Endoscopy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Endoscopy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

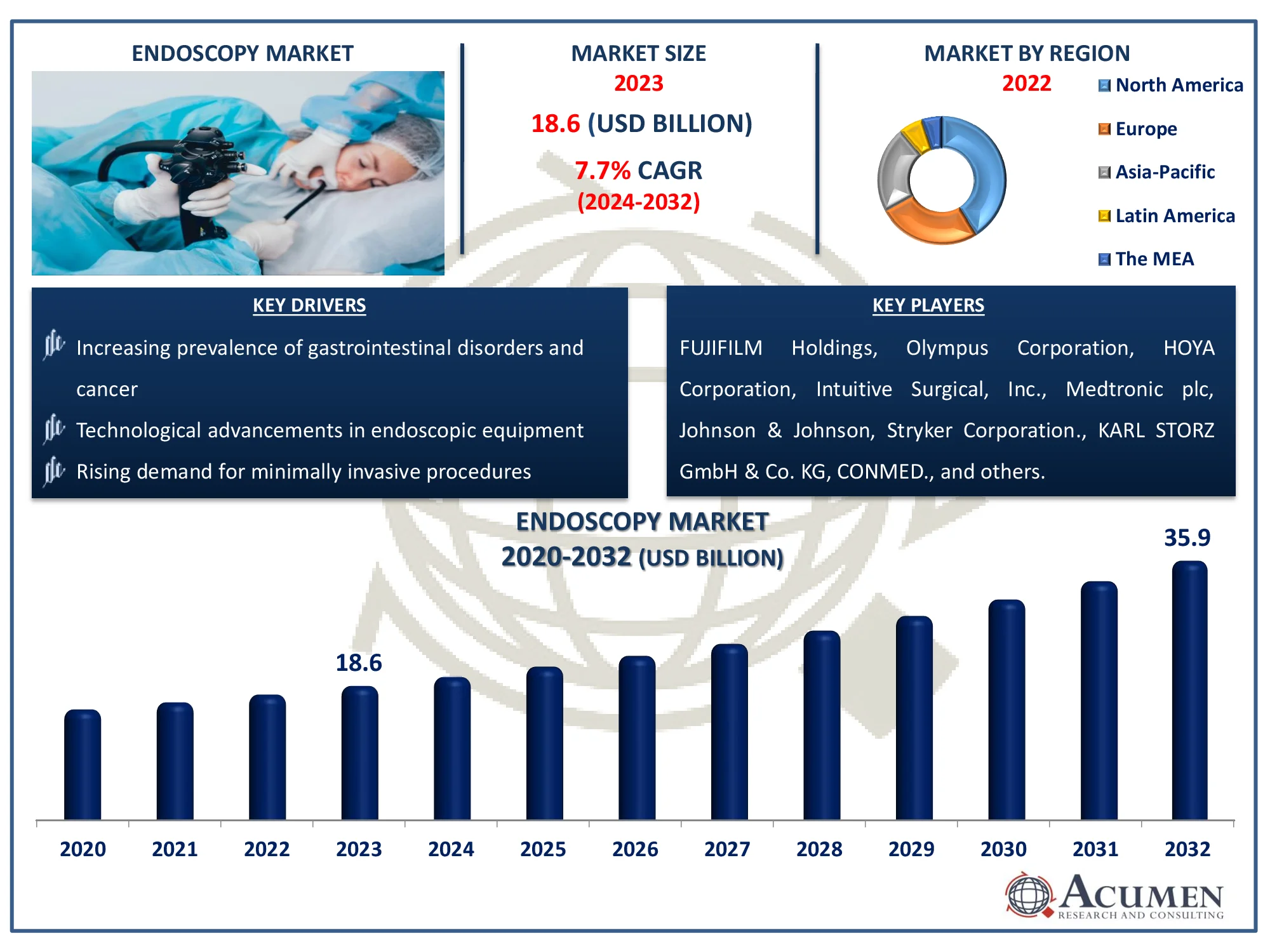

The Global Endoscopy Market Size accounted for USD 18.6 Billion in 2023 and is estimated to achieve a market size of USD 35.9 Billion by 2032 growing at a CAGR of 7.7% from 2024 to 2032.

