Farm Equipment Rental Market | Acumen Research and Consulting

Farm Equipment Rental Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

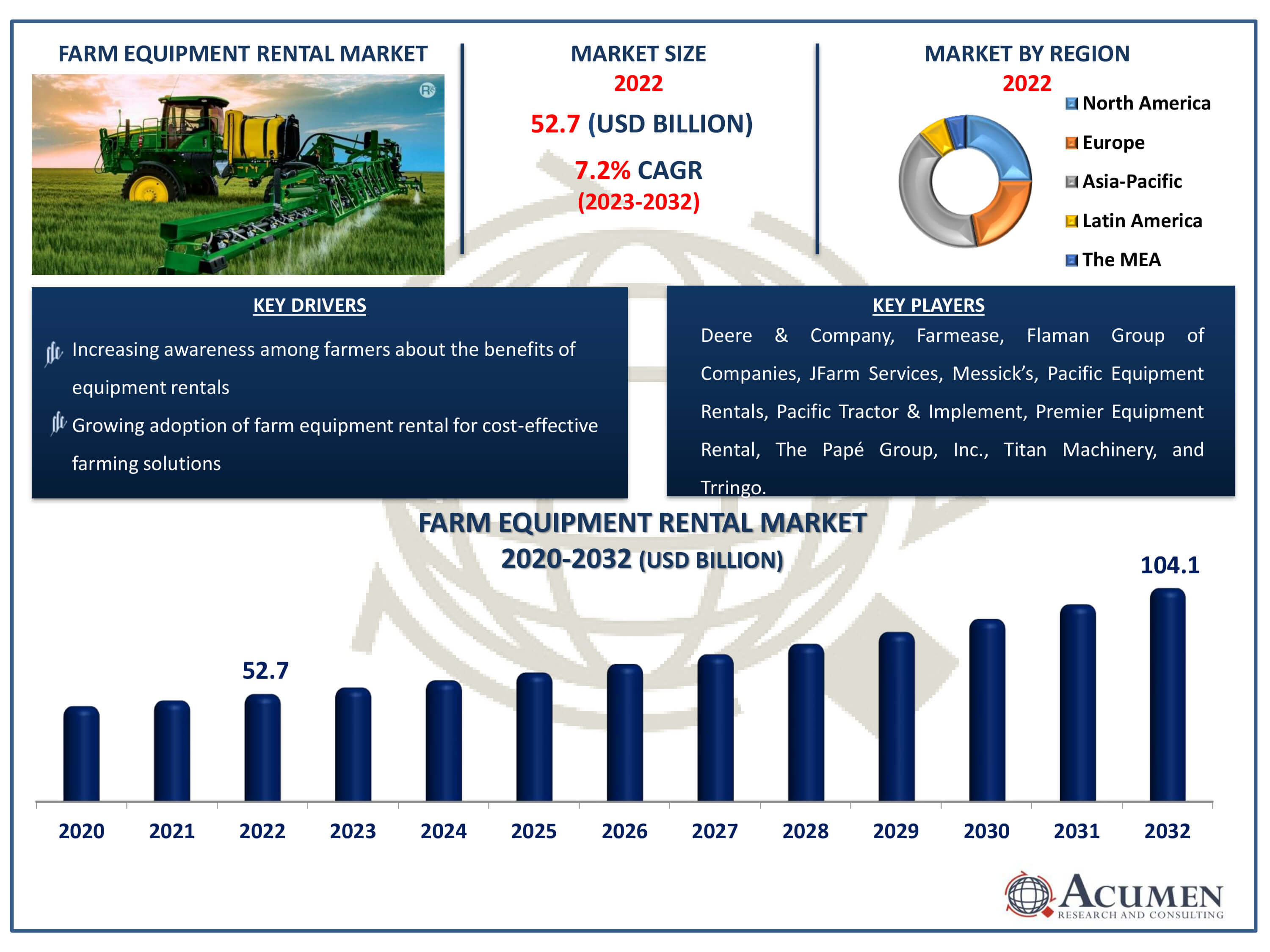

The Farm Equipment Rental Market Size accounted for USD 52.7 Billion in 2022 and is estimated to achieve a market size of USD 104.1 Billion by 2032 growing at a CAGR of 7.2% from 2023 to 2032.

