Encapsulation Resin Market | Acumen Research and Consulting

Encapsulation Resin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

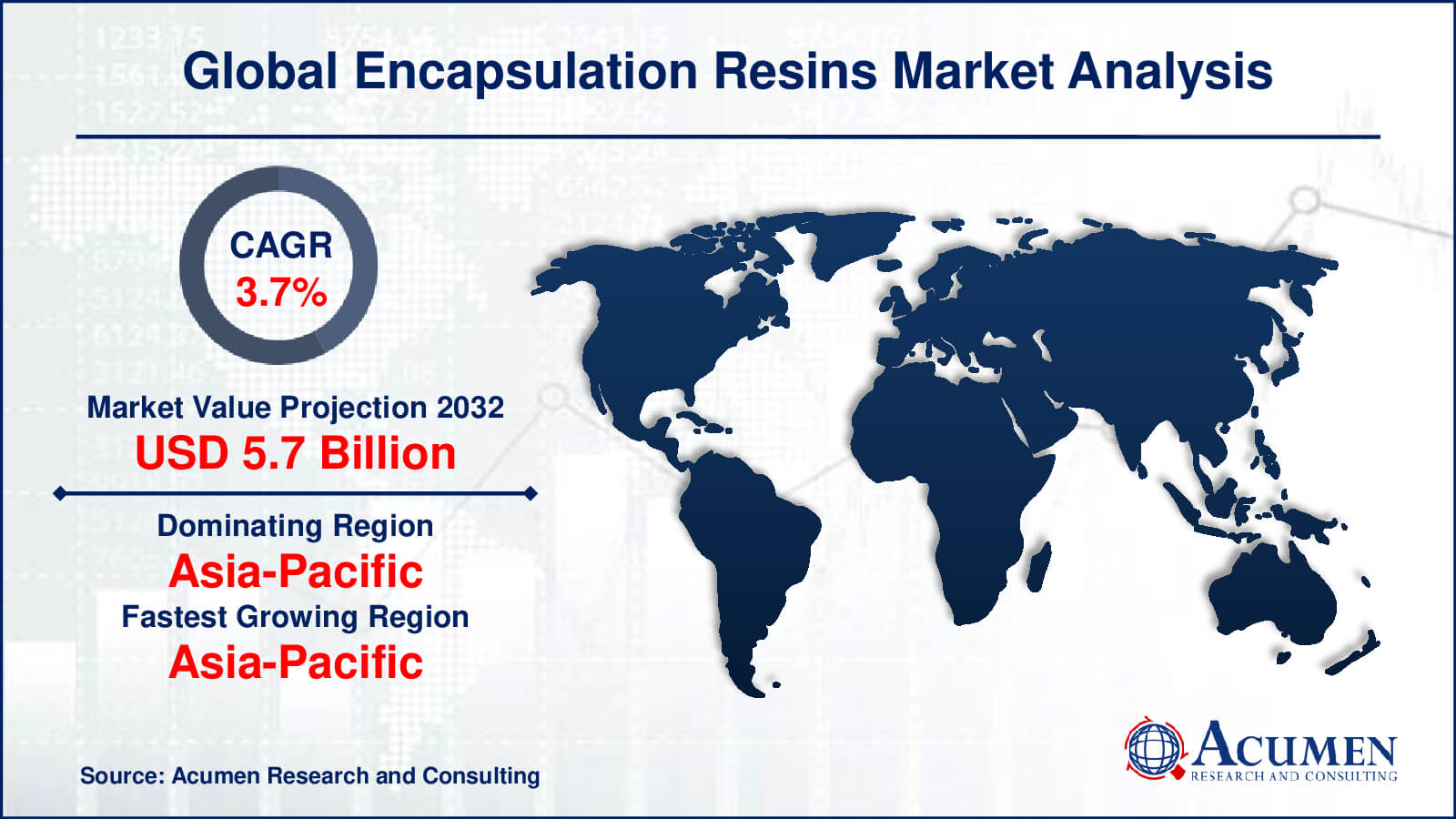

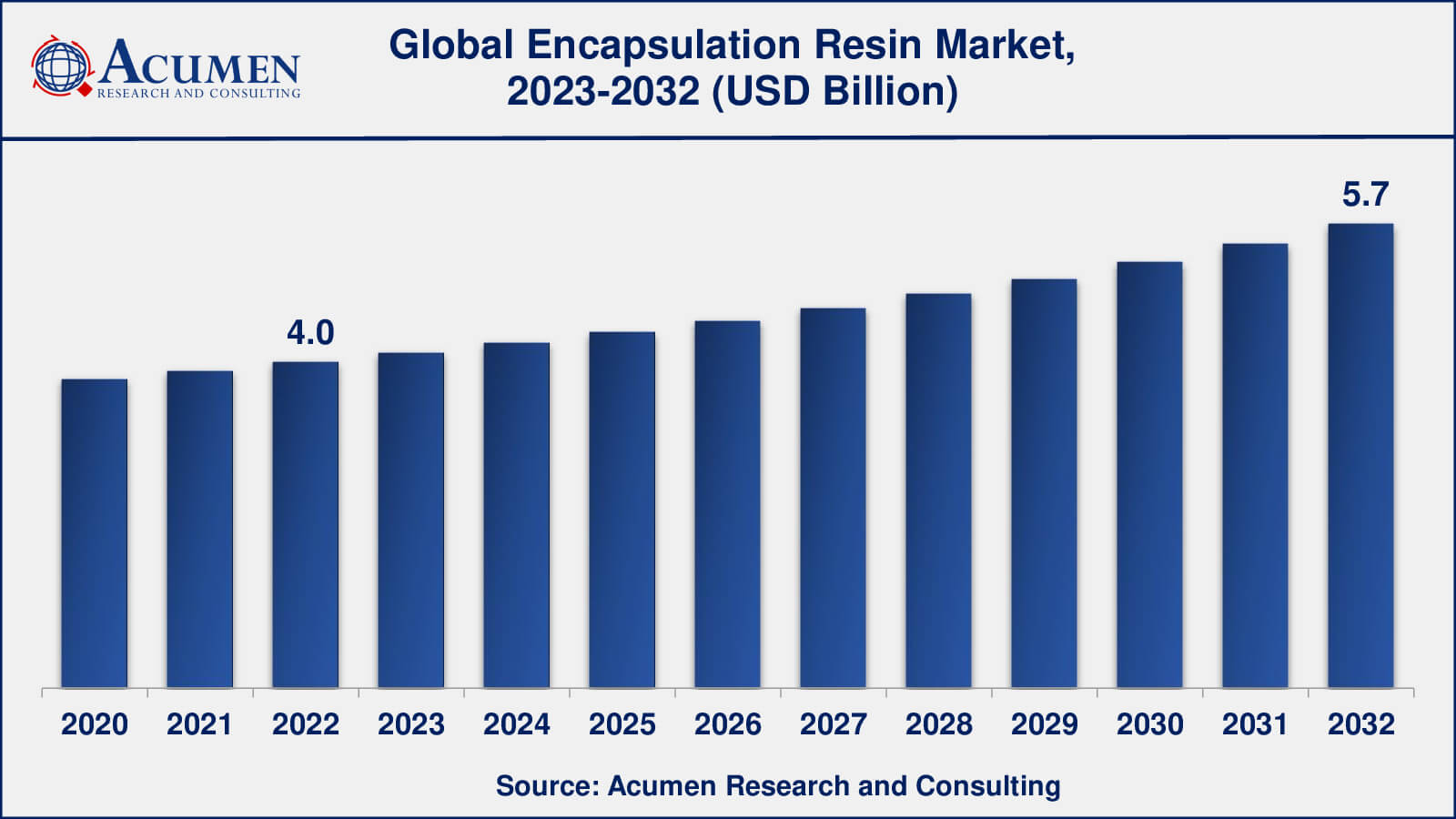

The Global Encapsulation Resin Market Size accounted for USD 4.0 Billion in 2022 and is estimated to achieve a market size of USD 5.7 Billion by 2032 growing at a CAGR of 3.7% from 2023 to 2032.

