Elastomeric Infusion Pumps Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Elastomeric Infusion Pumps Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

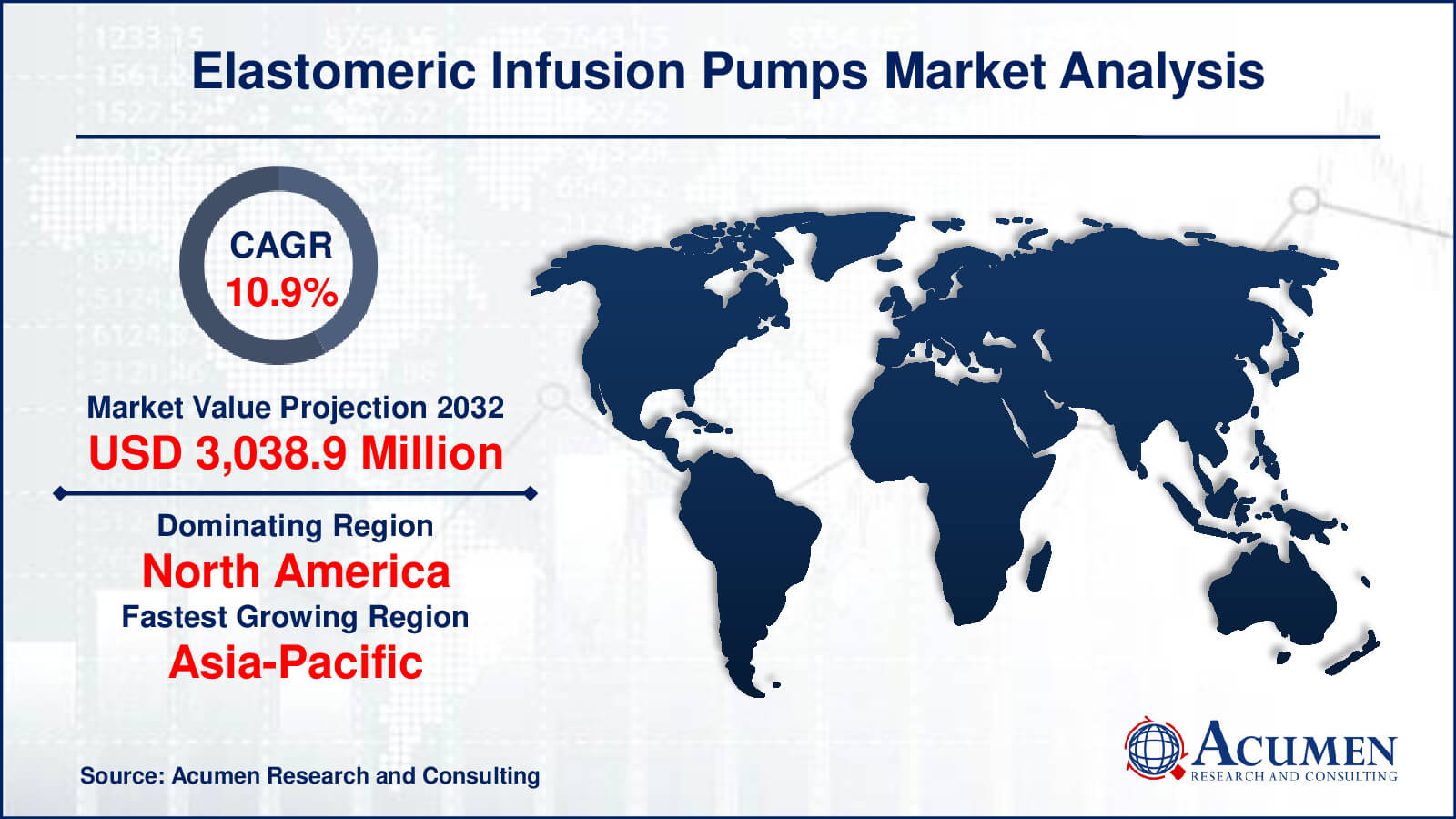

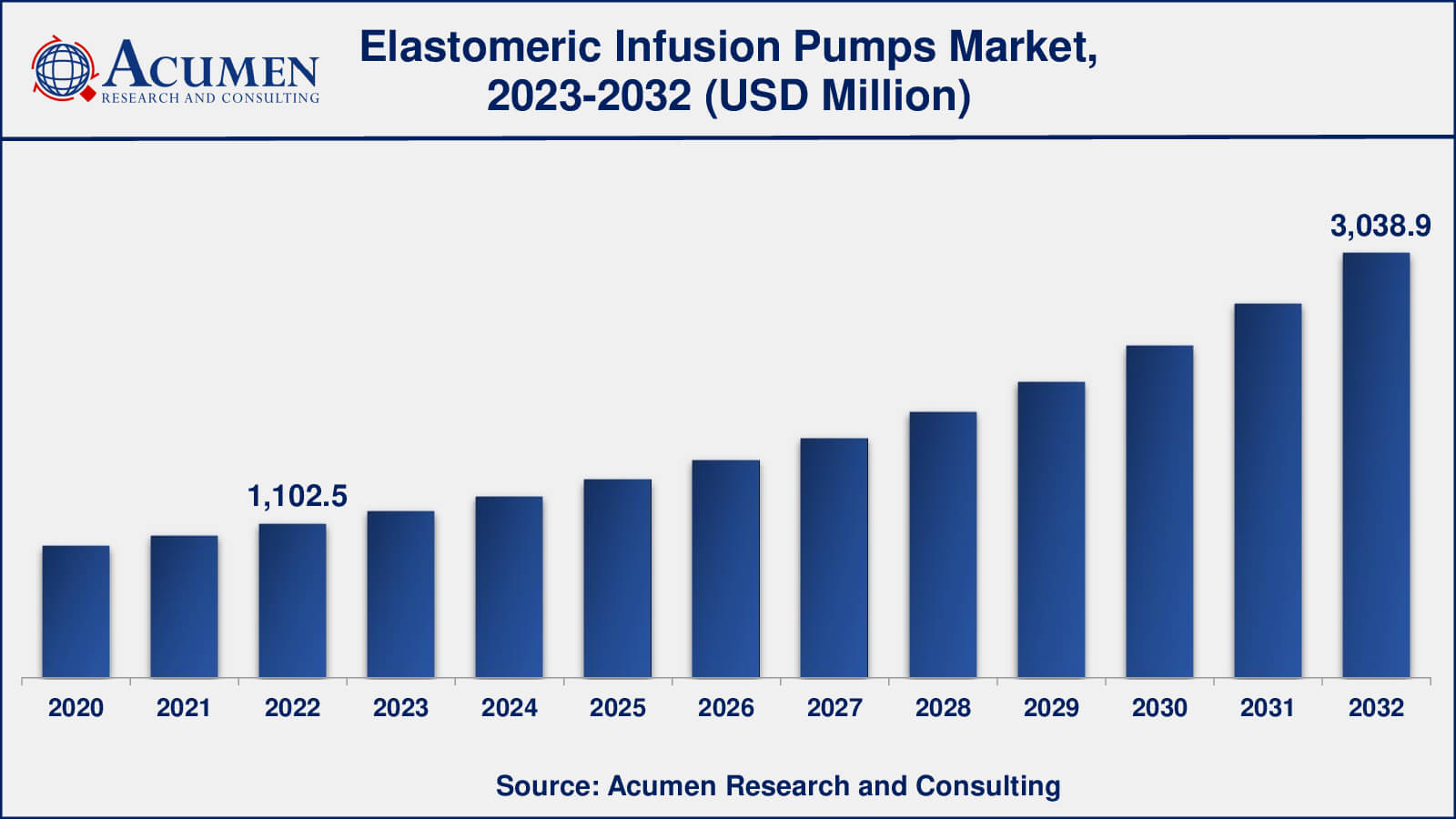

The global Elastomeric Infusion Pumps Market size was valued at USD 1,102.5 Million in 2022 and is projected to attain USD 3,038.9 Million by 2032 mounting at a CAGR of 10.9% from 2023 to 2032.

Elastomeric Infusion Pumps Market Highlights

- Global elastomeric infusion pumps market revenue is poised to garner USD 3,038.9 million by 2032 with a CAGR of 10.9% from 2023 to 2032

- North America elastomeric infusion pumps market value occupied around USD 397 million in 2022

- Asia-Pacific elastomeric infusion pumps market growth will record a CAGR of more than 11% from 2023 to 2032

- Among type, the continuous rate elastomeric pump sub-segment occupied over US$ 606.3 million revenue in 2022

- Based on application, the pain management sub-segment gathered around 54% share in 2022

- Collaborations of private and public organizations for product innovation is a popular elastomeric infusion pumps market trend that drives the industry demand

Elastomeric infusion pumps are medical devices that provide drugs and fluids to patients in a regulated and continuous manner. These devices are intended to provide a dependable and portable option for long-term administration of pharmaceuticals such as antibiotics, pain relievers, chemotherapeutic agents, and other therapeutic chemicals. In contrast to typical IV bags and electronic infusion pumps, which require power sources and extensive programming, elastomeric infusion pumps work on a more basic and mechanical foundation.

