Endoscopy Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Endoscopy Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

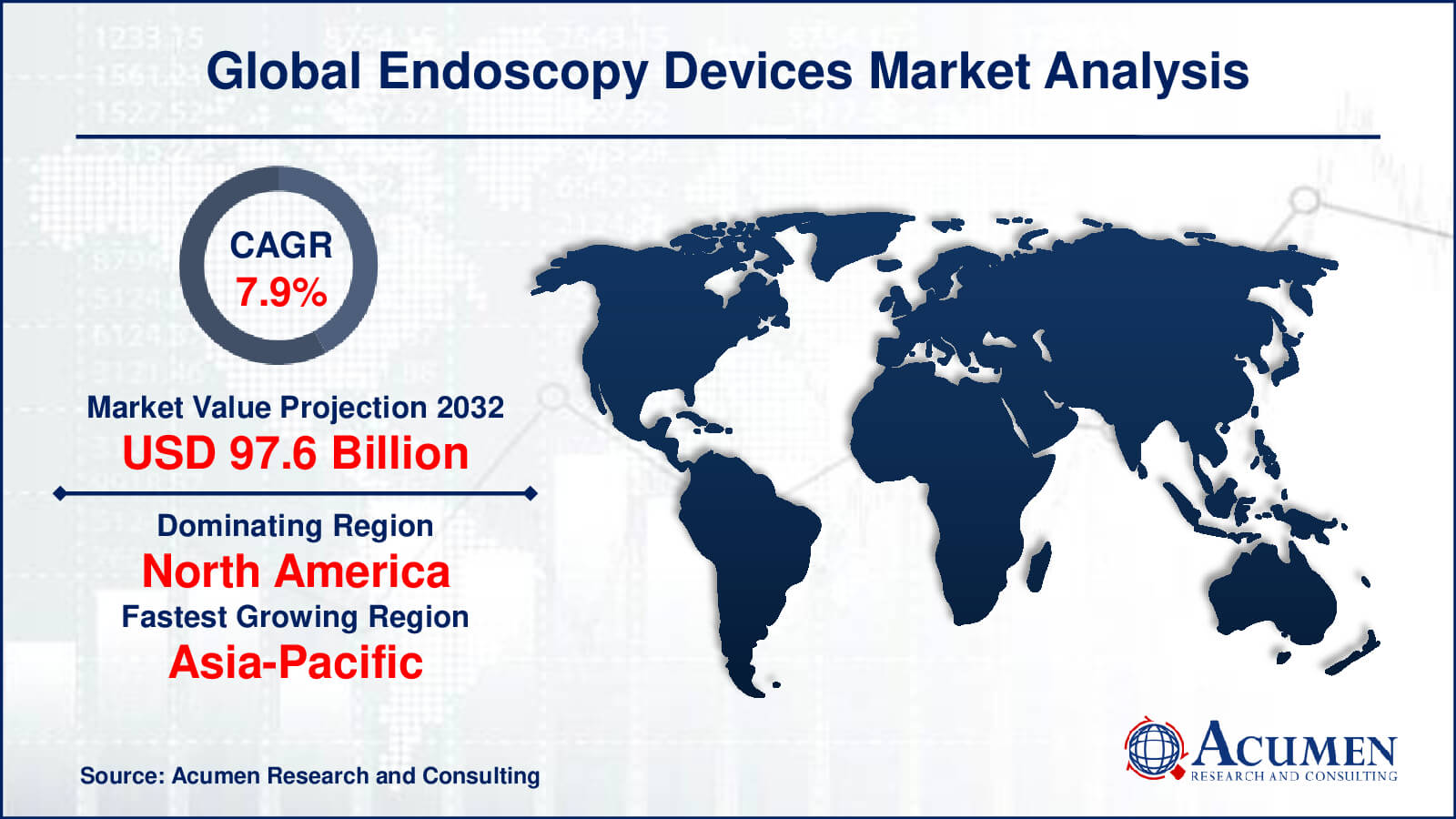

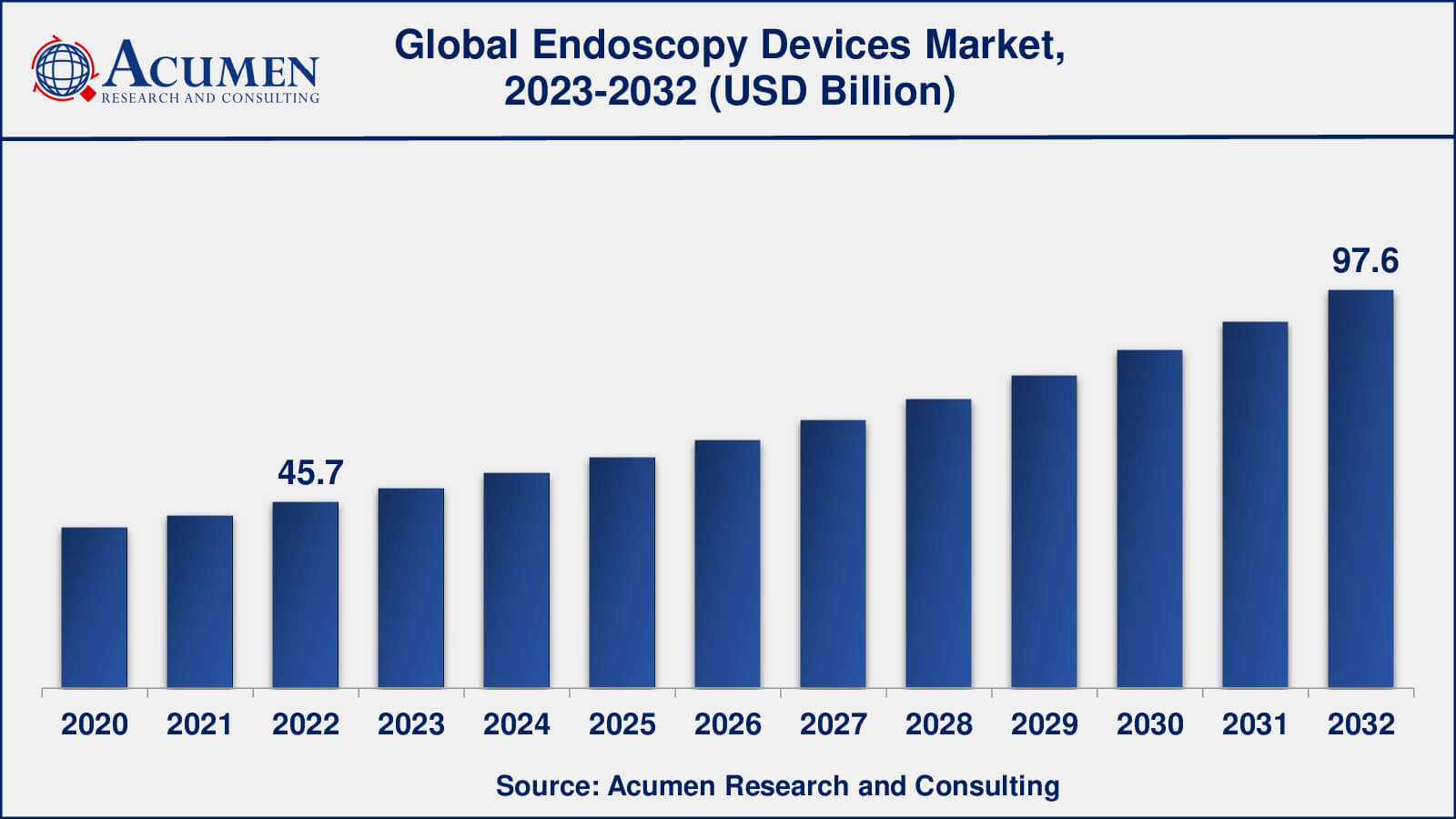

The Global Endoscopy Devices Market Size accounted for USD 45.7 Billion in 2022 and is estimated to achieve a market size of USD 97.6 Billion by 2032 growing at a CAGR of 7.9% from 2023 to 2032.