Encapsulation Resin Market Highlights

- Global encapsulation resin market revenue is poised to garner USD 5.7 billion by 2032 with a CAGR of 3.7% from 2023 to 2032

- Asia-Pacific encapsulation resin market value occupied almost USD 1.5 billion in 2022

- Asia-Pacific encapsulation resin market growth will record a CAGR of over 4% from 2023 to 2032

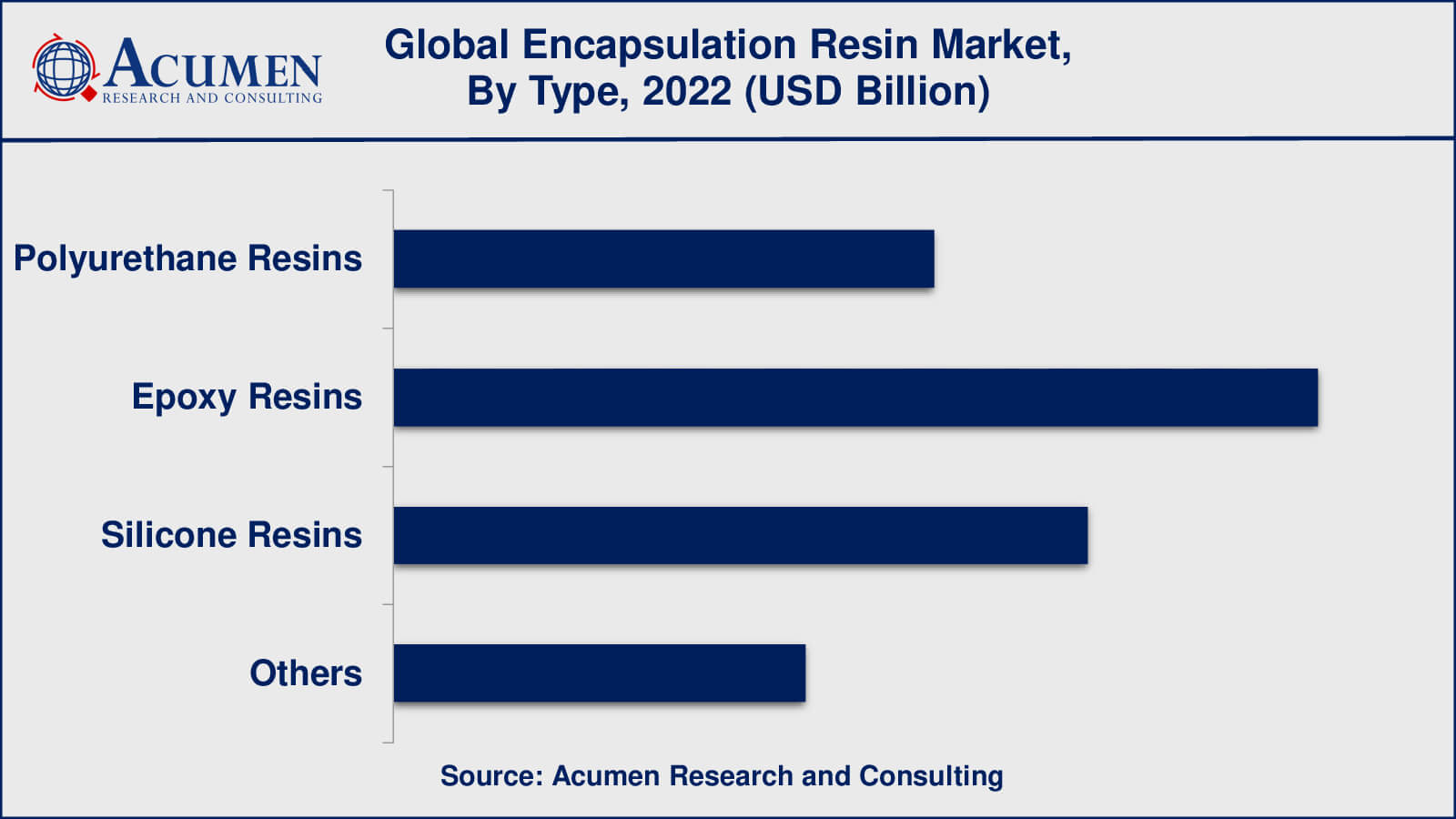

- Among type, the epoxy resins sub-segment generated over US$ 1.4 billion revenue in 2022

