Edible Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Edible Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

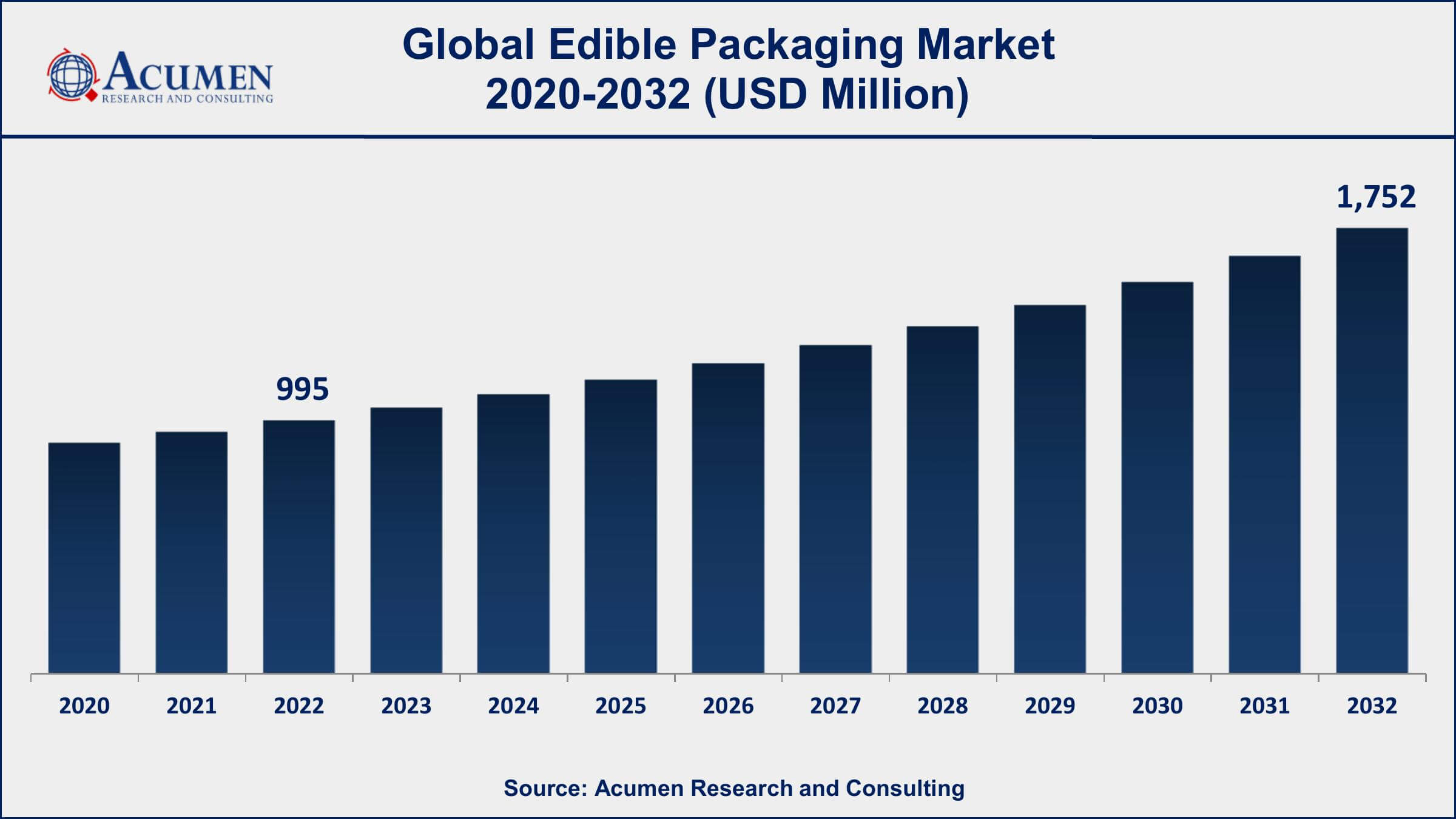

The Global Edible Packaging Market Size accounted for USD 995 Million in 2022 and is projected to achieve a market size of USD1,752 Million by 2032 growing at a CAGR of 5.9% from 2023 to 2032.

