Epigenetics Diagnostic Market | Acumen Research and Consulting

Epigenetics Diagnostic Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

The Epigenetics Diagnostic Market Size accounted for USD 11.7 Billion in 2022 and is estimated to achieve a market size of USD 53.5 Billion by 2032 growing at a CAGR of 16.6% from 2023 to 2032.

Epigenetics Diagnostic Market Highlights

- Global epigenetics diagnostic market revenue is poised to garner USD 53.5 billion by 2032 with a CAGR of 16.6% from 2023 to 2032

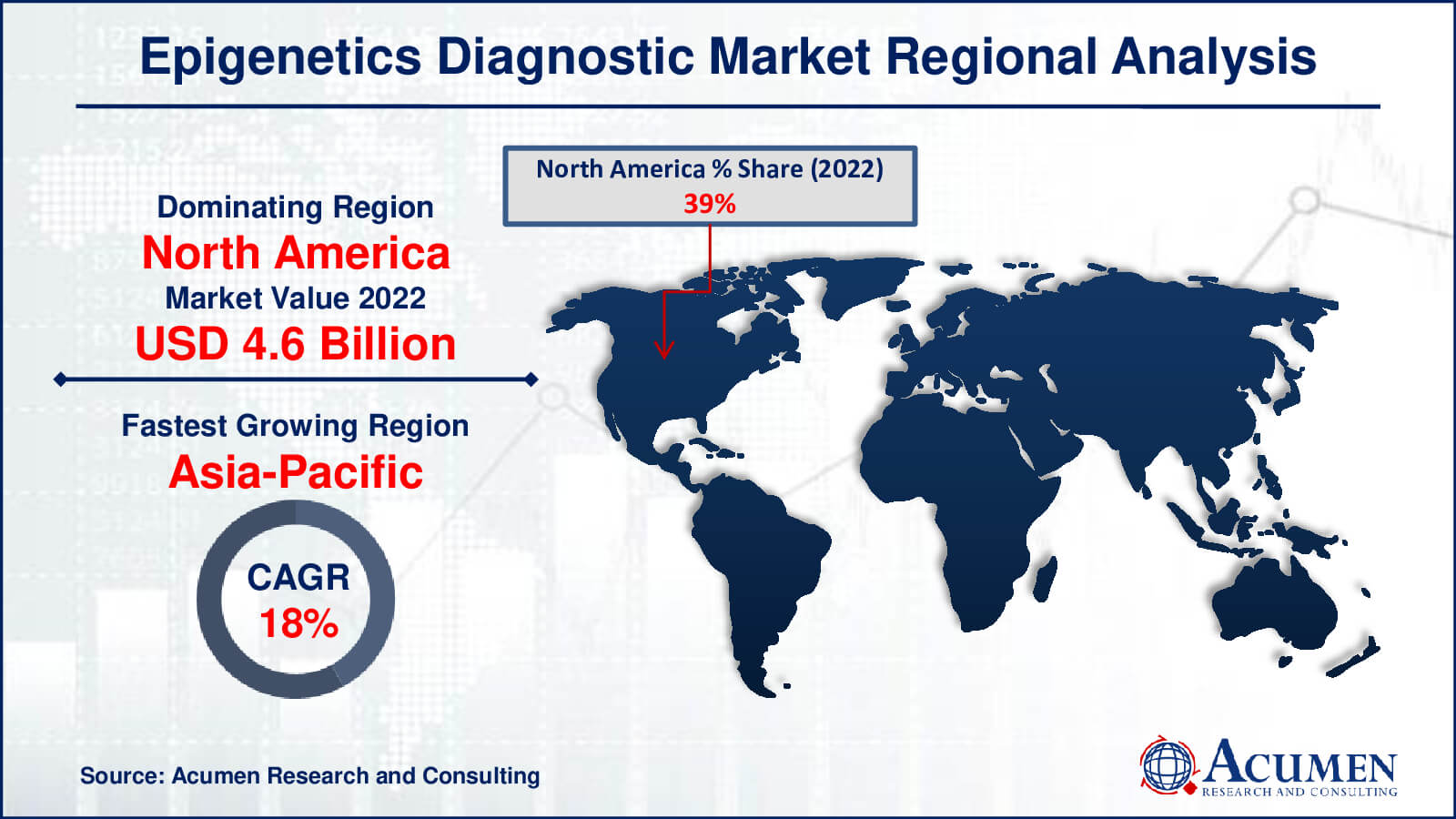

- North America epigenetics diagnostic market value occupied around USD 4.6 billion in 2022

- Asia-Pacific epigenetics diagnostic market growth will record a CAGR of more than 18% from 2023 to 2032

- Among product, the reagents sub-segment generated over US$ 3.6 billion revenue in 2022

- Based on application, the oncology sub-segment generated around 69% share in 2022

- Enhanced understanding of epigenetic biomarkers for early disease detection is a popular epigenetics diagnostic market trend that fuels the industry demand

Epigenetic diagnostics entail analyzing DNA changes that do not change the underlying sequence but have an impact on gene expression. These changes can provide information about illness risk, progression, and therapy responses. Diagnostics aim to anticipate, diagnose, and monitor numerous ailments ranging from cancer to neurological problems by evaluating epigenetic markers such as DNA methylation or histone changes, providing a greater understanding of individual health profiles. The increasing incidence of cancer, along with other chronic diseases, and the rising geriatric population are significant market drivers expected to fuel growth. Organizations such as the International Human Epigenome Consortium, the National Cancer Institute (NCI), and the National Health Institute (NIH) play a crucial role in supporting R&D and product development practices within the field of epigenetics. These entities actively encourage funding, with the NIH supporting epigenetic research globally through its Epigenomics Common Fund Program, which aids new epigenetic research endeavors worldwide.

