ECG Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

ECG Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

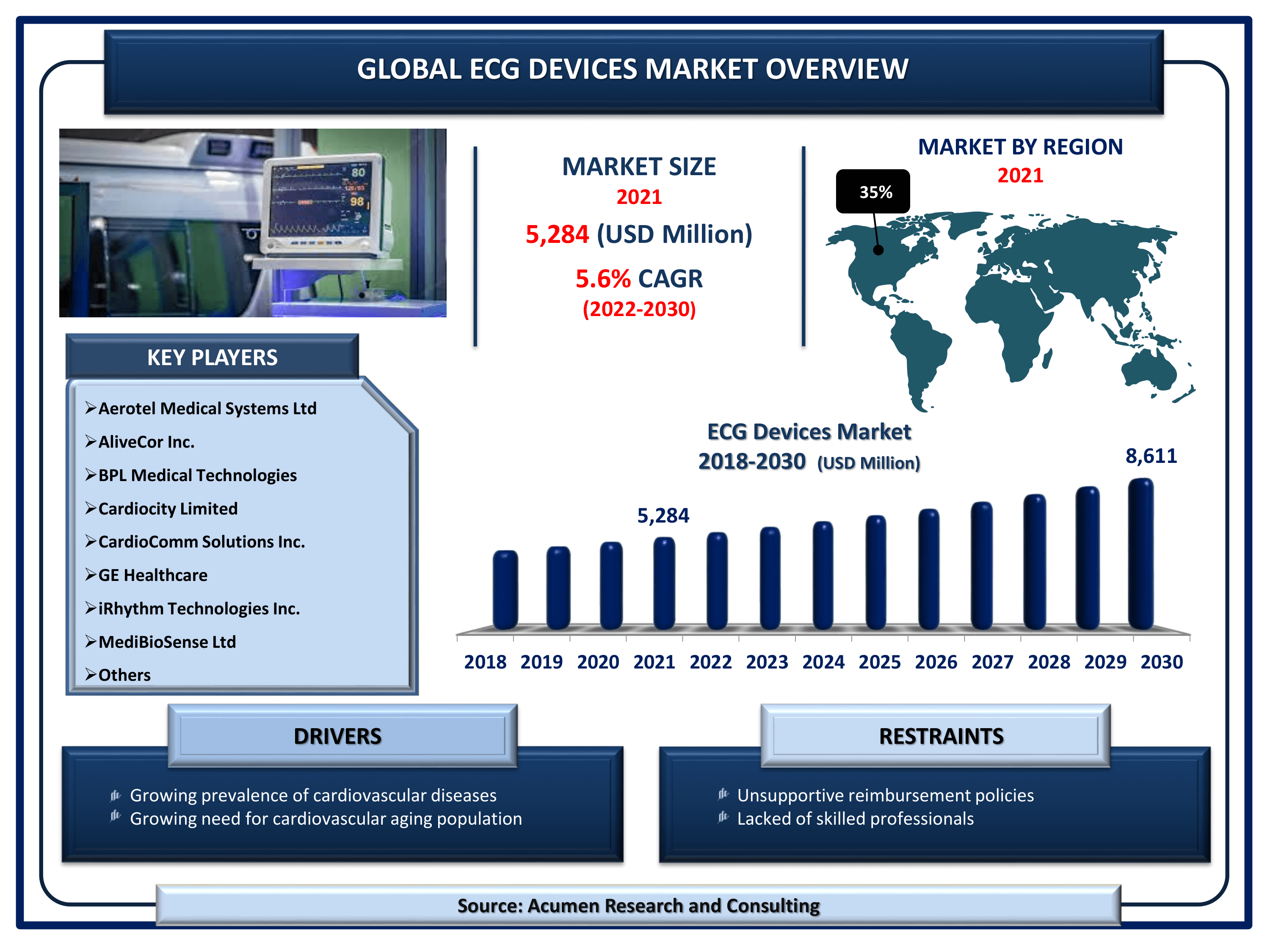

Request Sample Report

The Global ECG Devices Market Size accounted for USD 5,284 Million in 2021 and is estimated to garner a market size of USD 8,611 Million by 2030 rising at a CAGR of 5.6% from 2022 to 2030. Electrocardiography (ECG) tests are commonly used to detect aberrant heart rhythms because they capture and evaluate cardiac electrical activity throughout time. Arrhythmias affect around 4 million individuals in the United States each year, resulting in approximately half a million fatalities, according to the American Heart Association (AHA). The necessity to monitor patients for an extended period of time while assuring accuracy and boosting compliance led to the implementation of homebound outpatient telemetry services for patients undergoing post-coronary artery bypass graft (CABG), atrial fibrillation, and medication management. Technological advancements in these devices are one of the prominent ECG devices market trends that have been fueling the industry growth.

