Electronic Weighing Machines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Electronic Weighing Machines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

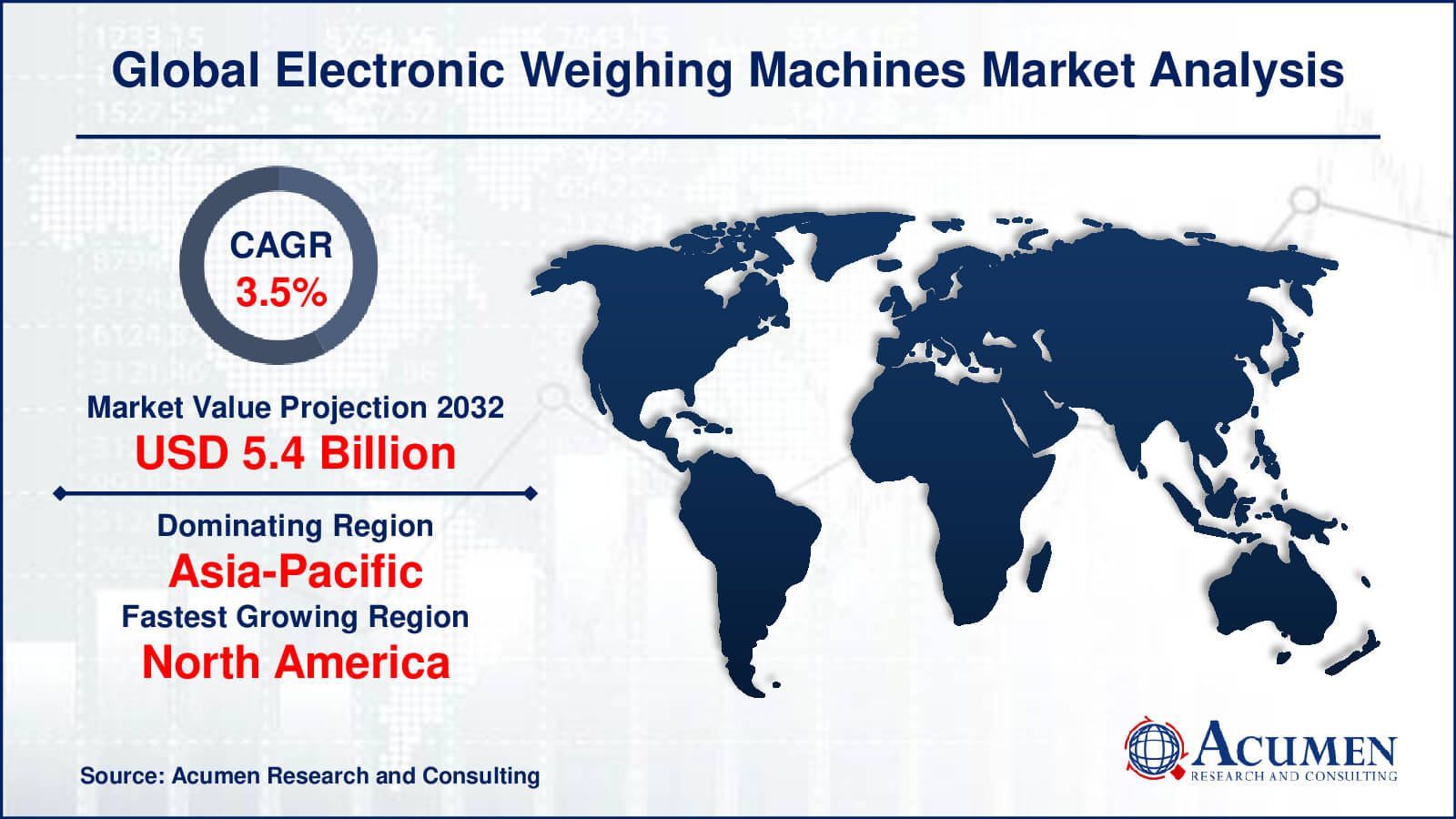

