Equine Surgery Market | Acumen Research and Consulting

Equine Surgery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

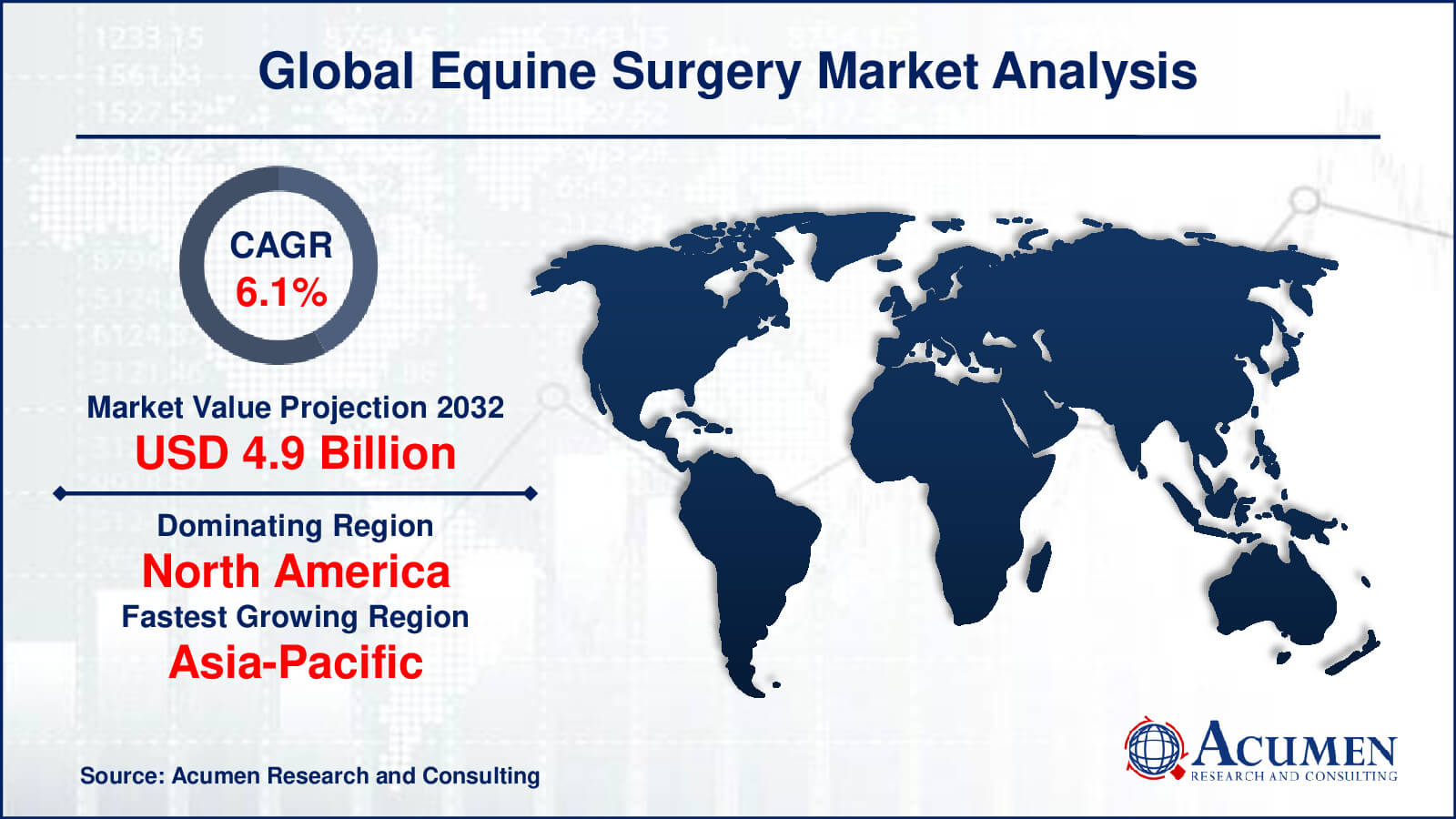

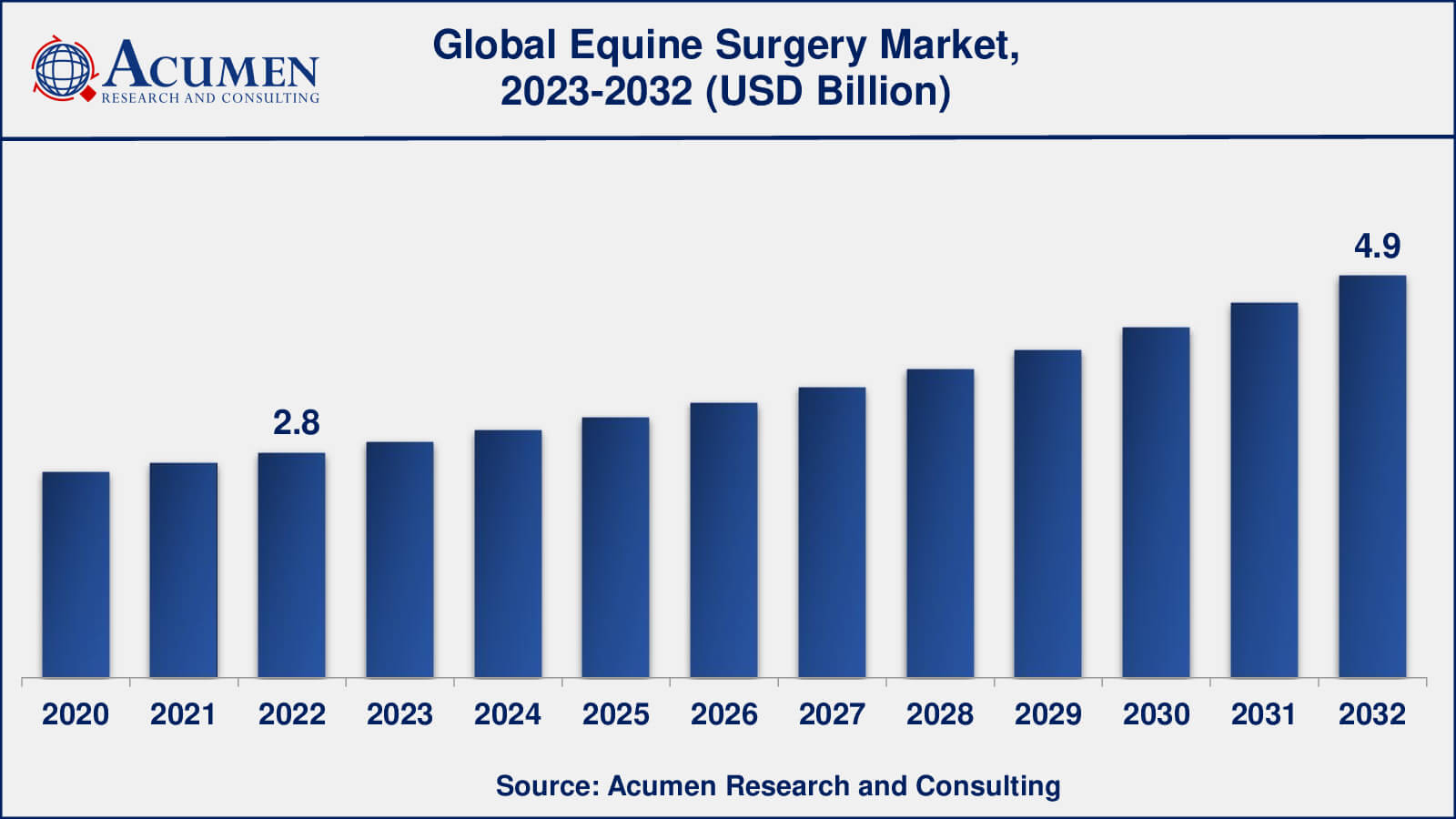

The Global Equine Surgery Market Size accounted for USD 2.8 Billion in 2022 and is estimated to achieve a market size of USD 4.9 Billion by 2032 growing at a CAGR of 6.1% from 2023 to 2032.

Equine Surgery Market Highlights

- Global equine surgery market revenue is poised to garner USD 4.9 billion by 2032 with a CAGR of 6.1% from 2023 to 2032

- North America equine surgery market value occupied around USD 966 million in 2022

- According to Horses Only data, there are 7.25 million horses in the U.S.

