Fabric Softener Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Fabric Softener Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

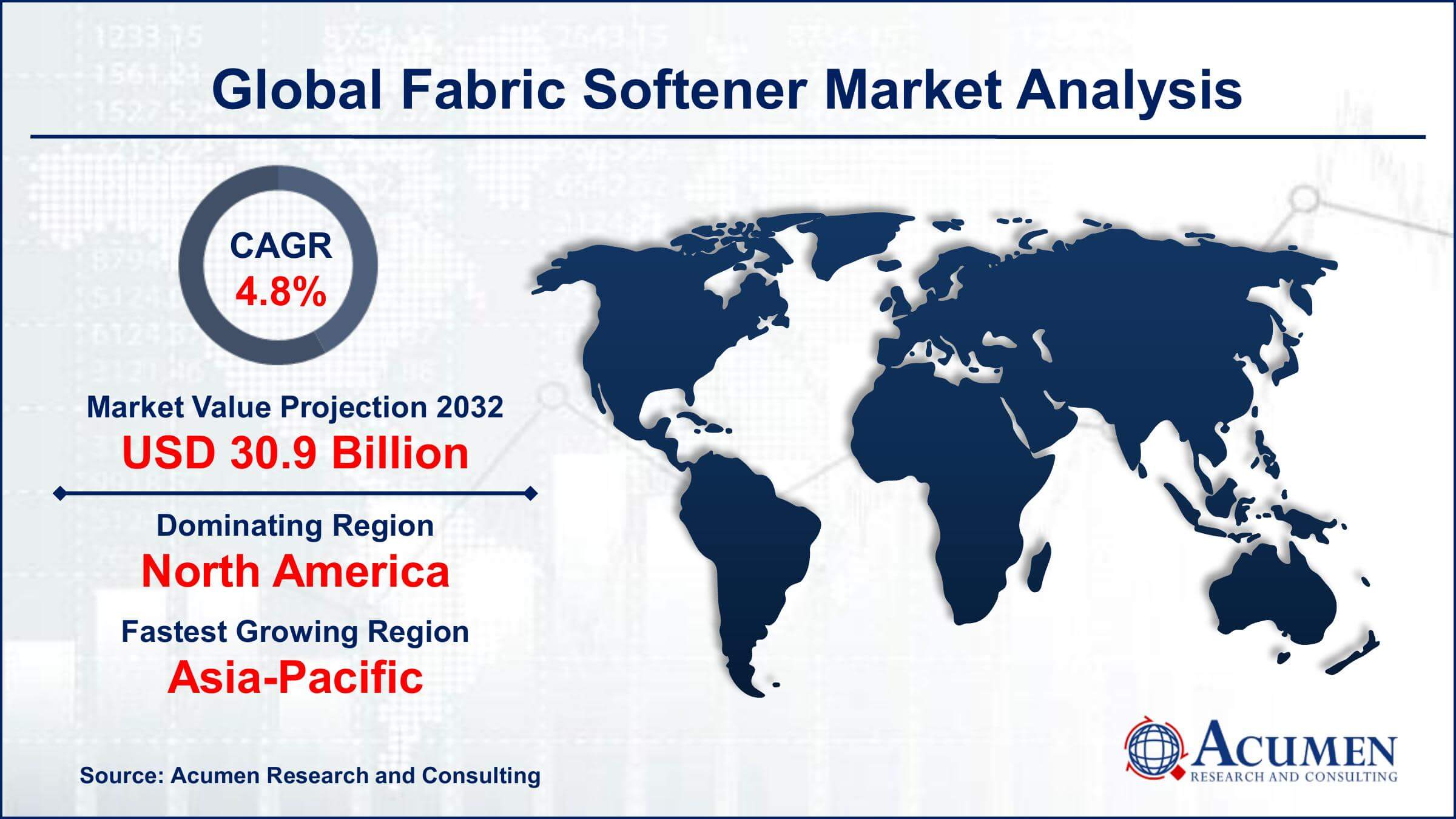

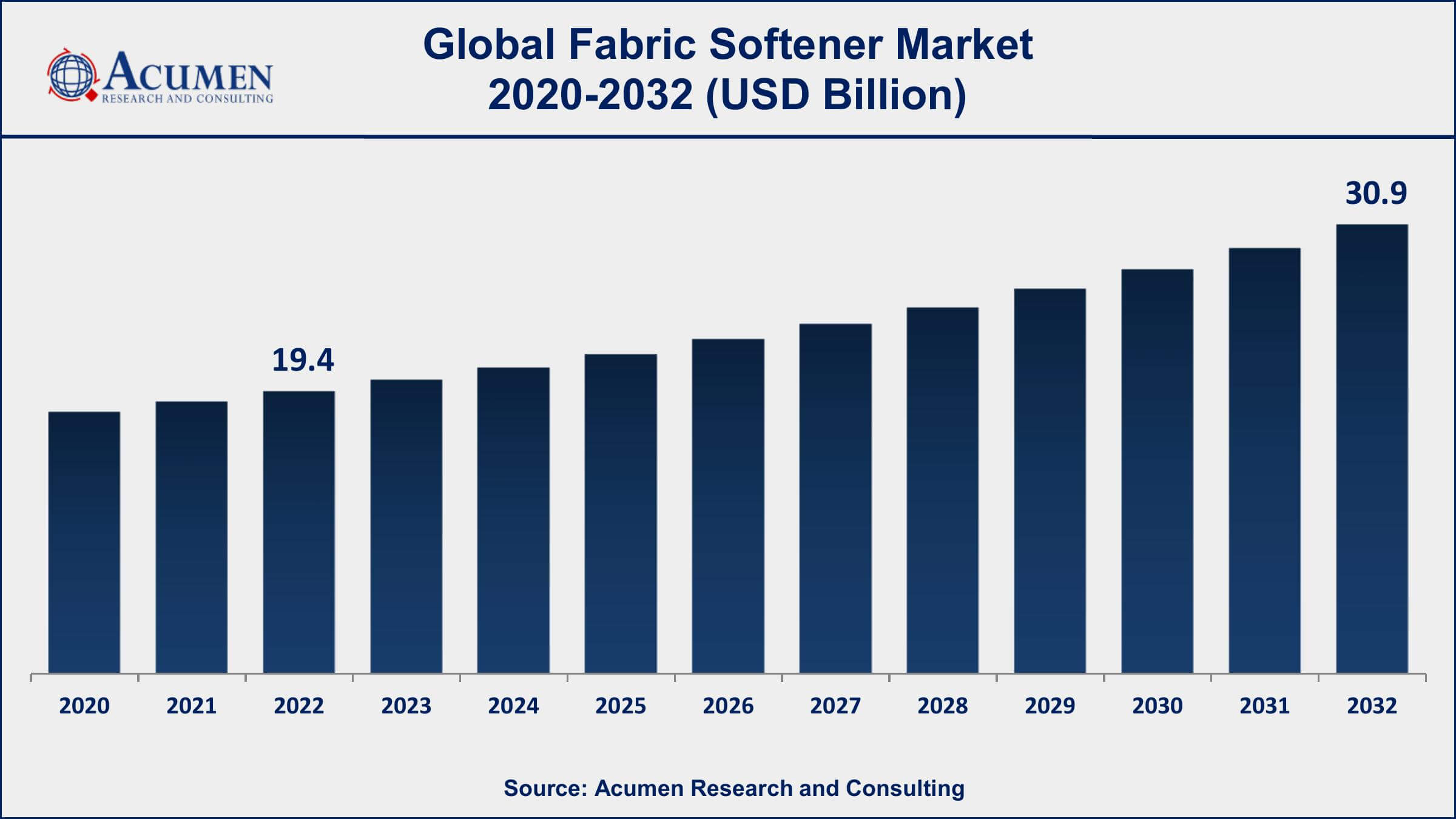

The Global Fabric Softener Market Size accounted for USD 19.4 Billion in 2022 and is projected to achieve a market size of USD 30.9 Billion by 2032 growing at a CAGR of 4.8% from 2023 to 2032.

