Electric Motor Sales Market | Acumen Research and Consulting

Electric Motor Sales Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format : ![]()

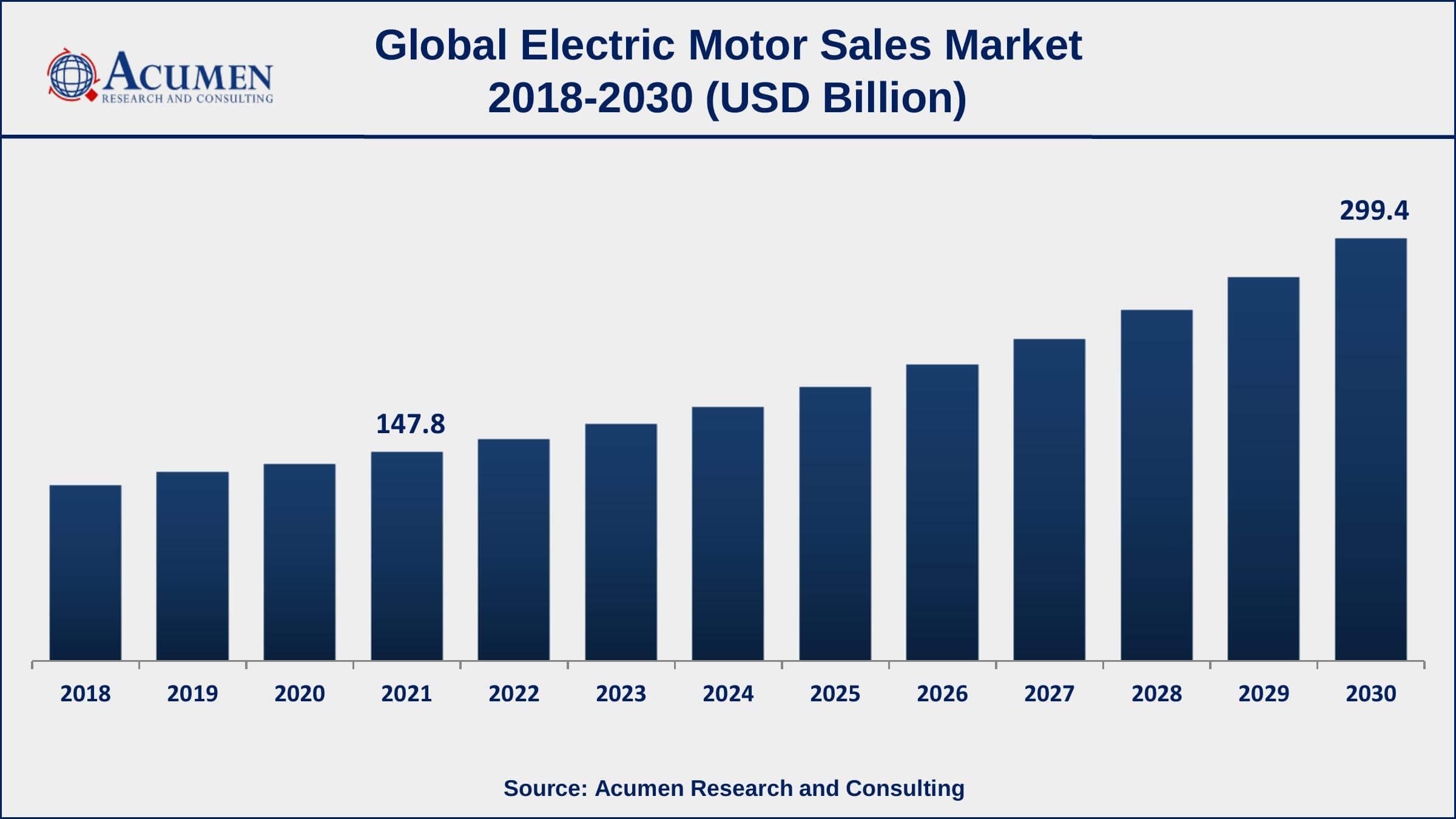

The Global Electric Motor Sales Market Size accounted for USD 147.8 Billion in 2021 and is estimated to achieve a market size of USD 299.4 Billion by 2030 growing at a CAGR of 8.4% from 2022 to 2030. Growing industrialization and urbanization, rapid technical improvement, and rising electric car production are all predicted to drive the electric motor sales market growth. Moreover, consumer spending for energy-efficient electric engines and customized electric motors are two aspects that will influence the expansion of the electric motor sales market value.

