Electrophysiology Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Electrophysiology Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

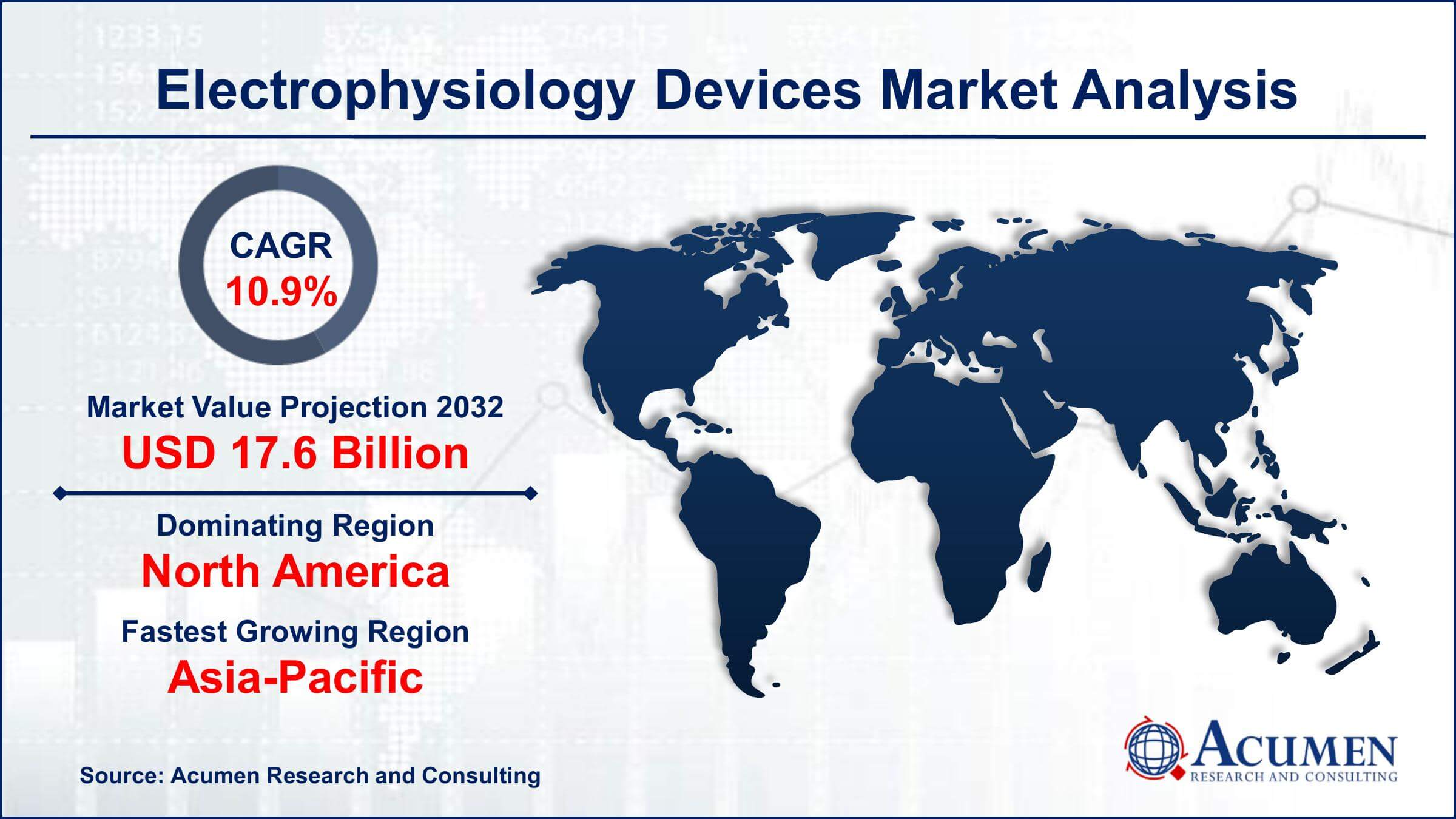

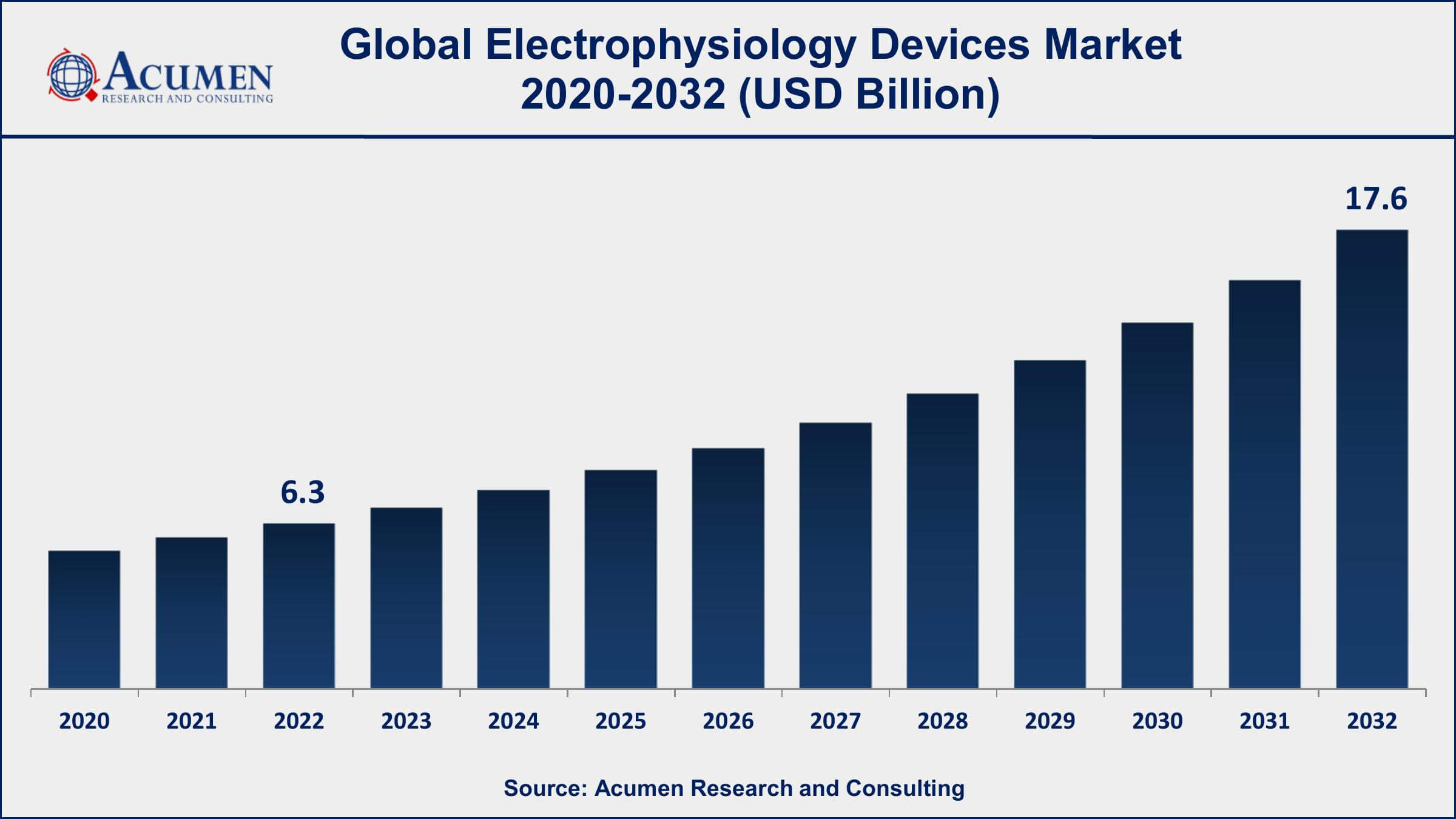

The Global Electrophysiology Devices Market Size accounted for USD 6.3 Billion in 2022 and is projected to achieve a market size of USD 17.6 Billion by 2032 growing at a CAGR of 10.9% from 2023 to 2032.

Electrophysiology Devices Market Highlights

- Global electrophysiology devices market revenue is expected to increase by USD 17.6 Billion by 2032, with a 10.9% CAGR from 2023 to 2032

