Feed Micronutrients Market Size - Global Industry Analysis, Share, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Feed Micronutrients Market Size - Global Industry Analysis, Share, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

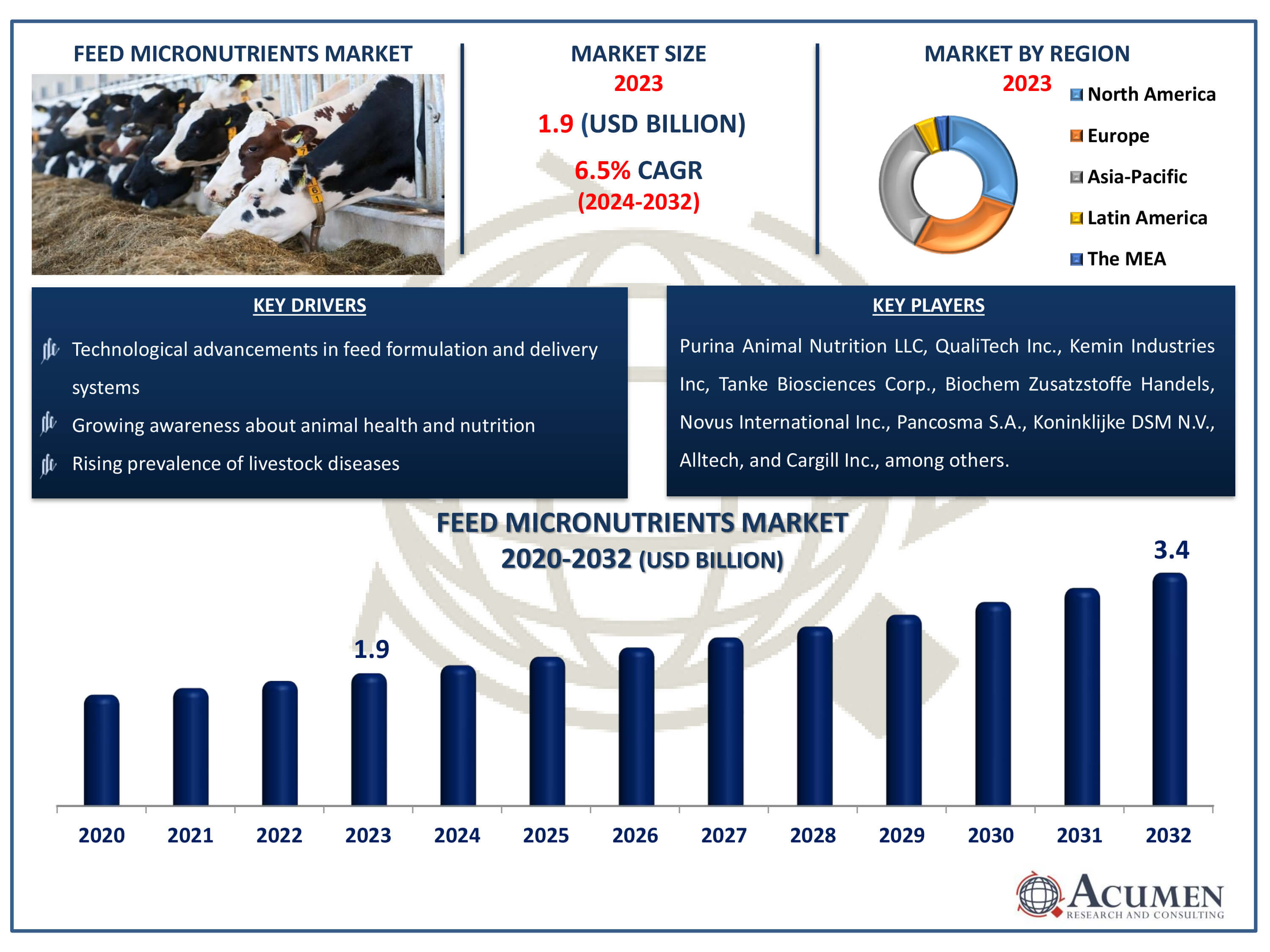

The Feed Micronutrients Market Size accounted for USD 1.9 Billion in 2023 and is estimated to achieve a market size of USD 3.4 Billion by 2032 growing at a CAGR of 6.5% from 2024 to 2032.

