Equine Healthcare Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

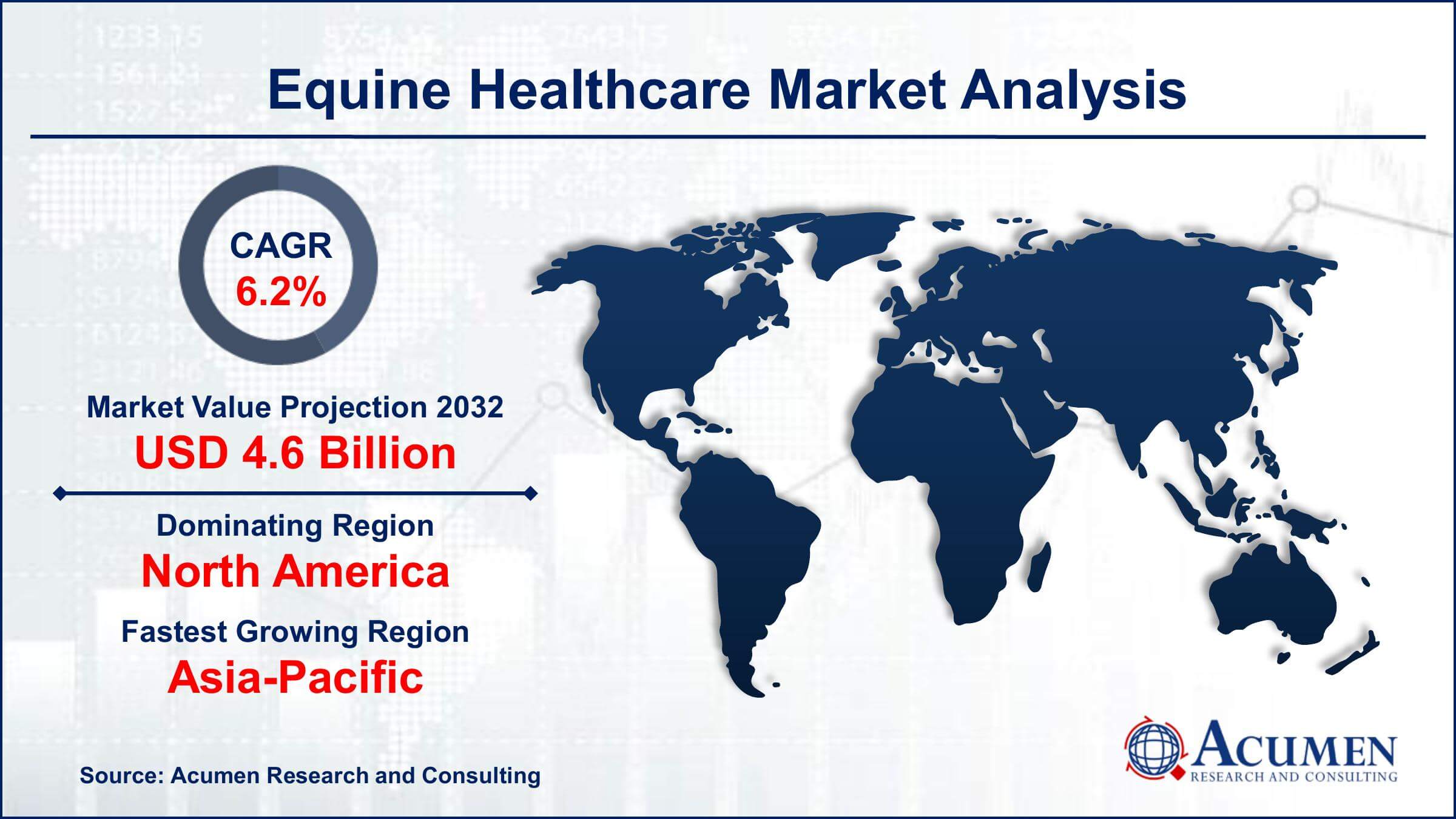

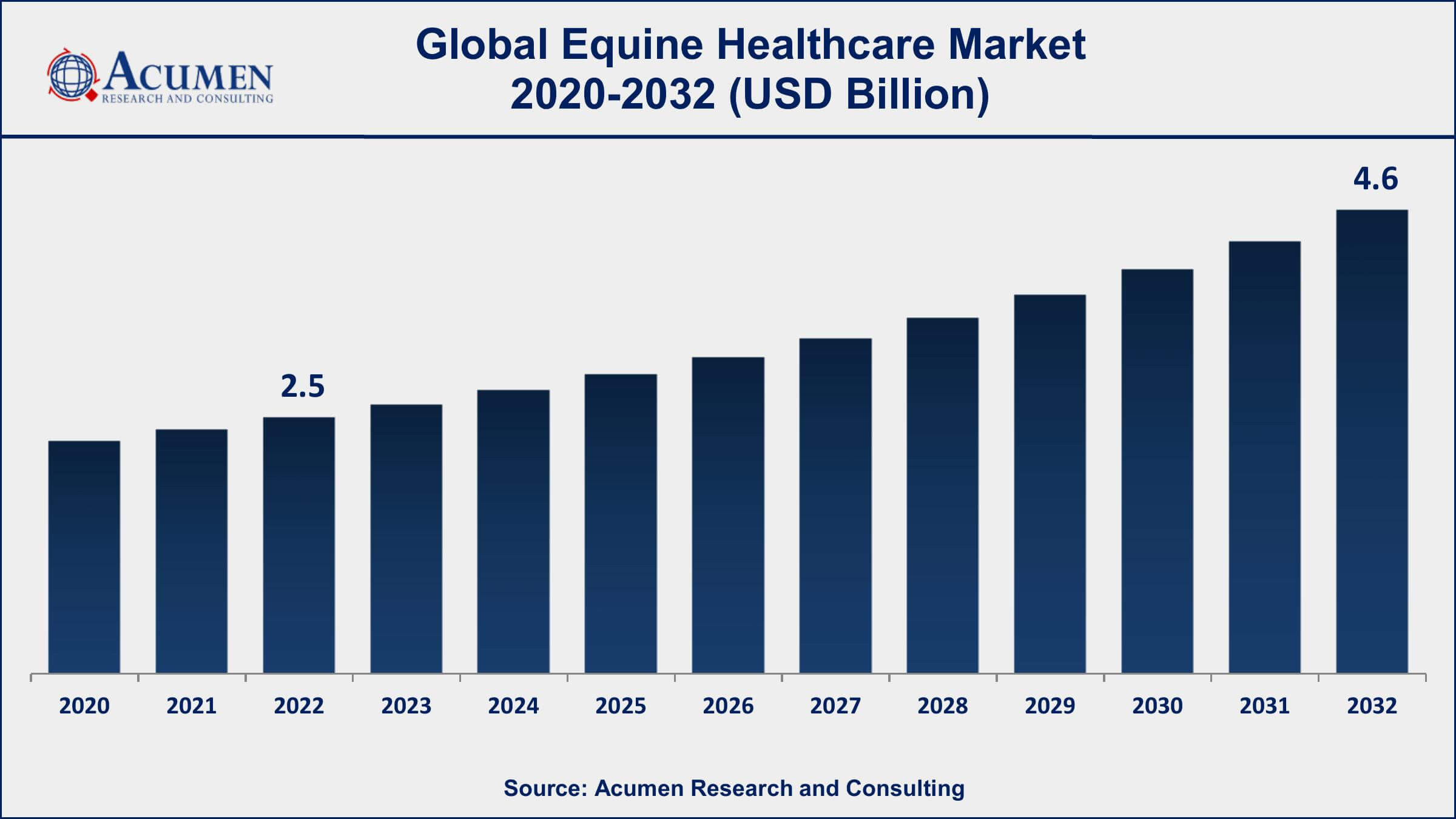

The Global Equine Healthcare Market Size accounted for USD 2.5 Billion in 2022 and is projected to achieve a market size of USD 4.6 Billion by 2032 growing at a CAGR of 6.2% from 2023 to 2032.

Equine Healthcare Market Highlights

- Global Equine Healthcare Market revenue is expected to increase by USD 4.6 Billion by 2032, with a 6.2% CAGR from 2023 to 2032

