First And Last Mile Delivery Market | Acumen Research and Consulting

First and Last Mile Delivery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

The Global First and Last Mile Delivery Market Size accounted for USD 155.1 Billion in 2021 and is projected to occupy a market size of USD 409.7 Billion by 2030 growing at a CAGR of 6.6% from 2022 to 2030.

First mile means the transfer of various products from a vendor to a courier service or to anyone who is wanted to move goods to their final users. The last mile refers to the final transfer of product to their final proposed customers. First mile delivery can simply be known as the last mile delivery for a manufacturer. The report provides analysis of global first and last mile delivery market for the period 2018-2030, wherein 2022 to 2030 is the forecast period and 2021 is considered as the base year.

First and Last Mile Delivery Market Report Statistics

- Global first and last mile delivery market revenue is projected to reach USD 409.7 billion by 2030 with a CAGR of 6.6% from 2022 to 2030

- Asia-Pacific first and last mile delivery market share generated over US$ 63.59 billion revenue in 2021

- North America first and last mile delivery market growth will record noteworthy CAGR from 2022 to 2030

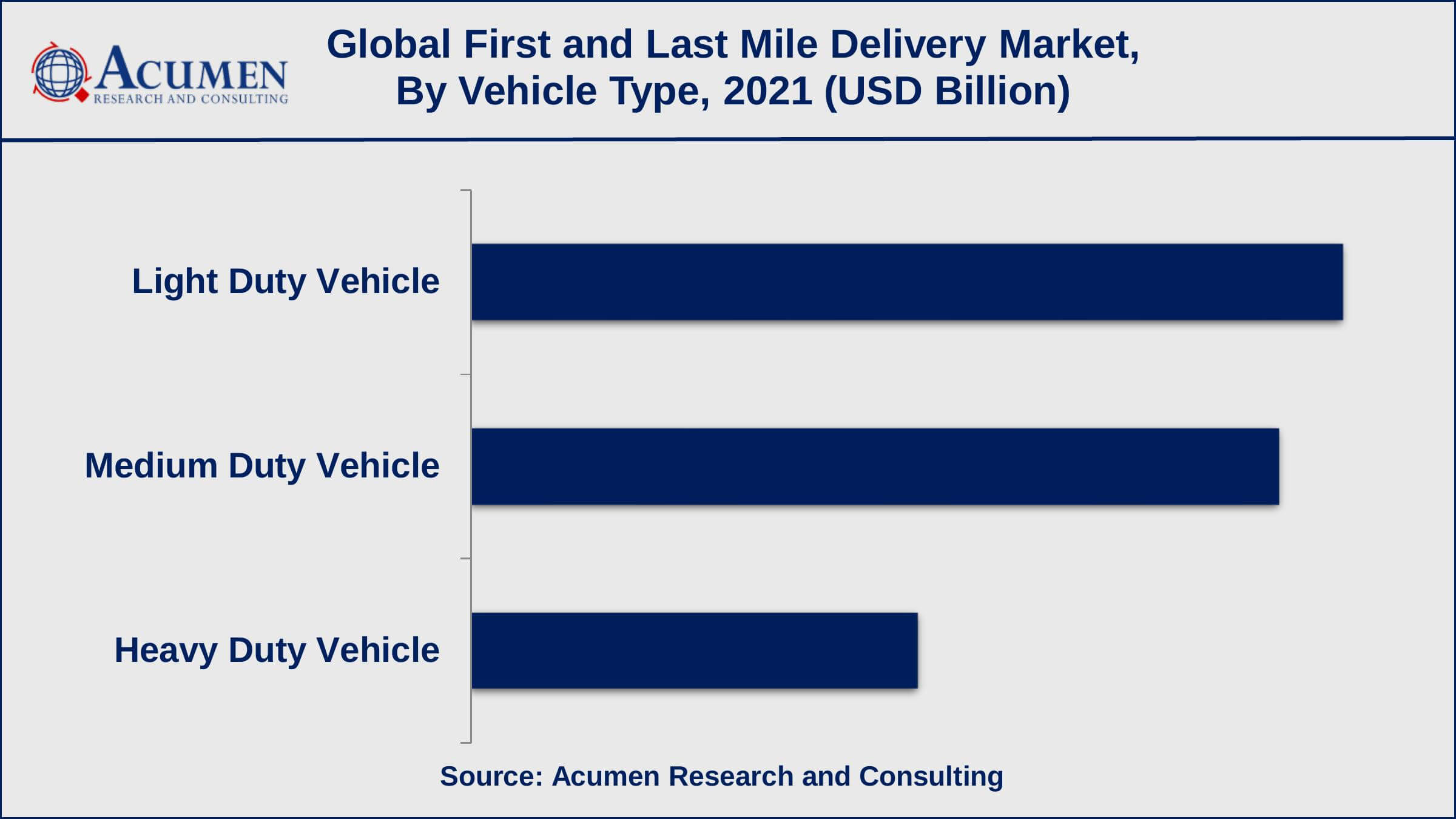

- Based on vehicle type, light duty vehicle sub-segment gathered 40% shares in 2021

- Among cargo type, dry goods recorded 39% shares in 2021

- Growing adoption of drones in delivery is a popular first and last mile delivery market trend that fuels the industry demand

Global First and Last Mile Delivery Market Dynamics

Market Drivers

- Growing popularity of technology-driven platforms

- Reduction in delivery cost

- Increasing development in ground delivery vehicles

- Rising penetration of internet and smartphones in developing nations

Market Restraints

- Poor management of last-mile delivery operations

- Stringent guidelines pertaining to operations of ground delivery vehicles

Market Opportunities

- Expanding e-commerce industry

- Increasing automation in warehousing and delivery processes

First and Last Mile Delivery Market Report Coverage

| Market | First and Last Mile Delivery Market |

| First and Last Mile Delivery Market Size 2021 | USD 155.1 Billion |

| First and Last Mile Delivery Market Forecast 2030 | USD 409.7 Billion |

| First and Last Mile Delivery Market CAGR During 2022 - 2030 | 6.6% |

