Electrical Steel Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Electrical Steel Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

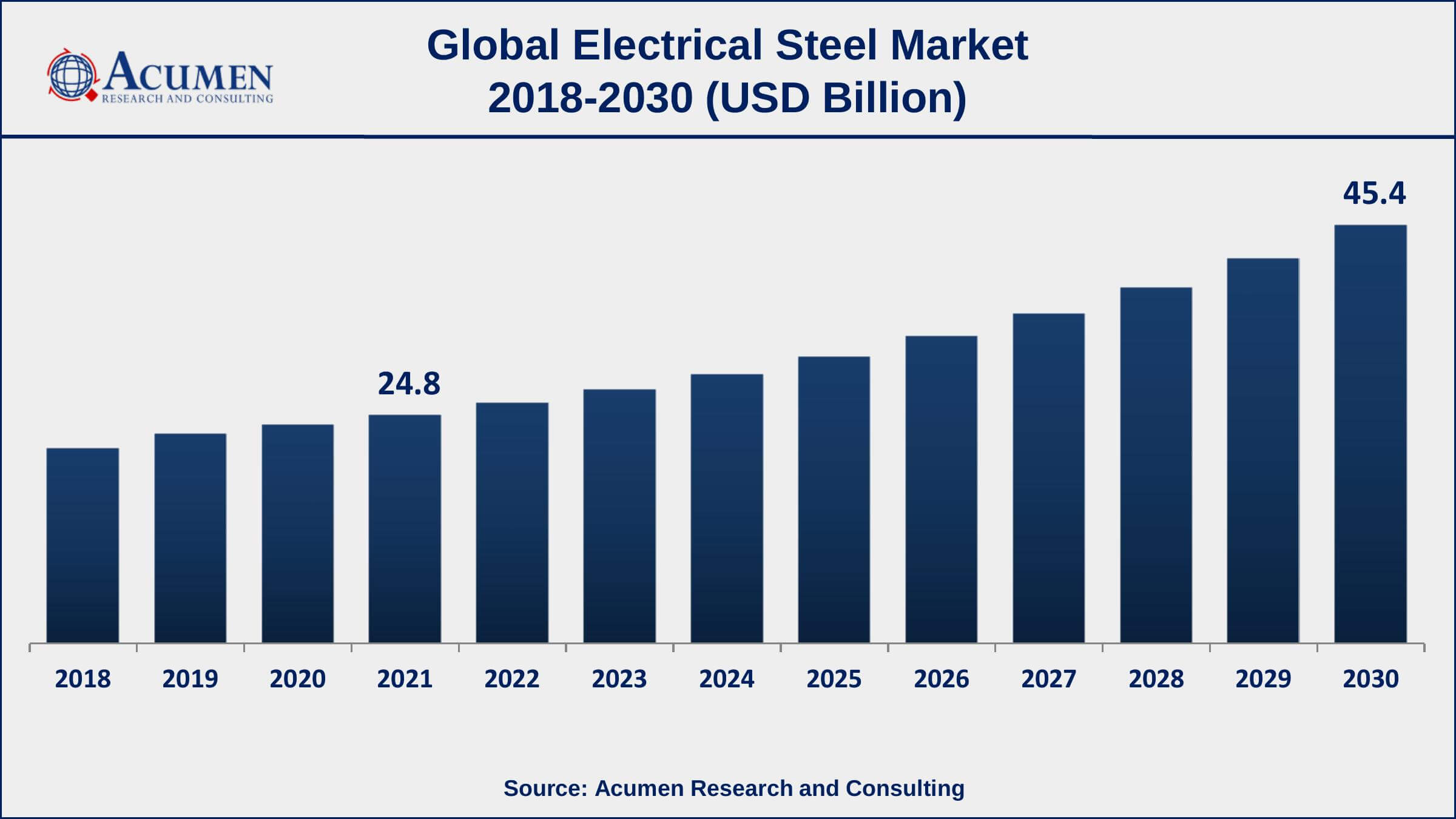

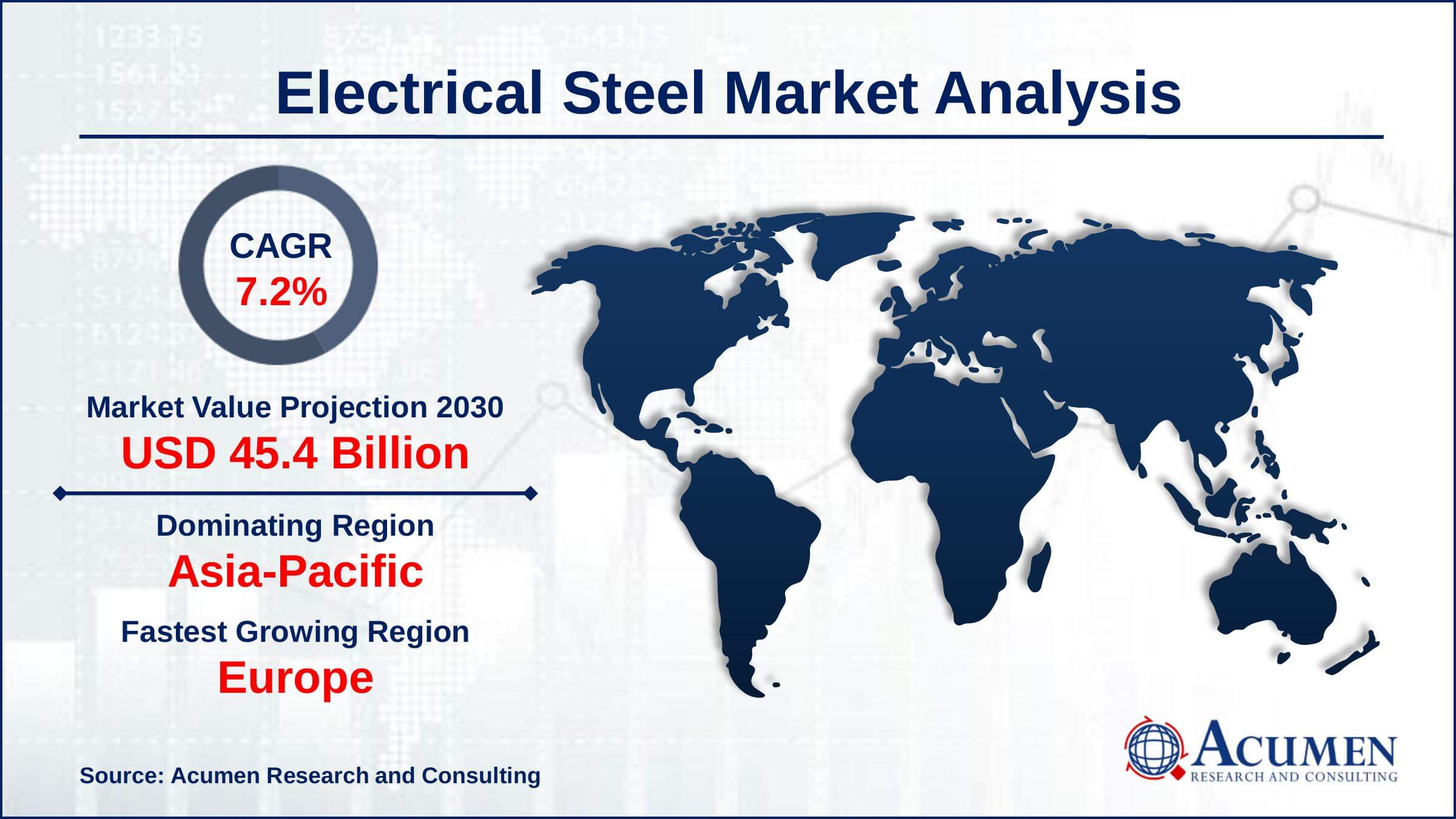

The Global Electrical Steel Market Size accounted for USD 24.8 Billion in 2021 and is estimated to achieve a market size of USD 45.4 Billion by 2030 growing at a CAGR of 7.2% from 2022 to 2030. Rising electricity production globally is one of the major driving factors for the electrical steel market growth. Furthermore, a surge in the use of electric vehicles in the Asia-Pacific and Europe region is likely to aid the growth of the electrical steel market value during the forecast period.

