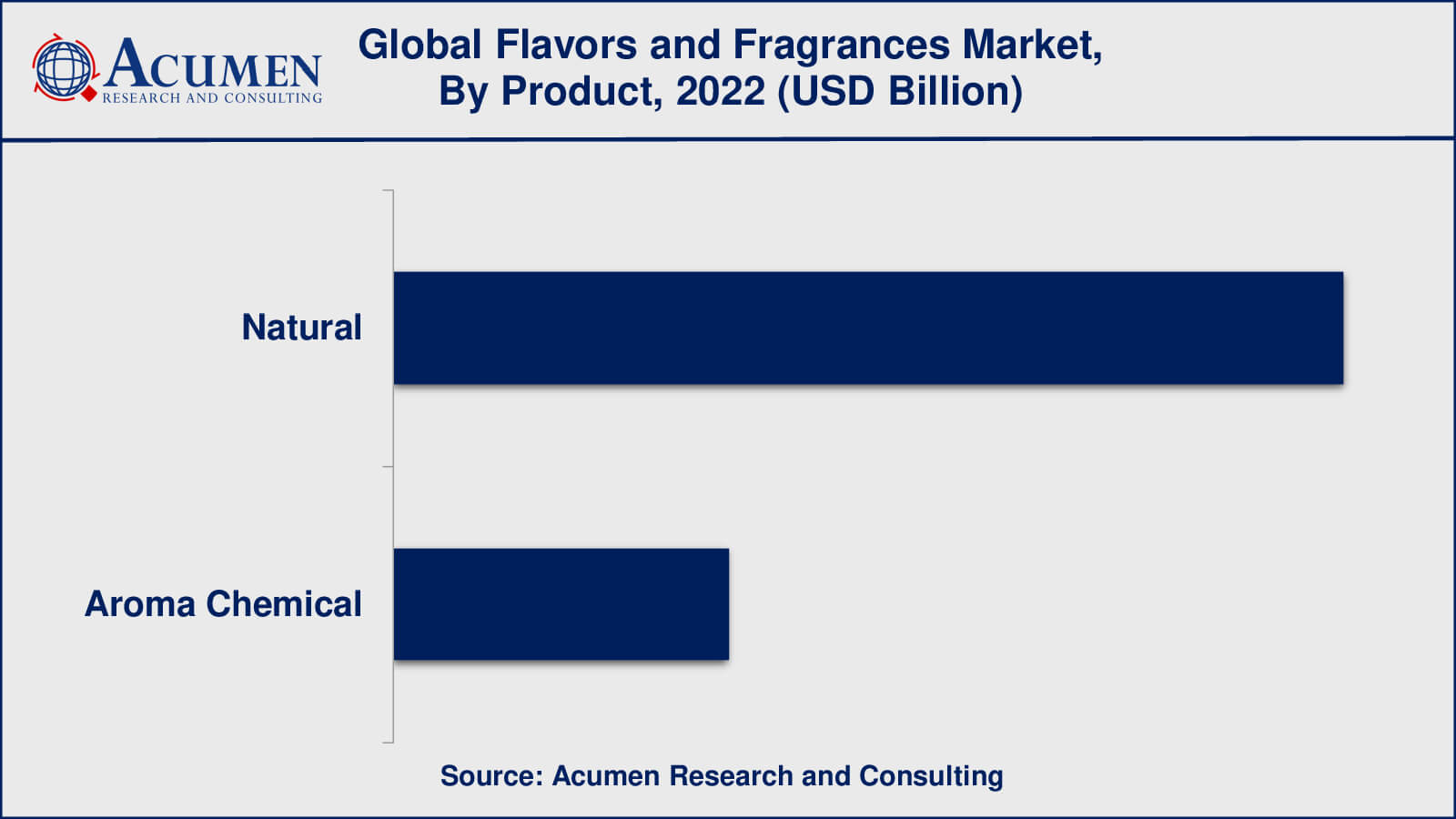

- Among product, the natural chemicals sub-segment generated around 74% share in 2022

