Electronic Drug Delivery Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Electronic Drug Delivery Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

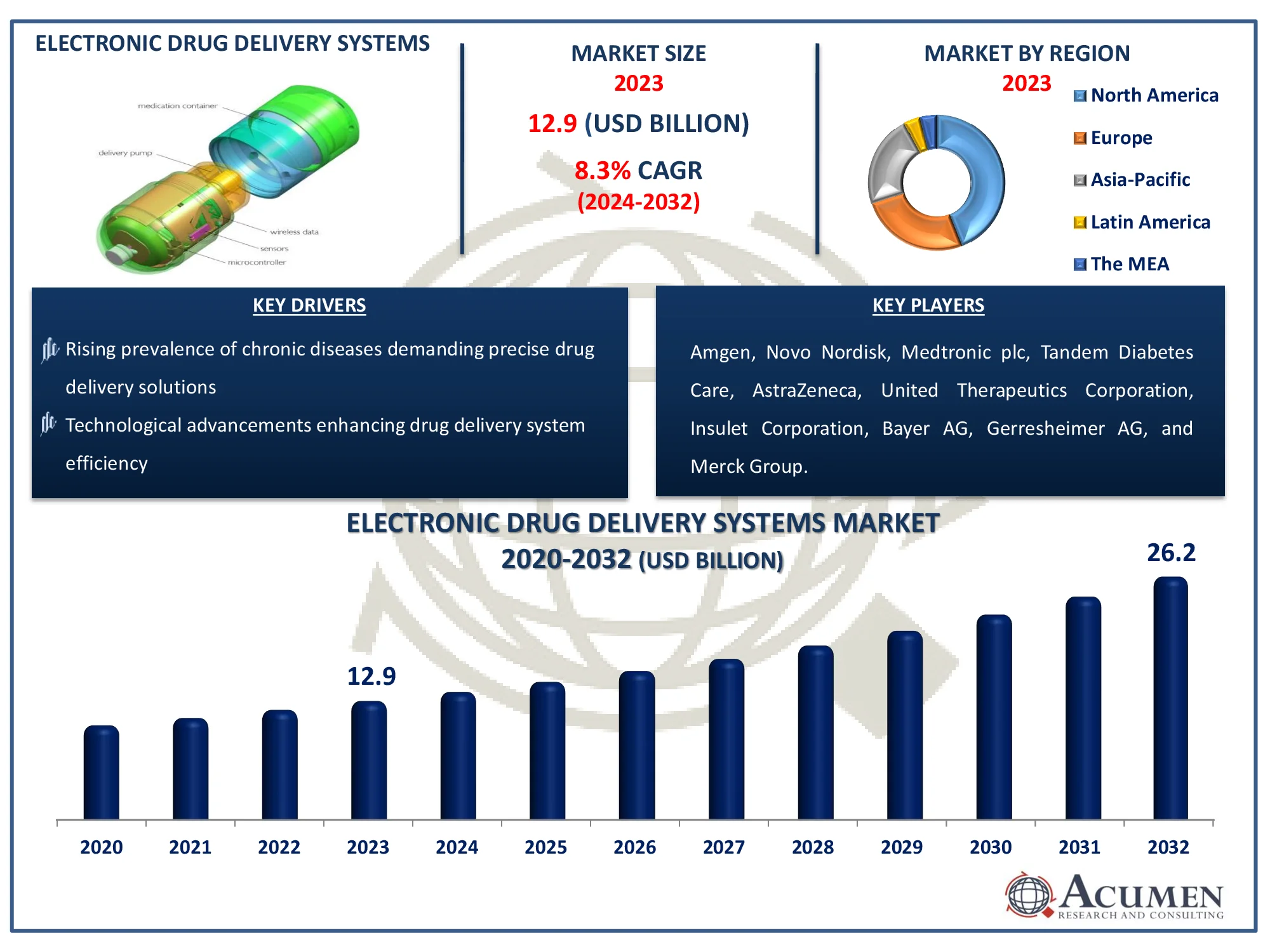

The Global Electronic Drug Delivery Systems Market Size accounted for USD 12.9 Billion in 2023 and is estimated to achieve a market size of USD 26.2 Billion by 2032 growing at a CAGR of 8.3% from 2024 to 2032.