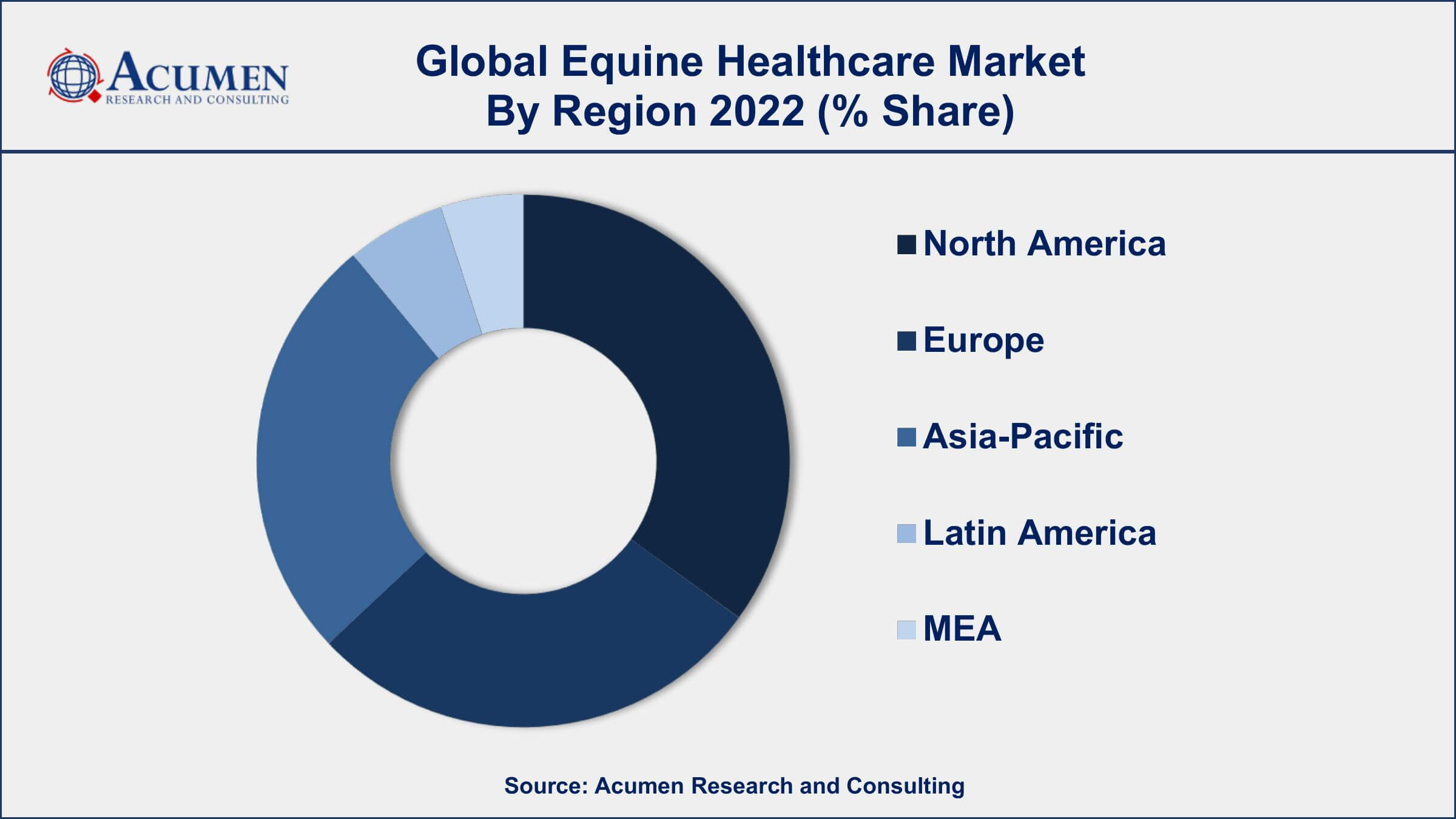

- North America region led with more than 36% of equine healthcare market share in 2022

- Asia-Pacific Equine Healthcare Market growth will record a CAGR of around 6.8% from 2023 to 2032

- By indication, the parasite control segment has recorded more than 21% of the revenue share in 2022

- By technology, the pharmaceuticals segment has accounted more than 29% of the revenue share in 2022

- Increasing participation in equestrian sports and recreational riding, drives the Equine Healthcare Market value

Equine healthcare refers to the specialized medical care and maintenance provided to horses. This sector encompasses a wide range of services and products aimed at promoting the health, well-being, and performance of horses, including preventive care, diagnostics, treatment of illnesses and injuries, nutrition, dental care, and pharmaceuticals. Equine healthcare is critical for the equine industry, which includes activities such as horse racing, breeding, equestrian sports, and leisure riding. Healthy horses are not only valuable assets but also companions, making the healthcare market for these animals significant.

