Elderly And Disabled Assistive Devices Market | Acumen Research and Consulting

Elderly and Disabled Assistive Devices Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

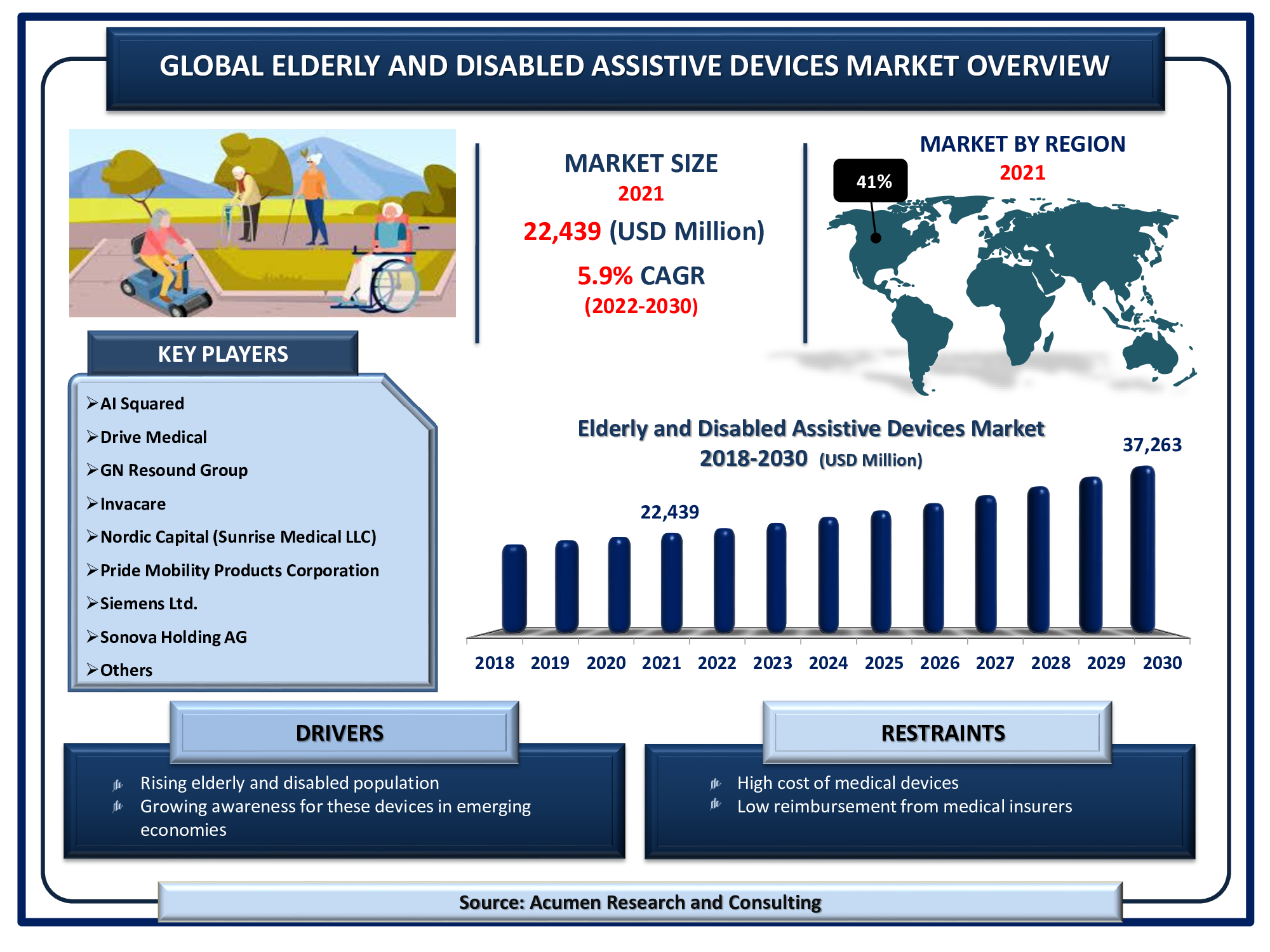

The Global Elderly and Disabled Assistive Devices Market Size is valued at USD 22,439 Million in 2021 and is projected to reach a market size of USD 37,263 Million by 2030; growing at a CAGR of 5.9%.

