Electronic Adhesives Market | Acumen Research and Consulting

Electronic Adhesives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

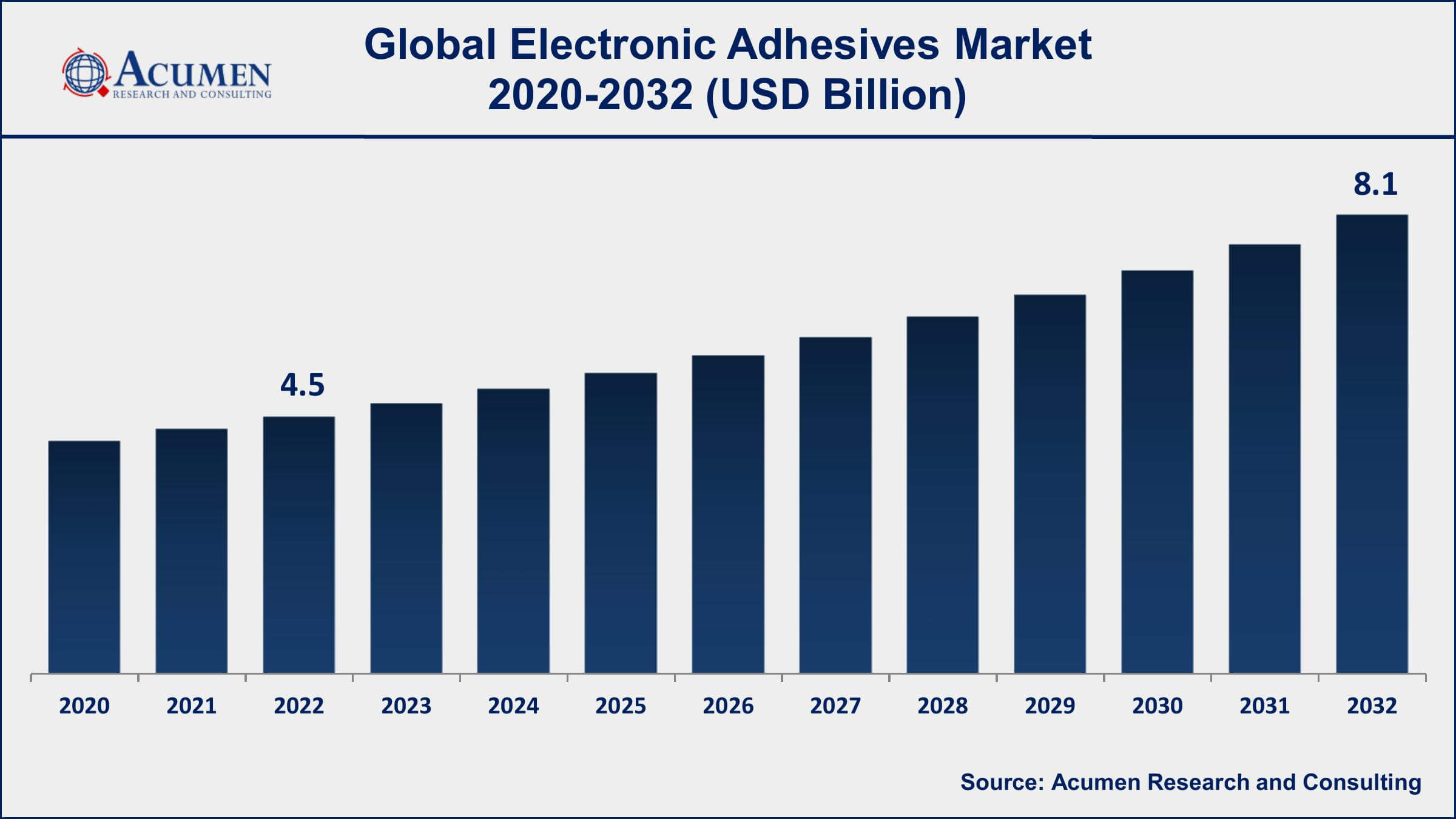

The Global Electronic Adhesives Market Size accounted for USD 4.5 Billion in 2022 and is projected to achieve a market size of USD 8.1 Billion by 2032 growing at a CAGR of 6% from 2023 to 2032.

