Extrusion Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Extrusion Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

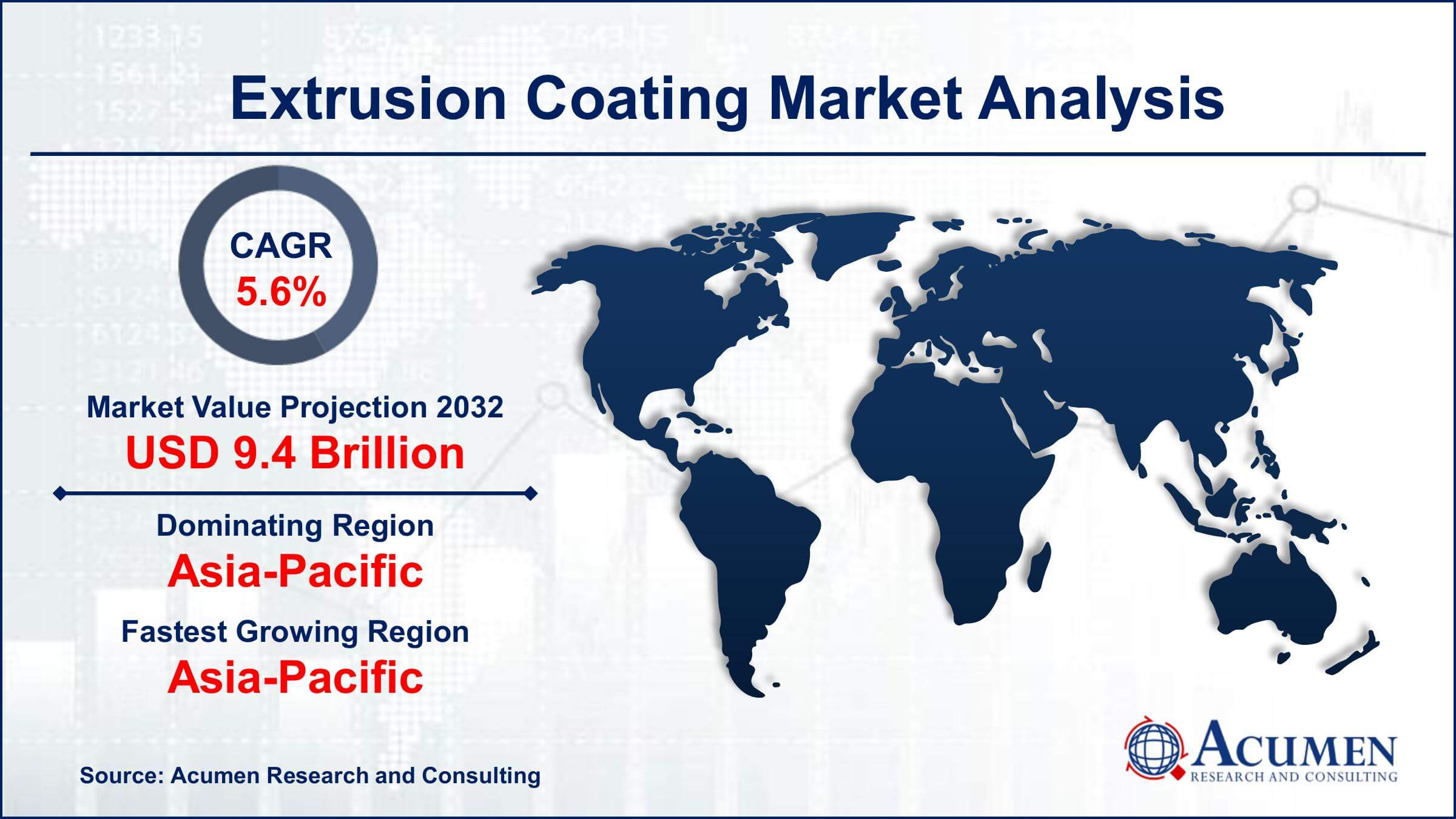

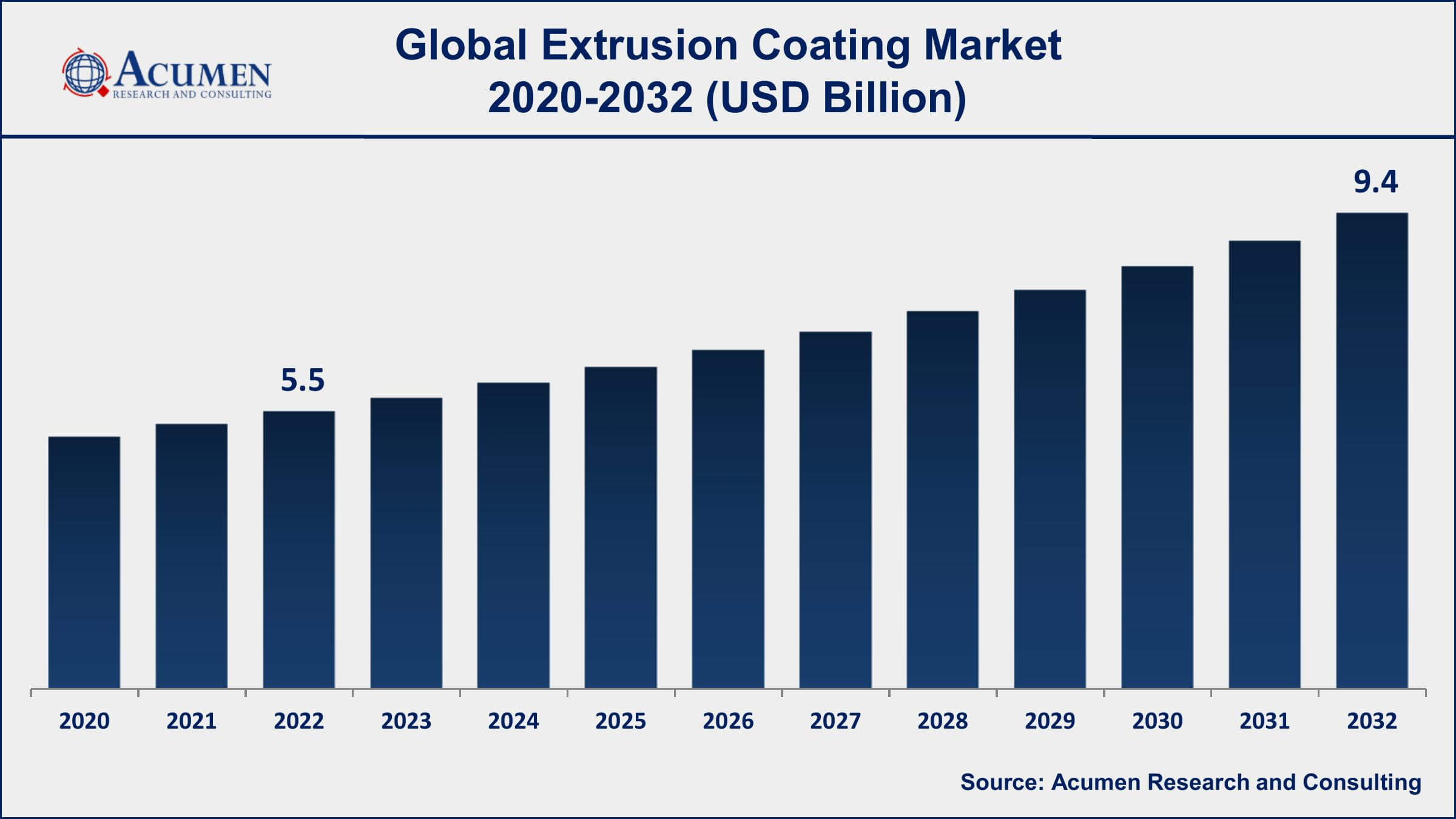

The Global Extrusion Coating Market Size accounted for USD 5.5 Billion in 2022 and is projected to achieve a market size of USD 9.4 Billion by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

Extrusion Coating Market Key Highlights

- Global extrusion coating market revenue is expected to increase by USD 9.4 Billion by 2032, with a 5.6% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 40% of extrusion coating market share in 2022

- According to the research report, global demand for extruded plastics will reach $290 billion in 2024

- The food packaging industry is the largest application segment for extrusion coating

- The major players in the extrusion coating industry include DowDuPont, ExxonMobil, LyondellBasell Industries, Borealis, and Akzo Nobel

- Increasing demand for eco-friendly and sustainable materials, drives the extrusion coating market size

Extrusion coating is a process in which a molten polymer is applied onto a substrate material to create a thin and continuous film. This process involves the use of an extruder to melt and pump the polymer through a die, which then applies the molten polymer onto the substrate. Extrusion coating is commonly used in the packaging industry to create various types of laminates, including paper, aluminum foil, and plastic films. It is also used in the production of building materials, automotive components, and electrical insulation.

