Fabry Disease Treatment Market | Acumen Research and Consulting

Fabry Disease Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

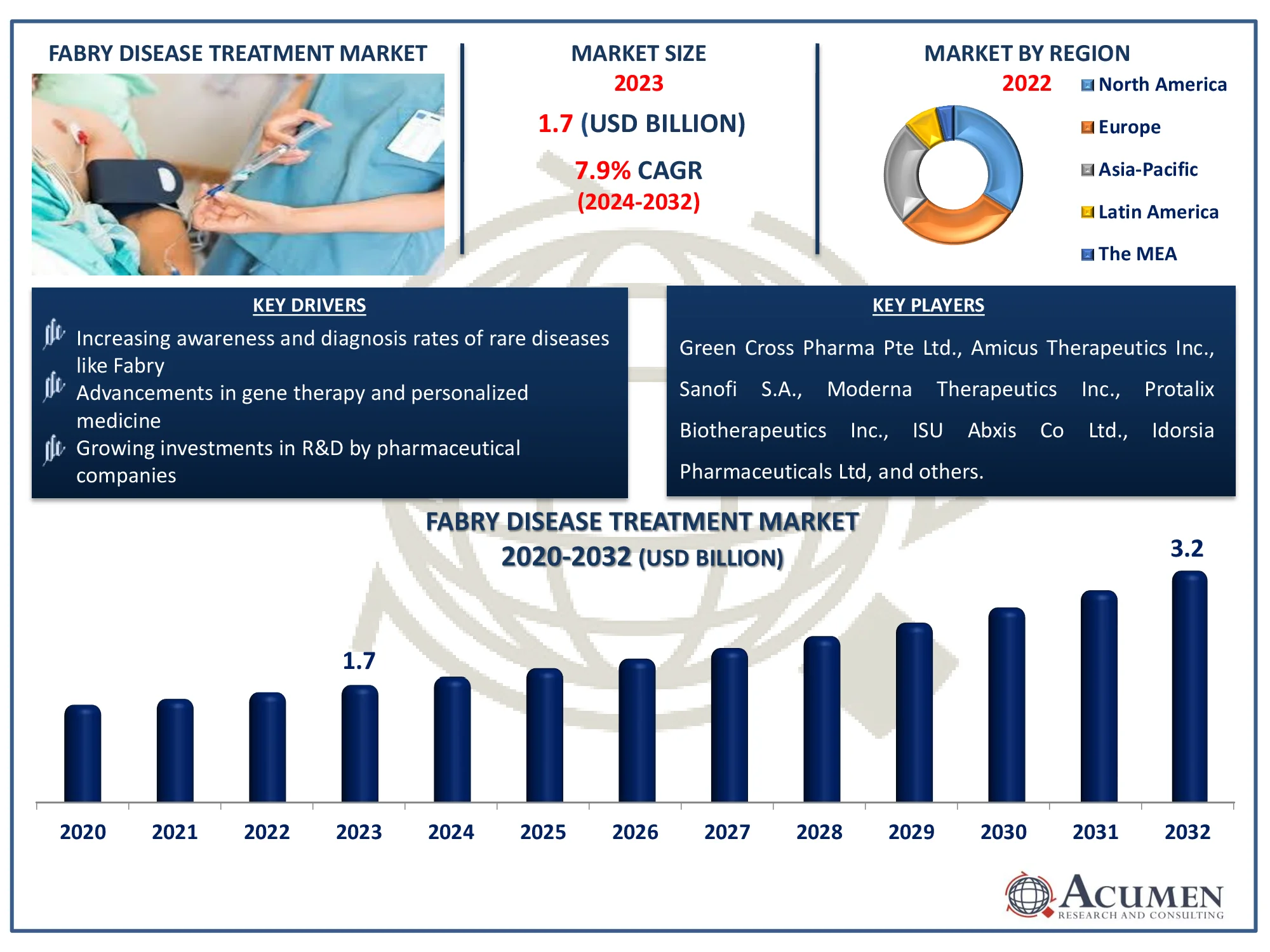

The Global Fabry Disease Treatment Market Size accounted for USD 1.7 Billion in 2023 and is estimated to achieve a market size of USD 3.2 Billion by 2032 growing at a CAGR of 7.9% from 2024 to 2032.