ECG Devices Market Report Key Highlights

- Global ECG devices market revenue is estimated to reach USD 8,611 Million by 2030 with a CAGR of 5.6% from 2022 to 2030

- According to the WHO, over 17.9 million people died due to cardiovascular diseases in 2019. 85% deaths of these occurred due to stroke and heart attack

- North America ECG devices market recorded over 35% regional shares in 2021

- Asia-Pacific ECG devices market would mount with a substantial CAGR from 2022 to 2030

- Based on product type segment, monitoring ECG systems evaluated more than 70% of the total market share in 2021

- Growing product innovation fuels the ECH devices market growth in coming years

An electrocardiogram (ECG or EKG) is used to record the electrical signals that are generated from the heart, particularly to check different heart activities. This device is used to diagnose different heart diseases and arrhythmias in patients to assist them with appropriate therapy. It’s a noninvasive and painless procedure that determines abnormality patterns in the heart.

Global ECG Devices Market Dynamics

Market Drivers

- Growing prevalence of cardiovascular diseases

- Growing need for cardiovascular aging population

- Increasing elderly population

- Robust demand for resting ECG procedures

Market Restraints

- Unsupportive reimbursement policies

- Lacked of skilled professionals

Market Opportunities

- New product development and innovation

- Growing advancement in electrocardiogram device technologies

ECG Devices Market Report Coverage

| Market | ECG Devices Market |

| ECG Devices Market Size 2021 | USD 5,284 Million |

| ECG Devices Market Forecast 2030 | USD 8,611 Million |

| ECG Devices Market CAGR During 2022 - 2030 | 5.6% |

| ECG Devices Market Analysis Period |

2018 - 2030 |

| ECG Devices Market Base Year | 2021 |

| ECG Devices Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aerotel Medical Systems Ltd, AliveCor Inc., BPL Medical Technologies, Cardiocity Limited, CardioComm Solutions Inc., GE Healthcare, iRhythm Technologies Inc., MediBioSense Ltd, Medtronic PLC, and Nihon Kohden Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Electrocardiogram Devices Market Insights

The growing geriatric population and increasing incidence of cardiovascular diseases (CVD) where long-term ECG monitoring is necessary are primarily driving the ECG devices market share. The rapid technological advancements in remote monitoring technologies and favorable policies for monitoring devices are supporting the market value. The availability of cost-effective and efficient wireless ECG devices has bolstered the adoption of wireless ECG. The portable mobile ECG devices are gaining pace in the market due to convenience, ease of use, and non-invasive method. Additionally, the increasing disposable income in emerging economies has pushed people to increase investment in healthcare solutions is further propelling the ECG devices market value.

On the other side, the unfavorable reimbursement policies and technical issues associated with device & technology is likely to hinder the growth over the forecast period from 2022 to 2030.

ECG Devices Market Segmentation

The worldwide electrocardiogram (ECG) devices market is split based on product type, end-user, and geography.

