Emission Control Catalyst Market | Acumen Research and Consulting

Emission Control Catalyst Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

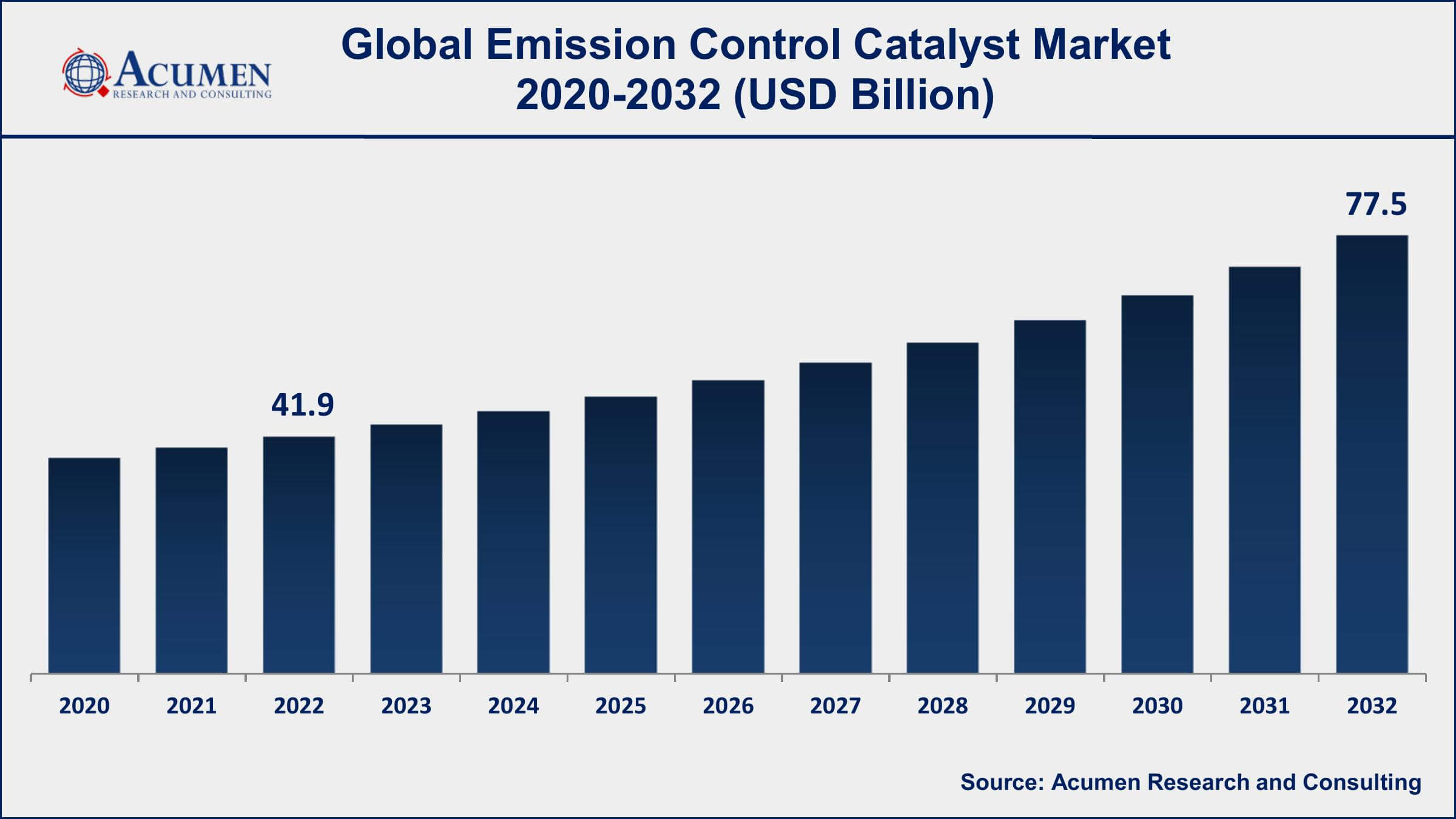

The Global Emission Control Catalyst Market Size accounted for USD 41.9 Billion in 2022 and is projected to achieve a market size of USD 77.5 Billion by 2032 growing at a CAGR of 6.5% from 2023 to 2032.

