ENT Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

ENT Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

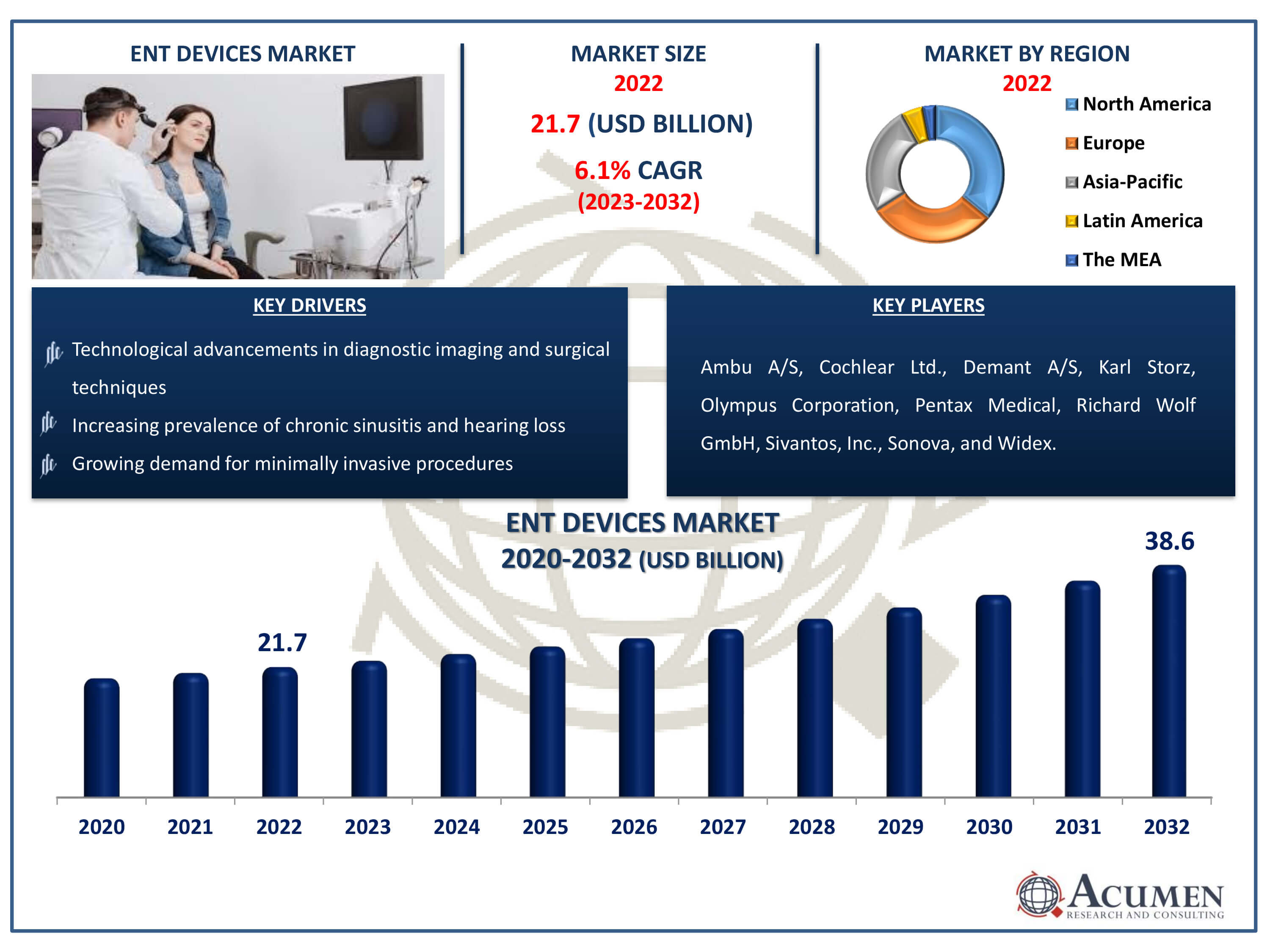

The ENT Devices Market Size accounted for USD 21.7 Billion in 2022 and is estimated to achieve a market size of USD 38.6 Billion by 2032 growing at a CAGR of 6.1% from 2023 to 2032.

