Esoteric Testing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Esoteric Testing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

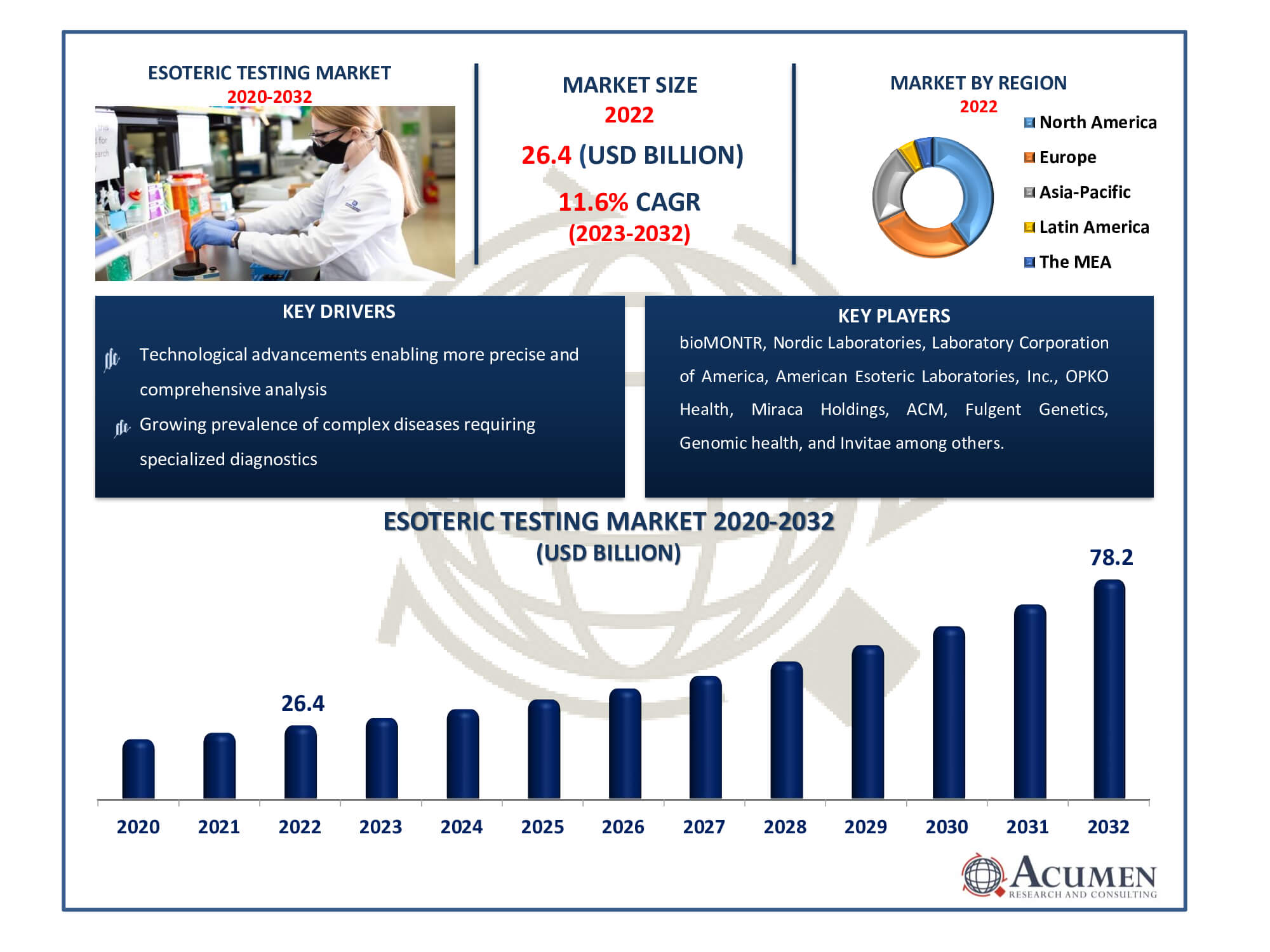

The Esoteric Testing Market Size accounted for USD 26.4 Billion in 2022 and is estimated to achieve a market size of USD 78.2 Billion by 2032 growing at a CAGR of 11.6% from 2023 to 2032.