Feed Micronutrients Market Highlights

- Global feed micronutrients market revenue is poised to garner USD 3.4 billion by 2032 at a CAGR of 6.5% from 2024 to 2032

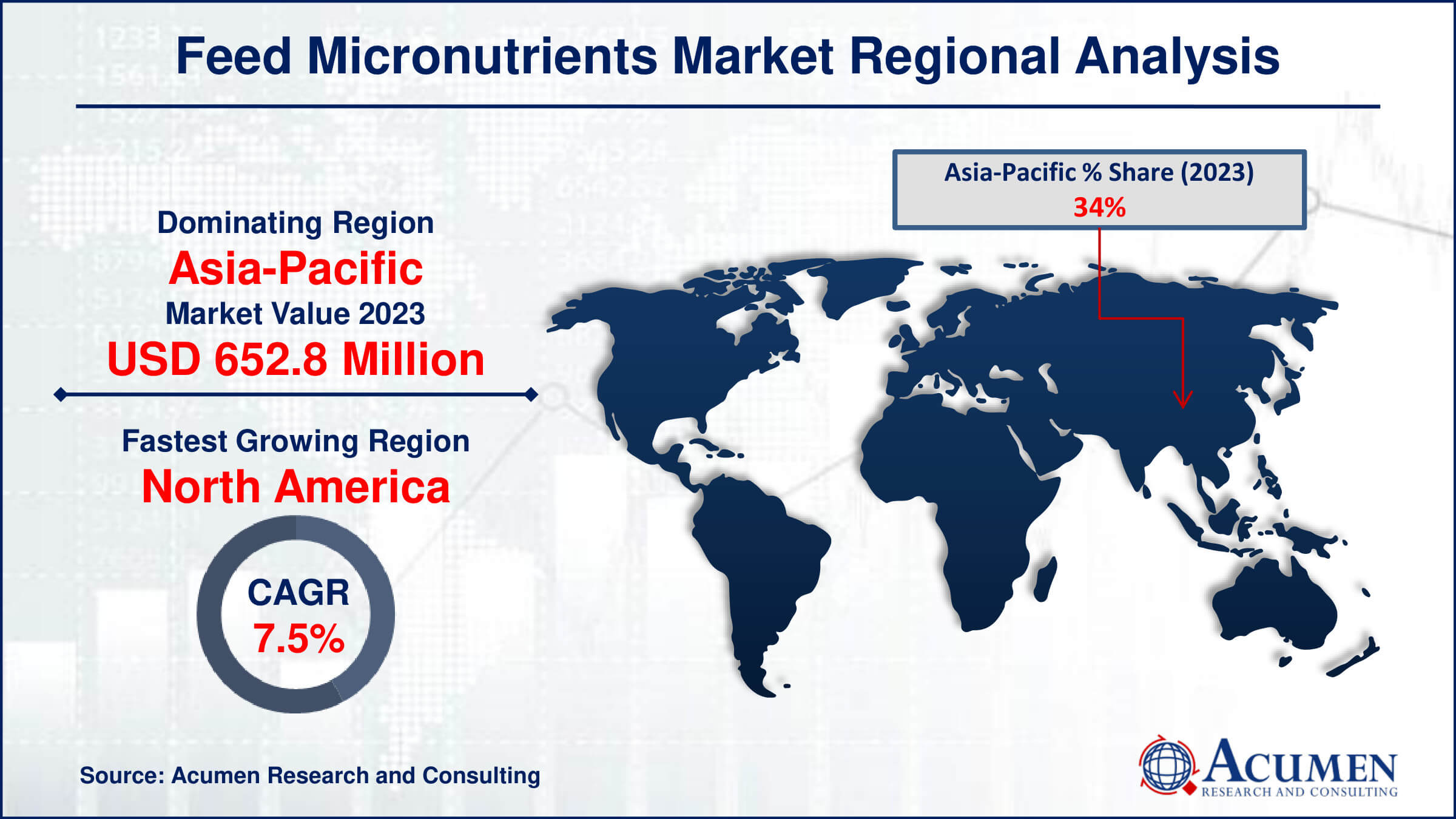

- Asia-Pacific feed micronutrients market value occupied around USD 652.8 million in 2023

- North America feed micronutrients market growth will record a CAGR of more than 7.5% from 2024 to 2032

- Among product, the trace minerals sub-segment generated USD 1.1 billion revenue in 2023

- Based on livestock, the poultry sub-segment generated 45% feed micronutrients market share in 2023

- Emerging markets and untapped regions for feed micronutrient products is a popular feed micronutrients market trend that fuels the industry demand