ENT Devices Market Highlights

- Global ENT devices market revenue is poised to garner USD 38.6 billion by 2032 with a CAGR of 6.1% from 2023 to 2032

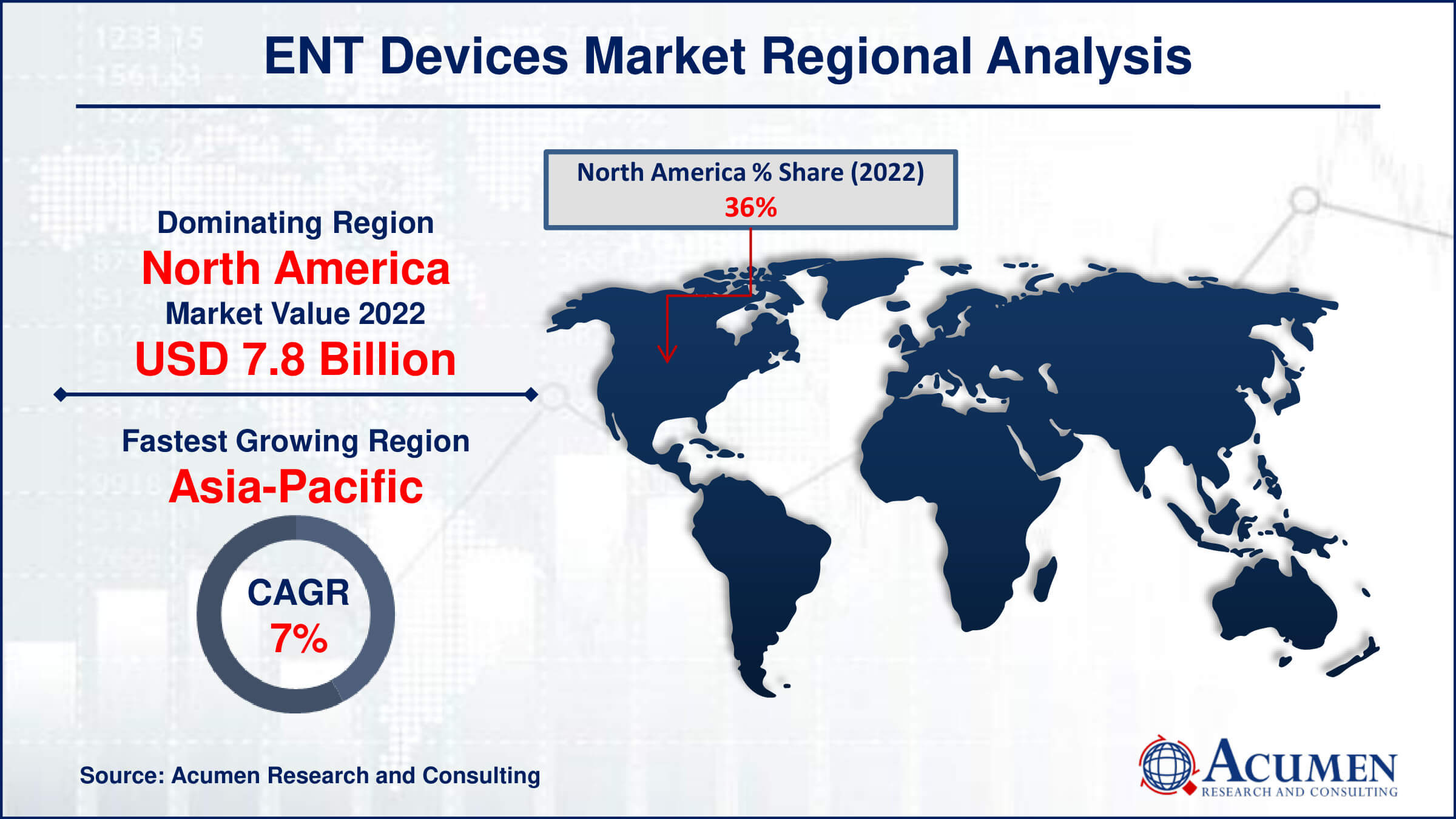

- North America ENT devices market value occupied around USD 7.8 billion in 2022

- Asia-Pacific ENT devices market growth will record a CAGR of more than 7% from 2023 to 2032

- Among product, the hearing aids sub-segment generated USD 6.7 billion revenue in 2022

- Based on end user, the hospitals sub-segment generated around 25% ENT devices market share in 2022

- Collaboration with healthcare providers for specialized ENT care delivery is a popular ENT devices market trend that fuels the industry demand

The ear, nose, and throat are critical components of the human body, required for total health and well-being. It is critical to ensure that these organs work properly since they are essential for sensory perception, breathing, and communication. However, several causes, including sinusitis and ageing, can affect their regular functions, resulting in a variety of health problems. ENT (Ear, Nose, and Throat) medicine, a foundation of medical science, focuses on detecting and treating disorders affecting these critical organs. ENT doctors use modern diagnostic tools and creative treatment modalities to treat a wide range of ear, nose, and throat illnesses, including allergies and infections as well as more complicated conditions including tumors and hearing loss. Furthermore, a wide range of ENT devices are available to help with the diagnosis, management, and treatment of ear, nose, and throat disorders, resulting in improved patient outcomes and higher quality of life.

