Evaporative Condensing Unit Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Evaporative Condensing Unit Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

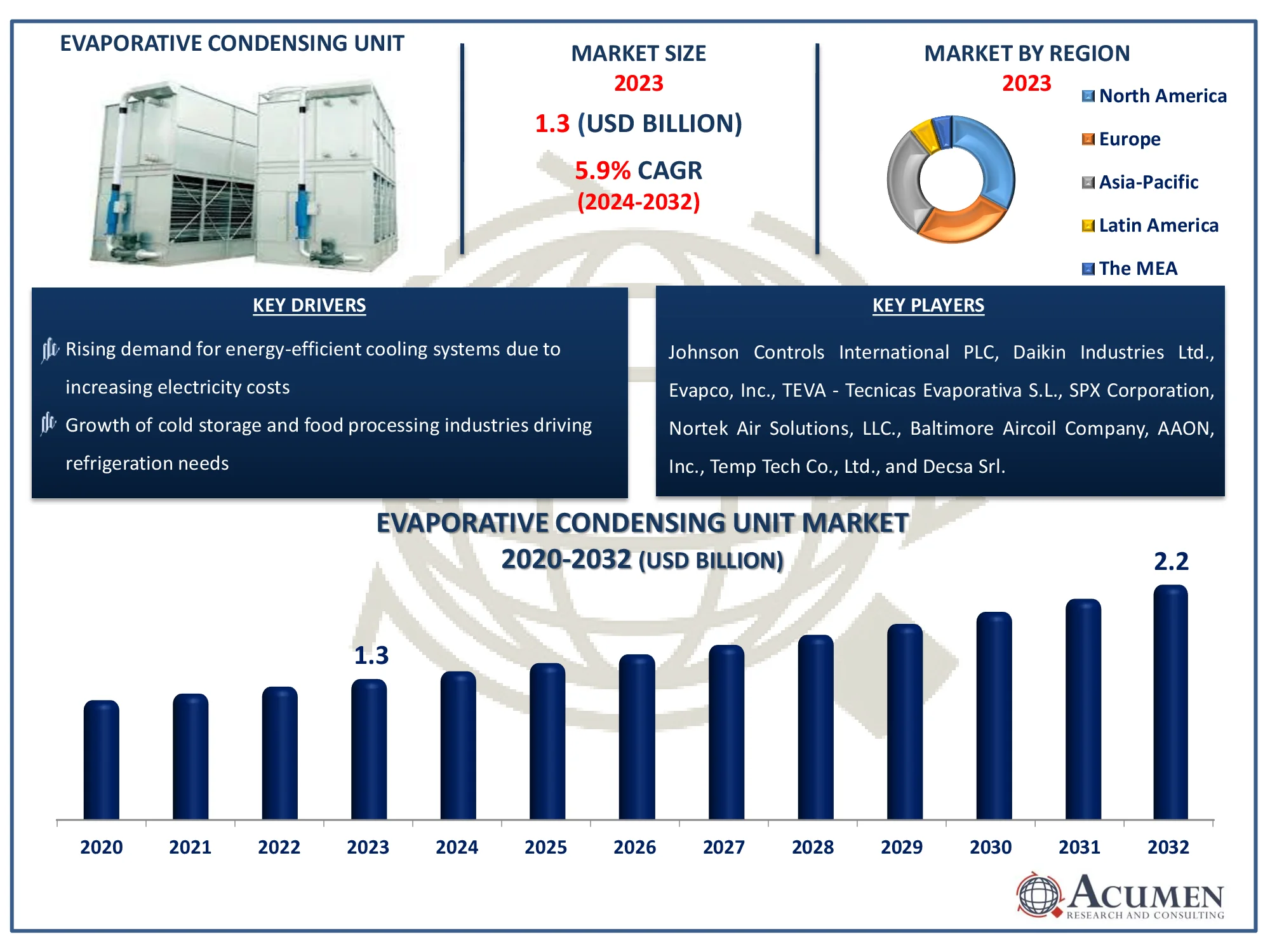

The Global Evaporative Condensing Unit Market Size accounted for USD 1.3 Billion in 2023 and is estimated to achieve a market size of USD 2.2 Billion by 2032 growing at a CAGR of 5.9% from 2024 to 2032.