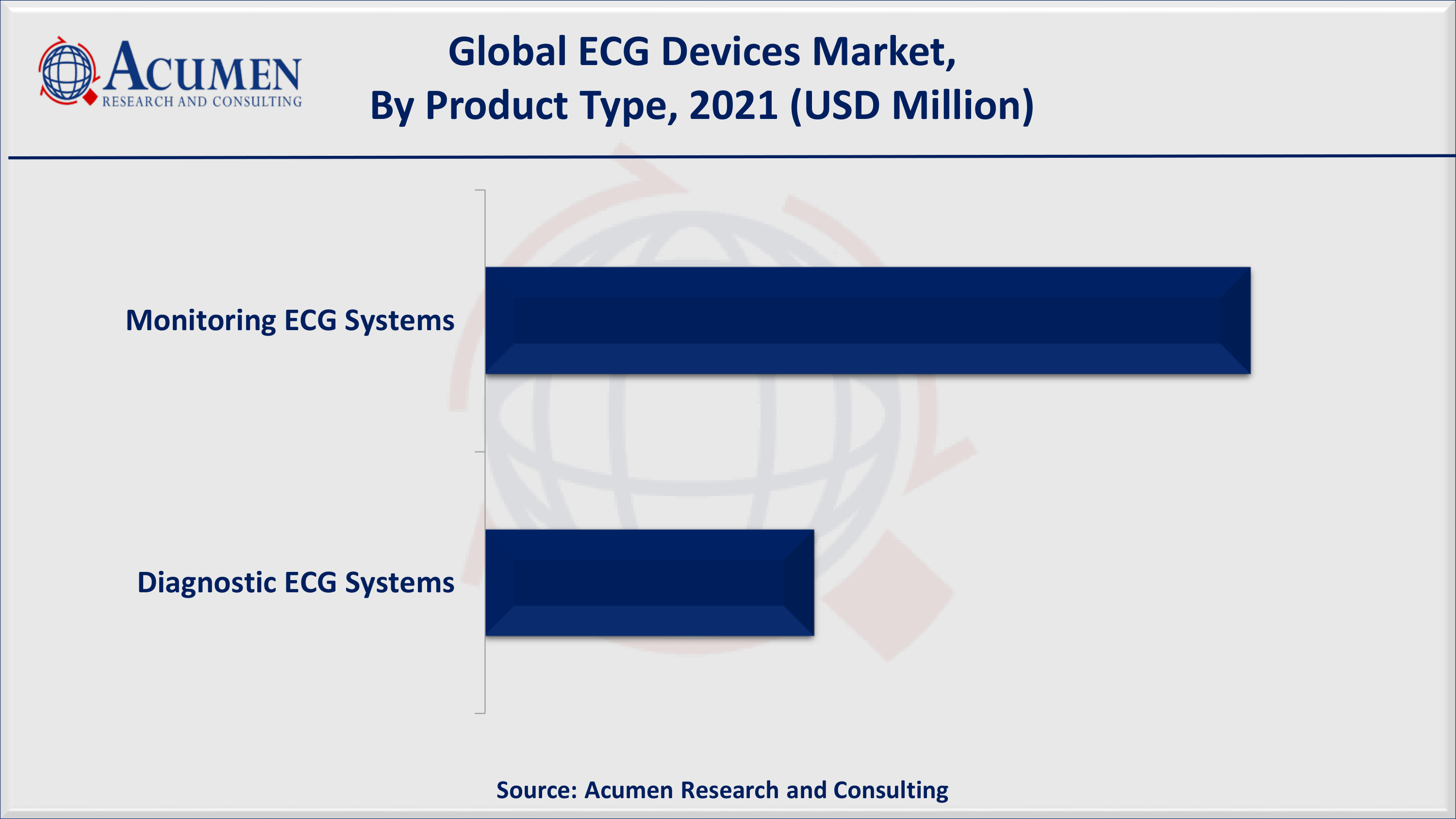

ECG Devices Market By Product Type

- Monitoring ECG Systems

- Remote Data Monitoring

- Event Monitoring

- Continuous Cardiovascular Monitoring Systems

- Diagnostic ECG Systems

- Rest ECG Systems

- Stress ECG Systems

- Holter ECG Systems

According to our ECG devices industry analysis, monitoring ECG systems have the maximum share (%) in terms of value (US$ Mn). The monitoring ECG systems segment is further bifurcated into remote data monitoring, event monitoring, and continuous cardiovascular monitoring systems. The rapidly increasing number of cardiovascular patients is proliferating the segmental market value. The necessity to monitor the regular health of patients with heart disease makes it a preferred choice for hospitals, clinic as well as for home care. The increasing availability of wireless devices across the globe and especially in developed and developing economies is bolstering the segmental market growth.

