Electrophoresis Reagents Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Electrophoresis Reagents Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

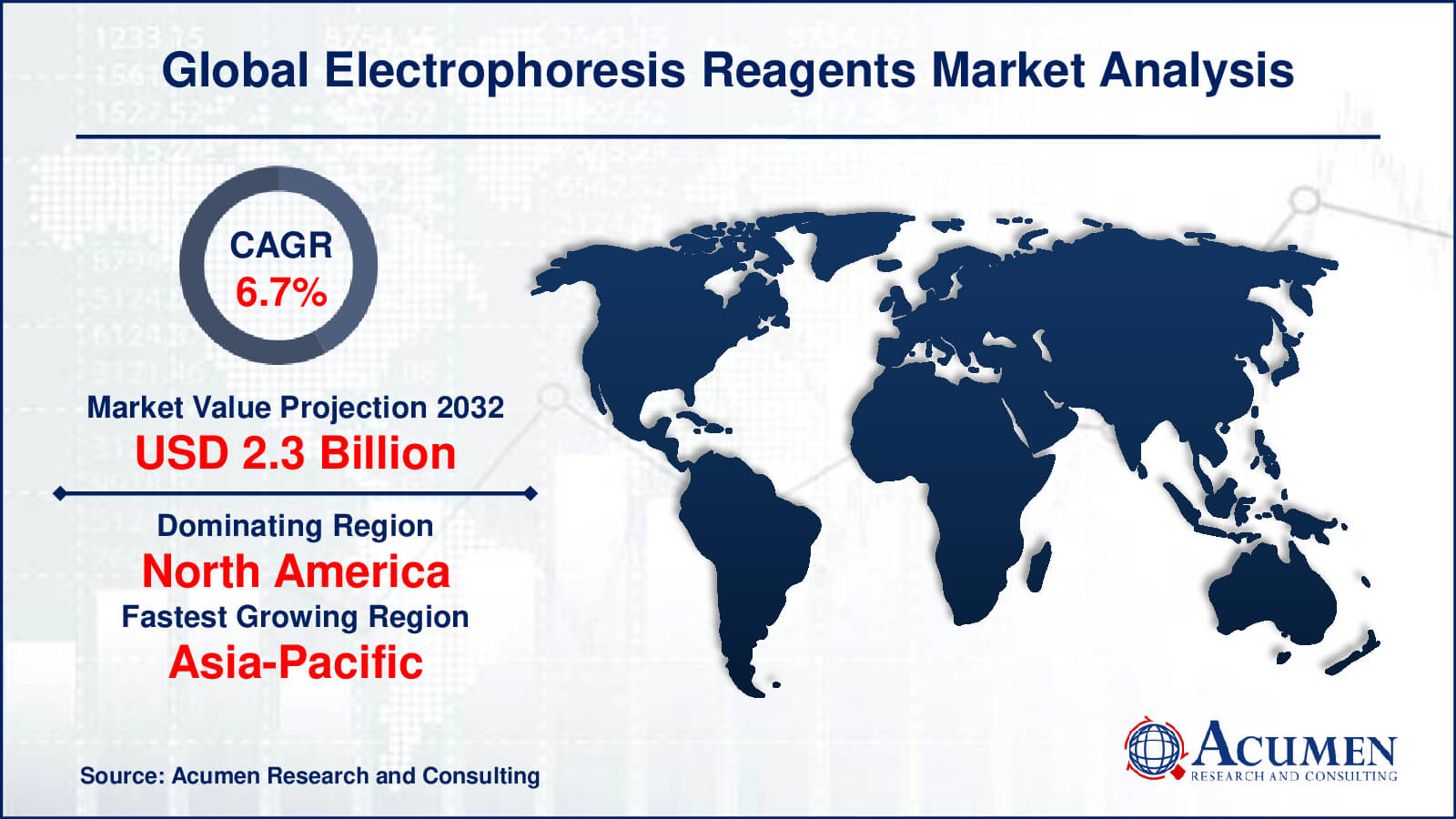