In recent years, the equine healthcare market has seen steady growth due to several factors. One key driver is the increasing awareness of the importance of horse health and welfare among horse owners, trainers, and breeders. Technological advancements in diagnostics and treatment options have also contributed to the expansion of the market. Moreover, the growth of equestrian sports and recreational riding has boosted the demand for equine healthcare products and services. As the equine industry continues to evolve, with a focus on performance improvement and the overall well-being of horses, the equine healthcare market is expected to experience continued growth, offering opportunities for innovation and investment in the coming years.

Global Equine Healthcare Market Trends

Market Drivers

- Increasing participation in equestrian sports and recreational riding

- Growing awareness of equine health and welfare

- Advancements in veterinary diagnostics and treatments

- Expanding global equine population

- Rising demand for specialized equine pharmaceuticals

Market Restraints

- High costs associated with equine healthcare

- Regulatory challenges in the approval of equine medications

Market Opportunities

- Adoption of digital health monitoring solutions for horses

- Expansion of telemedicine and telehealth services for equines

Equine Healthcare Market Report Coverage

| Market | Equine Healthcare Market |

| Equine Healthcare Market Size 2022 | USD 2.5 Billion |

| Equine Healthcare Market Forecast 2032 | USD 4.6 Billion |

| Equine Healthcare Market CAGR During 2023 - 2032 | 6.2% |

| Equine Healthcare Market Analysis Period | 2020 - 2032 |

| Equine Healthcare Market Base Year |

2022 |

| Equine Healthcare Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Indication, By Product, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Zoetis Inc., Merck & Co., Inc. (Animal Health Division), Boehringer Ingelheim Animal Health, Elanco Animal Health, IDEXX Laboratories, Inc., Dechra Pharmaceuticals PLC, CevaSantéAnimale, Vetoquinol S.A., Norbrook Laboratories Ltd., Neogen Corporation, Virbac Group, and Heska Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Horses, whether used for equestrian sports, leisure riding, agriculture, or other purposes, require a comprehensive range of healthcare services to ensure their optimal health, performance, and overall quality of life. Equine healthcare encompasses a broad spectrum of applications, including preventive care, diagnostic procedures, therapeutic interventions, and ongoing management of various health issues affecting horses. These applications extend to the development and distribution of pharmaceuticals, vaccines, supplements, and other products tailored specifically for equine health. Equine healthcare also encompasses nutritional guidance, exercise programs, and rehabilitation services for injured or ill horses.

The applications of equine healthcare are multifaceted. Preventive care, such as vaccinations, dental care, and routine check-ups, helps keep horses healthy and reduces the risk of diseases. Diagnostic procedures, including advanced imaging techniques like MRI and CT scans, aid in identifying and diagnosing various medical conditions and injuries in horses. Therapeutic interventions involve treatments, surgeries, and medications to address specific health issues or injuries. Additionally, equine healthcare supports the overall well-being of horses, which is critical for their performance, longevity, and the satisfaction of their owners and handlers. In essence, equine healthcare plays a vital role in ensuring the health, comfort, and longevity of these magnificent animals, whether they are companions, athletes, or work partners.

The equine healthcare market has exhibited consistent growth in recent years, driven by several key factors. One of the primary drivers is the increasing interest and participation in equestrian sports and recreational riding across the globe. As more individuals and organizations become involved in these activities, the demand for equine healthcare services, including veterinary care, diagnostics, and specialized treatments, has surged. This trend is further supported by a growing awareness of equine health and welfare, leading horse owners and enthusiasts to prioritize their animals' well-being. Advancements in veterinary medicine and technology have also played a pivotal role in the market's growth.

Equine Healthcare Market Segmentation

The global Equine Healthcare Market segmentation is based on indication, product, distribution channel, and geography.

Equine Healthcare Market By Indication

- Musculoskeletal Disorders

- Internal Medicine

- Parasite Control

- Equine Influenza

- Equine Herpes Virus

- West Nile Virus

- Tetanus

- Equine Encephalomyelitis

- Others

According to the equine healthcare industry analysis, the parasite control segment accounted for the largest market share in 2022. This growth can be attributed to several factors, including the recognition of the critical role that effective parasite management plays in maintaining the health and well-being of horses. Parasites, such as internal worms and external pests like ticks and flies, can have detrimental effects on equine health, leading to a range of issues, including weight loss, colic, and skin irritations. Consequently, horse owners and equine healthcare professionals have placed a strong emphasis on parasite control measures. Advancements in parasite control products and techniques have also driven growth in this segment. Pharmaceutical companies have developed more effective and safer anthelmintic drugs, allowing for more targeted and strategic deworming protocols.