Global ENT Devices Market Dynamics

Market Drivers

- Technological advancements in diagnostic imaging and surgical techniques

- Increasing prevalence of chronic sinusitis and hearing loss

- Growing awareness and demand for minimally invasive procedures

- Rising geriatric population requiring ENT care

Market Restraints

- Stringent regulatory approvals for new devices

- High cost associated with advanced ENT devices

- Limited reimbursement options for certain procedures

Market Opportunities

- Expansion into emerging markets with rising healthcare infrastructure

- Development of innovative devices for personalized treatment options

- Integration of telemedicine and remote monitoring solutions

ENT Devices Market Report Coverage

| Market | ENT Devices Market |

| ENT Devices Market Size 2022 | USD 21.7 Billion |

| ENT Devices Market Forecast 2032 |

USD 38.6 Billion |

| ENT Devices Market CAGR During 2023 - 2032 | 6.1% |

| ENT Devices Market Analysis Period | 2020 - 2032 |

| ENT Devices Market Base Year |

2022 |

| ENT Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ambu A/S, Cochlear Ltd., Demant A/S, Karl Storz, Olympus Corporation, Pentax Medical, Richard Wolf GmbH, Sivantos, Inc., Sonova, and Widex. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

ENT Devices Market Insights

The increasing use of modern technology, together with increased awareness of different health-related conditions and rising healthcare expenditures, is driving the strong expansion of the global ear-nose-throat (ENT) devices market. Furthermore, a favourable regulatory environment for ENT devices, along with an expanding elderly population, adds considerably to market growth potential. Furthermore, technological improvements and the availability of user-friendly ENT gadgets are changing lifestyle habits and increasing access to critical healthcare resources. The widespread availability of numerous ENT devices in the market, together with increased concerns about ear, nose, and throat disorders, drives rapid worldwide ear, nose, and throat devices market expansion. The incorporation of modern technology to improve the quality of ear, nose, and throat devices, as well as the introduction of new innovative products, contributes to overall market growth. Furthermore, technology implemented with ENT devices lowers mistakes and enhances precision, increasing demand for these devices. Despite these growth drivers, difficulties such as the high cost of ENT equipment and concerns with voice prosthesis may impede market expansion. Nonetheless, continued developments and strategic activities focused at solving unmet demands provide intriguing opportunities for long-term industry expansion.

ENT Devices Market Segmentation

The worldwide market for ENT devices is split based on product, end user, and geography.

Ear, Nose, and Throat Devices Market By Product

- Diagnostic ENT Devices

- Rigid Endoscopes

- Sinuscopes

- Otoscopes

- Laryngoscopes

- Flexible Endoscopes

- Bronchoscopes

- Laryngoscopes

- Nasopharyngoscopes

- Robot Assisted Endoscope

- Hearing Screening Device

- Rigid Endoscopes

- Surgical ENT Devices

- Radiofrequency handpieces

- Otological Drill Burrs

- ENT Hand Instruments

- Sinus Dilation Devices

- Nasal Packing Devices

- Hearing Aids

- Hearing Implants

- Nasal Splints

According to ENT devices industry analysis, the hearing aids category is the major contributor, playing an important role in managing hearing abnormalities and fostering improved auditory function. Hearing aids are an important option for those suffering from varied degrees of hearing loss, and they cater to a wide range of ages, from children to the elderly. Hearing loss is common over the world, and factors such as ageing populations, noise pollution exposure, and congenital diseases all contribute to its prevalence. As a result, demand for hearing aids is constantly strong, owing to increased knowledge of hearing health and the availability of cutting-edge technical solutions.