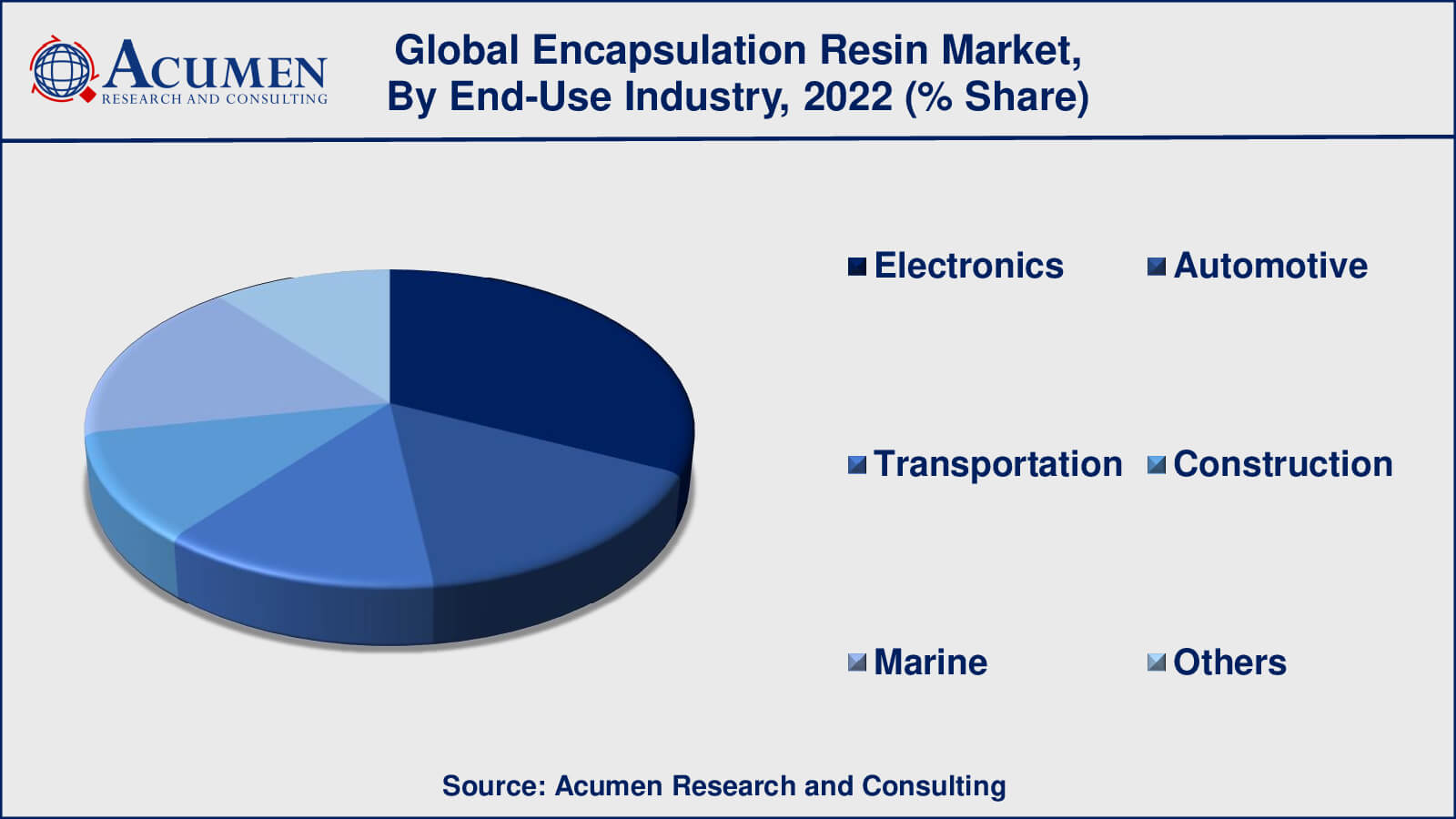

- Based on end-use industry, the electronics sub-segment generated around 32% share in 2022

- Rise of the internet of things (IoT) is a popular encapsulation resin market trend that fuels the industry demand

Encapsulation is the procedure of assembling an electronic device with a solid compound to protect it from corrosion, shock, moisture, and vibration. A variety of encapsulation resins such as polyurethane, epoxy, polyesters, silicone, and UV curing systems are used for the encapsulation procedure. Encapsulation resins are majorly used for various applications in the electronic and electrical industries. Encapsulation material for any device must be decided on its capability to work under heat and stress, and attain a low outgassing performance.

Global Encapsulation Resin Market Dynamics

Market Drivers

- Increasing demand from the electronics industry

- Growth in the automotive industry

- Rising demand for renewable energy

- Increasing demand for eco-friendly encapsulation resins

Market Restraints

- Volatility in raw material prices

- Limited product differentiation

- High production costs

Market Opportunities

- Growing demand for high-performance encapsulation resins

- Adoption of eco-friendly encapsulation resins

- Increasing use of automation and robotics in encapsulation processes

Encapsulation Resin Market Report Coverage

| Market | Encapsulation Resin Market |

| Encapsulation Resin Market Size 2022 | USD 4.0 Billion |

| Encapsulation Resin Market Forecast 2032 | USD 5.7 Billion |

| Encapsulation Resin Market CAGR During 2023 - 2032 | 3.7% |

| Encapsulation Resin Market Analysis Period | 2020 - 2032 |

| Encapsulation Resin Market Base Year | 2022 |

