Drug of Abuse Testing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Published :

Report ID:

Pages :

Format :

Drug of Abuse Testing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

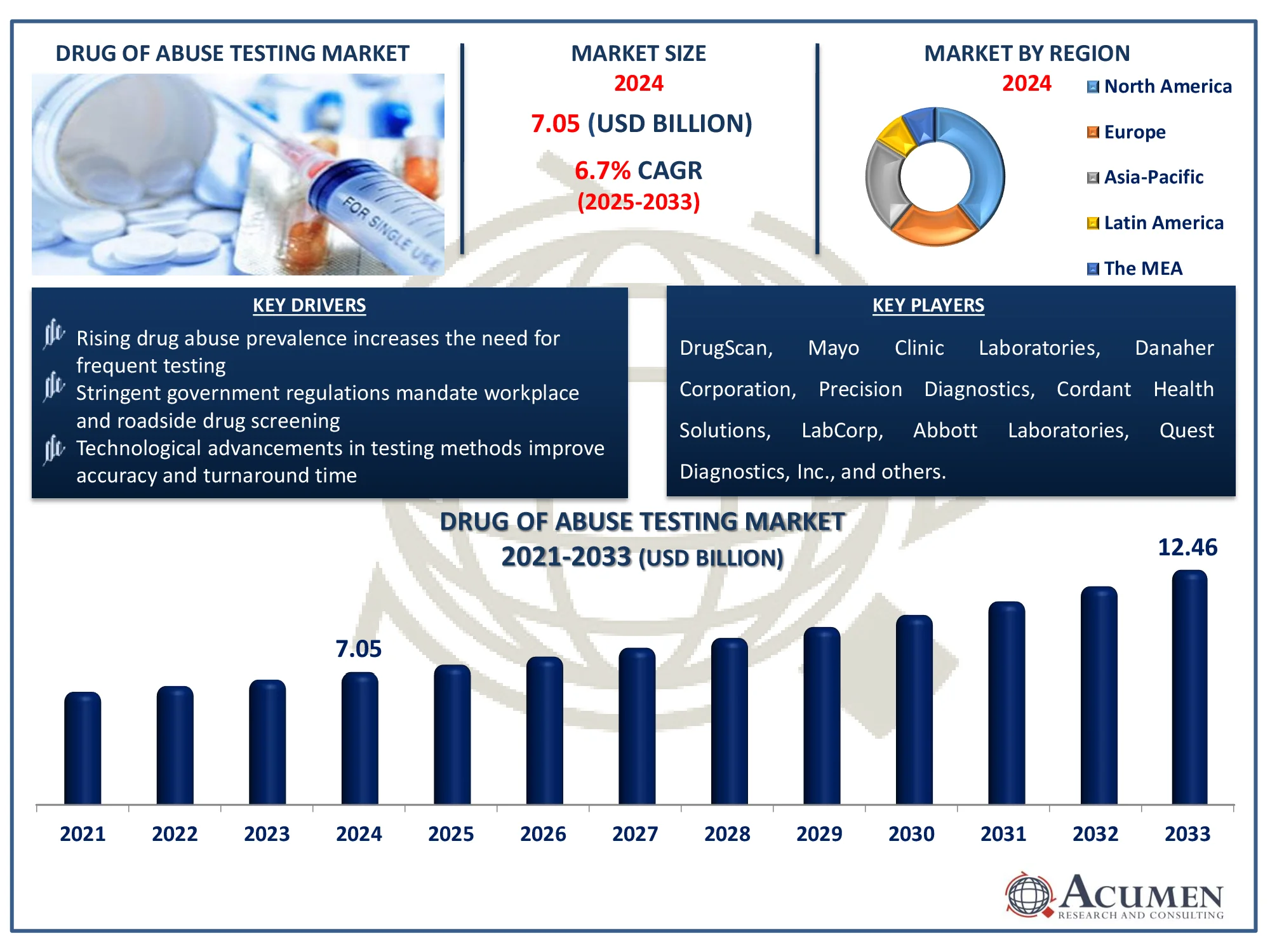

The Global Drug of Abuse Testing Market Size accounted for USD 7.05 Billion in 2024 and is estimated to achieve a market size of USD 12.46 Billion by 2033 growing at a CAGR of 6.7% from 2025 to 2033.