| First and Last Mile Delivery Market Analysis Period | 2018 - 2030 |

| First and Last Mile Delivery Market Base Year | 2021 |

| First and Last Mile Delivery Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Vehicle Type, By Cargo Type, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cargo Carriers Limited, United Parcel Service Inc., Swift Transport, Interlogix Pty. Ltd., Transtech Logistics, TNT Express, Tuma Transport, DB SCHENKER, FedEx Corporation, Concargo Private Limited, Procet Freight, J&J Global Limited, Kerry Logistics Network Limited, DHL Global Forwarding and KART. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

First and Last Mile Delivery Market Growth Factors

Rising number of last mile and first mile delivery companies and start-ups, rapid growth in the logistics industry, changing standards of living, expansion of transport facilities, growing penetration of smartphones, increased disposable income, increasing demand for automation and advancements in technology are some of the primary factors that are propelling the first and last mile delivery market growth across the globe. As first and last mile delivery service has large number of applications in the logistic industry, rising number of last mile and first mile delivery companies and start-ups are providing various intense opportunities for the logistics industry. Augment in population is increasing the consumption and supply of food and other goods across the globe. A number of customers are keen to pay extra charge for quick delivery, resulting in the high demand for first and last mile delivery and is anticipated to supplement the overall market growth in coming years. The ongoing developments in the last mile delivery ecosystem are helping the global market to grow. In addition, acceleration, retail price, fuel economy, ease of operation and interior volume of light duty vehicles are forcing most logistic companies to use light duty vehicles. Road transportation activities are increasing across the globe, thereby boosting the overall growth of the market. Development of electric vehicles and stringent emission norms by OEMs are expected to spur the global first and last mile delivery market during the forecast period. However, an increase in the unemployment rate because of the replacement of laborers and delivery boys by drones and robots may hinder the global first and last mile delivery market growth over the forecast time frame.