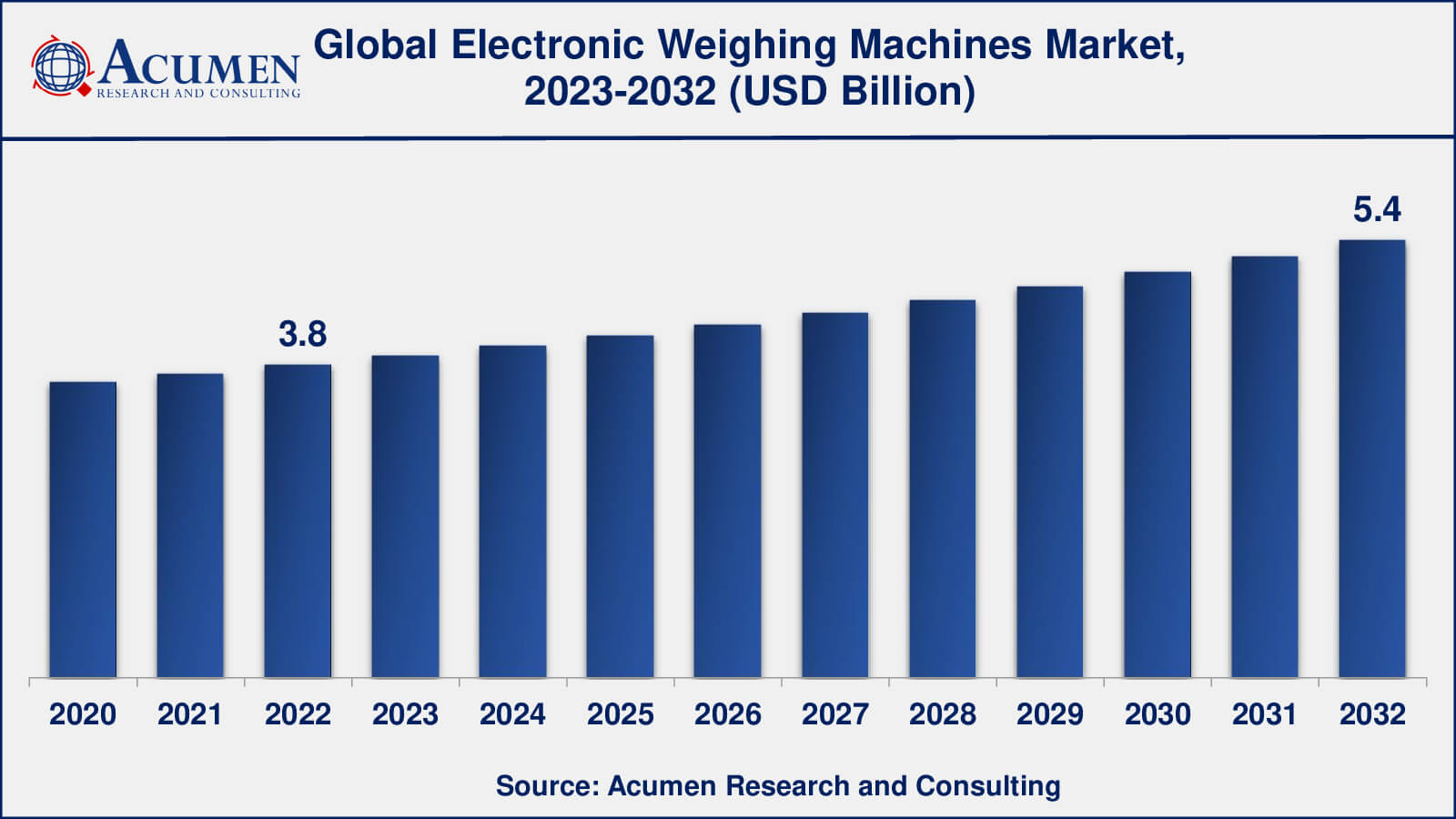

The Global Electronic Weighing Machines Market Size accounted for USD 3.8 Billion in 2022 and is estimated to achieve a market size of USD 5.4 Billion by 2032 growing at a CAGR of 3.5% from 2023 to 2032.