Edible Packaging Market Highlights

- Global Edible Packaging Market revenue is expected to increase by USD 1,752 Million by 2032, with a 5.9% CAGR from 2023 to 2032

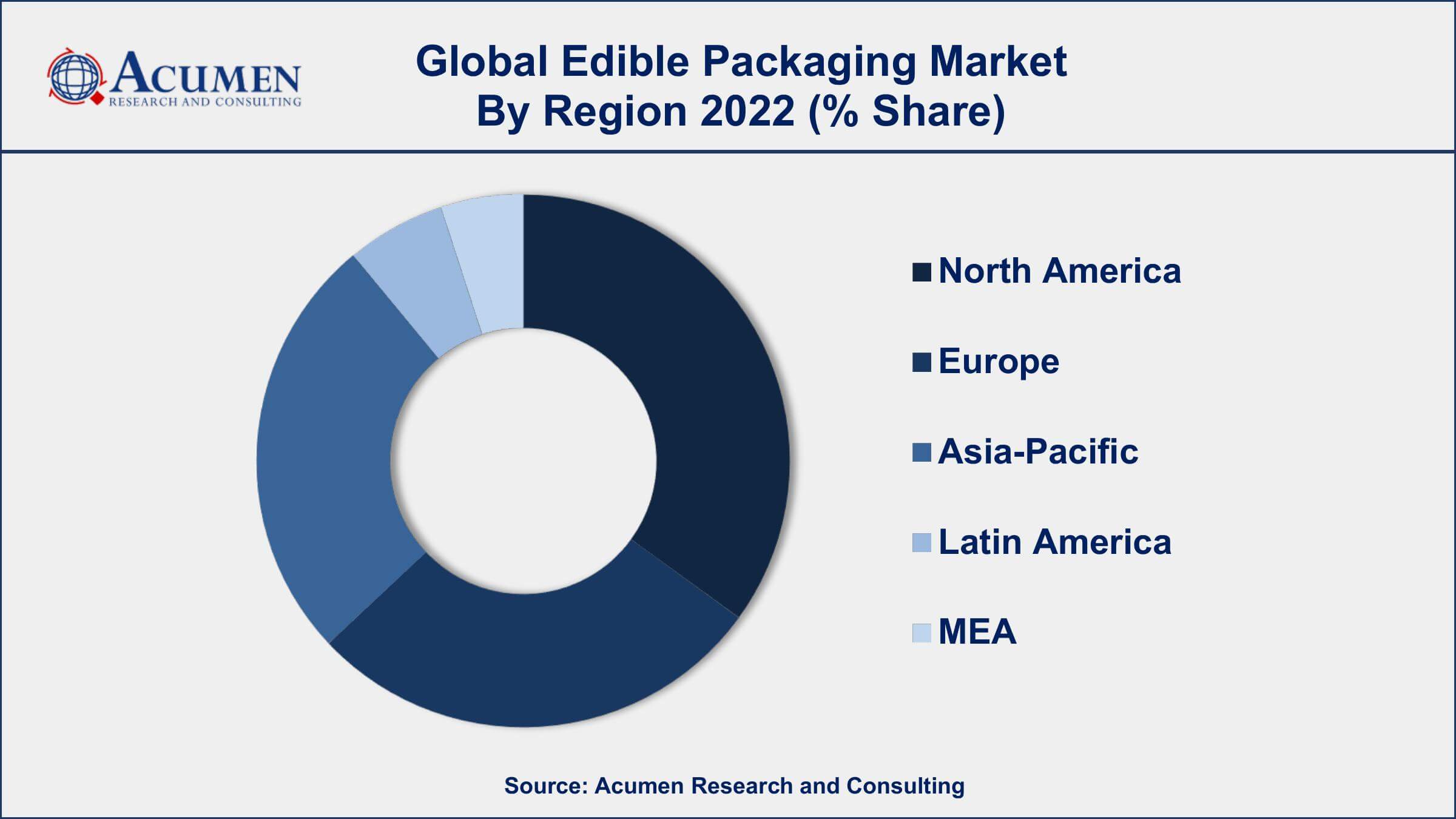

- North America region led with more than 37% of Edible Packaging Market share in 2022

- Asia-Pacific Edible Packaging Market growth will record a CAGR of around 6.4% from 2023 to 2032

- By material type, the proteins segment has generated about 45% of the revenue share in 2022

- By end-user, the food and beverages segment has accounted more than 79% of the revenue share in 2022

- Increasing environmental concerns and awareness about plastic pollution, drives the Edible Packaging Market value

Edible packaging refers to packaging materials that are safe for consumption along with the food or beverage they contain. It offers a sustainable and eco-friendly alternative to traditional packaging materials such as plastic, which often contribute to environmental pollution. Edible packaging can be made from various natural sources, including seaweed, starches, proteins, and other plant-based materials. These materials are biodegradable, compostable, and can even provide additional nutritional benefits.

