Emulsion Polymers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Emulsion Polymers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

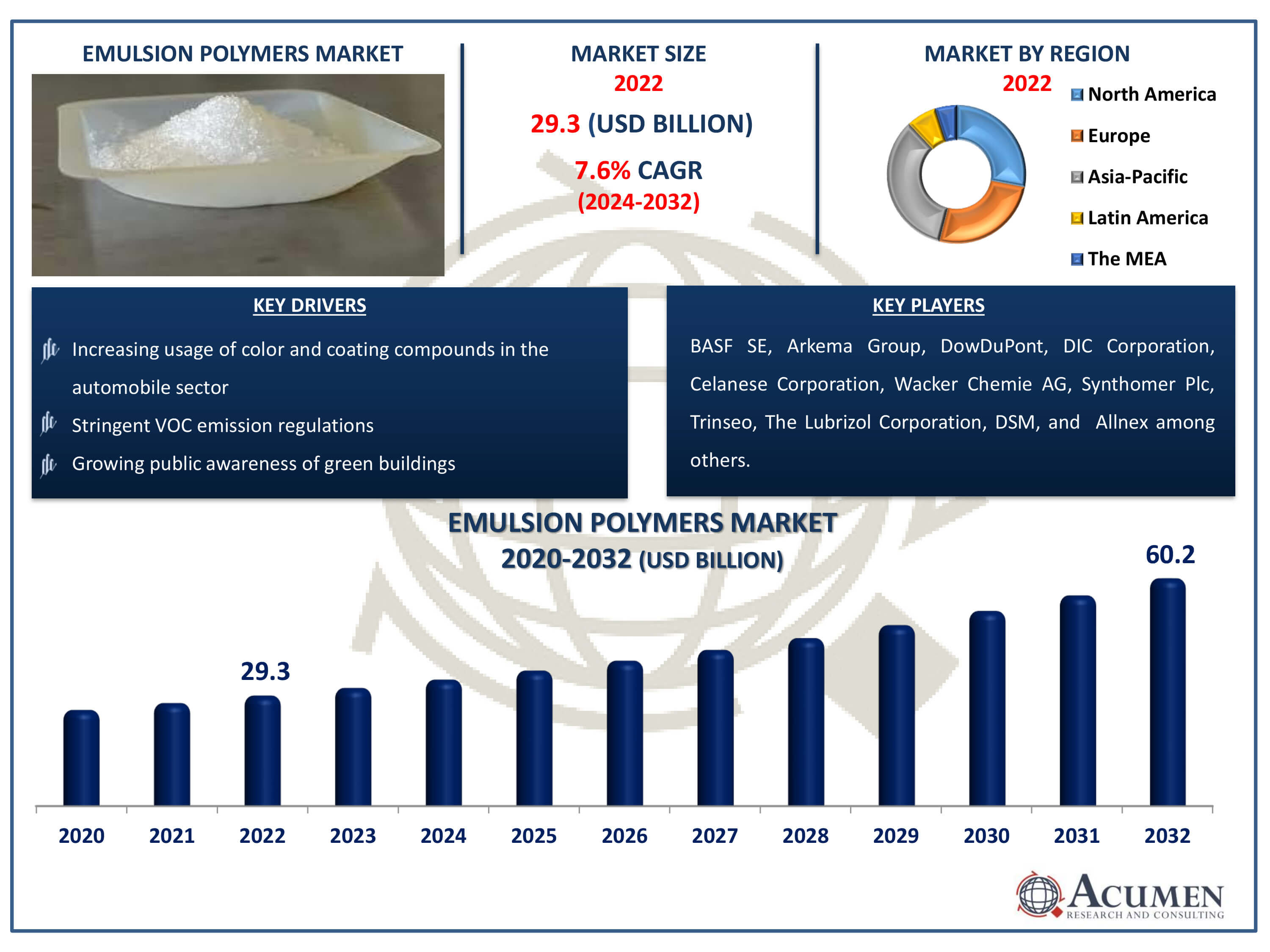

The Emulsion Polymers Market Size accounted for USD 29.3 Billion in 2022 and is estimated to achieve a market size of USD 60.2 Billion by 2032 growing at a CAGR of 7.6% from 2024 to 2032.

