Flat Glass Market | Acumen Research and Consulting

Flat Glass Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

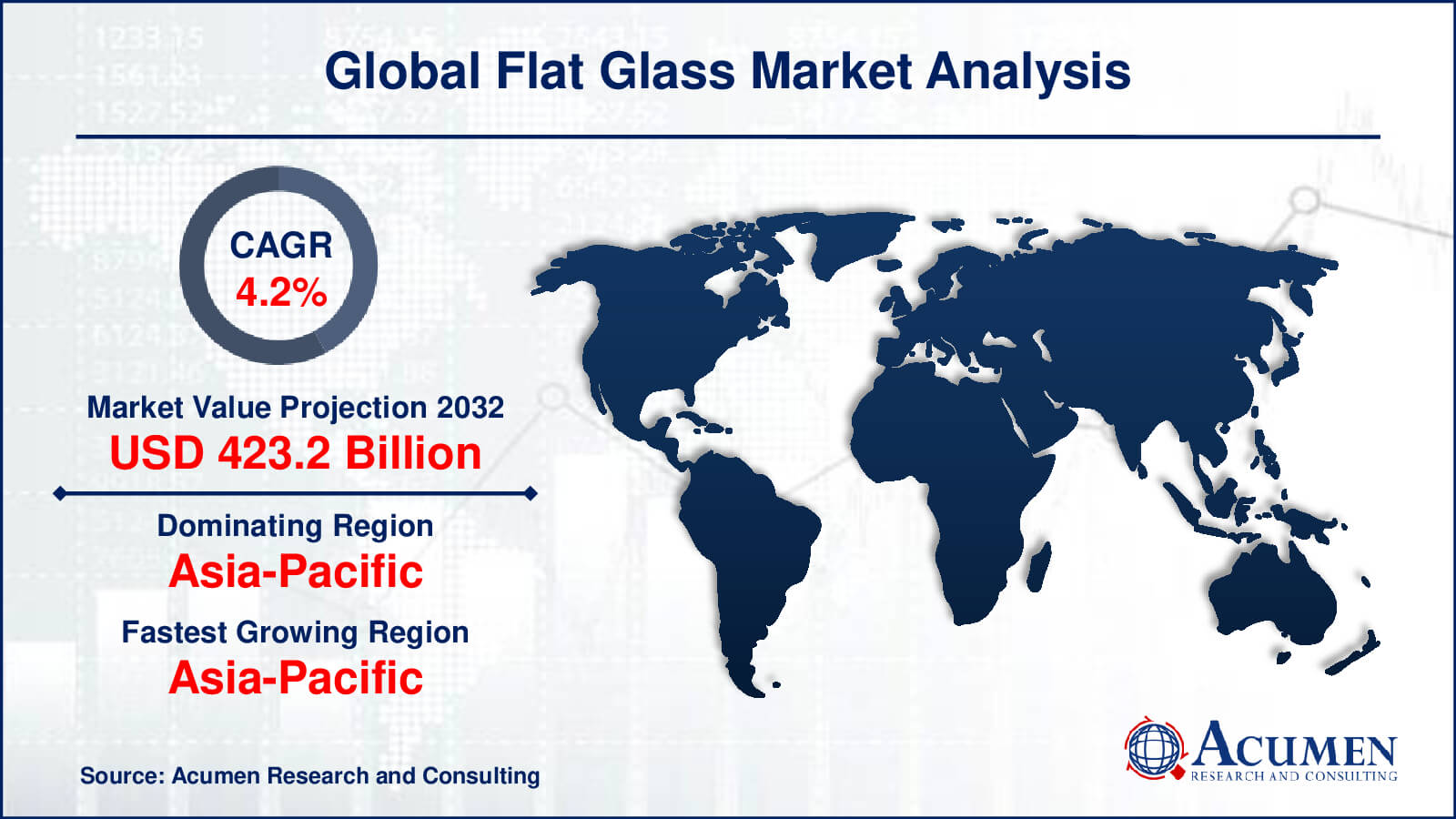

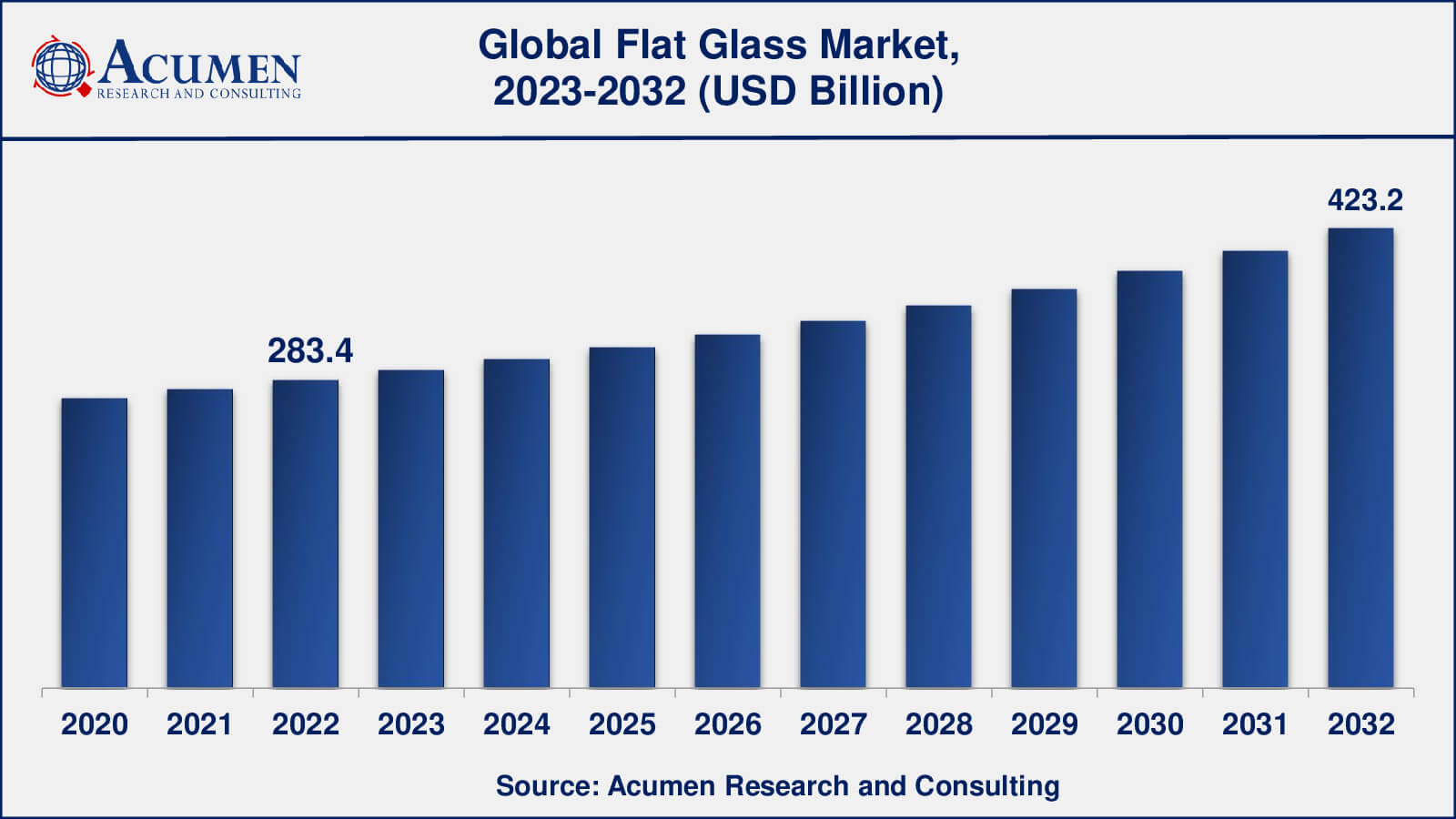

The Global Flat Glass Market Size accounted for USD 283.4 Billion in 2022 and is estimated to achieve a market size of USD 423.2 Billion by 2032 growing at a CAGR of 4.2% from 2023 to 2032.

Flat Glass Market Highlights

- Global flat glass market revenue is poised to garner USD 423.2 billion by 2032 with a CAGR of 4.2% from 2023 to 2032

- Asia-Pacific flat glass market value occupied more than USD 172 billion in 2022

- Asia-Pacific flat glass market growth will record a CAGR of more than 4.5% from 2023 to 2032

