Enterprise Network Firewall Market | Acumen Research and Consulting

Enterprise Network Firewall Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

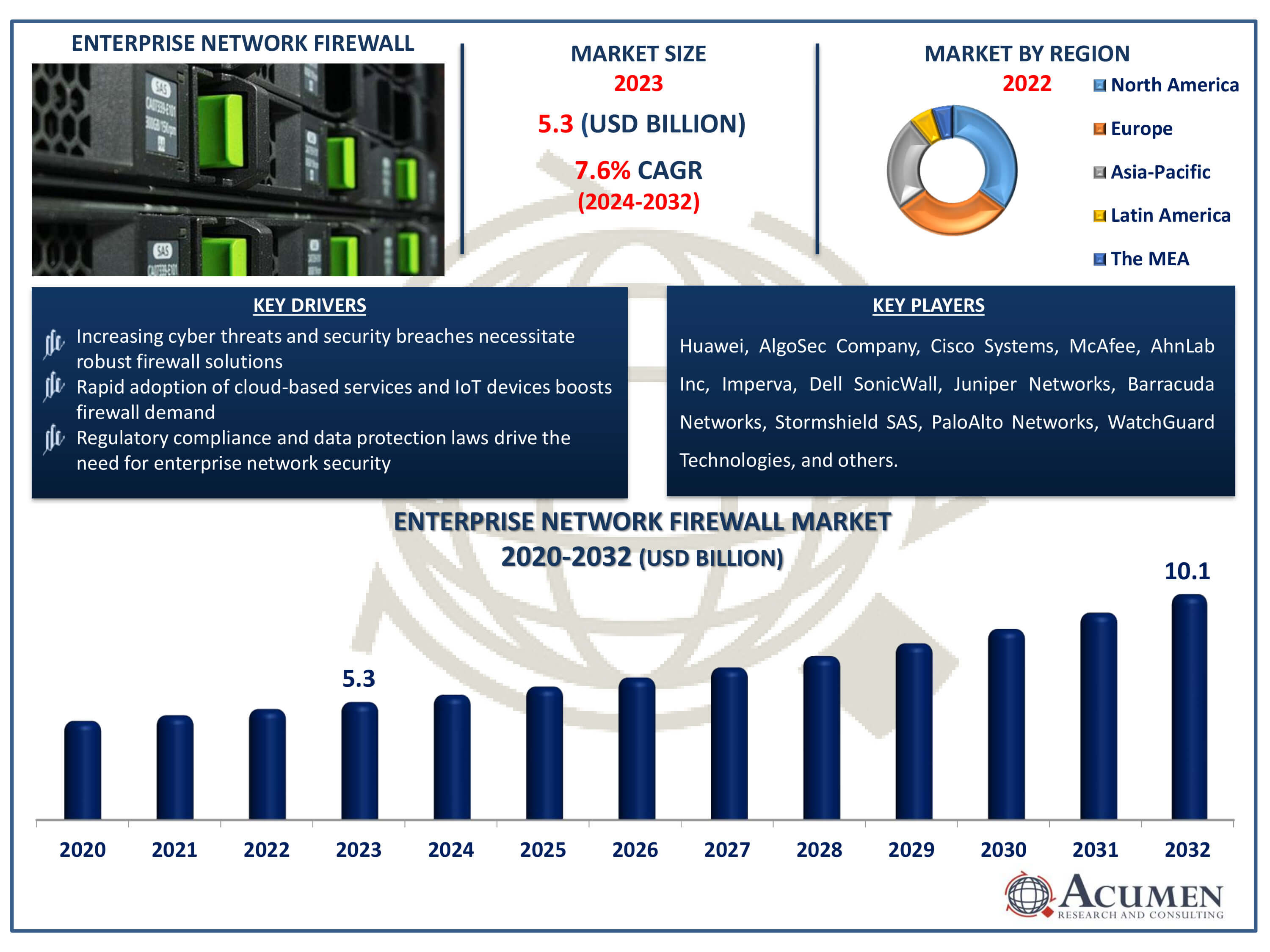

The Enterprise Network Firewall Market Size accounted for USD 5.3 Billion in 2023 and is estimated to achieve a market size of USD 10.1 Billion by 2032 growing at a CAGR of 7.6% from 2024 to 2032.