Emulsion Polymers Market Highlights

- Global emulsion polymers market revenue is poised to garner USD 60.2 billion by 2032 with a CAGR of 7.6% from 2024 to 2032

- Asia-Pacific emulsion polymers market value occupied around USD 9.9 billion in 2022

- North America emulsion polymers market growth will record a CAGR of more than 8% from 2024 to 2032

- Among type, the acrylics generator sub-segment generated more than USD 12.3 billion revenue in 2022

- Based on application, the paints & coatings sub-segment generated around 35% market share in 2022

- Growing applications in the construction sector for waterproofing and sealants is a popular emulsion polymers market trend that fuels the industry demand

Emulsion polymers are obtained through the combination of monomers, surfactants, and water. Oil and water-based are the most commonly used emulsion polymers. Emulsion polymers are majorly used for paints & coatings, and automotive applications as they exhibit low VOC. Regulations such as REACH and the clean air act are the major factors driving the emulsion polymer market. The growing use of the products in coatings, paints, and adhesives is likely to boost the emulsion polymers market growth. Furthermore, increasing the application of adhesives in the automobile coating sector is predicted to considerably contribute to the emulsion polymer market value in the coming years.

Global Emulsion Polymers Market Dynamics

Market Drivers

- Increasing usage of color and coating compounds in the automobile sector

- Stringent VOC emission regulations

- Growing public awareness of green buildings

- Strong application potential in the coatings and paint industries

Market Restraints

- Volatile raw material cost

- Certain emulsion polymers have a toxic nature

- Stringent environmental regulations on VOC emissions

Market Opportunities

- Growing interest in bio-based polymer emulsions

- Rising end-use industry demand from developing nations

- Rising adoption in the packaging industry for food and beverage products

Emulsion Polymers Market Report Coverage

| Market | Emulsion Polymers Market |

| Emulsion Polymers Market Size 2022 | USD 29.3 Billion |

| Emulsion Polymers Market Forecast 2032 |

USD 60.2 Billion |

| Emulsion Polymers Market CAGR During 2024 - 2032 | 7.6% |

| Emulsion Polymers Market Analysis Period | 2020 - 2032 |

| Emulsion Polymers Market Base Year |

2022 |

| Emulsion Polymers Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Arkema Group, DIC Corporation, DowDuPont, Celanese Corporation, Wacker Chemie AG, Synthomer Plc, Trinseo, The Lubrizol Corporation, DSM, Allnex, Pexichem Private Limited, Kamsons Chemicals Pvt. Ltd., Visen Industries Limited, and Omnova Solutions Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Emulsion Polymers Market Insights

The major driving factor for the emulsion polymers market is the upsurge in demand for emulsion polymers from the paints & coatings industry. Moreover, the stringent regulations by the government towards VOC emission also support the growth of the emulsion polymers market globally. In addition, the growing awareness regarding green buildings is also one of the driving factors for the emulsion polymer market. However, the volatility in the raw material cost is likely to restrict the growth of emulsion polymers during the forecast period. Also, the manufacturing of cost-effective emulsion polymers is one of the major challenges faced by manufacturers. Nevertheless, the increasing adoption of bio-based emulsion polymers globally offers huge growth opportunities for manufacturers during the emulsion polymers industry forecast period.

Increasing the application scope of vinyl acetate polymers in sealants should boost the market growth. Superior features such as binders, adhesion, as well as film forming, in addition to the widespread use of vinyl acetate in textiles, bookbinding, on-site building, and cardboard packaging, should drive the market size of emulsion polymers. The polymer emulsion total market is expected to be driven by an application perspective in the coatings and paints industry due to lower carbon dioxide and energy emissions during the manufacturing method. Paints and coatings are widely used in a variety of end-use industries, including automotive, maritime and aviation, construction, and manufacturing, which could have a favorable effect on market development.

Emulsion Polymers Market Segmentation

The worldwide market for emulsion polymers is split based on type, application end-use, and geography.