Electronic Adhesives Market Key Highlights

- Global electronic adhesives market revenue is expected to increase by USD 8.1 Billion by 2032, with a 6% CAGR from 2023 to 2032

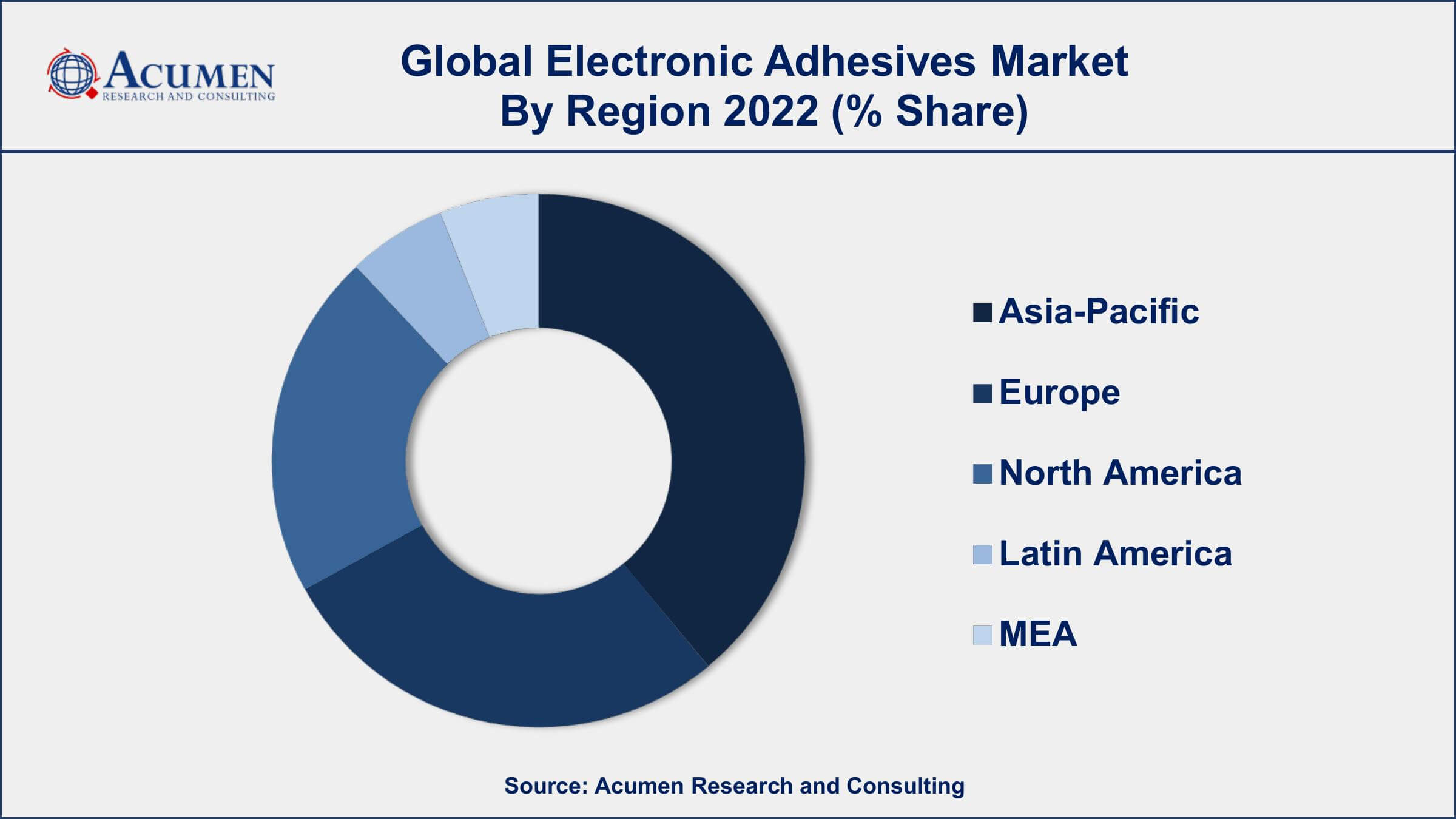

- Asia-Pacific region led with more than 42% of electronic adhesives market share in 2022

- Liquid electronic adhesives are the largest segment, accounting for over 50% of the global market share in 2022

- Epoxy-based electronic adhesives are the largest type of electronic adhesives, accounting for over 35% of the global market share in 2022

- By application, the communication and consumer electronics segment captured the majority of the market

- Increasing demand for consumer electronics, such as smartphones and laptops, drives the electronic adhesives market value

Electronic adhesives are a type of adhesive used in the assembly and packaging of electronic components and devices. They are used to bond substrates, such as printed circuit boards, semiconductors, and other electronic components, together. Electronic adhesives are specifically designed to withstand high temperatures, moisture, and other environmental stresses that can affect the performance and reliability of electronic devices. These adhesives come in various forms, including liquid, paste, and film, and are used in a variety of electronic applications, such as smartphones, laptops, wearables, and automotive electronics.