Equine Healthcare Market By Product

- Vaccines

- Pharmaceuticals

- Anti-infectives

- Parasiticides

- Anti-inflammatory & Analgesics

- Other Pharmaceuticals

- Diagnostics

- Medicinal Feed Additives

- Software & Services

- Others

In terms of products, the pharmaceuticals segment is expected to witness significant growth in the coming years. One of the primary drivers is the increasing demand for specialized medications and therapies tailored specifically to the unique needs of horses. Horses, whether involved in racing, breeding, or recreational activities, require a range of pharmaceutical products for various health conditions, including pain management, respiratory issues, and musculoskeletal disorders. Moreover, advancements in veterinary pharmacology and drug formulation have led to more effective and safer equine medications. Pharmaceutical companies have introduced innovative drug delivery methods, such as long-acting formulations and targeted therapies, which not only enhance the treatment outcomes but also improve the convenience of administration for both horse owners and veterinarians. This has contributed to a higher level of trust and reliance on pharmaceuticals as a vital component of equine healthcare.

Equine Healthcare Market By Distribution Channel

- Veterinary Hospitals & Clinics

- E-commerce

- Others

According to the equine healthcare market forecast, the veterinary hospitals & clinics segment is expected to witness significant growth in the coming years. One of the key drivers behind this growth is the rising demand for specialized and advanced healthcare services for horses. Horse owners and professionals in the equine industry increasingly recognize the importance of regular check-ups, diagnostics, and specialized treatments to ensure the health and well-being of their equine companions. This has led to a higher volume of visits to veterinary hospitals and clinics dedicated to equine care. Additionally, advancements in veterinary medicine and technology have played a crucial role in the growth of this segment.

Equine Healthcare Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Equine Healthcare Market Regional Analysis

North America has emerged as a dominant region in the equine healthcare market in 2022. North America has a long history of horse ownership and equestrian sports, with a substantial equine population. The United States and Canada, in particular, have a robust and diverse equine industry that spans from racing and competition to recreational riding and breeding. This strong equine culture has naturally led to a significant demand for equine healthcare services and products. Moreover, North America benefits from a well-developed and advanced veterinary healthcare infrastructure. The region boasts a large number of specialized equine veterinary hospitals, clinics, and practitioners with expertise in horse care. These facilities are equipped with state-of-the-art diagnostic and treatment capabilities, ensuring high-quality care for horses. Additionally, the availability of well-trained veterinarians who can provide specialized care and advice is a crucial factor contributing to the region's dominance in the equine healthcare market.

Equine Healthcare Market Player

Some of the top equine healthcare market companies offered in the professional report include Zoetis Inc., Merck & Co., Inc. (Animal Health Division), Boehringer Ingelheim Animal Health, Elanco Animal Health, IDEXX Laboratories, Inc., Dechra Pharmaceuticals PLC, CevaSantéAnimale, Vetoquinol S.A., Norbrook Laboratories Ltd., Neogen Corporation, Virbac Group, and Heska Corporation.

Frequently Asked Questions

What was the market size of the global equine healthcare in 2022?

The market size of equine healthcare was USD 2.5 Billion in 2022.

What is the CAGR of the global equine healthcare market from 2023 to 2032?

The CAGR of equine healthcare is 6.2% during the analysis period of 2023 to 2032.

Which are the key players in the equine healthcare market?

The key players operating in the global market are including Zoetis Inc., Merck & Co., Inc. (Animal Health Division), Boehringer Ingelheim Animal Health, Elanco Animal Health, IDEXX Laboratories, Inc., Dechra Pharmaceuticals PLC, CevaSantéAnimale, Vetoquinol S.A., Norbrook Laboratories Ltd., Neogen Corporation, Virbac Group, and Heska Corporation.

Which region dominated the global equine healthcare market share?

North America held the dominating position in equine healthcare industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of equine healthcare during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global equine healthcare industry?

The current trends and dynamics in the equine healthcare industry include increasing participation in equestrian sports and recreational riding, growing awareness of equine health and welfare, and advancements in veterinary diagnostics and treatments.

Which product held the maximum share in 2022?

The pharmaceuticals product held the maximum share of the equine healthcare industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date