Electronic Weighing Machines Market Highlights

- Global electronic weighing machines market revenue is poised to garner USD 5.4 billion by 2032 with a CAGR of 3.5% from 2023 to 2032

- Asia-Pacific electronic weighing machines market value occupied around USD 1.4 billion in 2022

- North America electronic weighing machines market growth will record a CAGR of more than 9% from 2023 to 2032

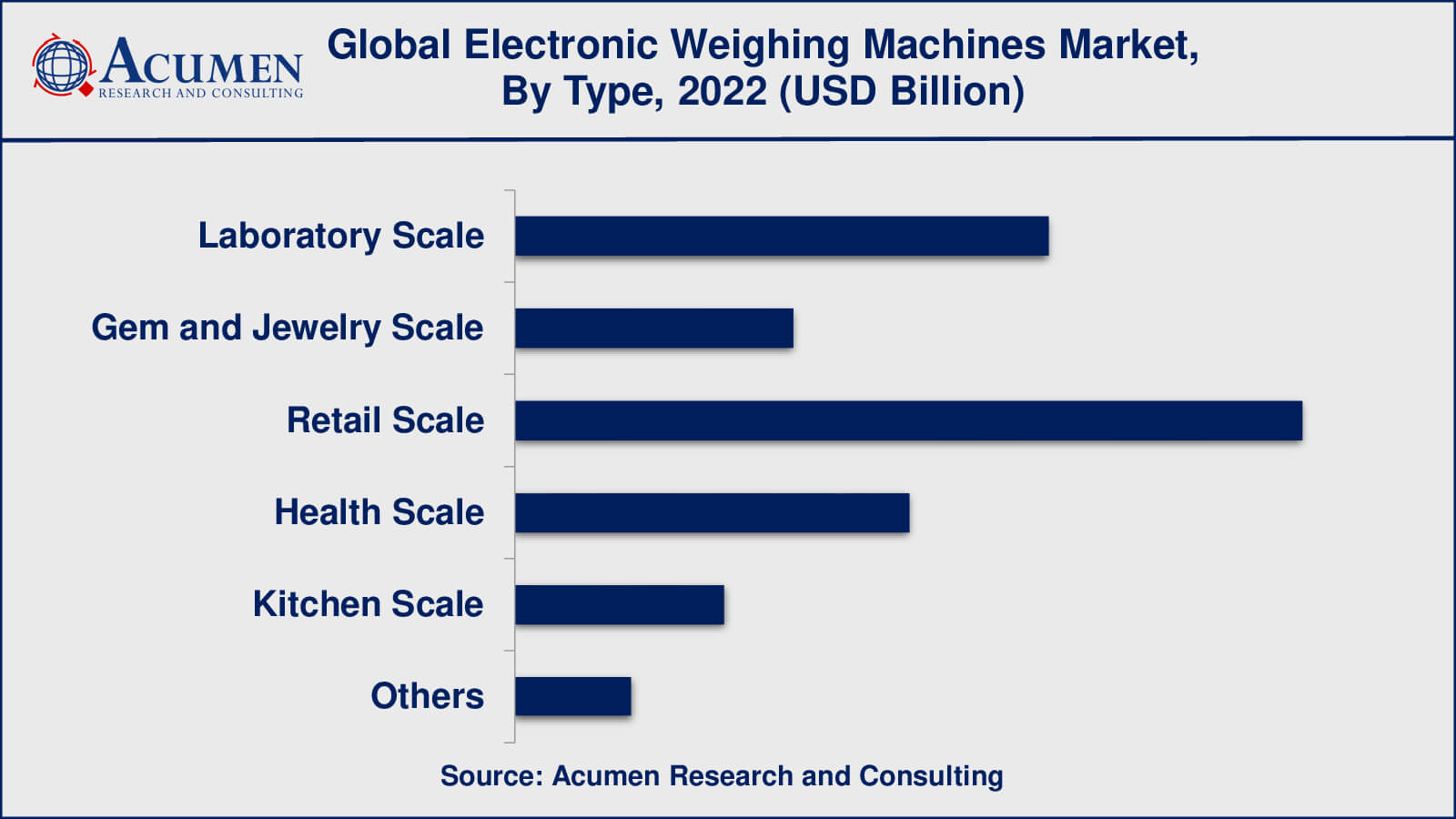

- Among type, the retail scale sub-segment generated over US$ 1.3 billion revenue in 2022

