Enterprise Governance Risk And Compliance Market | Acumen Research and Consulting

Enterprise Governance, Risk, and Compliance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

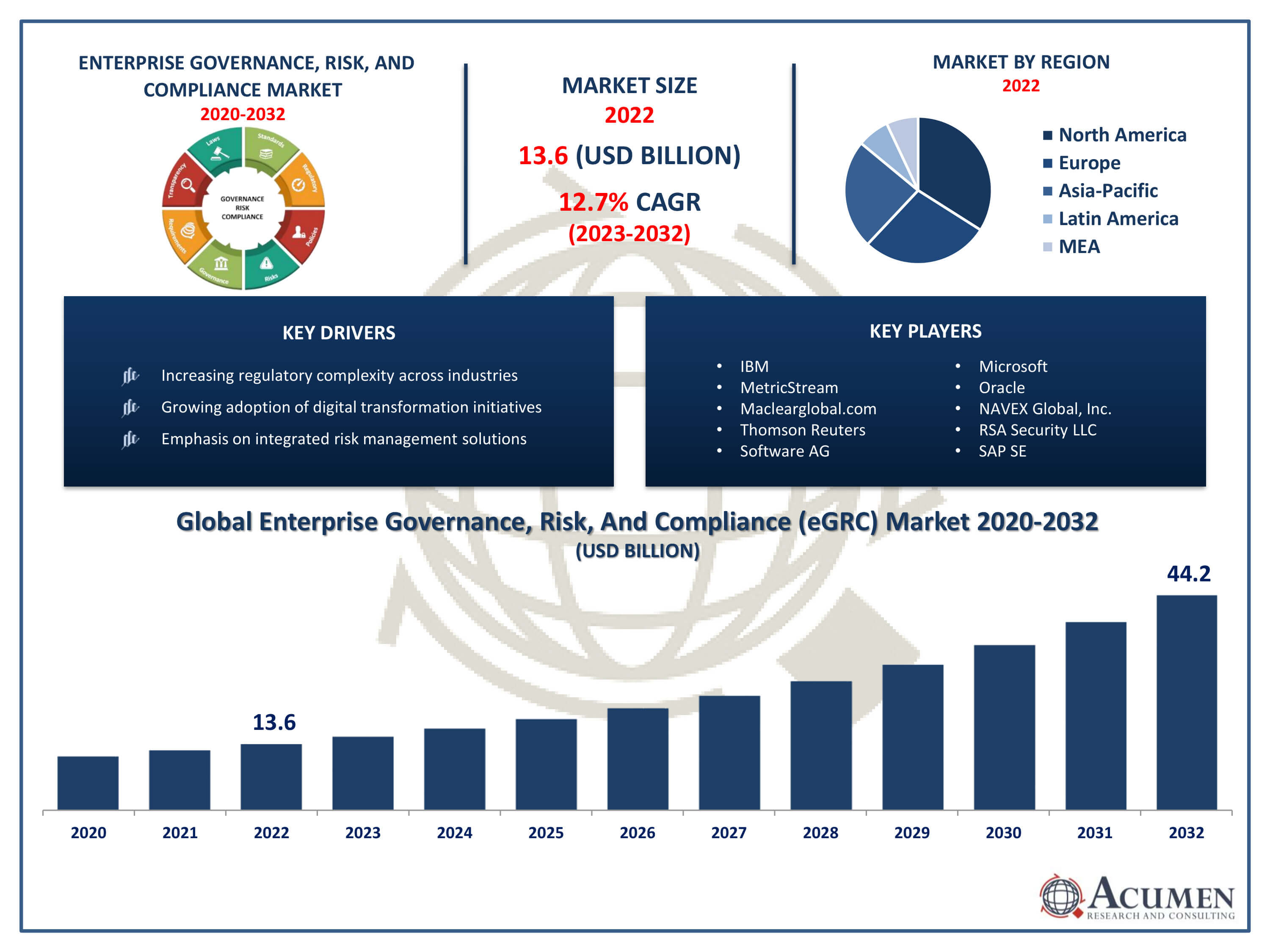

The Enterprise Governance, Risk, And Compliance Market Size accounted for USD 13.6 Billion in 2022 and is projected to achieve a market size of USD 44.2 Billion by 2032 growing at a CAGR of 12.7% from 2023 to 2032.