Emission Control Catalyst Market Highlights

- Global emission control catalyst market revenue is expected to increase by USD 77.5 Billion by 2032, with a 6.5% CAGR from 2023 to 2032

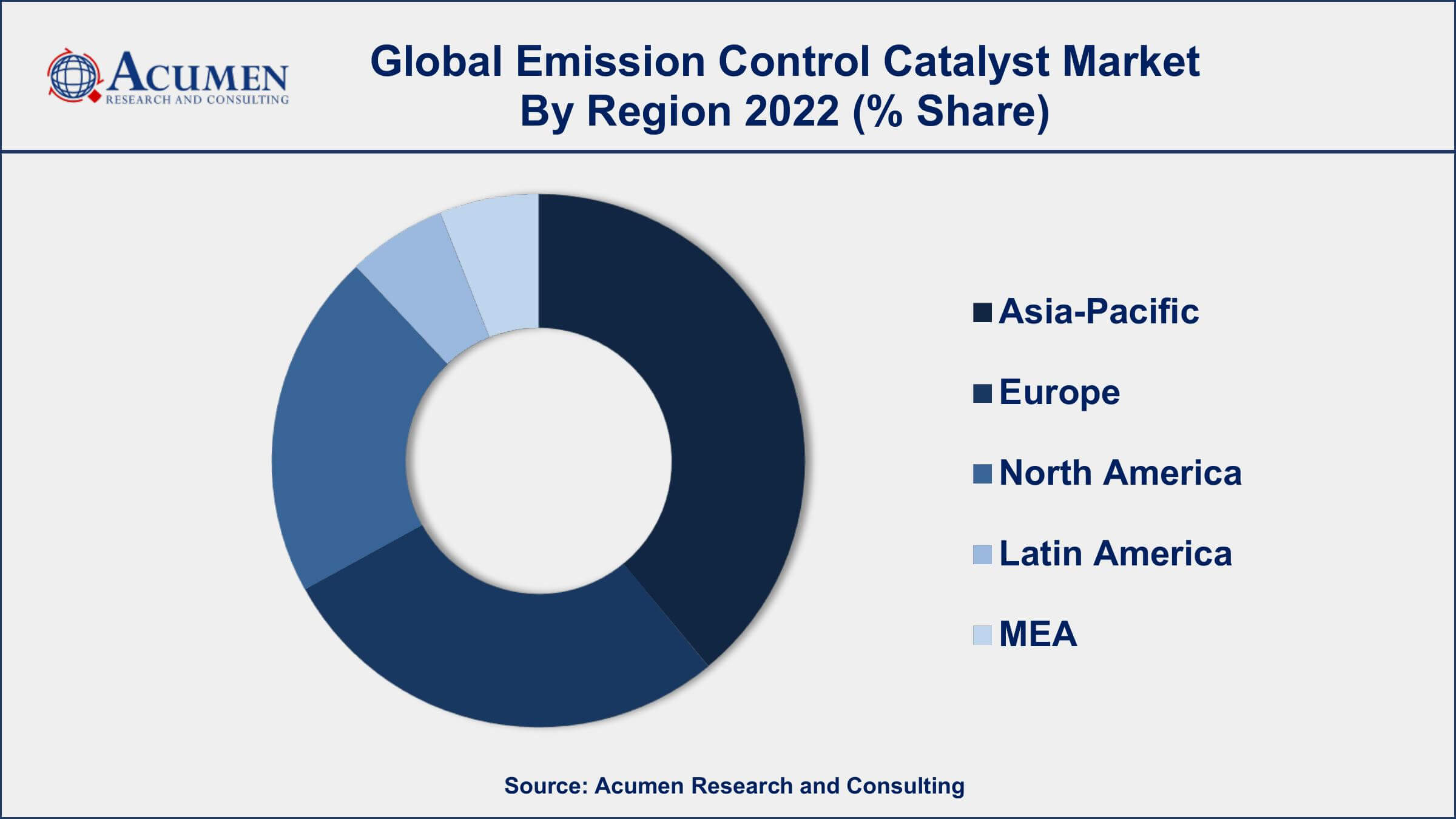

- Asia-Pacific region led with more than 36% of emission control catalyst market share in 2022