Evaporative Condensing Unit Market Highlights

- Global evaporative condensing unit market revenue is poised to garner USD 2.2 billion by 2032 with a CAGR of 5.9% from 2024 to 2032

- North America evaporative condensing unit market value occupied around USD 432.3 million in 2023

- Asia-Pacific evaporative condensing unit market growth will record a CAGR of more than 7% from 2024 to 2032

- Among end-use industry, the commercial sub-segment generated notable revenue in 2023

- Based on application, the refrigeration sub-segment generated significant evaporative condensing unit market share in 2023

- Government incentives promoting energy-efficient and eco-friendly HVAC systems is a popular evaporative condensing unit market trend that fuels the industry demand

In industrial operations, evaporative condensing units are employed to deliver compressor horsepower while also lowering condensing temperatures. Evaporative condensing units can save up to 15% when compared to standard systems. Advanced evaporative condensing units have features such as air-conditioning systems, adaptability, improved refrigeration performance, and increased durability and shelf life.

The market for evaporative condensing units is expanding because of the rise of end-use sectors such as food service, warehousing, and food processing in rising nations such as India, Thailand, China, Brazil, the United Arab Emirates, Saudi Arabia, and Malaysia. The increase is partly attributable to rising per capita income and a shift in people's lifestyles in emerging economies. However, greater knowledge of the negative impacts of global warming due to the use of chlorofluorocarbon (CFC) is currently limiting market expansion.

Global Evaporative Condensing Unit Market Dynamics

Market Drivers

- Rising demand for energy-efficient cooling systems due to increasing electricity costs

- Growth of cold storage and food processing industries driving refrigeration needs

- Strict environmental regulations promoting eco-friendly refrigeration solutions

- Expanding urbanization and commercial construction increasing HVAC adoption

Market Restraints

- High upfront costs limiting adoption among small and mid-sized businesses

- Water scarcity concerns restricting the use of evaporative cooling technologies

- Complex maintenance and operational challenges reducing user preference

Market Opportunities

- Increasing adoption of natural refrigerants driving demand for sustainable cooling

- Smart monitoring and automation advancements improving system efficiency

- Expansion of data centers boosting demand for industrial cooling solutions

Evaporative Condensing Unit Market Report Coverage

|

Market |

Evaporative Condensing Unit Market |

|

Evaporative Condensing Unit Market Size 2023 |

USD 1.3 Billion |

|

Evaporative Condensing Unit Market Forecast 2032 |

USD 2.2 Billion |

|

Evaporative Condensing Unit Market CAGR During 2024 - 2032 |

5.9% |

|

Evaporative Condensing Unit Market Analysis Period |

2020 - 2032 |

|

Evaporative Condensing Unit Market Base Year |

2023 |

|

Evaporative Condensing Unit Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Capacity, By Application, By End-Use Industry, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Johnson Controls International PLC, Daikin Industries Ltd., Evapco, Inc., TEVA - Tecnicas Evaporativa S.L., SPX Corporation, Nortek Air Solutions, LLC., Baltimore Aircoil Company, AAON, Inc., Temp Tech Co., Ltd., and Decsa Srl. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Evaporative Condensing Unit Market Insights

The evaporative condensing unit market is primarily driven by the growing need for energy-efficient cooling systems. As power prices climb, businesses and commercial buildings want cooling systems that consume less energy while yet offering adequate performance. Evaporative condensing units are gaining popularity because they use water evaporation to improve cooling efficiency while using less energy than conventional air-cooled units. This makes them excellent for organizations that need continuous refrigeration and HVAC systems, such as food storage, pharmaceuticals, and manufacturing.

Another key driver is the growth of the cold storage and food processing industries. As the global food supply chain increases, businesses are investing in novel refrigeration systems to meet rising demand for frozen and perishable foods. Evaporative condensing machines improve temperature management in cold storage warehouses, food processing industries, and supermarkets, extending product shelf life and lowering spoilage. Concerns about water scarcity provide a substantial barrier to the business, particularly in areas experiencing droughts or severe water usage rules. Because evaporative condensing units use water for cooling, their use may be limited in places where water conservation is a priority.

The proliferation of data centers represents a significant opportunity. As digital infrastructure expands, efficient cooling systems are in great demand to ensure peak server performance, creating new opportunities for evaporative condensing units.

Evaporative Condensing Unit Market Segmentation

Evaporative Condensing Unit Market Segmentation

The worldwide market for evaporative condensing unit is split based on type, capacity, application, end-use industry, and geography.

Evaporative Condensing Unit Market By Type

- Air-Cooled Condensing Unit

- Water-Cooled Condensing Unit

According to evaporative condensing unit industry analysis, the market is divided into two categories: air-cooled and water-cooled condensing units. While air-cooled units presently dominate the market due to their ease of installation and cheap maintenance costs, water-cooled systems are expected to rise significantly in the future years. Water-cooled condensing units have higher efficiency and cooling capacity than air-cooled units, making them excellent for large-scale applications like industrial facilities and commercial buildings. As enterprises prioritize energy efficiency and decrease their environmental footprint, demand for water-cooled condensing units is likely to increase. Furthermore, advances in water treatment technologies and the development of more efficient water-cooled systems are fueling the segment's expansion.

