Dual Chamber Prefilled Syringes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Dual Chamber Prefilled Syringes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

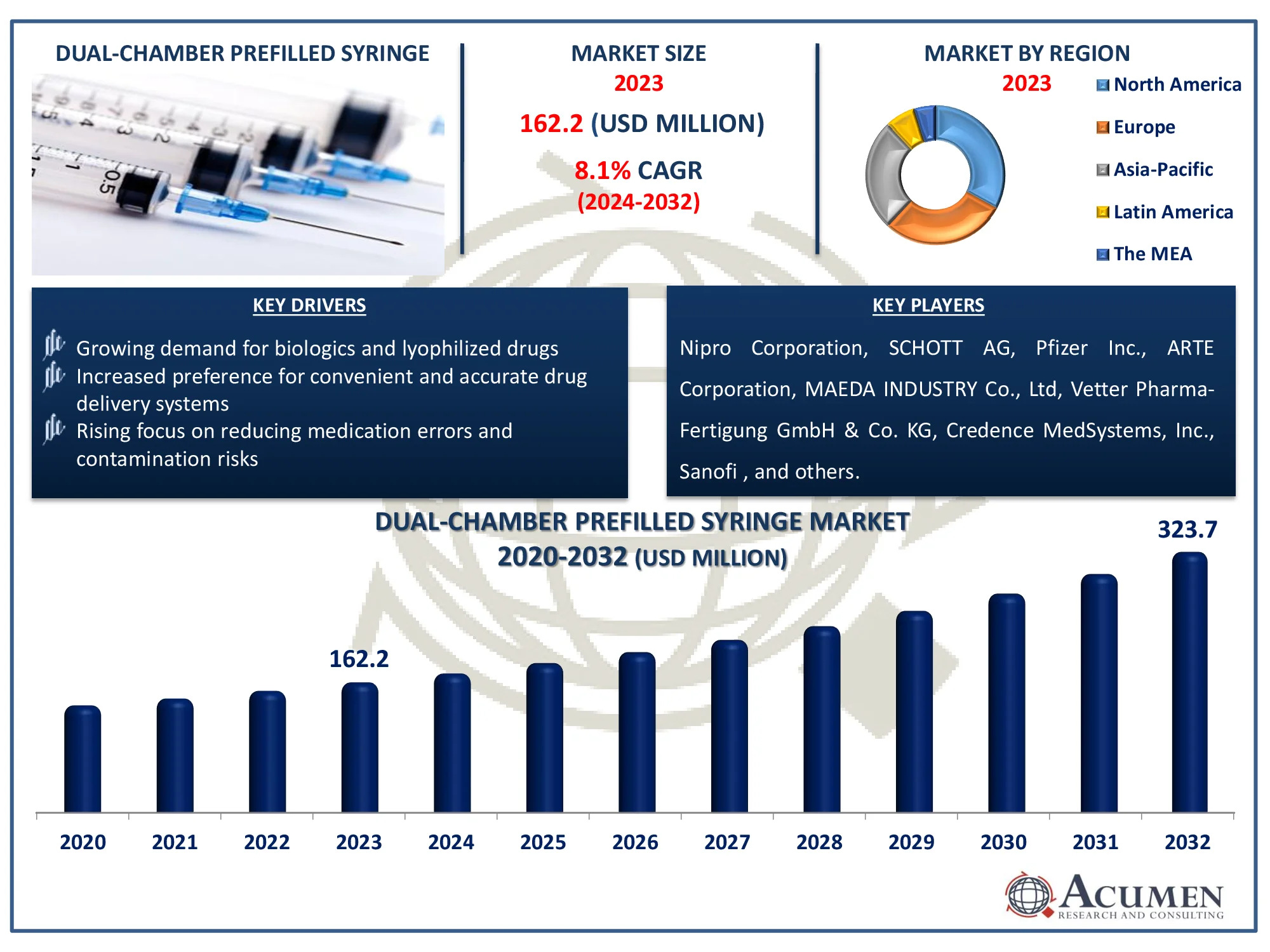

The Global Dual Chamber Prefilled Syringes Market Size accounted for USD 162.2 Million in 2023 and is estimated to achieve a market size of USD 323.7 Million by 2032 growing at a CAGR of 8.1% from 2024 to 2032.