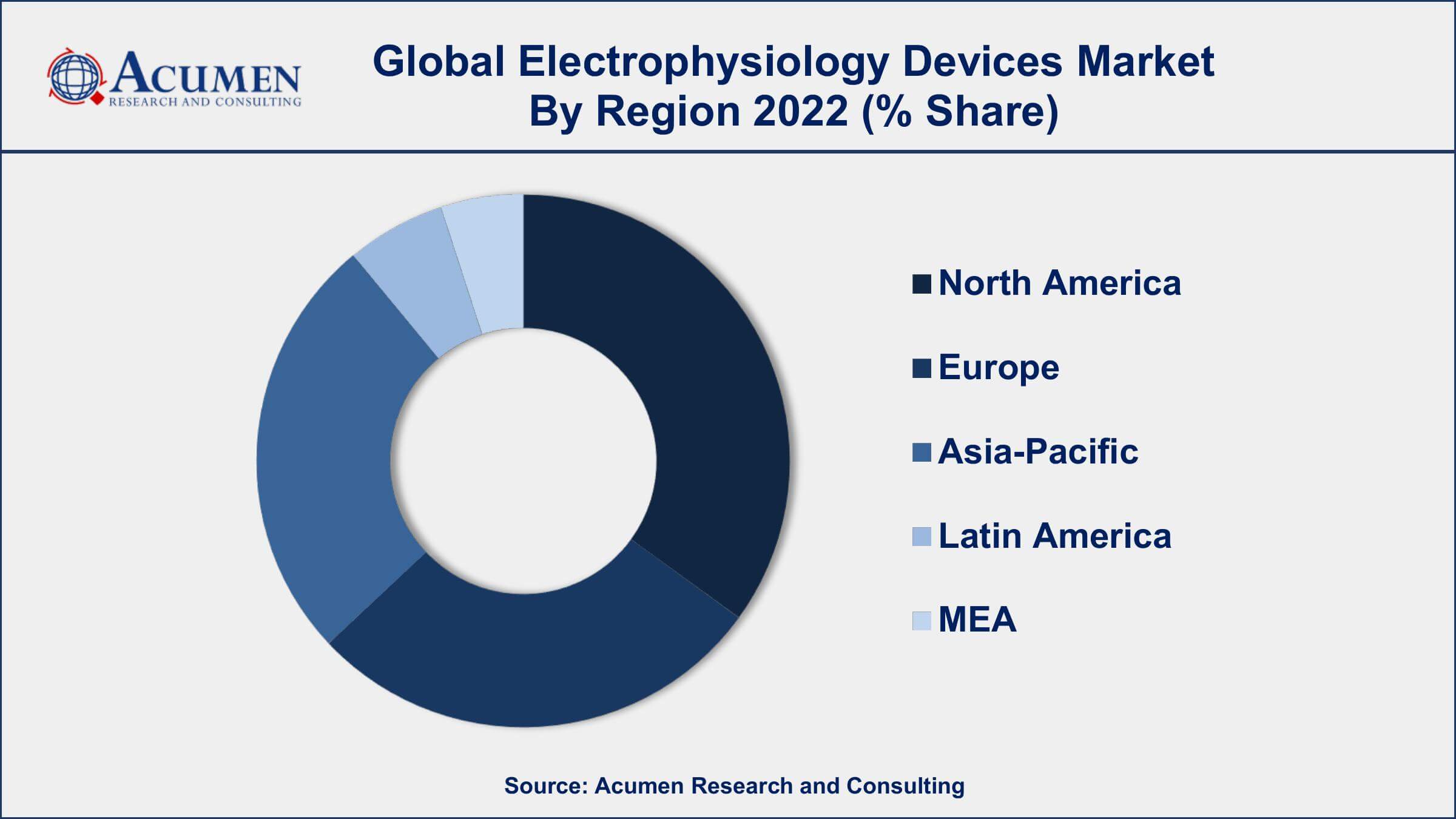

- North America region led with more than 38% of electrophysiology devices market share in 2022

- Asia-Pacific electrophysiology devices market growth will record a CAGR of around 12% from 2023 to 2032

- By indication, the atrial fibrillation segment has recorded more than 32% of the revenue share in 2022

- By End-use, the hospitals segment has accounted more than 54% of the revenue share in 2022

- Increasing prevalence of cardiovascular diseases and associated risk factors, drives the electrophysiology devices market value

Electrophysiology devices refer to a range of medical instruments used to study and record the electrical activity of the body's organs, particularly the heart and the brain. These devices are crucial for diagnosing and treating various cardiac and neurological conditions. They typically include catheters, electrodes, amplifiers, mapping systems, and imaging devices that allow healthcare professionals to visualize and analyze electrical signals in real time.

In recent years, the market for electrophysiology devices has experienced significant growth. Factors contributing to this growth include the increasing prevalence of cardiovascular diseases, technological advancements in device design and functionality, and a growing aging population worldwide. Additionally, the rising awareness about early disease detection and the increasing demand for minimally invasive procedures have also fueled the demand for electrophysiology devices. Technological advancements, such as the development of advanced mapping and navigation systems, improved imaging techniques, and robotic-assisted procedures, are anticipated to drive further adoption of these devices. Moreover, the growing focus on personalized medicine and the integration of artificial intelligence and machine learning in electrophysiology devices are likely to enhance their diagnostic and therapeutic capabilities, thereby boosting market growth.