Technological advancement in assistive devices is one of the trends in the elderly and disabled assistive devices market that is fueling industry demand from 2022 to 2030. The growing awareness of these devices is expected to boost the elderly and disabled assistive devices market value. According to the World Health Organization (WHO), assistive devices are those that help people maintain or improve their functioning and independence in order to improve their overall well-being. Assistive devices can greatly improve an elderly or disabled person’s lifestyle by making daily tasks easier. This factor will significantly fuel the demand for this technology.

Global Elderly and Disabled Assistive Devices Market DRO’s:

Market Drivers:

- Rising elderly and disabled population

- Growing awareness for these devices in emerging economies

- Increasing disposable income of baby boomers

Market Restraints:

- High cost of medical devices

- Lack of reimbursement policies from medical insurers

Market Opportunities:

- Technological advancements in these devices

- Extensive demand from emerging markets

Report Coverage

| Market | Elderly and Disabled Assistive Devices Market |

| Market Size 2021 | USD 22,439 Million |

| Market Forecast 2030 | USD 37,263 Million |

| CAGR During 2022 - 2030 | 5.9% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sonova Holding AG, Invacare, AI Squared, Pride Mobility Products Corporation, Drive Medical, Starkey hearing technologies, GN Resound Group, Siemens Ltd., Nordic Capital (Sunrise Medical LLC), William Demant Holding A/S. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

The growing number of elderly people who need help walking, standing, and performing a variety of tasks is the primary driver of the global elderly assistive devices market. As people age, their ability to live independently may deteriorate. Although the vast majority of the elderly prefer to age in place, many will struggle with daily activities and tasks. To care for themselves, maintain mobility, communicate, and stay safe, older adults require assistance. This assistance helps to improve or restore confidence, self-esteem, and independence.

Assistive devices are primarily required by people with disabilities, fueling the growth of the disabled assistive devices market. People with disabilities may require mobility assistance. Walkers, wheelchairs, prosthetic devices, canes, and crutches are examples of mobility aids. This industry's research and development has also resulted in communication aids for people who are unable to speak. Speech recognition software and speech-generating devices are greatly assisting these people in expressing themselves.

The increasing presence of disabled people in workplaces has prompted industry leaders to develop advanced equipment that allows any type of disabled person to learn and work in a stressful environment. Screen readers, adaptive keyboards, augmentative and alternative communication (AAC) tools, braille display, dictation software, electronic magnifiers, and optical character recognition software (OCR), among other advanced assistive technologies, have helped students and professionals perform daily activities.

The increasing disposable income of baby boomers allows them to acquire the latest and best-fitting devices for their disabilities. Some of the most recent assistive devices are costly, making them out of reach for some elderly or disabled people. However, many baby boomers (aged 57 to 75) have enough disposable income to afford them. Many international and national governments are assisting the elderly and disabled who have limited income and cannot afford an assistive device. For example, the Assistive Devices Program (ADP) pays up to 75% of the cost of a device such as a wheelchair, orthopedic brace, or breathing aid. ADP also contributes a set amount to devices such as hearing aids. In this way, many government organizations are assisting the elderly and disabled, thereby fueling the industry of assistive devices for the elderly and physically disabled.

Elderly and Disabled Assistive Devices Market Segmentation

The worldwide elderly and disabled assistive devices market is split based on type, end-user, and geography.