The global electronic adhesives market is expected to grow at a significant rate in the coming years. The increasing demand for consumer electronics, such as smartphones, tablets, and laptops, is one of the major factors driving the electronic adhesives market growth. The rising adoption of electric and hybrid vehicles is also expected to boost the demand for electronic adhesives in the automotive industry. Furthermore, the growing trend towards miniaturization and the increasing complexity of electronic devices are expected to drive the demand for electronic adhesives with advanced properties such as thermal conductivity and low outgassing.

Global Electronic Adhesives Market Trends

Market Drivers

- Increasing demand for consumer electronics, such as smartphones and laptops

- Growing trend towards miniaturization and increasing complexity of electronic devices

- Rising adoption of electric and hybrid vehicles

- Increasing demand for electronic adhesives with advanced properties such as thermal conductivity and low outgassing

Market Restraints

- Volatility in raw material prices

- Stringent regulations regarding the use of hazardous chemicals in electronic adhesives

Market Opportunities

- Growing demand for electronic adhesives in the healthcare and aerospace industries

- Increasing adoption of wearable devices and IoT technology

Electronic Adhesives Market Report Coverage

| Market | Electronic Adhesives Market |

| Electronic Adhesives Market Size 2022 | USD 4.5 Billion |

| Electronic Adhesives Market Forecast 2032 | USD 8.1 Billion |

| Electronic Adhesives Market CAGR During 2023 - 2032 | 6% |

| Electronic Adhesives Market Analysis Period | 2020 - 2032 |

| Electronic Adhesives Market Base Year | 2022 |

| Electronic Adhesives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Form, By Resin Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Henkel AG & Co. KGaA, H.B. Fuller, 3M Company, Huntsman Corporation, Dow Inc., Dymax Corporation, Panasonic Corporation, LG Chem Ltd., Indium Corporation, Hitachi Chemical Co., Ltd., Master Bond Inc., and Illinois Tool Works Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Electronic adhesives refer to a special type of adhesive chemicals that are generally a part of electronic components usually deployed in the assembly and manufacture of electronic products and circuits. They are majorly used in binding the components of surface mount, wire tacking as well as encapsulating components. Various raw materials utilized in the production of electronic adhesives include epoxies, silicones, polyurethanes, polysulfide, and cyanoacrylate. On the other hand, the miniaturization of existing electronic products leading to increasing usage of adhesives coupled with the rising number of mergers and acquisitions among key companies operating in the electronic adhesives industry are some of the key aspects bolstering the demand for electronic adhesives. In addition, growth in the global automobile industry is further accelerating the overall demand for electronic adhesives across the globe. This is owing to the fact that electronic adhesives find a wide range of applications in engine status displays, collision avoidance systems, anti-theft systems, power electronic modules, and LED packaging among others.

Integration of new and improved solid-state semiconductor technologies, especially in consumer and industrial applications is a key factor likely to augment the market growth in the foreseeable years. Various companies are concentrating on investing more in research and development activities to come up with advanced versions of electronic adhesive products for the use of microelectronic devices in niche application segments. This, in turn, is projected to impel the market growth of the electronic adhesives throughout the forecast period. Also, the rising adoption of electronic components and devices especially in vehicles as well as consumer products is another key factor resulting in the growing consumption of electronic adhesives across the globe. The global electronics adhesives market is further driven by factors such as the increasing inclination of consumers and electronic goods manufacturers towards the use of compact assemblies and components which are relatively less complex in production.

Electronic Adhesives Market Segmentation

The global electronic adhesives market segmentation is based on form, resin type, application, and geography.