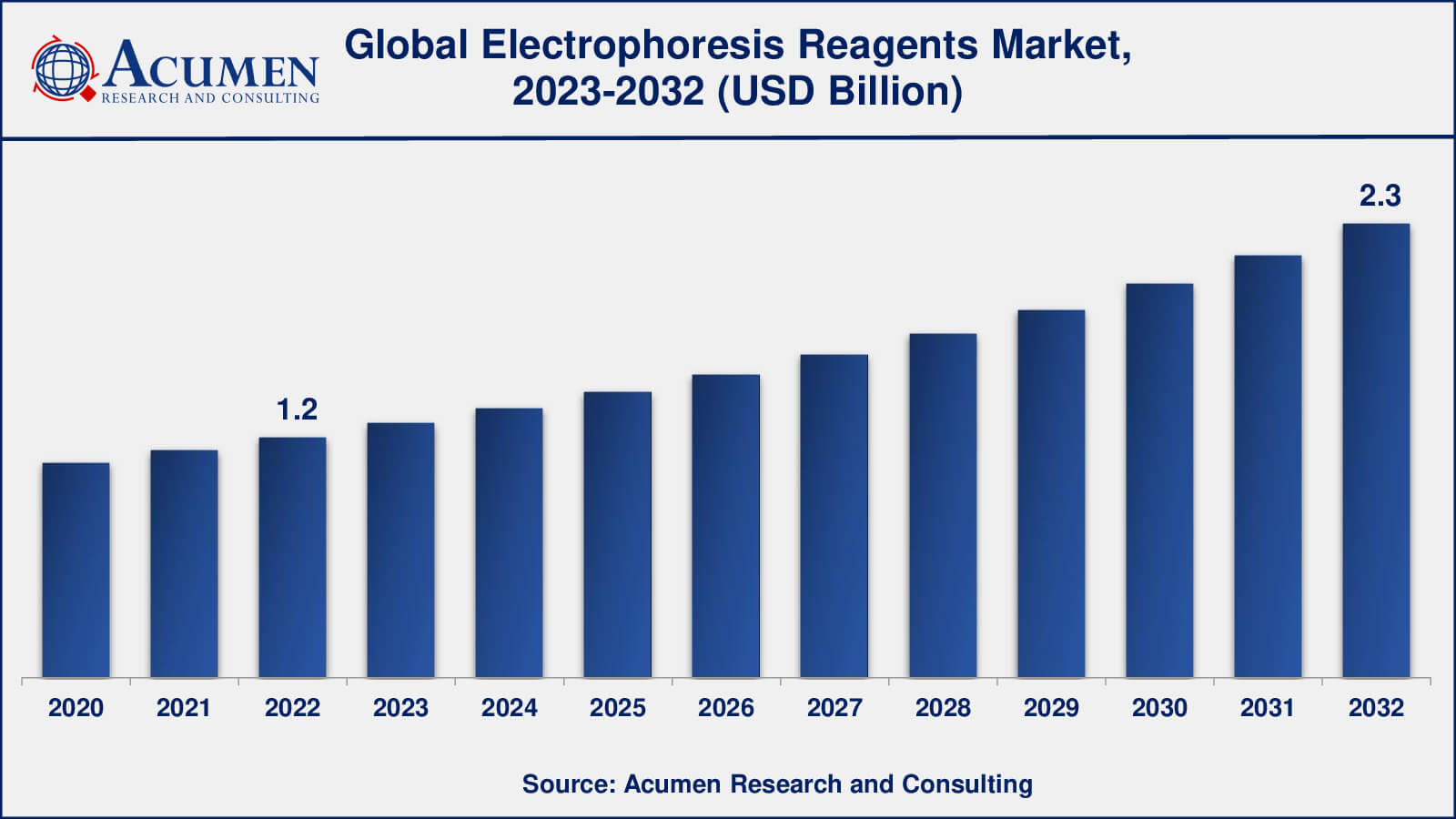

The global Electrophoresis Reagents Market size was valued at USD 1.2 Billion in 2022 and is projected to attain USD 2.3 Billion by 2032 mounting at a CAGR of 6.7% from 2023 to 2032.

