Duloxetine API Market | Acumen Research and Consulting

Duloxetine API Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

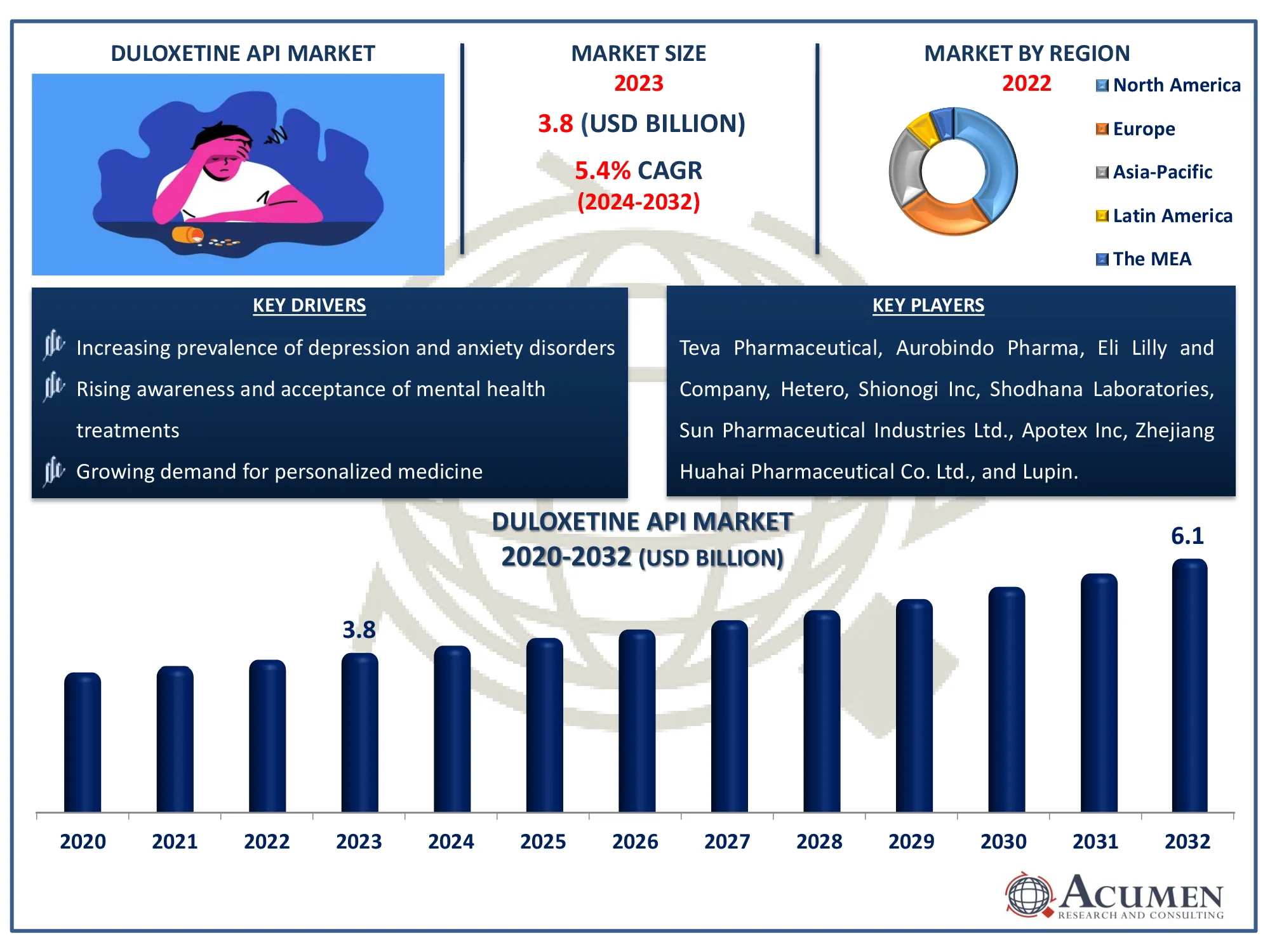

The Global Duloxetine API Market Size accounted for USD 3.8 Billion in 2023 and is estimated to achieve a market size of USD 6.1 Billion by 2032 growing at a CAGR of 5.4% from 2024 to 2032.

