Edible Oil and Fats Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Edible Oil and Fats Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

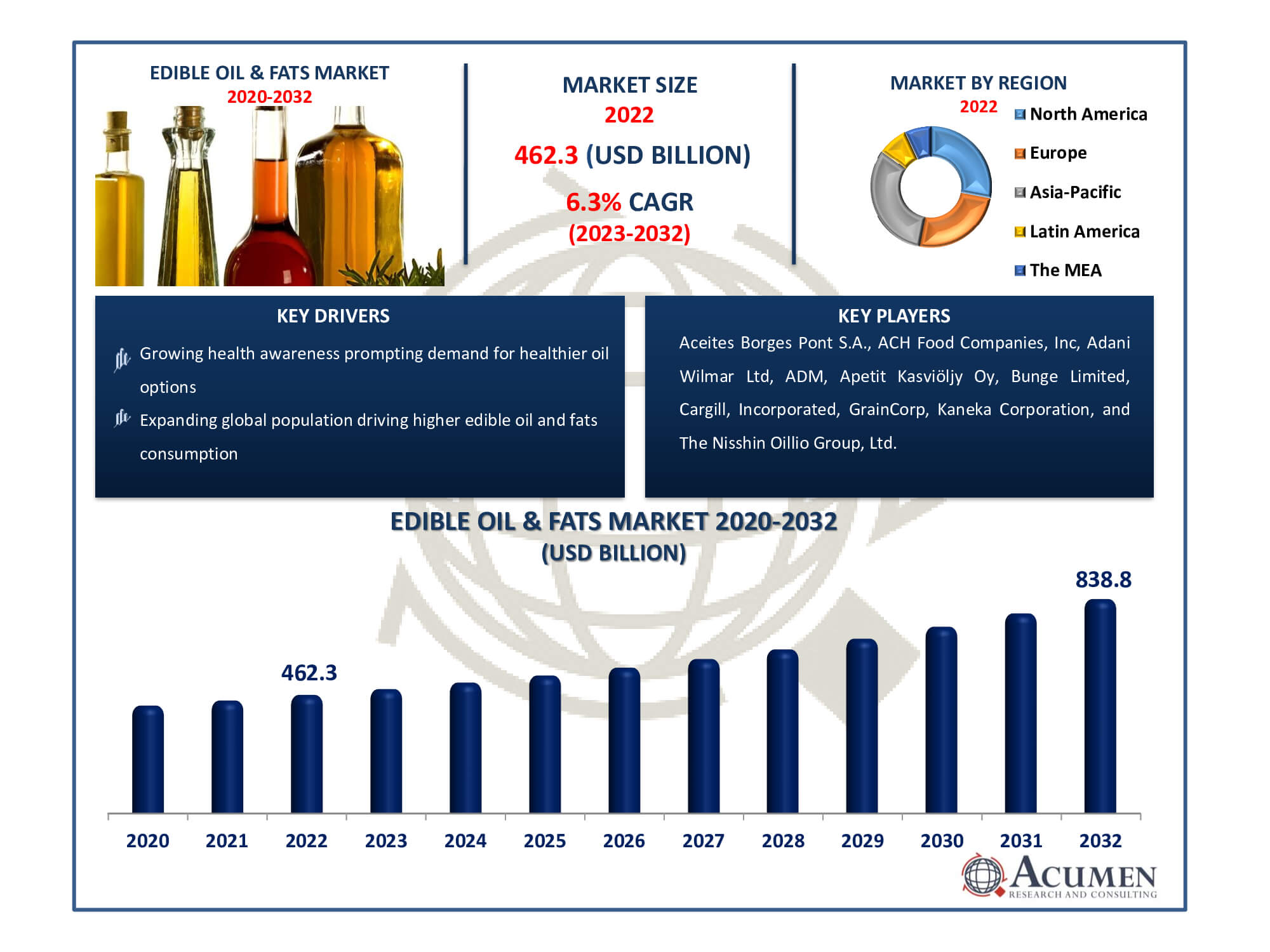

The Global Edible Oil and Fats Market Size accounted for USD 462.3 Billion in 2022 and is estimated to achieve a market size of USD 838.8 Billion by 2032 growing at a CAGR of 6.3% from 2023 to 2032.