The market for extrusion coating has been steadily growing over the years and is expected to continue to do so in the near future. One of the key drivers of this growth is the increasing demand for sustainable and eco-friendly packaging materials. Extrusion coating can provide a more sustainable alternative to traditional packaging materials, such as aluminum and glass, by using less material and reducing waste. Additionally, the growing popularity of online shopping and home delivery has led to an increased need for protective packaging materials, which can also drive the demand for extrusion coating.

Global Extrusion Coating Market Trends

Market Drivers

- Growing demand for sustainable and eco-friendly packaging materials

- Increasing popularity of online shopping and home delivery

- Rising demand for medical and pharmaceutical packaging

- Growing demand for food packaging with extended shelf-life

Market Restraints

- Volatility in raw material prices

- Stringent regulations on the use of certain materials, such as plastics

Market Opportunities

- Increased use of extrusion coating in construction and automotive industries

- Rising demand for customized and personalized packaging solutions

Extrusion Coating Market Report Coverage

| Market | Extrusion Coating Market |

| Extrusion Coating Market Size 2022 | USD 5.5 Billion |

| Extrusion Coating Market Forecast 2032 | USD 9.4 Billion |

| Extrusion Coating Market CAGR During 2023 - 2032 | 5.6% |

| Extrusion Coating Market Analysis Period | 2020 - 2032 |

| Extrusion Coating Market Base Year | 2022 |

| Extrusion Coating Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By Substrate, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | The Dow Chemical Company, ExxonMobil Chemical, LyondellBasell Industries N.V., Borealis AG, Celanese Corporation, Akzo Nobel N.V., NOVA Chemicals Corporation, Chevron Phillips Chemical Company LLC, Eastman Chemical Company, Formosa Plastics Corporation, INEOS Group Holdings S.A., and PPG Industries, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Extrusion Coating Market Dynamics

The extrusion of resin at a temperature of up to 320°C from a slot die is known as extrusion coating. Extrusion coating involves the application of melted synthetic resin on a substrate. It is used in several applications such as paperboard, aluminum foil, plastic films, fiberboard, cellulose, and non-woven. Extrusion coatings are cost-efficient and cover a wide range of applications in industries such as packaging, construction, and consumer products.

The global extrusion coating market value is growing at a significant pace owing to the growth in demand from the packaging industry. Moreover, the rise in demand from emerging economies of Asia-Pacific such as India, China, Malaysia, Taiwan, and Indonesia drives the market for extrusion coating. Also, the growing demand from the food industry is equally driving the market growth. However, the use of bio-based polymers instead of extrusion coating processes across various industries hampers the growth of the market. The market for extrusion coatings faces major challenges owing to government policies regarding the emission of carbon during the process. Asia-Pacific offers huge opportunities for the extrusion coating market growth. Rapidly increasing packaging, construction, and photographic industry are likely to drive the market for extrusion coating.

Extrusion Coating Market Segmentation

The global extrusion coating market segmentation is based on material, substrate, end use industry, and geography.

Extrusion Coating Market By Material

- Polyethylene

- High Density Polyethylene (HDPE)

- Low Density Polyethylene (LDPE)

- Other

- Ethylene Butyl Acrylate (EBA)

- Ethylene Vinyl Acetate (EVA)

- Polyethylene Terephthalate

- Polypropylene

- Other

According to the extrusion coating industry analysis, the polyethylene segment accounted for the largest market share in 2022. Polyethylene extrusion coatings offer several advantages, including good adhesion, excellent sealing properties, and high resistance to moisture, chemicals, and abrasion. These properties make polyethylene coatings ideal for a variety of applications, including food packaging, medical packaging, and construction. One of the key drivers of the growth of the polyethylene segment in the market is the increasing demand for flexible packaging solutions. Flexible packaging has become increasingly popular in recent years due to its convenience, sustainability, and cost-effectiveness. Polyethylene extrusion coatings are commonly used in the production of flexible packagings, such as pouches, bags, and wrappers. As the demand for flexible packaging continues to grow, the demand for polyethylene extrusion coatings is also expected to increase.

