Financial Protection Market | Acumen Research and Consulting

Financial Protection Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

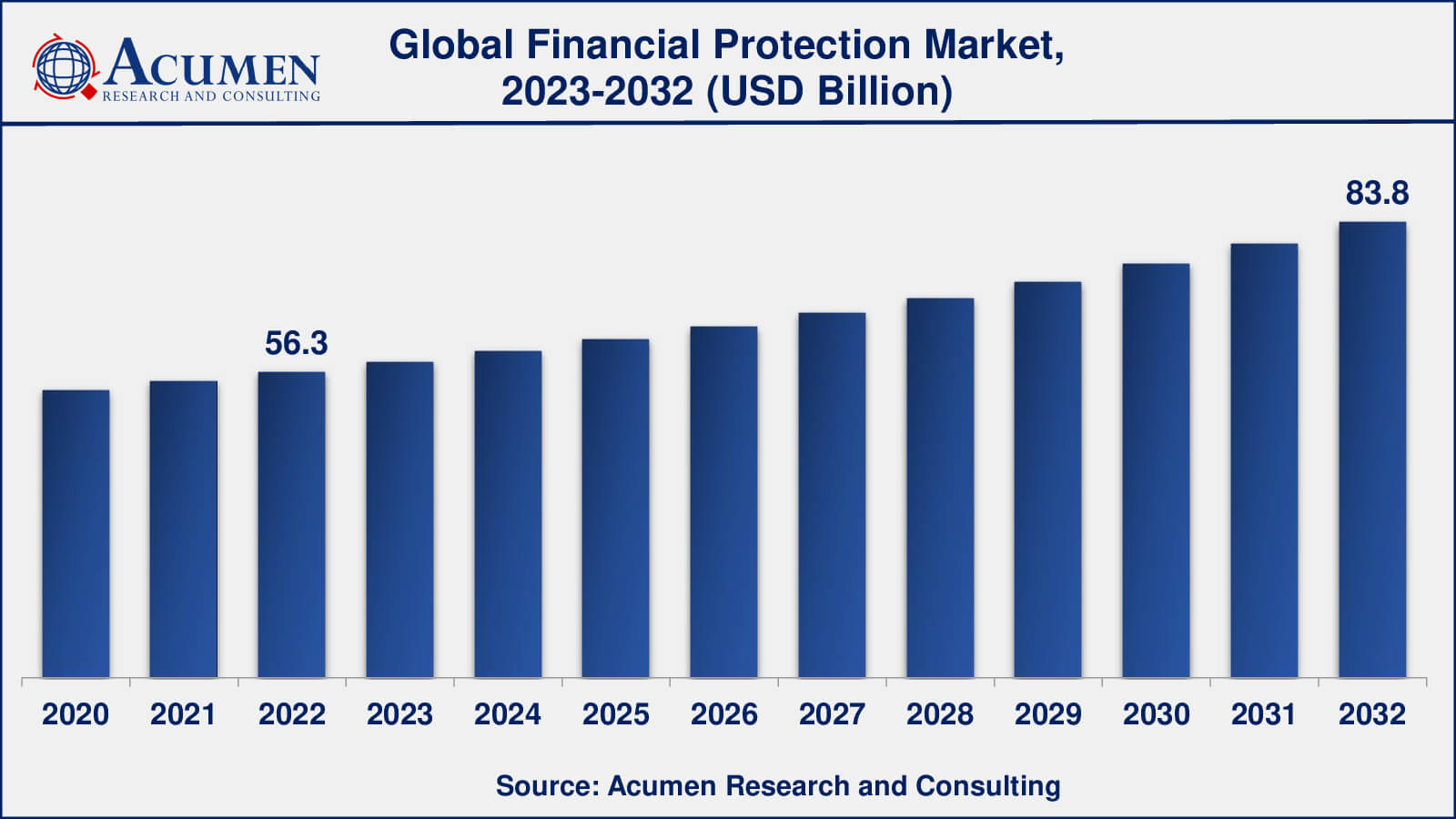

The Global Financial Protection Market size was valued at USD 56.3 Billion in 2022 and is projected to reach USD 83.8 Billion by 2032 mounting at a CAGR of 4.2% from 2023 to 2032.

