Ethyl Tertiary Butyl Ether Market | Acumen Research and Consulting

Ethyl Tertiary Butyl Ether Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

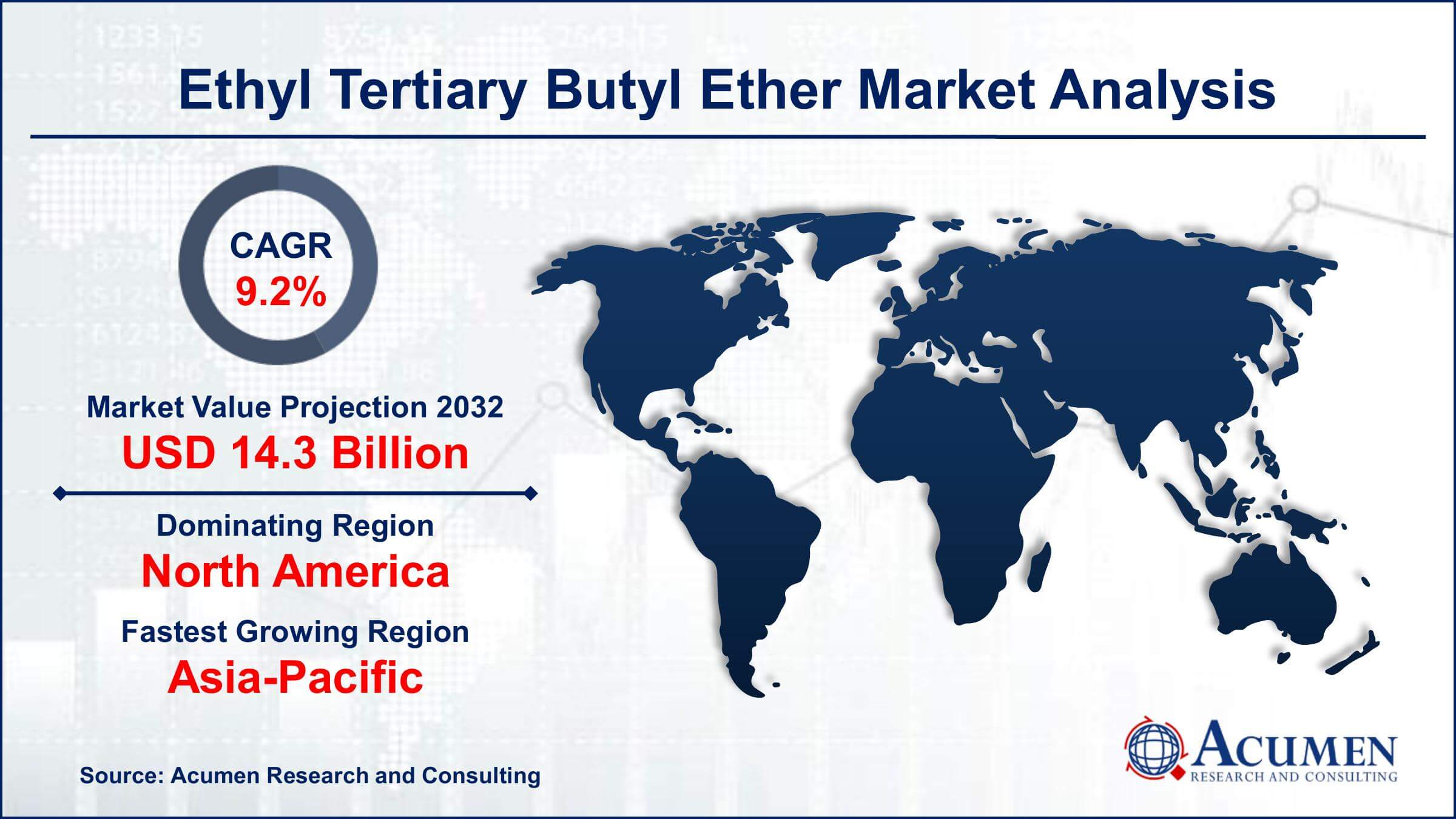

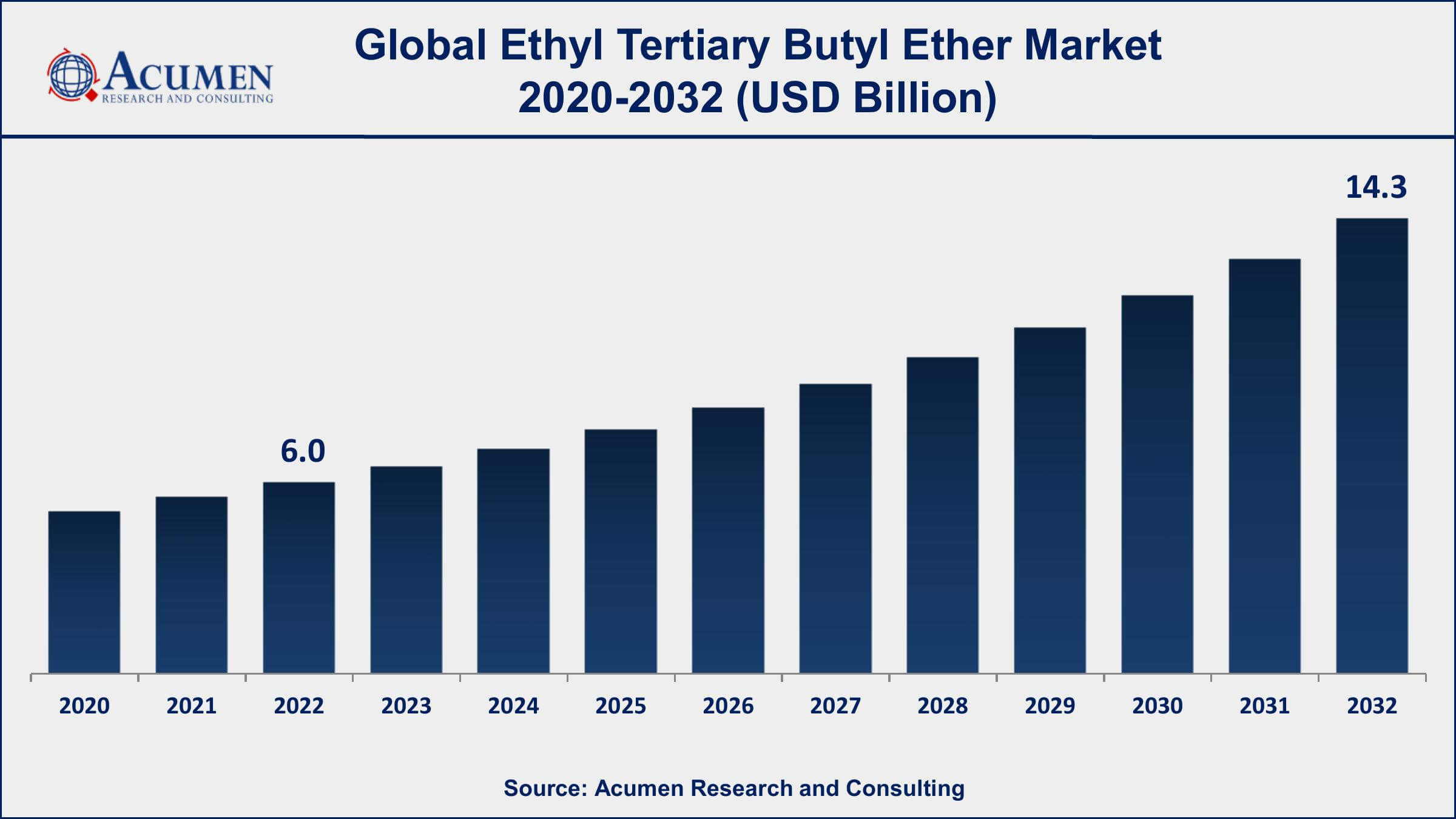

The Global Ethyl Tertiary Butyl Ether (ETBE) Market Size accounted for USD 6.0 Billion in 2022 and is projected to achieve a market size of USD 14.3 Billion by 2032 growing at a CAGR of 9.2% from 2023 to 2032.

