Electric Motor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

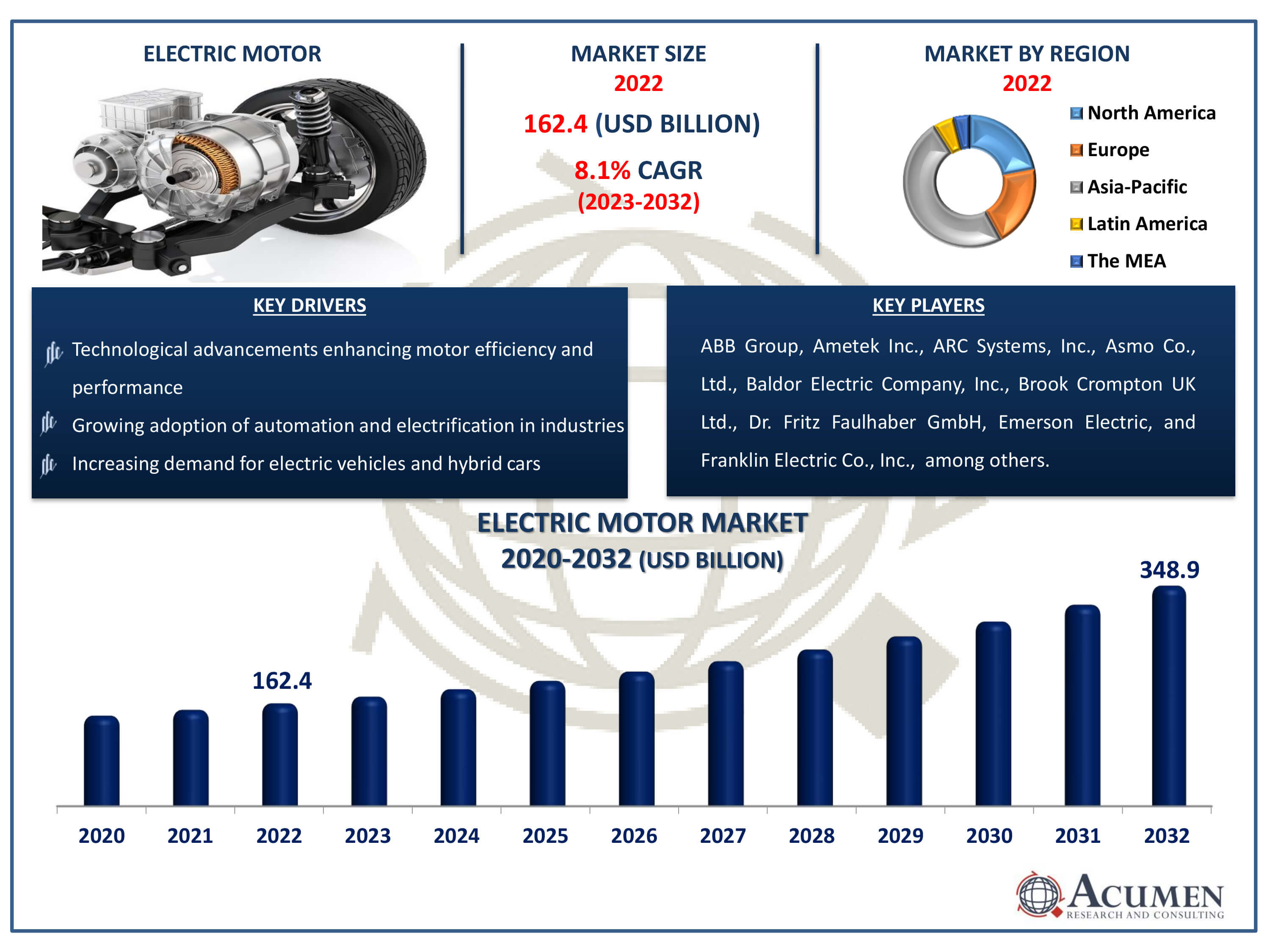

The Electric Motor Market Size accounted for USD 162.4 Billion in 2022 and is estimated to achieve a market size of USD 348.9 Billion by 2032 growing at a CAGR of 8.1% from 2023 to 2032.