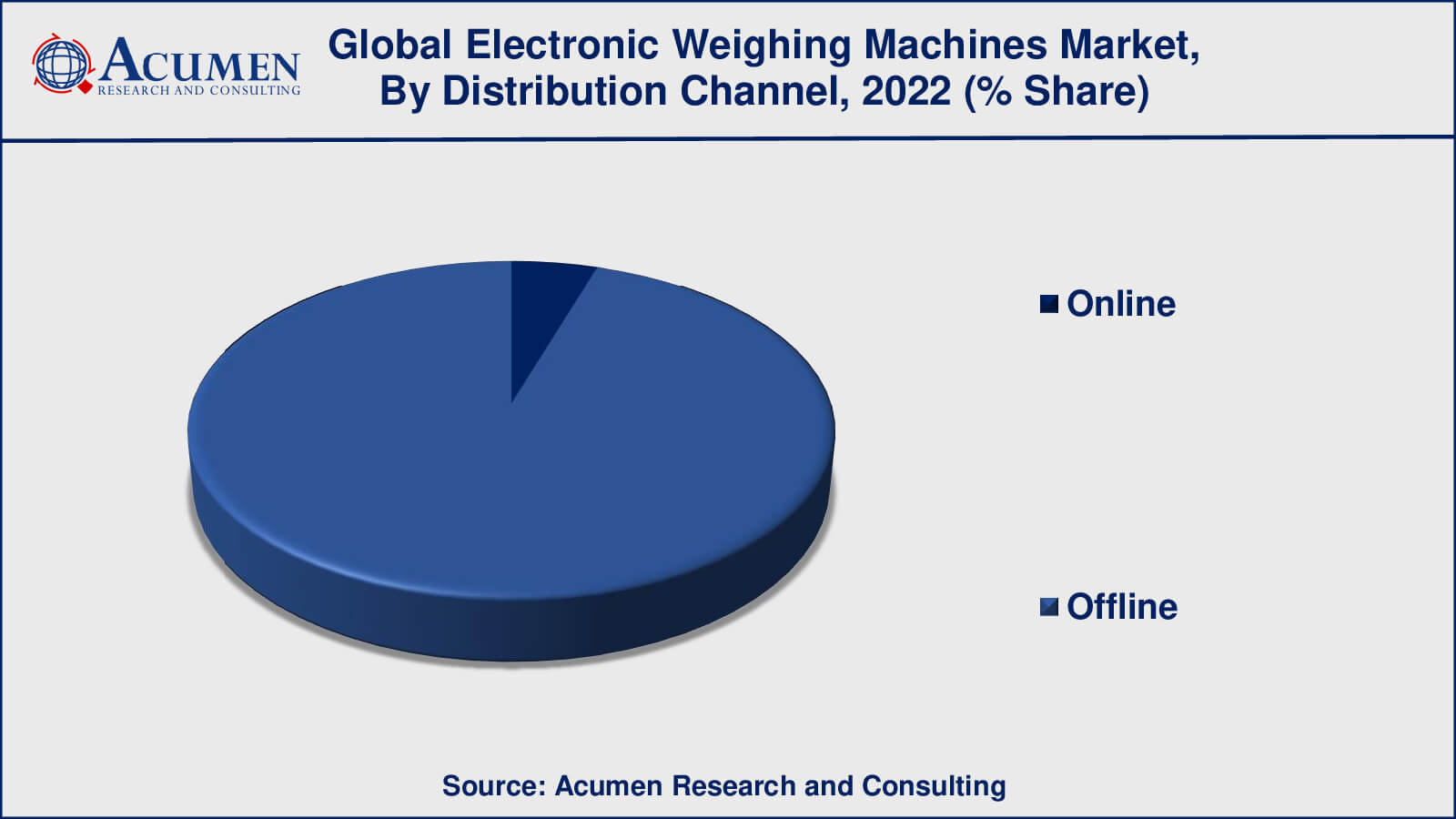

- Based on distribution channel, the offline sub-segment generated around 95% share in 2022

- Integration with digital platforms and software is a popular electronic weighing machines market trend that fuels the industry demand

Electronic weighing machines are devices that use electronic sensors to determine the weight of an object or substance. They are commonly used to correctly weigh and measure items, ingredients, and materials in a range of industries, including food and beverage, medicines, manufacturing, and logistics. Electronic weighing machines are utilized because they have various advantages over traditional mechanical scales, including improved precision, faster readings, and the capacity to calculate and store weight data automatically. Electronic scales can also be linked to other electronic systems, such as inventory management and quality control software, to enhance overall efficiency and accuracy.