Enterprise Network Firewall Market Highlights

- Global enterprise network firewall market revenue is poised to garner USD 10.1 billion by 2032 with a CAGR of 7.6% from 2024 to 2032

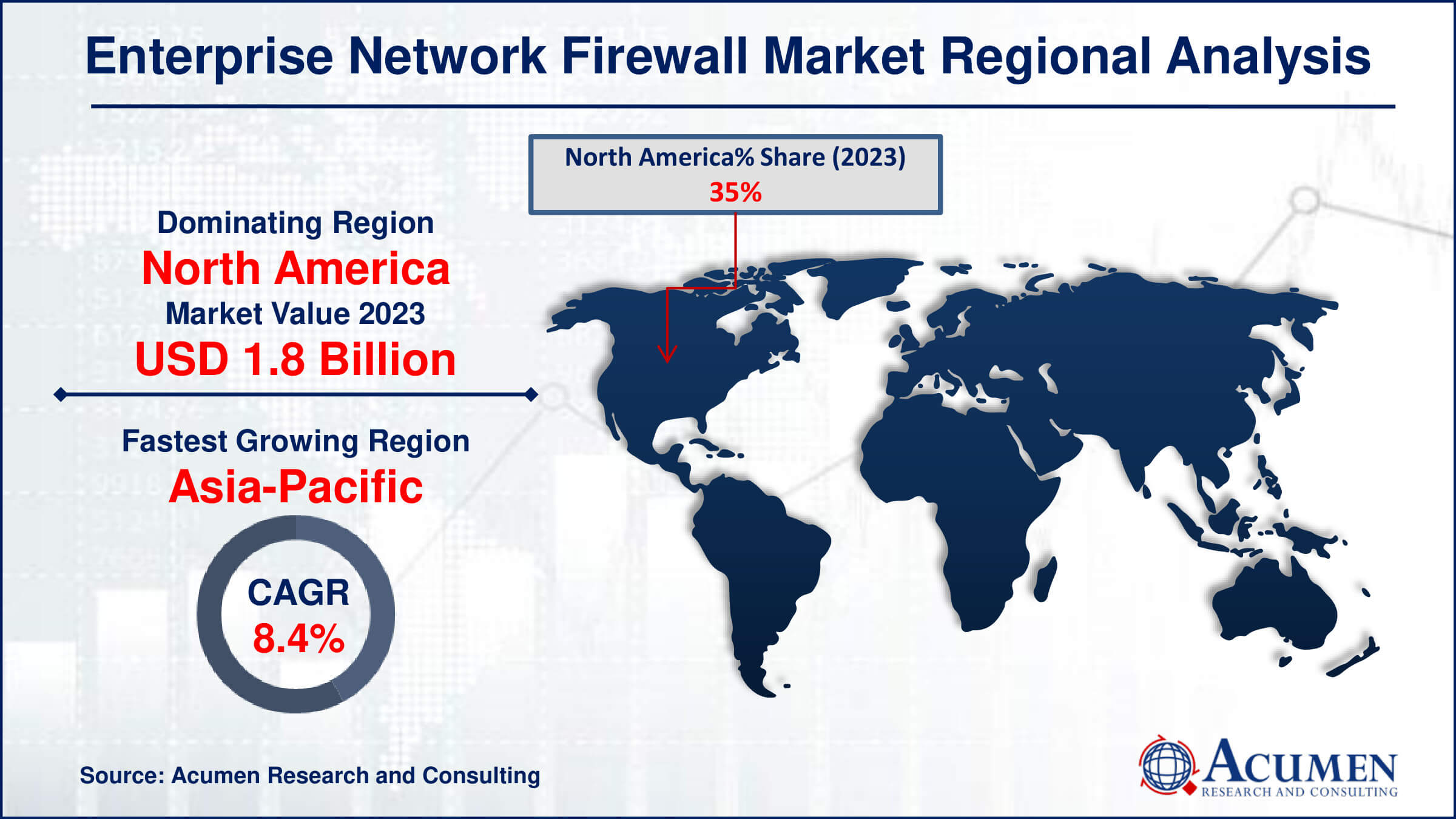

- North America enterprise network firewall market value occupied around USD 1.8 billion in 2023

- Asia-Pacific enterprise network firewall market growth will record a CAGR of more than 8.4% from 2024 to 2032

- Among component, the services sub-segment expected to generated significant share in 2023

- As per organization size, large enterprises anticipated to generate notable share in enterprise network firewall market

- Growing adoption of zero trust principles, driving the development of firewalls that enforce strict access controls based on identity and context rather than network location alone is a popular enterprise network firewall market trend that fuels the industry demand

An enterprise network firewall is a security system designed to protect an organization's internal network from unauthorized access and cyber threats. It acts as a barrier between the internal network and external networks, such as the internet, by monitoring and controlling incoming and outgoing network traffic based on predetermined security rules. This firewall helps prevent malware, ransomware, and other malicious activities from penetrating the network. Its applications include safeguarding sensitive data, ensuring compliance with regulatory requirements, providing secure remote access for employees, and enabling the segmentation of network traffic to isolate and protect critical systems. By employing advanced features like intrusion detection and prevention, VPN support, and real-time threat intelligence, enterprise firewalls are essential for maintaining the integrity and security of a company's IT infrastructure.