Electric Motor Market Highlights

- Global electric motor market revenue is poised to garner USD 348.9 billion by 2032 with a CAGR of 8.1% from 2023 to 2032

- Asia-Pacific electric motor market value occupied around USD 79.5 billion in 2022

- North America electric motor market growth will record a CAGR of more than 9% from 2023 to 2032

- Among type, the AC motors sub-segment generated more than USD 115.3 billion revenue in 2022

- Based on power output, the fractional HP output sub-segment generated around 86% market share in 2022

- Development of innovative motor technologies for niche applications is a popular electric motor market trend that fuels the industry demand

An electro-mechanical device, an electric motor uses the interaction of magnetic and electric fields to transform electrical energy into mechanical energy. AC motors and DC motors are the two primary categories of electric motors. DC motors run on direct current, whereas AC motors use alternating current. A number of factors are contributing to the huge growth of the electric motor market. Electric motors are becoming more and more popular than traditional combustion engines due to their increased motor efficiency, energy savings, and environmental considerations. Furthermore, the market is expanding due to the growing tendency in industries towards electrification and automation. In the electric motor market forecast period, it is anticipated that government programs promoting renewable energy sources and electric vehicles would open up profitable opportunities for the electric motor business.

Global Electric Motor Market Dynamics

Market Drivers

- Increasing demand for electric vehicles and hybrid cars

- Growing adoption of automation and electrification in industries

- Emphasis on energy efficiency and environmental sustainability

- Technological advancements enhancing motor efficiency and performance

Market Restraints

- High initial investment costs for electric motor adoption

- Limited infrastructure for charging electric vehicles

- Challenges in recycling and disposal of electric motor components

Market Opportunities

- Government incentives and subsidies for electric vehicle adoption

- Expansion of renewable energy sources driving demand for electric motors

- Rising awareness and consumer preference for sustainable transportation solutions

Electric Motor Market Report Coverage

| Market | Electric Motor Market |

| Electric Motor Market Size 2022 | USD 162.4 Billion |

| Electric Motor Market Forecast 2032 | USD 348.9 Billion |

| Electric Motor Market CAGR During 2023 - 2032 | 8.1% |

| Electric Motor Market Analysis Period | 2020 - 2032 |

| Electric Motor Market Base Year |

2022 |

| Electric Motor Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Type, By Power Output, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABB Group, Ametek Inc., ARC Systems, Inc., Asmo Co., Ltd., Baldor Electric Company, Inc., Brook Crompton UK Ltd., Dr. Fritz Faulhaber GmbH, Emerson Electric, Franklin Electric Co., Inc., Maxon Motors AG, Regal Beloit Corporation, Rockwell Automation, Inc., and Siemens AG |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Electric Motor Market Insights

The increasing usage of electric motors across major industries, particularly in automobile production, is driving the market value. The growing commercial and residential sectors, coupled with the rising demand for HVAC (Heating, Ventilation, and Air Conditioning) applications and motor-driven household appliances, are accelerating the market value. The rapid growth in the agricultural sector and the transition toward energy-efficient motors further support the market value. Meanwhile, expanding demand for electric vehicles in emerging economies and the growing robotics technology across the globe are likely to create potential opportunities over the electric motor industry forecast period from 2023 to 2032

Throughout the projected period, brushed DC motors' high maintenance costs will likely be a major barrier to market expansion. In order to transport electrical current to the rotor, brushed DC motors use brushes and a commutator, which over time causes wear and tear. Periodic replacement of these brushes is necessary, which raises maintenance costs and causes user downtime. Furthermore, when the brushes are in use, they produce heat and friction, which might lower the motor's dependability and efficiency. Because they require less maintenance and have longer operating lifespans, alternative motor technologies including brushless DC motors and AC induction motors are a good choice for industries and applications that demand high performance and continuous operation. The difficulty for makers of brushed DC motors to maintain their competitiveness in the market is further increased by the potential long-term cost savings associated with these alternative motors, which may offset their higher initial cost.

Electric Motor Market Segmentation

The worldwide market for electric motor is split based on component, type, power output, application, and geography.