Elastomeric pumps are built of elastomeric material and have a flexible, balloon-like reservoir that may expand and shrink. The reservoir contains the prescribed medicine or fluid and is linked to a tubing system with a flow regulator. The pressure formed within the elastomeric reservoir as it gradually compresses over time controls the flow of the material. This mechanism enables a steady and regulated infusion rate, making it appropriate for a wide range of medical procedures.

In clinical settings, these pumps have various advantages. They are portable, lightweight, and do not require electricity, making them ideal for ambulatory treatment or at home. Furthermore, elastomeric infusion pumps are easy to set up and use, lowering the chance of programming mistakes and improving patient safety. Furthermore, they are disposable, reducing the danger of contamination and infection that can occur with reusable infusion devices.

Elastomeric infusion pumps are used in a variety of medical fields, including cancer, pain treatment, and home healthcare, when long-term, continuous medicine delivery is required. Because of their ease of use and dependability, they are a vital tool for healthcare providers, leading to better patient outcomes and quality of life.

Global Elastomeric Infusion Pumps Market Dynamics

Market Drivers

- Growing demand for home healthcare

- Rising prevalence of chronic diseases

- Technological advancements in pump design

- Aging population requiring long-term therapy

Market Restraints

- Stringent regulatory requirements

- High cost of elastomeric pumps

- Competition from electronic infusion systems

- Limited drug compatibility

Market Opportunities

- Expansion in emerging markets

- Increasing adoption of ambulatory care

- Development of novel elastomeric pump materials

Elastomeric Infusion Pumps Market Report Coverage

| Market | Elastomeric Infusion Pumps Market |

| Elastomeric Infusion Pumps Market Size 2022 | USD 1,102.5 Million |

| Elastomeric Infusion Pumps Market Forecast 2032 | USD 3,038.9 Million |

| Elastomeric Infusion Pumps Market CAGR During 2023 - 2032 | 10.9% |

| Elastomeric Infusion Pumps Market Analysis Period | 2020 - 2032 |

| Elastomeric Infusion Pumps Market Base Year |

2022 |

| Elastomeric Infusion Pumps Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Baxter International Inc., B. Braun SE, Fresenius SE and Co. KGaA, Medline Industries LP, Vygon SAS, Smiths Group Plc, Owens & Minor Inc., Nipro Corp., Ambu AS, Avanos Medical Inc., MicroPort Scientific Corp., and Mindray Bio-Medical Electronics Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Elastomeric Infusion Pumps Market Insights

The elastomer infusion pumps market dynamics exhibit a complex interplay of elements that affect the industry's growth and evolution. The growing demand for home healthcare solutions is one of the primary forces moving the market ahead. Patients are increasingly looking for therapies that allow them to take medication at home, and elastomeric pumps, with their mobility and ease of use, meet this need. This need is fueled further by an ageing population that frequently requires long-term therapy for chronic illnesses.

The market, however, is not without its difficulties. Stringent regulatory regulations and quality standards are a major impediment. To assure the safety and efficacy of their goods, manufacturers must follow tight criteria, which can add time and expense to the development process. Furthermore, the high cost of elastomeric pumps may restrict their availability, especially in resource-constrained healthcare settings.

Another aspect at work is competition, with electronic infusion systems offering an alternative to elastomeric pumps. While electronic systems provide enhanced capabilities and programmability, elastomeric pumps remain popular owing to their ease of use and dependability. Drug compatibility is still an issue, since not all drugs can be supplied by elastomeric pumps, limiting their value in some therapeutic areas.

Despite these obstacles, the elastomer infusion pump industry offers several prospects for expansion. As healthcare infrastructure improves and demand for cost-effective infusion solutions develops, expanding into emerging nations provides a big potential. Furthermore, the use of ambulatory care settings, in which patients are treated outside of typical hospital settings, offers a favorable environment for elastomeric pumps. Manufacturers are also investing in the research of new materials and technologies to improve the performance and compatibility of these pumps, while industry partnerships drive innovation in product design and functionality. These forces will influence the future of the elastomeric infusion pump market as it adapts to changing healthcare requirements and technological improvements.

Elastomeric Infusion Pumps Market Segmentation

The worldwide market for elastomeric infusion pumps is split based on type, application, end-user, and geography.