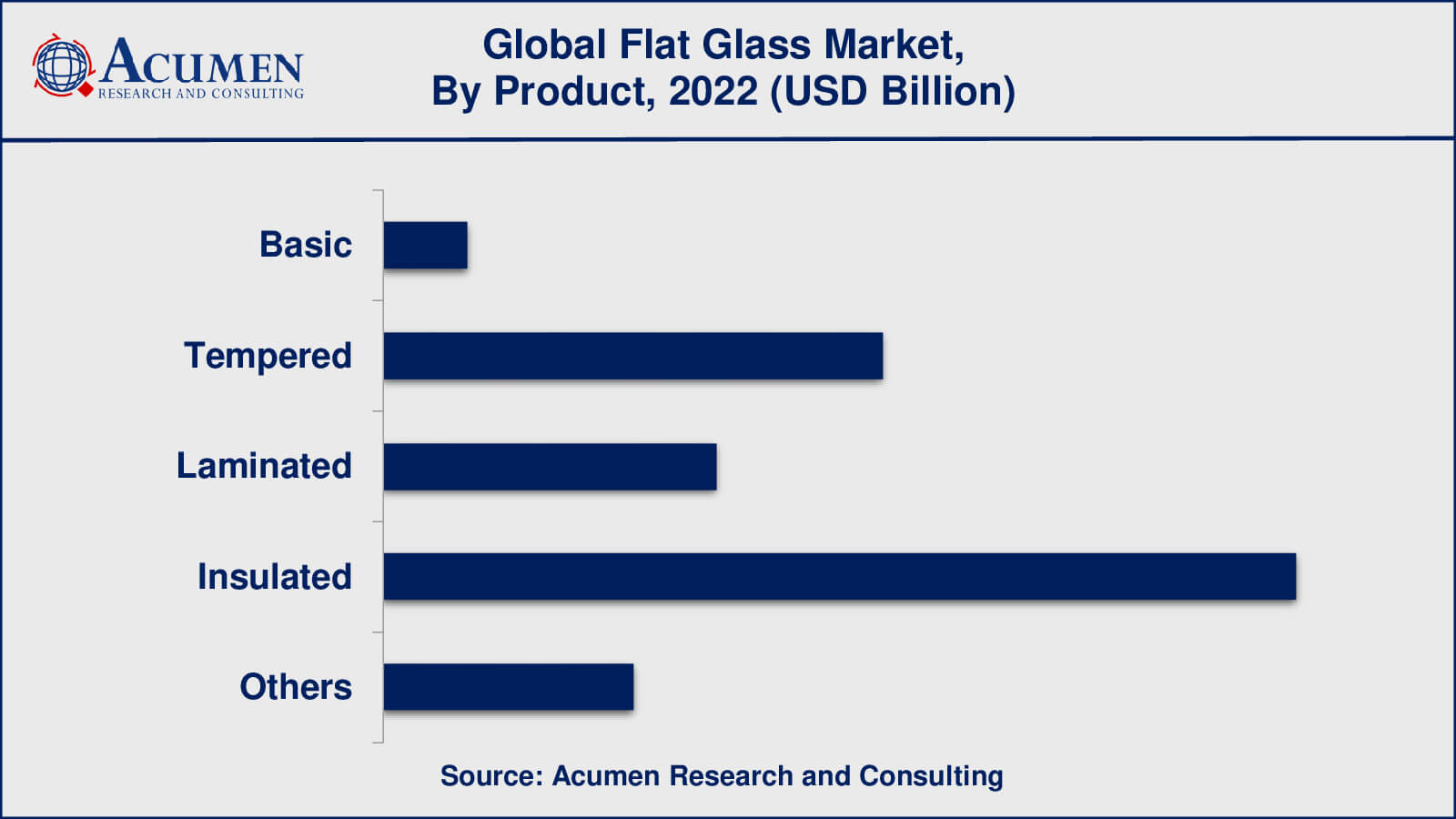

- Among product, the insulated sub-segment generated over US$ 124.7 billion revenue in 2022