Fabric Softener Market Highlights

- Global fabric softener market revenue is expected to increase by USD 30.9 Billion by 2032, with a 4.8% CAGR from 2023 to 2032

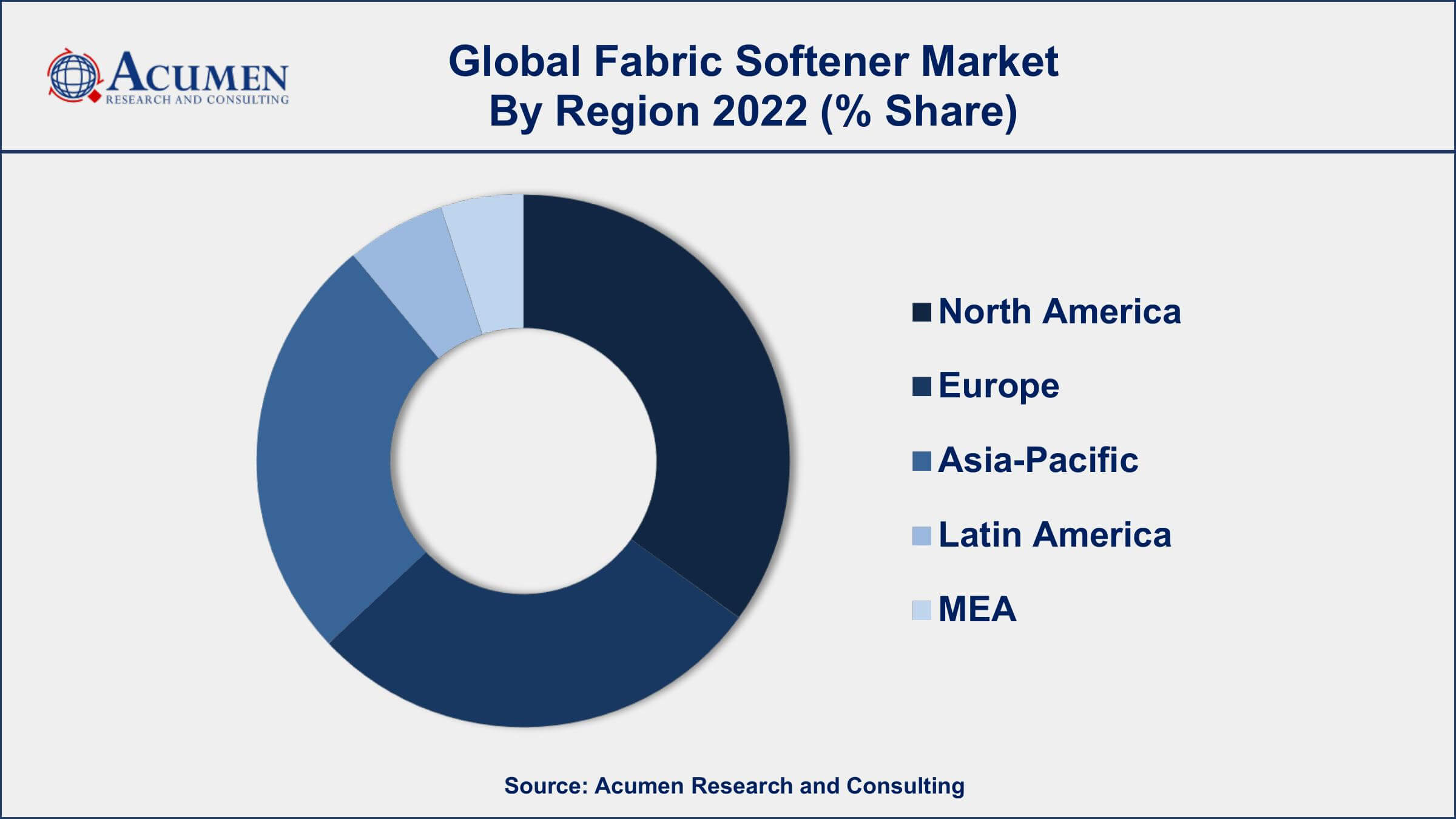

- North America region led with more than 38% of fabric softener market share in 2022

