Electronic Health Record Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Electronic Health Record Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

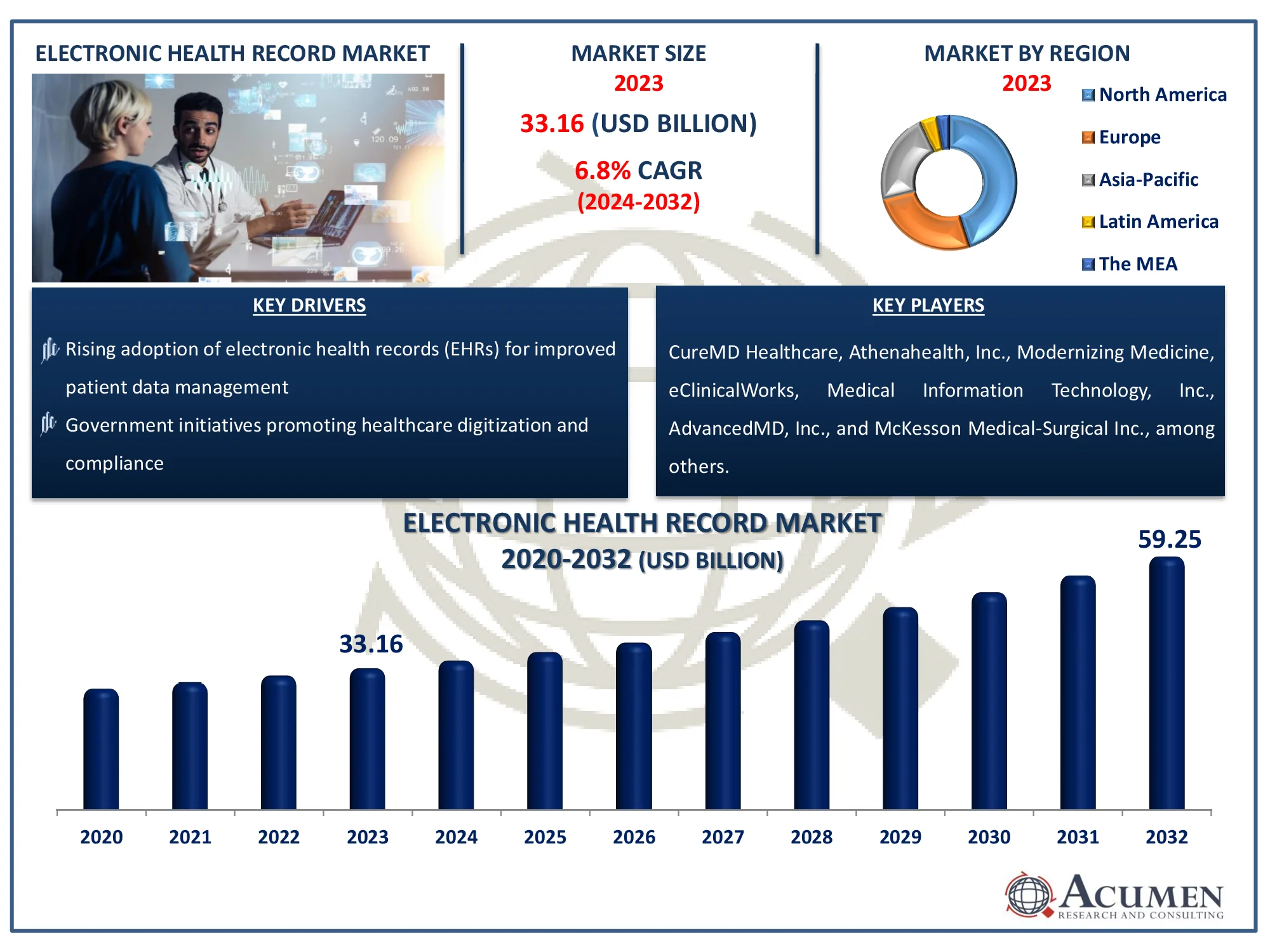

The Global Electronic Health Record Market Size accounted for USD 33.16 Billion in 2023 and is estimated to achieve a market size of USD 59.25 Billion by 2032 growing at a CAGR of 6.8% from 2024 to 2032.