ETBE Market Key Highlights

- Global ethyl tertiary butyl ether market revenue is expected to increase by USD 14.3 Billion by 2032, with a 9.2% % CAGR from 2023 to 2032

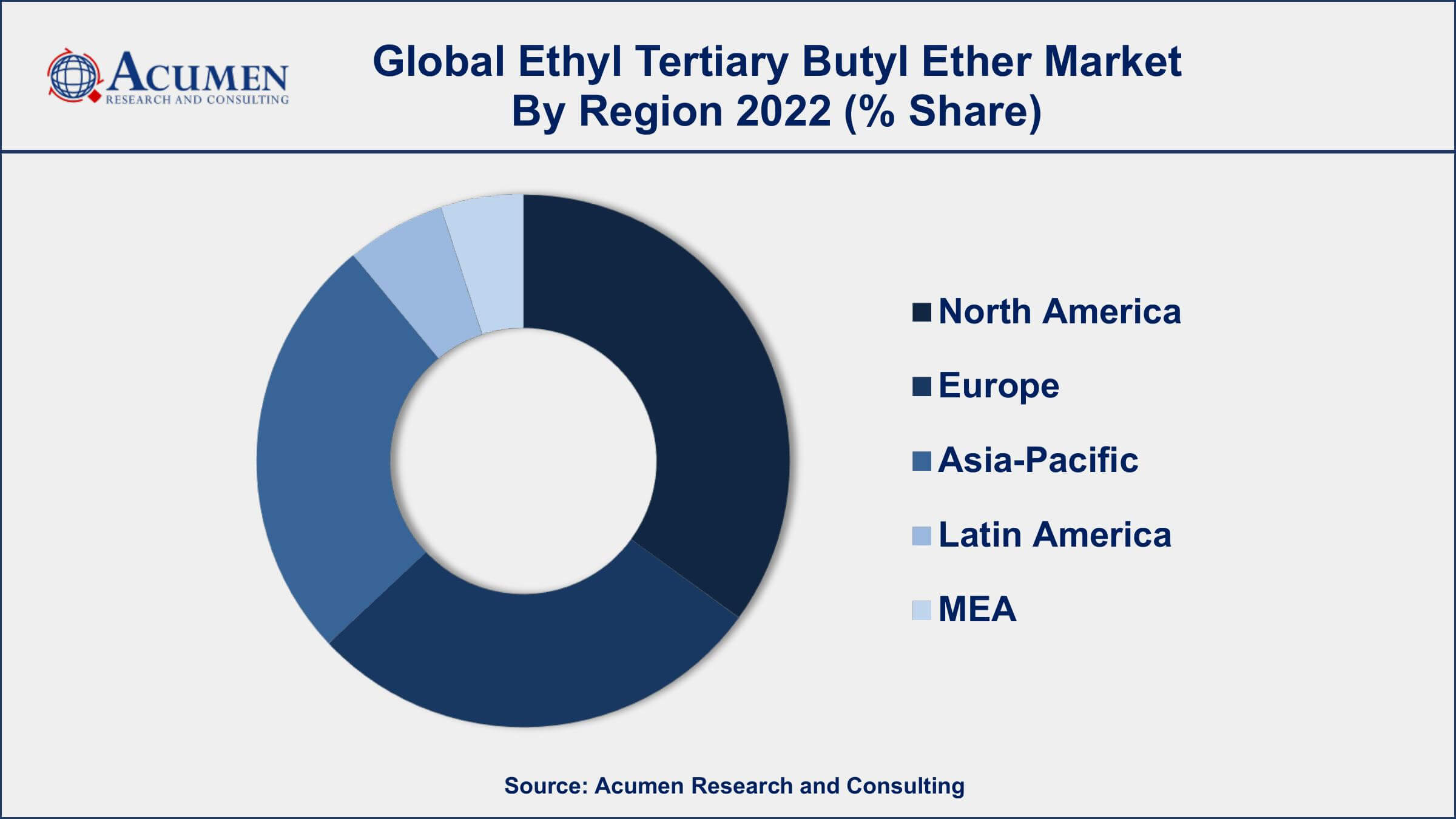

- Asia-Pacific region led with more than 40% of ethyl tertiary butyl ether market share in 2022

- Europe is also a significant market for ETBE, with Germany being the largest market in the region

- Asia-Pacific region is expected to witness the fastest growth in the ETBE market

- The direct solvent segment is the largest application segment for ETBE, accounting for over 44% of the global market share in 2022

- Increasing adoption of biofuels and the stringent environmental regulations, drives the ethyl tertiary butyl ether market value

Ethyl tertiary butyl ether (ETBE) is an oxygenate fuel additive that is commonly used in gasoline to enhance its combustion properties. It is produced by reacting ethanol with tertiary butyl alcohol (TBA), which is derived from isobutene. ETBE is widely used in the automotive industry as a replacement for methyl tertiary butyl ether (MTBE), which has been banned in many regions due to its harmful effects on the environment and human health.