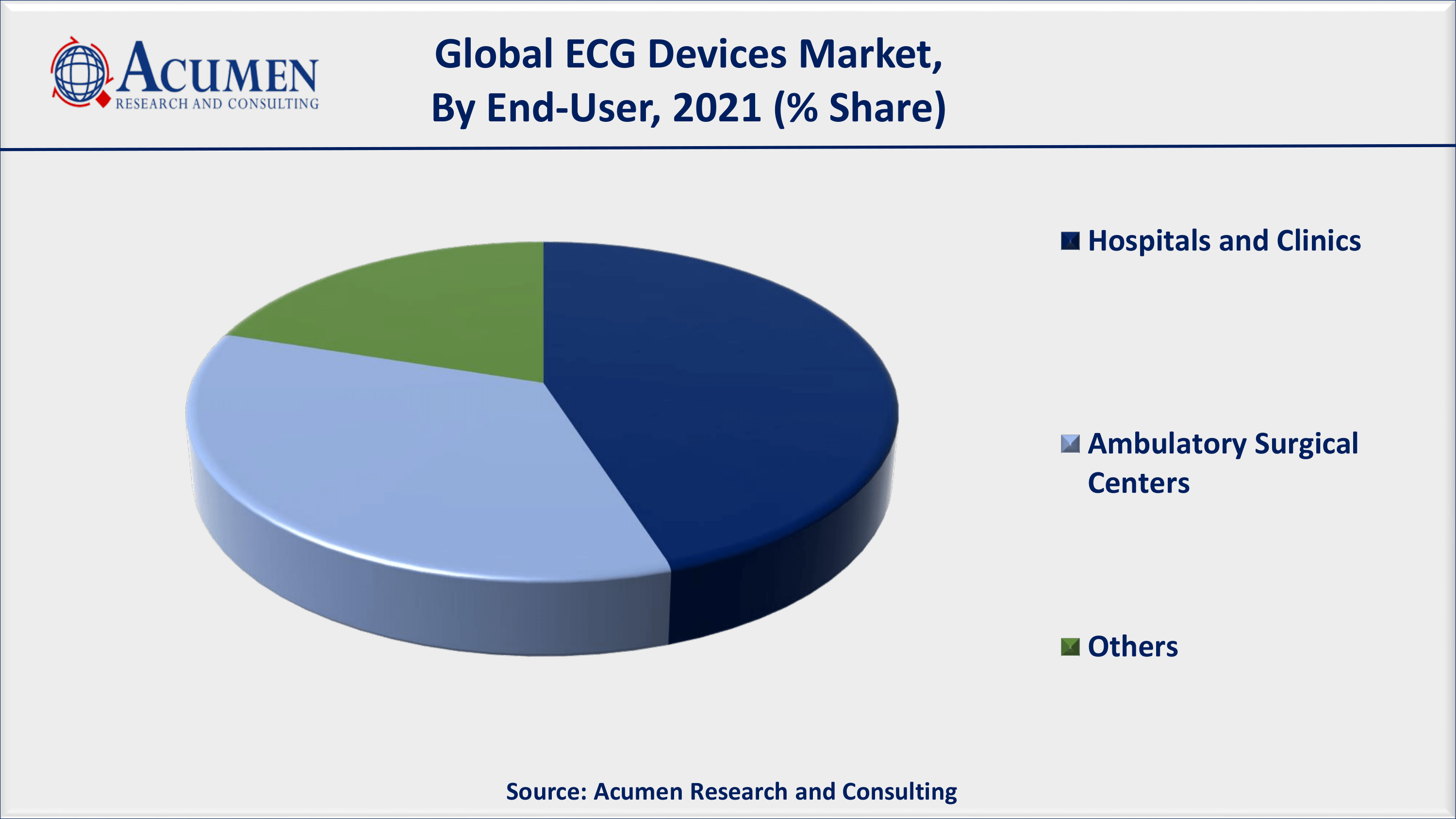

ECG Devices Market By End-User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

According to our ECG devices market forecast, the hospitals and clinics sub-segment generated the most revenue in 2021 and will continue to do so in the coming years. The rapid expansion in hospitals is attributed to hospitals' widespread use of ECG systems, as well as clinicians' routine use of ECG examinations. Ambulatory surgical centers, on the other hand, are expected to grow at a rapid pace in the near future.

ECG Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America dominated the ECG Devices Market with maximum share

In 2021, North America accounted for the major revenue share (%) in the global market. The presence of technologically advanced healthcare infrastructure in the region is supporting the regional market value. The major economies of the region including the US and Canada are major contributors to the dominating market value. The increasing incidence of cardiovascular diseases along with the increasing geriatric population in the region is supporting the regional market value. Moreover, Asia Pacific is anticipated to exhibit the fastest growth during the forecast period from 2022 to 2030. The emerging economies of the region including China and India are supporting the fastest growth. The developing healthcare infrastructure, increasing discretionary income, and rising investment by major players in the region are the factors propelling the regional market value. The developing countries of the region including Japan, China, and India are major contributors to the rapidly increasing regional market value.

ECG Devices Market Players

The players profiled in the report include Aerotel Medical Systems Ltd, AliveCor Inc., BPL Medical Technologies, Cardiocity Limited, CardioComm Solutions Inc., GE Healthcare, iRhythm Technologies Inc., MediBioSense Ltd, Medtronic PLC, and Nihon Kohden Corporation. The major ECG devices players were involved in strategic developments for escalating the profit share in regional as well as global market. The major investments were announced for the technological advancements associated with the changing consumer demand for the ECG devices.

Frequently Asked Questions

What is the size of global ECG devices market in 2021?

The market size of ECG devices market in 2021 was accounted to be USD 5,284 Million.

What is the CAGR of global ECG devices market during forecast period of 2022 to 2030?

The projected CAGR of ECG devices market during the analysis period of 2022 to 2030 is 5.6%.

Which are the key players operating in the market?

The prominent players of the global ECG devices market are Aerotel Medical Systems Ltd, AliveCor Inc., BPL Medical Technologies, Cardiocity Limited, CardioComm Solutions Inc., GE Healthcare, iRhythm Technologies Inc., MediBioSense Ltd, Medtronic PLC, and Nihon Kohden Corporation.

Which region held the dominating position in the global ECG devices market?

North America held the dominating ECG devices during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for ECG devices during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global ECG devices market?

Growing prevalence of cardiovascular diseases, growing need for cardiovascular aging population, and increasing elderly population drives the growth of global ECG devices market.

Which product type held the maximum share in 2021?

Based on product type, monitoring ECG systems segment is expected to hold the maximum share ECG devices market.