Farm Tire Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Farm Tire Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

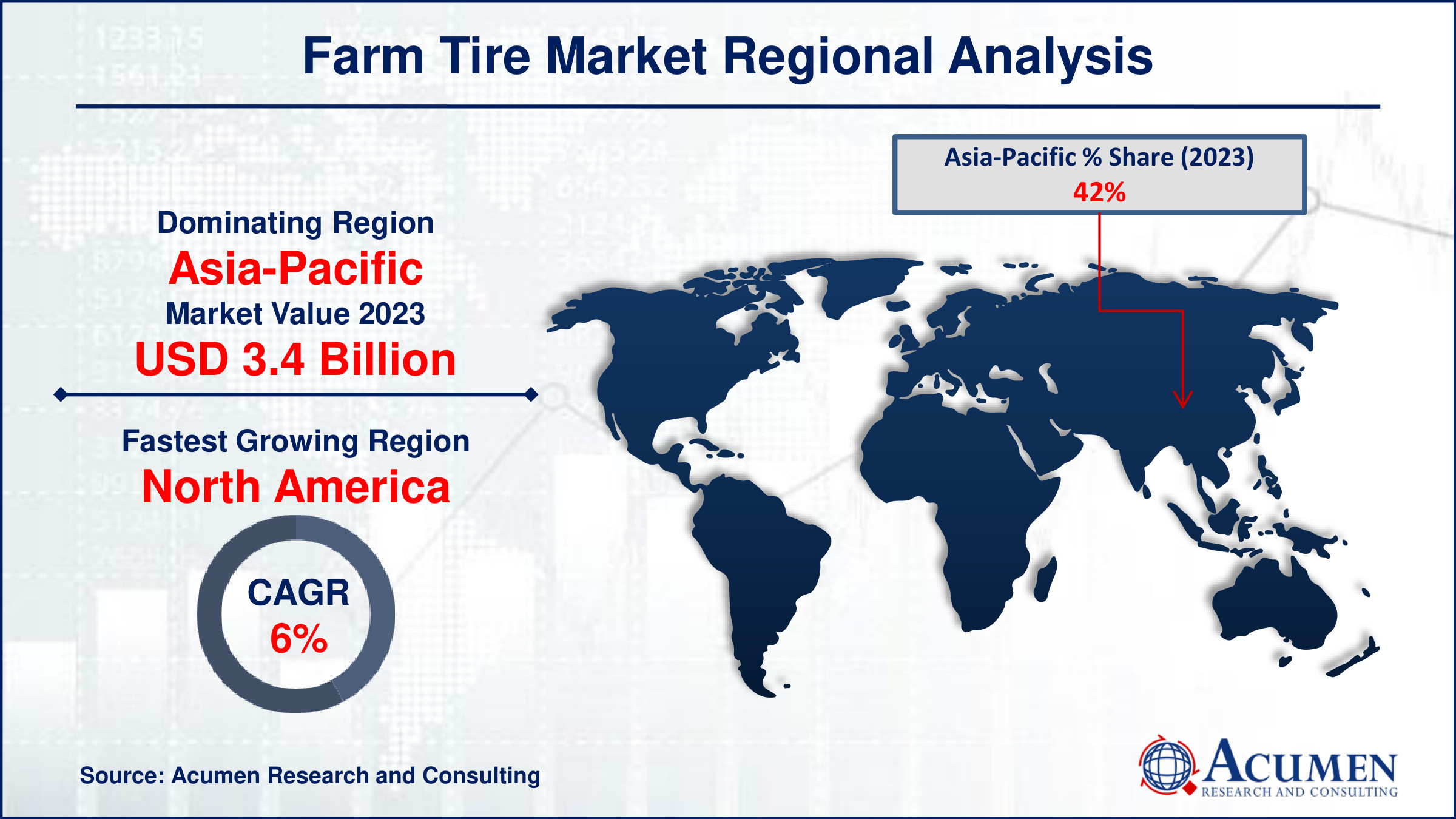

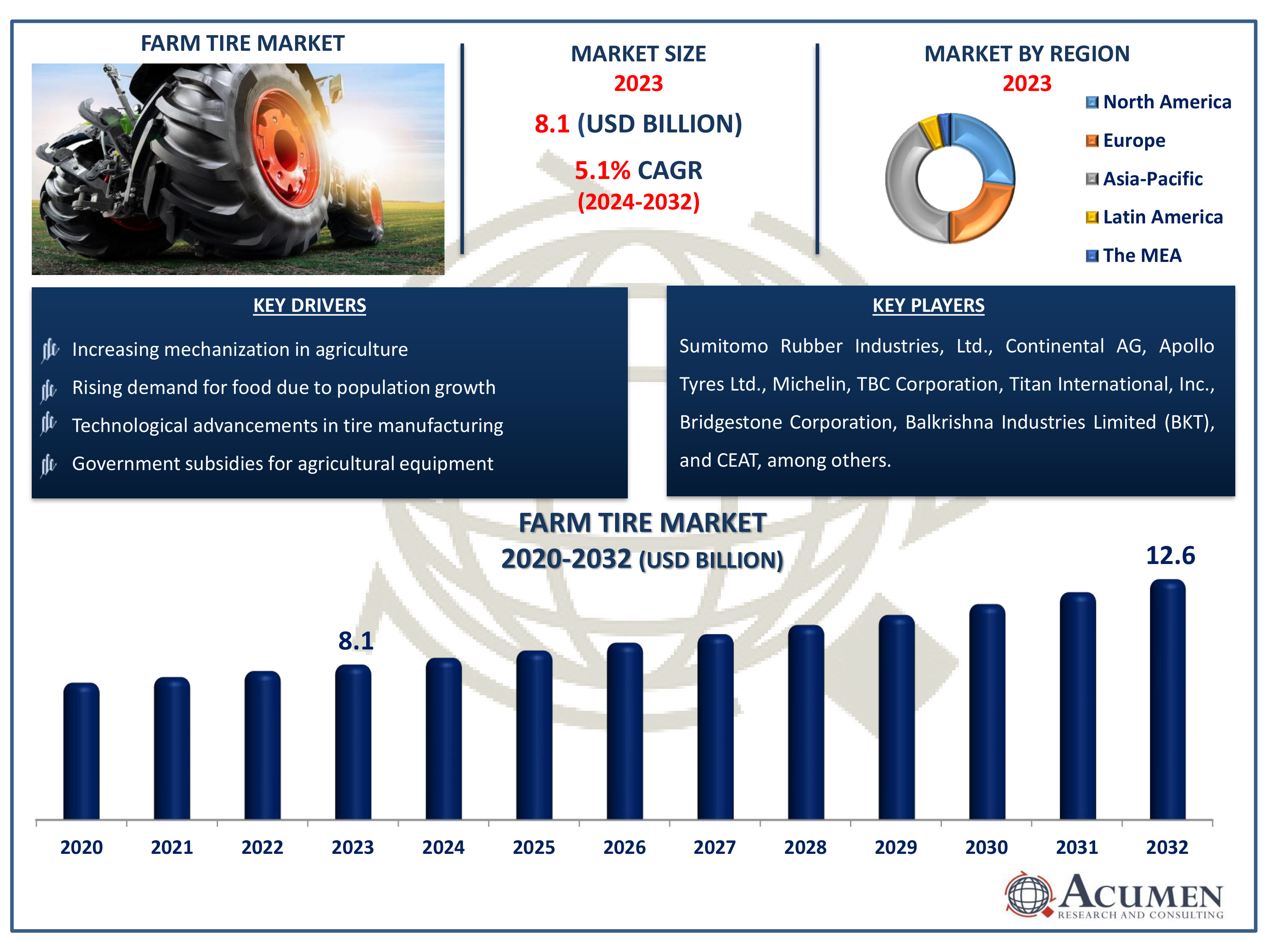

The Farm Tire Market Size accounted for USD 8.1 Billion in 2023 and is estimated to achieve a market size of USD 12.6 Billion by 2032 growing at a CAGR of 5.1% from 2024 to 2032.