Farm Equipment Rental Market Highlights

- Global farm equipment rental market revenue is poised to garner USD 104.1 billion by 2032 with a CAGR of 7.2% from 2023 to 2032

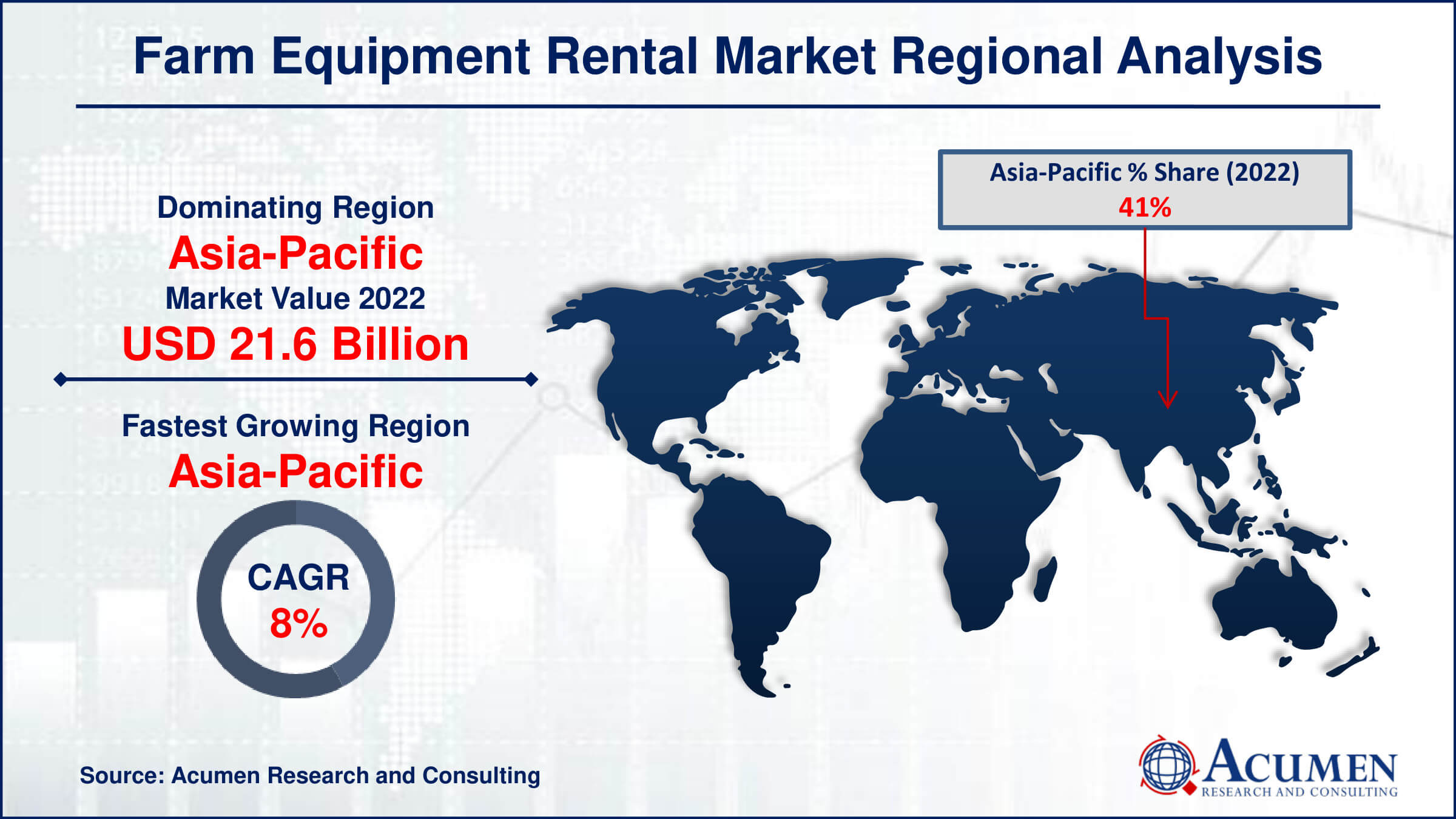

- Asia-Pacific farm equipment rental market value occupied around USD 21.6 billion in 2022

- Asia-Pacific farm equipment rental market growth will record a CAGR of more than 8% from 2023 to 2032

- Among equipment type, the tractors sub-segment generated more than USD 21.1 Billion revenue in 2022

- Based on drive, the four-wheel drive sub-segment generated around 75% share in 2022