Dual Chamber Prefilled Syringes Market Highlights

- The global dual chamber prefilled syringes market is expected to reach USD 323.7 million by 2032, growing at a CAGR of 8.1% from 2024 to 2032

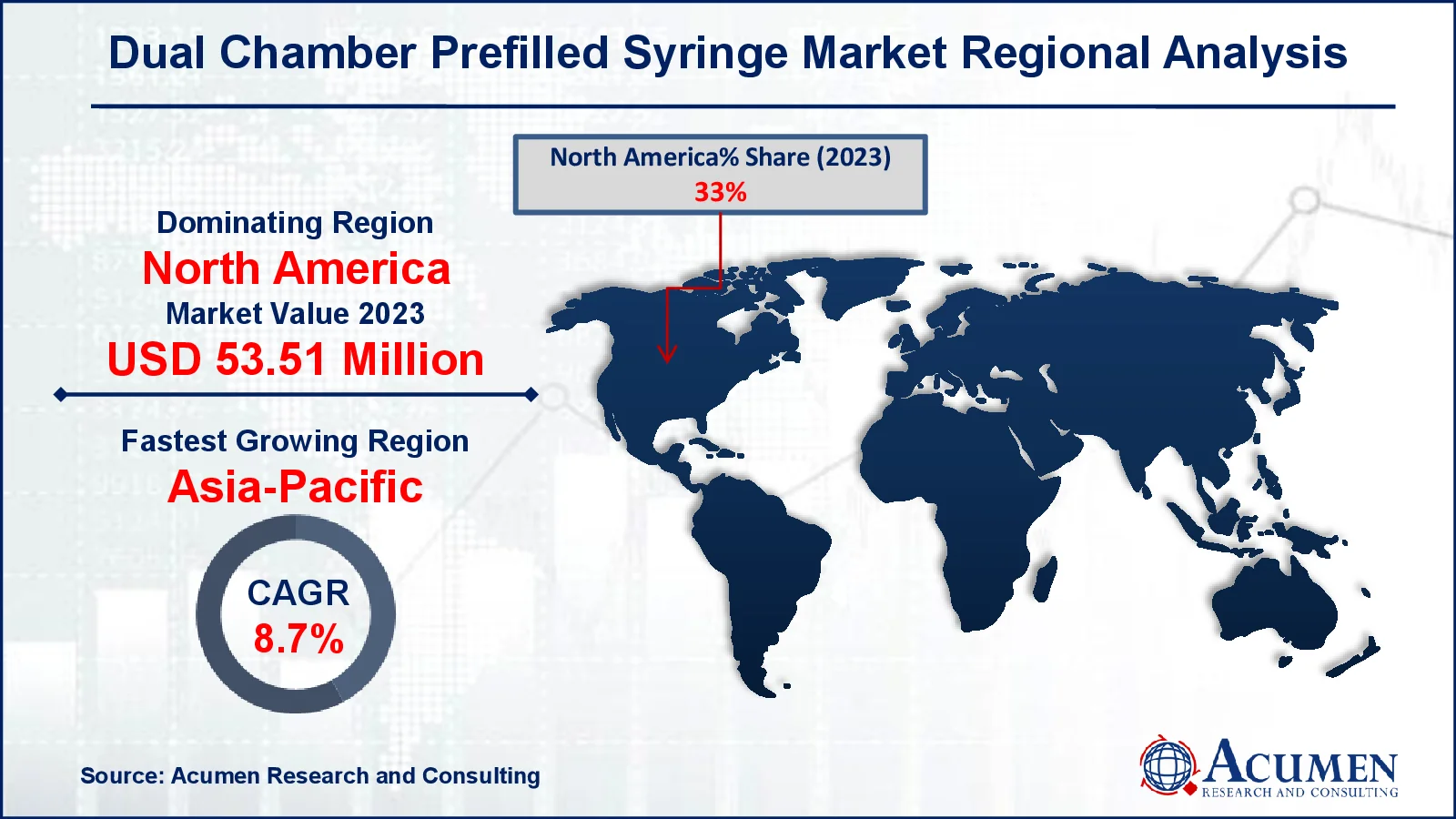

- In 2023, North America's dual chamber prefilled syringes market was valued at approximately USD 53.51 million

- The Asia-Pacific region is projected to grow at a CAGR of over 8.7% from 2024 to 2032

- Glass material dominated the market with a 52% share in 2023

- The vaccines and immunizations application sub-segment accounted for 26% of the market share in 2023

- Hospitals as the primary distribution channel holding revenue of USD 84.3 million in 2023

- Rising demand for biologics and complex injectable therapies is the dual chamber prefilled syringes market trend that fuels the industry demand

A dual chamber prefilled syringes is a medical device that has two distinct chambers: one for the lyophilized (freeze-dried) drug and one for the diluent (liquid). This design allows the medication to be mixed only before delivery, resulting in maximum efficacy and stability. It improves convenience, shortens preparation time, and reduces contamination hazards. These syringes are widely used for vaccines, biologics, and emergency medications that require immediate reconstitution. They increase dosing accuracy and are commonly used in hospitals and clinical settings to ensure safe and effective drug delivery.