Esoteric Testing Market Highlights

- Global esoteric testing market revenue is poised to garner USD 78.2 billion by 2032 with a CAGR of 11.6% from 2023 to 2032

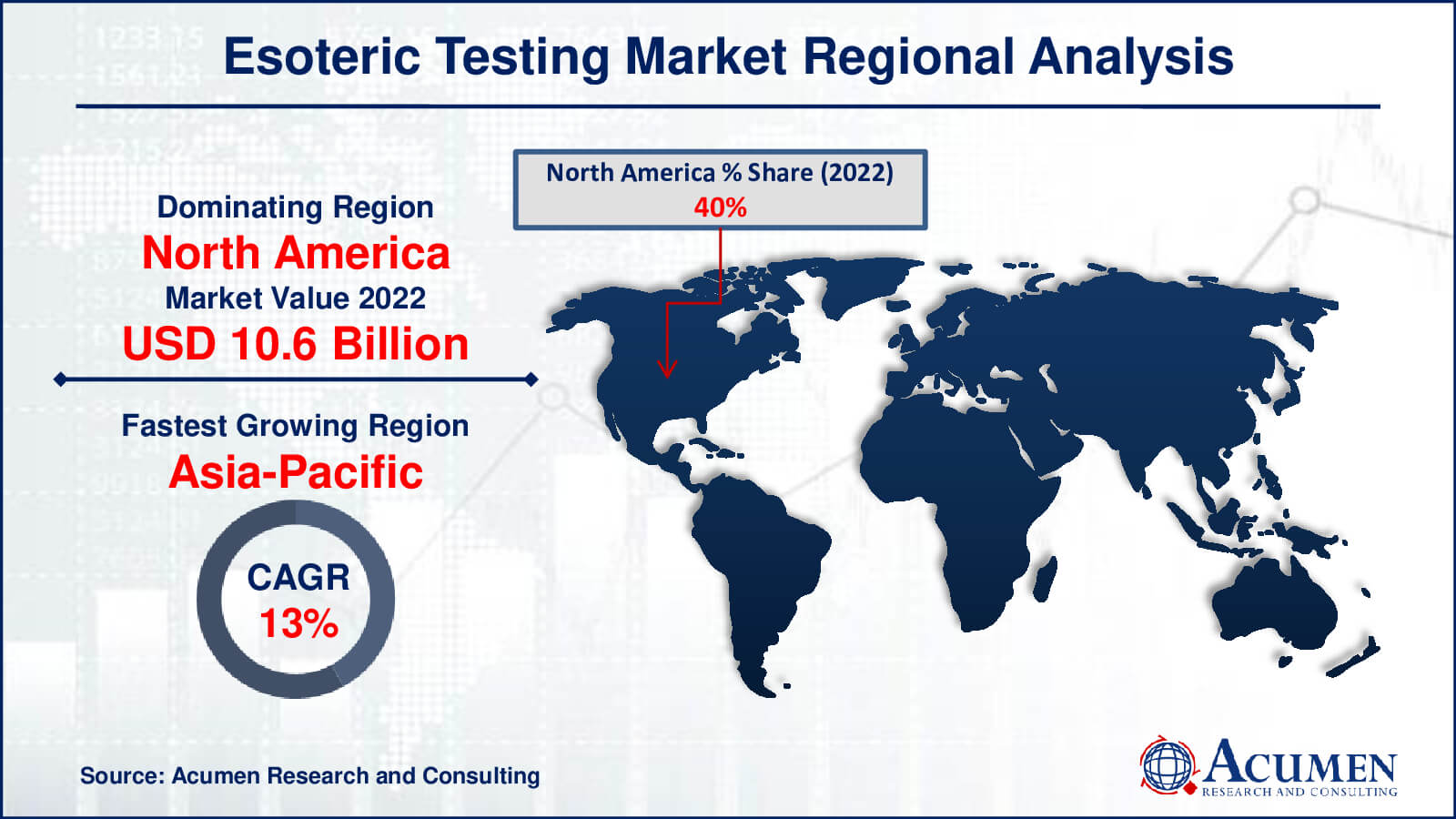

- North America esoteric testing market value occupied around USD 10.6 billion in 2022

- Asia-Pacific esoteric testing market growth will record a CAGR of more than 13% from 2023 to 2032

- Among technology, the chemiluminescence immunoassay sub-segment generated over US$ 6 billion revenue in 2022

- Based on end user, the independent and reference laboratories sub-segment generated around 53% share in 2022

- Development of portable or point-of-care testing for wider accessibility is a popular esoteric testing market trend that fuels the industry demand

Analysis of 'rare' molecules or substances constitutes esoteric testing, distinct from routine clinical laboratory procedures. These tests are only performed when additional information is essential to complement routine laboratory tests, aiding in accurate disease diagnosis, prognosis, treatment selection, and supervision. Esoteric testing entails intricate chemical and instrumental analyses conducted by qualified personnel in specialized and independent laboratories, given its high complexity and cost. Medical laboratories or hospitals cannot conduct these tests in-house due to their complexity. Esoteric testing is governed by stringent regulatory frameworks and is not part of regular testing protocols.