Global Enterprise Network Firewall Market Dynamics

Market Drivers

- Increasing cyber threats and security breaches necessitate robust firewall solutions

- Rapid adoption of cloud-based services and IoT devices boosts firewall demand

- Regulatory compliance and data protection laws drive the need for enterprise network security

Market Restraints

- High costs associated with advanced firewall solutions deter smaller enterprises

- Complexity in managing and configuring enterprise firewalls can be a barrier

- Emergence of alternative security solutions, such as zero trust architecture, challenges traditional firewalls

Market Opportunities

- Growing trend of remote working increases demand for secure network solutions

- Advancements in AI and machine learning offer potential for smarter, adaptive firewalls

- Expansion in emerging markets presents untapped potential for enterprise network firewall adoption

Enterprise Network Firewall Market Report Coverage

| Market | Enterprise Network Firewall Market |

| Enterprise Network Firewall Market Size 2022 | USD 5.3 Billion |

| Enterprise Network Firewall Market Forecast 2032 | USD 10.1 Billion |

| Enterprise Network Firewall Market CAGR During 2023 - 2032 | 7.6% |

| Enterprise Network Firewall Market Analysis Period | 2020 - 2032 |

| Enterprise Network Firewall Market Base Year |

2022 |

| Enterprise Network Firewall Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Component, By Deployment Mode, By Organization Size, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Huawei, AlgoSec Company, Cisco Systems, McAfee, AhnLab Inc, Imperva, Dell, SonicWall, Juniper Networks, Barracuda Networks, Stormshield SAS, PaloAlto Networks, WatchGuard Technologies, Fortinet, New H3C Technologies Co., Ltd., and GreyHeller. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Enterprise Network Firewall Market Insights

The rise in cyber threats and security breaches has heightened the need for robust firewall solutions, driving growth in the enterprise network firewall market. For instance, in 2023, India experienced 112,474 cybersecurity incidents, with more than 429,000 incidents targeting financial institutions in the first half of the year. A November 2022 report by CloudSEK also highlighted an increase in cyberattacks against India's banking, finance, and insurance (BFSI) sector. As organizations face increasingly sophisticated attacks, they invest in advanced firewalls to protect sensitive data and ensure network integrity. Regulatory compliance requirements further compel enterprises to adopt comprehensive security measures. The proliferation of cloud computing and remote work environments also fuels demand for scalable and flexible firewall solutions. Consequently, the enterprise network firewall market is experiencing significant expansion, driven by the imperative for enhanced cybersecurity.

High costs associated with advanced firewall solutions can deter smaller enterprises, acting as a restraint for the enterprise network firewall market. These sophisticated security systems often require significant financial investment, which smaller businesses may find prohibitive. The expenses include not only the initial purchase but also ongoing maintenance, updates, and specialized personnel for operation. Consequently, smaller enterprises might select for less expensive, and potentially less effective, security measures. This situation limits market growth as the adoption rate among small and medium-sized enterprises (SMEs) remains low.

The growing trend of remote working has amplified the need for robust network security, leading to a heightened demand for enterprise network firewalls. For instance, as of 2023, 12.7% of full-time employees are working from home, while 28.2% have adopted a hybrid work model. Additionally, 98% of workers express a desire to work remotely at least part of the time. As employees access corporate networks from various locations, the risk of cyber threats increases, necessitating advanced security measures. This shift creates a significant opportunity for the enterprise network firewall market to offer solutions that safeguard data and ensure secure connectivity. Companies are investing more in these technologies to protect their sensitive information and maintain business continuity. Consequently, the enterprise network firewall market is poised for substantial growth, driven by the need for enhanced cybersecurity in a remote working environment.

Enterprise Network Firewall Market Segmentation

The worldwide market for enterprise network firewall is split based on types, component, deployment mode, organization size, industry vertical, and geography.

Enterprise Network Firewall Types

- Conventional Firewall

- Next Generation Firewall (NGFW)

- Application Firewall

- Others

According to enterprise network firewall industry analysis, the next generation firewall (NGFW) expected to dominate the market due to its advanced capabilities beyond traditional firewall functions. NGFWs integrate intrusion prevention systems (IPS), application control, and threat intelligence to provide comprehensive security. This multifaceted approach addresses the evolving and complex cyber threats faced by enterprises today, ensuring robust protection and streamlined network management. Their ability to inspect traffic at a deeper level and offer granular control makes them the preferred choice for modern enterprise security needs.

Enterprise Network Firewall Components

- Hardware

- Software

- Services

- Managed Services

- Design & Consulting

- Integration & Deployment

- Others

Services anticipated to dominate enterprise network firewall industry. This is primarily due to the increasing complexity of network security needs and the demand for specialized expertise in firewall deployment, management, and monitoring. Enterprises often require customized solutions, ongoing support, and consultancy services to effectively implement and maintain firewall solutions. Hardware and software components, while essential, typically follow in importance as they support the foundational infrastructure and functionality required by these service-driven solutions.