Endoscopy Market Highlights

- The global endoscopy market is projected to reach revenue of USD 35.9 billion by 2032, with a CAGR of 7.7% from 2024 to 2032

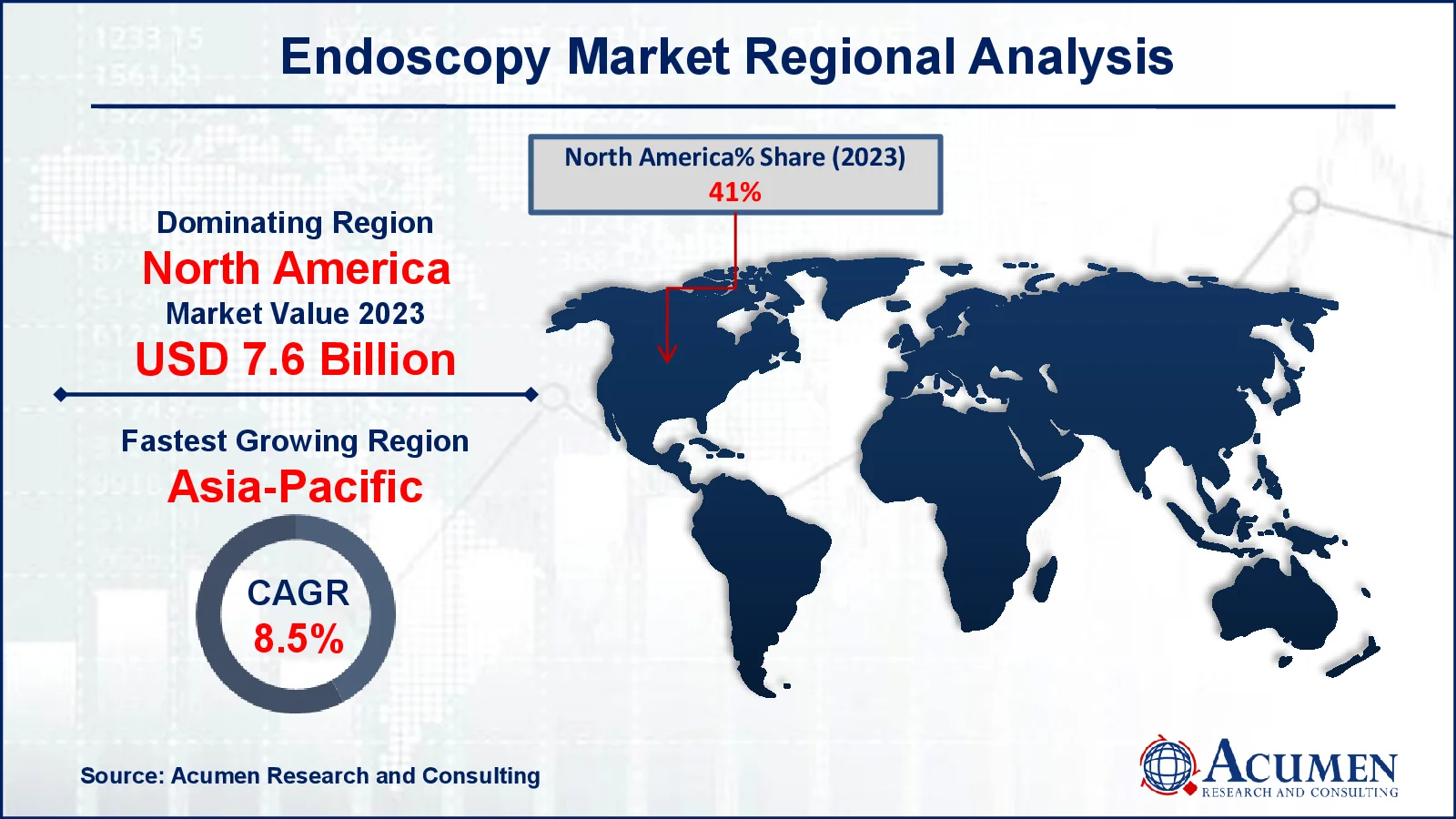

- In 2023, the North American endoscopy market was valued at approximately USD 7.6 billion

- The Asia-Pacific endoscopy market is expected to grow at a CAGR of over 8.5% from 2024 to 2032

- Flexible endoscopes accounted for 47% of the market share in 2023 among product categories

- Gastrointestinal (GI) endoscopy represented 51% of the market share in 2023 based on application

- Hospitals generated 48% of the market share in 2023 based on end-users

- Advancements in endoscope technology like high-definition, flexible, and multi-functional endoscopes is the endoscopy market trend that fuels the industry demand

Endoscopy is a medical procedure that uses an endoscope, a flexible tube with a camera and light at its end, to visualize the interior of a body cavity or organ. It is minimally invasive and allows for direct observation, diagnosis, and sometimes treatment of various conditions. Applications of endoscopy include examining the gastrointestinal tract (gastroscopy, colonoscopy), respiratory system (bronchoscopy), and urinary tract (cystoscopy). It is used to investigate symptoms such as abdominal pain, bleeding, or tumors. Endoscopy can also facilitate biopsies, the removal of foreign objects, and other therapeutic interventions. This technique is crucial for early detection and management of diseases with minimal recovery time for patients.