- As per the same statistics, the horse industry contributes USD 122 billion annually to the U.S. economy

- According to FAO 2019 statistics, there were nearly 424,036 horses living in the United Kingdom

- Asia-Pacific equine surgery market growth will record a CAGR of more than 6.5% from 2023 to 2032

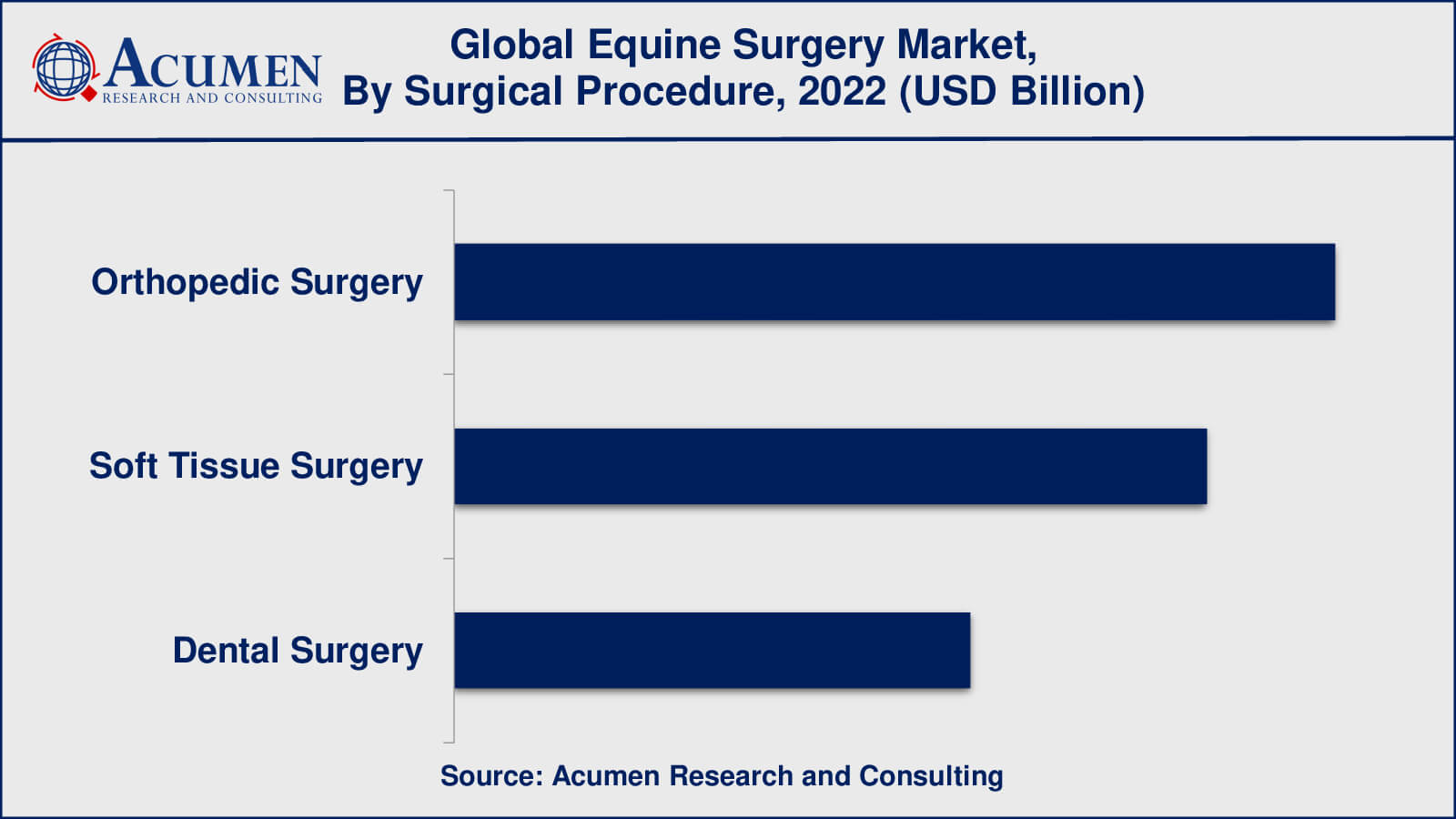

- Among surgical procedure, the orthopedic surgery sub-segment generated over US$ 1.1 billion revenue in 2022

