Ethylene Propylene Diene Monomer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Ethylene Propylene Diene Monomer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

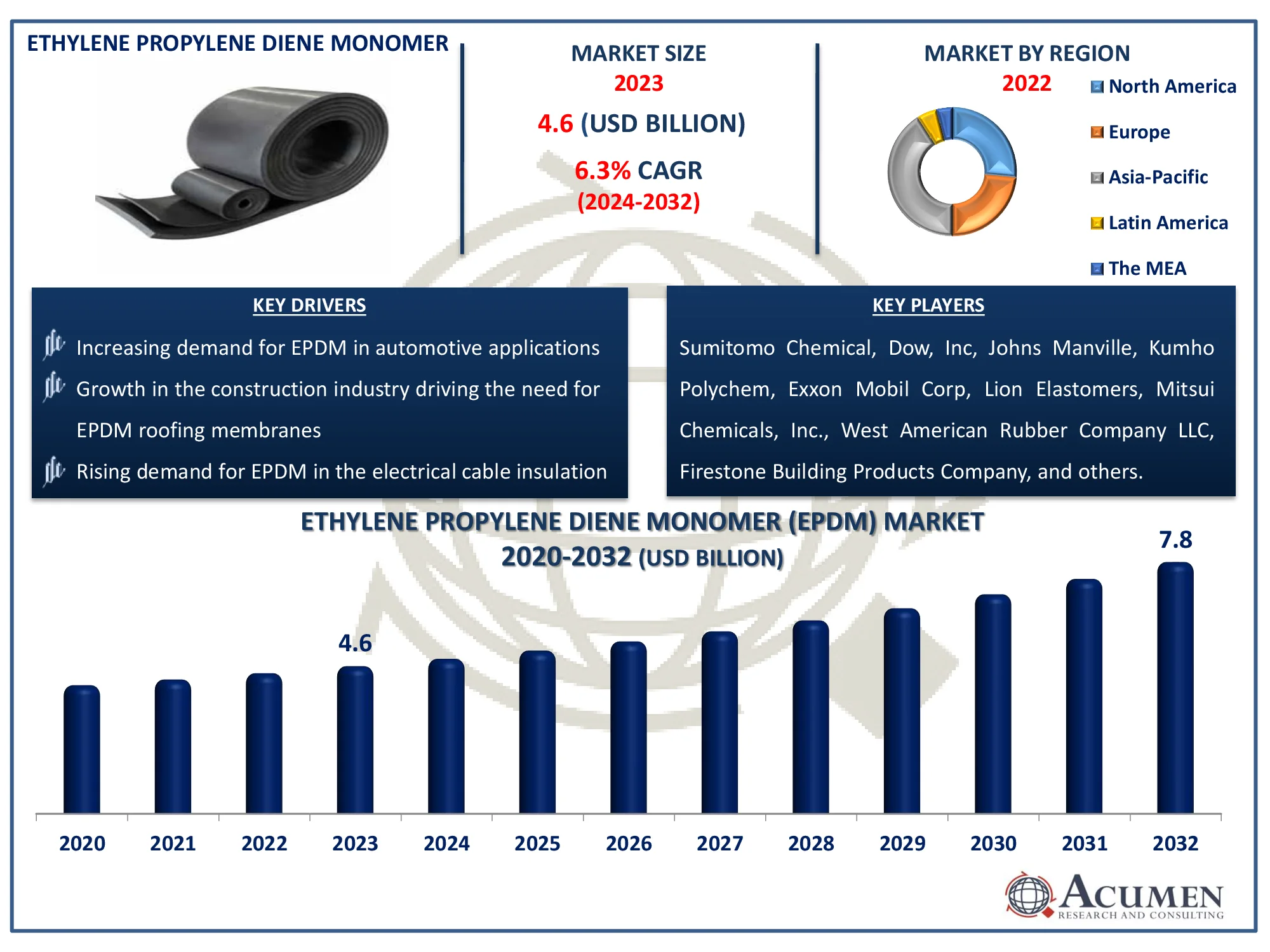

The Global Ethylene Propylene Diene Monomer Market Size accounted for USD 4.6 Billion in 2023 and is estimated to achieve a market size of USD 7.8 Billion by 2032 growing at a CAGR of 6.3% from 2024 to 2032.