Drug of Abuse Testing Market Highlights

- Global drug of abuse testing market revenue is poised to garner USD 12.46 billion by 2033 with a CAGR of 6.7% from 2025 to 2033

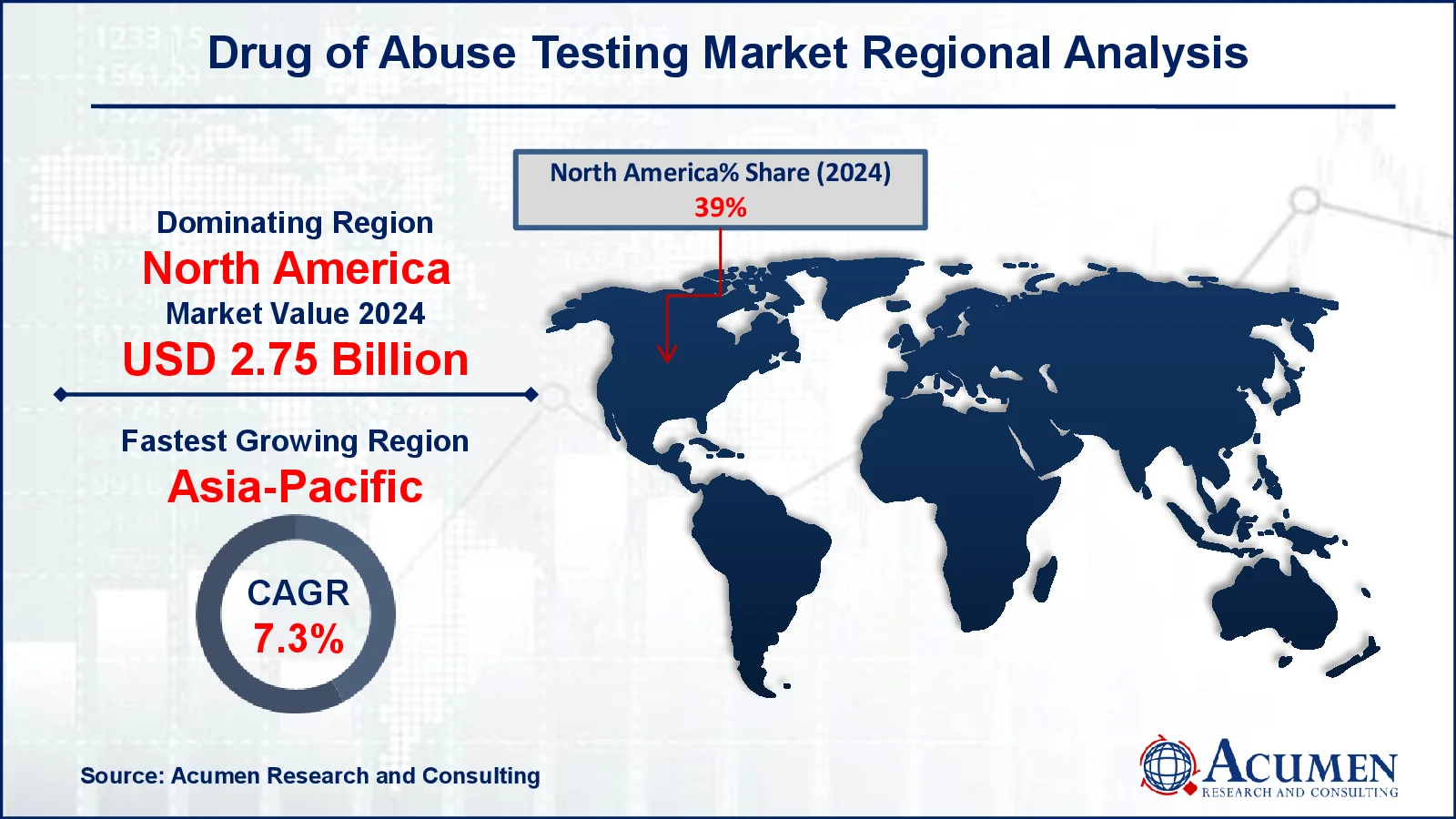

- North America drug of abuse testing market value occupied around USD 2.75 billion in 2024