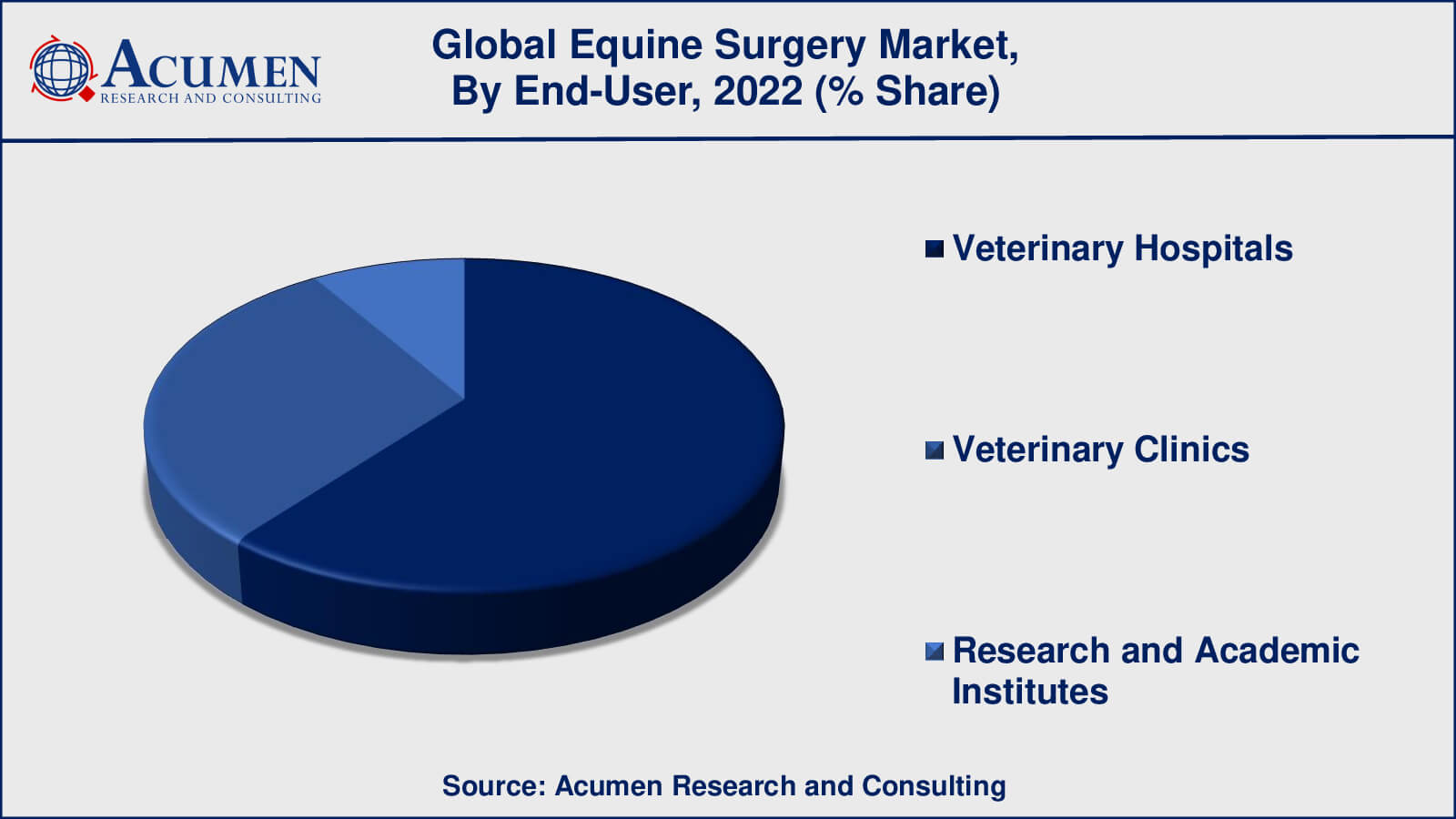

- Based on end-user, the veterinary hospitals sub-segment generated around 61% share in 2022

- Growing popularity of equine sports and recreational activities is a popular equine surgery market trend that fuels the industry demand

Equine surgery is the term used to describe surgical procedures performed on horses in order to diagnose, treat, and prevent a variety of medical conditions and injuries. These procedures are typically performed by licensed veterinary surgeons with specialized training in equine surgery.

Equine surgery is required for a variety of reasons. Horses, like all animals, can develop a wide range of medical conditions and injuries, some of which may necessitate surgical intervention to relieve pain, restore function, or prevent further damage. Musculoskeletal injuries, respiratory problems, gastrointestinal disorders, and reproductive issues are all common reasons for equine surgery. Surgery may also be required for diagnostic purposes, such as obtaining biopsy samples or performing exploratory surgery to determine the root cause of a medical problem.