Global Endoscopy Market Dynamics

Market Drivers

- Increasing prevalence of gastrointestinal disorders and cancer

- Technological advancements in endoscopic equipment

- Rising demand for minimally invasive procedures

Market Restraints

- High cost of endoscopic equipment and procedures

- Risk of complications and patient safety concerns

- Limited reimbursement and insurance coverage

Market Opportunities

- Expansion in emerging markets with growing healthcare infrastructure

- Development of advanced imaging and diagnostic technologies

- Increasing adoption of endoscopy in outpatient settings

Endoscopy Market Report Coverage

| Market | Endoscopy Market |

| Endoscopy Market Size 2022 |

USD 18.6 Billion |

| Endoscopy Market Forecast 2032 | USD 35.9 Billion |

| Endoscopy Market CAGR During 2023 - 2032 | 7.7% |

| Endoscopy Market Analysis Period | 2020 - 2032 |

| Endoscopy Market Base Year |

2022 |

| Endoscopy Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | FUJIFILM Holdings Corporation, Olympus Corporation, HOYA Corporation, Intuitive Surgical, Inc., Medtronic plc, Johnson & Johnson, Stryker Corporation., KARL STORZ GmbH & Co. KG, CONMED Corporation., Boston Scientific Corporation, Richard Wolf GmbH, and Smith and Nephew plc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Endoscopy Market Insights

The rising prevalence of gastrointestinal disorders and cancers has significantly boosted the growth of the endoscopy equipment market. For instance, according to National Institute of Health, in India, prevalence of self-reported gastrointestinal issues rises significantly with age. Notably, both men and women aged 75 and older are equally at high risk, with around 20% of each gender experiencing gastrointestinal problems. As these conditions become more common, the demand for diagnostic and therapeutic endoscopic procedures has surged. Endoscopies allow for minimally invasive examination and treatment, making them a preferred choice for both patients and healthcare providers. Consequently, the increasing burden of gastrointestinal diseases and cancer continues to propel market expansion and innovation in endoscopic solutions.

The risk of complications and patient safety concerns are significant restraints for the endoscopy equipment market. These risks can include adverse reactions to anesthesia, infections, and damage to internal organs during procedures, which can deter both patients and healthcare providers from opting for endoscopic interventions. Increased awareness and reporting of these complications often lead to heightened scrutiny and regulatory requirements, potentially limiting market growth. For instance, according to National Institute of Health, patient safety is a critical public health issue with significant implications for morbidity, mortality, and patients' quality of life. It also adversely impacts the reputation of healthcare institutions and professionals. Additionally, the fear of such risks may influence patient choices, shifting preference towards less invasive or alternative diagnostic and treatment options.

The expansion of healthcare infrastructure in emerging markets presents a significant opportunity for the endoscopes market. For instance, according to India Brand Equity Foundation, in 2023, the Indian healthcare industry maintained its robust growth, reaching a value of US$ 372 billion, fueled by contributions from both the private sector and the government. As these regions invest in advanced medical technologies and improve healthcare access, the demand for minimally invasive diagnostic and therapeutic procedures increases. This growth drives the need for endoscopic equipment and services, creating a lucrative market for manufacturers and providers.

Endoscopy Market Segmentation

The worldwide market for endoscopy is split based on product, application, end-user, and geography.

Endoscopy Products

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Urology endoscopes

- Cystoscopes

- Gynecology endoscopes

- Neuroendoscopes

- Other rigid endoscopes

- Flexible Endoscopes

- Upper gastrointestinal endoscopes

- Colonoscopes

- Bronchoscopes

- Sigmoidoscopes

- Laryngoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Other flexible endoscopes

- Capsule Endoscopes

- Disposable Endoscopes

- Robot Assisted Endoscopes

According to the endoscopy industry analysis, flexible endoscopes dominate the endoscopes market due to their versatility and ease of use in various diagnostic and therapeutic procedures. Their ability to navigate complex anatomical pathways makes them essential for minimally invasive surgeries. Various diseases, including stomach cancer, colon cancer, inflammatory bowel disease (IBD), respiratory infections, respiratory tumors, and other conditions, require flexible types of endoscopes for diagnosis. For instance, according to the American Cancer Society's 2023 report, an estimated 26,380 new cases of stomach cancer were diagnosed in the United States in 2022, with an estimated 26,500 new cases expected to be diagnosed in 2023. Additionally, their growing adoption in both gastroenterology and pulmonology boosts their market prominence.