Evaporative Condensing Unit Market By Capacity

- Below 50 kW

- 50 kW – 100 kW

- Above 100 kW

The above 100 kW segment of the evaporative condensing unit market is predicted to grow significantly due to rising industrial and commercial demand. Large condensing units are required for large-scale refrigeration applications such as cold storage facilities, food processing plants, and industrial cooling systems in order to ensure effective heat dissipation and energy savings. Growing concerns about energy efficiency and environmental sustainability are driving companies toward evaporative condensing technology, which uses less water and electricity than typical air-cooled systems. Furthermore, stringent refrigerant laws are prompting organizations to invest in high-capacity, environmentally friendly solutions. As industries expand, particularly in high-temperature regions, the need for above 100 kW evaporative condensing units is expected to increase dramatically.

Evaporative Condensing Unit Market By Application

- Refrigeration

- Air Conditioning

Refrigeration segment held the largest share in evaporative condensing units market forecast period, both in the terms of value and volume, owing to its properties such as adaptability, and improved performance of refrigeration & air-conditioning systems and extended durability and shelf life. Refrigeration is used in various industries, such as ice manufacturing, power plant, food processing units, and chemical plant. The segment accounted significant share of the market in 2023. The demand is due to the growth in food & beverage industry in the emerging economies.

Evaporative Condensing Unit Market By End-Use Industry

- Residential

- Industrial

- Chemical

- Commercial

The commercial sector is predicted to generate the largest revenue among the end-use industries. This is mostly due to the increased usage of evaporative condensing units in commercial buildings such as office complexes, shopping malls, and hotels. Commercial buildings frequently require large-scale cooling systems to offer acceptable indoor conditions for their residents. Evaporative condensing units have great efficiency and cooling capacity, making them ideal for these applications. Furthermore, the increased emphasis on energy efficiency and sustainability in the commercial sector is driving up demand for evaporative condensing units, which use less energy than typical air-cooled systems. As the commercial sector expands and invests in energy-efficient solutions, the market for evaporative condensing units is likely to increase significantly.

Evaporative Condensing Unit Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Evaporative Condensing Unit Market Regional Analysis

Evaporative Condensing Unit Market Regional Analysis

Based on region, the evaporative condensing units market can be segmented into North America, Latin America, Europe, Middle East & Africa (MEA), and Asia-Pacific.

North America was the largest market for evaporative condensing units, in terms of value and volume, in 2023 because of the presence of several commercial industries, power, and chemical plants in the region. Industrial refrigeration is the major driving factor for the growth of evaporative condensing units market. Moreover, the surge in manufacturing and construction industries is likely to have positive influence on evaporative condensing unit market during the forecast period.

In Asia-Pacific region is the fastest growing, the refrigeration application dominated the market for evaporative condensing unit. This trend is majorly observed because of the establishment of new chemical and power plants in China, South Korea, and India. The Middle East & Africa region is projected to be the fastest growing market for evaporative condensing units during the forecast period. The growth is mainly due to the development of manufacturing facilities in the region which leads to the increased usage of evaporative condensing units.

Evaporative Condensing Unit Market Players

Some of the top evaporative condensing unit companies offered in our report includes Johnson Controls International PLC, Daikin Industries Ltd., Evapco, Inc., TEVA - Tecnicas Evaporativa S.L., SPX Corporation, Nortek Air Solutions, LLC., Baltimore Aircoil Company, AAON, Inc., Temp Tech Co., Ltd., and Decsa Srl.

Frequently Asked Questions

How big is the evaporative condensing unit market?

The evaporative condensing unit market size was valued at USD 1.3 Billion in 2023.

What is the CAGR of the global evaporative condensing unit market from 2024 to 2032?

The CAGR of evaporative condensing unit is 5.9% during the analysis period of 2024 to 2032.

Which are the key players in the evaporative condensing unit market?

The key players operating in the global market are including Johnson Controls International PLC, Daikin Industries Ltd., Evapco, Inc., TEVA - Tecnicas Evaporativa S.L., SPX Corporation, Nortek Air Solutions, LLC., Baltimore Aircoil Company, AAON, Inc., Temp Tech Co., Ltd., and Decsa Srl.

Which region dominated the global evaporative condensing unit market share?

North America held the dominating position in evaporative condensing unit industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of evaporative condensing unit during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global evaporative condensing unit industry?

The current trends and dynamics in the evaporative condensing unit industry include strict environmental regulations promoting eco-friendly refrigeration solutions, and expanding urbanization and commercial construction increasing HVAC adoption.

Which capacity held the maximum share in 2023?

The above 100 kW capacity held the notable share of the evaporative condensing unit industry.