Flavored Veterinary Medication Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Flavored Veterinary Medication Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

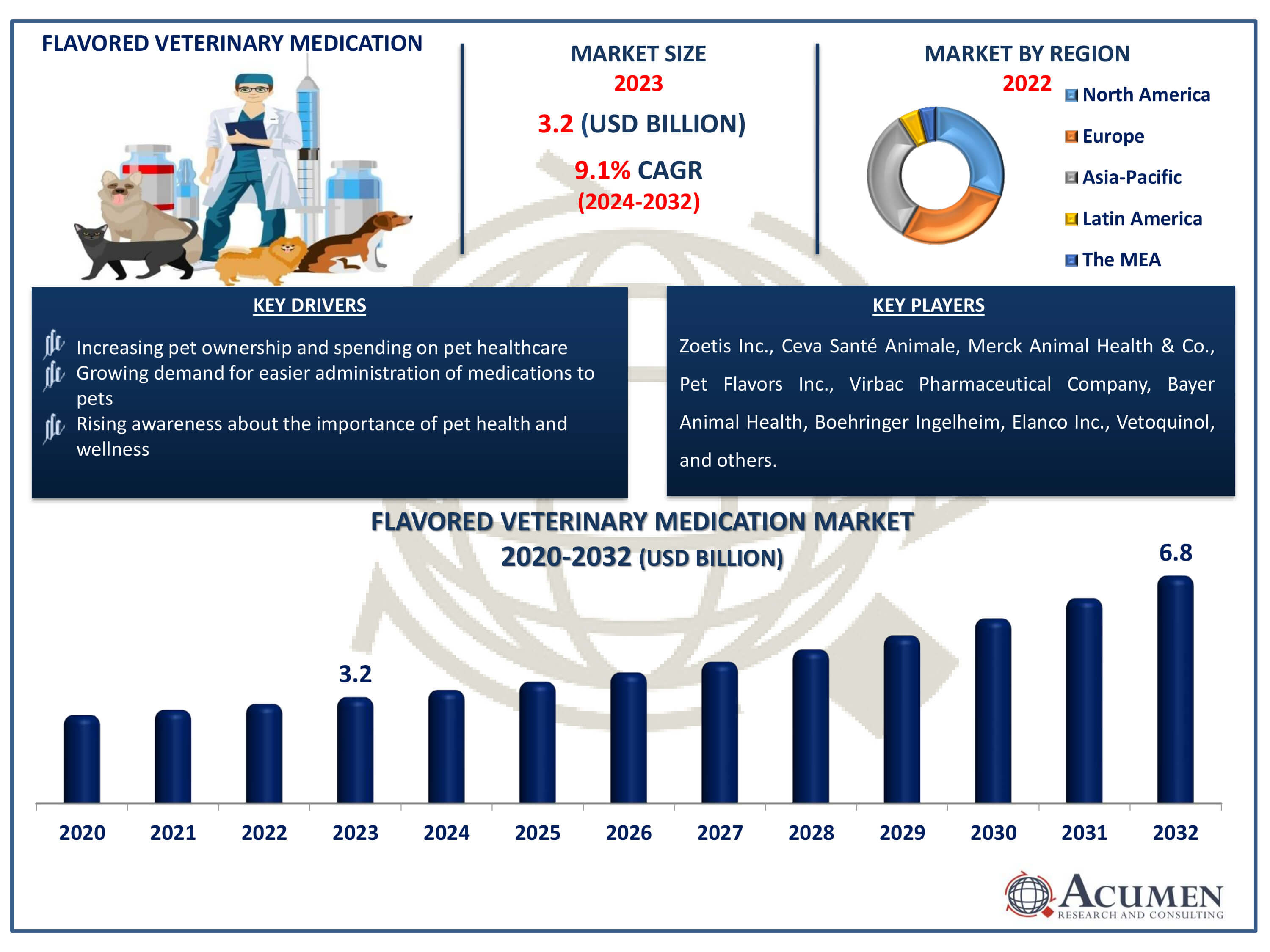

The Flavored Veterinary Medication Market Size accounted for USD 3.2 Billion in 2023 and is estimated to achieve a market size of USD 6.8 Billion by 2032 growing at a CAGR of 9.1% from 2024 to 2032.