Electrophoresis Reagents Market Highlights

- Global electrophoresis reagents market revenue is poised to garner USD 2.3 billion by 2032 with a CAGR of 6.7% from 2023 to 2032

- North America electrophoresis reagents market value occupied around USD 393 million in 2022

- Asia-Pacific electrophoresis reagents market growth will record a CAGR of more than 8% from 2023 to 2032

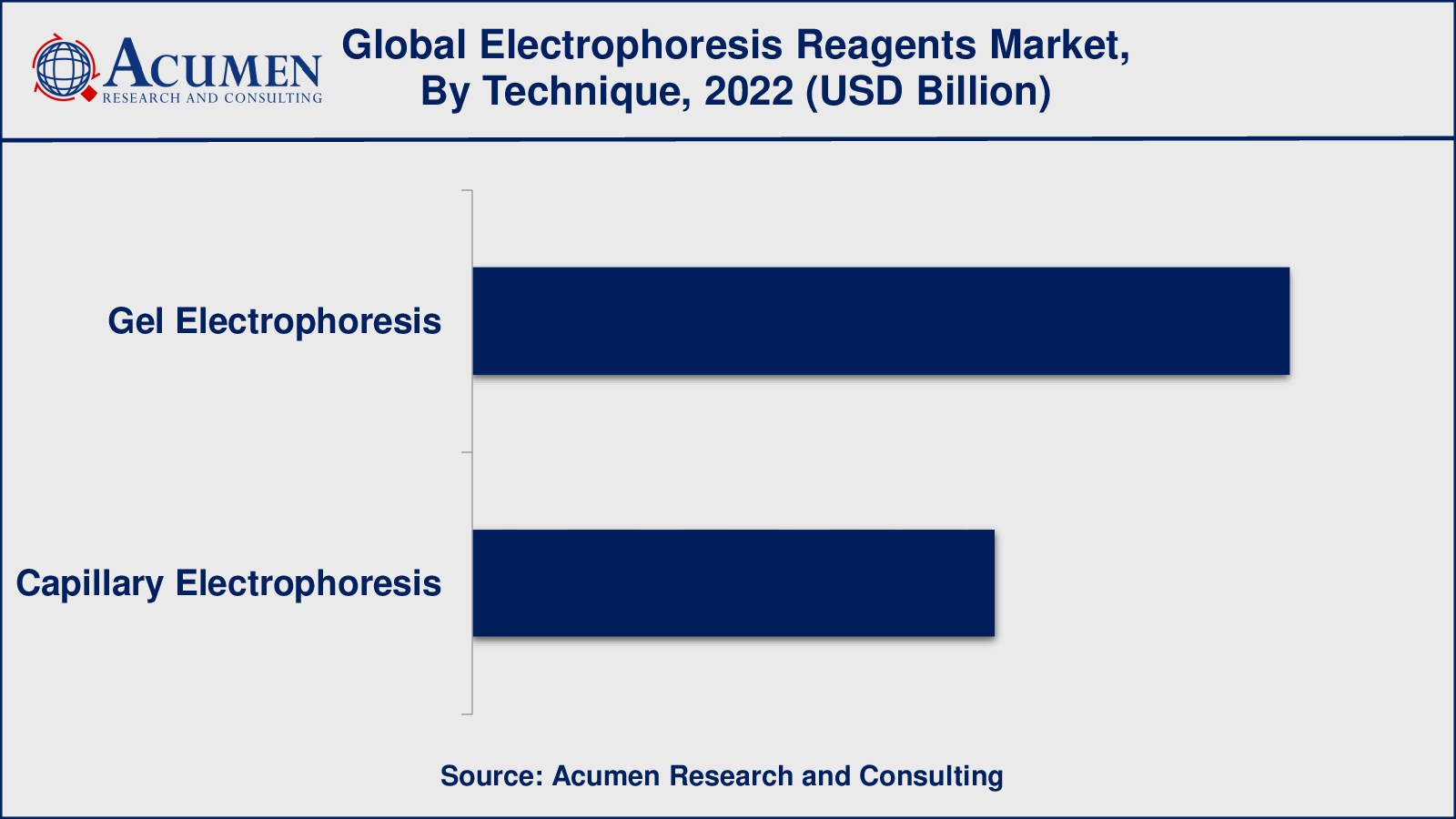

- Among techniques, the gel electrophoresis sub-segment occupied over US$ 750 million revenue in 2022