In recent years, there has been a growing interest in edible packaging due to its potential to reduce waste and environmental impact. Consumers are becoming more conscious of the ecological consequences of conventional packaging, leading to increased demand for sustainable alternatives. The market for edible packaging has witnessed significant growth, driven by factors such as increasing environmental awareness, stringent regulations on single-use plastics, and the shift towards sustainable packaging solutions across industries. The market growth of edible packaging has been notable in several sectors, including the food and beverage industry, where it is used to package a variety of products such as snacks, confectionery, and beverages. The cosmetics and personal care industry is also exploring the use of edible packaging for products like soap and toiletries. Additionally, pharmaceutical companies are considering edible packaging for medication, as it can offer a convenient and safe delivery method.

Global Edible Packaging Market Trends

Market Drivers

- Increasing environmental concerns and awareness about plastic pollution

- Growing demand for sustainable packaging solutions

- Stringent regulations and policies promoting the use of eco-friendly packaging

- Consumer preference for products with minimal environmental impact

- Rising adoption of biodegradable and compostable packaging materials

Market Restraints

- Limited scalability and production capabilities of edible packaging materials

- Higher costs compared to conventional packaging materials

Market Opportunities

- Expansion into various industries beyond food and beverage, such as cosmetics, pharmaceuticals, and personal care

- Increasing investment in research and development to improve the functionality and performance of edible packaging materials

Edible Packaging Market Report Coverage

| Market | Edible Packaging Market |

| Edible Packaging Market Size 2022 | USD 995 Million |

| Edible Packaging Market Forecast 2032 | USD 1,752 Million |

| Edible Packaging Market CAGR During 2023 - 2032 | 5.9% |

| Edible Packaging Market Analysis Period | 2020 - 2032 |

| Edible Packaging Market Base Year | 2022 |

| Edible Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Source, By Material Type, By Packaging Process, By End-users, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | WikiFoods Inc., Tipa Corp., MonoSol LLC, Evoware, JRF Technology LLC, BluWrap, Notpla Ltd., Loliware LLC, Wikicell Designs Inc., Apeel Sciences, Do Eat, and Incredible Foods. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Edible packaging offers a sustainable and eco-friendly alternative to traditional packaging materials such as plastic or metal. Edible packaging can be made from various natural sources such as seaweed, starches, proteins, and other plant-based materials. These materials are biodegradable, compostable, and often provide additional nutritional benefits.

The application of edible packaging is diverse and spans across various industries. In the food and beverage industry, edible packaging is used to package products like snacks, confectionery, and beverages. It can serve as an outer layer that protects the food or as a thin film that dissolves upon contact with moisture. For example, individual snack portions can be wrapped in edible film made from starch, creating a convenient and eco-friendly alternative to single-use plastic wrappers. Beyond the food industry, edible packaging is finding applications in other sectors as well. In the cosmetics and personal care industry, it can be used for packaging products like soap bars, solid shampoos, or bath bombs, eliminating the need for plastic packaging. In the pharmaceutical industry, edible packaging materials can be utilized to encapsulate medication, providing a safe and easily consumable method for drug delivery.

The edible packaging market has been experiencing significant growth in recent years, driven by the increasing demand for sustainable packaging solutions and the rising awareness about environmental concerns. Consumers are becoming more conscious of the negative impact of conventional packaging materials, such as plastic, on the environment, leading to a growing preference for eco-friendly alternatives. This has created a favorable market environment for edible packaging. Furthermore, the expansion of edible packaging beyond the food and beverage industry presents additional growth opportunities. Industries such as cosmetics, pharmaceuticals, and personal care are exploring the use of edible packaging for their products. This diversification of the market expands the potential customer base and provides new avenues for growth.

Edible Packaging Market Segmentation

The Global Edible Packaging Market segmentation is based on source, material type, packaging process, end-users, and geography.

Edible Packaging Market By Source

- Plant

- Animal

According to the edible packaging industry analysis, the plant segment accounted for the largest market share in 2022. This growth is due to the increasing demand for sustainable and plant-based packaging solutions. Consumers are becoming more conscious of the environmental impact of traditional packaging materials and are seeking alternatives that are derived from renewable sources. Plant-based edible packaging offers a promising solution as it utilizes materials such as seaweed, starches, proteins, and other plant-derived compounds. One of the key drivers behind the growth of the plant segment is the rising trend of plant-based diets and lifestyles. As more individuals embrace plant-based eating, there is a corresponding demand for packaging materials that align with their values. Plant-based edible packaging provides a natural and eco-friendly option that resonates with this consumer segment.