Global Epigenetics Diagnostic Market Dynamics

Market Drivers

- Increasing incidence of cancer and chronic diseases

- Growing geriatric population

- Support and funding from organizations like the NIH and NCI

- Advancements in technology and research aiding diagnostic capabilities

Market Restraints

- Ethical concerns surrounding genetic information

- High costs associated with advanced diagnostic technologies

- Regulatory complexities and compliance challenges

Market Opportunities

- Development of personalized medicine and targeted therapies

- Expansion into emerging markets globally

- Collaborations and partnerships for innovative research and development

Epigenetics Diagnostic Market Report Coverage

| Market | Epigenetics Diagnostic Market |

| Epigenetics Diagnostic Market Size 2022 | USD 11.7 Billion |

| Epigenetics Diagnostic Market Forecast 2032 | USD 53.5 Billion |

| Epigenetics Diagnostic Market CAGR During 2023 - 2032 | 16.6% |

| Epigenetics Diagnostic Market Analysis Period | 2020 - 2032 |

| Epigenetics Diagnostic Market Base Year |

2022 |

| Epigenetics Diagnostic Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abcam plc., Dovetail Genomics LLC., Eisai Co. Ltd., Element Biosciences, Inc., Illumina, Inc., Novartis AG, Roche Diagnostics, Thermo Fisher Scientific, Inc., and ValiRx Plc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Epigenetics Diagnostic Market Insights

These organizations are anticipated to provide financial support for research and development programs due to the imperative need to comprehend molecular-level epigenetic changes and develop therapeutic solutions. Moreover, research endeavors, such as the Epidemiology and Genomics Research Program (EGRP) within the NCI Cancer Division, serve as significant drivers in the market. According to the NIH, the estimated number of cancer-related deaths per 100,000 individuals annually in the U.S. is 171.2. High prevalence factors include incidence rates, mortality and survival statistics, information on cancer symptoms, risk factors, early detection, and initial treatments.