- Growing emphasis on sustainable and eco-friendly farming practices is a popular farm equipment rental market trend that fuels the industry demand

Farm equipment refers to machinery used in farming, with tractors being the most common. Tractors are employed to pull or push agricultural machinery or trailers, especially for tasks like tilling, planting, disking, plowing, harrowing, and similar activities. Other equipment utilized in farming includes harvesters, sprayers, and threshing equipment, among others. As more farmers and agricultural enterprises choose to rent rather than buy pricey machinery, the market for farm equipment rental is expanding significantly. The cost-effectiveness and flexibility provided by farm equipment rentals are blamed for this tendency. Farmers may now satisfy seasonal demand without having to worry about ownership costs thanks to the availability of rental services for tractors, harvesters, sprayers, and other agricultural machinery. The growing knowledge among farmers of the advantages of renting farm equipment, which enhances the sustainability and overall efficiency of contemporary agricultural techniques, is another factor propelling the market's growth.

Global Farm Equipment Rental Market Dynamics

Market Drivers

- Growing adoption of farm equipment rental for cost-effective farming solutions

- Increasing awareness among farmers about the benefits of equipment rentals

- Flexibility and accessibility offered by rental services for seasonal demands

- Rising demand for modern and advanced agricultural machinery

Market Restraints

- Limited availability and variety of specialized equipment for rental

- Concerns regarding the maintenance and condition of rented equipment

- Resistance to change traditional ownership practices in some farming communities

Market Opportunities

- Expanding market with the introduction of diverse and specialized rental equipment

- Technological advancements in smart farming equipment driving rental demand

- Collaborations between rental service providers and agricultural businesses

Farm Equipment Rental Market Report Coverage

| Market | Farm Equipment Rental Market |

| Farm Equipment Rental Market Size 2022 | USD 52.7 Billion |

| Farm Equipment Rental Market Forecast 2032 | USD 104.1 Billion |

| Farm Equipment Rental Market CAGR During 2023 - 2032 | 7.2% |

| Farm Equipment Rental Market Analysis Period | 2020 - 2032 |

| Farm Equipment Rental Market Base Year |

2022 |

| Farm Equipment Rental Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Equipment Type, By Drive, By Power Output, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Deere & Company, Farmease, Flaman Group of Companies, JFarm Services, Messick’s, Pacific Equipment Rentals, Pacific Tractor & Implement, Premier Equipment Rental, The Papé Group, Inc., Titan Machinery, and Trringo. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Farm Equipment Rental Market Insights

The increasing need to alleviate the financial burden on farmers, coupled with the rising demand for productivity and operational efficiency, drives the market value. The mechanization of farming activities in developing countries, leading to a shortage of skilled labor, further accelerates the market's growth. The high cost of agricultural equipment and the limited availability of arable land are boosting the demand for rental equipment. Additionally, favorable government support in terms of subsidies for farming equipment propels the market value. Furthermore, strong growth in emerging economies and the rising adoption of new and advanced technological machinery in farm applications are likely to create potential demand over the forecast period.

There are two main problems that are causing constraint in the farm equipment rental market. First of all, farmers in developing and undeveloped economies are often unaware of the benefits and accessibility of equipment leasing services. This incomplete knowledge prevents rental solutions from being adopted, which impedes market expansion. Furthermore, there is a notable obstacle with safety laws in growing areas. Concerns over appropriate training and equipment handling are raised when strict safety standards are lacking or insufficient, which may result in abuse and accidents. The issue of safety is a significant barrier for farmers and rental service providers alike, affecting the general growth and viability of the industry in these areas.

The market for farm equipment rentals is full of prospects as a result of changing agricultural methods and business trends. First off, new opportunities are created by the advent of specialized and varied rental equipment. The need for specialized, cutting-edge equipment increases as farming becomes more specialized. Rental service providers can take advantage of this by adding specialized equipment to their portfolio that is designed to meet the particular requirements of contemporary agriculture. Second, there is a big chance due to technology developments in intelligent farming equipment. The productivity and efficiency of farming activities are increased by the integration of technology, such as IoT sensors and precision agriculture instruments. By adopting and making these smart farming solutions accessible, rental companies can meet the growing need for cutting-edge agricultural technologies and establish themselves as leaders in the farm equipment rental industry.

Farm Equipment Rental Market Segmentation

The worldwide market for farm equipment rental is split based on equipment type, drive, power output, and geography.

