Dual Fuel Generator Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Dual Fuel Generator Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

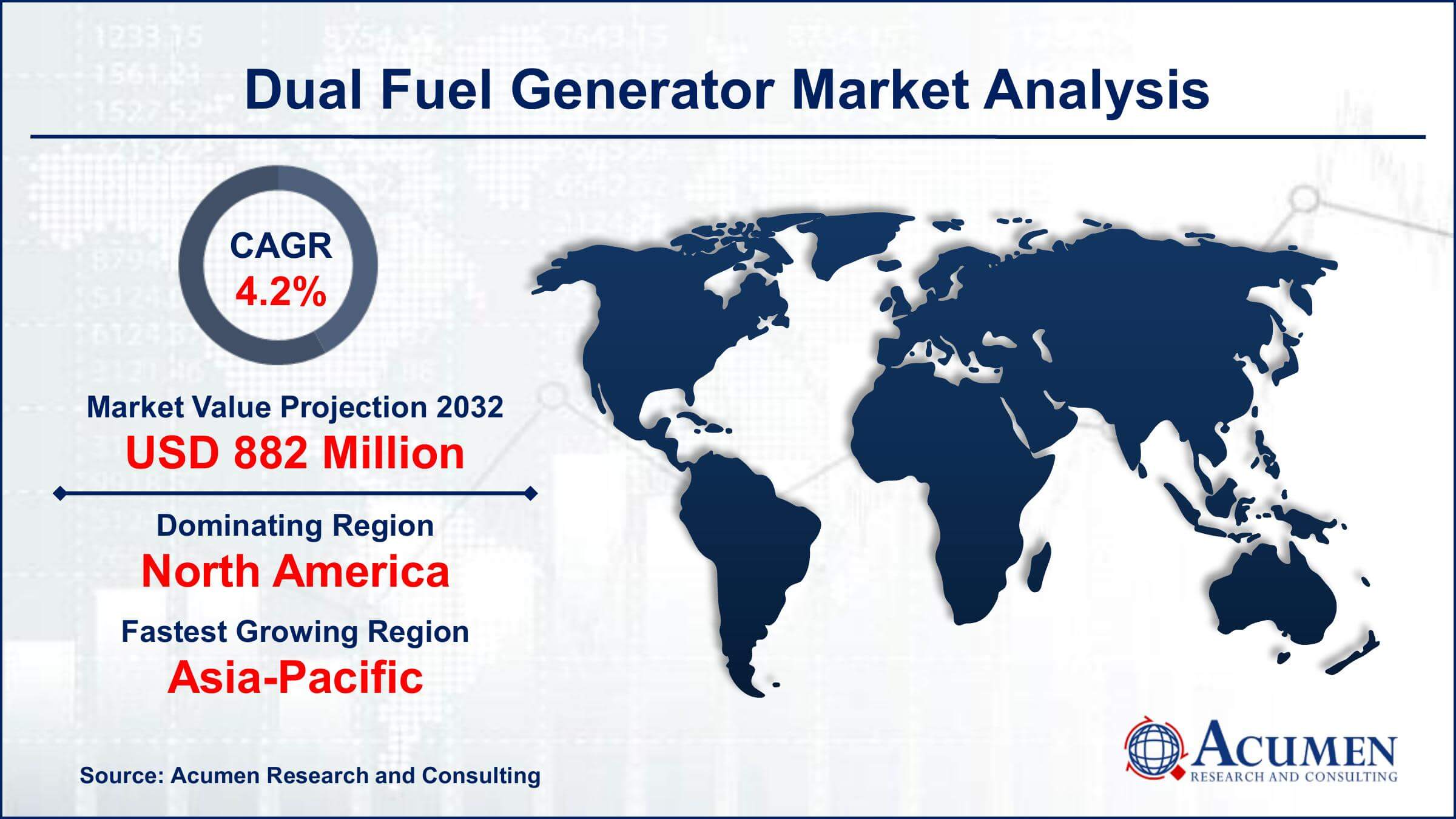

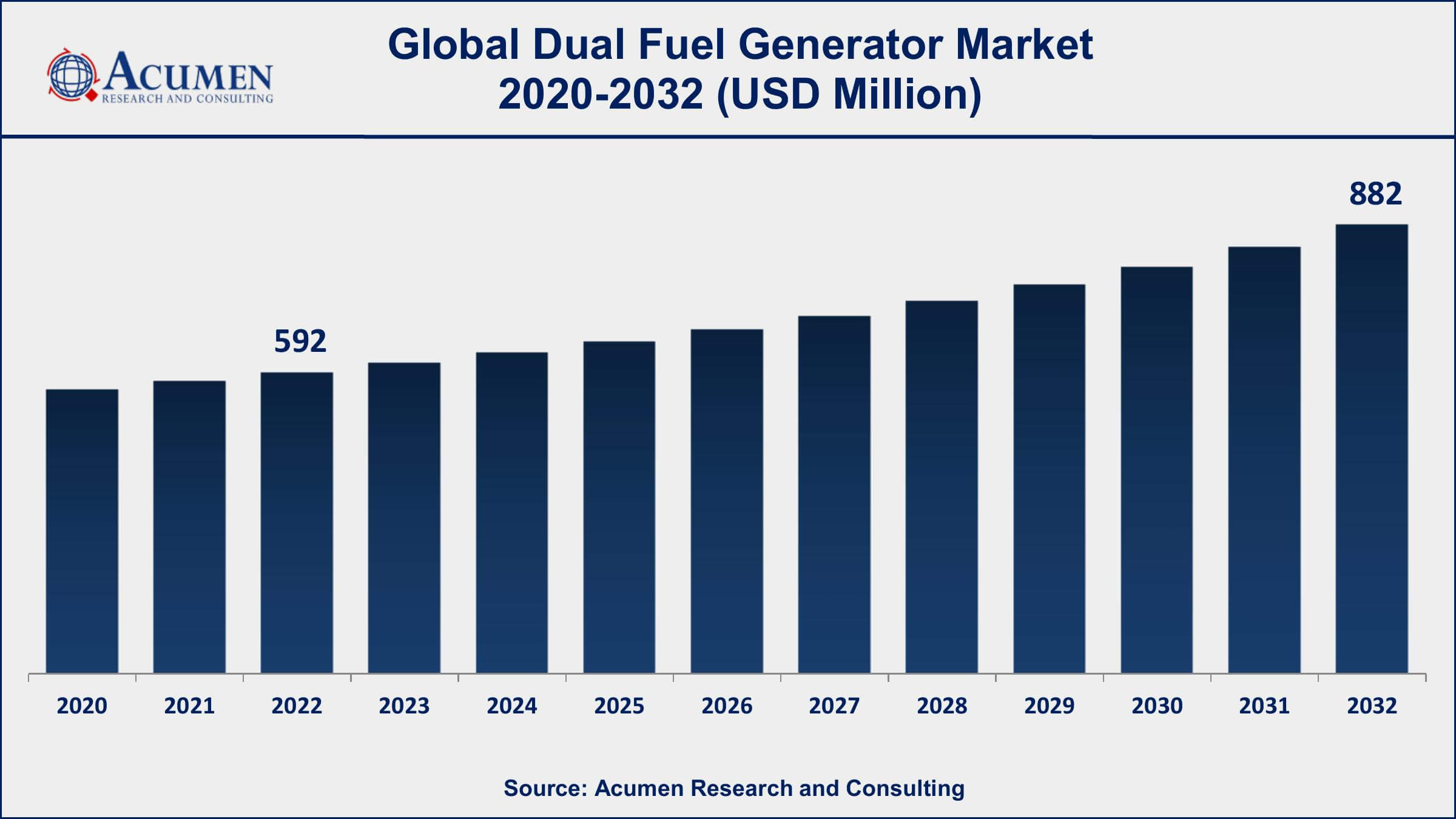

Request Sample Report

The Global Dual Fuel Generator Market Size accounted for USD 592 Million in 2022 and is projected to achieve a market size of USD 882 Million by 2032 growing at a CAGR of 4.2% from 2023 to 2032.