Electronic weighing devices are likely to improve in accuracy, speed, and functionality in the next years. Weighing equipment will be able to measure even smaller weights with greater precision as sensor technology advances. With the integration of artificial intelligence and machine learning algorithms, machines will be able to analyze and learn from data, resulting in more precise measurements and more efficient operations. Electronic weighing devices will also be coupled with other technologies such as blockchain and the Internet of Things (IoT) to create a more interconnected and transparent supply chain. Overall, electronic weighing machines will become more significant in a variety of industries and will continue to evolve to satisfy the changing needs of organizations.

Global Electronic Weighing Machines Market Dynamics

Market Drivers

- Increasing demand for accurate and efficient measurement of ingredients and portions in restaurants

- Growing adoption of automation and digitalization in the food and beverage industry

- Rising awareness among consumers about food safety and hygiene, leading to stricter regulations and standards

- Growing popularity of food delivery services and online ordering platforms, which require accurate portioning and weighing of food items

Market Restraints

- Weighing ingredients for recipes and portioning food items for service

- Measuring the weight of food items for inventory management and ordering

- Weighing waste and leftover food to monitor food waste and identify areas for improvement

- Ensuring accuracy in food delivery orders and reducing the risk of customer complaints and returns

Market Opportunities

- Increasing adoption of Industry 4.0 and smart manufacturing

- Growth in the aerospace and defense industries

- Increasing demand for Electronic Weighing Machines in emerging markets

- Development of hybrid Electronic Weighing Machines that combine additive and subtractive manufacturing capabilities

Electronic Weighing Machines Market Report Coverage

| Market | Electronic Weighing Machines Market |

| Electronic Weighing Machines Market Size 2022 | USD 3.8 Billion |

| Electronic Weighing Machines Market Forecast 2032 | USD 5.4 Billion |

| Electronic Weighing Machines Market CAGR During 2023 - 2032 | 3.5% |

| Electronic Weighing Machines Market Analysis Period | 2020 - 2032 |

| Electronic Weighing Machines Market Base Year | 2022 |

| Electronic Weighing Machines Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | A&D Company, Ltd., Avery Weigh-Tronix, LLC, BONSO Electronics International Inc., Doran Scales, Inc., Essae-Teraoka Pvt. Ltd., Fairbanks Scales Inc., Kern & Sohn GmbH, Mettler-Toledo International, Inc., Sartorius Group, and Shimadzu Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Electronic Weighing Machines Market Insights

The global electronic weighing machines market is expected to grow significantly in the coming years, owing to factors such as rising demand for accurate and efficient measurement of ingredients and portions in industries such as food and beverage, pharmaceuticals, and manufacturing. Automation and digitalization are also predicted to drive market expansion in these industries.

Electronic weighing machines are used in the food and beverage sector to correctly measure materials for recipes and portion food items for service, assuring uniformity and reducing the danger of over- or under-serving clients. By correctly weighing and measuring food items, they can also assist restaurants and other food service organizations in complying with food safety requirements and reducing the danger of contamination.

In addition, the increased popularity of food delivery services and online ordering platforms has increased demand for electronic weighing equipment. These platforms necessitate proper food portioning and weighing, and electronic weighing devices help ensure that orders are prepared accurately and consistently. Restaurants can lower the likelihood of customer complaints and refunds by employing computerized weighing devices, resulting in increased customer satisfaction and loyalty.

Furthermore, the growing emphasis on sustainability and food waste has given potential for electronic weighing devices to be utilized in monitoring and optimizing food expenditures, as well as minimizing food waste. Restaurants may identify areas for improvement and reduce food waste by properly measuring and tracking ingredient usage and waste, resulting in increased profitability and environmental sustainability.

Electronic Weighing Machines Market Segmentation

The worldwide market for electronic weighing machines is split based on type, distribution channel, and geography.

Electronic Weighing Machines Types

- Health Scale

- Gem and Jewelry Scale

- Kitchen Scale

- Laboratory Scale

- Retail Scale

- Others

According to electronic weighing machine industry analysis, laboratory scales are used in scientific and research laboratories to correctly measure and weigh numerous materials and substances, such as chemicals and pharmaceuticals. They are often quite precise and frequently include capabilities such as data recording and analysis. Retail scales, on the other hand, are used to weigh and price things for sale in commercial environments such as supermarkets and grocery shops. These scales are user-friendly and simple to use, with features like as barcode scanners and digital displays.