Enterprise Governance, Risk, And Compliance (eGRC) Market Key Highlights

- Global enterprise governance, risk, and compliance market revenue is expected to increase by USD 44.2 billion by 2032, with a 12.7% CAGR from 2023 to 2032

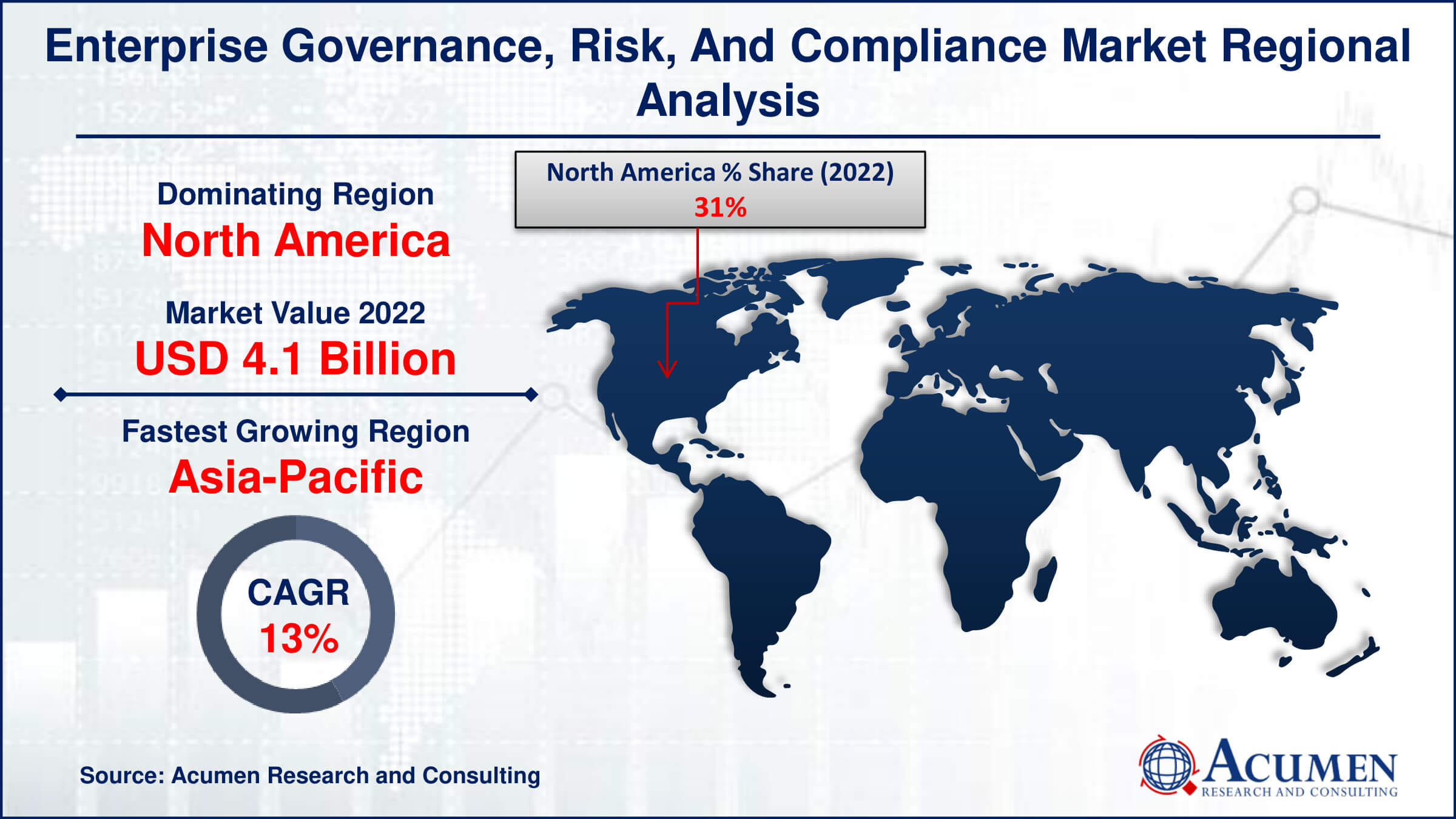

- North America region led with more than 31% of enterprise governance, risk, and compliance market share in 2022