Electrical Steel Market Report Key Highlights

- Global electrical steel market revenue is expected to increase by USD 45.4 billion by 2030, with a 7.2% CAGR from 2022 to 2030

- Asia-Pacific region led with more than 71.5% of electrical steel market share in 2021

- Europe electric steel market growth will observe strongest CAGR from 2022 to 2030

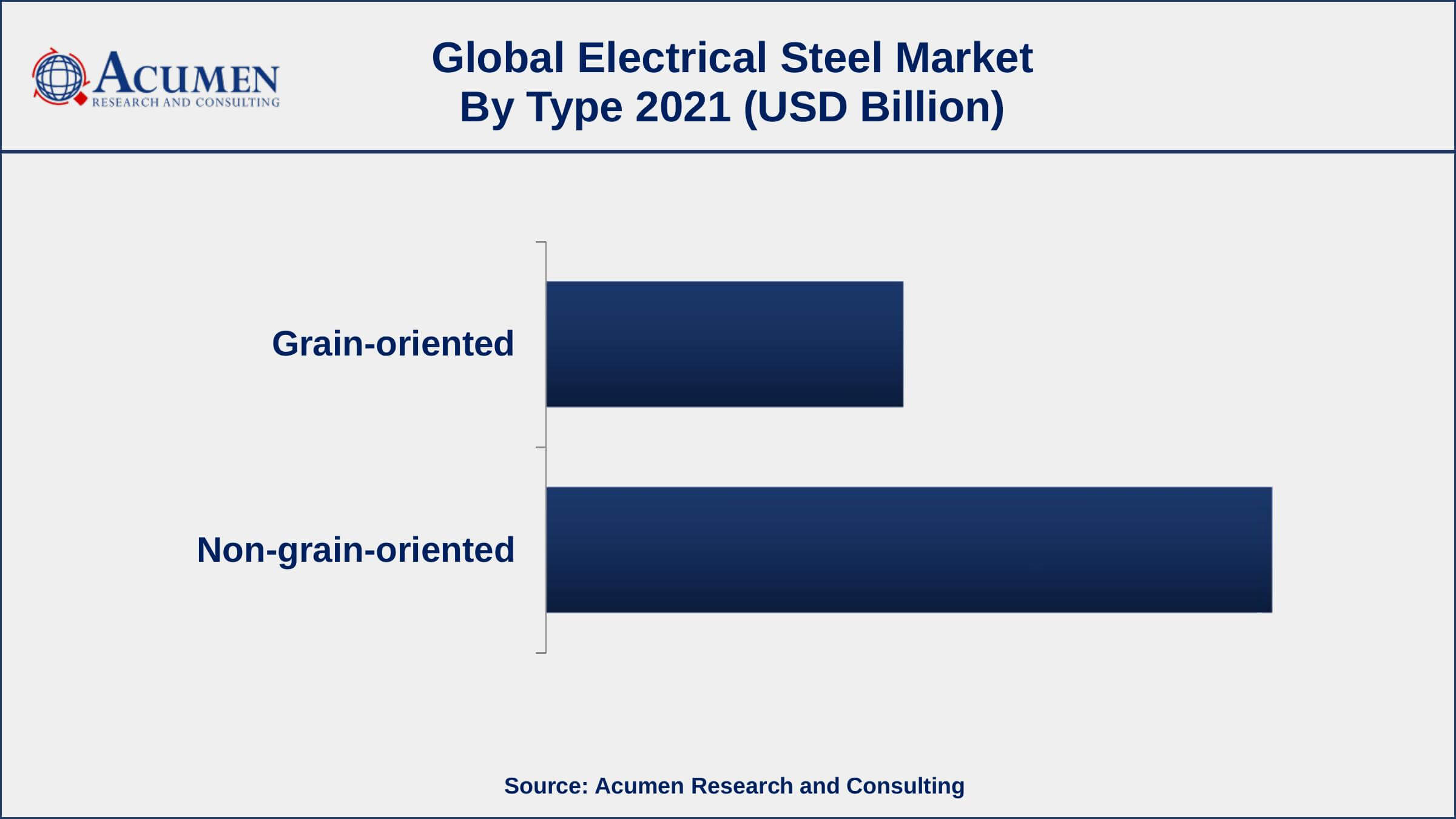

- By type, the non-grain-oriented segment has accounted market share of over 67% in 2021