Global Dual Chamber Prefilled Syringes Market Dynamics

Market Drivers

- Growing demand for biologics and lyophilized drugs

- Increased preference for convenient and accurate drug delivery systems

- Rising focus on reducing medication errors and contamination risks

Market Restraints

- High manufacturing costs and complex design requirements

- Stringent regulatory approvals and compliance standards

- Competition from alternative drug delivery systems like vials and single-chamber syringes

Market Opportunities

- Expanding applications in emergency medicine and chronic disease management

- Technological advancements in syringe design and materials

- Growing adoption in emerging markets with increasing healthcare infrastructure

Dual Chamber Prefilled Syringes Market Report Coverage

|

Market |

Dual Chamber Prefilled Syringes Market |

|

Dual Chamber Prefilled Syringes Market Size 2023 |

USD 162.2 Million |

|

Dual Chamber Prefilled Syringes Market Forecast 2032 |

USD 323.7 Million |

|

Dual Chamber Prefilled Syringes Market CAGR During 2024 - 2032 |

8.1% |

|

Dual Chamber Prefilled Syringes Market Analysis Period |

2020 - 2032 |

|

Dual Chamber Prefilled Syringes Market Base Year |

2023 |

|

Dual Chamber Prefilled Syringes Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Material, By Application, By Distribution Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Vetter Pharma-Fertigung GmbH & Co. KG, Nipro Corporation, SCHOTT AG, Pfizer Inc., ARTE Corporation, Credence MedSystems, Inc., Sanofi, Gerresheimer, AbbVie Inc., Otsuka America Pharmaceutical, Inc., and MAEDA INDUSTRY Co., Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Dual Chamber Prefilled Syringes Market Insights

With the increasing prevalence of chronic diseases including cancer and autoimmune disorders, there is a larger demand for biologic drugs, which are often sensitive and require precise dose. For example, according to the National Institute of Health (NIH), the prevalence of chronic disease in the United States has increased by 7 to 8 million people per five years during the last two decades. Furthermore, the Chemical Abstracts Service (CAS) Organization predicts that biologics would outsell new small molecules by $120 billion by 2027, accounting for 55% of all innovative medicine sales. The global biologics market was valued at $343 billion in 2021 and is predicted to reach $569.7 billion by 2027, representing a 9.2% growth rate. This convenience improves patient adherence and helps to fuel the growing trend of self-administration, particularly for chronic disease treatments.

To ensure drug stability and avoid component interactions, dual chamber prefilled syringes require innovative technology and specific materials. This complexity leads to higher production costs than traditional vials or single-chamber syringes. For example, to treat rheumatoid arthritis (RA), researchers developed a new "self-actuating" pharmaceutical delivery system that targets inflammation directly within the joints and releases therapeutic drugs precisely when needed. This discovery increases demand for Dual chamber prefilled syringes, which are ideal for delivering complex, condition-specific medications due to their exact dosing and ability to keep components separate until delivery. This convenience improves patient adherence and helps to fuel the growing trend of self-administration, particularly for chronic disease treatments.

To ensure drug stability and avoid component interactions, dual chamber prefilled syringes require innovative technology and specific materials. This complexity leads to higher production costs than traditional vials or single-chamber syringe. The high cost may limit dual-chamber prefilled syringes market penetration, particularly in cost-sensitive healthcare systems.

Sharps Technology Inc. intends to launch new specialized pre-fillable syringe systems in January 2023, featuring sophisticated polymer-based designs. This plan aims to boost revenue while satisfying growing healthcare demands. The new syringes are designed to increase the safety and efficiency of drug delivery. The launch of these new polymer-based pre-fillable syringe systems is expected to boost the dual-chamber prefilled syringes market, satisfying the growing need for safer and more efficient drug delivery solutions.

Dual Chamber Prefilled Syringes Market Segmentation

The worldwide market for dual chamber prefilled syringes is split based on material, application, distribution channel, and geography.

Dual Chamber Prefilled Syringes Market By Material

- Glass

- Plastic

According to the dual chamber prefilled syringes industry analysis, glass dominates the market due to its strong chemical inertness and compatibility with a wide range of medicinal formulations. It prevents drug interactions and maintains the stability and potency of sensitive biologics and lyophilized pharmaceuticals. Furthermore, in March 2024, SCHOTT Pharma will invest USD 371 million to develop a pre-fillable syringe manufacturing facility in Wilson, North Carolina. This facility will manufacture glass and polymer syringes, create over 400 jobs, and meet the expanding demand for mRNA and GLP-1 medicines, thereby improving the US supply chain by 2027. This shows an increase in demand for glass syringes.