Electronic Health Record Market Highlights

- Global electronic health record market revenue is poised to garner USD 59.25 billion by 2032 with a CAGR of 6.8% from 2024 to 2032

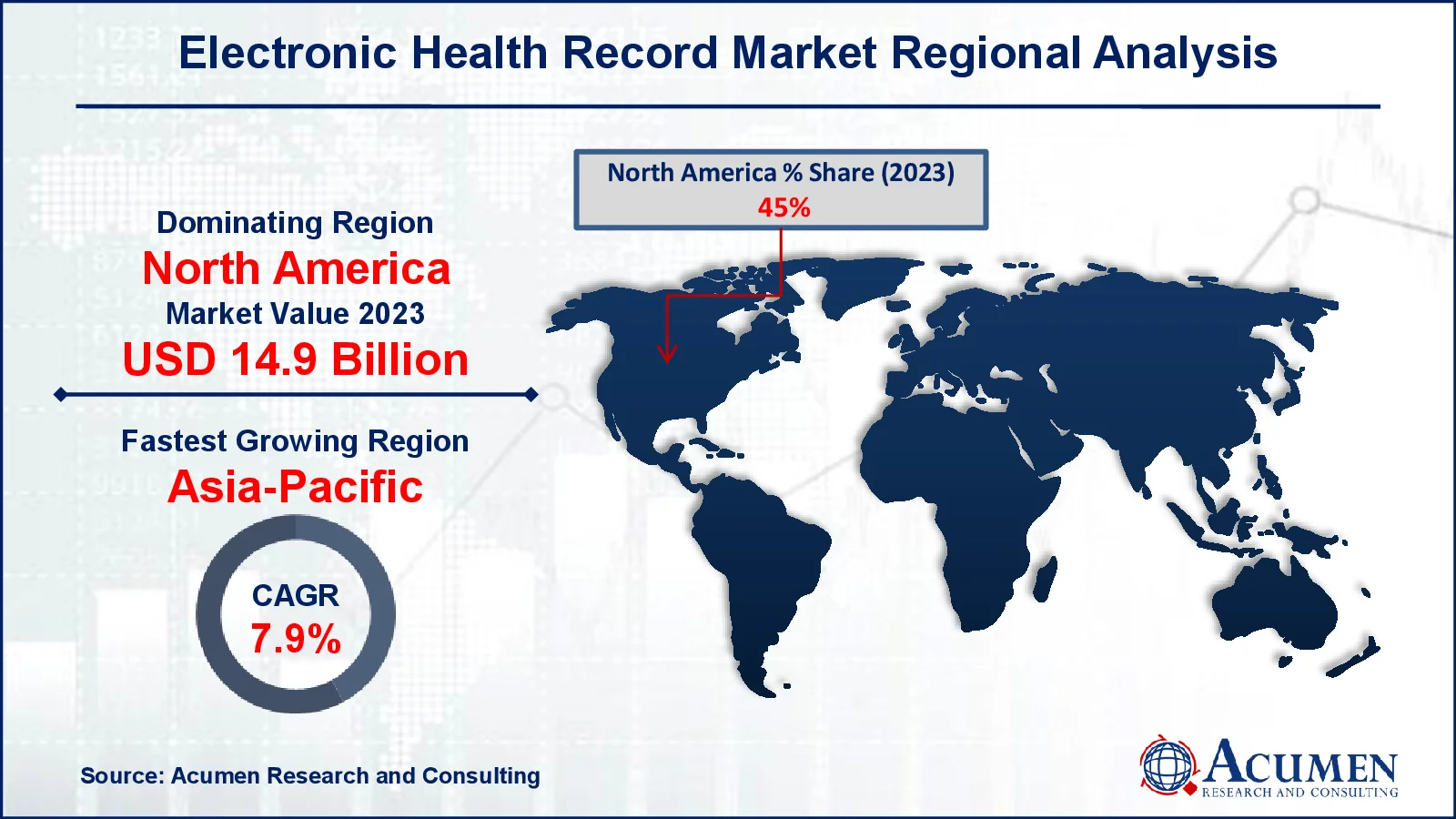

- North America electronic health record market value occupied around USD 14.9 billion in 2023

- Asia-Pacific electronic health record market growth will record a CAGR of more than 7.9% from 2024 to 2032

- Among product, the Web & Cloud-Based sub-segment generated USD 27.5 billion revenue in 2023

- Based on business model, the professional services sub-segment generated 33% electronic health record market share in 2023

- Expansion of EHR solutions in emerging markets with improving healthcare infrastructure is a popular electronic health record market trend that fuels the industry demand

EMRs refer to both individual patient documents and usually to systems that retain patient documents and serve as data entry interfaces and test ordering, other processes and prescriptions. A medical record is used as a documentation of the medical history and patient's health care service. It is anticipated that electronic transformation of patient medical records will improve patient care continuity between various suppliers and clinicians. Patient medical history electronic documentation also helps mitigate unnecessary repetition processes or prescriptions and assists in the processing of claims for insurance. More widespread implementation of EMRs across national healthcare systems, interoperability norms and other HIT solutions will enable exchanges of health information (HIE) to be formed.