The International Cancer Genome Consortium (ICGC) focuses on the genomic and epigenomic alterations, alongside transcriptomic changes in various tumor types. The DNA Elements Encyclopedia (ENCODE) was launched by the United States' National Institute for Human Genome Research to identify all functional elements within the human genome sequence. In the realm of developing epigenomic data generation and analytics, the International Human Epigenome Consortium (IHEC), established with support from the NIH, serves as a resource for epigenomic researchers. Specifically, epigenetics research aims at identifying treatment options for different types of tumors.

The product segment of kits is expected to emerge as the fastest-growing segment over the epigenetics diagnostic industry forecast period. Many biotechnology companies produce ready-to-use kits designed for detecting epigenetic modifications. These kits cater to diverse markets, offering solutions such as chromatin immunoprecipitation kits for nucleic acid purification, DNA methylation analysis, and the detection of histone changes using various enzymes. Epigenetic diagnostic kits play a crucial role in diagnosing disorders caused by epigenetic alterations in early stages and during treatment, assessing therapeutic effectiveness. They function by utilizing modification-specific monoclonal antibodies through immunoprecipitation methods.

Epigenetics Diagnostic Market Segmentation

The worldwide market for epigenetics diagnostic is split based on product, technology, application, and geography.

Epigenetics Diagnostic Products

- Reagents

- Kits

- Chip Sequencing Kit

- Whole Genomic Amplification Kit

- Bisulfite Conversion Kit

- RNA Sequencing Kit

- Others

- Instruments

- Enzymes

- Services

According to epigenetics diagnostic industry analysis, reagents dominated the market in 2022. The primary types of reagents utilized in epigenetics include histone and DNA modifiers. Epigenetic agents are segmented into PCR reagents, histones, primers, electrophoresis reagents, antimicrobial analysis reagents, and buffers. Among the advanced pyro-sequencing chemistry reactives, PyroMark Q24 offers improved real-time sequence detection and quantification capabilities.

Various technology platforms facilitate easier gene, protein, or cellular analysis, driving innovations in epigenetic reagents. For genomic analysis, the polymerase chain reaction (PCR) established a foundational platform. Epigenetic factors such as chromatin, DNA methylation, and non-coding RNAs significantly impact gene regulation. The market for life sciences and analytical instruments is largely propelled by the widespread use of reagents.

Epigenetics Diagnostic Technologies

- DNA Methylation

- Reagents

- Kits

- Instruments

- Enzymes

- Services

- Large non-coding RNA

- Reagents

- Kits

- Instruments

- Enzymes

- Services

- Histone Methylation

- Reagents

- Kits

- Instruments

- Enzymes

- Services

- Histone Acetylation

- Reagents

- Kits

- Instruments

- Enzymes

- Services

- Chromatin structures

- Reagents

- Kits

- Instruments

- Enzymes

- Services

- MicroRNA Modification

- Reagents

- Kits

- Instruments

- Enzymes

- Services

The biggest segment was methylation of DNA in 2022. A methyl group's covalent addition in the cytosine ring leads to transcription inhibition. Sensitive modification of bisulphite followed by PCR is carried out called PCR Sensitive Methylation (MSP). Real time PCR, methyl lights, and quantitative analysis are variations of MSP for detection of methylated alleles. MALDI-TOF MS also works well for DNA methylation, currently using quantitative methods, such as alloyspecific bisulfite sequencing, South based method, bisulphite-PCR and bisulphite pyrosequencing. Advances in technology allow for the evaluation of DNA methylation in the localus on a genome-wide scale increasingly.

Due to its improved efficacy, which could be attributed to the introduction of new methods, histone acetylation would have experienced the fastest growth during the epigenetics diagnostic market forecast period. Histone acetylation is the lysine residue enzyme embodiment of an acetyl group. Cellular processes such as the silencing of genes, chromatin transcription and dynamics, cell cycle progressions, differentiation, apoptosis, DNA replication, neuronal repression, nuclear imports and DNA repair include histone acetylation (histone acetylation). Histone Acetyl Transferases (HATs) are the enzyme involved in histone acetylation and histone deacetylases (HDACs) are the enzymes involved with deacetylation.