Ethylene Propylene Diene Monomer Market Highlights

- Global ethylene propylene diene monomer market revenue is poised to garner USD 7.8 billion by 2032 with a CAGR of 6.3% from 2024 to 2032

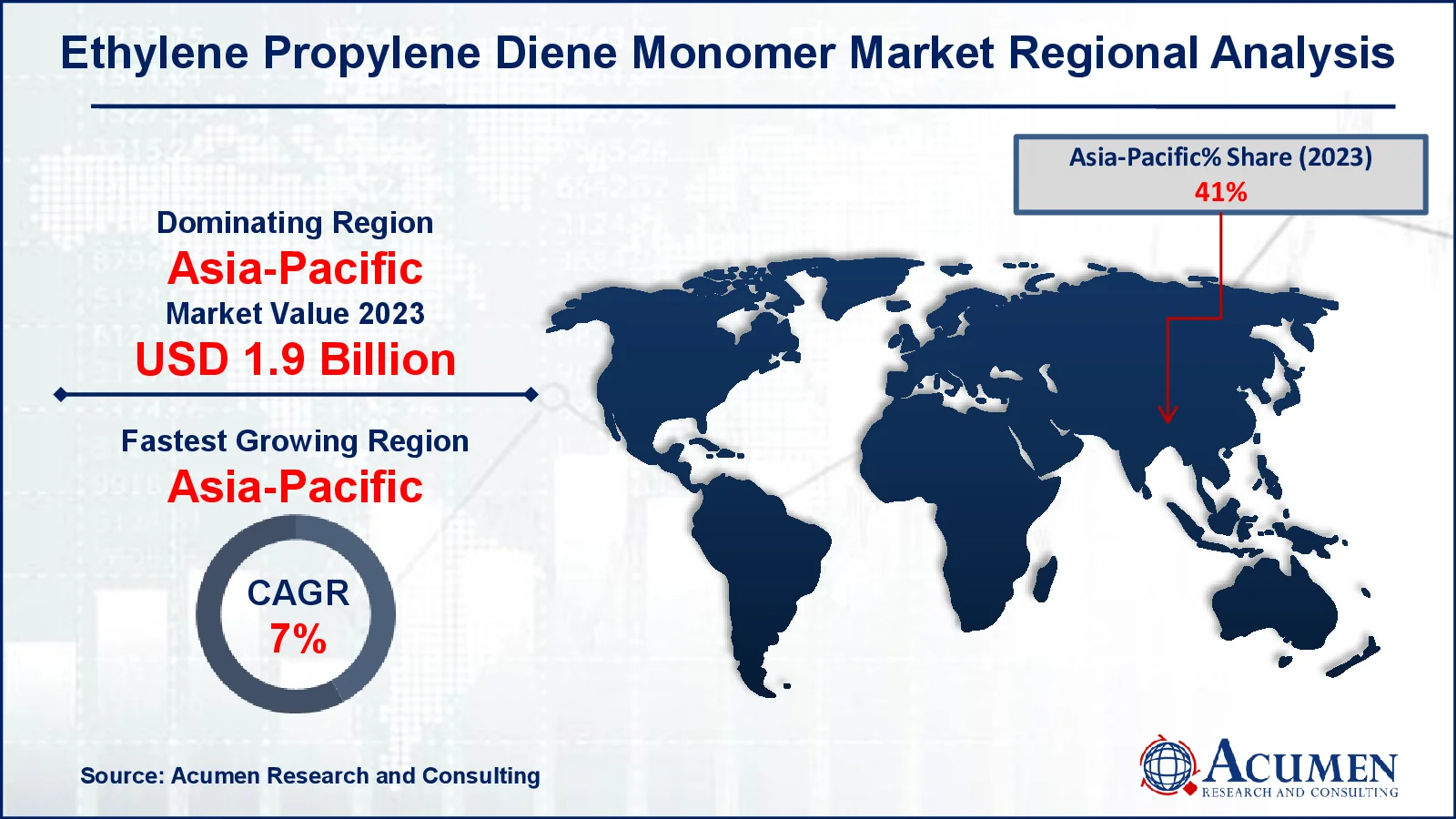

- North America ethylene propylene diene monomer market value occupied around USD 1.9 billion in 2023