Global Electronic Health Record Market Dynamics

Market Drivers

- Rising adoption of electronic health records (EHRs) for improved patient data management

- Government initiatives promoting healthcare digitization and compliance

- Increasing demand for integrated healthcare solutions across hospitals and clinics

- Advancements in cloud-based EHR systems enabling better accessibility and scalability

Market Restraints

- High initial implementation and maintenance costs of EHR systems

- Concerns over data security and patient privacy breaches

- Resistance to change from traditional systems among smaller healthcare providers

Market Opportunities

- Growing adoption of artificial intelligence to enhance EHR functionalities

- Rising demand for mobile health applications integrated with EHR systems

- Collaboration between EHR vendors and healthcare providers for customized solutions

Electronic Health Record Market Report Coverage

|

Market |

Electronic Health Record Market |

|

Electronic Health Record Market Size 2023 |

USD 33.16 Billion |

|

Electronic Health Record Market Forecast 2032 |

USD 59.25 Billion |

|

Electronic Health Record Market CAGR During 2024 - 2032 |

6.8% |

|

Electronic Health Record Market Analysis Period |

2020 - 2032 |

|

Electronic Health Record Market Base Year |

2023 |

|

Electronic Health Record Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Type, By Business Model, By Application, By End Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

CureMD Healthcare, Athenahealth, Inc., Modernizing Medicine, eClinicalWorks, Medical Information Technology, Inc., AdvancedMD, Inc., McKesson Medical-Surgical Inc., Greenway Health, LLC, NextGen Healthcare, Inc., Epic Systems Corporation, and CareCloud, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Electronic Health Record Market Insights

The electronic health record market is anticipated to boost in the coming years due to variables such as precise & up-to-date patient information, increased EHR acceptance and decreased long-term healthcare costs. On the other hand, it is anticipated that the elevated price of EHR and development in patient data security and security issues owing to the increase in cyber crime will hamper the development of the electronic health record market.

One of EHR's main features is that health information produced and managed by approved customers can be shared with other suppliers across various healthcare organizations such as laboratories, specialty centers, pharmacies, emergency clinics and other healthcare facilities to provide data to all patient care clinicians. Moreover, remote monitoring of geriatric patients is increasingly required to create demand for enhanced healthcare services. In addition, the introduction of technologically sophisticated software is anticipated to drive market development over the EHR market forecast period.

Electronic Health Record Market Segmentation

The worldwide market for electronic health record is split based on product, type, business model, application, end use, and geography.

Electronic Health Record (EHR) Market By Product

- Web & Cloud-Based

- On-premises

According to electronic health record industry analysis, the web & cloud-based segment has dominated the market due to its improved accessibility, scalability, and cost-effectiveness. Unlike on-premises solutions, cloud-based EHRs enable healthcare practitioners to access patient data in real time from any location, improving operational efficiency and continuity of treatment. These systems minimize the need for large investments in IT infrastructure, making them ideal for small and medium-sized healthcare facilities. They also enable smooth updates and interaction with other digital health technology, assuring compliance with changing healthcare standards. The expanding acceptance of telemedicine and remote patient monitoring has increased demand for cloud-based EHRs, cementing their position as the market's largest sector.

Electronic Health Record (EHR) Market By Type

- Acute

- Outpatient

- Post-Acute

The acute category leads the electronic health record EHR market, owing to the vital requirement for efficient data management in acute care settings including hospitals and emergency departments. Acute EHR systems are intended to handle large amounts of patient data while giving real-time updates to aid in speedy decision-making during crucial conditions. These systems work smoothly with diagnostic and imaging instruments, resulting in full patient records. The segment's dominance is strengthened by the increased prevalence of chronic diseases and emergencies, which necessitate strong data solutions for acute care. Furthermore, government obligations to use EHRs in hospitals have considerably increased acute EHR adoption, making it the market's largest sector.

Electronic Health Record (EHR) Market By Business Model

- Licensed Software

- Subscriptions

- Technology Resale

- Professional Services

- Others

The professional services category generates the most revenue in the electronic health record (EHR) market because it plays an important role in providing seamless EHR adoption and continuous maintenance. This section comprises services including system modification, training, consulting, and maintenance, all of which are necessary for maximizing EHR functionality in a variety of healthcare settings. As EHR systems evolve, healthcare providers increasingly rely on professional service providers to integrate with other technologies, meet regulatory standards, and modernize their systems. The difficulties of migrating from legacy systems to modern EHR platforms drives up demand for these services. Furthermore, the increased emphasis on data security and interoperability increases the demand for expert services, reinforcing this segment's revenue leadership.