Electronic Adhesives Market By Form

- Liquid

- Solid

- Paste

According to the electronic adhesives industry analysis, the liquid segment accounted for the largest market share in 2022. Liquid electronic adhesives are used in a variety of applications, such as surface mounting, wire bonding, and encapsulation. They offer several advantages over other forms of electronic adhesives, such as easy application, good flow properties, and high adhesion strength. The growth of the liquid segment is driven by several factors, such as the increasing demand for consumer electronics, the growing trend towards miniaturization of electronic devices, and the rising adoption of electric and hybrid vehicles. In addition, the increasing complexity of electronic devices and the need for advanced properties such as thermal conductivity and low outgassing are expected to boost the demand for liquid electronic adhesives.

Electronic Adhesives Market By Resin Type

- Epoxy

- Acrylic

- PU

- Silicone

- Others

In terms of resin types, the epoxy segment is expected to witness significant growth in the coming years. Epoxy-based electronic adhesives are widely used in a variety of applications, such as encapsulation, potting, and bonding. They offer several advantages over other types of electronic adhesives, such as high adhesion strength, good chemical resistance, and excellent thermal stability. The growth of the epoxy segment is driven by several factors, such as the increasing demand for consumer electronics, the growing trend towards miniaturization of electronic devices, and the rising adoption of electric and hybrid vehicles. In addition, the need for advanced properties such as thermal conductivity, low outgassing, and high moisture resistance is expected to boost the demand for epoxy-based electronic adhesives.

Electronic Adhesives Market By Application

- Computers & servers

- Consumer Electronics

- Communications

- Automotive

- Industrial

- Medical

- Commercial Aviation

According to the electronic adhesives market forecast, the consumer electronics segment is expected to witness significant growth in the coming years. Consumer electronics refer to electronic devices that are designed for everyday use by individuals, such as smartphones, tablets, laptops, televisions, and gaming consoles. These devices contain a wide range of electronic components, including printed circuit boards, semiconductors, and sensors, which require strong and reliable adhesives for bonding. The growth of the consumer electronics segment is driven by several factors, such as the increasing demand for smart devices, the growing trend towards miniaturization and portability of electronic devices, and the rising disposable income of consumers. In addition, the growing popularity of wearable devices and the adoption of IoT technology are expected to boost the demand for electronic adhesives in the consumer electronics segment.

Electronic Adhesives Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Electronic Adhesives Market Regional Analysis

The Asia-Pacific region is dominating the electronic adhesives market due to the presence of a large number of electronics manufacturing companies in countries such as China, Japan, South Korea, Taiwan, and India. These countries are major producers of electronic devices such as smartphones, laptops, tablets, and other consumer electronics, which are the largest consumers of electronic adhesives. This region is also home to several leading electronic adhesives manufacturers, which have established a strong foothold in the global market. The rapid economic growth and increasing disposable income of consumers in the Asia-Pacific region have resulted in a significant increase in demand for consumer electronics. This, in turn, has led to the growth of the electronic adhesives market in the region. Moreover, the increasing adoption of electric and hybrid vehicles in the region has further boosted the demand for electronic adhesives.

Electronic Adhesives Market Player

Some of the top electronic adhesives market companies offered in the professional report include Henkel AG & Co. KGaA, H.B. Fuller, 3M Company, Huntsman Corporation, Dow Inc., Dymax Corporation, Panasonic Corporation, LG Chem Ltd., Indium Corporation, Hitachi Chemical Co., Ltd., Master Bond Inc., and Illinois Tool Works Inc.

Frequently Asked Questions

What was the market size of the global electronic adhesives in 2022?

The market size of electronic adhesives was USD 4.5 Billion in 2022.

What is the CAGR of the global electronic adhesives market from 2023 to 2032?

The CAGR of electronic adhesives is 6% during the analysis period of 2023 to 2032.

Which are the key players in the electronic adhesives market?

The key players operating in the global market are including Henkel AG & Co. KGaA, H.B. Fuller, 3M Company, Huntsman Corporation, Dow Inc., Dymax Corporation, Panasonic Corporation, LG Chem Ltd., Indium Corporation, Hitachi Chemical Co., Ltd., Master Bond Inc., and Illinois Tool Works Inc.

Which region dominated the global electronic adhesives market share?

Asia-Pacific held the dominating position in electronic adhesives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of electronic adhesives during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global electronic adhesives industry?

The current trends and dynamics in the electronic adhesives industry include increasing demand for consumer electronics, such as smartphones and laptops, and growing trend towards miniaturization and increasing complexity of electronic devices.

Which application held the maximum share in 2022?

The communications application held the maximum share of the electronic adhesives industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date