Flame Retardant Chemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Flame Retardant Chemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

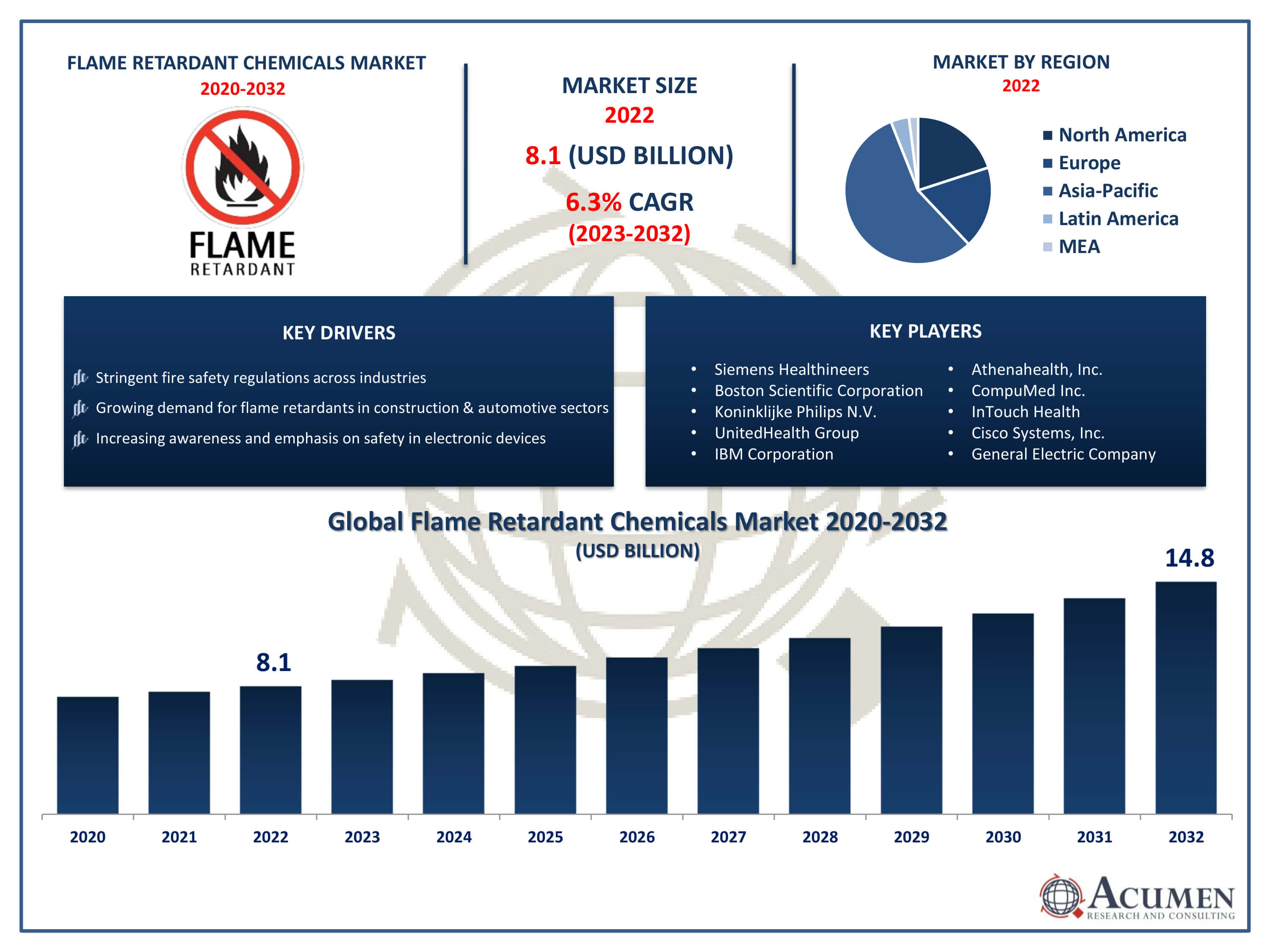

The Flame Retardant Chemicals Market Size accounted for USD 8.1 Billion in 2022 and is projected to achieve a market size of USD 14.8 Billion by 2032 growing at a CAGR of 6.3% from 2023 to 2032.