- According to the U.S. Environmental Protection Agency (EPA), catalytic converters reduce harmful emissions from cars by up to 90%

- The automotive segment is the largest application segment of the market, accounting for over 53% of the market share in 2022

- Platinum is the most commonly used material in emission control catalysts, accounting for over 41% of the global market share in 2022

- Rising demand for automobiles and light-duty vehicles, drives the emission control catalyst market value

An emission control catalyst is a device that reduces the level of harmful emissions that come out of the exhaust of vehicles and industrial processes. It is made up of a catalytic converter that converts harmful gases, such as carbon monoxide, nitrogen oxides, and hydrocarbons, into less harmful substances, such as water vapor, carbon dioxide, and nitrogen. The emission control catalyst plays a crucial role in reducing air pollution and improving overall air quality.

The market for emission control catalysts has been growing steadily in recent years. The increasing awareness of the harmful effects of air pollution on human health and the environment has led to a rise in demand for emission control catalysts. Additionally, government regulations in many countries mandating the use of emission control devices have also contributed to the growth of the market. The automotive industry is the primary driver of the demand for emission control catalysts, with increasing sales of cars and light-duty vehicles across the world. The market is also expanding in the industrial sector, where emission control catalysts are used in power plants and other industrial processes.

Global Emission Control Catalyst Market Trends

Market Drivers

- Increasing government regulations mandating the use of emission control devices

- Growing awareness of the harmful effects of air pollution on human health and the environment

- Rising demand for automobiles and light-duty vehicles

- Expansion of the industrial sector and increasing demand for emission control catalysts in power plants and other industries

Market Restraints

- High cost of emission control catalysts

- Limited availability of raw materials required to produce catalysts

Market Opportunities

- Growing demand for electric and hybrid vehicles

- Increasing focus on reducing emissions from heavy-duty vehicles and industrial processes

Emission Control Catalyst Market Report Coverage

| Market | Emission Control Catalyst Market |

| Emission Control Catalyst Market Size 2022 | USD 41.9 Billion |

| Emission Control Catalyst Market Forecast 2032 | USD 77.5 Billion |

| Emission Control Catalyst Market CAGR During 2023 - 2032 | 6.5% |

| Emission Control Catalyst Market Analysis Period | 2020 - 2032 |

| Emission Control Catalyst Market Base Year | 2022 |

| Emission Control Catalyst Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Metal, By Application, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Johnson Matthey PLC, Umicore SA, Clariant AG, Solvay SA, Corning Inc., CDTi Advanced Materials Inc., Heraeus Holding GmbH, Tenneco Inc., and Cataler Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

An emission control catalyst is a device that is used to reduce the level of harmful pollutants emitted from vehicles and industrial processes. It is typically made up of a catalytic converter that contains precious metals, such as platinum, palladium, and rhodium, which help to break down and convert the harmful gases produced by combustion into less harmful substances.

One of the most common applications of emission control catalysts is in the automotive industry, where they are used in the exhaust systems of cars, trucks, and other vehicles. In this application, the catalysts help to convert harmful gases such as carbon monoxide, nitrogen oxides, and hydrocarbons into less harmful substances, such as water vapor, carbon dioxide, and nitrogen. Emission control catalysts are also used in the industrial sector, where they are used in power plants, chemical plants, and other industrial processes to reduce emissions of harmful pollutants.

The emission control catalyst market has been experiencing significant growth in recent years due to increasing awareness about the harmful effects of air pollution on human health and the environment. The market is primarily driven by the automotive industry, where emission control catalysts are used in catalytic converters to reduce emissions from vehicles. The increasing demand for automobiles and light-duty vehicles across the world has been a major contributor to the growth of the market. Additionally, the expansion of the industrial sector and increasing demand for emission control catalysts in power plants and other industrial processes has further boosted the emission control catalyst market growth.

Emission Control Catalyst Market Segmentation

The global emission control catalyst market segmentation is based on metal, application, end use industry, and geography.