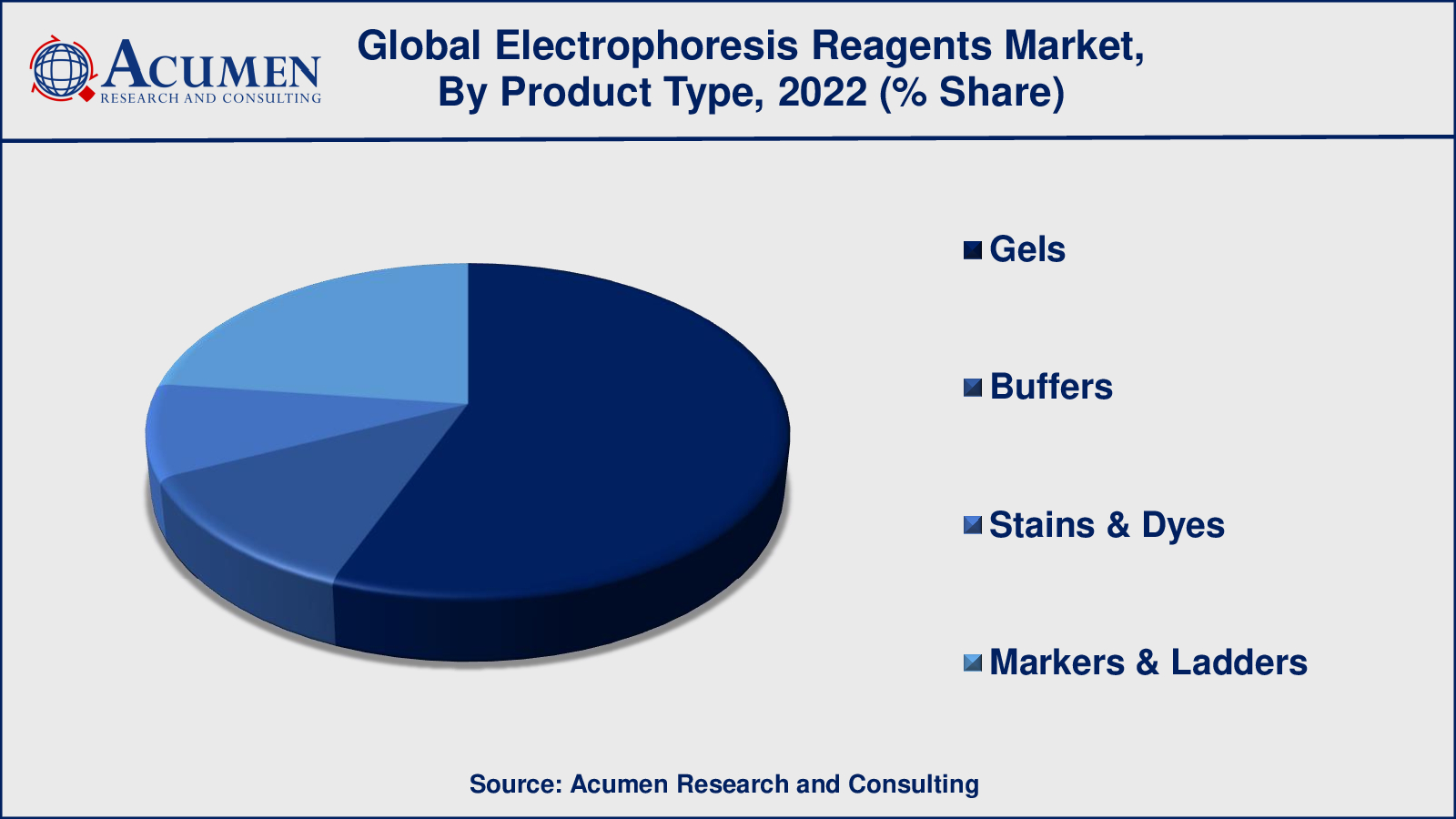

- Based on products, the gels sub-segment gathered around 56% share in 2022

- Adoption of capillary electrophoresis in clinical diagnostics is a popular electrophoresis reagents market trend that drives the industry demand

Electrophoresis reagents are chemicals and substances that are employed in the laboratory method of electrophoresis. In molecular biology, biochemistry, and genetics, this approach is commonly used to separate and analyze biomolecules according on their size, charge, or other features. The procedure includes the migration of charged molecules across a conductive material known as the electrophoresis buffer, which maintains a steady pH and supplies the ions required for molecule movement.

The gel matrix, which separates molecules, is a critical component in electrophoresis. Different types of gels are utilized depending on the type of biomolecules being analyzed. Agarose gels, for example, are frequently employed for DNA and RNA analysis, but polyacrylamide gels are favored for protein analysis.

Global Electrophoresis Reagents Market Dynamics

Market Drivers

- Growing demand for personalized medicine and molecular diagnostics

- Increasing applications in proteomics and genomics research

- Technological advancements in electrophoresis techniques

- Rising prevalence of chronic diseases and infectious disorders

Market Restraints

- High cost associated with advanced electrophoresis reagents and equipment

- Limited resolution and sensitivity for certain biomolecules

- Availability of alternative separation techniques

Market Opportunities

- Expanding biotechnology and pharmaceutical industries

- Emerging markets with increasing research funding

- Demand for point-of-care electrophoresis testing

Electrophoresis Reagents Market Report Coverage

| Market | Electrophoresis Reagents Market |

| Electrophoresis Reagents Market Size 2022 | USD 1.2 Billion |