Electric Motor Sales Market Report Key Highlights

- Global electric motor sales market revenue is expected to increase by USD 299.4 billion by 2030, with a 8.4% CAGR from 2022 to 2030

- Asia-Pacific region led with more than 48% of electric motor sales market share in 2021

- North America and Europe electric motor market growth will observe strongest CAGR from 2022 to 2030

- By motor type, the AC motor segment has accounted market share of over 69% in 2021

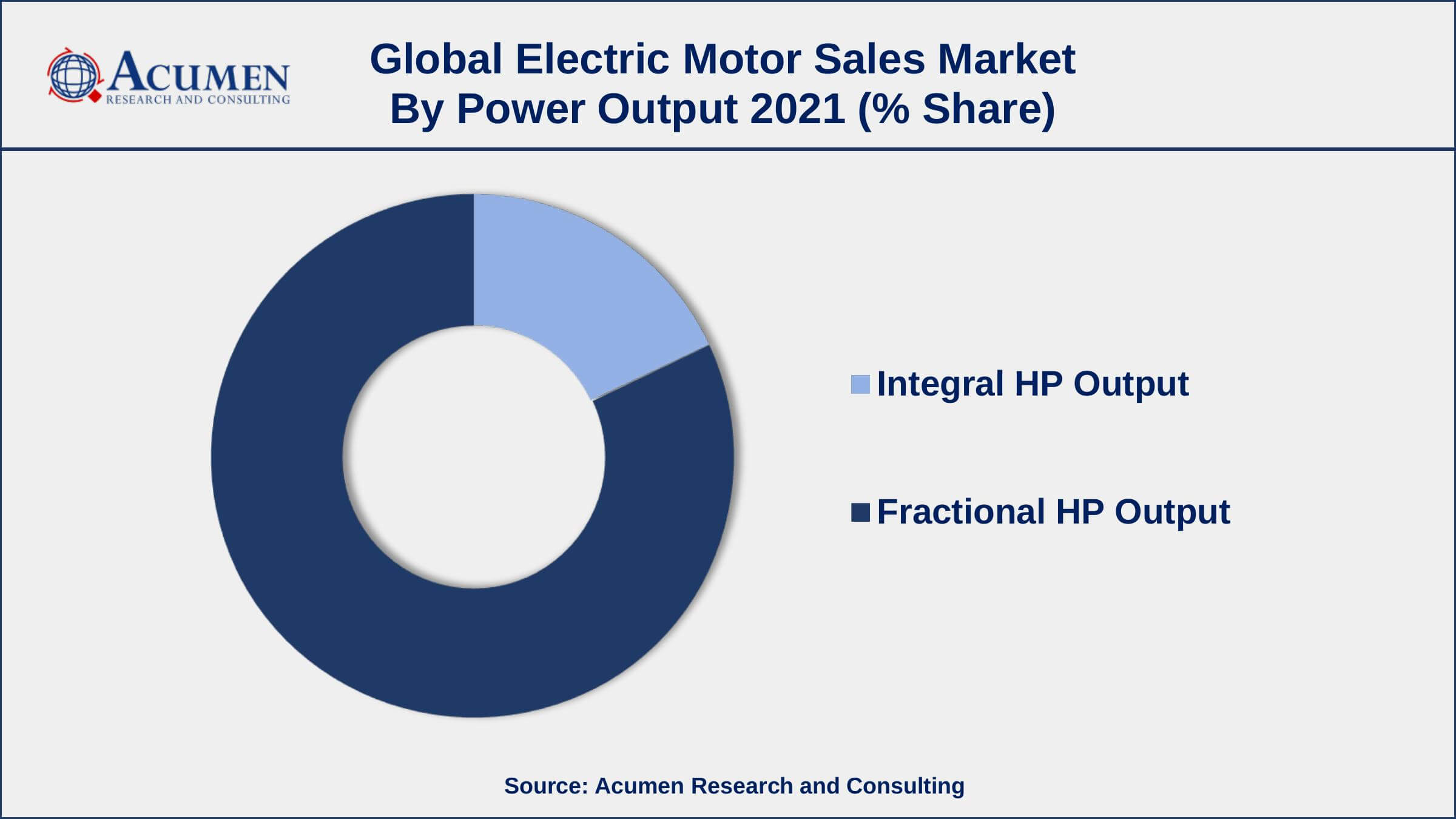

- By power output, fractional HP segment engaged more than 82% of the total market share in 2021

- Rising automobile manufacturing and growing demand for EVs, drives the electric motor sales market size

The electric motor is an electrical device that converts electrical energy into mechanical energy. The electric motor is an indivisible constituent of heating, ventilation, and cooling (HVAC) equipment. Electric motors are also used in several industrial applications such as industrial machinery, home appliance, and motor vehicles among others.

Global Electric Motor Sales Market Trends

Market Drivers

- Rising automobile manufacturing and growing demand for EVs

- Increasing industrialization and urbanization

- Expansion of the agricultural industry

- Growing usage of motor-driven appliances in HVAC & households

Market Restraints

- High initial cost of motors & limited portability

- High maintenance cost of brushed DC motors

Market Opportunities

- Growing demands for application-specific motor

- Increasing adoption of e-mobility

Electric Motor Sales Market Report Coverage

| Market | Electric Motor Sales Market |

| Electric Motor Sales Market Size 2021 | USD 147.8 Billion |

| Electric Motor Sales Market Forecast 2030 | USD 299.4 Billion |

| Electric Motor Sales Market CAGR During 2022 - 2030 | 8.4% |

| Electric Motor Sales Market Analysis Period | 2018 - 2030 |

| Electric Motor Sales Market Base Year | 2021 |