Global Esoteric Testing Market Dynamics

Market Drivers

- Technological advancements enabling more precise and comprehensive analysis

- Increasing demand for personalized medicine and targeted therapies

- Growing prevalence of complex diseases requiring specialized diagnostics

- Expanding awareness and adoption of precision medicine approaches

Market Restraints

- High costs associated with esoteric testing limiting accessibility

- Stringent regulatory hurdles and compliance requirements

- Limited availability of skilled personnel for intricate analyses

Market Opportunities

- Emerging markets offering untapped potential for esoteric testing

- Integration of artificial intelligence for enhanced analysis and interpretation

- Collaboration with healthcare providers for expanding testing capabilities

Esoteric Testing Market Report Coverage

| Market | Esoteric Testing Market |

| Esoteric Testing Market Size 2022 | USD 26.4 Billion |

| Esoteric Testing Market Forecast 2032 | USD 78.2 Billion |

| Esoteric Testing Market CAGR During 2023 - 2032 | 11.6% |

| Esoteric Testing Market Analysis Period | 2020 - 2032 |

| Esoteric Testing Market Base Year |

2022 |

| Esoteric Testing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Test Type, By Technology, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Laboratory Corporation of America, bioMONTR, American Esoteric Laboratories, Inc., OPKO Health, Nordic Laboratories, Miraca Holdings, ACM, Fulgent Genetics, Genomic health, Invitae, Mayo Medical Labors, Arup Laboratories, and Myriad Genetics. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Esoteric Testing Market Insights

The market is anticipated to be driven over the esoteric testing industry forecast period by heightened awareness and responsiveness towards early disease diagnosis and treatment of rare and complex diseases. According to the European Commission, nearly 27 to 36 million individuals in Europe are affected by rare diseases. In developing countries, rapid advancements in the healthcare sector and the proliferation of sophisticated laboratories providing advanced services will bolster industry growth. Additionally, the increasing number of baby boomers susceptible to various chronic conditions will significantly contribute to the industry's development.

The rising prevalence of chronic infectious diseases such as cancer and diabetes is expected to drive the demand for esoteric testing in the coming years. Additionally, technological advancements, including automation in antidote procedures, standardization of advanced devices, and analysis systems, will further propel the growth of esoteric testing. The increasing need for proteomics and genomics, coupled with augmented investments in developing innovative detection solutions for bodily functions, will stimulate business expansion. The rising demand for personalized genomics solutions in healthcare, driven by predictions and assessments of therapy responses and pharmaceutical growth, contributes to this increased demand. However, stringent regulations and a shortage of experts in emerging economies are expected to impede industry growth within the esoteric testing market forecast timeframe.

Esoteric Testing Market Segmentation

The worldwide market for esoteric testing is split based on test type, technology, end-user, and geography.

Esoteric Testing Test Types

- Infectious Disease Testing

- Oncology Testing

- Endocrinology Testing

- Genetic Testing

- Toxicology Testing

- Immunology Testing

- Neurology Testing

- Other Testing’s

According to the esoteric testing industry analysis, the infectious disease testing segment accounted for approximately 20% of the market in 2022 due to the high prevalence of infectious diseases and the escalating demand for advanced molecular tests. The availability of immunology laboratory services catering to each medical specialty is anticipated to positively impact sector growth.

Over the esoteric testing industry forecast period, increased awareness about early disease diagnosis and treatment, coupled with the rising incidence of cancer, will propel the esoteric oncology market. Notably, Quest Diagnostics' BRCAvantage, an esoteric testing development, will significantly influence patients with hereditary breast and ovarian cancer syndrome (HBOC), a group at higher cancer risk.

Esoteric Testing Technology

- Enzyme-linked Immunosorbent Assay

- Chemiluminescence Immunoassay

- Mass Spectrometry

- Real Time Polymerase Chain Reaction

- DNA Sequencing

- Flow Cytometry

- Other Technologies

The chemiluminescence esoteric technology market dominated the global industry in 2022. It is projected to grow largest percent compound annual growth rate (CAGR) due to its high efficiency and the requirement for small sample sizes. This technology, known for its superior sensitivity and accuracy, is expected to further stimulate business growth, particularly with low analyte concentrations.