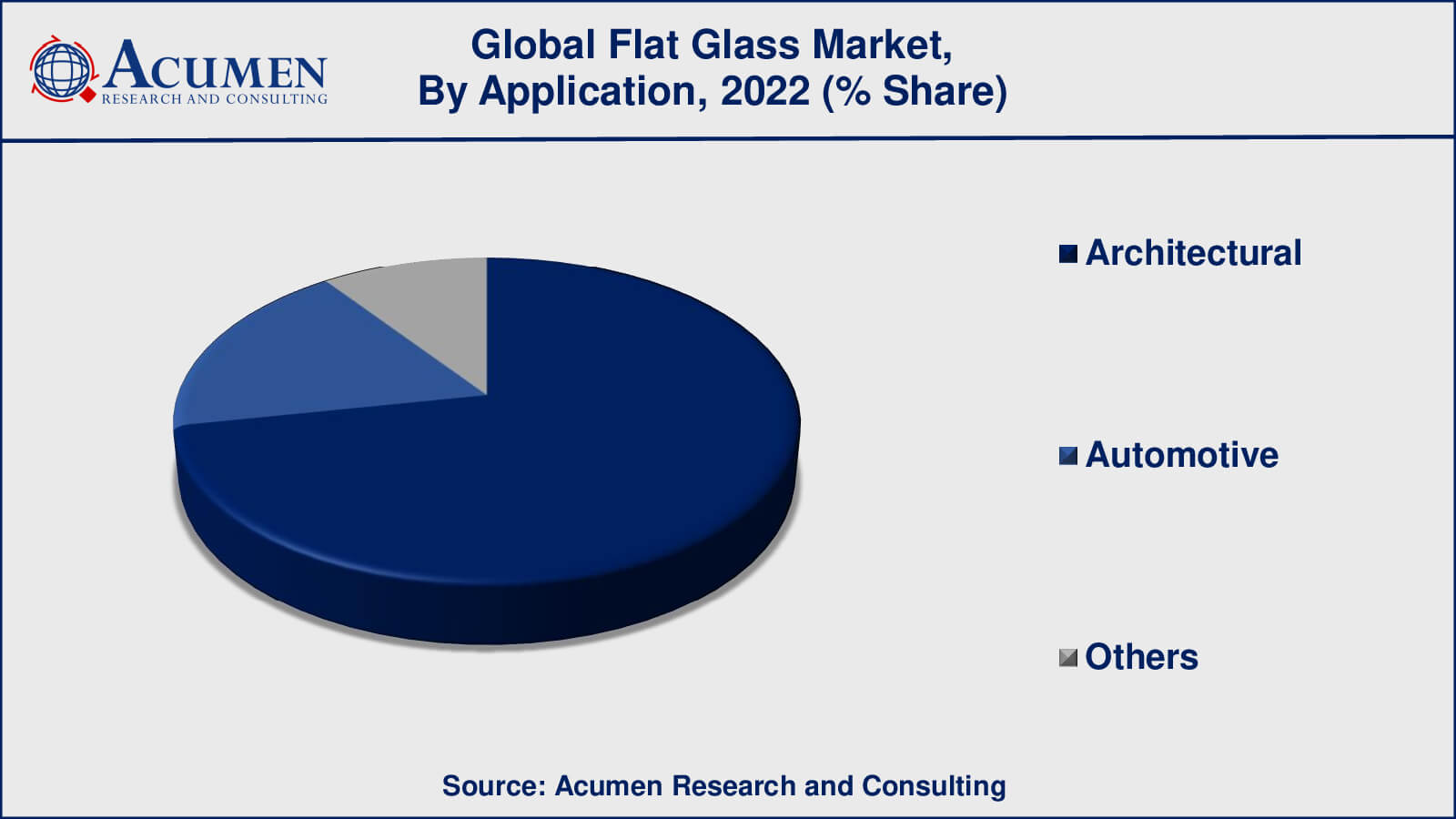

- Based on application, the architectural sub-segment generated around 72% share in 2022

- Rising adoption of smart glass is a popular flat glass market trend that fuels the industry demand

The flat glass is used in multiple industries from beverages to real estate. Growing demand for glass insulation from the construction industry is expected to propel the market for flat glass in the coming years. Flat glass includes all categories of glass manufactured in a flat form such as glass pane, glass sheet, or plate glass, regardless of the method of manufacturing. These glasses are majorly used in the construction sector for building doors, windows, transparent walls, ceilings, etc. It is also used by the automotive industry primarily for manufacturing windshields and windows of vehicles. The flat glass is made up of silica, magnesium oxide, calcium oxide, sodium oxide & aluminum oxide.

Global Flat Glass Market Dynamics

Market Drivers

- Increasing demand from the construction industry

- Growing automotive industry

- Surging demand for solar panels

- Rising disposable income and changing consumer preferences

Market Restraints

- High capital investment

- Fluctuating raw material prices

- Intense competition

Market Opportunities

- Rising demand for energy-efficient glass

- Increasing adoption of smart glass

- Growing demand for electric and hybrid vehicles

Flat Glass Market Report Coverage

| Market | Flat Glass Market |

| Flat Glass Market Size 2022 | USD 283.4 Billion |

| Flat Glass Market Forecast 2032 | USD 423.2 Billion |

| Flat Glass Market CAGR During 2023 - 2032 | 4.2% |

| Flat Glass Market Analysis Period | 2020 - 2032 |

| Flat Glass Market Base Year | 2022 |

| Flat Glass Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AJJ Ltd., Asahi Glass Co. (AGC), CARDINAL GLASS INDUSTRIES, INC, Cevital Group, Guardian Industries, Euroglas, NSG Group, Saint-Gobain, Oldcastle Inc., PPG Industries. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Flat Glass Market Insights

The flat glass market has witnessed notable progress in recent years owing to the rising awareness of the importance of tempered glass in the automotive industry in developing regions due to its lighter weight. The escalating use of insulating and laminated glass in solar energy applications is further expected to enhance market growth. The rise in the construction of new projects and refurbishments of the old ones in myriad regions across the globe combined with rising awareness for reliable building materials is anticipated to drive the growth of the flat glass market.