| Electrophoresis Reagents Market Forecast 2032 | USD 2.3 Billion |

| Electrophoresis Reagents Market CAGR During 2023 - 2032 | 6.7% |

| Electrophoresis Reagents Market Analysis Period | 2020 - 2032 |

| Electrophoresis Reagents Market Base Year | 2022 |

| Electrophoresis Reagents Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technique, By Product Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Agilent Technologies, Inc., Apacor Limited, Bio-Rad Laboratories, Inc., BioCT, EUROCLONE S.p.A., General Electric, Harvard Bioscience, Helena Laboratories Corporation, Lonza, Merck KGaA, Promega Corporation, QIAGEN, Sigma-Aldrich Corporation, Takara Bio, Inc., and Thermo Fisher Scientific Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Electrophoresis Reagents Market Insights

Several main reasons have led to the huge rise of the global electrophoresis reagents market. The increased desire for personalized medicine and molecular diagnostics is one of the key factors. As we gain a better knowledge of the genetic variables that influence disease susceptibility and treatment response, there is a greater demand for advanced molecular analytic techniques like electrophoresis to detect and characterize particular biomolecules like DNA, RNA, and proteins. This has resulted in an increase in the use of electrophoresis reagents in clinical and research settings, fueling market growth.

Moreover, the growing use of electrophoresis in proteomics and genomes research has supported market growth. Researchers can now analyze a vast number of biomolecules at the same time thanks to technological breakthroughs and the development of high-throughput devices, offering vital insights into diverse biological processes. This has increased the need for electrophoresis reagents, allowing researchers to more efficiently separate, measure, and investigate complicated protein and nucleic acid combinations.