Flame Retardant Chemicals Market Highlights

- Global flame retardant chemicals market revenue is expected to increase by USD 14.8 billion by 2032, with a 6.3% CAGR from 2023 to 2032

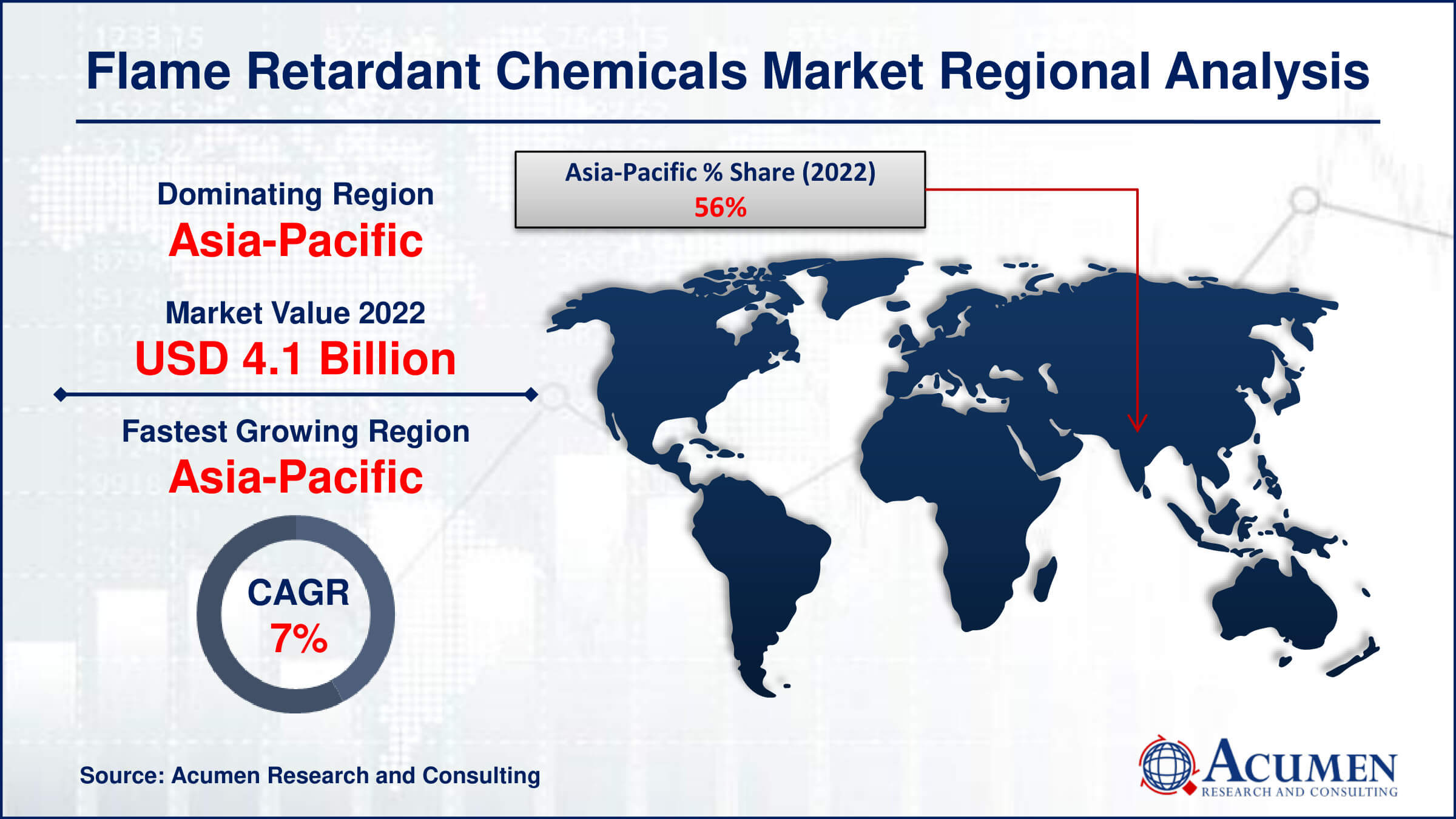

- Asia-Pacific region led with more than 56% of flame retardant chemicals market share in 2022

- By product, the non-halogenated segment captured more than 61% of revenue share in 2022.

- By application, the polyolefin’s segment generated over 27% of revenue share in 2022

- By end-use, the electrical & electronics segment had the largest market share of 38% in 2022

- Growing demand for flame retardants in construction and automotive sectors, drives the flame retardant chemicals market value

Flame retardant chemicals are like superheroes for materials, making things like fabrics, plastics, and foams less likely to catch fire and spread flames. They do this by messing with the way fire normally works, either by forming a shield on the material's surface or by releasing special gases that stop fire from starting or spreading. Over the past few years, there's been a big boom in the market for these flame retardants. People are more aware of fire safety than ever before, and rules about using flammable materials are getting stricter. This has especially boosted demand in industries like construction and automotive, where flame retardants are crucial for making buildings and vehicles safer. Even the world of electronics and appliances is getting in on the action, as more gadgets mean more need for fire-safe materials to protect all those electrical parts. With safety becoming a top priority across industries and regulations getting tougher, it's likely that the flame retardant market will keep on growing.