- Asia-Pacific drug of abuse testing market growth will record a CAGR of more than 7.3% from 2025 to 2033

- According to the National Survey on Drug Use and Health, people aged 12 or older in 2023, 59.0% (or 167.2 million people) used an illicit

- drug in the past month (also defined as “current use”), including 47.5% (or 134.7 million people) used illicit drug

- According to a 2020 Society for Human Resource Management survey, 84% of employers in the United States conduct pre-employment drug testing for some or all job candidates

- According to Quest Diagnostics' 2020 report, the overall positivity rate for workplace drug testing increased for the first time in three years, rising to 4.5% in 2019 from 4.4% in 2018

- Among drug type, the marijuana/cannabis sub-segment generated 28% of share in 2024

- Governments are refining policies to balance innovation with ethical considerations, shaping the future of Drug of Abuse Testing is a popular market trend that fuels the industry demand

Drug of abuse testing is required to detect the presence of numerous drugs in a person's body using samples such as urine, saliva, blood, and hair. Drug misuse testing is necessary in order to provide appropriate medical treatment to the individual or to screen or monitor for the usage of illicit drugs. Marijuana, methadone, amphetamine and methamphetamine, benzodiazepines like diazepam, lorazepam, and oxazepam, cocaine, Barbiturates (phenobarbital, secobarbital, and pentobarbital), opioids (heroin, codeine, and morphine), and phencyclidine (PCP) are some of the drugs that are abused globally. Drug misuse testing is used for a variety of objectives, including medical screening, athletic testing, workplace drug testing, and legal or forensic investigations. Medical drug screening is used to determine which substances a person has consumed, allowing healthcare providers to provide appropriate therapy. A drug's effectiveness is determined by a variety of factors, including the body's response, the dosage and combination of chemicals used, and the time of ingestion.

Drug testing is used legally to detect the presence of illicit substances in a variety of scenarios. Sample collection techniques for these tests are rigorously regulated and documented to ensure a legal chain of custody. Drug abuse testing is a subset of forensic testing that is used in organizations. It may be undertaken prior to employment, at random during work, following an accident, or when there is a reasonable suspicion of drug usage.

Athletes at the national and international levels are routinely drug tested, mostly to avoid doping. Certain illegal substances promote muscle growth, strength, and endurance. The World Anti-Doping Agency (WADA), the International Association of Athletics Federations (IAAF), and the United States Anti-Doping Agency (USADA) monitor and test competitors at national, international, and Olympic events. While most chemicals are illegal in any quantity, some, such as caffeine, are restricted only in high quantities. Furthermore, certain substances, such as peptide hormones (e.g., growth hormone, erythropoietin, insulin-like growth factor-1, and testosterone), are prohibited, but can be difficult to detect due to their natural presence in the body.

Global Drug of Abuse Testing Market Dynamics

Market Drivers

- Rising drug abuse prevalence increases the need for frequent testing

- Stringent government regulations mandate workplace and roadside drug screening

- Technological advancements in testing methods improve accuracy and turnaround time

Market Restraints

- High costs of advanced drug testing systems limit affordability

- Privacy concerns and legal challenges restrict widespread adoption

- Risk of false positives/negatives affects test reliability and trust

Market Opportunities

- Growing adoption of rapid and portable testing devices in law enforcement and workplaces

- Expansion in emerging markets due to increasing drug-related issues

- Integration of AI and automation to enhance drug testing efficiency and accuracy