Global Electrophysiology Devices Market Trends

Market Drivers

- Increasing prevalence of cardiovascular diseases and associated risk factors

- Growing aging population and the subsequent rise in age-related cardiac conditions

- Rising demand for minimally invasive procedures and shorter recovery times

- Growing awareness about early detection and diagnosis of cardiac abnormalities

Market Restraints

- High cost of electrophysiology devices and procedures, limiting accessibility in some regions

- Lack of skilled healthcare professionals trained in electrophysiology procedures

Market Opportunities

- Growing adoption of robotic-assisted electrophysiology procedures for improved precision and efficiency

- Expansion of applications beyond cardiology, such as neurology and neurophysiology, expanding the market scope

Electrophysiology Devices Market Report Coverage

| Market | Electrophysiology Devices Market |

| Electrophysiology Devices Market Size 2022 | USD 6.3 Billion |

| Electrophysiology Devices Market Forecast 2032 | USD 17.6 Billion |

| Electrophysiology Devices Market CAGR During 2023 - 2032 | 10.9% |

| Electrophysiology Devices Market Analysis Period | 2020 - 2032 |

| Electrophysiology Devices Market Base Year | 2022 |

| Electrophysiology Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, By Indication, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, Biosense Webster, Inc., St. Jude Medical, Inc., Biotronik SE & Co. KG, MicroPort Scientific Corporation, CardioFocus, Inc., Japan Lifeline Co., Ltd., Lepu Medical Technology Co., Ltd., Stereotaxis, Inc., and BIOTRONIK SE & Co. KG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Electrophysiology devices are medical instruments used to study and measure the electrical activity of the body, primarily focusing on the heart's electrical system. These devices play a crucial role in diagnosing and treating various cardiac conditions, such as arrhythmias, atrial fibrillation, and other heart rhythm disorders. They are designed to capture and record electrical signals generated by the heart, providing valuable insights into its functioning and identifying abnormalities. The applications of electrophysiology devices extend beyond diagnostics. They are also used in therapeutic interventions, such as cardiac ablation procedures. During an ablation, these devices are utilized to deliver controlled energy to specific areas of the heart, destroying or modifying abnormal tissue that causes irregular heart rhythms. By precisely targeting and treating the problem areas, electrophysiology devices help restore normal heart rhythm and improve overall cardiac function.

The electrophysiology devices market has witnessed robust growth in recent years and is expected to continue expanding. Factors contributing to the market's growth include the increasing prevalence of cardiovascular diseases, advancements in technology, and a growing aging population. Cardiovascular diseases, such as arrhythmias and heart rhythm disorders, are on the rise globally, creating a greater demand for electrophysiology devices. Technological advancements in device design and functionality have led to improved diagnostic accuracy, enhanced treatment options, and reduced invasiveness of procedures, driving market growth. Additionally, the aging population is more susceptible to cardiac conditions, resulting in a higher demand for electrophysiology devices. Furthermore, the market is expected to be driven by the growing adoption of minimally invasive procedures and the integration of artificial intelligence (AI) and machine learning (ML) in electrophysiology devices.

Electrophysiology Devices Market Segmentation

The global electrophysiology devices market segmentation is based on application, indication, end-use, and geography.

Electrophysiology Devices Market By Application

- Treatment Devices

- Automated External defibrillators (AEDs)

- Implantable Cardioverter Defibrillators (ICDs)

- Catheters

- Pacemakers

- CRT-D

- CRT-P

- Others

- Diagnostic Devices

- Diagnostic Electrophysiology Catheters

- Holter Monitoring Devices

- Electrocardiograph (ECG)

- Insertable Cardiac Monitors (ICM)

- EP Mapping & Imaging Systems

- Others

According to the electrophysiology devices industry analysis, the diagnostic devices segment accounted for the largest market share in 2022. Diagnostic devices play a crucial role in the detection, monitoring, and diagnosis of cardiac conditions and abnormalities. These devices provide valuable insights into the electrical activity of the heart and aid healthcare professionals in making accurate diagnoses and treatment decisions. One of the key drivers of growth in the diagnostic devices segment is the increasing prevalence of cardiovascular diseases. As the incidence of cardiac conditions rises globally, there is a growing need for effective diagnostic tools to identify and assess these conditions. Diagnostic devices, such as electrocardiography (ECG) machines and cardiac event monitors, enable healthcare providers to record and analyze the electrical signals of the heart, helping in the early detection and diagnosis of arrhythmias, atrial fibrillation, and other cardiac abnormalities.