Edible Oil and Fats Market Highlights

- Global edible oil and fats market revenue is poised to garner USD 838.8 billion by 2032 with a CAGR of 6.3% from 2023 to 2032

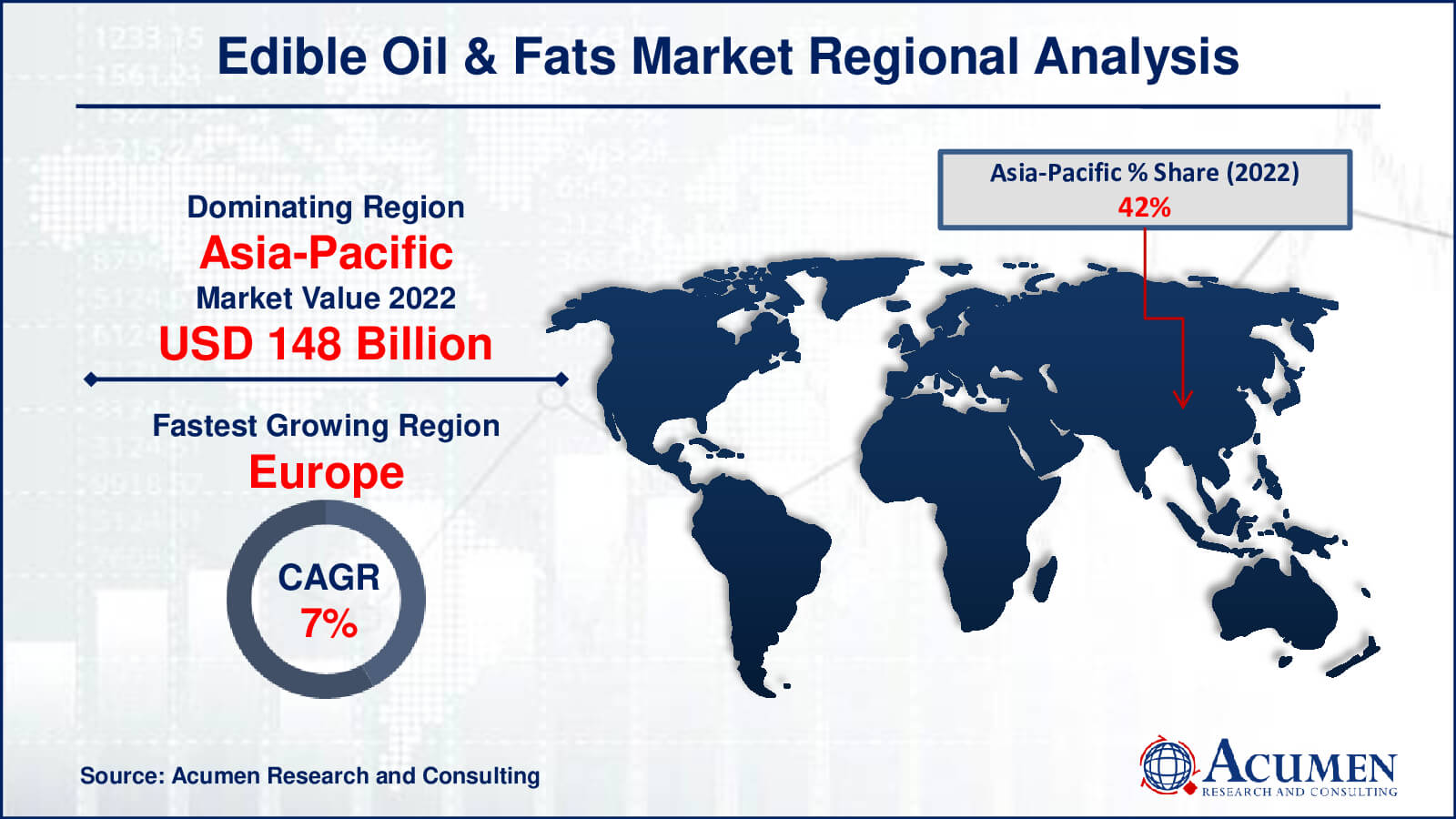

- Asia-Pacific edible oil and fats market value occupied around USD 148 billion in 2022

- Europe edible oil and fats market growth will record a CAGR of more than 7% from 2023 to 2032

- Among product, the edible oil sub-segment generated over US$ 346.7 billion revenue in 2022

- Based on source, the natural sub-segment generated around 85% share in 2022

- The development of value-added products catering to specific consumer needs is a popular edible oil and fats market trend that fuels the industry demand

Edible oils and fats are natural compounds obtained from plants or animals that can be consumed by humans. They are mostly made of fatty acids and are either liquid (oils) or solid (fats) at room temperature. These oils and fats are an important part of the human diet and are utilized in a variety of culinary applications such as cooking, frying, baking, and meal preparation. Ester carboxylic acids and glycerols constitute edible oils and fats. Oils remain in a liquid state at room temperature, whereas fats are partially solid. Fats and oils serve to enhance the taste and texture of cooked dishes. The rising demand for frying and processed foods, the proliferation of restaurants, the rapid expansion of food networks, urbanization, and the increasing population contribute to the consumption of edible oils and fats.