Global Equine Surgery Market Dynamics

Market Drivers

- Increasing demand for advanced equine healthcare services

- Growing awareness about equine health and wellness

- Rising prevalence of orthopedic and soft tissue injuries in horses

- Advancements in surgical techniques and equipment

- Increasing investments in research and development activities

Market Restraints

- High cost of equine surgical procedures

- Limited availability of skilled veterinary surgeons and specialists

- Stringent regulatory requirements for the approval of veterinary drugs and devices

- Concerns related to post-operative complications and infections

Market Opportunities

- Growing demand for minimally invasive surgical procedures

- Increasing use of regenerative medicine and stem cell therapy for equine injuries

- Rising adoption of telemedicine and teleconsultation services for equine healthcare

- Expansion of veterinary hospitals and clinics in emerging markets

Equine Surgery Market Report Coverage

| Market | Equine Surgery Market |

| Equine Surgery Market Size 2022 | USD 2.8 Billion |

| Equine Surgery Market Forecast 2032 | USD 4.9 Billion |

| Equine Surgery Market CAGR During 2023 - 2032 | 6.1% |

| Equine Surgery Market Analysis Period | 2020 - 2032 |

| Equine Surgery Market Base Year | 2022 |

| Equine Surgery Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Surgical Procedure, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | DePuy Synthes Vet, Eickemeyer Veterinary Equipment Inc., Ethicon, Heska Corporation, IDEXX Laboratories, Inc., Integra LifeSciences Corporation, Jorgensen Laboratories, Inc., Medtronic Plc, Mila International Inc., Neogen Corporation, Sound® Equine Medical Corp., STERIS plc, Surgical Holdings, Suture Express, and Veterinary Orthopedic Implants (VOI) Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Equine Surgery Market Insights

The market for equine surgery is driven by a number of factors, including rising demand for advanced equine healthcare services and increased awareness of equine health and wellness. The market has also been fueled by the rising prevalence of orthopedic and soft tissue injuries in horses, which has led to a greater need for surgical intervention. Advances in surgical techniques and equipment have also contributed to market growth by allowing for more precise and effective procedures.

The market for equine surgery, however, is not without difficulties. The high cost of equine surgical procedures, as well as the scarcity of skilled veterinary surgeons and specialists, is a major barrier. Furthermore, strict regulatory requirements for the approval of veterinary drugs and devices can impede the development and adoption of new treatments. Concerns have also been raised about post-operative complications and infections, which can have a negative impact on both the horse and its owner.

Despite these obstacles, the market for equine surgery offers numerous opportunities for expansion. For example, there is a growing demand for minimally invasive surgical procedures, which can shorten recovery times and improve outcomes. The use of regenerative medicine as well as stem cell therapy for equine injuries is also increasing, opening up new treatment options. The expansion of veterinary clinics and medical facilities in emerging markets is another opportunity, as is the increasing popularity of equine sports and recreational activities, which drives demand for high-quality equine healthcare services.

Equine Surgery Market Segmentation

The worldwide market for equine surgery is split based on product type, surgical procedure, end-user, and geography.

Equine Surgery Product Types

- Surgical Instruments

- Scalpels

- Forceps

- Scissors

- Needles

- Cannulas

- Others

- Surgical Equipment

- Operating Tables

- Anesthesia Equipment

- Others

- Consumables

- Sutures

- Staplers

- Ligatures

- Others

According to equine surgery industry analysis, the equine surgical equipment and consumables segment occupied utmost shares in 2022, accounting for more than half of the market share. Within this segment, consumables such as sutures, staples, and ligatures accounted for the majority, with surgical equipment such as operating tables and anaesthesia equipment accounting for the remainder. The surgical instruments segment, which includes scalpels, forceps, and scissors, had a smaller but still significant share of the market.