Endoscopy Devices Market Highlights

- Global endoscopy devices market revenue is poised to garner USD 97.6 billion by 2032 with a CAGR of 7.9% from 2023 to 2032

- North America endoscopy devices market value occupied more than USD 19.2 billion in 2022

- Asia-Pacific endoscopy devices market growth will record a CAGR of more than 8% from 2023 to 2032

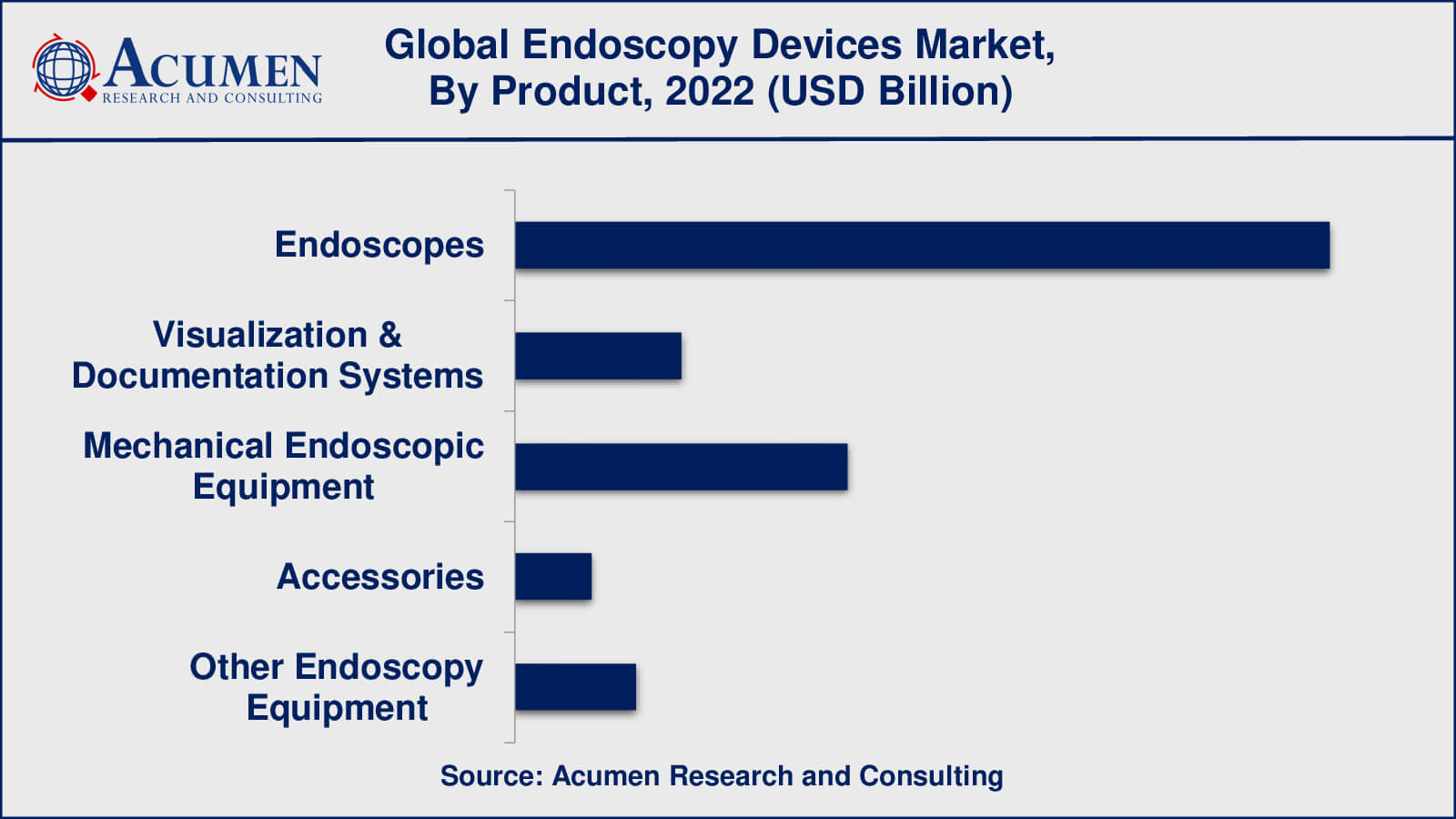

- Among product, the endoscopes sub-segment generated over US$ 24.7 billion revenue in 2022