Global Edible Oil and Fats Market Dynamics

Market Drivers

- Growing health awareness prompting demand for healthier oil options

- Increasing consumption of convenience and processed foods

- Technological advancements enhancing oil extraction methods

- Expanding global population driving higher edible oil and fats consumption

Market Restraints

- Fluctuating prices of raw materials impacting production costs

- Environmental concerns regarding oil palm cultivation

- Stringent regulations on trans fats limiting product innovation

Market Opportunities

- Rising demand for organic and sustainable oil sources

- Innovations in functional oils with enhanced nutritional profiles

- Expansion opportunities in emerging markets due to changing dietary habits

Edible Oil and Fats Market Report Coverage

| Market | Edible Oil and Fats Market |

| Edible Oil and Fats Market Size 2022 | USD 462.3 Billion |

| Edible Oil and Fats Market Forecast 2032 | USD 838.8 Billion |

| Edible Oil and Fats Market CAGR During 2023 - 2032 | 6.3% |

| Edible Oil and Fats Market Analysis Period | 2020 - 2032 |

| Edible Oil and Fats Market Base Year |

2022 |

| Edible Oil and Fats Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Source, By End-use, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aceites Borges Pont S.A., ACH Food Companies, Inc, Adani Wilmar Ltd, ADM, Apetit Kasviöljy Oy, Bunge Limited, Cargill, Incorporated, GrainCorp, Kaneka Corporation, and The Nisshin Oillio Group, Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Edible Oil and Fats Market Insights

Vegetable oils are expected to continue being a favorable factor in reducing the risk of cardiovascular disorders and decreasing the risk of breast cancer. Moreover, owing to the exceptional anti-inflammatory properties of omega-3 as a nutrient in the food industry, soybean, canola, and flaxseed oils are projected to be quickly adopted. Over recent years, the production of low-cholesterol products has led to increased spending by cooking oil manufacturers, including companies like Unilever PLC and Cargill, Inc. Furthermore, we aim to change consumer preferences and increase the demand for sunflower and coconut oils due to fluctuating dietary patterns and the hectic lifestyles of working people. Coconut oil provides immunity against bacteria and other pathogens as a rich source of fatty acids. Olive oil also helps balance the cholesterol ratio between HDL and LDL, ensuring proper blood circulation. Increasing concerns about adverse effects such as a high risk of coronary heart disease, type 2 diabetes, and strokes caused by trans-fat consumption are likely to encourage the use of vegetable oils as cooking alternatives. Additionally, edible oils serve as excellent flavoring agents due to the exceptional aroma achieved by combining peanut or groundnut oil with other ingredients.

During the Edible Oil and Fats industry forecast, it is projected that increasing numbers of hotels and restaurant chains from developing countries, including China and India, will boost the utilization of edible oils. This boost is attributed to supporting government policies aimed at improving urban infrastructure. In addition, the shifting preference of middle-class income groups from countries including Saudi Arabia and the UAE to opt out during weekends is expected to open new market avenues in the food service sector over the next eight years.

According to the edible oil and fats industry analysis, due to the rising global food demand, the market is experiencing rapid growth. The increased consumption of oils and fats, driven by the expansion of food outlets, hotels, and restaurant chains, is a significant factor propelling this growth. Additionally, busier lifestyles have led to a higher demand for processed foods, further contributing to market expansion. Despite this growth, increased public health awareness regarding cardiovascular risks has somewhat limited the market's growth potential.

However, major manufacturers' focus on producing healthier oils and low-cholesterol fats during the forecast period is expected to drive market demand. Another significant factor contributing to market growth in Iraq is the increasing consumption of oil-based products. Lifestyle changes and evolving eating habits are also fueling the demand for ready-to-eat packaged foods, which, in turn, promotes the development of the global market for food oils and fats.

Edible Oil and Fats Market Segmentation

The worldwide market for edible oil and fats is split based on product, source, end-use, distribution channel, and geography.

Edible Oil and Fats Products

- Edible Oil

- Soybean

- Coconut

- Olive

- Sunflower

- Other

- Edible Fat

- Cocoa Butter Replacer

- Cocoa Butter Substitute

- Filling Fats

- Milk-Fat Replacers

- Spread Fat

- Other

In terms of Edible Oil and Fats market analysis, the revenue generated by edible oils surpassed USD 346 billion in 2022, with sunflower oil holding largest global market share among oil products. Over the next eight years, the growing importance of sunflower oil is expected to persist due to its role as a key source of various nutritional components, such as vitamin E, selenium, phytosterols, and magnesium. Additionally, the presence of zinc in sunflower oils is recognized for its immune-boosting properties.

