Fencing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Fencing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Fencing Market Size accounted for USD 29.4 Billion in 2022 and is estimated to achieve a market size of USD 49.1 Billion by 2032 growing at a CAGR of 5.3% from 2023 to 2032.

Fencing Market Highlights

- Global fencing market revenue is poised to garner USD 49.1 billion by 2032 with a CAGR of 5.3% from 2023 to 2032

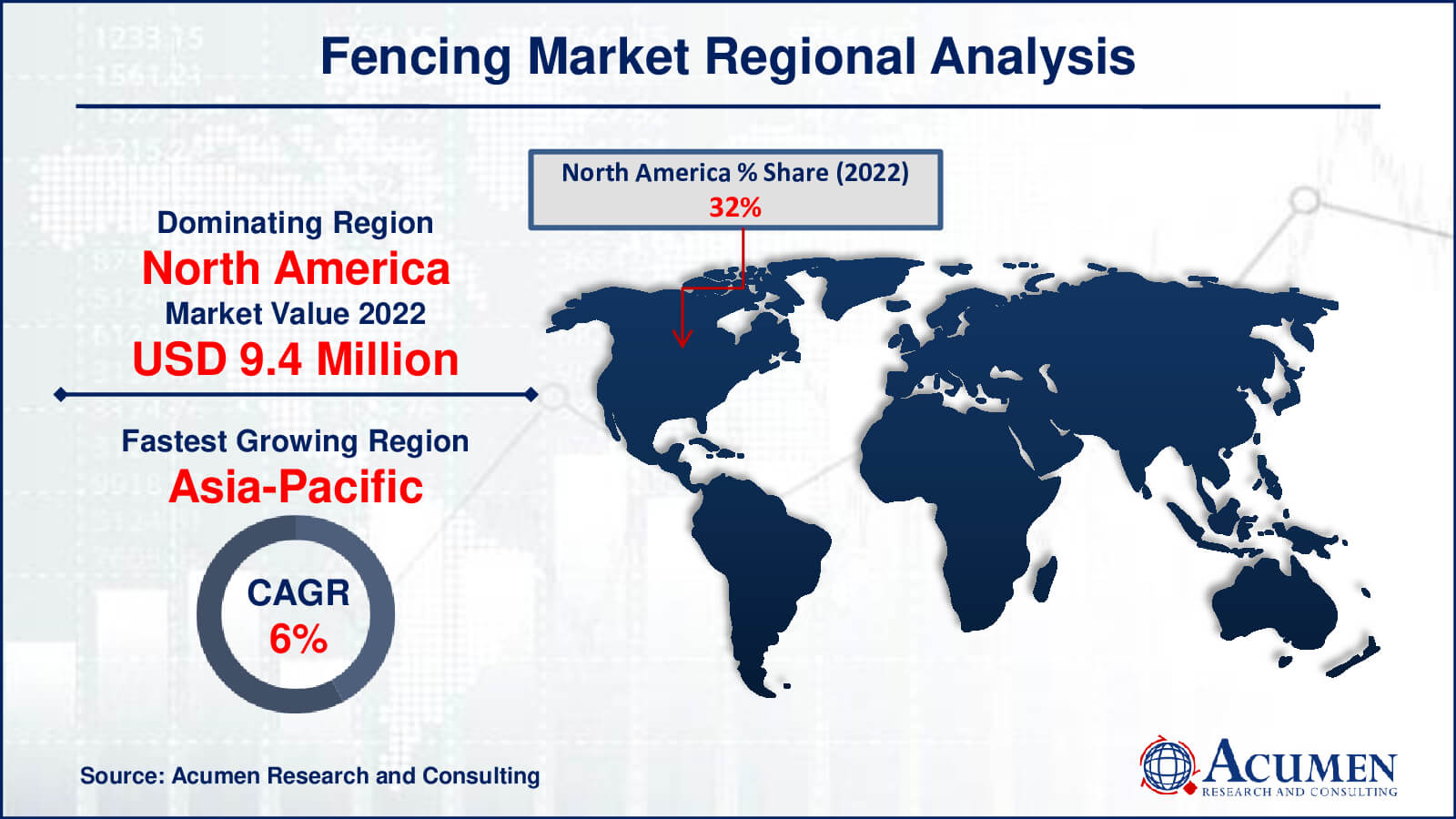

- North America fencing market value occupied around USD 9.4 billion in 2022

- Asia-Pacific fencing market growth will record a CAGR of more than 6% from 2023 to 2032