Flavored Veterinary Medication Market Highlights

- Global flavored veterinary medication market revenue is poised to garner USD 6.8 billion by 2032 with a CAGR of 9.1% from 2024 to 2032

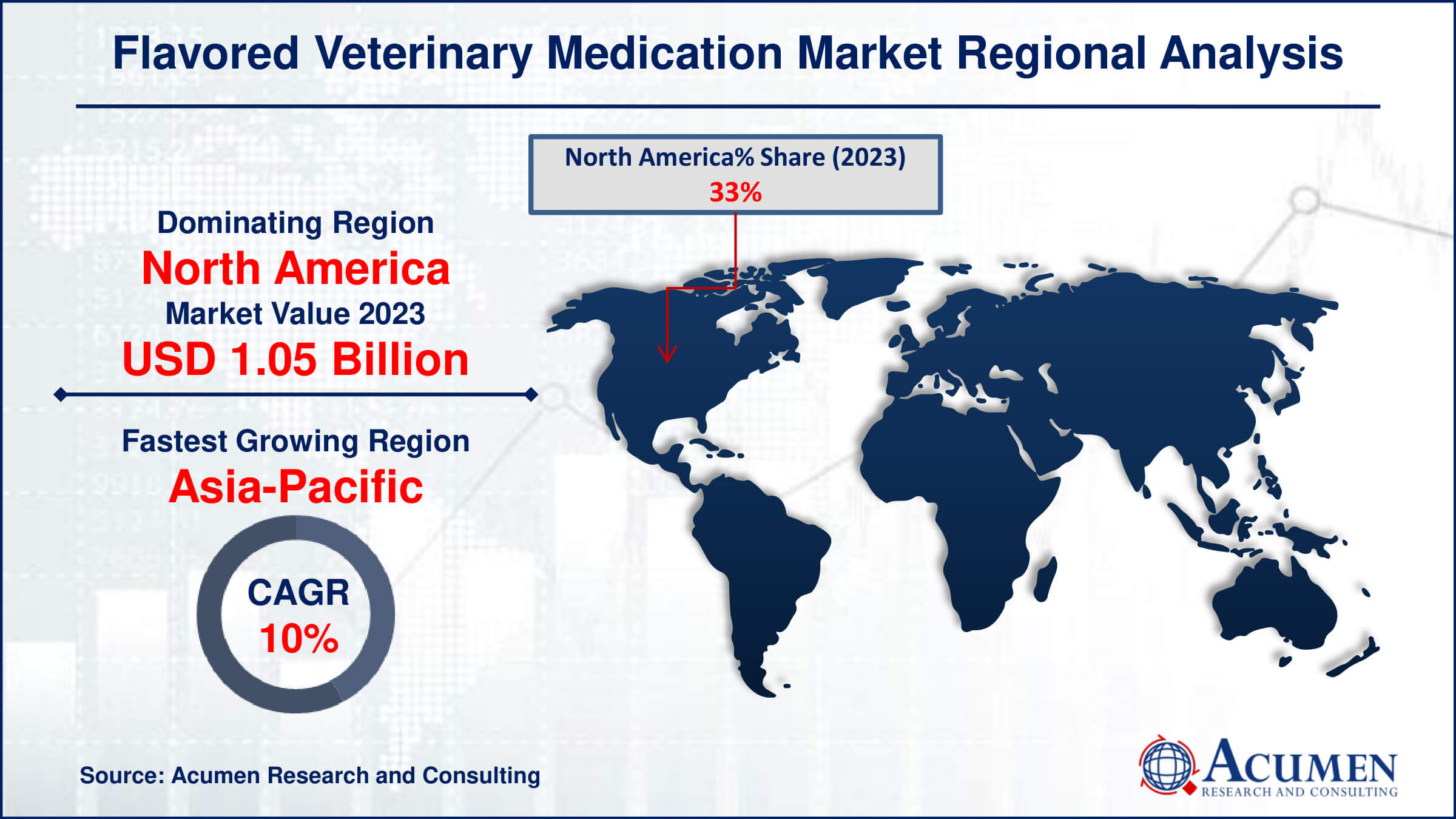

- North America flavored veterinary medication market value occupied around USD 1.05 billion in 2023

- Asia-Pacific flavored veterinary medication market growth will record a CAGR of more than 10% from 2024 to 2032