Farm Equipment Rental Market by Equipment Types

- Tractors

- Harvestors

- Sprayers

- Balers

- Others

Accordning to the farm equipment rental industry analysis, the tractors segment dominated the market, holding the major share by equipment type in 2022. This segment is projected to maintain its dominance throughout the farm equipment rental industry forecast period from 2023 to 2032. Technological advancements aimed at enhancing engine efficiency and increasing tractor horsepower capacity contribute favorably to the market value. The rising demand for tractors, driven by their versatile usage across various farming activities, significantly contributes to the segmental market value.

Farm Equipment Rental Market by Drive

- Two-Wheel Drive

- Four-Wheel Drive

In the farm equipment rental market, four-wheel drive is the dominant sector. Numerous variables that contribute to its market significance can be linked to its domination. Equipment with four wheels provides improved stability, traction, and manoeuvrability, which makes it ideal for a variety of terrains and demanding agricultural activities. This market is leading because to the growing need for sophisticated and adaptable machinery in contemporary farming methods and the capacity of four-wheel-drive equipment to manage a variety of field conditions. The demand for four-wheel-drive equipment is further fueled by the growing trend towards precision farming and the adoption of technology-driven agriculture, which further solidifies its leadership position in the farm equipment rental market.

Farm Equipment Rental Market by Power Outputs

- <30 HP

- 31-70 HP

- 71-130 HP

- 131-250 HP

- >250 HP

In terms of farm equipment rental market analysis, the industry is dominated by the 71-130 HP category. The reason for this segment's popularity is that it has an ideal power output that can accommodate a variety of farming tasks. 71-130 HP range equipment is efficient and versatile enough to be used for a wide range of agricultural chores, such as planting, ploughing, and harvesting. Farmers frequently look for machinery with this kind of power output in order to get operational flexibility and efficiently handle a range of field situations. The 71–130 HP category is a major driver in the farm equipment rental market, as seen by the industry's preference for machinery that can handle both normal and intensive agricultural tasks. This need for mid-range power output equipment reflects this choice.

Farm Equipment Rental Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Farm Equipment Rental Market Regional Analysis

In 2022, the Asia Pacific region led the market with a substantial share, and it is projected to exhibit the fastest growth over the estimated period from 2023 to 2032. Countries such as India, China, Vietnam, and Thailand play a pivotal role in supporting the market value. Simultaneously, the mechanization in the agricultural sector of high-income countries, coupled with a shift from labor-intensive farming techniques to advanced technological equipment-based farming, is further accelerating the market value. The increasing production of rice and crops like palm and cotton, along with growing demand for farm produce due to the expanding population, supports market growth. The presence of major players and their support for farmers, exemplified by companies like EM3 Agri Services and Trringo (owned by Mahindra’s Farm Equipment Sector), offering tractor-on-call services in different states in India, further boosts the market value.

Farm Equipment Rental Market Players

Some of the top farm equipment rental companies offered in our report includes Deere & Company, Farmease, Flaman Group of Companies, JFarm Services, Messick’s, Pacific Equipment Rentals, Pacific Tractor & Implement, Premier Equipment Rental, The Papé Group, Inc., Titan Machinery, and Trringo.

Frequently Asked Questions

How big is the farm equipment rental market?

The farm equipment rental market size was valued at USD 52.7 billion in 2022.

What is the CAGR of the global farm equipment rental market from 2023 to 2032?

The CAGR of farm equipment rental is 7.2% during the analysis period of 2023 to 2032.

Which are the key players in the farm equipment rental market?

The key players operating in the global market are including Deere & Company, Farmease, Flaman Group of Companies, JFarm Services, Messick’s, Pacific Equipment Rentals, Pacific Tractor & Implement, Premier Equipment Rental, The Papé Group, Inc., Titan Machinery, and Trringo.

Which region dominated the global farm equipment rental market share?

Asia-Pacific held the dominating position in farm equipment rental industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of farm equipment rental during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global farm equipment rental industry?

The current trends and dynamics in the farm equipment rental industry include growing adoption of farm equipment rental for cost-effective farming solutions, increasing awareness among farmers about the benefits of equipment rentals, flexibility and accessibility offered by rental services for seasonal demands, and rising demand for modern and advanced agricultural machinery.

Which equipment type Output held the maximum share in 2022?

The tractors equipment type held the maximum share of the farm equipment rental industry.