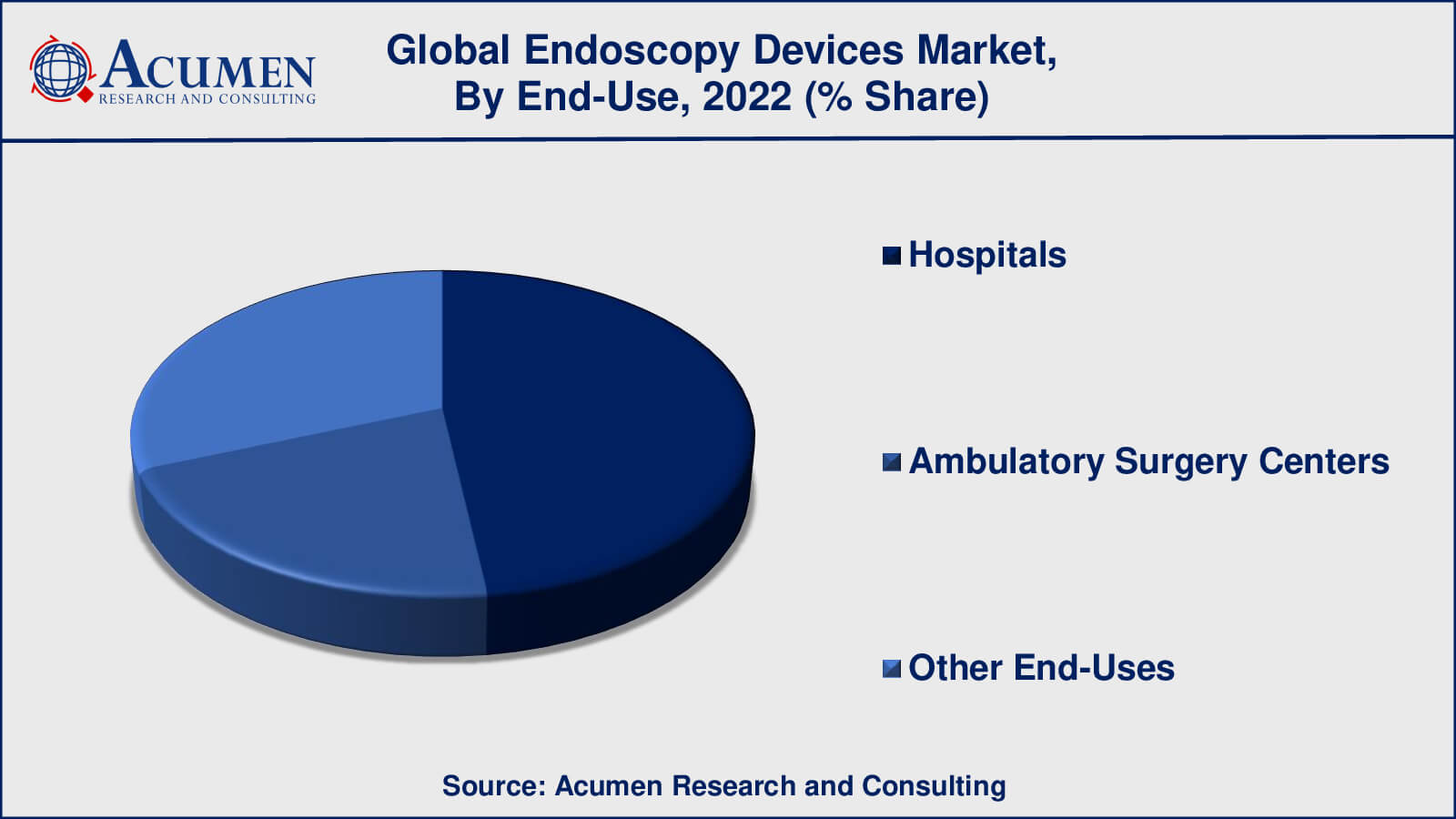

- Based end-use, the hospitals sub-segment generated around 48% share in 2022

- Expansion of endoscopic applications is a popular endoscopy devices market trend that fuels the industry demand

Endoscopy has emerged as one of the most prominent technologies in detecting diseases as well as performing surgeries, which has gained global attention. The endoscopic procedure is inexpensively resulting in fewer scars and minimal complications post-surgery. Endoscopic surgery reduces the time of stay at the hospital, and in contrast, acts as one of the prime drivers for the growth of the endoscopy devices market. The devices such as an endoscope, operative devices, and visualization systems are required to perform endoscopic surgery. The geriatric population mostly suffers from gastro-esophageal reflux disorder, gastrointestinal problems, ophthalmic diseases, orthopedic diseases, and cancer coupled with an increasing prevalence of chronic diseases are expected to boost the market growth for endoscopic devices.