- Based on types, the meat flavored (beef, chicken) sub-segment expected to generated significant market share in 2023

- Based on end-user, the dogs sub-segment shows notable growth in 2023

- Increasing demand for flavored medications to improve pet compliance with treatment regimens is the flavored veterinary medication market trend that fuels the industry demand

Flavored veterinary medication refers to medicines for animals that are enhanced with palatable flavors to make them more appealing. This approach is particularly beneficial for pets like dogs and cats, which can be notoriously difficult to medicate due to the unappealing taste of standard formulations. By incorporating flavors such as beef, chicken, or fish, these medications encourage voluntary consumption, reducing stress for both the animal and the owner. The primary applications include administering antibiotics, pain relief medications, and chronic disease treatments such as heartworm preventatives and insulin. Flavored medications can be in various forms, including tablets, chews, liquids, or powders. This innovation improves adherence to prescribed treatments, enhancing the overall health and well-being of pets.

Global Flavored Veterinary Medication Market Dynamics

Market Drivers

- Increasing pet ownership and spending on pet healthcare

- Growing demand for easier administration of medications to pets

- Rising awareness about the importance of pet health and wellness

Market Restraints

- Regulatory challenges and approvals for new flavors

- Concerns regarding the safety and efficacy of flavored medications

- Limited availability of specialized flavors for diverse pet preferences

Market Opportunities

- Expansion of product portfolios with innovative flavor combinations

- Untapped potential in emerging markets for flavored veterinary medications

- Collaborations between pharmaceutical companies and pet food manufacturers for product development

Flavored Veterinary Medication Market Report Coverage

| Market | Flavored Veterinary Medication Market |

| Flavored Veterinary Medication Market Size 2022 | USD 3.2 Billion |

| Flavored Veterinary Medication Market Forecast 2032 | USD 6.8 Billion |

| Flavored Veterinary Medication Market CAGR During 2023 - 2032 | 9.1% |

| Flavored Veterinary Medication Market Analysis Period | 2020 - 2032 |

| Flavored Veterinary Medication Market Base Year |

2022 |

| Flavored Veterinary Medication Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Types, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Zoetis Inc., Ceva Santé Animale, Merck Animal Health & Co.,Pet Flavors Inc., Virbac Pharmaceutical Company, Bayer Animal Health, Boehringer Ingelheim, Elanco Inc.,Vetoquinol, Dechra Pharmaceuticals, Lee Silsby Compounding Pharmacy, and Wedgewood Pharmacy. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Flavored Veterinary Medication Market Insights

The flavored veterinary medication market is experiencing growth driven by increasing awareness of pet health and wellness among owners. For instance, according to a survey of pet owners in the United States, around 40% of those who own dogs and cats visit the veterinarian annually. Besides, in 2020, consumers in the United States alone expended approximately $118 billion on pets and products related to pets. Pets may resist medication due to taste, making flavored medications crucial for compliance. These products enhance palatability, ensuring pets consume necessary treatments without difficulty. This trend reflects a broader shift towards ensuring pets receive effective healthcare, contributing to the market's expansion. Companies innovate to meet diverse pet preferences, supporting the market's evolution and meeting consumer demand for convenient and effective veterinary treatments.

The flavored veterinary medication market faces challenges due to concerns over safety and efficacy. Pet owners and veterinarians often worry about the potential for adverse reactions or reduced effectiveness when flavorings are added. These concerns can deter widespread adoption of flavored medications, limiting market growth. Regulatory examination also plays a role, as authorities analyze additives for their impact on animal health. Addressing these concerns through exact testing, transparent labeling, and clear communication of benefits could help improve doubts and foster market expansion in the future.

Collaborations between pharmaceutical companies and pet food manufacturers present significant opportunities for the flavored veterinary medication market. By leveraging expertise in pharmaceutical formulation with pet food flavoring technologies, these partnerships can create palatable medications that pets willingly consume. This approach addresses the challenge of administering medications to pets, enhancing compliance and efficacy. Moreover, it opens avenues for novel product development, catering to diverse pet preferences and therapeutic needs. Such collaborations are poised to drive innovation and growth in the burgeoning market for flavored veterinary medications.

Flavored Veterinary Medication Market Segmentation

The worldwide market for flavored veterinary medication is split based on type, end-user, and geography.