Endoscopy Applications

- Gastrointestinal (GI) Endoscopy

- Urology endoscopy (Cystoscopy)

- Laparoscopy

- Obstetrics/Gynecology Endoscopy

- Arthroscopy

- Bronchoscopy

- Mediastinoscopy

- Otoscopy

- Laryngoscopy

- Other applications

The gastrointestinal (gi) endoscopy segment is the largest application category in the endoscopy market, due to its widespread use in diagnosing and managing a variety of GI disorders. It includes procedures such as colonoscopy, gastroscopy, and enteroscopy, which are critical for detecting conditions like cancer, ulcers, and inflammatory diseases. The high prevalence of gastrointestinal issues, coupled with advancements in endoscopic technology, drives significant demand in this segment. Furthermore, the minimally invasive nature of GI endoscopy offers patients quicker recovery times, enhancing its appeal and usage.

Endoscopy End-Users

- Hospitals

- Ambulatory Surgery Centers

- Other End Uses

According to the endoscopy market forecast, hospitals are the dominant end-users in the market due to their extensive utilization of these devices for diagnostic and therapeutic procedures. The high patient volume and the need for advanced diagnostic tools in hospitals drive substantial demand for endoscopy equipment. Hospitals require endoscopes for a wide range of applications, from routine check-ups to complex surgeries. The integration of endoscopy in hospital settings also involves significant investment in training and technology maintenance, reinforcing their leading role.

Endoscopy Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Endoscopy Market Regional Analysis

For several reasons, North America dominates the endoscopy devices market due to advanced healthcare infrastructure, high adoption rates of new technologies, and strong presence of major medical device manufacturers. For instance, in January 2023, AA Medical partnered with Certified Endoscopy Products, a medical device reprocessing company based in Chicago that specializes in endoscopic devices. Together, AA Medical and Certified Endoscopy will establish a leading medical device reprocessing company serving the endoscopy, orthopedic, and other surgical device markets. The region benefits from significant investments in research and development, leading to innovation and improved endoscopic systems. Additionally, the growing prevalence of chronic diseases and an aging population further drive market demand. As a result, North America remains a leading market for endoscopic solutions globally.

The Asia-Pacific region is the fastest-growing in endoscopy devices market due to increasing healthcare investments, a rising elderly population, and improving access to advanced medical technologies. Rapid economic development and key players presence also drives demand for endoscopic procedures. For instance, in February 2020, Fujifilm India Private Limited expanded its presence in India by opening a new office. The company aims to grow its workforce by 30% across various divisions, including Electronic Imaging, Instax, Industrial Products, and Medical Systems. Additionally, advancements in healthcare infrastructure and increased healthcare spending in countries like China and India contribute to this growth trend.

Endoscopy Market Players

Some of the top endoscopy companies offered in our report include FUJIFILM Holdings Corporation, Olympus Corporation, HOYA Corporation, Intuitive Surgical, Inc., Medtronic plc, Johnson & Johnson, Stryker Corporation., KARL STORZ GmbH & Co. KG, CONMED Corporation., Boston Scientific Corporation, Richard Wolf GmbH, and Smith and Nephew plc.

Frequently Asked Questions

How big is the endoscopy market?

The endoscopy market size was valued at USD 18.6 billion in 2023.

What is the CAGR of the global endoscopy market from 2024 to 2032?

The CAGR of endoscopy is 7.7% during the analysis period of 2024 to 2032.

Which are the key players in the endoscopy market?

The key players operating in the global market are including FUJIFILM Holdings Corporation, Olympus Corporation, HOYA Corporation, Intuitive Surgical, Inc., Medtronic plc, Johnson & Johnson, Stryker Corporation., KARL STORZ GmbH & Co. KG, CONMED Corporation., Boston Scientific Corporation, Richard Wolf GmbH, and Smith and Nephew plc.

Which region dominated the global endoscopy market share?

North America held the dominating position in endoscopy industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of endoscopy during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global endoscopy industry?

The current trends and dynamics in the endoscopy industry include increasing prevalence of gastrointestinal disorders and cancer, technological advancements in endoscopic equipment, and rising demand for minimally invasive procedures.

Which product held the maximum share in 2023?

The flexible endoscopes product held the maximum share of the endoscopy industry.