| Electric Motor Sales Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Motor Type, By Power Output, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Allied Motion Technologies, Inc., Franklin Electric Co., Baldor Electric Company, Inc., General Electric Company, Ametek, Inc., Rockwell Automation, Denso Corporation, Siemens, Johnson Electric Holdings Ltd., and Asmo Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Increasing technological advancements, the surge in electric vehicles production, various advantages offered by the electric motor, the rise in awareness towards green vehicles, enhanced insulation and operational efficiency, and growing fuel prices across the globe are some of the key factors that are fueling the electric motor market value across the globe. Rising fuel costs over the globe are forcing individuals to shift to non-traditional fuel options. Electric vehicles are manufactured in order to reduce the overall operational costs and carbon footprint. An increase in electric vehicle production is anticipated to boost the demand for electric motors. Also, electric motors are used in performance components in order to console the components of the vehicle. Moreover, a growing number of government incentives in order to promote green vehicles sale for the protection of the environment from carbon emissions is playing a key factor drive the global electric motor market size.

The safety and functionalities of motors are improved with enhanced operational efficiency and insulation, resulting in the increased demand for electric motors across various industries. Rapid technological advancement is gaining traction in the market. The demand for electric motors is rapidly increasing in various countries, such as India, Brazil, Sri Lanka, Vietnam, and Argentina as they have an extensive population relying on agriculture. Hence, the demand for energy-efficient and cost-effective products has increased in these countries. An increase in electric vehicle production is anticipated to boost the demand for electric motors market revenue. Additionally, the environmental advantages provided by electric motors are increasing the penetration of electric motors in electric vehicles, thereby supplementing the overall market growth. Electric vehicles are manufactured in order to reduce the overall operational costs and carbon footprint. The growing adoption of energy-efficient products in agricultural and industrial sectors is further boosting the electric motor market share.