Feed micronutrients are essential additives in animal feed. They are included to supplement the diets of animals that may not acquire sufficient vitamins and nutrients from their regular feed. These additives aim to enhance milk production, support animal development, and maintain overall animal health. Micronutrients play a crucial role in disease prevention and treatment, as well as in improving digestibility in livestock. They are increasingly popular, primarily as growth promoters, due to their beneficial effects on digestibility, reproductive efficiency, and disease prevention and treatment. Trace minerals and essential metal ions are needed to combat significant illnesses, are among the key components of these additives. Chemicals produced through various processes and refinement of their formulation contributes to livestock well-being through the provision of micronutrients such as vitamins, minerals, and enzymes.

Global Feed Micronutrients market Dynamics

Market Drivers

- Increasing demand for high-quality animal products

- Growing awareness about animal health and nutrition

- Rising prevalence of livestock diseases

- Technological advancements in feed formulation and delivery systems

Market Restraints

- Stringent regulations regarding feed additives

- Complex manufacturing processes hinder production efficiency

- Limited awareness about the benefits of micronutrient feeding

Market Opportunities

- Expansion of the aquaculture industry

- Rising adoption of precision livestock farming techniques

- Increasing focus on organic and natural feed supplements

Feed Micronutrients market Report Coverage

| Market | Feed Micronutrients Market |

| Feed Micronutrients Market Size 2022 | USD 1.9 Billion |

| Feed Micronutrients Market Forecast 2032 |

USD 3.4 Billion |

| Feed Micronutrients Market CAGR During 2024 - 2032 | 6.4% |

| Feed Micronutrients Market Analysis Period | 2020 - 2032 |

| Feed Micronutrients Market Base Year |

2022 |

| Feed Micronutrients Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product, By Livestock, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Purina Animal Nutrition LLC, QualiTech Inc., Kemin Industries Inc, Tanke Biosciences Corp., Biochem Zusatzstoffe Handels, Novus International Inc., Pancosma S.A., Koninklijke DSM N.V., Alltech, Cargill Inc., Archer Daniels Midland Company, and Zinpro Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Feed Micronutrients Market Insights

Enhanced consumer awareness towards ruminant health, coupled with increased investments in animal husbandry and breeding, are expected to drive the growth of the feed micronutrients market. Heightened concerns regarding significant illnesses such as bovine spongiform encephalopathy, microbial contamination, and chronic feed-related illnesses are creating new business opportunities. The development of advanced animal husbandry methods, aimed at expediting animal production timelines, presents a favorable opportunity for product penetration. The increasing use of vitamins and trace minerals to activate key enzymes and hormones essential for animal metabolism will further stimulate sector growth. This favorable outlook will provide key benefits to product portfolios, including promoting skeletal growth, optimizing health, enhancing immunity, and facilitating increased dairy production. Significant shifts in meat and milk production trends worldwide, driven by changing nutritional preferences, are expected to further propel industry growth.

Rapid development offers favorable prospects for companies in the feed sector, particularly in developed economies such as China, India, South Africa, and Indonesia. Increased market demand is driven by growing health concerns due to reduced levels of essential components in animal feed. Additionally, significant investments in research and development will further stimulate market growth for feed micronutrients, fueled by rapid technological advancements in the forage sector and the rising demand for dairy and poultry products. Business expansion is expected within the feed micronutrients industry forecast period, particularly driven by regulatory bodies such as CFIA, REACH, and FDA aiming to prevent micronutrient malnutrition and reduce the consumption of synthetic additives. Furthermore, the increasing trend for clean label products, mandated by these regulatory bodies, will necessitate rigorous approval processes, enhancing product portfolios. However, the need for increased R&D expenditures to develop organic minerals and strict regulations controlling the use of soil pollutants like zinc and copper are anticipated to limit overall sector growth.

Feed Micronutrients Market Segmentation

The worldwide market for feed micronutrients is split based on product, livestock, and geography.