Epigenetics Diagnostic Applications

- Oncology

- Solid Tumors

- Liquid Tumors

- Non-oncology

- Inflammatory Diseases

- Metabolic Diseases

- Infectious Diseases

- Cardiovascular Diseases

- Others

In terms of epigenetics diagnostic market analysis, in 2022 oncology dominated the total market, accounting for approximately 69% of total sales. A key driving factor expected to significantly impact the market is the global increase in cancer prevalence and associated mortality rates. Furthermore, this segment is anticipated to maintain a substantial market share during the forecast period due to the introduction of new products and the potential future marketing of ongoing products. Epimutations, stemming from epigenetic changes, encompass hypermethylation and epigenetic silencing, known to play a role in cancer etiology. Extensive research and development efforts aim to specifically detect epimutations related to the suppression of tumor genes and activation of oncogenes. Unlike regular mutations, epimutations are inherently reversible.

Non-oncology is projected to be the fastest-growing segment, attributed to rigorous research and development initiatives undertaken by private institutions and biopharmaceutical enterprises in identifying epigenetic markers associated with these disorders. Private institutions and biopharmaceutical companies engage in extensive research to detect biomarkers for drug development purposes.

Epigenetics Diagnostic Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Epigenetics Diagnostic Market Regional Analysis

North America emerged as the dominant regional market in 2022. Key market drivers include state-of-the-art technological facilities, successful initiatives, an increasing geriatric population, improved healthcare facilities, government funding supporting continuous research activities in epigenetics, as well as diligent research and precise diagnostic procedures. Furthermore, the Common Fund-supported program in the United States is expected to bolster epigenetic research, encompassing various conditions like cardiovascular, metabolic, and inflammatory diseases, spanning both oncology and non-oncology fields.

The Asia Pacific region is anticipated to witness the fastest growth during the forecast period. This growth is attributed to increased disposable income, unmet clinical needs of patients, heightened awareness regarding early diagnosis, and the availability of effective treatments in emerging countries like India and China.

The rise in oncology and chronic diseases is anticipated due to the growing geriatric population in this region. Additionally, there's an upsurge in R&D initiatives focusing on epigenetic analysis across various diseases. The Consortium of EpiGen Research, based in the U.K., expanded its research facility in Singapore, particularly for chronic disease research, including diabetes and obesity.

Epigenetics Diagnostic Market Players

Some of the top epigenetics diagnostic companies offered in our report includes Abcam plc., Dovetail Genomics LLC., Eisai Co. Ltd., Element Biosciences, Inc., Illumina, Inc., Novartis AG, Roche Diagnostics, Thermo Fisher Scientific, Inc., and ValiRx Plc.

Frequently Asked Questions

How big is the epigenetics diagnostic market?

The market size of epigenetics diagnostic was USD 11.7 billion in 2022.

What is the CAGR of the global epigenetics diagnostic market from 2023 to 2032?

The CAGR of epigenetics diagnostic is 16.6% during the analysis period of 2023 to 2032.

Which are the key players in the epigenetics diagnostic market?

The key players operating in the global market are including Abcam plc., Dovetail Genomics LLC., Eisai Co. Ltd., Element Biosciences, Inc., Illumina, Inc., Novartis AG, Roche Diagnostics, Thermo Fisher Scientific, Inc., and ValiRx Plc.

Which region dominated the global epigenetics diagnostic market share?

North America held the dominating position in epigenetics diagnostic industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of epigenetics diagnostic during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global epigenetics diagnostic industry?

The current trends and dynamics in the epigenetics diagnostic industry include increasing incidence of cancer and chronic diseases, growing geriatric population, support and funding from organizations like the NIH and NCI, and advancements in technology and research aiding diagnostic capabilities.

Which product held the maximum share in 2022?

The reagents product held the maximum share of the epigenetics diagnostic industry.