Dual Fuel Generator Market Highlights

- Global Dual Fuel Generator Market revenue is expected to increase by USD 882 Million by 2032, with a 4.2% CAGR from 2023 to 2032

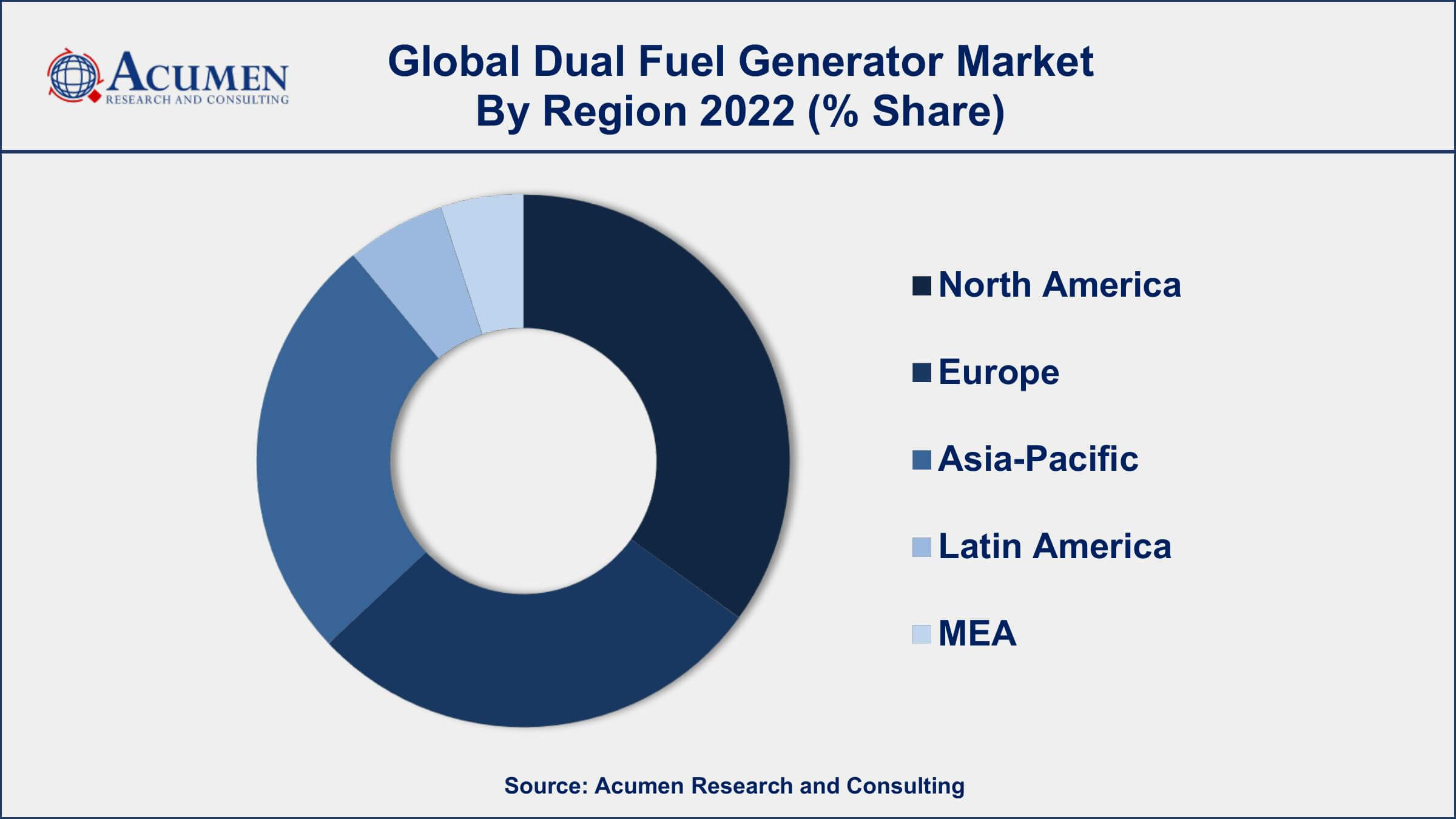

- North America region led with more than 36% of Dual Fuel Generator Market share in 2022

- According to the U.S. Energy Information Administration, power outages in the United States are on the rise, with an average of 36 power outages per year affecting 50,000 or more customers from 2000 to 2020

- Asia-Pacific Dual Fuel Generator Market growth will record a CAGR of more than 4.9% from 2023 to 2032

- By fuel type, the gasoline and liquid propane segment captured the largest market share in 2022

- Increasing demand for backup power solutions in residential and commercial sectors, drives the Dual Fuel Generator Market value

A dual fuel generator is a type of power generator that is capable of running on two different types of fuel, typically gasoline and propane or natural gas. These generators are designed to provide flexibility and convenience to users, allowing them to choose between different fuel options based on availability, cost, or specific requirements.