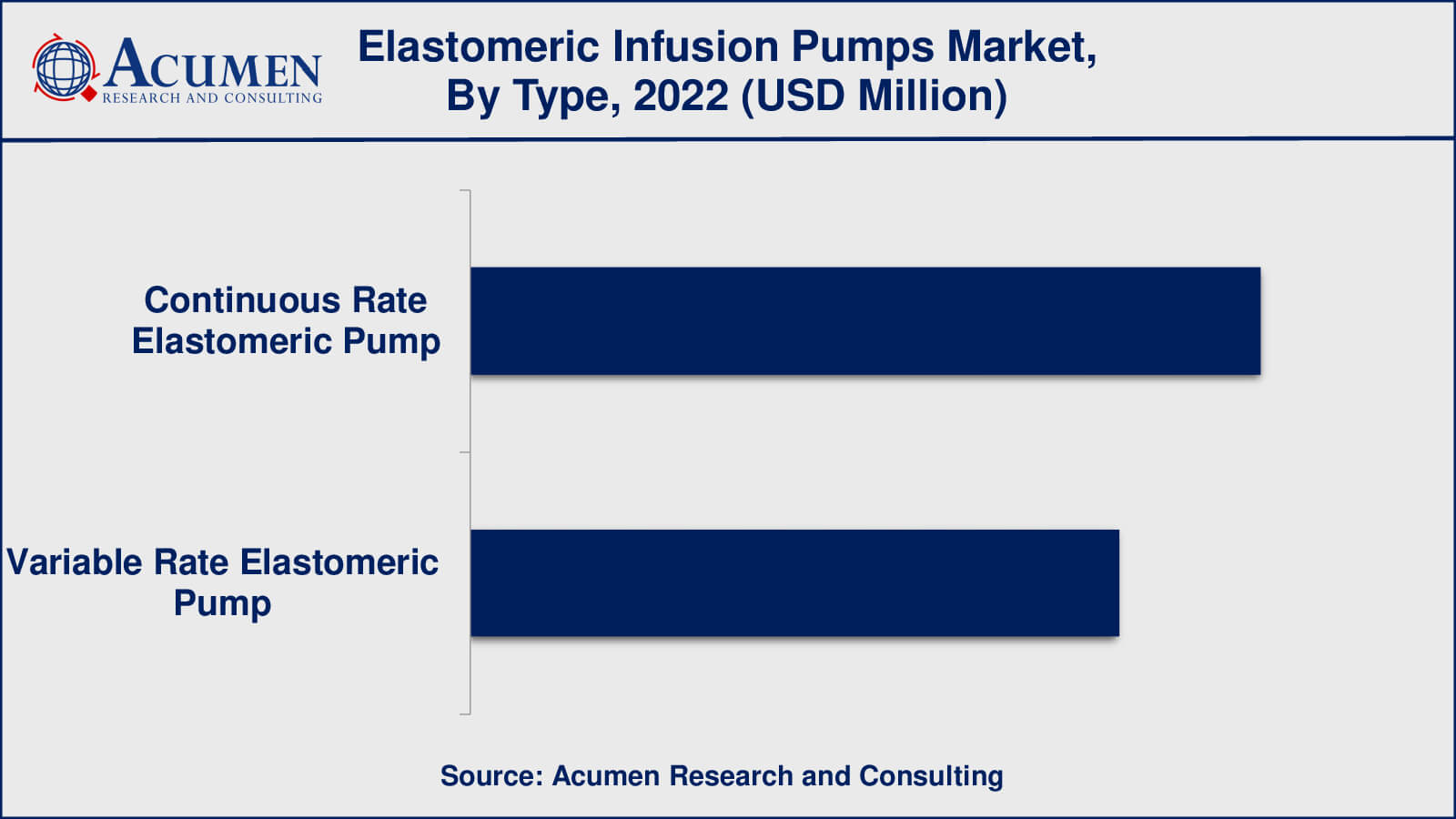

Elastomeric Infusion Pumps Types

- Continuous Rate Elastomeric Pump

- Variable Rate Elastomeric Pump

As per the elastomeric infusion pumps industry analysis, continuous rate elastomeric pumps is the leading type in the market. Continuous rate elastomeric pumps were frequently used for drugs and fluids that required a regular and continuous infusion rate over a long period of time. These pumps were commonly employed in situations when a steady medicine concentration was necessary, such as pain control, antibiotic treatment, or certain chemotherapy regimens.