Financial Protection Market Highlights

- Global financial protection market revenue is poised to garner USD 83.8 billion by 2032 with a CAGR of 4.2% from 2023 to 2032

- North America financial protection market value occupied around USD 20.3 billion in 2022

- Asia-Pacific financial protection market growth will record a CAGR of more than 5% from 2023 to 2032

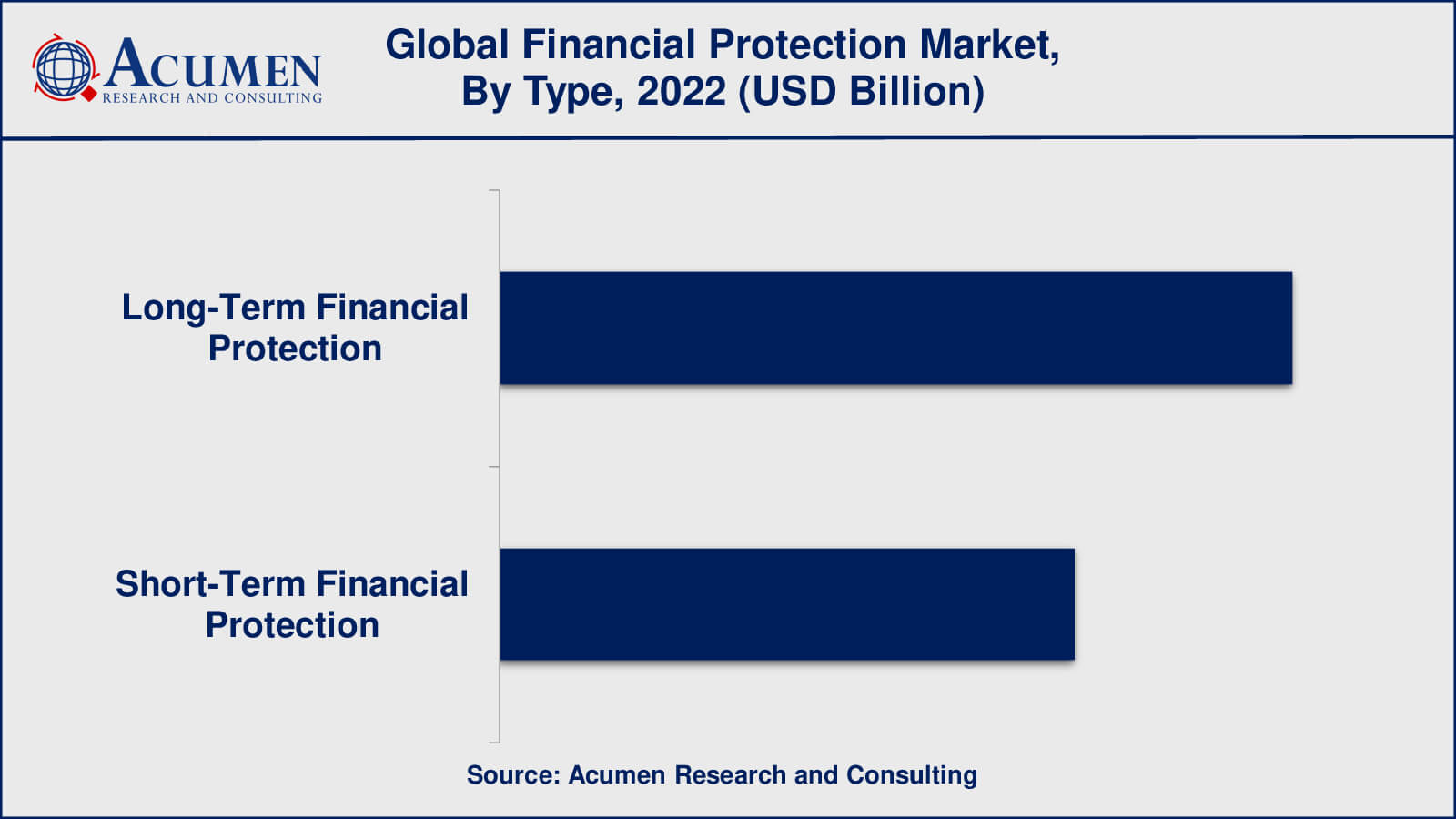

- Among type, the long-term financial protection sub-segment generated over US$ 32.7 billion revenue in 2022