The market for dual fuel generators has experienced significant growth in recent years. One of the key drivers of this growth is the increasing demand for backup power solutions in both residential and commercial sectors. Dual fuel generators offer a reliable source of backup power during power outages, allowing users to maintain essential operations or continue with their daily activities without disruption. Moreover, the rising focus on environmental sustainability and the shift towards cleaner energy sources have also contributed to the market growth of dual fuel generators. Propane and natural gas, which are commonly used as alternative fuels in dual fuel generators, produce lower emissions compared to gasoline, making them more environmentally friendly options. This has attracted environmentally conscious consumers and businesses looking to reduce their carbon footprint.

Global Dual Fuel Generator Market Trends

Market Drivers

- Increasing demand for backup power solutions in residential and commercial sectors

- Growing awareness and emphasis on environmental sustainability

- Availability of cleaner fuel options like propane and natural gas

- Advancements in generator technology, leading to improved efficiency and performance

- Rise in severe weather events and power outages, necessitating reliable backup power sources

Market Restraints

- High upfront cost of dual fuel generators compared to single-fuel alternatives

- Limited availability and accessibility of propane and natural gas infrastructure in certain regions

Market Opportunities

- Increasing adoption of dual fuel generators in off-grid and remote areas with limited access to electricity grids

- Integration of smart technologies and digital control systems in dual fuel generators, offering improved monitoring and remote operation capabilities

Dual Fuel Generator Market Report Coverage

| Market | Dual Fuel Generator Market |

| Dual Fuel Generator Market Size 2022 | USD 592 Million |

| Dual Fuel Generator Market Forecast 2032 | USD 882 Million |

| Dual Fuel Generator Market CAGR During 2023 - 2032 | 4.2% |

| Dual Fuel Generator Market Analysis Period | 2020 - 2032 |

| Dual Fuel Generator Market Base Year | 2022 |

| Dual Fuel Generator Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Fuel Type, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Briggs & Stratton Corporation, Cummins Inc., Generac Power Systems, Inc., Honda Motor Co., Ltd., Kohler Co., Caterpillar Inc., Champion Power Equipment, Westinghouse Electric Corporation, Yamaha Motor Co., Ltd., WEN Products, DuroMax Power Equipment, and Firman Power Equipment. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A dual fuel generator is a type of power generator that is capable of running on two different types of fuel, typically gasoline and propane or natural gas. These generators are designed to provide flexibility and versatility to users, allowing them to choose between different fuel options based on their needs and availability. By offering the ability to switch between fuels, dual fuel generators provide backup power solutions that are adaptable to various situations and fuel availability.

The applications of dual fuel generators are wide-ranging and cater to both residential and commercial needs. In residential settings, dual fuel generators serve as reliable backup power sources during utility power outages. They can power essential appliances and systems, such as refrigerators, lights, heating or cooling units, and security systems, ensuring the comfort, safety, and functionality of homes. In commercial and industrial applications, dual fuel generators find extensive use in providing backup power to essential operations. They are commonly employed in small businesses, offices, retail stores, and restaurants to maintain operations and prevent financial losses during power disruptions.

The dual fuel generator market has witnessed significant growth in recent years and is expected to continue expanding in the coming years. Several factors contribute to this market growth including, the increasing demand for backup power solutions is driving the growth of the dual fuel generator market. With frequent power outages due to severe weather events or infrastructure issues, both residential and commercial users are seeking reliable backup power sources. Dual fuel generators offer the advantage of running on multiple fuel types, such as gasoline and propane or natural gas, providing users with flexibility and uninterrupted power supply during emergencies. Moreover, the growing emphasis on environmental sustainability is propelling the market growth of dual fuel generators.

Dual Fuel Generator Market Segmentation

The Global Dual Fuel Generator Market segmentation is based on fuel type, application, end user, and geography.

Dual Fuel Generator Market By Fuel Type

- Natural Gas and Liquid Propane

- Gasoline and Liquid Propane

According to the dual fuel generator industry analysis, the gasoline and liquid propane segment accounted for the largest market share in 2022. This segment offers the advantage of combining the accessibility of gasoline with the versatility of liquid propane, making it a popular choice for various applications. One key driver of the growth in the gasoline and liquid propane segment is the increasing demand for portable power solutions. Portable dual fuel generators provide flexibility and convenience, allowing users to take them to outdoor activities, camping trips, RV adventures, and other remote locations. The availability and portability of gasoline make it a preferred fuel option in these scenarios. However, the option to switch to liquid propane provides an added advantage when gasoline may be scarce or when longer runtime is required. Another factor contributing to the growth of this segment is the rising awareness of environmental sustainability.