Hearing aid design and usefulness have been transformed by technological improvements, which include features such as digital signal processing, noise reduction, and Bluetooth connectivity. These enhancements improve the user experience by offering higher-quality sound and greater flexibility in a variety of listening scenarios. Furthermore, the miniaturisation of hearing aids has made them more unobtrusive and easy to use, increasing adoption rates. Furthermore, increased use of hearing aids among younger populations, such as those with noise-induced hearing loss and those looking for personalized audio augmentation, helps to drive market expansion. As a consequence, the hearing aids sector continues to dominate the ENT devices market, driven by continuous innovation, increasing accessibility, and the need to meet the changing demands of people with hearing impairments.

Ear, Nose, and Throat Devices Market By End User

- Hospitals

- Ambulatory settings

- ENT clinics

- Research and academic institutes

- Others

As per the ENT devices market forecast period, hospitals end-user is expected to be the largest from 2023 to 2032, acting as a foundation for the diagnosis, treatment, and management of ear, nose, and throat illnesses. Hospitals provide complete healthcare services, including specialised ENT departments and cutting-edge facilities, catering to a varied patient population with various healthcare requirements. Hospitals are key referral centres for those requiring specialised ENT treatment, including a variety of diagnostic techniques, surgical interventions, and post-operative care services. Hospitals have access to modern diagnostic imaging technologies including CT scans and MRI, which provide precise diagnosis and treatment planning for complicated ENT diseases.

Furthermore, hospitals offer a comprehensive approach to ENT care, allowing for collaboration among ENT physicians, audiologists, speech therapists, and other healthcare experts. This integrated approach ensures that patients with a variety of ear, nose, and throat diseases receive comprehensive care and achieve the best possible treatment outcomes. Hospitals also serve as teaching grounds for medical students, residents, and fellows, encouraging research and innovation in the area of otolaryngology. Research undertaken in hospitals fosters breakthroughs in ENT equipment, surgical procedures, and treatment regimens, ultimately improving patient care and broadening the scope of ENT practice.

ENT Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

ENT Devices Market Regional Analysis

In terms of ENT devices market analysis, North America appears as the largest area in the ENT devices market, thanks to a number of reasons that contribute to its dominance. To begin, North America has a well-established healthcare infrastructure, including superior medical facilities and a high rate of adoption of breakthrough healthcare technology. This promotes extensive access to ENT services and equipment throughout the area, resulting in market development. Furthermore, the area benefits from a strong regulatory system that ensures product quality, safety, and adherence to high standards, increasing customer trust in ENT devices.

Furthermore, the increased frequency of ENT illnesses, a growing elderly population, and rising healthcare costs all contribute to the continued need for ENT devices in North America. Furthermore, the presence of important market competitors in the area, as well as considerable research and development efforts, promote ongoing innovation and technical developments in ENT devices, bolstering North America's market leadership.

On the other hand, the Asia-Pacific region emerges as the fastest-growing area over the ENT devices industry forecast period, owing to rapid urbanization, expanding healthcare infrastructure, and rising awareness of ENT illnesses. The Asia-Pacific area includes populous nations such as China and India, where rising disposable incomes, improved healthcare access, and increasing adoption of Western lifestyles all contribute to increased demand for ENT devices. Government efforts targeted at enhancing healthcare facilities and addressing unmet medical needs also contribute to market growth in the Asia-Pacific region. Overall, the combination of these criteria places North America as the largest ENT device market, with Asia-Pacific emerging as the area with the greatest development potential.

ENT Devices Market Players

Some of the top ENT devices companies offered in our report includes Ambu A/S, Cochlear Ltd., Demant A/S, Karl Storz, Olympus Corporation, Pentax Medical, Richard Wolf GmbH, Sivantos, Inc., Sonova, and Widex.

Frequently Asked Questions

How big is the ENT devices market?

The ENT devices market size was valued at USD 21.7 billion in 2022.

What is the CAGR of the global ENT devices market from 2023 to 2032?

The CAGR of ENT devices is 6.1% during the analysis period of 2023 to 2032.

Which are the key players in the ENT devices market?

The key players operating in the global market are including Ambu A/S, Cochlear Ltd., Demant A/S, Karl Storz, Olympus Corporation, Pentax Medical, Richard Wolf GmbH, Sivantos, Inc., Sonova, and Widex.

Which region dominated the global ENT devices market share?

North America held the dominating position in ENT devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ENT devices during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global ENT devices industry?

The current trends and dynamics in the ENT Devices industry include technological advancements in diagnostic imaging and surgical techniques, increasing prevalence of chronic sinusitis and hearing loss, growing awareness and demand for minimally invasive procedures, and rising geriatric population requiring ENT care.

Which end user held the maximum share in 2022?

The hospitals end user held the maximum share of the ENT devices industry.