Variable rate elastomeric pumps, on the other hand, provided flexibility in regulating the infusion rate based on the patient's changing demands. When treatments required periodic changes or drugs needed to be supplied at different rates over time, these pumps were recommended.

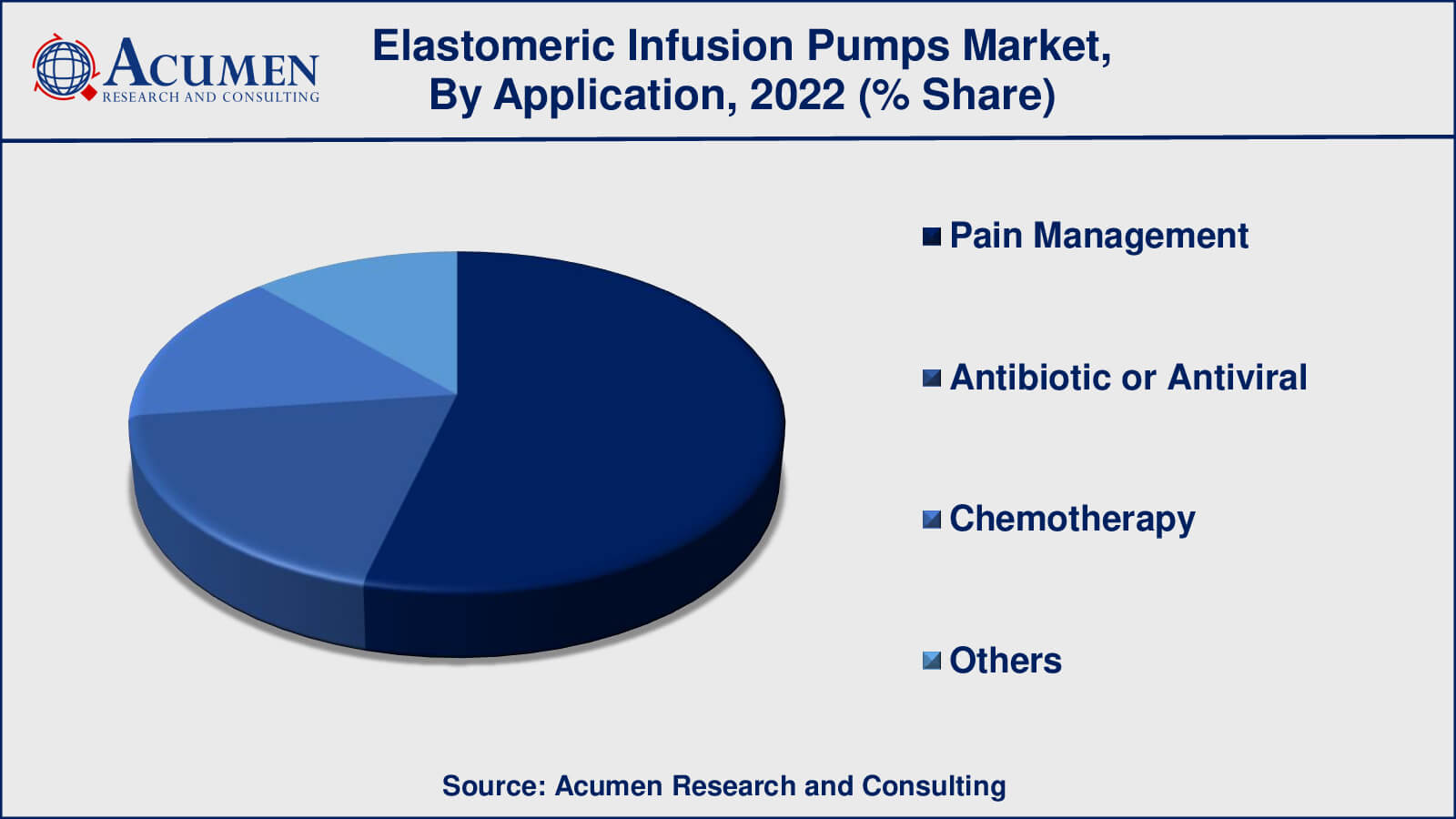

Elastomeric Infusion Pumps Applications

- Pain Management

- Antibiotic or Antiviral

- Chemotherapy

- Others

According to our elastomeric infusion pumps market analysis, the pain management application will have the most market share in 2022. In pain treatment applications, elastomeric infusion pumps were extensively employed. These pumps enabled the regulated and continuous administration of pain drugs, making them especially useful in post-surgical treatment and chronic pain management.