Continuous technical improvements in electrophoresis methods are another important factor driving the electrophoresis reagents market. Gel compositions, buffer systems, and detection technologies have been improved to improve the resolution, sensitivity, and repeatability of electrophoresis investigations. As a result, researchers may now acquire more precise and dependable findings, boosting the global usage of electrophoresis reagents.

Certain obstacles, however, are limiting market expansion. The high cost of sophisticated electrophoresis reagents and equipment might be prohibitively expensive, especially for smaller research facilities and universities with restricted funds. Furthermore, while electrophoresis is a strong separation method, it may have difficulties in resolving some complex mixtures, particularly those including proteins with identical molecular weights or post-translational modifications.

Nonetheless, the electrophoresis reagents market offers various potential prospects. Electrophoresis methods are in high demand in drug development and quality control applications due to the booming biotechnology and pharmaceutical industries. Furthermore, the introduction of new markets with greater research funding is creating a favorable climate for electrophoresis reagent uptake.

Demand for point-of-care electrophoresis testing is another intriguing prospect. Integration of electrophoresis at point-of-care settings may revolutionize illness detection and monitoring as healthcare systems seek quick and precise diagnostic solutions. Furthermore, the use of capillary electrophoresis in clinical diagnostics is likely to open up new opportunities for market participants since it provides greater resolution, quicker analysis, and lower sample needs than traditional gel-based electrophoresis techniques.

Electrophoresis Reagents Market Segmentation

The worldwide market for electrophoresis reagents is split based on technique, product type, application, end-user, and geography.

Electrophoresis Reagents Techniques

- Gel Electrophoresis

- Capillary Electrophoresis

According to an electrophoresis reagents industry analysis, gel electrophoresis has traditionally been more dominant and widely employed in many scientific and therapeutic contexts. Gel electrophoresis is a well-known and adaptable method for separating nucleic acids (DNA and RNA) and proteins according to their size and charge. It's commonly used in molecular biology labs for activities including DNA fragment analysis, PCR product verification, RNA analysis, and protein separation. For DNA and RNA analysis, agarose gel electrophoresis is typically utilised, but polyacrylamide gel electrophoresis is used for protein separation.

Capillary electrophoresis, on the other hand, is a more current and sophisticated technology that has various benefits over standard gel electrophoresis. It offers greater resolution, quicker separation, and automated sample analysis. Capillary electrophoresis is ideal for DNA sequencing, fragment analysis, and tiny molecule analysis, making it useful in research, forensics, and pharmaceutical applications.

Electrophoresis Reagents Product Types

- Gels

- Buffers

- Stains & Dyes

- Markers & Ladders

According to our industry estimate, gels will have a large market share in 2022. Gels are an important component of electrophoresis and are used to separate biomolecules depending on their size and charge. The most popular forms are agarose and polyacrylamide gels, with agarose gels chosen for nucleic acid analysis and polyacrylamide gels for protein analysis. Electrophoresis buffers are required for the formation of the conductive medium required for the movement of charged biomolecules during electrophoresis. In nucleic acid electrophoresis, the most often used buffer systems are tris-acetate-EDTA (TAE) and tris-borate-EDTA (TBE).

After electrophoresis, these reagents are employed to see and detect the separated biomolecules on the gel. Traditionally, EtBr was used to visualise DNA, however because to safety concerns, safer alternatives such as SYBR Green and GelRed have gained favour. Coomassie Brilliant Blue and Silver Staining are two extensively used stains for protein analysis.

Electrophoresis Reagents Applications

- Protein Analysis

- DNA & RNA Analysis

Electrophoresis is widely utilised in research and clinical applications for protein separation and analysis. Polyacrylamide gel electrophoresis (PAGE) is used by researchers to separate proteins depending on their molecular weight. This method is often used to investigate protein expression, identify protein isoforms, and investigate post-translational changes. Furthermore, Western blotting, a method that combines electrophoresis with the detection of protein-specific antibodies, is commonly employed to examine protein expression levels and interactions.