Fabry Disease Treatment Market Highlights

- Global fabry disease treatment market revenue is poised to garner USD 3.2 billion by 2032 with a CAGR of 7.9% from 2024 to 2032

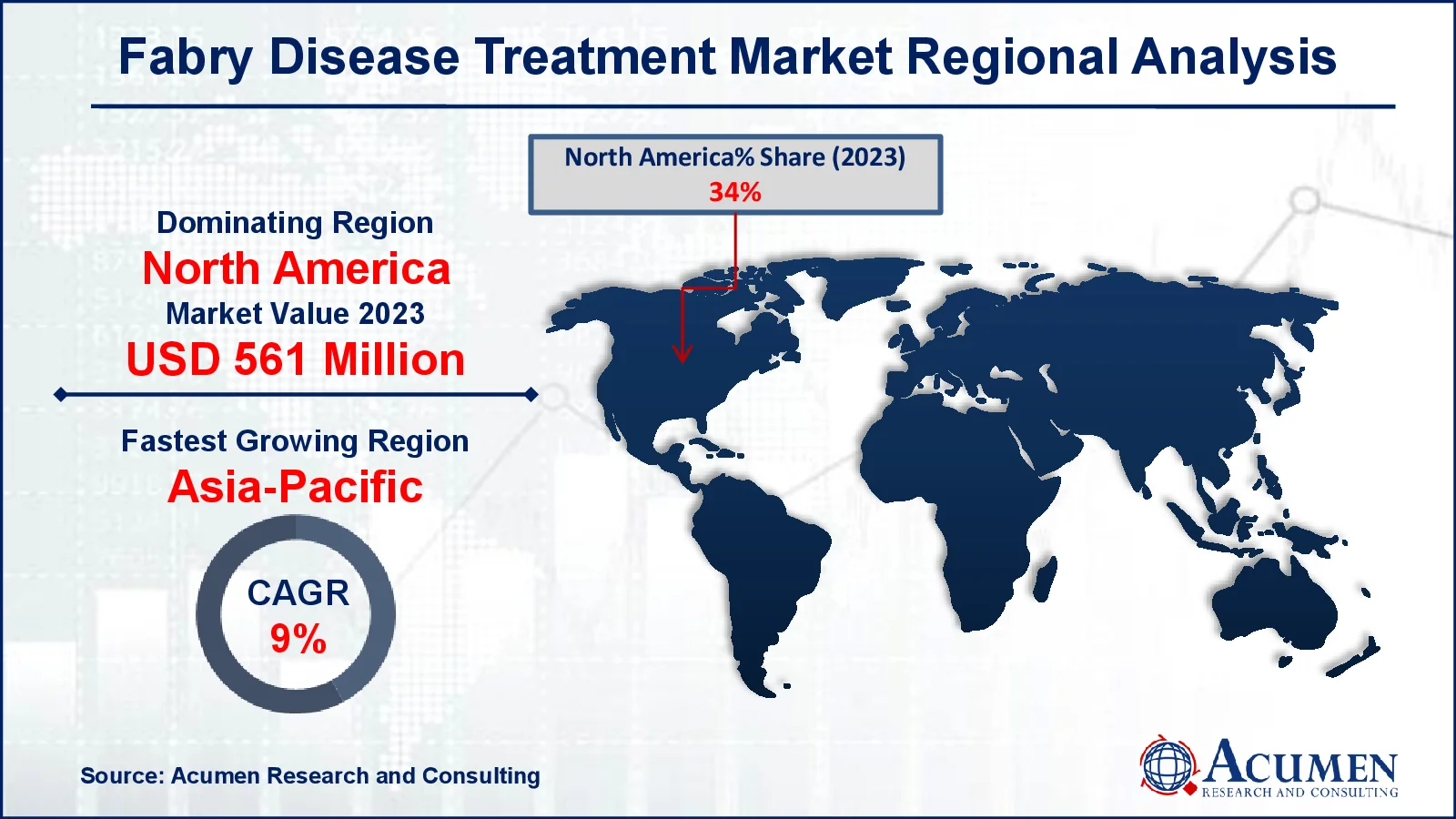

- North America fabry disease treatment market value occupied around USD 561 million in 2023