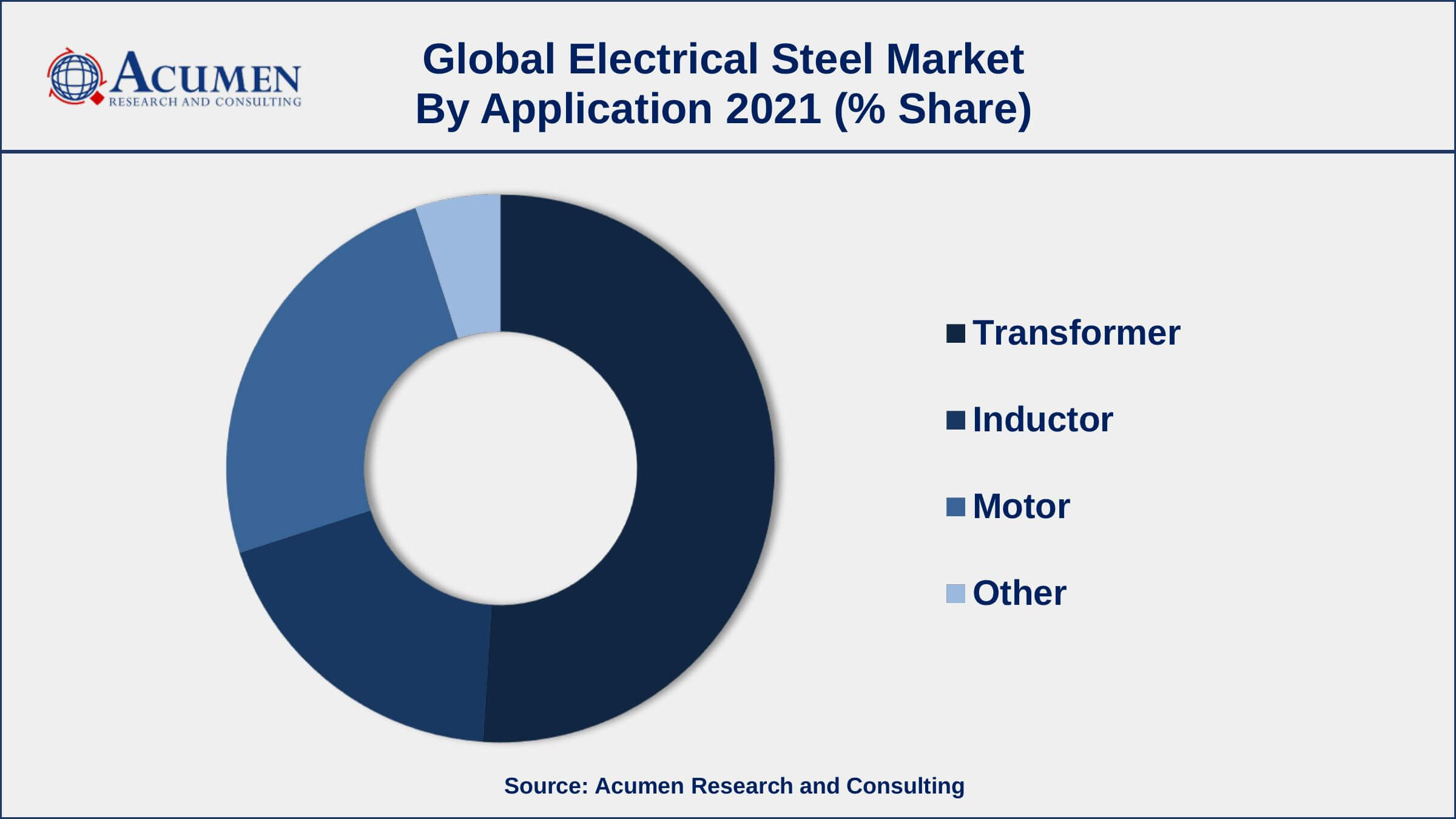

- By application, transformer segment engaged more than 51% of the total market share in 2021

- Rising automobile manufacturing and growing demand for EVs, drives the electrical steel market size

Electrical steel is a specialty steel that is produced by customizing the magnetic properties of usual steel in order to offer high permeability for ensuring low core loss in electrical components. It is used in the production of various devices such as the core of generators, power transformers, and inductors, among others. As silicon is added to electrical steel, it is also called laminate steel. It is mostly used for lamination methods in the cores of electrical components. Electrical steel is generally produced in cold rolled strips.

Global Electrical Steel Market Trends

Market Drivers

- Increased demand from the energy-producing and transmission industries

- Increasing global electricity production

- Growing use in automobile and household products by manufacturers

- Rising deployment of alternative electricity

Market Restraints

- Volatile price of raw materials

- Safety and technical limitations

Market Opportunities

- Increasing reliance on electric cars

- Governments' increased emphasis on energy efficiency

Electrical Steel Market Report Coverage

| Market | Electrical Steel Market |

| Electrical Steel Market Size 2021 | USD 24.8 Billion |

| Electrical Steel Market Forecast 2030 | USD 45.4 Billion |

| Electrical Steel Market CAGR During 2022 - 2030 | 7.2% |

| Electrical Steel Market Analysis Period | 2018 - 2030 |

| Electrical Steel Market Base Year | 2021 |

| Electrical Steel Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Shandong Iron and Steel Group Co Ltd, ArcelorMittal, SAIL, Nippon Steel & Sumitomo Metal Corporation (NSSMC) Group, Tata Steel Limited, Baosteel Group, United States Steel Corporation, JFE Steel Corporation, Shagang Group Inc., Jindal Steel and Power Limited, Ansteel Group Corporation, Voestalpine Group, and HBIS Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Electrical Steel Market Dynamics