Emission Control Catalyst Market By Metal

- Platinum

- Rhodium

- Palladium

- Other Metals

According to the emission control catalyst industry analysis, the platinum segment accounted for the largest market share in 2022. Platinum is one of the key components of emission control catalysts, and its demand has been growing steadily in recent years. Platinum-based catalysts are widely used in the automotive industry, where they are used in catalytic converters to reduce emissions from vehicles. Platinum is preferred over other metals due to its high activity and stability at high temperatures, making it an ideal catalyst for converting harmful emissions into less harmful substances. The platinum segment has been experiencing significant growth due to the increasing demand for automobiles and light-duty vehicles across the world. The automotive industry is the primary driver of the demand for platinum-based catalysts, and the growth of the industry is expected to continue fueling the demand for platinum in the coming years.

Emission Control Catalyst Market By Application

- Stationary Emission

- Mobile Emission

In terms of applications, the stationary emission segment is expected to witness significant growth in the coming years. The stationary emission segment includes applications in power plants, industrial boilers, and other stationary sources of emissions. This segment has been experiencing significant growth in recent years due to increasing awareness of the harmful effects of air pollution and the implementation of strict emission regulations by governments worldwide. The demand for stationary emission control catalysts is driven by the need to reduce emissions of nitrogen oxides, carbon monoxide, and other pollutants from stationary sources. The growth of the stationary emission segment is expected to continue in the coming years due to the increasing demand for energy and the expansion of the industrial sector.

Emission Control Catalyst Market By End Use Industry

- Automotive

- Industrial

- Others

According to the emission control catalyst market forecast, the industrial segment is expected to witness significant growth in the coming years. The industrial segment includes applications in chemical manufacturing, oil and gas, and other industrial processes. The growth of this segment is driven by the increasing awareness of the harmful effects of air pollution on human health and the environment and the implementation of strict emission regulations by governments worldwide. The demand for emission control catalysts in the industrial segment is driven by the need to reduce emissions of pollutants such as nitrogen oxides, sulfur oxides, and volatile organic compounds from industrial processes. The growth of the industrial segment is expected to continue in the coming years due to the expansion of the industrial sector and the increasing demand for cleaner and more sustainable industrial processes.

Emission Control Catalyst Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Emission Control Catalyst Market Regional Analysis

The Asia-Pacific region dominates the emission control catalyst market due to the high demand for emission control technologies in the region. The region's rapid industrialization and urbanization have led to an increase in emissions from various sources such as power plants, transportation, and industrial processes. This has led to a rise in air pollution levels and an increased focus on reducing emissions to improve air quality and reduce environmental impact. As a result, governments in the region have implemented strict emission regulations and encouraged the adoption of emission control technologies, driving the demand for emission control catalysts. Moreover, the region's large population and increasing demand for automobiles have also contributed to the growth of the emission control catalyst market. With rising incomes and urbanization, there has been a significant increase in the number of vehicles on the roads, leading to an increase in emissions. To address this issue, governments in the region have mandated the use of catalytic converters in vehicles and encouraged the adoption of cleaner fuels, driving the demand for emission control catalysts.

Emission Control Catalyst Market Player

Some of the top emission control catalyst market companies offered in the professional report include BASF SE, Johnson Matthey PLC, Umicore SA, Clariant AG, Solvay SA, Corning Inc., CDTi Advanced Materials Inc., Heraeus Holding GmbH, Tenneco Inc., and Cataler Corporation.

Frequently Asked Questions

What was the market size of the global emission control catalyst in 2022?

The market size of emission control catalyst was USD 41.9 Billion in 2022.

What is the CAGR of the global emission control catalyst market from 2023 to 2032?

The CAGR of emission control catalyst is 6.5% during the analysis period of 2023 to 2032.

Which are the key players in the emission control catalyst market?

The key players operating in the global market are including BASF SE, Johnson Matthey PLC, Umicore SA, Clariant AG, Solvay SA, Corning Inc., CDTi Advanced Materials Inc., Heraeus Holding GmbH, Tenneco Inc., and Cataler Corporation.

Which region dominated the global emission control catalyst market share?

Asia-Pacific held the dominating position in emission control catalyst industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of emission control catalyst during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global emission control catalyst industry?

The current trends and dynamics in the emission control catalyst industry include increasing government regulations mandating the use of emission control devices, and growing awareness of the harmful effects of air pollution on human health and the environment.

Which application held the maximum share in 2022?

The mobile emission application held the maximum share of the emission control catalyst industry.