Electrophysiology Devices Market By Indication

- Atrial Fibrillation (AF)

- Atrioventricular Nodal Re-entry Tachycardia (AVNRT)

- Supraventricular Tachycardia

- Bradycardia

- Wolff-Parkinson-White Syndrome (WPW)

- Other

In terms of indication, the atrial fibrillation segment is expected to witness significant growth in the coming years. Atrial fibrillation (AF) is the most common type of cardiac arrhythmia, characterized by irregular and rapid heartbeats. The rising prevalence of AF, coupled with increasing awareness and improved diagnostic capabilities, has fueled the demand for electrophysiology devices specifically designed for the diagnosis and treatment of this condition. One of the key drivers of growth in the atrial fibrillation segment is the aging population. AF is more prevalent in older individuals, and as the global population continues to age, there is an increased likelihood of AF cases. This demographic shift has created a greater demand for electrophysiology devices that can effectively diagnose and treat atrial fibrillation. Technological advancements in the field of electrophysiology have also played a significant role in the growth of the atrial fibrillation segment.

Electrophysiology Devices Market By End-Use

- Ambulatory Surgical Centers

- Hospitals

- Others

According to the electrophysiology devices market forecast, the hospitals segment is expected to witness significant growth in the coming years. Hospitals are the primary settings for performing electrophysiology procedures, including diagnostic tests and therapeutic interventions. As the prevalence of cardiovascular diseases and the demand for electrophysiology services increase, hospitals play a pivotal role in driving the growth of this segment. One of the key factors driving the growth of the hospitals segment is the increasing adoption of advanced electrophysiology devices and technologies. Hospitals have been investing in state-of-the-art equipment and infrastructure to provide advanced diagnostic and treatment options to patients with cardiac conditions. This includes the installation of specialized electrophysiology labs and the procurement of high-quality mapping systems, ablation catheters, and recording devices. The availability of these advanced devices and technologies in hospitals enables healthcare professionals to deliver optimal care to patients and contributes to the growth of the segment.

Electrophysiology Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Electrophysiology Devices Market Regional Analysis

North America dominates the electrophysiology devices market due to several factors, including the high prevalence of cardiovascular diseases, favourable reimbursement policies, and the presence of established healthcare infrastructure and advanced technologies. The region has a high incidence of cardiac conditions, including atrial fibrillation, arrhythmias, and heart failure, which has led to an increasing demand for electrophysiology devices and services. Furthermore, the region has a well-established healthcare infrastructure with a large number of hospitals and specialized healthcare centers equipped with advanced electrophysiology labs and technologies. These facilities have dedicated electrophysiology teams that are highly trained and experienced in performing complex procedures, including catheter ablation, implantable cardiac devices, and electrophysiology studies. This has contributed to the high adoption of electrophysiology devices in North America and the growth of the market. In addition, favorable reimbursement policies for electrophysiology procedures have also played a significant role in the dominance of North America in the market.

Electrophysiology Devices Market Player

Some of the top electrophysiology devices market companies offered in the professional report include Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, Biosense Webster, Inc., St. Jude Medical, Inc., Biotronik SE & Co. KG, MicroPort Scientific Corporation, CardioFocus, Inc., Japan Lifeline Co., Ltd., Lepu Medical Technology Co., Ltd., Stereotaxis, Inc., and BIOTRONIK SE & Co. KG.

Frequently Asked Questions

What was the market size of the global electrophysiology devices in 2022?

The market size of electrophysiology devices was USD 6.3 Billion in 2022.

What is the CAGR of the global electrophysiology devices market from 2023 to 2032?

The CAGR of electrophysiology devices is 10.9% during the analysis period of 2023 to 2032.

Which are the key players in the electrophysiology devices market?

The key players operating in the global market are including Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, Biosense Webster, Inc., St. Jude Medical, Inc., Biotronik SE & Co. KG, MicroPort Scientific Corporation, CardioFocus, Inc., Japan Lifeline Co., Ltd., Lepu Medical Technology Co., Ltd., Stereotaxis, Inc., and BIOTRONIK SE & Co. KG.

Which region dominated the global electrophysiology devices market share?

North America held the dominating position in electrophysiology devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of electrophysiology devices during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global electrophysiology devices industry?

The current trends and dynamics in the electrophysiology devices industry include increasing prevalence of cardiovascular diseases and associated risk factors, and growing aging population and the subsequent rise in age-related cardiac conditions.

Which end-use held the maximum share in 2022?

The hospitals end-use held the maximum share of the electrophysiology devices industry.