Drug of Abuse Testing Market Report Coverage

|

Market |

Drug of Abuse Testing Market |

|

Drug of Abuse Testing Market Size 2024 |

USD 7.05 Billion |

|

Drug of Abuse Testing Market Forecast 2033 |

USD 12.46 Billion |

|

Drug of Abuse Testing Market CAGR During 2025 - 2033 |

6.7% |

|

Drug of Abuse Testing Market Analysis Period |

2021 - 2033 |

|

Drug of Abuse Testing Market Base Year |

2024 |

|

Drug of Abuse Testing Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Drug Type, By Product, By Sample Type, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

DrugScan, Mayo Clinic Laboratories, Danaher Corporation, Precision Diagnostics, Cordant Health Solutions, LabCorp, Abbott Laboratories, Quest Diagnostics, Inc., LGC Group, and Legacy Medical Services. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Drug of Abuse Testing Market Insights

The global drug abuse testing market is increasing rapidly, owing to increased acceptance of drug testing in organizations and rising illicit drug production and trade around the world. Furthermore, factors such as the increasing number of traffic accidents and fatalities, the spike in illegal drug consumption, and developments in drug testing technology are driving market expansion.

Drug testing is used in organizations to increase productivity, minimize absenteeism, and improve workplace safety. According to a report by the Substance Abuse and Mental Health Services Administration (SAMHSA), marijuana was the most commonly used illicit drug in 2023, with 21.8% of those aged 12 and up, or 61.8 million people, reporting use in the previous year. Young adults aged 18 to 25 were the most likely to use marijuana, accounting for 36.5% (12.4 million) of all users. This was followed by adults aged 26 and up, with 20.8% (46.5 million) reporting use, and adolescents aged 12 to 17, with 11.2% (2.9 million) consuming marijuana. The increasing emphasis on drug testing in the workplace is projected to drive drug abuse testing market expansion.

Furthermore, the increased manufacture and trafficking of illegal narcotics is driving up the demand for drug testing. According to UNODC data issued on November 6, opium cultivation in 2024 increased by an estimated 19% year on year to 12,800 hectares, but remains considerably below pre-ban levels. The scale of drug seizures is an indirect indicator of the growing worldwide drug traffic. According to UNODC, since 2002, Afghanistan, Iran, and Pakistan have accounted for more than 90% of global opium seizures, a pattern that continued in 2013. Additionally, around 40 tons of cocaine was seized in Brazil that year. The increased manufacturing and trafficking of illicit drugs globally is predicted to drive the demand for drug misuse testing.

Drug of Abuse Testing Market Segmentation

Drug of Abuse Testing Market Segmentation

The worldwide market for drug of abuse testing is split based on drug type, product, sample type, end-user, and geography.

Drug of Abuse Testing Market By Drug Type

- Alcohol

- LSD

- Cocaine

- Opioids

- Marijuana/Cannabis

- Amphetamine & Methamphetamine

- Others

According to drug of abuse testing industry analysis the marijuana/cannabis sector had the biggest market share in 2024 and remains an important part of the drug abuse testing industry. Marijuana is one of the most commonly used substances in the world, and its popularity is growing due to its legalization for medical and/or recreational use in a number of nations and states. This growing acceptance has increased the demand for drug testing systems that can accurately detect THC, the psychoactive ingredient in marijuana, in an individual's system.

Drug of Abuse Testing Market By Product

- Equipment

- Immunoassay Analyzers

- Breath Analyzers

- Chromatography Instruments

- Consumables

- Reagents

- Rapid Test Kits

- Others

According to drug of abuse testing industry analysis, the consumables industry has grown significantly in recent years and is likely to continue doing so in the future. Consumables, such as drug testing kits, reagents, sample cups, and controls, are critical components of the testing process and are usually used once before being discarded. These items are critical in assuring accurate and consistent drug testing results in a variety of situations, including healthcare, the workplace, and the criminal justice system.

This segment's expansion is being driven by a number of factors, including rising drug misuse rates, increased demand for drug testing goods, and expanded availability of drug testing services. Furthermore, advances in drug testing technology are increasing the demand for novel consumables that improve the accuracy, efficiency, and convenience of drug testing procedures.