Electronic Drug Delivery Systems Market Highlights

- Global electronic drug delivery systems market revenue is poised to garner USD 26.2 billion by 2032 with a CAGR of 8.3% from 2024 to 2032

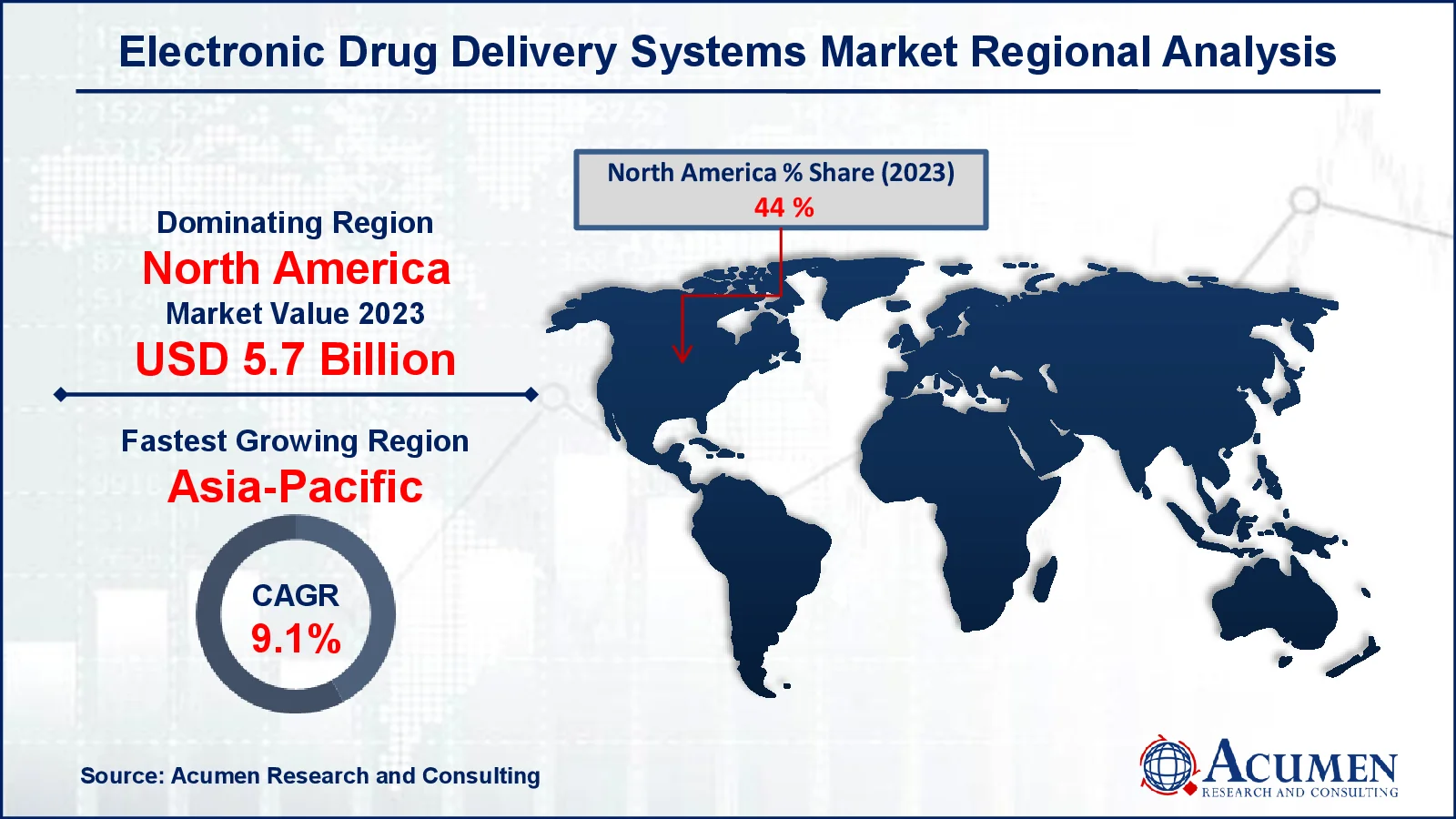

- North America electronic drug delivery systems market value occupied around USD 5.7 billion in 2023

- Asia-Pacific electronic drug delivery systems market growth will record a CAGR of more than 9.1% from 2024 to 2032

- Among indication, the diabetes sub-segment generated more than USD 4.9 billion revenue in 2023

- Based on distribution channel, the retail pharmacies sub-segment generated around 40% electronic drug delivery systems market share in 2023

- Rising demand for home healthcare solutions due to the aging population is a popular electronic drug delivery systems market trend that fuels the industry demand

Electronic drug delivery systems are smart devices that allow the patient to administer medicines in small quantities. These devices add value to traditional and non-automated devices and thereby improve the ease of administration, convenience, and portability. Key electronic drug delivery systems are electronic pens, wearable infusion pumps, electronic inhalers, and electronic autoinjectors. Electronic, wireless connected and smart drug delivery devices are suitable for home applications.