The swiftly emerging energy market is anticipated to offer strong growth opportunities for the flat glass market during the forecast period. Increasing utilization of photovoltaic modules, e-modules, and solar panels charting to the requirement of clean energy is expected to be the prime factor driving the market growth. Technological advancements regarding energy binding coupled with superior properties comprising sustainability and recycling are predicted to make a positive impact on market growth. However, the accessibility of raw materials and price fluctuations may impact the demand-supply scenario in intensely saturated and concentrated markets. Increasing R&D activities in terms of the development of advanced, customized, and specialized products is anticipated to create new opportunities for the market in the coming years. Several characteristics of flat glass such as noise control, energy saving, luxury design, chemical inertness, self-cleaning properties, cost benefits, and fire resistance make it one of the most preferred choices. Additionally, the application of flat glasses in modern architectural designs is fuelling the global flat glass industry. The regulatory ecosystem of the flat glass market is considered by the implementation of BS codes and other similar strict safety rules. The flat glass market would foresee strong growth owing to the increasing usage of flat glass by OEMs in the developing automotive sector.

Flat Glass Market Segmentation

The worldwide market for flat glass is split based on product, application, and geography.

Flat Glass Market By Product

- Basic

- Tempered

- Laminated

- Insulated

- Others

According to a flat glass industry analysis, the insulated glass segment dominated the global flat glass market. Insulated glass, also known as double glazing, is composed of two or more glass panes separated by a spacer and filled with air or gas, resulting in better insulation and energy efficiency than single-pane glass.

Tempered glass, on the other hand, was the fastest growing product sub-segment in the global flat glass market. Tempered glass is a type of safety glass that is extremely resistant to breaking and is used in a variety of applications such as construction, automotive, and electronics. Factors such as rising safety concerns, increased construction activity, and rising demand for energy-efficient glass products are driving demand for tempered glass.

Flat Glass Market By Application

- Architectural

- Automotive

- Others

According to the flat glass market forecast, the architectural application is expected to lead the flat glass market. Flat glass is widely used in residential and commercial architectural applications such as windows, doors, facades, and partitions. Flat glass demand in the architectural segment is being driven by factors such as increased construction activity, increased urbanisation, and rising demand for energy-efficient building materials.

Flat glass is also used extensively in automotive applications, such as windscreens, side windows, and rear windows. Flat glass demand in the automotive segment is being driven by factors such as increased automobile production and rising demand for vehicle safety and comfort features.

Flat Glass Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Flat Glass Market Regional Analysis

Asia-Pacific dominated the global flat glass market, accounting for the largest share of the market. The growth of the Asia-Pacific flat glass market was driven by factors such as increasing construction activities, rising demand for automobiles, and growing investments in infrastructure development in emerging economies such as China and India.

North America and Europe were the other major regions in the flat glass market, with a significant demand for flat glass in the construction and automotive industries. The growth in the flat glass market in these regions was driven by factors such as increasing demand for energy-efficient and specialty glass products, rising awareness about environmental sustainability, and stringent government regulations regarding energy efficiency in buildings and vehicles.

Flat Glass Market Players

Some of the top flat glass companies offered in the professional report include AJJ Ltd., Asahi Glass Co. (AGC), CARDINAL GLASS INDUSTRIES, INC, Cevital Group, Guardian Industries, Euroglas, NSG Group, Saint-Gobain, Oldcastle Inc., PPG Industries, and Vitro.

Frequently Asked Questions

What was the market size of the global flat glass in 2022?

The market size of flat glass was USD 283.4 Billion in 2022.

What is the CAGR of the global flat glass market from 2023 to 2032?

The CAGR of flat glass is 4.2% during the analysis period of 2023 to 2032.

Which are the key players in the flat glass market?

The key players operating in the global market are including AJJ Ltd., Asahi Glass Co. (AGC), CARDINAL GLASS INDUSTRIES, INC, Cevital Group, Guardian Industries, Euroglas, NSG Group, Saint-Gobain, Oldcastle Inc., PPG Industries.

Which region dominated the global flat glass market share?

Asia-Pacific held the dominating position in flat glass industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of flat glass during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global flat glass industry?

The current trends and dynamics in the flat glass industry include increasing demand from the construction industry, growing automotive industry, and surging demand for solar panels.

Which product held the maximum share in 2022?

The insulated product held the maximum share of the flat glass industry.