Antibiotic and antiviral medications are frequently administered on a continuous and long-term basis. Elastomeric pumps were widely used in these applications to ensure patients got the correct dosage over an extended period of time, particularly when intravenous antibiotic treatment was required.

Elastomeric infusion pumps were crucial in chemotherapy treatments. They enabled the regulated continuous administration of chemotherapy medications, making them suited for outpatient or home-based chemotherapy regimens.

The others category included a diverse variety of medical applications requiring regulated and continuous medication or fluid delivery. Hydration therapy, immunoglobulin therapy, and other specialised therapies may fall under this category.

Elastomeric Infusion Pumps End-Users

- Hospitals

- Ambulatory Service Centers

- Clinics

- Others

According to the elastomeric infusion pumps market forecast, hospital end-user is expected to gain significant traction from 2023 to 2032. Hospitals have traditionally accounted for a sizable portion of the elastomeric infusion pump industry. Elastomeric pumps were extensively utilised at these healthcare institutions for a variety of applications, including post-surgical care, pain management, chemotherapy, and antibiotic delivery.

Elastomeric infusion pumps were rapidly being used in ambulatory care centres, commonly known as outpatient clinics or day surgery centres. These centres provided a convenient and cost-effective alternative to regular hospital settings for delivering certain medical services. Elastomeric infusion pumps were also used in clinics, including specialised and general care clinics, for specific therapies. They were especially useful for pain treatment, cancer, and infectious disease management clinics.

Furthermore. others included a wide range of healthcare settings, such as home healthcare and long-term care institutions. Elastomeric pumps have become more popular in home healthcare settings, allowing patients to receive continuous medicine or fluid treatment while remaining in the comfort of their own homes.

Elastomeric Infusion Pumps Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Elastomeric Infusion Pumps Market Regional Analysis

North America, notably the United States and Canada, accounted for a sizable portion of the elastomeric infusion pump industry. The region's sophisticated healthcare infrastructure, the high prevalence of chronic illnesses, and a strong emphasis on home treatment all contributed to market expansion. Because of its vast population and high healthcare spending, the United States was a big contributor to the industry.

Another important market for elastomeric infusion pumps was Europe. Germany, France, and the United Kingdom were significant donors. The market in this region benefited from a well-established healthcare system, an aging population, and the adoption of cost-effective home-based therapies.

The Asia-Pacific area, which includes China, Japan, and India, was witnessing rapid expansion in the elastomer infusion pump market. APAC market expansion was driven by factors such as a growing middle-class population, more healthcare awareness, and increased access to healthcare services. Furthermore, the rising frequency of chronic illnesses in this region has increased demand for infusion pumps.

Elastomeric Infusion Pumps Market Players

Some of the top elastomeric infusion pumps companies offered in our report includes Baxter International Inc., B. Braun SE, Fresenius SE and Co. KGaA, Medline Industries LP, Vygon SAS, Smiths Group Plc, Owens & Minor Inc., Nipro Corp., Ambu AS, Avanos Medical Inc., MicroPort Scientific Corp., and Mindray Bio-Medical Electronics Co. Ltd.

Frequently Asked Questions

What was the size of the global elastomeric infusion pumps market in 2022?

The size of elastomeric infusion pumps market was USD 1,102.5 million in 2022.

What is the elastomeric infusion pumps market CAGR from 2023 to 2032?

The elastomeric infusion pumps market CAGR during the analysis period of 2023 to 2032 is 10.9%.

Which are the key players in the elastomeric infusion pumps market?

The key players operating in the global elastomeric infusion pumps market are Baxter International Inc., B. Braun SE, Fresenius SE and Co. KGaA, Medline Industries LP, Vygon SAS, Smiths Group Plc, Owens & Minor Inc., Nipro Corp., Ambu AS, Avanos Medical Inc., MicroPort Scientific Corp., and Mindray Bio-Medical Electronics Co. Ltd.

Which region dominated the global elastomeric infusion pumps market share?

North America region held the dominating position in elastomeric infusion pumps industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of elastomeric infusion pumps during the analysis period of 2023 to 2032.

What are the current trends in the global elastomeric infusion pumps industry?

The current trends and dynamics in the elastomeric infusion pumps industry include growing need to reduce medical waste, reprocessed devices offer healthcare cost reduction, and stringent regulatory framework to ensure safety and efficacy standards.

Which type held the maximum share in 2022?

The continuous rate elastomeric pump type held the maximum share of the elastomeric infusion pumps industry.