Rising investment in infrastructure development, increasing usage of electrical steel in the power industry, escalating demand in high-speed cars, improved per capita electricity consumption, growing urbanization, and technological advancements are some of the key factors that are fueling the electrical steel market growth across the globe. Developed and developing economies are rapidly shifting in the direction of sustainable and efficient energy systems. The electric or hybrid vehicle industry is also growing increasingly. This industry needs high-grade electrical steel for a variety of applications. An increase in the manufacturing of electrical steel is projected to be mainly driven by the development of various application segments. Governments of various economies have implemented various regulations for the usage of transformers in order to reduce the loss of energy and emissions of carbon dioxide.

Furthermore, the demand for transformers is anticipated to increase due to the rapid growth in the global power industry, thereby fueling market growth. Due to the ability to the transmission of power over long distances with minimum energy losses and high power efficiency, the demand for grain-oriented electrical steel is rapidly increasing. Moreover, electrical steel enhances efficiency and minimizes losses in many applications. Increasing investment in infrastructure development is also driving the growth of the global market. Due to the ability to improve efficiency, reduce energy loss, and reduce carbon emissions, electrical steel products are generally used in the power industry, transformers, and high-speed cars. Also, the continuous technological advancements and development of power infrastructure are helping the growth of the global electrical steel market.