| Encapsulation Resin Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ELANTAS GmbH, Henkel AG & Co. KGaA, Master Bond Inc., Dymax Corporation, MG Chemicals, LORD Corp, Robnor Resins Ltd, Aremco Products Inc., Shanghai Sepna Chemical Technology Co., and RBC Industries, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Encapsulation Resin Market Insights

The global encapsulation resin market is driven by the growth in consumer electronics, industrial, and aerospace sectors. Moreover, the growing energy and power industry is also expected to boost the demand for encapsulation resins during the forecast period. Also, the thermal conductivity offered by encapsulation resins augments its demand. However, the special screening practice of encapsulation resins, which leads to additional cost is the major restraining factor for the market. Also, the matured electronic industry in developed economies of North America and Europe hampers the market growth for encapsulation resins. Nevertheless, the two-component polyurethane encapsulation resin is expected to provide major growth opportunities for manufacturers of encapsulation resins.

Encapsulation Resin Market, By Segmentation

The worldwide market for encapsulation resin is split based on type, application, end-use industry, and geography.

Encapsulation Resin Types

- Polyurethane Resins

- Epoxy Resins

- Silicone Resins

- Others

According to an analysis of the encapsulation resin market, polyurethane resins are widely used in the electronics and automotive industries because of their excellent adhesion, flexibility, and resistance to chemicals and temperature changes. These resins are commonly used for potting, encapsulation, and coating applications and can be formulated as one-part or two-part systems.

Epoxy resins are also commonly used in the electronics industry due to their excellent electrical insulation properties, high strength, and durability. They're frequently used to encapsulate and pot electronic components like printed circuit boards and power supplies.