Electronic Health Record (EHR) Market By Application

- Neurology

- Cardiology

- Radiology

- Mental and Behavioral Health

- Oncology

- Nephrology and Urology

- Pediatrics

- Gastroenterology

- Physical Therapy and Rehabilitation

- General Medicine

- Others

The general medicine type contributes the majority of revenue in the EHR market due to its widespread use in primary care and general practice settings. General medicine serves as the core of healthcare systems, hence there is a considerable demand for EHR solutions customized to this market. These systems make it easier to handle patient records, improve clinical workflows, and make better decisions for a variety of medical diseases. The growing emphasis on preventative care, routine check-ups, and chronic illness management drives the use of EHRs in general practice. Furthermore, government initiatives pushing EHR use in primary care facilities, as well as the high patient volume managed by general practitioners, contribute to the segment's market revenue domination.

Electronic Health Record (EHR) Market By End Use

- Ambulatory Surgical Centers

- Hospitals

- Others

Hospitals dominate the electronic health records market, accounting for over 53% of the total market share. This significant share is being driven by the widespread use of EHR systems in hospital settings to expedite patient data management, improve clinical workflows, and improve decision-making procedures. Hospitals rely on these technologies to maintain compliance with healthcare regulations and easy connectivity between departments. Furthermore, the expanding trend of healthcare digitization, combined with major infrastructure expenditures, promotes the wider adoption of EHR solutions in hospitals. The category also benefits from government programs and financial incentives that encourage EHR adoption, making it an important part of the market's growth.

Electronic Health Record Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Electronic Health Record Market Regional Analysis

North America governs the electronic health record market in terms of revenue in 2023. Considering the advanced healthcare model and its straight proportional connection with the developments in the EHR market, the position of developed countries is significantly powerful in claiming national ownership. On that note, the U.S. will arise as a powerful global competitor with around significant CAGR goal. Other than the favorable medical infrastructure, there will be further proliferation of market penetration by public support and huge investments in the region. a law referred as the Health Information Technology for Economic and Clinical Health Act (HITECH) was adopted by the United States government. This legislation has allocated billions of bucks to encourage the exercise of EHR schemes by qualified healthcare practitioners across the nation.

On the other hand, Canada electronic health record market is also anticipated to grow at a considerable CAGR amid the forecast period. Increasing EHR application across all physicians and healthcare suppliers in Canada will appear as an impact factor for elevated market growth. An increasing amount of study organizations and clinics in the field of pharmacovigilance will boost demand for EHR system software. In addition, the existence of top national market players will have a major effect on the magnitude of the Canadian electronic health record sector in the coming years.

Asia-Pacific is anticipated to be the fastest growing market over the electronic health record market forecast period. Strong economic growth has been experienced by emerging economies in this region including China and India. High demand for healthcare IT services in healthcare sector is anticipated to boost the EHR industry in this region. Other variables affecting market growth include increasing public e-Health projects, rising medical tourism, and growing demand for quality healthcare in this region. Moreover, China is regarded as home to low-cost electronic chips and parts that are anticipated to draw more buyers.

Latin America's electronic health record market is driven by health care infrastructure development and population growth. While variables such as rising of health consciousness among people are expected to increase rapidly, this will assist Latin America achieve traction in the near future. The Middle East & Africa is gaining a substantial proportion of the worldwide industry for electronic health records. However, the industry is anticipated to grow owing to elevated purchases by personal players in the Middle East & African nations.

Electronic Health Record Market Players

Some of the top electronic health record market companies offered in our report includes CureMD Healthcare, Athenahealth, Inc., Modernizing Medicine, eClinicalWorks, Medical Information Technology, Inc., AdvancedMD, Inc., McKesson Medical-Surgical Inc., Greenway Health, LLC, NextGen Healthcare, Inc., Epic Systems Corporation, and CareCloud, Inc.

Frequently Asked Questions

How big is the electronic health record market?

The electronic health record market size was valued at USD 33.16 billion in 2023.

What is the CAGR of the global electronic health record market from 2024 to 2032?

The CAGR of electronic health record is 6.8% during the analysis period of 2024 to 2032.

Which are the key players in the electronic health record market?

The key players operating in the global market are including CureMD Healthcare, Athenahealth, Inc., Modernizing Medicine, eClinicalWorks, Medical Information Technology, Inc., AdvancedMD, Inc., McKesson Medical-Surgical Inc., Greenway Health, LLC, NextGen Healthcare, Inc., Epic Systems Corporation, and CareCloud, Inc.

Which region dominated the global electronic health record market share?

North America held the dominating position in electronic health record industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of electronic health record during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global electronic health record industry?

The current trends and dynamics in the electronic health record industry include rising adoption of electronic health records (EHRs) for improved patient data management, and government initiatives promoting healthcare digitization and compliance.

Which type held the maximum share in 2023?

The acute type held the maximum share of the electronic health record industry.