However, their advantages are also valuable within clinic and hospital settings. For instance, timely and appropriate insulin dosing are key concerns in diabetes patients and electronic insulin pen can help patients. Each dose through pen is recorded & logged and programmable dosing help to deliver an accurate amount of insulin after a particular period. Diabetes, cardiovascular diseases, multiple sclerosis, and COPD & asthma are the key indications for electronic drug delivery systems.

Global Electronic Drug Delivery Systems Market Dynamics

Market Drivers

- Rising prevalence of chronic diseases demanding precise drug delivery solutions

- Technological advancements enhancing drug delivery system efficiency

- Increasing adoption of self-administration drug devices among patients

- Growing investment in healthcare infrastructure in emerging economies

Market Restraints

- High costs associated with the development and deployment of electronic drug delivery systems

- Stringent regulatory requirements delaying product approvals

- Limited awareness and accessibility in low-income regions

Market Opportunities

- Expanding applications of wearable drug delivery devices for personalized medicine

- Integration of IoT and AI technologies for smarter and more connected drug delivery systems

- Growth in emerging markets driven by improving healthcare infrastructure and economic conditions

Electronic Drug Delivery Systems Market Report Coverage

| Market | Electronic Drug Delivery Systems Market |

| Electronic Drug Delivery Systems Market Size 2022 |

USD 12.9 Billion |

| Electronic Drug Delivery Systems Market Forecast 2032 | USD 26.2 Billion |

| Electronic Drug Delivery Systems Market CAGR During 2023 - 2032 | 8.3% |

| Electronic Drug Delivery Systems Market Analysis Period | 2020 - 2032 |

| Electronic Drug Delivery Systems Market Base Year |

2023 |

| Electronic Drug Delivery Systems Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product, By Indication, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amgen, Novo Nordisk, Medtronic plc, Tandem Diabetes Care, AstraZeneca, United Therapeutics Corporation, Insulet Corporation, Bayer AG, Gerresheimer AG, and Merck Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Electronic Drug Delivery Systems Market Insights

The electronic drug delivery systems market is rapidly growing, driven mostly by increased demand for technologically advanced solutions. The growing awareness among patients and healthcare providers regarding effective medicine delivery systems, combined with the increasing frequency of chronic diseases, has expedited global adoption of these systems.. Conditions such as cardiovascular disease, diabetes, asthma, and chronic obstructive pulmonary disease (COPD), which are frequently associated with unhealthy lifestyles, highlight the need for accurate and effective drug delivery systems.

Advanced equipment, such as autoinjectors and electronic pumps, play an important role in controlling these chronic conditions by allowing for the delivery of smaller, more exact doses. The market is also being boosted by the approval and commercialization of novel systems that prioritize ease of use and high dosing accuracy, hence increasing treatment outcomes.

However, the electronic drug delivery systems market confronts significant hurdles, such as greater costs for electronic medication delivery systems compared to traditional methods. This financial hurdle is exacerbated by the lack of reimbursement mechanisms in many underdeveloped nations, limiting access to sophisticated technologies. Despite these challenges, the market is likely to grow over the forecast period due to continuing emphasis on technical developments and increased investments in healthcare infrastructure.

Electronic Drug Delivery Systems Market Segmentation

The worldwide market for electronic drug delivery systems is split based on product, indication, distribution channel, and geography.

Electronic Drug Delivery Systems Market By Product

- Electronic Wearable Infusion Pumps

- Electronic Injection Pens

- Electronic Inhalers

- Autoinjectors

According to electronic drug delivery systems industry analysis, by product, electronic wearable infusion pumps are dominating the market in terms of share. The segment is also anticipated to maintain its dominance during the forecast period due to wider availability and high demand from consumers in the market. Presence of various market players and their wide range of commercial products, application of infusion pumps in the delivery of medicine for the treatment of various chronic diseases, and rising awareness are the key factors propelling the segment growth. The pump reduces the risk associated with bolus dosing due to pump failures and also provides a wide range of alerts, notifications, and alarms over currently available other pumps.