Electric Motor Sales Market Segmentation

The global electric motor sales market segmentation is based on motor type, power output, application, and geography.

Electric Motor Sales Market By Motor Type

- AC Motor

- Induction AC Motor

- Synchronous AC Motor

- DC Motor

- Brushed DC Motor

- Brushless DC Motor

- Hermetic Motor

According to an electric motor sales industry analysis, the AC motor segment lead the market in 2021. This large proportion is due to the wide range of uses for AC motors, which include irrigation pumps and sophisticated robots. Moreover, they are compact, less expensive, and more light in weight, and they are widely employed in HVAC equipment. Due to the development of extremely cost-effective and inexpensive electronics, as well as advancements in permanent magnetic materials, the popularity of electric AC motors in the automobile industry has expanded tremendously.

Electric Motor Sales Market By Power Output

- Integral HP Output

- Fractional HP Output

In terms of power outputs, the fractional horsepower segment held the largest market share in 2021. This large proportion is due to its vast range of applications in various domestic appliances, from vacuums to coffee makers and freezers. They are also widely used in industrial machinery since they are appropriate for hard industrial applications. These electric motors have numerous benefits, particularly high starting power and stability against changes in electric current.

Electric Motor Sales Market By Application

- Industrial Machinery

- HVAC Equipment

- Motor Vehicles

- Household Appliances

- Aerospace & Transportation

- Others

According to the electric motor sales market forecast, the industrial machinery segment would dominate the market and grow significantly in the coming years. Electric motors are utilized in compressors, pumping systems, and other turbocharger machinery for the processing and manufacturing of products in a wide range of industries, including chemicals, natural gas production, metallurgy, mines, as well as the beverage and food industries.

Electric Motor Sales Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Dominates The Global Electric Motor Sales Market

The Asia-Pacific region dominates the global electric motors market and is likely to maintain its leadership in the next few years due to significant industrial growth. The region is witnessing continuous growth in sectors including the automotive, chemical, fertilizer, & petrochemical industries, which is anticipated to present enormous potential opportunities for worldwide electric motor companies. China has played a significant role in propelling the global industrial industry. The country leads the world in chemical, electricity, steel, and cements manufacturing, and it is a major player in petroleum and petroleum products. A number of brand-new industrial applications are being considered for inclusion in the nation's manufacturing portfolio.

Electric Motor Sales Market Players

Some of the top electric motor sales market companies offered in the professional report include Allied Motion Technologies, Inc., Franklin Electric Co., Baldor Electric Company, Inc., General Electric Company, Ametek, Inc., Rockwell Automation, Denso Corporation, Siemens, Johnson Electric Holdings Ltd., and Asmo Co., Ltd.

Frequently Asked Questions

What is the size of global electric motor sales market in 2021?

The estimated value of global electric motor sales market in 2021 was accounted to be USD 147.8 Billion.

What is the CAGR of global electric motor sales market during forecast period of 2022 to 2030?

The projected CAGR electric motor sales market during the analysis period of 2022 to 2030 is 8.4%.

Which are the key players operating in the market?

The prominent players of the global electric motor sales market are Allied Motion Technologies, Inc., Franklin Electric Co., Baldor Electric Company, Inc., General Electric Company, Ametek, Inc., Rockwell Automation, Denso Corporation, Siemens, Johnson Electric Holdings Ltd., and Asmo Co., Ltd.

Which region held the dominating position in the global electric motor sales market?

Asia-Pacific held the dominating electric motor sales market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for electric motor sales market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global electric motor sales market?

Increasing industrialization and urbanization, and rising automobile manufacturing and growing demand for EVs drives the growth of global electric motor sales market.

By Power Output segment, which sub-segment held the maximum share?

Based on power output, fractional HP output segment is expected to hold the maximum share of the electric motor sales market.