- Among material, the metal sub-segment generated over US$ 15 billion revenue in 2022

- Based on end-use, the military & defense sub-segment generated around 30% share in 2022

- The increased emphasis on border security measures around the world is a fencing popular market trend that fuels the industry demand

Fencing serves as a structure or boundary used to enclose an area, often constructed from interconnected posts, wire, sheets, mesh, or rails. These barriers find application in areas where control of wildlife or livestock is necessary, or where access for individuals needs restriction, enhancing security measures. Increasing border security concerns and growing construction activities are significant factors driving market growth. Fence manufacturers are offering a variety of options to enhance security. For instance, in July 2017, Danbury Fencing, a security and agricultural fencing manufacturer, introduced an innovative addition to its product line called Living Fencing. These panels comprise metal frameworks with plants at the base and a biodegradable trough, increasing their adaptability and functionality.

Global Fencing Market Dynamics

Market Drivers

- Increasing concerns for safety and security

- Rising construction activities and urbanization

- Growing agricultural ventures escalate the requirement for fencing to protect and manage agricultural lands

- Demand rises for fencing to protect natural habitats and prevent wildlife encroachment

Market Restraints

- Stringent regulations and compliance standards impact fencing material choices and designs

- High initial investment and maintenance expenses

- Concerns about environmental impact and land use regulations

Market Opportunities

- Innovations in fencing materials and designs

- Rural development programs and government schemes

- Increased residential construction activities

Fencing Market Report Coverage

| Market | Fencing Market |

| Fencing Market Size 2022 | USD 29.4 Billion |

| Fencing Market Forecast 2032 | USD 49.1 Billion |

| Fencing Market CAGR During 2023 - 2032 | 5.3% |

| Fencing Market Analysis Period | 2020 - 2032 |

| Fencing Market Base Year |

2022 |

| Fencing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By Distribution Channel, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ameristar Perimeter Security, Associated Materials, LLC., Bekaert, Betafence Group, Builders Fence Company (BFC), Inc., Compagnie de Saint-Gobain S.A., Gregory Industries, Inc., Jerith Manufacturing LLC., Long Fence Company Inc., and Ply Gem Holding Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Fencing Market Insights

The demand for fencing items is expected to rise due to the increasing need to enhance property appearances and value. Accelerating institutional construction spending is anticipated to drive growth in the fencing industry. Moreover, the increase in government expenditure on enhancing parks, public spaces, and government premises is expected to boost demand. Major buying criteria such as cost, quality, design, and aesthetic value significantly influence purchasing decisions.

The growth in renovation projects and residential properties is projected to drive market sales over the forecast period. Commercial sectors, including educational institutions and industrial premises, utilize fences to enhance the security of people and property.

Activities such as new housing construction, development, and remodeling work are expected to fuel industry growth in the forecast period. The rise in safety and security concerns, coupled with increased spending on office, transportation, and commercial constructions, is also likely to stimulate market growth. The expansion in the fencing market can be attributed to residential renovations and new construction projects. Security requirements and the execution of transportation infrastructure projects are expected to drive industry growth during the fencing market forecast.

Fences are poised to experience a significant surge in demand due to the need for aesthetically appealing and distinctive properties. Government initiatives aimed at enhancing safety and security in public spaces and parks further stimulate business growth prospects. Consumer preferences predominantly hinge on fence design, cost, quality, and appearance.

The demand for fences among farmers, to safeguard their livestock and property, is significantly propelling the need for fencing. Innovative materials that enhance durability at lower costs tend to drive market advantages.

According to the fencing industry analysis, key factors driving the global fencing market include high residential renovations and increasing construction projects. However, market growth could be hindered over the forecast period. Additionally, the demand for barriers, such as ditches or water-filled structures, serving as alternatives to fencing, might pose challenges for the global fencing market. Nevertheless, factors such as growth in real estate and renovation projects, coupled with increasing government investments in promoting safety and security, are anticipated to propel market growth globally.

Fencing Market Segmentation

The worldwide market for fencing is split based on material, distribution channel, application, end-use, and geography.

Fencing Materials

- Metal

- Wood

- Plastic

- Composite

Based on material, the worldwide fencing market is named solid fencing, plastic and composite fencing, wood fencing, metal fencing, and others. Among the previously mentioned fragments, the metal fencing section is foreseen to represent the moderately high-esteem share over the figure time frame, inferable from the high quality of the psychological fencing when contrasted with different portions. The metal material section is foreseen to remain the significant fragment over the gauge time frame and represented more than half of the global market share by the end of the fencing industry forecast period. This can be credited to the expanding utilization of fences in open spots and government associations. Steel and elaborate fences may additionally drive the metal fence fragment.