Edible Packaging Market By Material Type

- Lipids

- Proteins

- Polysaccharides

- Others

In terms of material types, the proteins segment is expected to witness significant growth in the coming years. Proteins derived from sources such as plant-based proteins (e.g., soy, pea) or animal-based proteins (e.g., gelatin) are utilized in the production of edible packaging materials. These proteins offer several advantages, including their biodegradability, high barrier properties, and versatility in terms of forming various packaging formats. One of the key drivers behind the growth of the proteins segment is the growing consumer interest in plant-based and alternative protein products. Proteins derived from plants, such as soy or pea proteins, are utilized to create edible packaging that resonates with environmentally conscious consumers.

Edible Packaging Market By Packaging Process

- Antimicrobial

- Microorganisms

- Nanotechnology

- Coatings

- Electro hydrodynamic

According to the edible packaging market forecast, the coatings segment is expected to witness significant growth in the coming years. This growth is due to its versatile applications and the demand for enhanced food preservation and quality. Edible coatings are thin layers applied to food products to extend their shelf life, improve appearance, and provide protection against moisture loss and microbial spoilage. These coatings can be made from various edible materials such as proteins, lipids, carbohydrates, and natural polymers. One of the key drivers behind the growth of the coatings segment is the increasing focus on food safety and quality. Edible coatings offer a natural and sustainable alternative to traditional synthetic coatings, reducing the need for chemical additives and preservatives.

Edible Packaging Market By End-users

- Pharmaceuticals

- Food and beverages

Based on the end-users, the food and beverages segment is expected to continue its growth trajectory in the coming years. This growth is due to the increasing demand for sustainable and eco-friendly packaging solutions in the industry. As consumers become more conscious of the environmental impact of packaging waste, there is a growing preference for food and beverage products that are packaged using sustainable materials. Edible packaging offers a promising solution, as it provides a natural and biodegradable alternative to conventional packaging materials. One of the key drivers behind the growth of the food and beverages segment is the rising consumer awareness and demand for sustainable packaging options. Food and beverage manufacturers are responding to this demand by adopting edible packaging materials that are derived from natural sources such as plant-based materials or proteins.

Edible Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Edible Packaging Market Regional Analysis

North America dominates the edible packaging market for several reasons, including a combination of factors such as consumer awareness, regulatory environment, and technological advancements. North America has well-developed consumer awareness and demand for sustainable and eco-friendly products. Consumers in the region are increasingly conscious of the environmental impact of conventional packaging materials and are actively seeking greener alternatives. This heightened awareness has led to a greater acceptance and adoption of edible packaging options in the market. Moreover, the regulatory environment in North America supports the growth of the edible packaging market. The region has implemented strict regulations and policies to reduce plastic waste and promote sustainable packaging solutions. Government initiatives and regulations have played a crucial role in encouraging businesses to adopt eco-friendly packaging practices. This regulatory support has provided a conducive environment for the development and expansion of the edible packaging market.

Edible Packaging Market Player

Some of the top edible packaging market companies offered in the professional report include WikiFoods Inc., Tipa Corp., MonoSol LLC, Evoware, JRF Technology LLC, BluWrap, Notpla Ltd., Loliware LLC, Wikicell Designs Inc., Apeel Sciences, Do Eat, and Incredible Foods.

Frequently Asked Questions

What was the market size of the global edible packaging in 2022?

The market size of edible packaging was USD 995 Million in 2022.

What is the CAGR of the global edible packaging market from 2023 to 2032?

The CAGR of edible packaging is 5.9% during the analysis period of 2023 to 2032.

Which are the key players in the edible packaging market?

The key players operating in the global market are including WikiFoods Inc., Tipa Corp., MonoSol LLC, Evoware, JRF Technology LLC, BluWrap, Notpla Ltd., Loliware LLC, Wikicell Designs Inc., Apeel Sciences, Do Eat, and Incredible Foods.

Which region dominated the global edible packaging market share?

North America held the dominating position in edible packaging industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of edible packaging during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global edible packaging industry?

The current trends and dynamics in the edible packaging industry include increasing environmental concerns and awareness about plastic pollution, growing demand for sustainable packaging solutions, and stringent regulations and policies promoting the use of eco-friendly packaging.

Which material type held the maximum share in 2022?

The proteins material type held the maximum share of the edible packaging industry.