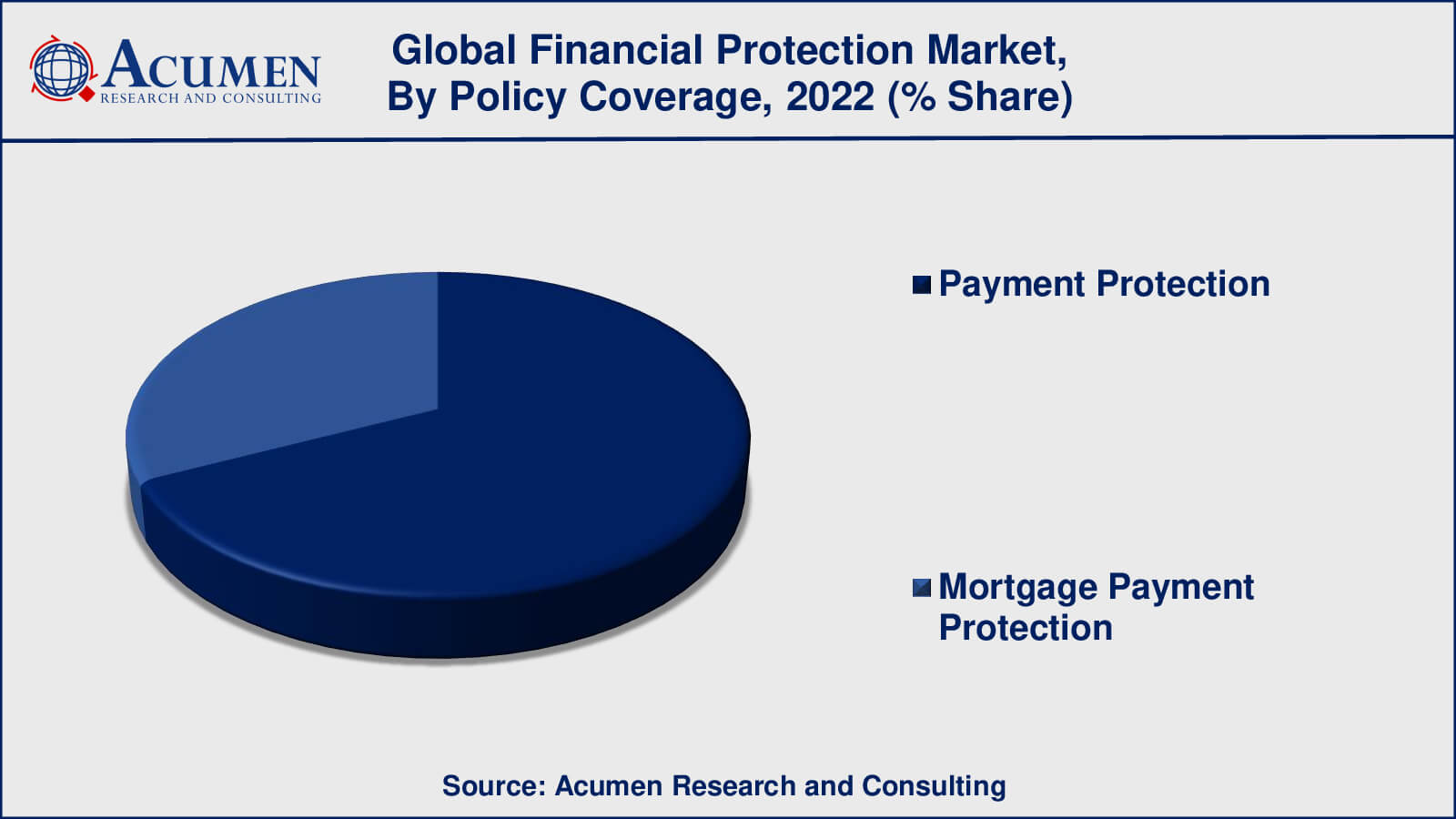

- Based on policy coverage, the payment protection sub-segment generated around 68% share in 2022

- Customization and innovation of financial protection solutions is a popular market trend that fuels the industry demand

Financial protection refers to the measures and strategies individuals and businesses implement to safeguard themselves against potential financial risks and uncertainties. It involves acquiring appropriate insurance coverage, establishing contingency plans, and implementing risk management practices. Financial protection is important because it helps manage and minimize the impact of unforeseen events on one's financial well-being. It provides peace of mind by alleviating anxiety and allowing individuals and businesses to focus on their daily activities without constant worry about financial setbacks. Financial protection also safeguards valuable assets, preserves net worth, ensures income stability, and supports long-term financial planning. Overall, it enhances financial security and resilience in the face of uncertainties.