Fencing Distribution Channels

- Online

- Retail

The retail segment has historically held the largest part of the fence market because to its extensive accessibility and convenience for consumers. Customers seeking fast purchasing options and personalised help are drawn to retail locations because of their physical presence and diverse product offerings. Furthermore, these stores frequently provide a variety of fencing materials and styles, allowing buyers to visually view products before making a purchase decision. This convenience, combined with customer service and a wide range of options, adds considerably to the retail segment's supremacy in the fencing industry.

Fencing Applications

- Residential

- Commercial

- Agriculture

The residential segment leads the fence industry due to a multitude of factors. As homeowners prioritise privacy, safety, and property delineation, fencing becomes an important component. Residential properties frequently necessitate a variety of fencing types and materials to enhance aesthetics and fulfil varied functions such as security and landscaping. Furthermore, the ongoing need for property enhancement, restorations, and increased urbanisation feeds demand for residential fence. The growing trend of customised fence solutions adapted to specific homeowner preferences fuels the segment's growth, making it the greatest contributor among the fencing market's application segments.

Fencing End-Uses

- Energy & Power

- Transport

- Government

- Petroleum & Chemicals

- Military & Defense

- Mining

- Others

In terms of fencing market analysis, the military & defence segment's dominance in the fencing market originates from severe security requirements and the vital need for high-performance perimeter protection. Military and defence installations, sensitive government facilities, and border security zones all necessitate advanced fencing solutions with characteristics such as intrusion detection, surveillance integration, and resistance to unauthorised access. To maintain solid security measures, this segment necessitates specialised fencing systems, which frequently involve expensive technology and materials. The strict security requirements, together with continuous modernization initiatives and increased defence spending, solidify the military & defence segment's dominant position among fencing market end-use segments.

Fencing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Fencing Market Regional Analysis

North America dominates the fencing market for a variety of reasons. The region's established building industry, rigorous regulations requiring security measures, and significant investments in infrastructure all contribute to its leadership. Additionally, the market is driven by the prevalence of residential renovations and the desire for enhanced security solutions. Strong economic conditions, combined with greater disposable income, encourage homeowners and companies to invest in fence for property enhancement and safety. Furthermore, technological developments and the introduction of innovative fence materials and designs consolidate North America's leadership position, producing a dynamic market landscape with a diverse range of fencing options.

The Asia-Pacific fence industry is expanding rapidly as a result of numerous factors. The demand for fencing solutions is being driven by rising urbanization, increased construction activity, and expanding industrial sectors. Rapid urban population growth increases the demand for residential and commercial infrastructure, driving up fencing demand. Furthermore, higher government investments in infrastructure development, as well as a growing emphasis on safety and security measures across numerous sectors, boost market expansion. As the region's infrastructure improves, together with changing consumer preferences and increased awareness of property security, Asia-Pacific emerges as the fastest-growing region in the worldwide fencing industry.

Fencing Market Players

Some of the top Fencing companies offered in our report includes Ameristar Perimeter Security, Associated Materials, LLC., Bekaert, Betafence Group, Builders Fence Company (BFC), Inc., Compagnie de Saint-Gobain S.A., Gregory Industries, Inc., Jerith Manufacturing LLC., Long Fence Company Inc., and Ply Gem Holding Inc.

Frequently Asked Questions

How big is the fencing market?

The market size of fencing was USD 29.4 billion in 2022.

What is the CAGR of the global fencing market from 2023 to 2032?

The CAGR of fencing is 5.3% during the analysis period of 2023 to 2032.

Which are the key players in the fencing market?

The key players operating in the global market are including Ameristar Perimeter Security, Associated Materials, LLC., Bekaert, Betafence Group, Builders Fence Company (BFC), Inc., Compagnie de Saint-Gobain S.A., Gregory Industries, Inc., Jerith Manufacturing LLC., Long Fence Company Inc., and Ply Gem Holding Inc.

Which region dominated the global fencing market share?

North America held the dominating position in fencing industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of fencing during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global fencing industry?

The current trends and dynamics in the fencing industry include increasing concerns for safety and security, rising construction activities and urbanization, growing agricultural ventures escalate the requirement for fencing to protect and manage agricultural lands, and demand rises for fencing to protect natural habitats and prevent wildlife encroachment.

Which material held the maximum share in 2022?

The metal material held the maximum share of the fencing industry.