Farm Tire Market Highlights

- Global farm tire market revenue is poised to garner USD 12.6 billion by 2032 with a CAGR of 5.1% from 2024 to 2032

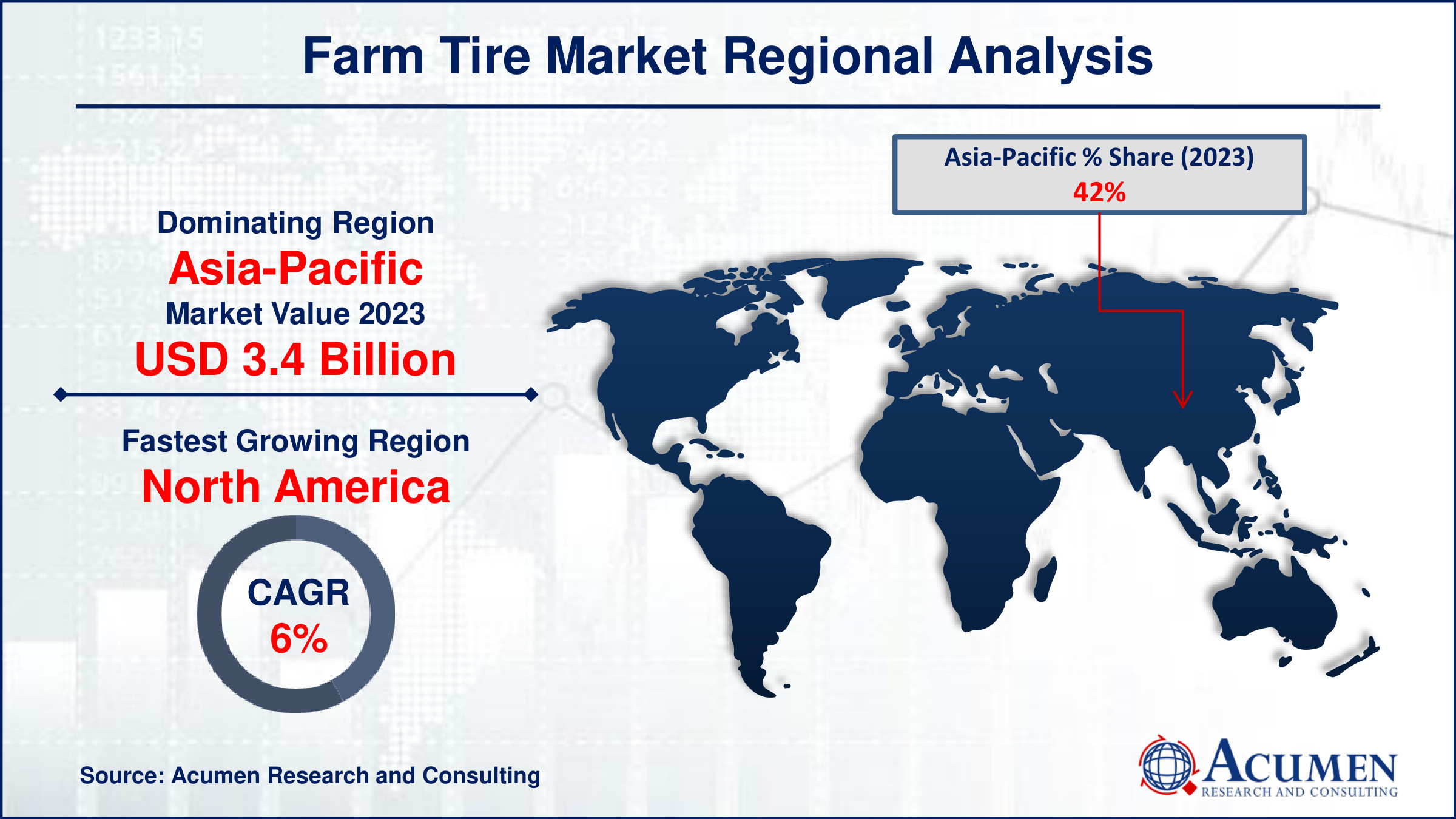

- Asia-Pacific farm tire market value occupied around USD 3.4 million in 2023

- North America farm tire market growth will record a CAGR of more than 6% from 2024 to 2032

- Among application, the tractors sub-segment generated more than USD 3.6 million revenue in 2023

- Based on product, the bias tires sub-segment generated around 58% farm tire market share in 2023

- Emerging nations in Asia-Pacific and Africa is a popular farm tire market trend that fuels the industry demand

Farm tires are specialized tires designed for agricultural vehicles and equipment, such as tractors, harvesters, and plows. These tires are built to provide optimal traction, durability, and stability on various terrains, including mud, dirt, and loose soil. They are typically larger and more robust than standard vehicle tires, featuring deeper treads and wider profiles to distribute weight evenly and minimize soil compaction. This ensures that the tires do not damage crops or disrupt the soil structure during farming operations. Farm tires also offer enhanced grip and control, crucial for maneuvering heavy machinery in challenging conditions. Additionally, they are designed to withstand the rigors of agricultural work, including resistance to punctures and wear, ensuring long-term performance and reliability in demanding farm environments.