- Asia-Pacific fabric softener market growth will record a CAGR of around 5% from 2023 to 2032

- Liquid fabric softeners are the most popular form of fabric softeners, accounting for more than 55% of the market share

- By end-use, the household sector is expected to grow at a CAGR of 5.6% from 2023 to 2032

- Rising demand for premium and high-end fabric softener products, drives the fabric softener market value

Fabric softener is a laundry product used to enhance the feel and appearance of clothing and other textiles. It is typically added to the final rinse cycle of the washing machine and works by coating the fabric fibers with a thin layer of chemicals that help to reduce static cling, decrease drying time, and provide a pleasant scent. Fabric softeners can be either liquid or dryer sheets.

The global fabric softener market has experienced significant growth in recent years due to the increasing demand for laundry care products, rising disposable income, and changing lifestyles. The market is highly competitive, with major players constantly innovating and introducing new products to meet changing consumer needs. The Asia-Pacific region is the fastest-growing market for fabric softeners, with rising urbanization, increased disposable income, and a growing middle class driving demand. North America and Europe are also significant markets, with consumers seeking environmentally friendly and hypoallergenic fabric softener options. The market is expected to continue to grow in the coming years as consumers increasingly prioritize convenience, ease of use, and fragrance options when purchasing laundry care products.

Global Fabric Softener Market Trends

Market Drivers

- Increasing demand for laundry care products

- Increasing adoption of e-commerce channels for product sales

- Changing lifestyles and increased focus on personal hygiene

- Growing urbanization and middle-class population

- Innovative product launches by major players

Market Restraints

- Environmental concerns associated with fabric softeners

- Availability of alternative laundry care products

Market Opportunities

- Growing demand for eco-friendly and hypoallergenic fabric softeners

- Rising demand for premium and high-end fabric softener products

Fabric Softener Market Report Coverage

| Market | Fabric Softener Market |

| Fabric Softener Market Size 2022 | USD 19.4 Billion |

| Fabric Softener Market Forecast 2032 | USD 30.9 Billion |

| Fabric Softener Market CAGR During 2023 - 2032 | 4.8% |

| Fabric Softener Market Analysis Period | 2020 - 2032 |

| Fabric Softener Market Base Year | 2022 |

| Fabric Softener Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Procter & Gamble, Unilever, Henkel AG & Co. KGaA, Colgate-Palmolive Company, Church & Dwight Co., Inc., Kao Corporation, Lion Corporation, The Clorox Company, Reckitt Benckiser Group plc, S.C. Johnson & Son, Inc., Seventh Generation, Inc., and Ecover. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Fabric softeners are cationic surfactants that help keep the fabric soft and eliminate static cling by forming an electrically conductive chemical layer, thus increasing the longevity of the fabric. The market for fabric softeners has witnessed significant growth due to rising demand from various applications such as fragrant and natural care products along with the rising popularity of longer-lasting softeners.

The increasing use of fabric conditioners that have the ability to enhance the life span of fabric in terms of softening fabrics, increasing endurance ability of clothes against stains, reducing the formation of wrinkles, and preventing musty odor of clothes; along with the high growth in end-use industries is driving the market for fabric softeners, globally. An increase in lucrative opportunities from the underpenetrated and untapped market, an increase in disposable income, and growth in demand for technically advanced and sustainable fabric softeners are expected to change the dynamics of the market in near future. The major challenges faced by market players include stringent government regulations, and exposure to health and environmental hazards owing to the overuse of fabric softeners such as liquid fabric softeners and dryer sheets among others.

Fabric Softener Market Segmentation

The global fabric softener market segmentation is based on type, application, end-use, and geography.

Fabric Softener Market By Type

- Dryer Sheets

- Liquid

- Others

According to the fabric softener industry analysis, the liquid segment accounted for the largest market share in 2022. Liquid fabric softeners are preferred by consumers due to their ease of use and effectiveness in reducing static cling and providing a soft and fresh feel to the fabric. Additionally, liquid fabric softeners offer a wider range of fragrance options and are generally less expensive per load compared to dryer sheets. The growth of the liquid fabric softener segment can also be attributed to the increasing demand for concentrated and eco-friendly products. Concentrated liquid fabric softeners use less packaging and require less storage space, making them a more environmentally friendly option. They are also more cost-effective for consumers as they require smaller doses per load. Additionally, many consumers are becoming more conscious about the environmental impact of their household products, leading to a rise in demand for eco-friendly and sustainable fabric softeners.