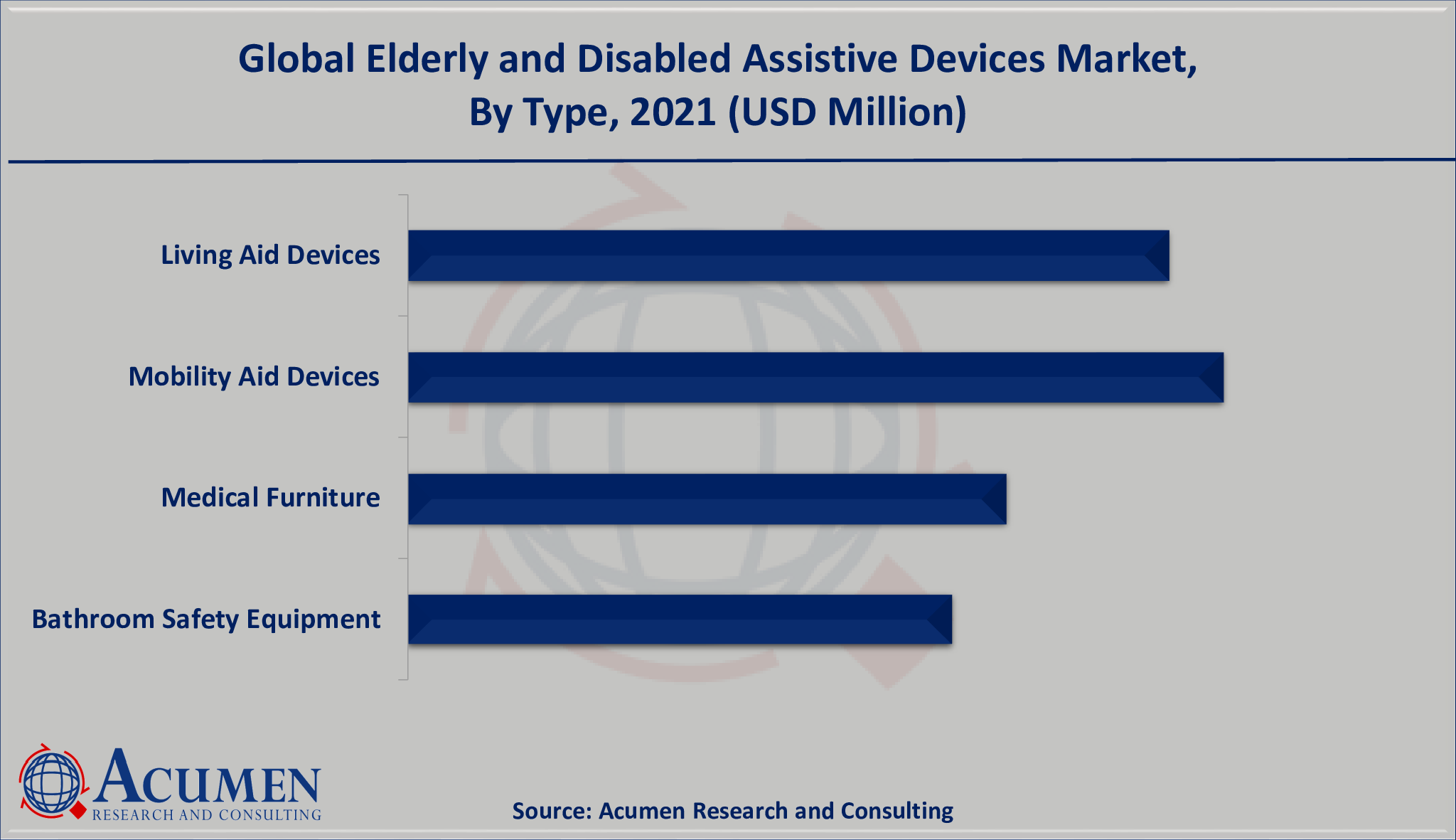

Market by Type

Living Aids Devices

- Hearing Aids

- BAHA (Bone Anchored Hearing Aids)