Global Farm Tire Market Dynamics

Market Drivers

- Increasing mechanization in agriculture

- Rising demand for food due to population growth

- Technological advancements in tire manufacturing

- Government subsidies for agricultural equipment

Market Restraints

- High cost of advanced farm tires

- Fluctuating raw material prices

- Limited adoption in developing regions

Market Opportunities

- Growing trend of precision farming

- Expansion of the organic farming sector

- Innovations in sustainable and eco-friendly tires

Farm Tire Market Report Coverage

| Market | Farm Tire Market |

| Farm Tire Market Size 2022 | USD 8.1 Billion |

| Farm Tire Market Forecast 2032 | USD 12.6 Billion |

| Farm Tire Market CAGR During 2023 - 2032 | 5.1% |

| Farm Tire Market Analysis Period | 2020 - 2032 |

| Farm Tire Market Base Year |

2022 |

| Farm Tire Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sumitomo Rubber Industries, Ltd., Continental AG, Apollo Tyres Ltd., Michelin, TBC Corporation, Titan International, Inc., Bridgestone Corporation, Balkrishna Industries Limited (BKT), CEAT, JK Tyre & Industries Ltd., Mitas, Hankook Tire, and MRF Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Farm Tire Market Insights

The farm tire market is experiencing notable growth driven by several key factors. One significant driver is the increasing consumer awareness of the benefits associated with modernized agricultural equipment, such as sprayers, spreaders, seed sowers, and plows. These advanced tools enhance farming efficiency and productivity, which is crucial given the shortage of labor as more people shift their preferences toward the service sector. This labor shortage compels farmers to rely on mechanized solutions, thereby boosting the demand for farm tires. Additionally, the growing global population and the need for expanded infrastructure have led to limited agricultural land. This scarcity necessitates the use of highly-efficient agricultural machinery to minimize turnaround time and maximize productivity on the available farmland. Farmers are becoming increasingly aware of the benefits of these advancing technologies, prompting them to upgrade their equipment to include automated and semi-automated farming vehicles. This trend is a prime factor catalyzing the demand for farm tires, thereby increasing revenue in the global farm tire market.

Major participants in the global farm tire market are adopting strategies focused on new product development to meet the specific demands of advanced and complex machinery and equipment in the agriculture sector. This approach aims to improve production efficiency and drive worldwide demand for farm tires. Furthermore, there is a growing requirement for high-performance farm tires with a long-lasting shelf life, which is expected to spur research and development (R&D) activities in the agricultural sector during the forecast period. Key players in the market are concentrating on R&D to develop modernized technologies for manufacturing tires. They are applying these advanced strategies across various stages of their value chains to gain a competitive edge in the global farm tire market. This comprehensive approach to innovation and efficiency is expected to sustain the farm tyre market growth trajectory.

Farm Tire Market Segmentation

The worldwide market for farm tire is split based on product, application, sales channel, and geography.

Farm Tire Products

- Bias Tires

- Radial Tires

According to farm tire industry analysis, there are two main types of tires: bias tires and radial tires. Among these, the bias tires segment holds the largest market share. Bias tires, also known as cross-ply tires, have a unique construction where the ply cords are placed at alternating angles, usually at 30 to 45 degrees to the tire's centerline. This design provides bias tires with certain advantages that make them highly preferred in the agricultural sector.

One of the key benefits of bias tires is their robust sidewalls, which offer superior resistance to cuts, punctures, and impacts. This durability is essential for agricultural operations, where equipment often traverses rough and uneven terrains. Additionally, bias tires generally have a lower initial cost compared to radial tires, making them a cost-effective choice for many farmers, especially in regions where budget constraints are significant.