Dual Fuel Generator Market By Application

- Standby/Backup Generators

- Portable Generators

In terms of applications, the standby/backup generators segment is expected to witness significant growth in the coming years. This segment caters to residential, commercial, and industrial users who require reliable backup power solutions during power outages or emergencies. One of the key drivers of growth in the standby/backup generators segment is the increasing demand for uninterrupted power supply. With the growing dependence on electrical devices and systems in various industries, any disruption in power can result in significant financial losses and operational downtime. Standby/backup generators provide a reliable source of power, automatically switching on when the main power supply is interrupted, ensuring continuous operation and mitigating potential losses. Another factor fueling the growth of this segment is the rising frequency of severe weather events, such as hurricanes, storms, and wildfires, which can cause prolonged power outages.

Dual Fuel Generator Market By End User

- Residential

- Commercial

- Industrial

According to the dual fuel generator market forecast, the commercial segment is expected to witness significant growth in the coming years. This segment caters to a wide range of commercial applications, including small businesses, offices, retail stores, restaurants, hotels, construction sites, and various other commercial establishments that require a reliable and efficient backup power source. One of the key drivers of growth in the commercial segment is the increasing reliance on technology and digital infrastructure in commercial operations. Many businesses today heavily depend on electronic systems, data centers, communication networks, and other critical equipment to ensure smooth operations. Any interruption in power supply can lead to financial losses, downtime, and potential damage to sensitive equipment. Dual fuel generators offer a dependable backup power solution that helps maintain business continuity, protect valuable assets, and avoid disruptions in commercial operations.

Dual Fuel Generator Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Dual Fuel Generator Market Regional Analysis

Geographically, North America dominates the dual fuel generator market in 2022. North America has a robust infrastructure and a reliable supply of both natural gas and gasoline, which are the primary fuel sources for dual fuel generators. The region has a well-established network of pipelines for natural gas distribution, and gasoline is readily available at fuel stations across the continent. This accessibility and reliability of fuel sources make dual fuel generators a practical and convenient choice for power generation in North America. Moreover, North America has a diverse range of industries and applications that require backup power solutions. From residential homes to commercial buildings, data centers, and industrial facilities, there is a significant demand for reliable backup power in the region. Dual fuel generators offer flexibility by allowing users to switch between natural gas and gasoline as fuel sources, providing an added layer of reliability and convenience. This versatility makes them well-suited for various applications, further driving their dominance in the market.

Dual Fuel Generator Market Player

Some of the top dual fuel generator market companies offered in the professional report include Briggs & Stratton Corporation, Cummins Inc., Generac Power Systems, Inc., Honda Motor Co., Ltd., Kohler Co., Caterpillar Inc., Champion Power Equipment, Westinghouse Electric Corporation, Yamaha Motor Co., Ltd., WEN Products, DuroMax Power Equipment, and Firman Power Equipment.

Frequently Asked Questions

What was the market size of the global dual fuel generator in 2022?

The market size of dual fuel generator was USD 592 Million in 2022.

What is the CAGR of the global dual fuel generator market from 2023 to 2032?

The CAGR of dual fuel generator is 4.2% during the analysis period of 2023 to 2032.

Which are the key players in the dual fuel generator market?

The key players operating in the global market are including Briggs & Stratton Corporation, Cummins Inc., Generac Power Systems, Inc., Honda Motor Co., Ltd., Kohler Co., Caterpillar Inc., Champion Power Equipment, Westinghouse Electric Corporation, Yamaha Motor Co., Ltd., WEN Products, DuroMax Power Equipment, and Firman Power Equipment.

Which region dominated the global dual fuel generator market share?

North Americaheld the dominating position in dual fuel generator industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of dual fuel generator during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global dual fuel generator industry?

The current trends and dynamics in the dual fuel generator industry include increasing demand for backup power solutions in residential and commercial sectors, growing awareness and emphasis on environmental sustainability, and availability of cleaner fuel options like propane and natural gas.

Which application held the maximum share in 2022?

The standby/backup generators application held the maximum share of the dual fuel generator industry.