- Asia-Pacific ethylene propylene diene monomer market growth will record a CAGR of more than 7% from 2024 to 2032

- Based on manufacturing process, the solution polymerization process sub-segment expected to generated significant market share in 2023

- Based on application, the automotive sub-segment shows 42% share in 2023

- Rising adoption in the electrical insulation sector is the ethylene propylene diene monomer market trend that fuels the industry demand

The market is largely driven by increasing demand for bio-based products and research and development needs in the field. High demand for EPDM, particularly in the Asia Pacific region due to the growth of end-use industries like automotive and construction, is also fueling market expansion. Growing investment in development and infrastructure by central governments, driven by rising populations and rapid urbanization and industrialization in developing economies, will further support market growth.

Global Ethylene Propylene Diene Monomer Market Dynamics

Market Drivers

- Increasing demand for EPDM in automotive applications due to its durability and resistance to weathering

- Growth in the construction industry driving the need for EPDM roofing membranes

- Rising demand for EPDM in the electrical cable insulation sector for its excellent electrical properties

Market Restraints

- Fluctuations in raw material prices affecting production costs

- Competition from alternative materials such as silicone and polyurethane

- Environmental concerns and regulatory pressures regarding the production and disposal of synthetic polymers

Market Opportunities

- Expanding applications in the renewable energy sector, such as in solar panel installations

- Technological advancements leading to improved EPDM formulations and performance

- Increasing focus on green and sustainable materials creating demand for eco-friendly EPDM solutions

Ethylene Propylene Diene Monomer Market Report Coverage

|

Market |

Ethylene Propylene Diene Monomer Market |

|

Ethylene Propylene Diene Monomer Market Size 2023 |

USD 4.6 Billion |

|

Ethylene Propylene Diene Monomer Market Forecast 2032 |

USD 7.8 Billion |

|

Ethylene Propylene Diene Monomer Market CAGR During 2024 - 2032 |

6.3% |

|

Ethylene Propylene Diene Monomer Market Analysis Period |

2020 - 2032 |

|

Ethylene Propylene Diene Monomer Market Base Year |

2023 |

|

Ethylene Propylene Diene Monomer Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Manufacturing Process, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Sumitomo Chemical Co., Ltd, Dow, Inc, Johns Manville, Kumho Polychem, Exxon Mobil Corp, Lion Elastomers, Mitsui Chemicals, Inc., West American Rubber Company LLC, Firestone Building Products Company, LLC, and Carlisle Companies Incorporated |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ethylene Propylene Diene Monomer Market Insights

In the global EPDM market, the major application segments include building and construction, wires and cables, electrical and electronics, oil additives, plastic modifications, automotive, tires and hoses, and others. As of 2023, the automotive sector was the largest application segment. EPDM is used in various automotive applications, including hydraulic braking systems, wire and cable assemblies, tubing, window spacers, radiators, belts, weather stripping and seals, glass run channels, and door, window, and trunk seals. It's also used for interior trim, striker plate seals, and engine parts. EPDM's growing popularity in these applications is due to its non-reflective and high-quality finish.

Keltan Eco is made using bio-based ethylene supplied by Braskem, a Brazilian company. Braskem produces this bio-based ethylene from sugarcane at its Triunfo, Brazil facility. The addition of a single bio-based component has no influence on EPDM's technical performance characteristics, such as oxidative and water resistance, safety and security, processing, and automotive performance.

Increasing demand for EPDM in automotive applications due to its durability and resistance to weathering drives growth of ethylene propylene diene monomer market in forecast year. For instance, according to India Meteorological Department (IMD), in 2023, China became the world's largest automotive production industry, with a total output of 30 million vehicles, including global leadership in the manufacture of new energy vehicles (NEVs).

Ethylene Propylene Diene Monomer Market Segmentation

The worldwide market for ethylene propylene diene monomer (EPDM) is split based on manufacturing process, application, and geography.