- Asia Pacific fabry disease treatment market growth will record a CAGR of more than 9% from 2024 to 2032

- Among treatment, the enzyme replacement therapy (ERT) sub-segment generated 65% of the market share in 2023

- Based on route of administration, the intravenous route sub-segment generated significant market share in 2023

- Increasing research in gene therapy as a potential cure is the fabry disease treatment market trend that fuels the industry demand

Fabry disease is a rare inherited lysosomal storage disorder caused by a genetic mutation that affects the function of the alpha-galactosidase enzyme. The disease typically presents with late-onset, mild symptoms, leading to many cases going undiagnosed. The standard treatment for managing fabry disease is enzyme replacement therapy (ERT). Sanofi's Fabrazyme and Shire's Replagal are the only approved ERTs in the EU; however, in the U.S., only Fabrazyme has received approval. The growing number of Fabry disease cases, the expanding use of novel treatments such as chaperone therapy, and the potential approval of pipeline drugs, including substrate reduction therapies and enzyme replacement therapies, are driving significant growth in the market.

Global Fabry Disease Treatment Market Dynamics

Market Drivers

- Increasing awareness and diagnosis rates of rare diseases like fabry

- Advancements in gene therapy and personalized medicine

- Growing investments in R&D by pharmaceutical companies

Market Restraints

- High cost of treatment and limited access to therapies

- Regulatory challenges and lengthy approval processes

- Limited patient pool due to the rarity of the disease

Market Opportunities

- Expansion of treatment options with innovative gene and enzyme replacement therapies

- Growth potential in emerging markets with improving healthcare infrastructure

- Collaboration between biotech firms and academic institutions for drug development

Fabry Disease Treatment Market Report Coverage

| Market | Fabry Disease Treatment Market |

| Fabry Disease Treatment Market Size 2022 |

USD 1.7 Billion |

| Fabry Disease Treatment Market Forecast 2032 | USD 3.2 Billion |

| Fabry Disease Treatment Market CAGR During 2023 - 2032 | 7.9% |

| Fabry Disease Treatment Market Analysis Period | 2020 - 2032 |

| Fabry Disease Treatment Market Base Year |

2022 |

| Fabry Disease Treatment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Route Of Administration, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Green Cross Pharma Pte Ltd., Amicus Therapeutics Inc., Sanofi S.A., Moderna Therapeutics Inc., Protalix Biotherapeutics Inc., ISU Abxis Co Ltd., Idorsia Pharmaceuticals Ltd, Takeda Pharmaceutical Company Limited, and JCR Pharmaceuticals Co Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Fabry Disease Treatment Market Insights

The growing number of patients with fabry disease, coupled with the increasing adoption of novel treatments such as chaperone therapy, has driven significant momentum in the market. Additionally, extensive research and development activities, along with the potential approval of promising pipeline products like substrate reduction therapies and enzyme replacement therapies, are expected to further fuel fabry disease treatment market growth over the forecast period.

Fabry disease is a rare X-linked lysosomal storage disorder characterized by a deficiency of the alpha-galactosidase enzyme, leading to progressive organ dysfunction. This condition is caused by the abnormal accumulation of a specific fatty substance called globotriaosylceramide in various tissues throughout the body, including the eyes, skin, kidneys, gastrointestinal system, central nervous system, heart, and brain.

Patients with fabry disease often experience severe pain in the extremities, compromised kidney function that can progress to full kidney failure, early heart problems, stroke, and debilitating gastrointestinal symptoms. Due to the lack of a curative treatment for fabry disease, current therapeutic options primarily focus on managing complications associated with disease progression and providing symptomatic relief.