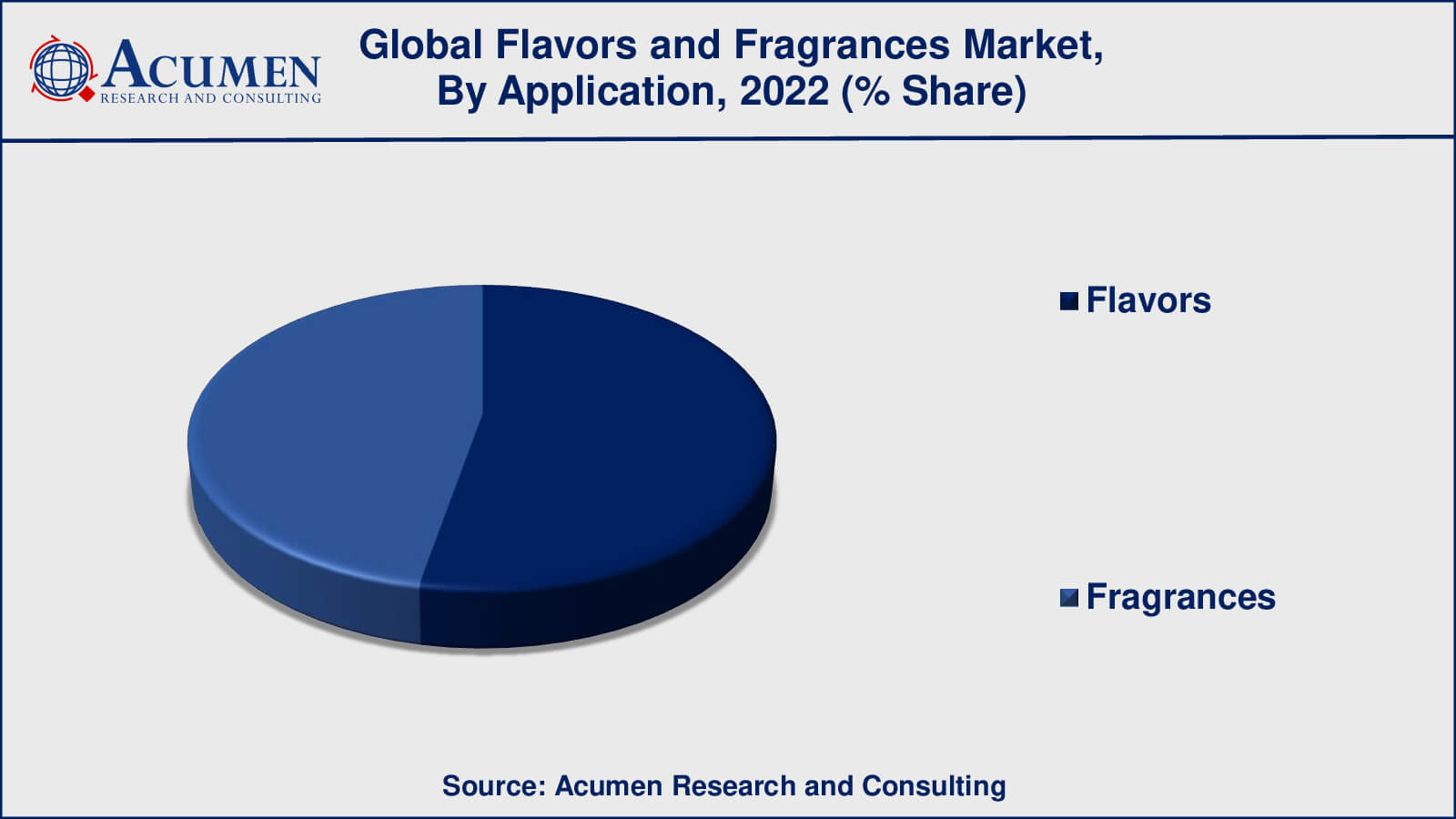

- Based on application, the flavors sub-segment generated around US$ 15.5 billion revenue in 2022

- Emphasis on sensory experiences is a popular flavors and fragrances market trend that fuels the industry demand