Electric Motor Components

- Rotor

- Stator

- Bearings

- Frame

- End-bracket

- Others

According to electric motor industry analysis, owing to its vital function in transforming electrical energy into mechanical energy, the rotor sector is gaining the greatest share of the market. In order to provide the rotational motion needed for a variety of applications across industries, the rotor, the motor's moving part, works with the stator. Further propelling its widespread acceptance are improvements in motor performance, efficiency, and dependability brought about by developments in rotor design, materials, and manufacturing techniques. Further strengthening this segment's market domination are advancements in rotor technology, such as the creation of permanent magnet rotors and high-efficiency designs. The need for superior rotors is growing, emphasizing their role as a major growth driver in the electric motor market as industries place a premium on energy economy and operational excellence.

Electric Motor Types

- AC Motors

- DC Motors

- Hermetic Motor

The AC motors category leads the electric motor market because of its broad application in a variety of sectors and end-use situations. Strongness, dependability, and affordability are just a few of the benefits that make AC motors the ideal option for a variety of applications. Furthermore, AC motors suit a variety of needs in the commercial, residential, and industrial domains thanks to their exceptional performance traits, which include high torque, efficiency, and speed control skills. Their dominance in the industry is further supported by developments in AC motor technology, such as sensor less vector control and variable frequency drives, which further increase their efficiency and adaptability. The need for AC motors is anticipated to be high, maintaining their dominant position in the electric motor industry as long as industries continue to place a high priority on sustainability and energy efficiency.

Electric Motor Power Outputs

- Integral HP Output

- Fractional HP Output

The market for electric motors is dominated by the fractional HP output category because of its broad use across many sectors. These motors, typically ranging from a few watts to a few horsepower, find broad application in various consumer appliances, HVAC systems, pumps, fans, and small industrial. Their small size, affordability, and adaptability make them very popular for jobs requiring a moderate power output. Furthermore, fractional HP motors' increased performance and efficiency as a result of technological and design breakthroughs have cemented their position as the industry standard for a wide range of industrial and commercial applications.

Electric Motor Applications

- Industrial Machinery

- Motor Vehicles

- HVAC Equipment

- Aerospace & Transportation

- Household Appliances

- Others

By application, the motor vehicle segment registered the maximum share in 2022 and is projected to maintain its dominance over the estimated period from 2023 to 2032. The increasing investment in electric vehicles and the automobile industry is primarily driving the market value. Furthermore, the inclination towards energy-efficient solutions in the automobile sector of emerging economies is further supporting the market value.

Electric Motor Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Electric Motor Market Regional Analysis