The global ETBE market has been experiencing steady growth over the past few years due to the increasing demand for cleaner-burning fuels and the tightening of environmental regulations. The use of ETBE as an oxygenate additive in gasoline helps to reduce harmful emissions such as carbon monoxide, nitrogen oxides, and volatile organic compounds. In addition, ETBE is compatible with existing fuel infrastructure and does not require significant modifications to the existing engine technology. Additionally, the development of new technologies and the increasing investments in research and development activities by key market players are expected to contribute to the ethyl tertiary butyl ether market growth in the future.

Global Ethyl Tertiary Butyl Ether Market Trends

Market Drivers

- Increasing demand for cleaner-burning fuels

- Rising adoption of biofuels

- Growing awareness of environmental issues

- Stringent environmental regulations

- Compatibility with existing fuel infrastructure

Market Restraints

- Fluctuating crude oil prices

- High production costs

Market Opportunities

- Growing demand for alternative fuel sources

- Potential for applications beyond the fuel industry, such as in the pharmaceutical and chemical industries

Ethyl Tertiary Butyl Ether Market Report Coverage

| Market | Ethyl Tertiary Butyl Ether Market |

| Ethyl Tertiary Butyl Ether Market Size 2022 | USD 6.0 Billion |

| Ethyl Tertiary Butyl Ether Market Forecast 2032 | USD 14.3 Billion |

| Ethyl Tertiary Butyl Ether Market CAGR During 2023 - 2032 | 9.2% |

| Ethyl Tertiary Butyl Ether Market Analysis Period | 2020 - 2032 |

| Ethyl Tertiary Butyl Ether Market Base Year | 2022 |

| Ethyl Tertiary Butyl Ether Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, By End-use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | LyondellBasell Industries Holdings B.V., Exxon Mobil Corporation, SABIC, Royal Dutch Shell Plc, Evonik Industries AG, TotalEnergies SE, Repsol S.A., PETRONAS, ENI S.p.A., Neste Corporation, China Petroleum & Chemical Corporation (Sinopec), and JX Nippon Oil & Energy Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ethyl tertiary-butyl ether, abbreviated as ETBE, is largely used as an oxygenated added substance amid the generation of gas from unrefined petroleum. ETBE outfits moderately more prominent advantages, for example, productive air quality when contrasted with ethanol. ETBE does not cause gasoline evaporation, which is one of the reasons for the mist, and does not absorb moisture from the environment. The number of oxygenic compounds (oxygenates) available for use in gasoline can reduce vehicle exhaust emissions, and aromatic mixtures, and maintain high octane numbers using organo-lead mixtures.

The environmental contamination crisis and new environmental regulations have aided the need for cleaner-burning gasoline. Oxygenate extracts, which can upsurge the octane evaluation and persuade complete fuel incineration, play an important role in the growth of a greener and more sustainable environment. Likewise, one of the known oxygenate extracts, ethyl tertiary-butyl ether (ETBE) is preferred more after the negative effects caused by the addition of methyl tertiary-butyl ether (MTBE) to gasoline were discovered. Considering the biodegradation aspect, ETBE could have a minor advantage over MTBE, however, the presence of this compound probably has a little hindering effect on BTEX degradation. Although the use of ETBE is more advantageous, it is uneconomic in comparison to MTBE.

The rising use of ETBE as an uncommon solvent to break down gallstones additionally reinforces the market development. Additionally, rising interest for ETBE to yield methyl methacrylate is utilized as a part of the plastics produce and PVC which is foreseen to increase the market growth. Likewise, expanding interest for condition agreeable gas-added substances combined with expanding gradient of refiners towards practical choices of ethanol drives the general interest for ETBE across the globe. Moreover, expanding vehicular contamination, solid interest in cleaner energy, expanding gas utilization, and a rise in vehicle generation are some other key perspectives quickening the development of the worldwide ETBE market.

Ethyl Tertiary Butyl Ether Market Segmentation

The global ethyl tertiary butyl ether market segmentation is based on application, end-use industry, and geography.