The flexibility of bias tires also contributes to better traction in soft soil conditions, which is crucial for tasks such as plowing and tilling. These characteristics make bias tires an attractive option for farmers looking to optimize their operational efficiency while managing costs, thus driving their dominance in the agriculture tire market.

Farm Tire Applications

- Tractors

- Forestry

- Sprayers

- Harvesters

- Implements

- Others

The tractor segment commands the largest market share and it is expected to increase during the farm tire industry forecast period. Tractors are indispensable in modern agriculture due to their versatility and ability to perform a wide range of tasks, from plowing and tilling to planting and harvesting. This multifunctionality necessitates a high demand for specialized tires that can endure various conditions and provide optimal performance. Tractor tires are designed to offer excellent traction, durability, and stability, which are critical for efficient farm operations. They need to navigate through diverse terrains, including muddy, rocky, and uneven fields, often while carrying heavy loads or pulling implements. The robustness and adaptability of tractor tires make them a crucial component for maximizing the productivity and efficiency of farming activities.

Moreover, the increasing mechanization of agriculture, driven by the need to improve yield and efficiency, further boosts the demand for tractors and, consequently, tractor tires. As farmers continue to invest in advanced tractor models with higher horsepower and capabilities, the market for tractor tires is expected to sustain its dominant position.

Farm Tire Sales Channels

- OEM

- Aftermarket

In the terms of farm tire market analysis, the aftermarket segment holds the maximum share. This dominance is driven by the constant need for tire replacements due to wear and tear from rigorous agricultural activities. Farmers often face challenging terrain and heavy workloads, leading to frequent tire degradation. The aftermarket provides a wide range of tire options, catering to various needs and budgets, making it a preferred choice for farmers seeking cost-effective solutions. Additionally, the ease of availability and accessibility of aftermarket tires through numerous retailers and distributors further supports this segment's growth. The flexibility to choose from multiple brands and types, along with competitive pricing, makes the aftermarket segment the leading sales channel in the farm tire market.

Farm Tire Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Farm Tire Market Regional Analysis

In the Asia Pacific region, the farm tire market is anticipated to largest from 2024 to 2032. This growth can be attributed to the significant increase in agricultural activities in major economies within the region. The rising focus on improving agricultural productivity and efficiency in countries such as China and India is driving the demand for farm tires. The expansion of agricultural operations and the adoption of mechanized farming techniques are key factors contributing to the robust growth of the farm tire market in Asia Pacific.

North America is projected to fastest growing region in the industry and this region maintains their growth during the farm tire market in forecast period. This growth is driven by the region's advanced agricultural market, which is characterized by its readiness to adopt and evolve with new technologies. North America's agriculture industry is highly change-driven, constantly updating to modern farming activities and equipment. This continuous upgrading of farming equipment is expected to fuel the demand for farm tires in the region.

Farm Tire Market Players

Some of the top farm tire companies offered in our report include Sumitomo Rubber Industries, Ltd., Continental AG, Apollo Tyres Ltd., Michelin, TBC Corporation, Titan International, Inc., Bridgestone Corporation, Balkrishna Industries Limited (BKT), CEAT, JK Tyre & Industries Ltd., Mitas, Hankook Tire, and MRF Limited.

Frequently Asked Questions

How big is the farm tire market?

The farm tire market size was valued at USD 8.1 Billion in 2023.

What is the CAGR of the global farm tire market from 2024 to 2032?

The CAGR of farm tire is 5.1% during the analysis period of 2024 to 2032.

Which are the key players in the farm tire market?

The key players operating in the global market are including Sumitomo Rubber Industries, Ltd., Continental AG, Apollo Tyres Ltd., Michelin, TBC Corporation, Titan International, Inc., Bridgestone Corporation, Balkrishna Industries Limited (BKT), CEAT, JK Tyre & Industries Ltd., Mitas, Hankook Tire, and MRF Limited.

Which region dominated the global farm tire market share?

Asia-Pacific held the dominating position in farm tire industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of farm tire during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global farm tire industry?

The current trends and dynamics in the farm tire industry include increasing mechanization in agriculture, rising demand for food due to population growth, technological advancements in tire manufacturing, and government subsidies for agricultural equipment.

Which application held the maximum share in 2023?

The tractors application held the maximum share of the farm tire industry.