Flame retardant chemicals are like superheroes for materials, making things like fabrics, plastics, and foams less likely to catch fire and spread flames. They do this by messing with the way fire normally works, either by forming a shield on the material's surface or by releasing special gases that stop fire from starting or spreading. Over the past few years, there's been a big boom in the market for these flame retardants. People are more aware of fire safety than ever before, and rules about using flammable materials are getting stricter. This has especially boosted demand in industries like construction and automotive, where flame retardants are crucial for making buildings and vehicles safer. Even the world of electronics and appliances is getting in on the action, as more gadgets mean more need for fire-safe materials to protect all those electrical parts. With safety becoming a top priority across industries and regulations getting tougher, it's likely that the flame retardant market will keep on growing.

Global Flame Retardant Chemicals Market Dynamics

Market Drivers

- Stringent fire safety regulations across industries

- Growing demand for flame retardants in construction and automotive sectors

- Increasing awareness and emphasis on safety in electronic devices

- Growing awareness of fire safety propelling market expansion worldwide

Market Restraints

- Environmental concerns associated with certain flame retardant formulations

- Regulatory scrutiny leading to restrictions on specific chemical types

Market Opportunities

- Development of eco-friendly and sustainable flame retardant alternatives.

- Emerging applications, such as 3D printing materials, creating new demand avenues

Flame Retardant Chemicals Market Report Coverage

| Market | Flame Retardant Chemicals Market |

| Flame Retardant Chemicals Market Size 2022 | USD 8.1 Billion |

| Flame Retardant Chemicals Market Forecast 2032 | USD 14.8 Billion |

| Flame Retardant Chemicals Market CAGR During 2023 - 2032 | 6.3% |

| Flame Retardant Chemicals Market Analysis Period | 2020 - 2032 |

| Flame Retardant Chemicals Market Base Year |

2022 |

| Flame Retardant Chemicals Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Albemarle Corporation, CLARIANT, ICL, Huber Engineered Materials, LANXESS, DSM, Italmatch Chemicals S.p.A, THOR, BASF SE, DuPont, FRX Innovations, and Jiangsu Yoke Technology Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Flame retardant chemicals play a crucial role in enhancing fire safety by inhibiting and slowing down the combustion process of materials. This helps to significantly improve the fire resistance of various products and materials across industries such as construction, automotive, and electronics. In construction, flame retardants are commonly used in insulation, coatings, and textiles to meet stringent fire safety standards for buildings. Similarly, in the automotive sector, these chemicals are integrated into components like seat covers, dashboard materials, and wiring to bolster the fire resistance of vehicles.

The market for flame retardant chemicals is witnessing robust growth, driven by stringent regulations and standards governing fire safety, particularly in industries like construction, automotive, and electronics. The imperative to enhance the fire resistance of materials across diverse applications has led to widespread adoption among manufacturers. Additionally, heightened awareness of safety measures and the increasing occurrence of fire incidents further stimulate market expansion. While construction and automotive sectors continue to drive growth, opportunities are emerging in novel applications, such as the utilization of flame retardants in 3D printing materials.

In recent years, the flame retardant chemicals industry has experienced significant shifts, particularly in response to growing concerns about the environmental impact of existing formulations. A notable trend is the increasing demand for ecologically friendly flame retardants, prompting manufacturers to focus on developing non-toxic and sustainable alternatives. These efforts aim to address regulatory requirements and consumer preferences for greener products. Furthermore, technological advancements are enabling the creation of innovative flame retardant solutions tailored to emerging applications, such as 3D printing materials. These trends underscore a movement towards sustainability and technical innovation within the flame retardant chemicals industry, shaping its future trajectory.

Flame Retardant Chemicals Market Segmentation

The global flame retardant chemicals market segmentation is based on product, application, end-use, and geography.

Flame Retardant Chemicals Market By Product

- Halogenated

- Antimony Trioxide

- Chlorinated Phosphates

- Brominated

- Others

- Non-Halogenated

- Phosphorus Based

- Magnesium Dihydroxide

- Aluminum Hydroxide

- Others

According to the flame retardant chemicals industry analysis, the dominance of non-halogenated flame retardants in 2022 was a notable trend, largely fueled by mounting concerns surrounding the environmental and health impacts linked with traditional halogenated variants. Industries are increasingly gravitating towards non-halogenated options, like phosphorus-based compounds and mineral fillers, owing to their reduced toxicity and environmental footprint. As regulatory bodies tighten restrictions on halogenated flame retardants, sectors like electronics, construction, and textiles are swiftly embracing these eco-friendly alternatives. Especially in the realm of electronics, where stringent regulations meet consumer demands for greener products, non-halogenated solutions are gaining traction among manufacturers. The halogen segment is projected to experience significant market share growth during the flame retardant chemicals market forecast period. In 2022, halogen compounds constituted the largest segment of the market, and they are expected to maintain their leading position throughout the forecast period.