Soybean oils are expected to undergo significant growth between the edible oil and fats market forecast period, mainly attributed to expanded soy usage. They serve as a substantial source of nutrients such as omega-6, vitamin E, and vitamin K, driving this upward trend.

Edible fats generated notable revenue in recent few years. Anticipating the development of vegetable margarine as a significant butter substitute in developed markets like Germany and the UK, it is expected that new markets will emerge. Furthermore, growing concerns about lactose intolerance and glutamic disorders in these countries are projected to steer consumers towards using margarine as a vegetable-based fat alternative for direct consumption in the near future.

Edible Oil and Fats Sources

- Synthetic

- Natural

The natural subsegment dominates the Edible Oil and Fats market due to rising customer demand for healthier and organic products. Natural oils produced from plants and seeds such as olive, coconut, and avocado are in line with the trend towards clean-label, less processed products. Consumers value these oils for their claimed health benefits, such as high levels of unsaturated fats and antioxidants. Because of this spike in demand, the Natural sector has surpassed synthetic alternatives in both appeal and market share.

Edible Oil and Fats End-Uses

- Pharmaceuticals

- Food & Beverage

- Personal Care & Cosmetics

- Biofuel & Energy

- Others

The food & beverage subsegment is the leading segment in the Edible Oil and Fats market due to its wide applications in culinary practises and food processing. These oils and fats are essential in improving the taste, texture, and shelf life of a variety of food products. They also respond to nutritional choices, such as low-fat or high-omega-3 formulations, in order to suit changing consumer expectations. The Food and beverage industry's extensive use and ongoing innovation maintain its market leadership.

Edible Oil and Fats Distribution Channels

- Online

- Offline

In the past, offline channels yielded substantial revenues. Edible oils were predominantly retailed through supermarkets and convenience stores, with leading chains like Walmart, Reliance Mart, SPAR, and Carrefour. Online sales are poised for steady growth, driven by e-commerce portals becoming the favored avenue for buyers. This shift is due to the allure of exceptional value-added tax (VAT) services, including Cash-on-Delivery (COD) and coupon benefits.

Edible Oil and Fats Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Edible Oil and Fats Market Regional Analysis

The Asia-Pacific region reigns supreme as the largest market in the dynamic world of Edible Oil and Fats. This broad category includes countries such as China and India, where the use of different oils in cooking is firmly rooted in their culinary traditions. These countries have a ravenous desire for oils such as soybean, palm, and sunflower, which are essential elements in infusing their different cuisines with distinct flavors and textures. This dependency on food propels the Asia-Pacific region to the forefront of the worldwide market.

Europe, on the other hand, emerges as the fastest-growing region in the Edible Oil and Fats industry. Consumer behavior is changing in favor of healthier options. Health consciousness is growing, which is causing a shift in food patterns. Because of their purported health benefits, countries such as Germany and France are embracing oils such as olive and canola. These oils are well-known for their heart-healthy benefits and overall well-being. As a result, they're growing in popularity among Europeans trying to boost the nutritious worth of their meals.

Edible Oil and Fats Market Players

Some of the top Edible Oil and Fats companies offered in our report include Aceites Borges Pont S.A., ACH Food Companies, Inc, Adani Wilmar Ltd, ADM, Apetit Kasviöljy Oy, Bunge Limited, Cargill, Incorporated, GrainCorp, Kaneka Corporation, and The Nisshin Oillio Group, Ltd.

Frequently Asked Questions

How big is the edible oil and fats market?

The market size of edible oil and fats was USD 462.3 billion in 2022.

What is the CAGR of the global edible oil and fats market from 2023 to 2032?

The CAGR of edible oil and fats is 6.3% during the analysis period of 2023 to 2032.

Which are the key players in the edible oil and fats market?

The key players operating in the global market are including Aceites Borges Pont S.A., ACH Food Companies, Inc, Adani Wilmar Ltd, ADM, Apetit Kasvi�ljy Oy, Bunge Limited, Cargill, Incorporated, GrainCorp, Kaneka Corporation, and The Nisshin Oillio Group, Ltd.

Which region dominated the global edible oil and fats market share?

Asia-Pacific held the dominating position in edible oil and fats industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of edible oil and fats during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global edible oil and fats industry?

The current trends and dynamics in the edible oil and fats industry include growing health awareness prompting demand for healthier oil options, increasing consumption of convenience and processed foods, technological advancements enhancing oil extraction methods, and expanding global population driving higher edible oil and fats consumption.

Which product held the maximum share in 2022?

The edible oil product held the maximum share of the edible oil and fats industry.