Duloxetine API Market (By Type of Drug: Generic, and Brand; By Application: Major Depressive Disorder, Generalized Anxiety Disorder, Fibromyalgia, Neuropathic Pain, Chronic Musculoskeletal Pain, and Others; By End-User: Pharmaceutical and Biopharma Industries, Hospital, and Other; and By Region: North America, Europe, Asia-Pacific, Latin America, and the MEA)

Duloxetine API Market Highlights

- The global duloxetine API market is projected to reach USD 6.1 billion by 2032, growing at a CAGR of 5.4% from 2024 to 2032

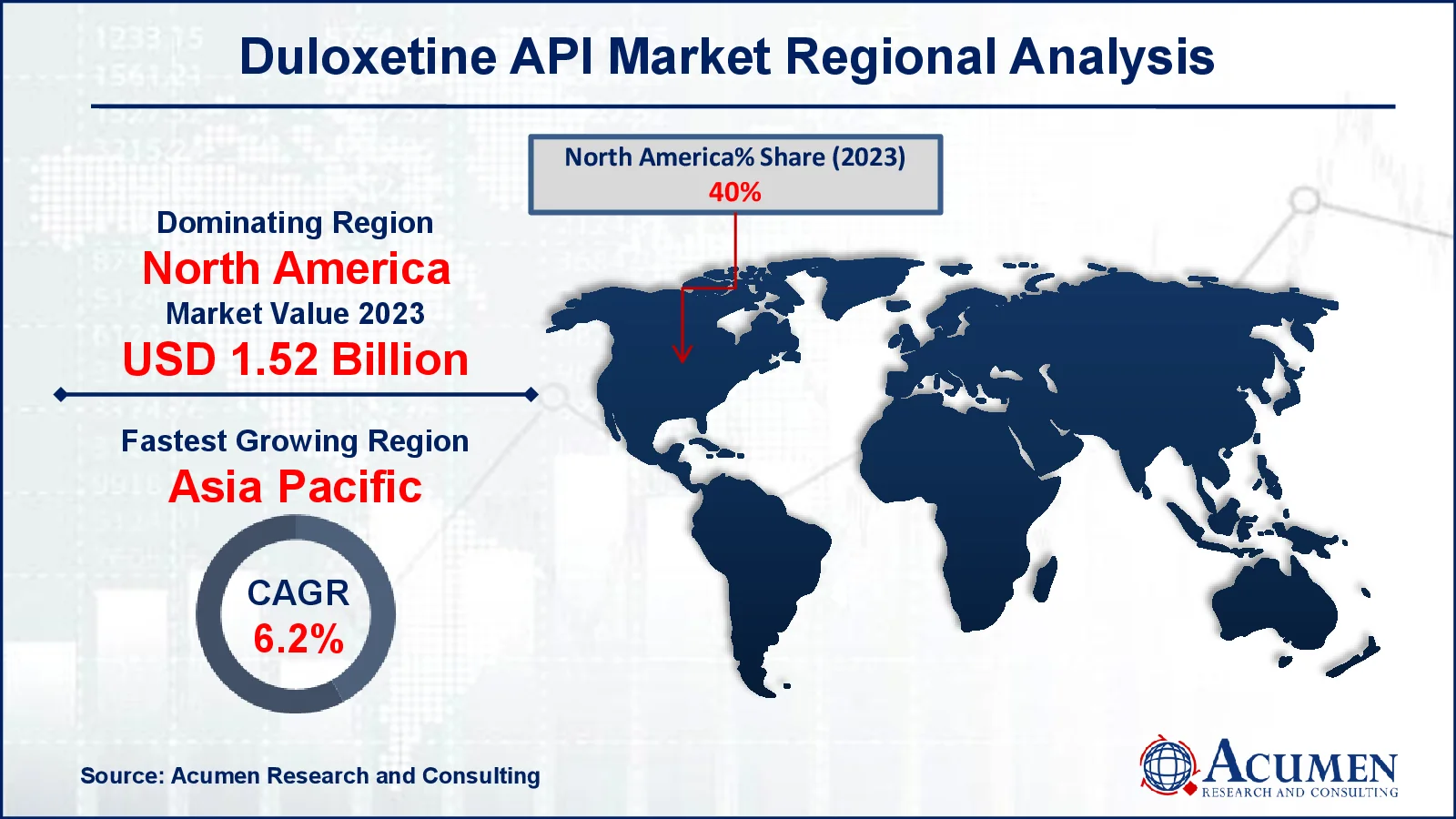

- North America accounted for approximately USD 1.52 billion of the duloxetine API market value in 2023