Drug of Abuse Testing Market By Sample Type

- Urine

- Breath

- Saliva

- Blood

- Hair

- Others

According to drug of abuse testing industry analysis, in recent years, the urine testing segment is expected to increase significantly in the future years. As drug addiction remains a major public health concern, demand for drug testing goods and services is projected to increase. Furthermore, technological improvements and developments in urine testing are expected to drive this growth, with the development of more accurate and efficient testing methods furthering the segment's expansion in drug abuse testing market.

Drug of Abuse Testing End-user

- Hospitals

- Workplaces

- Research Labs

- Criminal Justice Systems

According to drug of abuse testing market forecast, workplace sector led the drug abuse testing market in 2024 and will continue to play an important role in the industry. Drug testing is commonly employed in the workplace to improve employee safety and productivity, as substance usage can lead to accidents, injuries, and lower efficiency, as well as legal and financial issues for companies. As a result, several firms have integrated drug testing systems into their employee screening and safety procedures.

Several factors are propelling the expansion of this market, including regulatory regulations, the need to maintain a safe and productive work environment, and the availability of low-cost and precise drug testing technologies. Furthermore, the increasing frequency of drug addiction in society fuels the demand for workplace drug testing programs.

Drug of Abuse Testing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Drug of Abuse Testing Market Regional Analysis

Drug of Abuse Testing Market Regional Analysis

In terms of regional segments, several major reasons have contributed to North America's dominance in the drug abuse testing market. One of the key factors driving market expansion in this region is the increasing prevalence of drug usage, notably in the United States. According to the 2023 National Survey on Drug Use and Health (NSDUH), 2.3 million persons aged 12 and up experienced alcohol use disorder (AUD) in the previous year. This widespread drug usage has resulted in a high demand for drug testing products and services throughout North America.

Furthermore, the region benefits from a well-developed healthcare infrastructure and a well controlled drug abuse testing market. Workplace and criminal justice drug testing programs are also commonly used, which increases demand for testing solutions. Moreover, North America is home to numerous important market participants with robust distribution networks, ensuring that drug testing products are widely available and used across a variety of industries, including healthcare and occupational contexts.

Drug of Abuse Testing Market Players

Some of the top drug of abuse testing companies offered in our report includes DrugScan, Mayo Clinic Laboratories, Danaher Corporation, Precision Diagnostics, Cordant Health Solutions, LabCorp, Abbott Laboratories, Quest Diagnostics, Inc., LGC Group, and Legacy Medical Services.

Frequently Asked Questions

What was the market size of the global Drug of Abuse Testing in 2024?

The market size of drug of abuse testing was USD 7.05 billion in 2024.

What is the CAGR of the global Drug of Abuse Testing market from 2025 to 2033?

The CAGR of drug of abuse testing is 6.7% during the analysis period of 2025 to 2033.

Which are the key players in the Drug of Abuse Testing market?

The key players operating in the global market are including DrugScan, Mayo Clinic Laboratories, Danaher Corporation, Precision Diagnostics, Cordant Health Solutions, LabCorp, Abbott Laboratories, Quest Diagnostics, Inc., LGC Group, and Legacy Medical Services.

Which region dominated the global Drug of Abuse Testing market share?

North America held the dominating position in drug of abuse testing industry during the analysis period of 2025 to 2033.

Which region registered fastest CAGR from 2025 to 2033?

Asia-Pacific region exhibited fastest growing CAGR for market of drug of abuse testing during the analysis period of 2025 to 2033.

What are the current trends and dynamics in the global drug of abuse testing market?

The current trends and dynamics in the drug of abuse testing industry include rising drug abuse prevalence increases the need for frequent testing, stringent government regulations mandate workplace and roadside drug screening, and technological advancements in testing methods improve accuracy and turnaround time.

Which drug type held the maximum share in 2024?

The marijuana/cannabis held the maximum share of the drug of abuse testing industry.