Extrusion Coating Market By Substrate

- Paperboard and Cardboard

- Metal Foils

- Polymer Films

- Other

In terms of substrates, the polymer films segment is one of the largest and fastest-growing segments in the extrusion coating market. Polymer films are widely used as substrates for extrusion coating, as they provide a smooth and consistent surface for the coating material to adhere to. Additionally, polymer films offer several advantages, including high strength, flexibility, and resistance to moisture, chemicals, and UV radiation. Polymer films are used in a variety of applications, such as food and beverage packaging, medical packaging, and construction. One of the key drivers of the growth of the polymer films segment is the increasing demand for sustainable and eco-friendly packaging materials.

Extrusion Coating Market By End Use Industry

- Packaging

- Personal Care

- Pharmaceutical

- Food & Beverage

- Construction

- Others

According to the extrusion coating market forecast, the packaging segment is expected to witness significant growth in the coming years. Extrusion coating is widely used in the production of various types of packaging, including food and beverage packaging, medical packaging, and industrial packaging. Extrusion coating can improve the barrier properties of the packaging, enhancing its ability to protect the contents from moisture, oxygen, and other contaminants. One of the key drivers of the growth of the packaging segment is the increasing demand for sustainable and eco-friendly packaging solutions. Consumers and companies are becoming increasingly aware of the environmental impact of traditional packaging materials, such as plastic and metal.

Extrusion Coating Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Extrusion Coating Market Regional Analysis

The Asia-Pacific region is dominating the extrusion coating market, accounting for a significant share of the global market. There are several factors driving this growth, including the rapid economic development of the region, increasing population, and the growth of end-user industries such as packaging, construction, and automotive. One of the key factors contributing to the dominance of the Asia-Pacific region is the increasing demand for packaging solutions. The region has a large and growing population, with a rising middle class that has increased purchasing power and demand for consumer goods. This has led to an increased demand for packaging, particularly flexible packaging, which is a major application of extrusion coatings. Another factor contributing to the growth of the extrusion coating industry in the Asia-Pacific region is the increasing investment in infrastructure development.

Extrusion Coating Market Player

Some of the top extrusion coating market companies offered in the professional report includes The Dow Chemical Company, ExxonMobil Chemical, LyondellBasell Industries N.V., Borealis AG, Celanese Corporation, Akzo Nobel N.V., NOVA Chemicals Corporation, Chevron Phillips Chemical Company LLC, Eastman Chemical Company, Formosa Plastics Corporation, INEOS Group Holdings S.A., and PPG Industries, Inc.

Frequently Asked Questions

What was the market size of the global extrusion coating in 2022?

The market size of extrusion coating was USD 5.5 Billion in 2022.

What is the CAGR of the global extrusion coating market from 2023 to 2032?

The CAGR of extrusion coating is 5.6% during the analysis period of 2023 to 2032.

Which are the key players in the extrusion coating market?

The key players operating in the global market are including The Dow Chemical Company, ExxonMobil Chemical, LyondellBasell Industries N.V., Borealis AG, Celanese Corporation, Akzo Nobel N.V., NOVA Chemicals Corporation, Chevron Phillips Chemical Company LLC, Eastman Chemical Company, Formosa Plastics Corporation, INEOS Group Holdings S.A., and PPG Industries, Inc.

Which region dominated the global extrusion coating market share?

Asia-Pacific held the dominating position in extrusion coating industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of extrusion coating during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global extrusion coating industry?

The current trends and dynamics in the extrusion coating industry include growing demand for sustainable and eco-friendly packaging materials, and increased use in construction and automotive industries.

Which material held the maximum share in 2022?

The polyethylene material held the maximum share of the extrusion coating industry.