Fabry Disease Treatment Market Segmentation

The worldwide market for fabry disease treatment is split based on treatment, route of administration, distribution channel, and geography.

Fabry Disease Treatment Type

- Enzyme Replacement Therapy (ERT)

- Chaperone Treatment

- Substrate Reduction Therapy (SRT)

- Others

According to the fabry disease treatment industry analysis, enzyme replacement therapy (ERT) is the dominant treatment because it directly addresses the enzyme deficiency caused by the genetic disorder. By supplementing the missing or deficient alpha-galactosidase an enzyme, ERT helps reduce the accumulation of harmful substances in cells, alleviating symptoms and slowing disease progression. Its efficacy in managing the disease and improving patient outcomes has made it the standard of care in the fabry disease treatment market.

Fabry Disease Treatment Route of Administration

- Intravenous Route

- Oral Route

The intravenous route segment is the largest route of administration category in the fabry disease treatment market, due to its effectiveness in delivering enzyme replacement therapies (ERTs) directly into the bloodstream. IV administration ensures optimal bioavailability, allowing the therapeutic enzymes to reach target tissues efficiently. This method is preferred for managing the disease's systemic effects and is essential for achieving consistent and controlled therapeutic outcomes.

Fabry Disease Treatment Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

According to the fabry disease treatment industry forecast, hospital pharmacies dominate as the primary distribution channel due to their role in managing complex therapies that often require specialized handling and administration. Patients with fabry disease typically receive enzyme replacement therapies or other advanced treatments that need to be administered under medical supervision, making hospital pharmacies essential.

Fabry Disease Treatment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Fabry Disease Treatment Market Regional Analysis

For several reasons, North America was the leading regional market, followed by Europe. The adoption of novel therapies, superior healthcare facilities, and favorable reimbursement policies are key factors driving market growth in these regions. Additionally, the inclusion of expensive medications like fabrazyme in health insurance programs and supportive government healthcare policies are encouraging pharmaceutical companies to boost R&D efforts in the area of rare diseases.

The Asia-Pacific region offers significant growth opportunities for pharmaceutical companies, driven by increasing healthcare expenditures and improving infrastructure. This region is expected to experience the fastest growth in the coming years, followed by Latin America, largely due to the substantial populations in emerging countries.

Fabry Disease Treatment Market Players

Some of the top fabry disease treatment companies offered in our report include Green Cross Pharma Pte Ltd., Amicus Therapeutics Inc., Sanofi S.A., Moderna Therapeutics Inc., Protalix Biotherapeutics Inc., ISU Abxis Co Ltd., Idorsia Pharmaceuticals Ltd, Takeda Pharmaceutical Company Limited, and JCR Pharmaceuticals Co Ltd.

Frequently Asked Questions

How big is the fabry disease treatment market?

The fabry disease treatment market size was valued at USD 1.7 billion in 2023.

What is the CAGR of the global fabry disease treatment market from 2024 to 2032?

The CAGR of fabry disease treatment is 7.9% during the analysis period of 2024 to 2032.

Which are the key players in the fabry disease treatment market?

The key players operating in the global market are including Green Cross Pharma Pte Ltd., Amicus Therapeutics Inc., Sanofi S.A., Moderna Therapeutics Inc., ProtalixBiotherapeutics Inc., ISU Abxis Co Ltd., Idorsia Pharmaceuticals Ltd, Takeda Pharmaceutical Company Limited, and JCR Pharmaceuticals Co Ltd.

Which region dominated the global fabry disease treatment market share?

North America held the dominating position in fabry disease treatment industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of fabry disease treatment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Fabry Disease Treatment industry?

The current trends and dynamics in the fabry disease treatment industry include increasing awareness and diagnosis rates of rare diseases like fabry, advancements in gene therapy and personalized medicine, and growing investments in R&D by pharmaceutical companies.

Which treatment held the maximum share in 2023?

The enzyme replacement therapy (ERT) treatment held the maximum share of the fabry disease treatment industry.