Emulsion Polymers Types

- Acrylics

- Vinyl Acetate Polymers

- SB Latex

- Others

According to the emulsion polymers industry analysis, the acrylics type segment captured a substantial market share in 2022. This expansion is due to increased product demand from the superabsorbent polymer & sealants and adhesives markets. Growth in building and construction activity in emerging regions is likely to raise demand even further. Due to their durability, advanced tech, and molecular purity, acrylics are commonly utilized in products for personal care and hydrogel polymers. Acrylics are also expected to maintain a dominant market share due to quick technical improvements and outstanding properties such as toughness, preservation, and alkali tolerance.

Emulsion Polymers Applications

- Paints & Coatings

- Adhesives & Sealants

- Paper & Paperboard

- Others

According to the emulsion polymers market forecast period, the paint & coating-based applications segment dominates the marketplace and is expected to grow significantly in the industry over the next few years. This expansion is due to increased investment in the sector of real estate. Growth in renovation operations of current facilities in European can boost industrial growth, aided by strong government rules relating to the uptake of bio-based products. Product demand is being driven by rising environmental factors as well as rapid technological improvements.

Emulsion Polymers End-uses

- Building & Construction

- Automotive

- Chemicals

- Textile & Coatings

- Others

The building & construction category is the largest end-use segment in the emulsion polymers market, accounting for a considerable portion of the revenue. This dominance might be traced to the widespread usage of emulsion polymers in many applications in the building and construction industries. Emulsion polymers are commonly used in architectural coatings, adhesives, sealants, and waterproofing compounds, among other applications, due to their flexibility, durability, and adhesive characteristics.

Emulsion polymers are important in the building and construction industry because they improve the performance and endurance of construction materials while also providing benefits such as increased weather resistance, flexibility, and adhesion. Furthermore, tight rules on environmental sustainability and VOC emissions have accelerated the use of emulsion polymers in eco-friendly construction materials and coatings. As urbanization continues to drive global construction activity, demand for emulsion polymers in the building and construction industry is likely to stay strong, cementing its position as the major end-use category in the emulsion polymer market.