Global Endoscopy Devices Market Dynamics

Market Drivers

- Increasing demand for minimally invasive surgeries

- Growing prevalence of chronic diseases

- Surging healthcare expenditure

- Rising aging population

Market Restraints

- High cost of endoscopy devices

- Stringent regulatory requirements

- Lack of skilled professionals

Market Opportunities

- Growing demand for flexible endoscopes

- Increasing adoption of capsule endoscopy

- Development of disposable endoscopes

Endoscopy Devices Market Report Coverage

| Market | Endoscopy Devices Market |

| Endoscopy Devices Market Size 2022 | USD 45.7 Billion |

| Endoscopy Devices Market Forecast 2032 | USD 97.6 Billion |

| Endoscopy Devices Market CAGR During 2023 - 2032 | 7.9% |

| Endoscopy Devices Market Analysis Period | 2020 - 2032 |

| Endoscopy Devices Market Base Year | 2022 |

| Endoscopy Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | CONMED, Cook, Olympus Corporation, Johnson and Johnson, Fujifilm Holding Corporation, Pentax Medical, Boston Scientific Corporation, Stryker Corporation, Smith & Nephew, KARL STORZ GmbH & Co. KG, Medtronic, and Richard Wolf GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Endoscopy Devices Market Insights

The development of the global endoscopy devices market can be attributed to the increasing investment, grants, and funds by government organizations, globally coupled with an increasing number of hospitals and growing hospital investments. Furthermore, an increasing acceptance of minimally invasive surgeries and technological advancement in endoscopy devices will boost the market for endoscopy devices. Moreover, an increasing prevalence of chronic disease, a rising geriatric population, and favorable reimbursement policies are further expected to fuel the growth of the market in the forecast period. However, the lack of trained endoscopists and physicians and infections caused by endoscopes are the major factors restraining the market during the forecast period.

Endoscopy Devices Market Segmentation

The worldwide market for endoscopy devices is split based on product, application, end-use, and geography.

Endoscopy Device Market Products

- Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Urology Endoscopes

- Gynecology Endoscopes

- Arthroscopes

- Cystoscopes

- Neuroendoscopes

- Other Rigid Endoscopes

- Flexible Endoscopes

- GI Endoscopes

- Gastroscopes

- Colonoscopes

- Sigmoidoscopes

- Duodenoscopes

- Others

- ENT Endoscopes

- Nasopharyngoscopes

- Otoscope

- Rhinoscopes

- Laryngoscopes

- Others

- Bronchoscopes

- Other Flexible Endoscopes

- GI Endoscopes

- Capsule Endoscopes

- Robot-Assisted Endoscope

- Rigid Endoscopes

- Visualization & Documentation Systems

- Light Sources

- Camera Heads

- Wireless Display & Monitors

- Endoscopy Cameras

- Carts

- Digital Documentation Systems

- Video Processors & Video Convertors

- Transmitters & Receivers

- Others

- Mechanical Endoscopic Equipment

- By Devices

- Endoscopic implants

- Trocars

- Graspers

- Snares

- Biopsy forceps

- Others

- By Therapeutics

- Biopsy (FNA and FNB)

- Polypectomy (ESD and EMR)

- Biliary Stone Management & Drainage

- Hemostasis & Suturing

- Esophageal & Colon Stricture Management

- Gastroesophageal Reflux Disease (GERD) & Obesity

- Others

- By Devices

- Accessories

- Biopsy Valves

- Overtubes

- Mouth Pieces

- Surgical Dissectors

- Needle Holders & Needle Forceps

- Cleaning Brushes

- Light Cables

- Others

- Others

- Insufflators

- Endoscopy Fluid Management Systems

- Other Electronic Endoscopy Equipment

Endoscopes have been the dominant product type segment in the market, according to our endoscopy devices industry analysis, because they are the primary tool used in endoscopic procedures for visualisation and diagnosis. Endoscopes come in a variety of shapes and sizes, including rigid, flexible, and capsule endoscopes, and are used in a variety of settings, including gastroenterology, pulmonology, urology, gynaecology, and orthopaedics.

However, due to technological advancements and increased demand for high-quality imaging and video documentation, other product types such as visualisation and documentation systems and mechanical endoscopic equipment have seen significant growth in recent years. Endoscopy accessories, such as biopsy forceps and cleaning brushes, are also required for procedures and contribute to market growth.