- The Asia-Pacific duloxetine API market is expected to grow at a CAGR of over 6.2% from 2024 to 2032

- In 2023, the generic drug sub-segment is anticipated to experience strong growth

- The major depressive disorder application sub-segment is expected to capture a notable share in 2023

- Increased interest in generic formulations is a key trend driving demand in the duloxetine API market

Duloxetine is a serotonin-norepinephrine reuptake inhibitor (SNRI) that is prescribed to treat depression and anxiety. It is particularly useful in treating nerve pain in diabetics as well as continuous pain caused by medical diseases such as arthritis or chronic back pain. Duloxetine can also improve mood, sleep, appetite, and energy levels while reducing anxiousness. This can also help with discomfort from some medical disorders. Tablets and capsules are manufactured using active pharmaceutical ingredients (APIs).

Global Duloxetine API Market Dynamics

Market Drivers

- Increasing prevalence of depression and anxiety disorders

- Rising awareness and acceptance of mental health treatments

- Growing demand for personalized medicine

Market Restraints

- High cost of Duloxetine API production

- Stringent regulatory requirements

- Side effects and potential for abuse

Market Opportunities

- Expansion into emerging markets with unmet medical needs

- Development of novel formulations and delivery systems

- Increasing investments in mental health research and development

Duloxetine API Market Report Coverage

| Market | Duloxetine API Market |

| Duloxetine API Market Size 2022 |

USD 3.8 Billion |

| Duloxetine API Market Forecast 2032 | USD 6.1 Billion |

| Duloxetine API Market CAGR During 2023 - 2032 | 5.4% |

| Duloxetine API Market Analysis Period | 2020 - 2032 |

| Duloxetine API Market Base Year |

2022 |

| Duloxetine API Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type Of Drug, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Teva Pharmaceutical Industries Ltd, Aurobindo Pharma, Eli Lilly and Company, Hetero, Shionogi Inc., Shodhana Laboratories, Sun Pharmaceutical Industries Ltd., Apotex Inc., Zhejiang Huahai Pharmaceutical Co. Ltd., and Lupin. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Duloxetine API Market Insights

Some of the factors driving market expansion include an increase in the prevalence of depression and anxiety. The increasing penetration of generic medications, the expanding tendency of outsourcing, a solid drug pipeline, and rising demand for freshly produced branded drugs are all adding to market value. Furthermore, growing economies and their respective endeavors to advance in the sector in order to deliver advanced solutions to the conditions are expected to provide significant chances throughout the forecast period.

The high cost of making Duloxetine API is a restraint for the duloxetine active pharmaceutical ingredient (API) market. Complex production processes and strict quality controls drive up the price. This makes it hard for manufacturers to keep prices low, which can limit market growth and make the drug more expensive for patients. As a result, companies may struggle to stay profitable.

The duloxetine API market is growing because new and better ways to deliver the drug are being developed. These include improved forms like extended-release capsules and new delivery methods like patches or dissolvable films. These innovations help make the drug more effective and easier for patients to use. This makes duloxetine more appealing to doctors and patients, boosting its market potential. As a result, the duloxetine API market is becoming more dynamic and competitive.

In 2021, one of the biggest market competitors, Teva Pharmaceutical, gained FDA permission from US legislation for a medicine that efficiently cures schizophrenia, and recent legal challenges have slowed. This FDA approval for a drug by key players further enhances market growth in coming years.

Duloxetine API Market Segmentation

The worldwide market for duloxetine API is split based on type of drug, application, end-user, and geography.

Duloxetine Active Pharmaceutical Ingredient (API) Market By Type of Drug

- Generic

- Brand

According to the duloxetine API industry analysis, generics are the most common type of duloxetine API on the market because the patent for Cymbalta, the brand-name drug, has expired. This means that cheaper generic versions can now be sold. People and healthcare systems prefer these generics because they cost less. Since many companies make generics, there are lots of options available. This high availability and lower price make generics the dominant choice. As a result, they hold a large share of the Duloxetine API market.