Global Financial Protection Market Dynamics

Market Drivers

- Increasing awareness of financial risks and uncertainties

- Changing demographics drive demand for financial protection

- Technological advancements enhance accessibility to financial protection products

Market Restraints

- Affordability hinders adoption of financial protection products

- Lack of understanding about available financial protection options

Market Opportunities

- Growth potential in emerging markets

- Partnerships and expanded distribution channels

- Rising healthcare costs drive demand for medical-related protection products

- Supportive regulatory frameworks promote market growth

Financial Protection Market Report Coverage

| Market | Financial Protection Market |

| Financial Protection Market Size 2022 | USD 56.3 Billion |

| Financial Protection Market Forecast 2032 | USD 83.8 Billion |

| Financial Protection Market CAGR During 2023 - 2032 | 4.2% |

| Financial Protection Market Analysis Period | 2020 - 2032 |

| Financial Protection Market Base Year | 2022 |

| Financial Protection Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Policy Coverage, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Allianz SE. Prudential Financial Inc., AIG (American International Group), MetLife Inc., AXA SA, Zurich Insurance Group Ltd., Manulife Financial Corporation, New York Life Insurance Company, Ping An Insurance Group, and Berkshire Hathaway Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Financial Protection Market Insights

Various dynamic forces impact the financial protection market, shaping its landscape and driving its expansion. One of the important factors is the growing awareness among individuals and organizations of the need of mitigating financial risks and uncertainties. People are becoming more aware of potential financial setbacks, therefore they seek strategies to limit these risks, resulting in an increase in demand for financial protection goods and services.

Demographic changes can have a substantial impact on market dynamics. The need for financial security is being driven by factors such as an ageing population and rising family income. As people age and gain money, they look for strategies to protect their assets and secure a steady income in the future. This demographic transition opens up chances for financial protection providers to cater to the individual demands of different age groups and income levels.

Technological improvements have changed the financial protection industry by making it more accessible and convenient. The growth of digital platforms and internet technologies has made purchasing financial protection solutions easier. Customers may now evaluate various alternatives, acquire quotations, and purchase policies online. Because of this improved accessibility, financial protection companies' customer base has grown and new distribution channels have opened up.

However, there are market constraints that impact its behavior. Many individuals and companies are concerned about affordability. Some potential consumers may be put off by the expense of financial protection solutions, such as insurance premiums and fees. Because of the perceived high prices, they may refrain from acquiring proper protection, impeding market expansion.

Another barrier is a lack of understanding or knowledge about the many financial protection choices accessible. Many people may be unaware of the numerous products and services available to assist minimize financial risks. This misunderstanding stifles market growth because potential clients may be unaware of the benefits of financial protection or how it might meet their individual needs.

Financial Protection Market Segmentation

The worldwide market for financial protection is split based on type, policy coverage, end-user, and geography.

Financial Protection Types

- Long-Term Financial Protection

- Short-Term Financial Protection

According to financial protection industry analysis, in 2022, long-term protection held the biggest market share. Long-term financial protection usually refers to products and methods that offer coverage and assurance over a long period of time, frequently several years or even a lifetime. Life insurance policies, retirement plans, and long-term growth investment vehicles are all examples. These products are designed to provide long-term financial stability and security by addressing risks like as mortality, disability, and retirement income.

In contrast, short-term financial protection focuses on providing coverage for current or near-future risks and uncertainties. This can include things like health insurance, property and casualty insurance, emergency cash, and short-term savings. Short-term financial protection is usually aimed at limiting risks that have an immediate impact on one's financial condition.