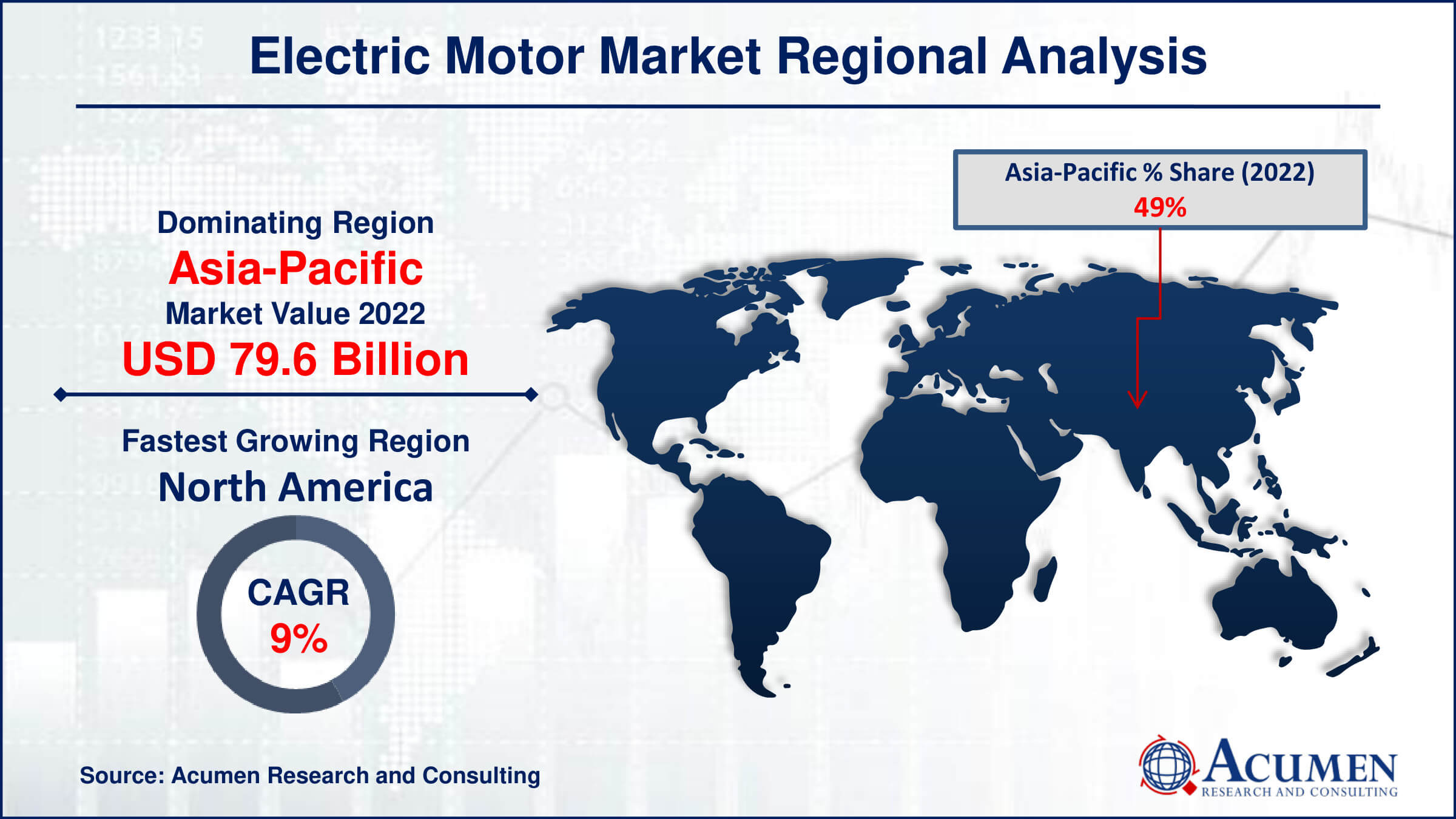

In terms of electric motor market analysis, Asia-Pacific led in 2022 in terms of value and is expected to maintain its dominance from 2023 to 2032. The region, driven by emerging economies like China and India, experiences rapid industrialization, rising disposable income, and commercial sector expansion. Increasing demand for electric vehicles and manufacturers' focus further accelerate regional market growth, supported by favorable government policies.

North America emerges as the fastest-growing region in the electric motor market. Technological innovations in automotive and manufacturing sectors are propelling the adoption of electric vehicles and industrial automation, driving the need for electric motors. Additionally, the region's increasing focus on sustainability and government support through regulations and incentives further stimulate market expansion. With its strong industrial base and technological advancement, North America is positioned to sustain the electric motor market's growth.

Electric Motor Market Players

Some of the top electric motor companies offered in our report includes ABB Group, Ametek Inc., ARC Systems, Inc., Asmo Co., Ltd., Baldor Electric Company, Inc., Brook Crompton UK Ltd., Dr. Fritz Faulhaber GmbH, Emerson Electric, Franklin Electric Co., Inc., Maxon Motors AG, Regal Beloit Corporation, Rockwell Automation, Inc., and Siemens AG.

Frequently Asked Questions

How big is the electric motor market?

The electric motor market size was valued at USD 162.4 billion in 2022.

What is the CAGR of the global electric motor market from 2023 to 2032?

The CAGR of electric motor is 8.1% during the analysis period of 2023 to 2032.

Which are the key players in the electric motor market?

The key players operating in the global market are including ABB Group, Ametek Inc., ARC Systems, Inc., Asmo Co., Ltd., Baldor Electric Company, Inc., Brook Crompton UK Ltd., Dr. Fritz Faulhaber GmbH, Emerson Electric, Franklin Electric Co., Inc., Maxon Motors AG, Regal Beloit Corporation, Rockwell Automation, Inc., and Siemens AG

Which region dominated the global electric motor market share?

Asia-Pacific held the dominating position in electric motor industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of electric motor during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global electric motor industry?

The current trends and dynamics in the electric motor industry include increasing demand for electric vehicles and hybrid cars, and growing adoption of automation and electrification in industries, and emphasis on energy efficiency and environmental sustainability, and technological advancements enhancing motor efficiency and performance.

Which type held the maximum share in 2022?

The AC motors type the maximum share of the electric motor industry.