Endoscopy Device Market Applications

- Arthroscopy

- Bronchoscopy

- Gastrointestinal (GI) Endoscopy

- Laparoscopy

- Laryngoscopy

- Mediastinoscopy

- Obstetrics/gynecology Endoscopy

- Otoscopy

- Urology Endoscopy (Cystoscopy)

- Other Applications

According to endoscopy devices market forecast, gastrointestinal (GI) endoscopy has been the dominant application in the market due to the high prevalence of gastrointestinal disorders and the wide range of endoscopy procedures used in gastroenterology. Laparoscopy, which is used in surgery that is minimally invasive for abdominal and pelvic procedures, is also a substantial application in the endoscopy devices market, driven by rising demand for minimally invasive procedures and rising prevalence of diseases such as obesity and gastrointestinal cancers. Other endoscopy device applications include arthroscopy, bronchoscopy, and urology endoscopy (cystoscopy), each with its own set of endoscopy procedures and devices. Endoscopy in obstetrics and gynaecology is another important application, especially for diagnostic and therapeutic procedures in women's health.

Endoscopy Device Market End-Uses

- Hospitals

- Ambulatory Surgery Centers

- Other End-Uses

Hospitals have traditionally been the dominant end-use segment in the endoscopy device market due to the high volume of endoscopic procedures performed in hospital settings. Endoscopy procedures necessitate specialised equipment and skilled healthcare professionals, so hospitals are the most common setting for these procedures.

Ambulatory Surgery Centers (ASCs) are another important end-use segment for endoscopy devices. ASCs are outpatient surgical facilities that offer same-day surgical care, including endoscopic procedures. They have grown in popularity in recent years due to their convenience, cost-effectiveness, and lower risk of hospital-acquired infections.

Other end-users, such as diagnostic and imaging centres and specialty clinics, contribute to the endoscopy device market, especially in regions with a large outpatient care market. These facilities may specialise in specific types of endoscopy procedures, such as gastroenterology or urology, and these procedures may necessitate the use of specialised equipment.

Endoscopy Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Endoscopy Devices Market Regional Analysis

North America is the most important regional market for endoscopy devices, owing to factors such as the high prevalence of chronic diseases, the increasing adoption of minimally invasive procedures, and the existence of advanced healthcare infrastructure. Because of its large patient population and high healthcare expenditure, the United States is the region's largest market.

Europe is another important market for endoscopy devices, owing to factors such as an ageing population, an increase in demand for minimally invasive procedures, and the presence of well-established healthcare systems. The region's major markets are Germany, France, and the United Kingdom.

The Asia-Pacific region has the fastest-growing market for endoscopy devices, owing to factors such as an ageing population, an increase in chronic disease incidence, and improved healthcare infrastructure. China, Japan, and India are the region's major markets, with China being the largest due to its large population and rising healthcare expenditure.

Endoscopy Devices Market Players

Some of the top endoscopy devices companies offered in the professional report include CONMED, Cook, Olympus Corporation, Johnson and Johnson, Fujifilm Holding Corporation, Pentax Medical, Boston Scientific Corporation, Stryker Corporation, Smith & Nephew, KARL STORZ GmbH & Co. KG, Medtronic, and Richard Wolf GmbH.

Frequently Asked Questions

What was the market size of the global endoscopy devices in 2022?

The market size of endoscopy devices was USD 45.7 billion in 2022.

What is the CAGR of the global endoscopy devices market from 2023 to 2032?

The CAGR of endoscopy devices is 7.9% during the analysis period of 2023 to 2032.

Which are the key players in the endoscopy devices market?

The key players operating in the global market are including CONMED, Cook, Olympus Corporation, Johnson and Johnson, Fujifilm Holding Corporation, Pentax Medical, Boston Scientific Corporation, Stryker Corporation, Smith & Nephew, KARL STORZ GmbH & Co. KG, Medtronic, and Richard Wolf GmbH.

Which region dominated the global endoscopy devices market share?

North America held the dominating position in endoscopy devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of endoscopy devices during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global endoscopy devices industry?

The current trends and dynamics in the endoscopy devices industry include increasing demand for minimally invasive surgeries, growing prevalence of chronic diseases, and surging healthcare expenditure.

Which product held the maximum share in 2022?

The endoscopes product held the maximum share of the endoscopy devices industry.