Silicone resins are widely used in the aerospace and construction industries due to their excellent thermal stability, water resistance, and UV resistance. They are also used in the electronics industry for high temperature and humidity resistance applications.

In some applications, other types of encapsulation resins, such as polyester and phenolic resins, are also used. However, in comparison to polyurethane, epoxy, and silicone resins, their market share is relatively small.

Encapsulation Resin Applications

- Dip Coating

- Spray Coating

- Potting

- Casting

According to market forecasts for encapsulation resins, potting and encapsulation are the two most commonly used applications of encapsulation resins, accounting for a significant share of the market.

The method of completely encapsulating an electronic component, such as a printed circuit board, in a protective resin is known as potting. This process protects the electronic component from moisture, dust, and other environmental factors that can damage it. Potting resins are widely used in the electronics industry, especially in applications requiring high levels of protection and durability.

The process of partially encapsulating an electronic component in a protective resin is known as encapsulation. This process offers excellent environmental protection while allowing for simple inspection and maintenance of the electronic component. Encapsulation resins are also widely used in the electronics industry, particularly in applications requiring both protection and accessibility.

Encapsulation Resin End-Use Industries

- Automotive

- Electronics

- Aerospace

- Construction

- Others

As per the encapsulation resin market forecast, the electronics industry is the largest and most significant end-use industry for encapsulation resins, accounting for a significant share of the market. Encapsulation resins are widely used in the electronics industry to protect and insulate electronic components such as printed circuit boards, sensors, and other electronic devices. The growing use of electronics in a variety of applications, including automotive, medical, and industrial equipment, is expected to drive demand for encapsulation resins in the electronics industry.

Another important end-use industry for encapsulation resins is the automotive industry. Encapsulation resins are used in a variety of automotive applications, including the potting of sensors, control units, and LED lights. Encapsulation resins are expected to be in high demand in the automotive industry due to rising demand for electric and hybrid vehicles.

Encapsulation Resin Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Encapsulation Resin Market Regional Analysis

The Asia-Pacific encapsulation resin market is the largest and is expected to grow significantly during the forecast period. The increasing demand for electronics and automotive industries, particularly in China, Japan, and India, is driving growth in this region. Rising construction investment and the development of new infrastructure projects are also expected to drive demand for encapsulation resins in the region.

North America and Europe are relatively well developed for encapsulation resins, with steady growth expected during the forecast period. The increasing demand for electronics, automotive, and aerospace industries is driving growth in these regions. Environmental and safety regulations are expected to increase demand for environmentally friendly encapsulation resins in these regions.

Encapsulation Resin Market Players

Some of the top encapsulation resin companies offered in the professional report include ELANTAS GmbH, Henkel AG & Co. KGaA, Master Bond Inc., Dymax Corporation, MG Chemicals, LORD Corp, Robnor Resins Ltd, Aremco Products Inc., Shanghai Sepna Chemical Technology Co., and RBC Industries, Inc.

Frequently Asked Questions

What was the market size of the global encapsulation resin in 2022?

The market size of encapsulation resin was USD 4.0 billion in 2022.

What is the CAGR of the global encapsulation resin market from 2023 to 2032?

The CAGR of encapsulation resin is 3.7% during the analysis period of 2023 to 2032.

Which are the key players in the encapsulation resin market?

The key players operating in the global encapsulation resin market are includes ELANTAS GmbH, Henkel AG & Co. KGaA, Master Bond Inc., Dymax Corporation, MG Chemicals, LORD Corp, Robnor Resins Ltd, Aremco Products Inc., Shanghai Sepna Chemical Technology Co., and RBC Industries, Inc.

Which region dominated the global encapsulation resin market share?

Asia-Pacific held the dominating position in encapsulation resin industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of encapsulation resin during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global encapsulation resin industry?

The current trends and dynamics in the encapsulation resin industry include increasing demand from the electronics industry, growth in the automotive industry, and rising demand for renewable energy.

Which type held the maximum share in 2022?

The epoxy resins type held the maximum share of the encapsulation resin industry.