Enterprise Network Firewall Deployment Modes

- On-Premises

- Cloud-Based

In the enterprise network firewall market, on-premises solutions are poised to dominate the market; cloud-based deployment mode dominates for several reasons. It offers scalability, flexibility, and cost-efficiency compared to traditional on-premises solutions. Cloud-based firewalls enable easier integration with other cloud services and provide robust security measures without requiring extensive hardware maintenance. Additionally, they support remote workforces effectively by securing data across diverse access points, making them increasingly preferred in today's dynamic and distributed business environments.

Enterprise Network Firewall Organization Sizes

- Small and Medium Enterprises (SMEs)

- Large Enterprises

In the enterprise network firewall market, large enterprises typically dominate over SMEs. This dominance stems from several factors: large enterprises often have more complex and extensive networks requiring robust security measures, including sophisticated firewall solutions. They also tend to have larger budgets dedicated to cybersecurity investments compared to SMEs. Moreover, regulatory compliance requirements and the need for comprehensive threat protection further drive large enterprises towards investing in advanced firewall technologies, thus consolidating their dominance in this market segment.

Enterprise Network Firewall Industry Verticals

- IT and Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail

- Government

- Energy and Utilities

- Others

In the enterprise network firewall market, the banking, financial services, and insurance (BFSI) vertical typically dominate. This sector places a high emphasis on data security and regulatory compliance due to handling sensitive financial information. Enterprise-level network firewalls are crucial in safeguarding customer data, transaction details, and preventing cyber threats like data breaches and financial fraud. The stringent regulatory requirements and the need for robust cybersecurity measures make BFSI a significant driver in adopting advanced firewall solutions tailored to their specific security needs.

Enterprise Network Firewall Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Enterprise Network Firewall Market Regional Analysis

In enterprise network firewall market, North America dominates market, driven by increasing cybersecurity threats and the adoption of advanced networking technologies. For instance, in May 2020, Fortinet launched the FortiGate 4200F, the world's first hyperscale enterprise network firewall, bolstered by substantial exhibition support. This advancement is attributed to its seventh-generation network processor, enhancing flexibility and performance. The FortiGate 4200F remains a crucial component of the Fortinet Security Fabric, designed to enable an innovative, security-centric approach to networking that seamlessly integrates networking and security functionalities. Companies are increasingly investing in robust firewall solutions to protect their networks from evolving security risks and compliance requirements. The region's strong economic growth and technological advancements further bolster the demand for secure network infrastructure.

Asia-Pacific region is fastest-growing due to its burgeoning economies and rapid digital transformation. For instance, in July, Shanghai unveiled a blueprint aimed at accelerating the growth of its digital economy throughout the 14th Five-Year Plan (2021-2025). This initiative includes ambitious objectives and a range of supportive policies designed to foster the digital transformation of enterprises. Companies in sectors like finance, telecommunications, and manufacturing drive robust demand for advanced network security solutions. Government regulations on data protection also bolster adoption rates. Key players in the region capitalize on this demand by offering tailored solutions that cater to both large enterprises and SMEs, ensuring robust protection against evolving cyber threats.

Enterprise Network Firewall Market Players

Some of the top enterprise network firewall companies offered in our report include Huawei, AlgoSec Company, Cisco Systems, McAfee, AhnLab Inc, Imperva, Dell, SonicWall, Juniper Networks, Barracuda Networks, Stormshield SAS, PaloAlto Networks, WatchGuard Technologies, Fortinet, New H3C Technologies Co., Ltd., and GreyHeller.

Frequently Asked Questions

How big is the enterprise network firewall market?

The enterprise network firewall management market size was valued at USD 5.3 billion in 2023.

What is the CAGR of the global enterprise network firewall market from 2024 to 2032?

The CAGR of enterprise network firewall is 7.6% during the analysis period of 2024 to 2032.

Which are the key players in the enterprise network firewall market?

The key players operating in the global market are including Huawei, AlgoSec Company, Cisco Systems, McAfee, AhnLab Inc, Imperva, Dell, SonicWall, Juniper Networks, Barracuda Networks, Stormshield SAS, PaloAlto Networks, WatchGuard Technologies, Fortinet, New H3C Technologies Co., Ltd., and GreyHeller.

Which region dominated the global enterprise network firewall market share?

North America held the dominating position in enterprise network firewall industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of enterprise network firewall during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global enterprise network firewall industry?

The current trends and dynamics in the enterprise network firewall industry include increasing cyber threats and security breaches necessitate robust firewall solutions, rapid adoption of cloud-based services and IoT devices boosts firewall demand, and regulatory compliance and data protection laws drive the need for enterprise network security.

Which component held the maximum share in 2023?

The services expected to held the maximum share of the enterprise network firewall industry.