- BTE (Behind-the-ear) Aids

- Canal Hearing Aids

- Cochlear Implants

- ITE (In-the-Ear) Aids

- RITE (Receiver-in-the-Ear) Aids

- Reading and Vision Aids

- Braille Translators

- Reading Machines

- Video Magnifiers

- Others

Mobility Aids Devices

- Wheelchairs

- Manual Wheelchairs

- Powered Wheelchairs

- Mobility Scooters

- Crutches and Cranes

- Patient Mechanical Lift Handling

- Walkers and Rollators

- Others

Medical Furniture

- Door Openers

- Medical Beds

- Riser Reclining Chairs

- Others

Bathroom Safety Equipment

- Bars, Grips, and Rails

- Commode Chairs

- Ostomy Equipment

- Shower Chairs

According to our elderly and disabled assistive devices market forecast, mobility aids will have a significant market share from 2022 to 2030. According to WHO statistics, more than 7 million community-dwelling Americans use mobility devices such as canes, walkers, and crutches, with two-thirds of those people being over the age of 65. With an increasing number of older adults in the community and an increasing number of those adults suffering from multiple chronic disorders, disability, and the resulting mobility issues are expected to become more common. According to the American Academy of Family Physicians data, over 1.8 million people use wheelchairs or scooters, with another 6.2 million using walkers, cranes, or crutches.

Market by End-User

- Hospitals

- Homecare

- Nursing Homes

- Assisted Living Facilities

Among all end-users, hospitals had the highest market share for elderly and disabled assistive devices. Hospitalized assistive technology devices, such as therapeutic intervention equipment and diagnostic equipment, are modified to be used only in the hospital setting. The hospital assistive devices are intended to assist the patient with everyday routines in the hospital. Furthermore, these hospitalized devices are used by healthcare professionals to detect and diagnose diseases. The homecare elderly and disabled assistive devices sub-segment, on the other hand, is expected to grow at the fastest rate during the forecast timeframe of 2022 to 2030.