Financial Protection Policy Coverage

- Payment Protection

- Mortgage Payment Protection

As per the financial protection market forecast, the payment protection insurance often cover a wide range of financial responsibilities, such as mortgage payments, loan repayments, credit card bills, and other recurring costs. These plans are intended to protect people or companies from income loss or financial difficulty as a result of causes like as illness, disability, job loss, or death. They frequently provide a variety of coverage alternatives, including features like as income replacement, loan payment deferral, and debt forgiveness.

Mortgage payment protection, on the other hand, is designed to cover mortgage payments in the case of a loss of income or other qualifying conditions. It is intended to assist homeowners or mortgage borrowers in meeting their mortgage commitments during difficult times. Mortgage payment protection insurance may include provisions such as interim payment coverage, mortgage payment postponement, and help in the event of job loss or incapacity.

While payment protection insurance cover a larger variety of financial responsibilities, including mortgage payments, they are more well recognised and available in the market. Mortgage payment protection insurance, on the other hand, address just mortgage-related issues. The dominance of either policy coverage in the financial protection market would necessitate an examination of market share, customer demand, and industry trends relevant to the market and timeframe under consideration.

Financial Protection End-Users

- Men

- Women

In recent years, there has been a trend towards gender equality and a clearer understanding of the special financial issues that women confront. Women's need for financial protection solutions has risen as they advance in the job, become major wage earners, and make critical financial decisions. Women are increasingly recognising the importance of products such as life insurance, health insurance, income protection, and retirement planning in protecting their financial well-being and the well-being of their families.

Financial Protection Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Financial Protection Market Regional Analysis

The financial protection market in North America is impacted by factors such as a healthy insurance business, increased consumer awareness, and an emphasis on retirement planning. The United States and Canada are prominent competitors in this sector, offering a diverse variety of insurance and retirement planning alternatives. Market dynamics are shaped by regulatory frameworks and customer preferences, with a rising emphasis on customized solutions and digital platforms.

Europe has a developed financial protection industry that is distinguished by a wide range of insurance products and a strong emphasis on risk management. Countries with well-established insurance industries and strong penetration of life insurance and pension products include the United Kingdom, Germany, and France. Regulatory frameworks, demographic trends, and technology improvements all have an impact on market dynamics.

The Asia-Pacific area is witnessing substantial expansion in the financial protection industry as a result of factors like as growing wages, expanding middle-class populations, and increased awareness of the need for protection. China, Japan, India, and South Korea are major participants in this industry. Cultural norms, regulatory settings, and the use of digital channels for insurance distribution all influence market dynamics.

Financial Protection Market Players

Some of the top financial protection companies offered in our report include Allianz SE. Prudential Financial Inc., AIG (American International Group), MetLife Inc., AXA SA, Zurich Insurance Group Ltd., Manulife Financial Corporation, New York Life Insurance Company, Ping An Insurance Group, and Berkshire Hathaway Inc.

Financial Protection Industry Recent Developments

- In March 2023, MetLife has launched its new digital health platform, "MetLife Health Solutions." To assist clients live healthier lifestyles, this platform provides a variety of personalized health and wellness services, such as virtual health consultations, mental health support, and wellness coaching.

- In February 2023, Prudential announced its plan to acquire Assurance IQ, a leading insurtech company. This acquisition is expected to strengthen Prudential's digital capabilities and expand its reach to customers through Assurance IQ's technology platform, which enables online distribution of insurance products.

Frequently Asked Questions

What was the market size of the global financial protection in 2022?

The market size of financial protection was USD 56.3 billion in 2022.

What is the CAGR of the global financial protection market from 2023 to 2032?

The CAGR of financial protection is 4.2% during the analysis period of 2023 to 2032.

Which are the key players in the financial protection market?

The key players operating in the global market are including Allianz SE. Prudential Financial Inc., AIG (American International Group), MetLife Inc., AXA SA, Zurich Insurance Group Ltd., Manulife Financial Corporation, New York Life Insurance Company, Ping An Insurance Group, and Berkshire Hathaway Inc.

Which region dominated the global financial protection market share?

North America held the dominating position in financial protection industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of financial protection during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global financial protection industry?

The current trends and dynamics in the financial protection industry include increasing awareness of financial risks and uncertainties, changing demographics drive demand for financial protection, and technological advancements enhance accessibility to financial protection products.

Which type held the maximum share in 2022?

The long-term financial protection held the maximum share of the financial protection industry.