Ethylene Propylene Diene Monomer (EPDM) Market By Manufacturing Process

- Solution Polymerization Process

- Slurry/Suspension Process

- Gas-Phase Polymerization Process

The solution polymerization process segment is expected to increase over the EPDM market because of its capacity to generate high-quality polymers with superior performance properties such as increased elasticity and resistance to heat, weathering, and ozone. This method also provides additional customisation and versatility, enabling the creation of customized EPDM grades tailored to specific industrial requirements. Technological advances have reduced the cost of solution polymerization, increasing its economic feasibility. Furthermore, increased demand in important industries including as automotive and construction, which require high-performance materials, contributes to the dominance of this technique in the EPDM market.

Ethylene Propylene Diene Monomer (EPDM) Market By Application

- Building & Construction

- Wires & Cables

- Electrical & Electronics

- Lubricant Additive

- Plastic Modifications

- Automotive

- Tires & Tubes

- Others

According to the ethylene propylene diene monomer (EPDM) industry analysis, the automotive application category dominates the market due to its outstanding features, which include great resistance to heat, oxidation, and weathering. EPDM is commonly utilized in the manufacture of automobile seals, gaskets, weatherstripping, and hoses, which are critical to vehicle performance and longevity. The increasing global manufacturing of autos drives the demand for EPDM in this segment.

Ethylene Propylene Diene Monomer Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ethylene Propylene Diene Monomer Market Regional Analysis

For several reasons, the Asia-Pacific region has the largest EPDM market share and fastest growing even more due to strong demand from key industries such as automotive, construction, and electronics. In recent years, the manufacturing industry in Asia-Pacific has received significant investment from big worldwide corporations. For instance, according to The Centre for Economic Policy Research (CEPR), China is presently the world’s only manufacturing superpower. Its output exceeds that of the next nine largest firms combined. Companies in Northeast Asia are aggressively attempting to grow their economies by concentrating on raw material extraction, manufacturing, and services.

Governments around the region have converted their rural industries into world-class manufacturing facilities through protectionist policies, financial investments, and regulatory assistance. For instance, according to India Brand Equity Foundation, Positive advances in the manufacturing sector, fueled by expanded production capacity, government policy support, increased M&A activity, and PE/VC-led investment, is laying the groundwork for the country's long-term economic prosperity. Furthermore, cheap labor costs and proximity to raw material suppliers are enticing investors. China, Indonesia, South Korea, India, and Taiwan are expected to lead the Asia-Pacific EPDM market over the projection period. As a result, China is one of the world's largest manufacturers and purchasers of EPDM.

Ethylene Propylene Diene Monomer Market Players

Some of the top ethylene propylene diene monomer EPDM companies offered in our report include Sumitomo Chemical Co., Ltd, Dow, Inc, Johns Manville, Kumho Polychem, Exxon Mobil Corp, Lion Elastomers, Mitsui Chemicals, Inc., West American Rubber Company LLC, Firestone Building Products Company, LLC, and Carlisle Companies Incorporated.

Frequently Asked Questions

How big is the Ethylene Propylene Diene Monomer (EPDM) Market?

The Ethylene Propylene Diene Monomer Market size was valued at USD 4.6 billion in 2023.

What is the CAGR of the global Ethylene Propylene Diene Monomer EPDM Market from 2024 to 2032?

The CAGR of ethylene propylene diene monomer (EPDM) is 6.3% during the analysis period of 2024 to 2032.

Which are the key players in the Ethylene Propylene Diene Monomer Market?

The key players operating in the global market are including Sumitomo Chemical Co., Ltd, Dow, Inc, Johns Manville, Kumho Polychem, Exxon Mobil Corp, Lion Elastomers, Mitsui Chemicals, Inc., West American Rubber Company LLC, Firestone Building Products Company, LLC, and Carlisle Companies Incorporated.

Which region dominated the global EPDM Market share?

Asia-Pacific held the dominating position in ethylene propylene diene monomer (EPDM) industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ethylene propylene diene monomer (EPDM) during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Ethylene Propylene Diene Monomer (EPDM) industry?

The current trends and dynamics in the ethylene propylene diene monomer (EPDM) industry include increasing demand for EPDM in automotive applications due to its durability and resistance to weathering, growth in the construction industry driving the need for EPDM roofing membranes, and rising demand for EPDM in the electrical cable insulation sector for its excellent electrical properties.

Which manufacturing process held the maximum share in 2023?

The solution polymerization process expected to hold the maximum share of the ethylene propylene diene monomer (EPDM) industry.