- Asia-Pacific enterprise governance, risk, and compliance market growth will record a CAGR of more than 13.3% from 2023 to 2032

- By component, the software segment contributed over 65% of revenue share in 2022

- By vertical, the BFSI segment captured more than 21% of revenue share in 2022

- Increasing regulatory complexity across industries, drives the enterprise governance, risk, and compliance market value

Enterprise governance, risk, and compliance (eGRC) is a framework that enables organizations to effectively manage and align their governance, risk management, and compliance processes. It integrates various aspects of operations, such as policies, regulations, and risks, into a unified system, providing a holistic approach to decision-making and strategy implementation. eGRC solutions typically include software platforms that automate and streamline processes related to risk assessment, regulatory compliance, policy management, and internal controls.

Enterprise governance, risk, and compliance (eGRC) is a framework that enables organizations to effectively manage and align their governance, risk management, and compliance processes. It integrates various aspects of operations, such as policies, regulations, and risks, into a unified system, providing a holistic approach to decision-making and strategy implementation. eGRC solutions typically include software platforms that automate and streamline processes related to risk assessment, regulatory compliance, policy management, and internal controls.

In recent years, the market for eGRC solutions has experienced significant growth driven by several factors. One key driver is the increasing complexity of regulatory environments across various industries, such as finance, healthcare, and energy. Organizations face growing pressure to comply with a myriad of regulations and standards, which necessitates robust eGRC frameworks to ensure adherence and mitigate associated risks. Additionally, the rise of digital transformation initiatives and the proliferation of data have heightened cybersecurity concerns, prompting businesses to invest in eGRC solutions to enhance their resilience against cyber threats and data breaches.

Global Enterprise Governance, Risk, and Compliance Market Trends

Market Drivers

- Increasing regulatory complexity across industries

- Growing adoption of digital transformation initiatives

- Heightened awareness due to high-profile data breaches and scandals

- Emphasis on integrated risk management solutions

- Focus on enhancing operational efficiency and transparency

Market Restraints

- Implementation challenges in large organizations

- Resistance to change in traditional governance structures

Market Opportunities

- Innovations in AI and automation for risk management

- Demand for cloud-based eGRC platforms

Enterprise Governance, Risk, And Compliance Market Report Coverage

| Market | Enterprise Governance, Risk, and Compliance Market |

| Enterprise Governance, Risk, and Compliance Market Size 2022 | USD 13.6 Billion |

| Enterprise Governance, Risk, and Compliance Market Forecast 2032 |

USD 44.2 Billion |

| Enterprise Governance, Risk, and Compliance Market CAGR During 2023 - 2032 | 12.7% |

| Enterprise Governance, Risk, and Compliance Market Analysis Period | 2020 - 2032 |

| Enterprise Governance, Risk, and Compliance Market Base Year |

2022 |

| Enterprise Governance, Risk, and Compliance Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Software Usage, By Deployment Mode, By Business Function, By Organization Size, By vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | IBM, MetricStream, Maclearglobal.com, Thomson Reuters, Software AG, Microsoft, Oracle, NAVEX Global, Inc., RSA Security LLC, SAP SE, SAI Global Pty Limited, and SAS Institute Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Enterprise governance, risk, and compliance (eGRC) is essential for navigating the complexities of today's business landscapes. It's more than a framework; it's a strategic imperative that aligns governance, risk management, and compliance activities to strengthen organizational resilience and drive long-term growth. By integrating these critical functions, eGRC ensures not only strategic alignment, but also regulatory compliance and proactive risk mitigation. This comprehensive approach encourages cross-departmental collaboration, streamlines processes, and increases transparency, allowing organizations to make informed decisions and respond quickly to changing challenges.

EGRC is a multifaceted discipline that includes a wide range of activities, from internal controls and audit management to policy governance and regulatory compliance monitoring. Its applications span a wide range of industries and functions, making it critical for maintaining integrity and promoting trust. In the financial sector, for example, eGRC solutions are essential tools for institutions dealing with regulatory complexities, allowing them to navigate compliance complexities, monitor financial risks, and maintain the integrity of internal controls in the face of a constantly changing regulatory landscape.