Flavors and fragrances are crucially essential materials and come under distinct packaged foods and consumer goods. Synthetic and natural compositions are used to generate flavor in toothpaste, cherry cola, etc. Fragrance compositions add a fresh smell to household cleaning products and fine perfumes. The global flavors and fragrances market is anticipated to witness significant growth over the forecast period. The global market is primarily driven by increasing demand from manufacturers of food and beverages, perfumes, cosmetics, toiletries, and household products. In addition, the use of flavors and fragrances in emerging and developing economies is a key factor propelling the growth of the global flavors and fragrances market. The growth of this market indirectly depends on the geographical distribution and availability of fragrances and flavors. Also, the manufacturing of fragrant and aroma chemicals by chemical synthesis process has elevated the overall fragrance industry and has opened doors for a new branch of chemistry. Flavors and fragrances include a distinct set of chemical compounds including esters, alcohol, acids, lactones, aldehydes, and ketones. The use and production of flavors and fragrances in the industrial sector kicked off in the early nineteenth century with the synthesis and isolation of chemicals that are responsible for the aroma of natural compounds such as cinnamaldehyde which is isolated from cinnamon oil, and benzaldehyde which is extracted from the bitter almond oil. The synthesis of fragrant aroma chemicals which evolved the taste and odor of naturally synthesized products became a common practice.

Global Flavors and Fragrances Market Dynamics

Market Drivers

- Growing demand from the food and beverage industry

- Increased consumer awareness and preference for natural products

- Rising demand from emerging markets

- Increasing demand from the personal care and cosmetics industry

Market Restraints

- Stringent regulations

- Fluctuations in raw material prices

- Health concerns

Market Opportunities

- Increasing demand for natural and organic ingredients

- Growing popularity of functional ingredients

- Increasing importance of digital technologies

Flavors and Fragrances Market Report Coverage

| Market | Flavors and Fragrances Market |

| Flavors and Fragrances Market Size 2022 | USD 29.3 Billion |

| Flavors and Fragrances Market Forecast 2032 | USD 49.3 Billion |

| Flavors and Fragrances Market CAGR During 2023 - 2032 | 5.4% |

| Flavors and Fragrances Market Analysis Period | 2020 - 2032 |

| Flavors and Fragrances Market Base Year | 2022 |

| Flavors and Fragrances Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Givaudan SA, Firmenich SA, Agilex Flavors & Fragrances, Inc., Symrise AG, Bedoukian Research, Inc., International Flavors & Fragrances, Inc., BASF SE, Aromatech SAS, Sensient Technologies Corp., Bell Flavors & Fragrances Inc., Royal DSM NV and Takasago International Corp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Flavors and Fragrances Market Insights

The global flavors and fragrances market has witnessed significant growth over recent years owing to the rising demand for bio-based and natural fragrant products. Additionally, several factors contribute to the growth of the global flavors and fragrances market. Factors such as rapidly growing industrialization across the globe are leading to the bulk production of scented and flavored products to be used in processed foods, soap, personal care products, oral hygiene products, detergents, and other household cleaning products. However, apart from several advantages of flavors and fragrances, fluctuating raw material price is the major factor hindering the growth of this market.

Flavors and Fragrances Market Segmentation

The worldwide market for flavors and fragrances is split based on product, application, and geography.

Flavors and Fragrances Products

- Natural

- Essential Oils

- Citronella Essential Oils

- Clove Essential Oils

- Corn mint Essential Oils

- Eucalyptus Essential Oils

- Lavender Essential Oils

- Lemon Essential Oils

- Orange Essential Oils

- Patchouli Essential Oils

- Pepper Mint Essential Oils

- Ylang Ylang/Canaga Essential Oils

- Oleoresins

- Paprika Oleoresins

- Black Pepper Oleoresins

- Turmeric Oleoresins

- Ginger Oleoresins

- Others

- Essential Oils

- Aroma Chemical

- Alcohol

- Aldehydes

- Esters

- Phenol

- Terpenes

- Others

According to the flavours and fragrances industry report, the the natural flavours and fragrances category has been developing at a quicker pace than the aroma chemical segment, driven by the increased demand for natural and organic products by consumers. Products in the natural flavours and fragrances market include those made from foods including fruits, vegetables, and herbs, which are frequently regarded as safer and healthier alternatives to synthetic items.