Feed Micronutrients Product

- Vitamins

- Vitamin E

- Vitamin K

- Vitamin D

- Vitamin C

- Vitamin B

- Vitamin A

- Carotenoids

- Others ( Essential nutrients, Fatty acids)

- Trace Minerals

- Manganese

- Iron

- Copper

- Zinc

- Boron

- Others (Selenium, Iodine, Cobalt)

According to feed micronutrientsindustry analysis, the market share for trace minerals is largest in 2023. The increased prevalence of diseases among poultry and ruminants caused by deficiencies in iron, copper, zinc, boron, manganese, etc., is expected to positively impact the demand for these products. Additionally, the rising demand for antioxidants in animal feed is expected to further expand the overall sector size, enhancing and regulating the body functions of livestock.The demand for vitamins is projected to witness a noteworthy Compound Annual Growth Rate (CAGR) of over feed micronutrients market forecast period. This increase in demand is driven by the need to enhance metabolism, immunity, and reproductive efficiency. The rising demand for quality meat, health concerns, and outbreaks of animal diseases are likely to accelerate the adoption rate of vitamin products. Furthermore, this segment is expected to play a crucial role in development, driven by increased demand for dairy products, growing interest in pet ownership, and the recognition of the importance of animal feed micronutrients.

Feed Micronutrients Livestock

- Poultry

- Swine

- Aquaculture

- Ruminant

- Equine

In 2023, poultry accounted for over 45% of the worldwide share in the feed micronutrients sector. Particularly in European nations such as Germany, the UK, France, and Russia, the rapid development of production facilities will bolster the portfolio of poultry products. Factors such as customer preferences for poultry products with higher nutrient levels and the increased prices of poultry substitutes, such as beef and pork, are driving growth in this segment. Positive animal performance, attributed to enhanced consumption of vitamins and nutrients, will further drive demand in the sector.

In the forecast period from 2024 to 2032, ruminants are expected to expand. Significant health benefits for ruminants, attributed to improved nutrient consumption, will positively impact market demand. The segment's growth will be driven by increasing demand for milk and its by-products such as butter, cheese, curd, and cream, along with the rise in global meat consumption. Moreover, increasing consumer awareness of meat products rich in vitamins and minerals is expected to further boost growth in this segment.

Feed Micronutrients market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Feed Micronutrients market Regional Analysis

In terms of feed micronutrients market analysis, more than 34% of the global share of the feed micronutrient sector in 2023 was accounted for in the Asia Pacific region. Due to rapid urbanization and changing nutritional trends in developing economies such as Indonesia, India, China, and Japan, the consumption of several meat products is expected to increase, driving market growth. For instance, China consumed approximately 65.7 million tons of meat in 2016, according to the Global Tracker. Additionally, increased demand for nutritious animal food, particularly for bone health among the geriatric population, will further promote overall market growth in the region.

North America is the fastest growing region in the feed micronutrients market. The Middle East and Africa are projected to see profits between 2024 and 2032. High imports of meat and broader socioeconomic patterns present numerous opportunities for premium meat imports throughout the region. Increased use of imported beef in high-end foodservice markets, along with the growth of the tourism sector, ongoing westernization, and urbanization, will contribute to regional industry development. The significant expansion of meat and pork cold storage facilities, especially in Saudi Arabia, the UAE, and Kuwait, will provide favorable conditions for the region's market growth for feed micronutrients.

Feed Micronutrients Market Players

Some of the top feed micronutrients companies offered in our report includes Purina Animal Nutrition LLC, QualiTech Inc., Kemin Industries Inc, Tanke Biosciences Corp., Biochem Zusatzstoffe Handels, Novus International Inc., Pancosma S.A., Koninklijke DSM N.V., Alltech, Cargill Inc., Archer Daniels Midland Company, and Zinpro Corporation.

Frequently Asked Questions

How big is the feed micronutrients market?

The feed micronutrients market size was valued at USD 1.9 billion in 2023.

What is the CAGR of the global feed micronutrients market from 2024 to 2032?

The CAGR of feed micronutrients is 6.5% during the analysis period of 2024 to 2032.

Which are the key players in the feed micronutrients market?

The key players operating in the global market are including Purina Animal Nutrition LLC, QualiTech Inc., Kemin Industries Inc, Tanke Biosciences Corp., Biochem Zusatzstoffe Handels, Novus International Inc., Pancosma S.A., Koninklijke DSM N.V., Alltech, Cargill Inc., Archer Daniels Midland Company, and Zinpro Corporation.

Which region dominated the global feed micronutrients market share?

Asia-Pacific held the dominating position in feed micronutrients industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of feed micronutrients during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global feed micronutrients industry?

The current trends and dynamics in the feed micronutrients industry include increasing demand for high-quality animal products, growing awareness about animal health and nutrition, rising prevalence of livestock diseases, and technological advancements in feed formulation and delivery systems.

Which livestock held the maximum share in 2023?

The poultry livestock held the maximum share of the feed micronutrients industry.