The market for eGRC solutions is experiencing a surge in demand, driven by the increasing complexity of regulatory requirements and the relentless march of digital transformation. With regulations evolving and multiplying across industries, organizations are under increasing pressure to ensure compliance while navigating a maze of data protection laws and industry standards. The growing demand for comprehensive eGRC solutions emphasizes the importance of streamlined compliance processes and strong risk mitigation strategies. Furthermore, as businesses adopt cutting-edge technologies such as cloud computing, artificial intelligence, and data analytics to drive innovation and efficiency, the importance of eGRC in mitigating emerging risks such as cybersecurity threats and data privacy concerns grows. In this dynamic landscape, eGRC emerges not only as a requirement, but also as a strategic enabler for organizations seeking to thrive in an age of unprecedented change and uncertainty.

Enterprise Governance, Risk, and Compliance Market Segmentation

The global market for enterprise governance, risk, and compliance segmentation is based on component, software usage, deployment mode, business function, organization size, vertical, and geography.

Enterprise Governance, Risk, and Compliance Market By Component

- Software

- Audit Management

- Risk Management

- Compliance Management

- Incident Management

- Policy Management

- Others

- Services

- Integration

- Support

- Consulting

According to enterprise governance, risk, and compliance industry analysis, the software segment held the largest market share in 2022. One key contributor to this growth is the increasing recognition of the limitations of manual processes in managing governance, risk, and compliance activities. Organizations are turning to software solutions to automate and streamline these processes, enabling them to enhance efficiency, accuracy, and scalability. This shift towards software-based eGRC solutions has become imperative, particularly for large enterprises dealing with vast amounts of data and complex regulatory requirements. Furthermore, advancements in technology, particularly in areas such as artificial intelligence (AI), machine learning, and predictive analytics, have significantly contributed to the expansion of the software segment in the eGRC market.

Enterprise Governance, Risk, and Compliance Market By Software Usage

- External

- Internal

In terms of software usage, the internal segment is dominate the enterprise governance, risk, and compliance market in 2022. One major driver is the increasing recognition among organizations of the importance of internal controls and processes in mitigating risks and ensuring compliance. As businesses face mounting pressures from regulatory bodies and stakeholders to uphold transparency and accountability, there's a heightened emphasis on strengthening internal governance structures. This includes implementing robust policies, procedures, and monitoring mechanisms to detect and address potential risks and compliance breaches proactively. Moreover, the rise of digital transformation initiatives has led to a greater focus on internal controls within organizations.

Enterprise Governance, Risk, and Compliance Market By Deployment Mode

- Cloud

- On-premise

According to the enterprise governance, risk, and compliance market forecast, the cloud segment is expected to witness significant growth in the coming years. This growth is primarily driven by the increasing adoption of cloud-based solutions across industries. Organizations are recognizing the benefits of cloud computing, such as scalability, flexibility, and cost-effectiveness, in managing their governance, risk, and compliance activities. Cloud-based eGRC platforms offer centralized access to data, streamlined collaboration among stakeholders, and seamless integration with other business systems, making them highly attractive options for businesses seeking to enhance their eGRC capabilities. Additionally, the growing complexity of regulatory requirements and the need for real-time risk management have further propelled the demand for cloud-based eGRC solutions.

Enterprise Governance, Risk, And Compliance Market By Business Function

- Finance

- Legal

- Information Technology

- Operations

Based on the business function, the information technology segment is expected to witness significant growth in the coming years in the enterprise governance, risk, and compliance market. IT solutions tailored for eGRC purposes have become indispensable for organizations seeking to navigate complex regulatory landscapes and mitigate emerging risks effectively. These solutions encompass a range of technologies, including data analytics, artificial intelligence, and automation, which empower organizations to streamline processes, enhance decision-making, and improve overall risk management capabilities. Furthermore, as businesses increasingly rely on digital infrastructure and systems to conduct their operations, the need for robust IT-based eGRC solutions has become paramount. Organizations face a myriad of IT-related risks, including cybersecurity threats, data breaches, and system vulnerabilities, which can significantly impact business continuity and reputation.