Because to their broad application in the food and beverage, cosmetics, and home care industries, aroma chemicals continue to rule the industry in terms of volume and earnings. Aroma chemicals are synthetic substances that closely resemble the odours of natural substances. They are frequently employed to improve or develop novel scents and flavours. They are more affordable and provide a greater choice of options than natural ingredients.

Flavors and Fragrances Applications

- Flavors

- Confectionery

- Convenience Food

- Bakery Food

- Dairy Food

- Beverages

- Animal Feed

- Others

- Fragrances

- Fine Fragrances

- Cosmetics & Toiletries

- Soaps & Detergents

- Aromatherapy

- Others

As per the flavors and fragrances market forecast, the flavour application has historically been the larger category due to its extensive use in the food and beverage industry, and is anticipated to continue to be so in the upcoming years. Flavors are frequently employed in goods like soft drinks, snacks, and processed foods in order to improve items' taste, scent, and appearance. The rise of the flavours application in recent years has also been spurred by changing consumer tastes and preferences as well as rising demand for convenience foods.

The fragrances application, on the other hand, is used in a variety of industries such as cosmetics, toiletries, and home care. Fragrances are added to these products to provide a pleasing aroma and sensory experience for consumers. In recent years, the fragrance application has seen significant growth due to the increasing demand for personal care and home care products, as well as the rising trend of using fragrances in luxury and premium products.

Flavors and Fragrances Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Flavors and Fragrances Regional Analysis

The Asia-Pacific region dominates the market for flavors and fragrances. The food and beverage industry in the region has expanded significantly, particularly in China and India, increasing demand for flavors and perfumes. Furthermore, factors such as the region's rapid population growth, rising disposable incomes, and shifting consumer preferences have all contributed to the market's expansion.

However, due to factors such as population growth, increased disposable income, and shifting consumer preferences, the Asia-Pacific region is expected to see the fastest rate of growth in the market for tastes and fragrances over the next few years. The region has seen significant growth in the food and beverage industries, particularly in China and India, and is expected to see increased demand for fragrances in the personal care and home care industries.

North America, followed by Europe, has the largest market for flavors and fragrances. North America is home to many of the major players in the flavors and fragrances market, as well as a well-established food and beverage industry. Europe also has a robust food and beverage industry and a sizable fragrance market.

Flavors and Fragrances Market Players

Some of the top flavors and fragrances companies offered in the professional report include Givaudan SA, Firmenich SA, Agilex Flavors & Fragrances, Inc., Symrise AG, Bedoukian Research, Inc., International Flavors & Fragrances, Inc., BASF SE, Aromatech SAS, Sensient Technologies Corp., Bell Flavors & Fragrances Inc., Royal DSM NV and Takasago International Corp.

Frequently Asked Questions

What was the market size of the global flavors and fragrances in 2022?

The market size of flavors and fragrances was USD 29.3 billion in 2022.

What is the CAGR of the global flavors and fragrances market from 2023 to 2032?

The CAGR of flavors and fragrances is 5.4% during the analysis period of 2023 to 2032.

Which are the key players in the flavors and fragrances market?

The key players operating in the global market are including Givaudan SA, Firmenich SA, Agilex Flavors & Fragrances, Inc., Symrise AG, Bedoukian Research, Inc., International Flavors & Fragrances, Inc., BASF SE, Aromatech SAS, Sensient Technologies Corp., Bell Flavors & Fragrances Inc., Royal DSM NV and Takasago International Corp.

Which region dominated the global flavors and fragrances market share?

Asia-Pacific held the dominating position in flavors and fragrances industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of flavors and fragrances during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global flavors and fragrances industry?

The current trends and dynamics in the flavors and fragrances industry include growing demand from the food and beverage industry, increased consumer awareness and preference for natural products, rising demand from emerging markets, and increasing demand from the personal care and cosmetics industry.

Which product held the maximum share in 2022?

The flavors product held the maximum share of the flavors and fragrances industry.