Duloxetine Active Pharmaceutical Ingredient (API) Market By Application

- Major Depressive Disorder

- Generalized Anxiety Disorder

- Fibromyalgia

- Neuropathic Pain

- Chronic Musculoskeletal Pain

- Others

According to duloxetine active pharmaceutical ingredient (API) industry analysis, the major depressive disorder segment is expected to increase over the industry. Major Depressive Disorder (MDD) leads because duloxetine is very effective for treating it. MDD is common, and doctors often use duloxetine as a main treatment option. This high demand for duloxetine for MDD boosts its market share. Although duloxetine helps with other conditions like anxiety and pain, major depressive disorder is the biggest reason for its popularity.

Duloxetine Active Pharmaceutical Ingredient (API) Market By End-User

- Pharmaceutical and Biopharma Industries

- Hospital

- Others

According to the duloxetine API market forecast, pharmaceutical and biopharma companies are the main users. They need large amounts of duloxetine to produce medicines for depression, anxiety, and other conditions. These companies drive the market because they handle the production and distribution of the drug. Hospitals also use duloxetine, but their role is smaller compared to these big pharmaceutical firms. The large-scale manufacturing and distribution by pharmaceutical companies make them the key players in the market.

Duloxetine API Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Duloxetine API Market Regional Analysis

For several reasons, North America had the highest revenue share (40%) in the duloxetine active pharmaceutical ingredient (API) market, and it is expected to maintain its dominance during the forecast period. The region's established healthcare infrastructure and developed economies contribute to its market worth. The rising prevalence of diabetes in the region is driving regional market expansion. The presence of large manufacturers in the region, as well as their efforts to advance in the region, is adding to the regional market's worth. Chronic musculoskeletal pain is one of the most common painful problems handled by healthcare providers, and duloxetine API is suggested by doctors. Chronic low back pain and chronic osteoarthritis are two of the most frequent types of arthritis in the U.S.

Asia-Pacific and its growing economies are expected to see the fastest growth, with a significant CAGR (6.2%). The region's largest economies, including Japan, China, and India, are helping to drive regional market expansion. The increased investment of the region's leading players in research and development operations in the healthcare industry in order to capitalise on potential opportunities is driving up regional market value. The high frequency of mental problems and neurological diseases caused by demanding work-life schedules, as well as the growing trend of poor eating habits, are driving up regional duloxetine active pharmaceutical ingredient (API) industry value. The presence of a high number of manufacturers in the region boosts the regional market value.

Duloxetine API Market Players

Some of the top duloxetine API companies offered in our report include Teva Pharmaceutical Industries Ltd, Aurobindo Pharma, Eli Lilly and Company, Hetero, Shionogi Inc., Shodhana Laboratories, Sun Pharmaceutical Industries Ltd., Apotex Inc., Zhejiang Huahai Pharmaceutical Co. Ltd., and Lupin.

Frequently Asked Questions

How big is the Duloxetine API market?

The duloxetine API market size was valued at USD 3.8 billion in 2023.

What is the CAGR of the global Duloxetine API market from 2024 to 2032?

The CAGR of duloxetine API is 5.4% during the analysis period of 2024 to 2032.

Which are the key players in the Duloxetine API market?

The key players operating in the global market are including Teva Pharmaceutical Industries Ltd, Aurobindo Pharma, Eli Lilly and Company, Hetero, Shionogi Inc, Shodhana Laboratories, Sun Pharmaceutical Industries Ltd., Apotex Inc, Zhejiang Huahai Pharmaceutical Co. Ltd., and Lupin.

Which region dominated the global Duloxetine API market share?

North America held the dominating position in duloxetine API industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of duloxetine API during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Duloxetine API industry?

The current trends and dynamics in the duloxetine API industry include increasing prevalence of depression and anxiety disorders, rising awareness and acceptance of mental health treatments, and growing demand for personalized medicine.

Which type of drug held the maximum share in 2023?

The generic type of drug expected to held the maximum share of the duloxetine API industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date