Enterprise Governance, Risk, and Compliance Market By Organization Size

- Small & Medium Enterprise

- Large Enterprise

In terms of organization size, the large enterprise segment has been experiencing significant growth in recent years. Large enterprises typically operate on a global scale with complex operations spanning multiple jurisdictions and regulatory environments. As a result, they face unique challenges in managing governance, risk, and compliance across their vast organizational structures. To address these challenges, large enterprises are increasingly turning to comprehensive eGRC solutions that offer scalability, customization, and integration capabilities tailored to their specific needs. Moreover, the escalating regulatory landscape and the growing scrutiny from stakeholders have heightened the importance of robust eGRC frameworks for large enterprises.

Enterprise Governance, Risk, and Compliance Market By Vertical

- BFSI

- Energy & Utilities

- Construction & Engineering

- Retail & consumer goods

- Transportation & Logistics

- Telecom & IT

- Government

- Manufacturing

- Healthcare

- Others

In terms of vertical, the BFSI segment has been experiencing significant growth in recent years. This growth is driven by stringent regulatory requirements, evolving customer expectations, and increasing cyber threats. As one of the most heavily regulated industries, BFSI firms face a myriad of compliance obligations spanning from financial regulations like Basel III to data protection laws such as GDPR and CCPA. Consequently, there's a heightened demand for comprehensive eGRC solutions tailored to the unique needs of the BFSI sector, encompassing risk management, regulatory compliance, and cybersecurity measures. Moreover, the BFSI industry is grappling with the challenges posed by digital transformation, including the proliferation of digital channels, fintech disruption, and rising cyber risks.

Enterprise Governance, Risk, and Compliance Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Enterprise Governance, Risk, and Compliance Market Regional Analysis

North America dominates the enterprise governance, risk, and compliance (eGRC) market. The North America region boasts a highly developed regulatory landscape across various industries, including finance, healthcare, and manufacturing. This complex regulatory environment necessitates robust eGRC solutions to ensure compliance with stringent laws and standards, such as Sarbanes-Oxley (SOX) Act, HIPAA, and SEC regulations. As a result, North American organizations, particularly large enterprises, prioritize investments in EGRC technologies to navigate regulatory complexities effectively. Moreover, North America is home to a plethora of technology vendors specializing in eGRC solutions, offering a wide range of products and services tailored to diverse industry requirements. These vendors leverage advanced technologies such as artificial intelligence, machine learning, and predictive analytics to deliver innovative eGRC platforms that automate processes, enhance risk visibility, and improve decision-making capabilities. Additionally, the region's strong focus on innovation and digital transformation initiatives further drives the adoption of eGRC solutions, as organizations seek to leverage technology to optimize governance practices, mitigate risks, and achieve compliance objectives.

Enterprise Governance, Risk, And Compliance Market Player

Some of the top enterprise governance, risk, and compliance market companies offered in the professional report include IBM, MetricStream, Maclearglobal.com, Thomson Reuters, Software AG, Microsoft, Oracle, NAVEX Global, Inc., RSA Security LLC, SAP SE, SAI Global Pty Limited, and SAS Institute Inc.

Frequently Asked Questions

How big is the enterprise governance, risk, and compliance market?

The enterprise governance, risk, and compliance market size was USD 13.6 Billion in 2022.

What is the CAGR of the global enterprise governance, risk, and compliance (eGRC) market from 2023 to 2032?

The CAGR of enterprise governance, risk, and compliance is 12.7% during the analysis period of 2023 to 2032.

Which are the key players in the enterprise governance, risk, and compliance market?

The key players operating in the global market are including IBM, MetricStream, Maclearglobal.com, Thomson Reuters, Software AG, Microsoft, Oracle, NAVEX Global, Inc., RSA Security LLC, SAP SE, SAI Global Pty Limited, and SAS Institute Inc.

Which region dominated the global enterprise governance, risk, and compliance (eGRC) market share?

North America held the dominating position in enterprise governance, risk, and compliance industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of enterprise governance, risk, and compliance during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global enterprise governance, risk, and compliance (eGRC) industry?

The current trends and dynamics in the enterprise governance, risk, and compliance industry include increasing regulatory complexity across industries, growing adoption of digital transformation initiatives, and heightened awareness due to high-profile data breaches and scandals.

Which component held the maximum share in 2022?

The software component held the maximum share of the enterprise governance, risk, and compliance (eGRC) industry.