In 2022, the ELISA Esoteric Technology market held noteworthy market share due to its increasing application in detecting various analytes. ELISA serves as a common technique in basic research, drug discovery, and high-performance laboratory screening. The sector anticipates sales growth through new biomarker discoveries, leading to the availability of new targets.

Esoteric Testing End-Users

- Hospital-based Laboratories

- Independent and Reference Laboratories

Within the esoteric testing market, the independent and reference laboratories segment is the largest. These labs provide specialized diagnostic services and reference testing to different healthcare practitioners, all while operating independently of hospital-based facilities. Their popularity is a result of the wide range of testing services they offer, which address complex and uncommon diagnostic requirements that go beyond the purview of standard clinical evaluations.

In terms of esoteric testing market analysis, Numerous esoteric testing, such as molecular, genetic, and specialised assays, are available from these independent laboratories. These tests are essential for precise diagnosis and customised treatment regimens. Their independence lets them concentrate solely on complex and sophisticated testing procedures, guaranteeing accuracy and dependability in their evaluations.

A subset of independent facilities known as reference laboratories work with clinics, research centres, and healthcare institutions around the world to provide specialised testing services from their central hubs. They are essential for intricate diagnoses and research projects due to their wide networks and proficiency in esoteric testing.

Esoteric Testing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Esoteric Testing Market Regional Analysis

The largest regional market for esoteric testing is now North America. Numerous factors contribute to this supremacy, such as the region's strong healthcare system, technological developments, and a high frequency of chronic illnesses requiring specialized diagnostic techniques. Further strengthening North America's market dominance are significant investments in research and development, supportive government programmes, and the presence of important industry participants.

On the other hand, the esoteric testing market shows that Asia-Pacific is expanding at the quickest rate. Numerous causes, including a growing population, rising healthcare costs, and improvements in healthcare infrastructure across emerging countries, are driving the region's rapid expansion. In addition, the Asia-Pacific region's need for esoteric testing is fueled by the increased prevalence of chronic and infectious diseases as well as the adoption of cutting-edge diagnostic technology.

In terms of the esoteric testing market, Europe is the second-largest market. The advanced healthcare systems, significant investments in healthcare research, and growing emphasis on precision medicine highlight the significance of this region. The need for esoteric testing is fueled by Europe's well-established infrastructure and strategic partnerships between academic institutions and major industry actors, especially in the detection and treatment of uncommon and difficult diseases.

In spite of their different locations, these areas contribute equally to market expansion. The global expansion of the esoteric testing market is driven by technological advancements, growing awareness of personalized medicine and early disease diagnosis, and growing demand for sophisticated diagnostic instruments.

Esoteric Testing Market Players

Some of the top esoteric testing companies offered in our report include Laboratory Corporation of America, bioMONTR, American Esoteric Laboratories, Inc., OPKO Health, Nordic Laboratories, Miraca Holdings, ACM, Fulgent Genetics, Genomic health, Invitae, Mayo Medical Labors, Arup Laboratories, and Myriad Genetics.

Frequently Asked Questions

How big is the esoteric testing market?

The esoteric testing market size was USD 26.4 Billion in 2022.

What is the CAGR of the global esoteric testing market from 2023 to 2032?

The CAGR of esoteric testing is 11.6% during the analysis period of 2023 to 2032.

Which are the key players in the esoteric testing market?

The key players operating in the global market are including Laboratory Corporation of America, bioMONTR, American Esoteric Laboratories, Inc., OPKO Health, Nordic Laboratories, Miraca Holdings, ACM, Fulgent Genetics, Genomic health, Invitae, Mayo Medical Labors, Arup Laboratories, and Myriad Genetics.

Which region dominated the global esoteric testing market share?

North America held the dominating position in esoteric testing industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of esoteric testing during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global esoteric testing industry?

The current trends and dynamics in the esoteric testing industry include technological advancements enabling more precise and comprehensive analysis, increasing demand for personalized medicine and targeted therapies, growing prevalence of complex diseases requiring specialized diagnostics, and expanding awareness and adoption of precision medicine approaches.

Which test type held the maximum share in 2022?

The infectious disease testing test type held the maximum share of the esoteric testing industry.