Electronic Drug Delivery Systems Market By Indication

- Diabetes

- Cardiovascular Diseases

- Multiple Sclerosis

- COPD & Asthma

The diabetes segment accounted for the largest share of the market in 2023 by indication. Diabetes, cardiovascular diseases, multiple sclerosis, and COPD & asthma are the key segment of the electronic drug delivery systems market by indication. Wider availability of electronic insulin delivery devices, such as insulin pen and pumps, high prevalence of diabetes around the world, and investment by market players for the development and commercialization of devices for diabetes are the key factors responsible for the dominance of the diabetes segment in the market. For instance, according to the World Health Organization, diabetes affects around 830 million individuals globally. Hence, rapidly increasing diabetes and other chronic diseases are likely to propel the electronic drug delivery systems market during the forecast period.

Electronic Drug Delivery Systems Market By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Retail pharmacies account for 40% of the electronic drug delivery systems market due to their accessibility and extensive presence. These pharmacies are frequently the first point of contact for patients, making it easy to purchase prescription and over-the-counter electronic drug delivery devices. Retail pharmacies are trustworthy and dependable, which encourages clients to seek advice and make purchases there. Furthermore, retail pharmacies provide specialized assistance to ensure that customers understand how to use and benefit from this unique technology. Their engagement with healthcare providers and insurance companies allows them to better satisfy the diverse demands of their patients. This dominant position is reinforced by the growing prevalence of chronic diseases that require regular medication and home-based therapy.

Electronic Drug Delivery Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Electronic Drug Delivery Systems Market Regional Analysis

North America region dominated the regional segment in the year 2023 and is also expected to maintain its dominance during the forecast period. This can be attributed to the increasing incidence of chronic diseases in the region. According to the Centers for Disease Control and Prevention (CDC), In the United States, an estimated 129 million people suffer from at least one serious chronic condition (1). Additionally, technological advancement and higher acceptance to the advanced technology, favorable reimbursement scenario, commercialization of various innovative drug delivery systems, and presence of key market players in the region are some of the major factors responsible for the dominance of the region in the market. In June 2018, AbbVie partnered with Eisai to launch an auto injector pen for the Humira drug. The systems come with alert sounds, inspection window, and lock functions.

However, Asia Pacific is anticipated to propel the industry with the fastest rate during the electronic drug delivery systems market forecast period due to presence of large targeted patient population, increasing investment by market players in the region due to supportive government regulations, and presence of emerging economies such as China, Russia, and India. Hence, increasing technological adoption, supportive reimbursement, rising chronic diseases, and commercialization of various devices are the key driving factors for the electronic drug delivery devices across the world.

Electronic Drug Delivery Systems Market Players

Some of the top electronic drug delivery systems companies offered in our report includes Amgen, Novo Nordisk, Medtronic plc, Tandem Diabetes Care, AstraZeneca, United Therapeutics Corporation, Insulet Corporation, Bayer AG, Gerresheimer AG, and Merck Group.

Frequently Asked Questions

How big is the electronic drug delivery systems market?

The electronic drug delivery systems market size was valued at USD 12.9 Billion in 2023.

What is the CAGR of the global electronic drug delivery systems market from 2024 to 2032?

The CAGR of electronic drug delivery systems is 8.3% during the analysis period of 2024 to 2032.

Which are the key players in the electronic drug delivery systems market?

The key players operating in the global market are including Amgen, Novo Nordisk, Medtronic plc, Tandem Diabetes Care, AstraZeneca, United Therapeutics Corporation, Insulet Corporation, Bayer AG, Gerresheimer AG, and Merck Group.

Which region dominated the global electronic drug delivery systems market share?

North America held the dominating position in electronic drug delivery systems industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of electronic drug delivery systems during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global electronic drug delivery systems industry?

The current trends and dynamics in the electronic drug delivery systems industry include rising prevalence of chronic diseases demanding precise drug delivery solutions, and technological advancements enhancing drug delivery system efficiency.

Which distribution channel held the maximum share in 2023?

The retail pharmacies distribution channel held the maximum share of the electronic drug delivery systems industry.