Flame Retardant Chemicals Market By Application

- Polyolefins

- Rubber

- Epoxy Resins

- Styrenics

- UPE

- PVC

- ETP

- Others

Looking ahead, the polyolefins segment is poised for substantial growth in the foreseeable future. This surge is underpinned by the widespread utilization of polyolefin materials, such as polyethylene and polypropylene, across diverse industries. Renowned for their lightweight, durable, and cost-effective properties, polyolefins find application in everything from packaging materials to automotive components. With fire safety regulations tightening across sectors, the demand for flame retardant polyolefins has surged, driven by the imperative to bolster the fire resistance of these versatile materials. The automotive industry, in particular, is propelling the growth of the polyolefins segment, as the pursuit of lightweight materials to enhance fuel efficiency places polyolefins at the forefront of automotive design.

Flame Retardant Chemicals Market By End-use

- Construction

- Electrical & Electronics

- Transportation

- Others

Forecasting the future of the flame retardant chemicals market, significant growth is anticipated in the electrical and electronics segment. This trajectory is propelled by the burgeoning integration of electronic components into various consumer and industrial applications. As electronic devices become ubiquitous in our daily lives, ensuring their fire safety emerges as a paramount concern. Flame retardant chemicals play a pivotal role in safeguarding electronic components and mitigating fire propagation, rendering them indispensable in the design and manufacturing processes of electrical and electronic devices. The stringent safety standards mandated by regulatory bodies further underscore the demand for flame retardant chemicals in this segment, compelling manufacturers to prioritize enhancing the fire resistance of products ranging from circuit boards to casings.

The construction segment is anticipated to experience the fastest growth over the forecast period, propelled by significant increases in commercial construction investments. Statistics Canada reported a 1.4% rise in investments in commercial construction in November 2021 compared to 2020. Similarly, the European Union's December 2021 report indicated a 4.6% increase in building construction from the previous year. This rapid expansion in the building and construction sector is driving heightened demand and usage of Flame Retardant Chemicals, consequently fueling market growth during the flame retardant chemicals industry forecast period.

Flame Retardant Chemicals Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Flame Retardant Chemicals Market Regional Analysis

The Asia-Pacific region has swiftly risen as a dominant force in the flame retardant chemicals market, driven by the rapid pace of industrialization, urbanization, and burgeoning construction and manufacturing endeavors. This dynamic landscape is fueled by the significant economic growth experienced across countries in the region, prompting a heightened emphasis on safety regulations and standards. Notably, the construction sector has emerged as a key driver of growth, with nations such as China and India spearheading extensive infrastructure development initiatives. The demand for flame retardant materials in building construction and interior applications has notably propelled the Asia-Pacific region to the forefront of the market.

Plus, the manufacturing growth in Asia-Pacific, notably in the electronics and automotive industries, has increased the need for flame retardant chemicals to improve product safety requirements. With a thriving electronics sector and a large customer base for electronic gadgets, there is a significant need for flame retardants to assure the fire safety of both components and devices. Furthermore, tight environmental laws and growing awareness of the harmful consequences of old flame retardants have accelerated the adoption of newer, eco-friendly alternatives throughout the area. This trend highlights the importance of Asia-Pacific in fostering innovation and sustainability in the flame retardant chemicals industry.

Flame Retardant Chemicals Market Player

Some of the top flame retardant chemicals market companies offered in the professional report include Albemarle Corporation, CLARIANT, ICL, Huber Engineered Materials, LANXESS, DSM, Italmatch Chemicals S.p.A, THOR, BASF SE, DuPont, FRX Innovations, and Jiangsu Yoke Technology Co. Ltd.

Frequently Asked Questions

How big is the flame retardant chemicals market?

The flame retardant chemicals market size was USD 8.1 Billion in 2022.

What is the CAGR of the global flame retardant chemicals market from 2023 to 2032?

The CAGR of flame retardant chemicals is 6.3% during the analysis period of 2023 to 2032.

Which are the key players in the flame retardant chemicals market?

The key players operating in the global market are including Albemarle Corporation, CLARIANT, ICL, Huber Engineered Materials, LANXESS, DSM, Italmatch Chemicals S.p.A, THOR, BASF SE, DuPont, FRX Innovations, and Jiangsu Yoke Technology Co. Ltd.

Which region dominated the global flame retardant chemicals market share?

North America held the dominating position in flame retardant chemicals industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of flame retardant chemicals during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global flame retardant chemicals industry?

The current trends and dynamics in the flame retardant chemicals industry include stringent fire safety regulations across industries, growing demand for flame retardants in construction and automotive sectors, and increasing awareness and emphasis on safety in electronic devices.

Which application held the maximum share in 2022?

The polyolefins application held the maximum share of the flame retardant chemicals industry.