Electrophoresis is a basic method for analysing nucleic acids (DNA and RNA). Agarose gel electrophoresis is a popular method for separating and visualising DNA fragments such as PCR products, DNA markers, and plasmids. This approach is critical for activities such as sizing DNA fragments, analysing restriction enzyme digestion, and confirming DNA sequencing. RNA electrophoresis is also used to analyse RNA integrity and quantify gene expression levels.

Electrophoresis Reagents End-Users

- Academic & Research Institutions

- Pharmaceutical and Biotechnology Companies

- Hospitals and Clinics

- Diagnostic Laboratories

- Others

According to the electrophoresis reagents market prediction, academic institutions such as universities, research centres, and academic labs have been important users of electrophoresis reagents. These organisations perform a wide range of research in subjects such as molecular biology, biochemistry, genetics, and proteomics, all of which rely significantly on electrophoresis methods for various studies and experiments.

In addition, electrophoresis reagents are widely used in the pharmaceutical and biotechnology sectors for drug discovery, development, and quality control activities. They use electrophoresis methods to analyse proteins, DNA, and RNA, allowing them to investigate therapeutic targets, perform genetic testing, and evaluate the purity and stability of biopharmaceutical products.

Electrophoresis Reagents Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Electrophoresis Reagents Market Regional Analysis

North America, particularly the United States, has long been a market leader in electrophoresis reagents. The region's excellent R&D skills, well-established university and research institutions, and a burgeoning biotechnology and pharmaceutical sector have all contributed to its market supremacy. Furthermore, the increased emphasis on personalized medicine and molecular diagnostics has increased demand for electrophoresis reagents in clinical and research settings.

Europe dominates the electrophoresis reagents industry, with nations like as Germany, the United Kingdom, and France making significant contributions. Because of the region's well-developed healthcare infrastructure, support for life sciences research, and strong academic institutions, electrophoresis methods have been used for a variety of applications, including genetic testing and protein analysis.

The Asia-Pacific region has seen rapid expansion in the electrophoresis reagents market. Factors such as increased R&D investments, expanding biotechnology and pharmaceutical sectors, and rising healthcare expenditures have boosted demand for electrophoresis reagents in countries such as China, Japan, and India.

Electrophoresis Reagents Market Players

Some of the top electrophoresis reagents companies offered in our report include Agilent Technologies, Inc., Apacor Limited, Bio-Rad Laboratories, Inc., BioCT, EUROCLONE S.p.A., General Electric, Harvard Bioscience, Helena Laboratories Corporation, Lonza, Merck KGaA, Promega Corporation, QIAGEN, Sigma-Aldrich Corporation, Takara Bio, Inc., and Thermo Fisher Scientific Inc.

Frequently Asked Questions

What was the size of the global electrophoresis reagents market in 2022?

The size of electrophoresis reagents market was USD 1.2 billion in 2022.

What is the electrophoresis reagents market CAGR from 2023 to 2032?

The electrophoresis reagents market CAGR during the analysis period of 2023 to 2032 is 6.7%.

Which are the key players in the electrophoresis reagents market?

The key players operating in the global electrophoresis reagents market are including Agilent Technologies, Inc., Apacor Limited, Bio-Rad Laboratories, Inc., BioCT, EUROCLONE S.p.A., General Electric, Harvard Bioscience, Helena Laboratories Corporation, Lonza, Merck KGaA, Promega Corporation, QIAGEN, Sigma-Aldrich Corporation, Takara Bio, Inc., and Thermo Fisher Scientific Inc.

Which region dominated the global electrophoresis reagents market share?

North America region held the dominating position in electrophoresis reagents industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of electrophoresis reagents during the analysis period of 2023 to 2032.

What are the current trends in the global electrophoresis reagents industry?

The current trends and dynamics in the electrophoresis reagents industry include growing demand for personalized medicine and molecular diagnostics, increasing applications in proteomics and genomics research, and technological advancements in electrophoresis techniques.

Which product type held the maximum share in 2022?

The gel electrophoresis product type held the maximum share of the electrophoresis reagents industry.