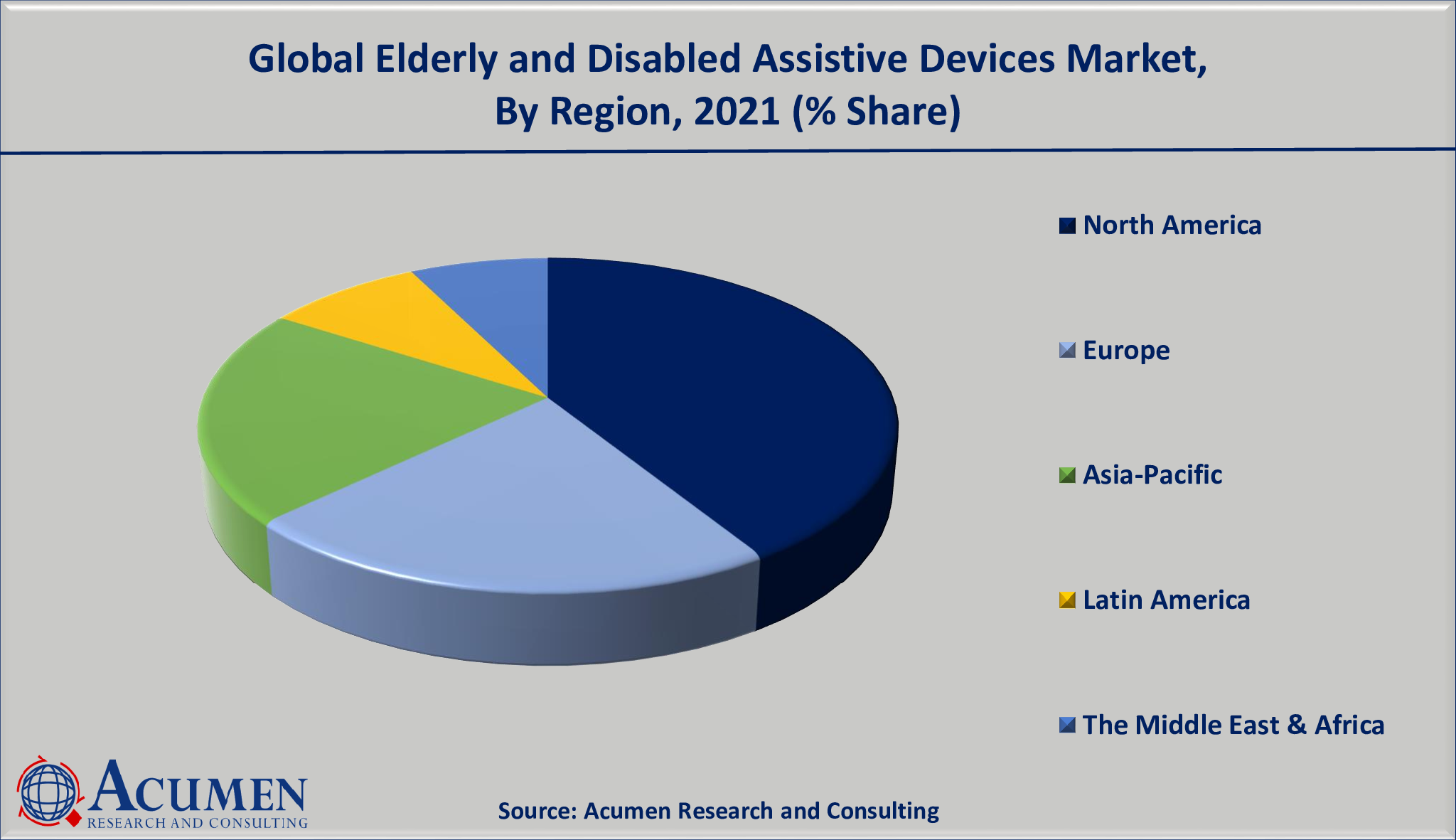

Elderly and Disabled Assistive Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

The presence of a large number of elderly as well as the disabled population in North America fuels the elderly and disabled assistive devices market growth

According to our regional analysis of the elderly and disabled assistive devices market, North America generated the largest market share in 2021 and is expected to continue to do so through the forecasted years of 2022 to 2030. The region's dominance is attributed to the presence of a large geriatric and disabled population. Furthermore, the presence of a large number of patients suffering from chronic disorders such as diabetes, arthritis, Parkinson's disease, and heart disease is supporting the North American elderly and disabled assistive devices market.

The Asia-Pacific region, on the other hand, is expected to experience the fastest growth rate between 2022 and 2030. The region's rapid growth can be attributed to increased healthcare spending, rising disposable income, and favorable government policies and support. Furthermore, improving healthcare infrastructure and increasing awareness in countries such as China, India, Indonesia, Thailand, and South Korea, among others, are fueling the Asia-Pacific elderly and disabled population.

Elderly and Disabled Assistive Devices Market Players

Some of the top elderly and disabled assistive devices companies offered in the professional report include Sonova Holding AG, Invacare, AI Squared, Pride Mobility Products Corporation, Drive Medical, Starkey hearing technologies, GN Resound Group, Siemens Ltd., Nordic Capital (Sunrise Medical LLC), William Demant Holding A/S.

Frequently Asked Questions

How much was the estimated value of the global elderly and disabled assistive devices market in 2021?

The estimated value of global elderly and disabled assistive devices market in 2021 was accounted to be USD 22,439 Million.

What will be the projected CAGR for global elderly and disabled assistive devices market during forecast period of 2022 to 2030?

The projected CAGR elderly and disabled assistive devices market during the analysis period of 2022 to 2030 is 5.9%.

Which are the prominent competitors operating in the market?

The prominent players of the global elderly and disabled assistive devices market are Sonova Holding AG, AI Squared, Pride Mobility Products Corporation, Drive Medical, Starkey hearing technologies, GN Resound Group, Invacare, Siemens Ltd., Nordic Capital (Sunrise Medical LLC), William Demant Holding A/S.

Which region held the dominating position in the global elderly and disabled assistive devices market?

North America held the dominating elderly and disabled assistive devices during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for elderly and disabled assistive devices during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global elderly and disabled assistive devices market?

Rising elderly and disabled population, growing awareness for these devices in emerging economies, and increasing disposable income of baby boomers drives the growth of global elderly and disabled assistive devices market.

By type segment, which sub-segment held the maximum share?

Based on type, mobility aids device segment held the maximum share elderly and disabled assistive devices market in 2021.