Flavored Veterinary Medication Types

- Meat Flavored (Beef, Chicken)

- Fish Flavored (Tuna)

- Cheese Flavored

- Chocolate Flavored

- Others (Tutti-Frutti And Butterscotch)

The meat flavored (beef, chicken) segment is expected to increase over the industry. This dominance stems from their ability to closely mimic familiar tastes that pets find appealing, thereby increasing acceptance and compliance with medication administration. Pets are naturally drawn to meat flavors due to their carnivorous instincts, making these formulations more effective in masking the medicinal taste and ensuring pets consume their prescribed medications without resistance. This preference drives manufacturers to focus heavily on developing meat-flavored options, catering to both pet owner satisfaction and ease of administration in veterinary care.

Flavored Veterinary Medication End-Users

- Cats

- Dogs

- Birds

- Small Animal Reptiles

- Horses

- Others

According to the flavored veterinary medication industry analysis, dogs dominate as the primary end user. This dominance is largely due to the total number of pet dogs worldwide compared to other animals listed. Dogs are also more commonly treated with medications due to their susceptibility to a wide range of health issues, including infections, allergies, and chronic conditions. Additionally, dogs tend to have a higher acceptance of flavored medications compared to cats and other animals, making it easier for owners to administer treatments. The market caters heavily to dog owners preferences for palatable medications, driving product innovation and market growth in this segment.

Flavored Veterinary Medication Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Flavored Veterinary Medication Market Regional Analysis

For several reasons, North America leads the flavored veterinary medication market due to several factors. First, pet ownership rates and higher pet population are high in the region, driving demand for veterinary medications. For instance, since 2010, the percentage of households owning pets has remained relatively stable. However, the total number of pet-owning households in the U.S. has increased in line with the growing population. In 2010, there were 73 million households with pets, a number that has risen to 82 million by 2024. Second, a strong focus on pet health and wellness encourages the adoption of flavored medications to improve compliance. Third, a well-established veterinary healthcare infrastructure supports the development and distribution of these products. Fourth, innovations in formulation techniques make medications more palatable, appealing to both pets and owners. Lastly, stringent regulatory standards ensure quality and safety, bolstering consumer confidence in these products across the continent.

Asia-Pacific is fastest-growing region in flavored veterinary medication market, due to increasing pet ownership and rising awareness about animal health. Demand for flavored medications is driven by pet owners' preference for easy administration and improved palatability. This trend is supported by advancements in veterinary pharmaceuticals catering to diverse animal species across the region.

Flavored Veterinary Medication Market Players

Some of the top flavored veterinary medication companies offered in our report include Zoetis Inc., Ceva Santé Animale, Merck Animal Health & Co., Pet Flavors Inc., Virbac Pharmaceutical Company, Bayer Animal Health, Boehringer Ingelheim, Elanco Inc., Vetoquinol, Dechra Pharmaceuticals, Lee Silsby Compounding Pharmacy, and Wedgewood Pharmacy.

Frequently Asked Questions

How big is the flavored veterinary medication market?

The flavored veterinary medication market size was valued at USD 3.2 billion in 2023.

What is the CAGR of the global flavored veterinary medication market from 2024 to 2032?

The CAGR of flavored veterinary medication is 9.1% during the analysis period of 2024 to 2032.

Which are the key players in the flavored veterinary medication market?

The key players operating in the global market are including Zoetis Inc., Ceva Sant� Animale, Merck Animal Health & Co.,Pet Flavors Inc., Virbac Pharmaceutical Company, Bayer Animal Health, Boehringer Ingelheim, Elanco Inc.,Vetoquinol, Dechra Pharmaceuticals, Lee Silsby Compounding Pharmacy, and Wedgewood Pharmacy.

Which region dominated the global flavored veterinary medication market share?

North America held the dominating position in flavored veterinary medication industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of flavored veterinary medication during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global flavored veterinary medication industry?

The current trends and dynamics in the flavored veterinary medication industry include increasing pet ownership and spending on pet healthcare, growing demand for easier administration of medications to pets, and rising awareness about the importance of pet health and wellness.

Which type held the maximum share in 2023?

The meat flavored (beef, chicken) expected to held the maximum share of the flavored veterinary medication industry.