First and Last Mile Delivery Market Segmentation

The global first and last mile delivery market is segmented based on vehicle type, cargo type, end-use, and geography.

First and Last Mile Delivery Market By Vehicle Type

- Light Duty Vehicle

- Medium Duty Vehicle

- Heavy Duty Vehicle

According to our first and last mile delivery industry analysis, the light duty vehicle sub-segment accounted for majority of the revenue in 2021, and this trend is expected to continue in the coming years. The light duty vehicle segment's first and last mile delivery market share is expected to grow, as light commercial vehicle sales are high and it can easily transport FMCG and food & beverage products.

First and Last Mile Delivery Market By Cargo Type

- Dry Goods

- Postal

- Liquid Goods

According to our first and last mile delivery market forecast, the dry goods cargo type will account for a sizable market share from 2022 to 2030. Chemicals, liquor, oil, and other liquid goods face transportation and delivery constraints in various countries and such materials require a leak-proof vessel for transportation, raising the cost even further.

First and Last Mile Delivery Market By End-Use

- Chemical

- Pharmaceutical and Healthcare

- FMCG

- Hi-tech Product Industry

- Food and Beverage

- Others

Based on end-use segment, the FMCG sub-segment is expected to generate significant market share in 2021 and is likely to do so in the coming years. The noteworthy market share in the segment is credited to increased disposable income, increased digital connectivity in rural and urban areas, and increased demand for FMCG products via e-commerce portals. On the other hand, food & beverage and pharmaceutical and healthcare are likely to gain significant impetus during the forecasted timeframe from 2022 to 2030.

First and Last Mile Delivery Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

First and Last Mile Delivery Market Regional Analysis

Asia-Pacific leads the global first and last mile delivery markets due to the countries' large populations, which serve as a major consumer base for the e-commerce space. Population growth, an increase in commodity requirements, the existence of third-party logistics (3PL) service providers offering first and last mile deliveries and an increase in the trend of online shopping are some of the key factors driving the Asia-Pacific market. North America and Europe have emerged as the leading first and last mile markets.

First and Last Mile Delivery Market Players

The global first and last mile delivery market is characterized by the presence of experienced and established players. The global first and last mile delivery market is characterized by the presence of experienced and established players. Some of the key players include Cargo Carriers Limited, United Parcel Service Inc., Swift Transport, Interlogix Pty. Ltd., Transtech Logistics, TNT Express, Tuma Transport, DB SCHENKER, FedEx Corporation, Concargo Private Limited, Procet Freight, J&J Global Limited, Kerry Logistics Network Limited, DHL Global Forwarding and KART.

Frequently Asked Questions

What is the size of global first and last mile delivery market in 2021?

The market size of first and last mile delivery market in 2021 was accounted to be USD 155.1 Billion.

What is the CAGR of global first and last mile delivery market during forecast period of 2022 to 2030?

The projected CAGR of first and last mile delivery market during the analysis period of 2022 to 2030 is 6.6%.

Which are the key players operating in the market?

The prominent players of the global first and last mile delivery market include Cargo Carriers Limited, United Parcel Service Inc., Swift Transport, Interlogix Pty. Ltd., Transtech Logistics, TNT Express, Tuma Transport, DB SCHENKER, FedEx Corporation, Concargo Private Limited, Procet Freight, J&J Global Limited, Kerry Logistics Network Limited, DHL Global Forwarding and KART.

Which region held the dominating position in the global first and last mile delivery market?

North America held the dominating first and last mile delivery during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for first and last mile delivery during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global first and last mile delivery market?

Growing popularity of technology-driven platforms, reduction in delivery cost, and increasing development in ground delivery vehicles drives the growth of global first and last mile delivery market.

Which vehicle type held the maximum share in 2021?

Based on vehicle type, light duty vehicle segment is expected to hold the maximum share of the first and last mile delivery market.