Emulsion Polymers Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

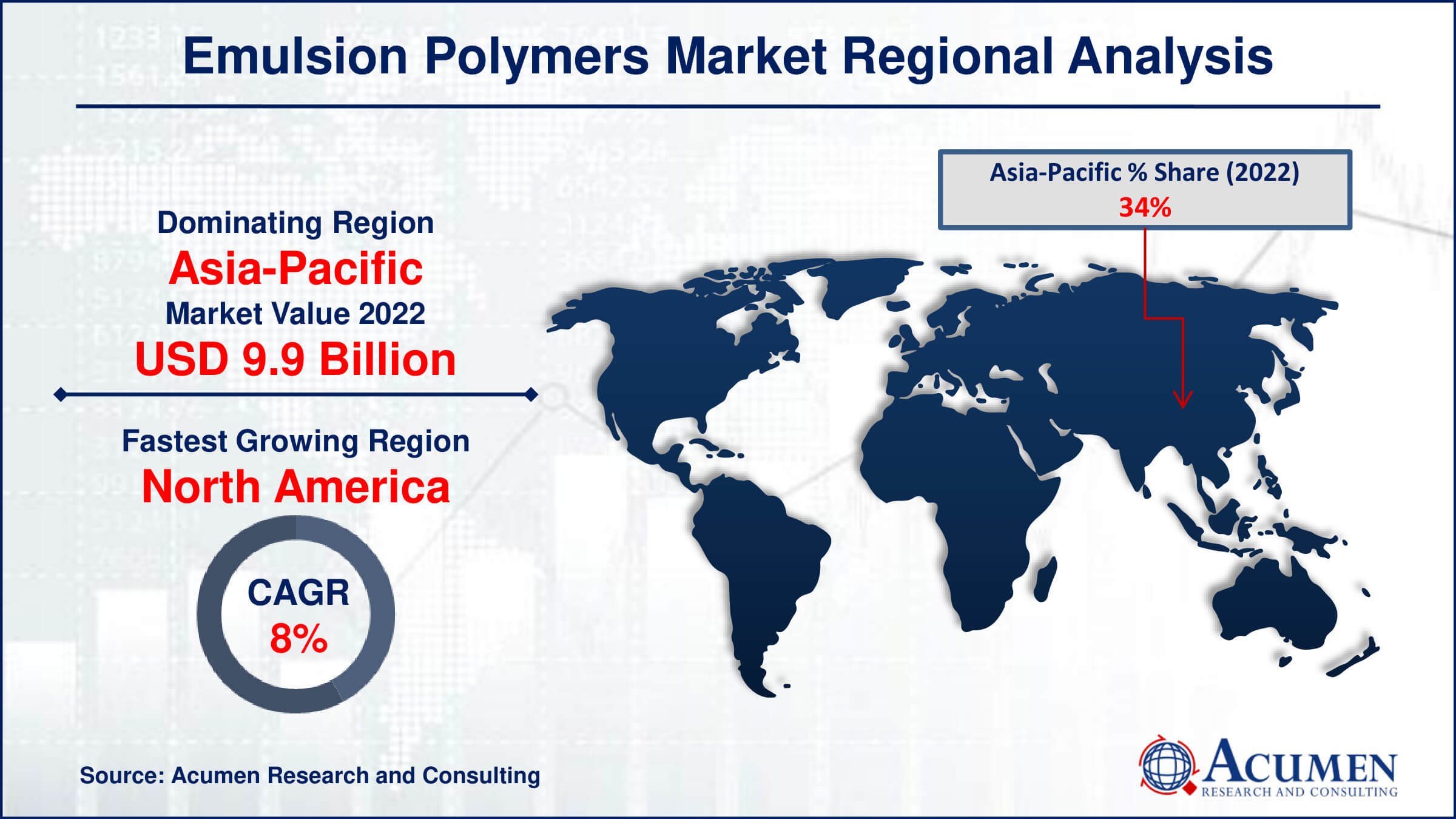

Emulsion Polymers Market Regional Analysis

In 2022, Asia-Pacific emerged as a key revenue driver for the worldwide emulsion polymer market, boosted by rising demand across a wide range of manufacturing industries. However, a notable trend arose in North America, which demonstrated quick growth within the emulsion polymer market environment. North America's dynamic industrial environment, along with a focus on sustainability and regulatory compliance, has accelerated the use of emulsion polymers in a variety of applications, including paints, coatings, and automotive components. The region's devotion to innovation and environmentally responsible solutions fueled the market for emulsion polymers.

Also, North America has a strong infrastructure, a highly qualified workforce, and a favorable investment climate, establishing it as a major participant in the global emulsion polymer market. As a result, North America appears as a rapidly rising region, providing attractive chances for emulsion polymer makers looking to expand and penetrate the market. This increase in North America matches the growth trajectory seen in Asia-Pacific, improving the global market environment and propelling future breakthroughs in emulsion polymer technology and application.

Emulsion Polymers Market Players

Some of the top emulsion polymers companies offered in our report includes BASF SE, Arkema Group, DIC Corporation, DowDuPont, Celanese Corporation, Wacker Chemie AG, Synthomer Plc, Trinseo, The Lubrizol Corporation, DSM, Allnex, Pexichem Private Limited, Kamsons Chemicals Pvt. Ltd., Visen Industries Limited, and Omnova Solutions Inc.

Frequently Asked Questions

How big is the emulsion polymers market?

The emulsion polymers market size was valued at USD 29.3 billion in 2022.

What is the CAGR of the global emulsion polymers market from 2024 to 2032?

The CAGR of emulsion polymers is 7.6% during the analysis period of 2024 to 2032.

Which are the key players in the emulsion polymers market?

The key players operating in the global market are including BASF SE, Arkema Group, DIC Corporation, DowDuPont, Celanese Corporation, Wacker Chemie AG, Synthomer Plc, Trinseo, The Lubrizol Corporation, DSM, Allnex, Pexichem Private Limited, Kamsons Chemicals Pvt. Ltd., Visen Industries Limited, and Omnova Solutions Inc.

Which region dominated the global emulsion polymers market share?

Asia-Pacific held the dominating position in emulsion polymers industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of emulsion polymers during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global emulsion polymers industry?

The current trends and dynamics in the emulsion polymers industry include increasing usage of color and coating compounds in the automobile sector, stringent VOC emission regulations, growing public awareness of green buildings, and strong application potential in the coatings and paint industries.

Which application held the maximum share in 2022?

The paints & coatings application held the maximum share of the emulsion polymers industry.