Ethyl Tertiary Butyl Ether Market By Application

- Direct Solvent

- Chemical Intermediate

- Others

In terms of applications, the direct solvent segment has seen significant growth in the ethyl tertiary butyl ether market in recent years. ETBE is a versatile solvent that is widely used in the manufacturing of a variety of products such as coatings, adhesives, inks, and cleaning agents. One of the key drivers of the growth of the direct solvent segment in the ETBE market is the increasing demand for eco-friendly solvents. ETBE is considered to be a more environmentally friendly alternative to conventional solvents due to its lower toxicity and lower volatility. This has led to a growing preference for ETBE-based solvents in various applications, particularly in the automotive and construction industries. In addition, the increasing focus on sustainable and eco-friendly products is expected to further drive the growth of the direct solvent segment in the ETBE market.

Ethyl Tertiary Butyl Ether Market By End-use Industry

- Industrial Fluid

- Manufacturing Industries

- Consumer Goods

- Chemical Industries

- Others

According to the ethyl tertiary butyl ether market forecast, the industrial fluid segment is expected to witness significant growth in the coming years. ETBE is a commonly used solvent in various industrial fluids such as hydraulic fluids, cutting fluids, and metalworking fluids. One of the key drivers of the growth of the industrial fluid segment in the ETBE market is the increasing demand for high-performance industrial fluids. ETBE-based industrial fluids offer several benefits over conventional fluids, including improved thermal stability, reduced volatility, and better lubricating properties. These benefits make ETBE-based industrial fluids more suitable for high-performance applications in the automotive, aerospace, and heavy machinery industries. In addition, the growing awareness of environmental issues and the increasing focus on sustainable production practices are expected to drive the growth of the industrial fluid segment in the ETBE market.

Ethyl Tertiary Butyl Ether Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ethyl Tertiary Butyl Ether Market Regional Analysis

North America is dominating the ethyl tertiary butyl ether (ETBE) market due to several factors, including the high demand for cleaner-burning fuels, the stringent environmental regulations, and the well-established infrastructure for fuel production and distribution. The region is a significant producer and consumer of ETBE, with the United States being the largest market in North America. One of the key drivers of the growth of the ETBE market in North America is the increasing demand for cleaner-burning fuels. The region has been actively pursuing policies to reduce emissions from the transportation sector, which is a major source of pollution. ETBE is considered to be a more environmentally friendly alternative to conventional fuel additives, and its use has been promoted by several regulatory bodies in the region. In addition, the well-established infrastructure for fuel production and distribution in North America has also contributed to the dominance of the region in the ETBE market.

Ethyl Tertiary Butyl Ether Market Player

Some of the top ethyl tertiary butyl ether market companies offered in the professional report include LyondellBasell Industries Holdings B.V., Exxon Mobil Corporation, SABIC, Royal Dutch Shell Plc, Evonik Industries AG, TotalEnergies SE, Repsol S.A., PETRONAS, ENI S.p.A., Neste Corporation, China Petroleum & Chemical Corporation (Sinopec), and JX Nippon Oil & Energy Corporation.

Frequently Asked Questions

What was the market size of the global ethyl tertiary butyl ether in 2022?

The market size of ethyl tertiary butyl ether was USD 6.0 Billion in 2022.

What is the CAGR of the global ethyl tertiary butyl ether market from 2023 to 2032?

The CAGR of ethyl tertiary butyl ether is 9.2% during the analysis period of 2023 to 2032.

Which are the key players in the ethyl tertiary butyl ether market?

The key players operating in the global market are including LyondellBasell Industries Holdings B.V., Exxon Mobil Corporation, SABIC, Royal Dutch Shell Plc, Evonik Industries AG, TotalEnergies SE, Repsol S.A., PETRONAS, ENI S.p.A., Neste Corporation, China Petroleum & Chemical Corporation (Sinopec), and JX Nippon Oil & Energy Corporation.

Which region dominated the global ethyl tertiary butyl ether market share?

North America held the dominating position in ethyl tertiary butyl ether industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ethyl tertiary butyl ether during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global ethyl tertiary butyl ether industry?

The current trends and dynamics in the ethyl tertiary butyl ether industry include increasing demand for cleaner-burning fuels, and rising adoption of biofuels.

Which application held the maximum share in 2022?

The direct solvent application held the maximum share of the ethyl tertiary butyl ether industry.