Electrical Steel Market Segmentation

The global electrical steel market segmentation is based on type, application, end-user, and geography.

Electrical Steel Market By Type

- Grain-oriented

- Non-grain-oriented

- Fully-Processed

- Semi-Processed

According to the electrical steel market forecast, the grain-oriented electrical steel segment is anticipated to grow the fastest throughout the projected timeline. Grain-oriented electrical steel is primarily used in transformers & electric vehicle charging facilities. It has a strong electromagnetic induction & stacking factor, allowing for less material to be used for the core winding. Its electromagnetic characteristics minimize core losses as well as provide transformers with cost-effective & efficient solutions.

Electrical Steel Market By Application

- Transformer

- Inductor

- Motor

- Other

In terms of applications, the transformer segment leads the market in 2021. Electrical steel is used in power transformers and other electric devices because of its low viscous dissipation, high permeability, & high resistance. It is commonly used to manufacture iron centers for electric engines. The growing complexity of electrical networks, the adoption of EVs, the increase in digital workloads, and the expansion of decentralized generation have all increased the demand for transformers. This section's expansion is primarily related to the high demand for electric steel, which is used in the power generating, transmission, as well as distribution industries.

Electrical Steel Market By End-User

- Energy

- Automotive

- Manufacturing

- Household Appliances

- Others

According to an electrical steel industry analysis, the manufacturing segment is predicted to increase considerably in the market over the next several years. The expansion of this segment is mostly attributed to the factors that the expansion of economies around the world is closely related to the expansion of the manufacturing industry. Furthermore, the increased industrialization of both emerging and developed economies is likely to propel the market even further.

Electrical Steel Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Dominates The Global Electrical Steel Market

In terms of volume and revenue growth, the Asia-Pacific regional market is predicted to grow at the fastest rate. The presence of the biggest market for transmission systems is the cause for the development of the electrical steel industry in the region. Power transformers are in high demand in many Asian countries, including India, China, and Indonesia. India is also predicted to expand at a rapid rate due to a variety of causes such as the rising need for sustainable power, growing energy demand owing to urbanization, and industrialization.

Electrical Steel Market Players

Some of the top electrical steel market companies offered in the professional report include Shandong Iron and Steel Group Co Ltd, ArcelorMittal, SAIL, Nippon Steel & Sumitomo Metal Corporation (NSSMC) Group, Tata Steel Limited, Baosteel Group, United States Steel Corporation, JFE Steel Corporation, Shagang Group Inc., Jindal Steel and Power Limited, Ansteel Group Corporation, Voestalpine Group, and HBIS Group.

Frequently Asked Questions

What is the size of global electrical steel market in 2021?

The estimated value of global electrical steel market in 2021 was accounted to be USD 24.8 Billion.

What is the CAGR of global electrical steel market during forecast period of 2022 to 2030?

The projected CAGR electrical steel market during the analysis period of 2022 to 2030 is 7.2%.

Which are the key players operating in the market?

The prominent players of the global electrical steel market are Shandong Iron and Steel Group Co Ltd, ArcelorMittal, SAIL, Nippon Steel & Sumitomo Metal Corporation (NSSMC) Group, Tata Steel Limited, Baosteel Group, United States Steel Corporation, JFE Steel Corporation, Shagang Group Inc., Jindal Steel and Power Limited, Ansteel Group Corporation, Voestalpine Group, and HBIS Group.

Which region held the dominating position in the global electrical steel market?

Asia-Pacific held the dominating electrical steel market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Europe region exhibited fastest growing CAGR for electrical steel market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global electrical steel market?

Increased demand from the energy-producing and transmission industries and growing global electricity production drives the growth of global electrical steel market.

By application segment, which sub-segment held the maximum share?

Based on application, transformer segment is expected to hold the maximum share of the electrical steel market.