Dual Chamber Prefilled Syringes Market By Application

- Oncology

- Diabetes

- Anaphylaxis

- Autoimmune Diseases

- Rheumatoid Arthritis

- Vaccines and Immunizations

- Others

Vaccines and immunizations dominate the dual chamber prefilled syringes sector, reflecting the increased demand for safe and efficient vaccine delivery technologies. These syringes allow for fast reconstitution of lyophilized vaccines with their diluents, preserving vaccine potency and decreasing contamination hazards. Their convenience improves mass immunization programs by reducing preparation time and assuring precise dose. As worldwide immunization programs increase to prevent infectious illnesses, the need for Dual chamber prefilled syringes in vaccine administration grows.

Dual Chamber Prefilled Syringes Market By Distribution Channel

- Hospitals

- Mail Order Pharmacies

- Ambulatory Surgery Centers

According to the dual chamber prefilled syringes market forecast, hospitals are the principal distribution channel due to their high demand for precise and efficient medicine delivery systems. These syringes make medicine delivery easier, cutting preparation time and lowering contamination concerns in critical care situations. Hospitals also handle a wide range of complicated biologics and emergency medications that require accurate reconstitution, thus dual-chamber syringes are an excellent choice. Their implementation improves patient safety and operational efficiency, resulting in market growth through hospital procurement.

Dual Chamber Prefilled Syringes Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Dual Chamber Prefilled Syringes Market Regional Analysis

For several reasons, North America dominates the dual-chamber prefilled syringes market because of its advanced healthcare infrastructure and high demand for biologics and specialty pharmaceuticals. Furthermore, the existence of major pharmaceutical companies, as well as ongoing investment in R&D, drives market expansion. For example, in July 2024, Genentech received FDA approval for the 6.0 mg single-dose prefilled syringe (PFS) version of faricimab-svoa (Vabysmo), which is intended to treat wet age-related macular degeneration (AMD), diabetic macular edema (DME), and macular edema after retinal vein occlusion (RVO). The region's robust regulatory structure assures safety and quality standards, while encouraging the use of new medication delivery devices fuels the expansion of the dual chamber prefilled syringes industry.

Asia-Pacific is quickly expanding its dual-chamber prefilled syringes market as healthcare investments increase and demand for innovative drug delivery systems rises. The region's developing pharmaceutical production capabilities, as well as rising awareness of novel cures fuel the dual chamber prefilled syringe market growth.

Europe growing notably, driven by an aging population and a rising frequency of chronic diseases. For example, according to the Organisation for Economic Cooperation and Development (OECD), the proportion of the EU population aged 65 and over increased from 18% to 21.1% between 2012 and 2022, with Germany's share increasing from 20.7% to 22.1%. This figure is expected to reach 28% by 2050. Chronic diseases are more common in older people, hence Germany's aging population contributes to a higher-than-average proportion of adults aged 65 and up reporting several chronic illnesses. Furthermore, supportive regulatory rules and the presence of major pharmaceutical manufacturers contribute to dual-chamber prefilled syringes market growth in Europe.

Dual Chamber Prefilled Syringes Market Players

Some of the top dual chamber prefilled syringes companies offered in our report include Vetter Pharma-Fertigung GmbH & Co. KG, Nipro Corporation, SCHOTT AG, Pfizer Inc., ARTE Corporation, Credence MedSystems, Inc., Sanofi, Gerresheimer, AbbVie Inc., Otsuka America Pharmaceutical, Inc., and MAEDA INDUSTRY Co., Ltd.

Frequently Asked Questions

How big is the dual chamber prefilled syringes market?

The dual chamber prefilled syringes market size was valued at USD 162.2 million in 2023.

What is the CAGR of the global dual chamber prefilled syringes market from 2024 to 2032?

The CAGR of dual chamber prefilled syringes is 8.1% during the analysis period of 2024 to 2032.

Which are the key players in the dual chamber prefilled syringes market?

The key players operating in the global market are including Vetter Pharma-Fertigung GmbH & Co. KG, Nipro Corporation, SCHOTT AG, Pfizer Inc., ARTE Corporation, Credence MedSystems, Inc., Sanofi, Gerresheimer, AbbVie Inc., Otsuka America Pharmaceutical, Inc., and MAEDA INDUSTRY Co., Ltd.

Which region dominated the global dual chamber prefilled syringes market share?

North America held the dominating position in dual chamber prefilled syringes industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of dual chamber prefilled syringes during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global dual chamber prefilled syringes industry?

The current trends and dynamics in the dual chamber prefilled syringes industry include growing demand for biologics and lyophilized drugs, increased preference for convenient and accurate drug delivery systems, and rising focus on reducing medication errors and contamination risks.

Which material held the maximum share in 2023?

The glass material held the maximum share of the dual chamber prefilled syringes industry.