Equine Surgery Surgical Procedures

- Orthopedic Surgery

- Arthroscopy

- Fracture Repair

- Joint Fusion

- Others

- Soft Tissue Surgery

- Colic Surgery

- Upper Airway Surgery

- Ophthalmic Surgery

- Others

- Dental Surgery

- Tooth Extraction

- Endodontic Treatment

- Others

According to equine surgery market forecasts, the orthopaedic surgery segment will dominate the equine surgery market by 2032, accounting for the largest share of the market. Arthroscopy, fracture repair, and joint fusion are examples of surgical procedures included in this category. According to the report, the orthopaedic surgery segment accounted for about 40% of the total equine surgery market share. The soft tissue surgery segment, which includes procedures such as colic surgery, upper airway surgery, and ophthalmic surgery, had a slightly smaller but still significant market share, estimated at around 35%.

The dental surgery segment, which involves procedures such as tooth extraction and endodontic treatment, had a smaller market share, estimated at around 25%. However, it's crucial to remember that market share estimates can differ depending on the methodology and the source.

Equine Surgery End-Users

- Veterinary Hospitals

- Veterinary Clinics

- Research and Academic Institutes

In 2022, the sector of veterinary hospitals held the biggest market share for equine surgery. Large veterinary hospitals that focus on equine care and have the infrastructure and tools necessary to carry out intricate surgical treatments are included in this group. According to the survey, the veterinary hospitals market category held around 60% of the overall equine surgery market share.

A lesser but still considerable portion of the industry, estimated at roughly 30%, was accounted for by the veterinary clinics segment, which consists of smaller clinics that offer general equine care and certain simple surgical operations.

A lesser portion of the market, roughly 10%, was accounted for by the research and academic institutes segment, which comprises veterinary schools and research facilities that undertake surgical procedures on horses for study purposes. However, it's crucial to remember that market share estimates can differ depending on the methodology and the source.

Equine Surgery Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Equine Surgery Market Regional Analysis

North America is the largest market for equine surgery, with the United States accounting for the majority of the market share because to the high demand for modern veterinary care and the significant number of horse owners in the country. Europe is also an important market for horse surgery, with countries such as the United Kingdom, Germany, and France having well-established equine healthcare sectors.

The Asia-Pacific region is expected to be a high-growth market for equine surgery, due to the increasing popularity of equine sports and recreational activities in countries such as China and India. The Middle East and Africa region is also expected to grow, due to the region's rising demand for high-quality equine healthcare services.

Equine Surgery Market Players

Some of the top equine surgery companies offered in the professional report include DePuy Synthes Vet, Eickemeyer Veterinary Equipment Inc., Ethicon, Heska Corporation, IDEXX Laboratories, Inc., Integra LifeSciences Corporation, Jorgensen Laboratories, Inc., Medtronic Plc, Mila International Inc., Neogen Corporation, Sound® Equine Medical Corp., STERIS plc, Surgical Holdings, Suture Express, and Veterinary Orthopedic Implants (VOI) Inc.

In 2021, Ethicon introduced the V-LocTM Wound Closure Device for use in equine surgery. The device is intended to provide secure wound closure while reducing infection risk and enhancing healing times.

In 2020, Integra LifeSciences Corporation will introduce the Integra® Laminectomy System, a new surgical instrument set intended for use in equine spinal surgeries. The system includes a variety of specialised instruments for performing laminectomies, a popular surgical procedure for treating spinal conditions in horses.

Frequently Asked Questions

What was the market size of the global equine surgery in 2022?

The market size of equine surgery was USD 2.8 billion in 2022.

What is the CAGR of the global equine surgery market from 2023 to 2032?

The CAGR of equine surgery is 6.1% during the analysis period of 2023 to 2032.

Which are the key players in the equine surgery market?

The key players operating in the global market are including DePuy Synthes Vet, Eickemeyer Veterinary Equipment Inc., Ethicon, Heska Corporation, IDEXX Laboratories, Inc., Integra LifeSciences Corporation, Jorgensen Laboratories, Inc., Medtronic Plc, Mila International Inc., Neogen Corporation, Sound® Equine Medical Corp., STERIS plc, Surgical Holdings, Suture Express, and Veterinary Orthopedic Implants (VOI) Inc.

Which region dominated the global equine surgery market share?

North America held the dominating position in equine surgery industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of equine surgery during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global equine surgery industry?

The current trends and dynamics in the equine surgery industry include increasing demand for advanced equine healthcare services, growing awareness about equine health and wellness, rising prevalence of orthopedic and soft tissue injuries in horses, and advancements in surgical techniques and equipment.

Which surgical procedure held the maximum share in 2022?

The orthopedic surgery held the maximum share of the equine surgery industry.?