In the kitchen, kitchen scales are used to weigh items for cooking and baking. Small digital scales for measuring herbs and spices to larger scales for weighing larger quantities of ingredients are available in a variety of sizes and types. Gem and jewellery scales, health scales, and specialised industrial scales used in manufacturing and transportation are all examples of electronic weighing machines.

Electronic Weighing Machines Distribution Channels

- Online

- Offline

Offline distribution channels are most commonly seen in commercial and industrial contexts, including as manufacturing and logistics, where electronic weighing devices are used to precisely measure and weigh materials and products. Offline distribution channels include retail scales used in supermarkets and grocery stores.

According to the electronic weighing machines market estimate, online distribution channels are predicted to develop at the quickest rate between 2023 and 2032. On the other hand, online distribution channels are becoming increasingly essential in the food and beverage business, where electronic weighing machines are utilised to weigh and portion food products for delivery and online ordering platforms. To ensure precise and efficient order fulfilment, these online apps must be integrated with digital platforms and software.

The COVID-19 pandemic has also hastened the shift to online distribution channels, as more consumers have turned to online buying and delivery services to decrease contact and the risk of infection. As a result, electronic weighing devices that are integrated with digital platforms and software are in high demand.

Electronic Weighing Machines Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Electronic Weighing Machines Market Regional Analysis

The Asia-Pacific region is the largest market for electronic weighing machines, owing to rising need for accurate and efficient measurement and weighing in a variety of industries such as food and beverage, pharmaceuticals, and manufacturing. The region is also home to a big number of electronic weighing machine manufacturers, which has aided industry expansion.

North America and Europe are also important markets for electronic weighing machines, owing to a growing need for automation and digitalization across a variety of industries. The food and beverage sectors drive demand for electronic weighing equipment in North America, while the manufacturing and logistics industries drive demand in Europe.

The COVID-19 epidemic has had a substantial influence on the electronic weighing machine business, causing supply chain disruptions and decreased demand in several industries. However, the market is likely to rebound in the next years, owing to rising demand for precise and efficient measurement and weighing, as well as increased adoption of digital platforms and software.

Electronic Weighing Machines Market Players

Some of the top electronic weighing machine companies offered in our report include A&D Company, Ltd., Avery Weigh-Tronix, LLC, BONSO Electronics International Inc., Doran Scales, Inc., Essae-Teraoka Pvt. Ltd., Fairbanks Scales Inc., Kern & Sohn GmbH, Mettler-Toledo International, Inc., Sartorius Group, and Shimadzu Corporation.

In May 2021, Avery Weigh-Tronix, LLC introduced the ZQ375, a new range of check weighers. The ZQ375 is intended to increase weighing accuracy and speed for manufacturing and packing lines, and it includes advanced networking and data collection capabilities.

In February 2021, A&D Company, Ltd. introduced the EJ Compact Balance, a new range of compact balances. The EJ Compact Balance is designed for scientific and educational purposes and has enhanced weighing accuracy and ease of use.

Frequently Asked Questions

What was the market size of the global electronic weighing machines in 2022?

The market size of electronic weighing machines was USD 3.8 billion in 2022.

What is the CAGR of the global electronic weighing machines market from 2023 to 2032?

The CAGR of electronic weighing machines is 3.5% during the analysis period of 2023 to 2032.

Which are the key players in the electronic weighing machines market?

The key players operating in the global market are including A&D Company, Ltd., Avery Weigh-Tronix, LLC, BONSO Electronics International Inc., Doran Scales, Inc., Essae-Teraoka Pvt. Ltd., Fairbanks Scales Inc., Kern & Sohn GmbH, Mettler-Toledo International, Inc., Sartorius Group, and Shimadzu Corporation.

Which region dominated the global electronic weighing machines market share?

Asia-Pacific held the dominating position in electronic weighing machines industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of electronic weighing machines during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global electronic weighing machines industry?

The current trends and dynamics in the electronic weighing machines industry include increasing demand for accurate and efficient measurement of ingredients and portions in restaurants, growing adoption of automation and digitalization in the food and beverage industry, and rising awareness among consumers about food safety and hygiene, leading to stricter regulations and standards.

Which type held the maximum share in 2022?

The retail scale type held the maximum share of the electronic weighing machines industry.