Fabric Softener Market By Application

- Laundry Services

- Hospitality

- Household Cleaning

- Others

In terms of applications, the laundry services segment is expected to witness significant growth in the coming years. This can be attributed to the increasing demand for laundry services, particularly in urban areas where busy lifestyles and smaller living spaces make it difficult for consumers to do their own laundry. Laundry services often use fabric softeners to provide customers with clean and fresh-smelling clothes, making fabric softeners an essential component of their operations. The laundry services segment is also growing due to the rising demand for commercial laundry services in industries such as hospitality, healthcare, and retail. These industries require high-quality laundry services to maintain cleanliness and hygiene standards, and fabric softeners are an important part of the laundry process. The growth of these industries is driving the demand for fabric softeners in commercial laundry services.

Fabric Softener Market By End-use

- Household

- Commercial

According to the fabric softener market forecast, the household segment is expected to witness significant growth in the coming years. Fabric softeners are widely used in households to improve the feel and appearance of clothes and to eliminate static cling. The increasing demand for household fabric softeners can be attributed to changing consumer preferences, rising disposable income, and the growth of the middle-class population in emerging economies. Manufacturers are introducing new and innovative fabric softener products to meet the evolving needs of consumers. For example, some companies are offering eco-friendly and hypoallergenic fabric softeners that appeal to environmentally conscious and health-conscious consumers. Others are developing fabric softeners with longer-lasting fragrances, which are becoming increasingly popular among consumers. In addition, many manufacturers are introducing fabric softeners that are compatible with high-efficiency washing machines, which are becoming more common in households.

Fabric Softener Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Fabric Softener Market Regional Analysis

Geographically, North America is the dominant region in the fabric softener market in 2022. One of the primary reasons is the high standard of living and disposable income of consumers in North America. This has led to a higher demand for laundry care products, including fabric softeners, which are considered a staple in many households. In addition, the increasing awareness about personal hygiene and cleanliness has led to a growing demand for fabric softeners in North America. Another factor contributing to the dominance of North America in the fabric softener market is the presence of major market players in the region. Many of the leading manufacturers of fabric softeners are based in North America and have established a strong presence in the market. These companies have invested heavily in research and development to introduce new and innovative fabric softener products to meet changing consumer preferences.

Fabric Softener Market Player

Some of the top Fabric Softener market companies offered in the professional report include Procter & Gamble, Unilever, Henkel AG & Co. KGaA, Colgate-Palmolive Company, Church & Dwight Co., Inc., Kao Corporation, Lion Corporation, The Clorox Company, Reckitt Benckiser Group plc, S.C. Johnson & Son, Inc., Seventh Generation, Inc., and Ecover.

Frequently Asked Questions

What was the market size of the global fabric softener in 2022?

The market size of fabric softener was USD 592.4 Billion in 2022.

What is the CAGR of the global fabric softener market from 2023 to 2032?

The CAGR of fabric softener is 5.3% during the analysis period of 2023 to 2032.

Which are the key players in the fabric softener market?

The key players operating in the global market are including Procter & Gamble, Unilever, Henkel AG & Co. KGaA, Colgate-Palmolive Company, Church & Dwight Co., Inc., Kao Corporation, Lion Corporation, The Clorox Company, Reckitt Benckiser Group plc, S.C. Johnson & Son, Inc., Seventh Generation, Inc., and Ecover.

Which region dominated the global fabric softener market share?

North America held the dominating position in fabric softener industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of fabric softener during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global fabric softener industry?

The current trends and dynamics in the fabric softener industry include increasing demand for laundry care products, growing adoption of e-commerce channels for product sales, and changing lifestyles and increased focus on personal hygiene.

Which Application held the maximum share in 2022?

The laundry services application held the maximum share of the fabric softener industry.