Downstream Processing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Downstream Processing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

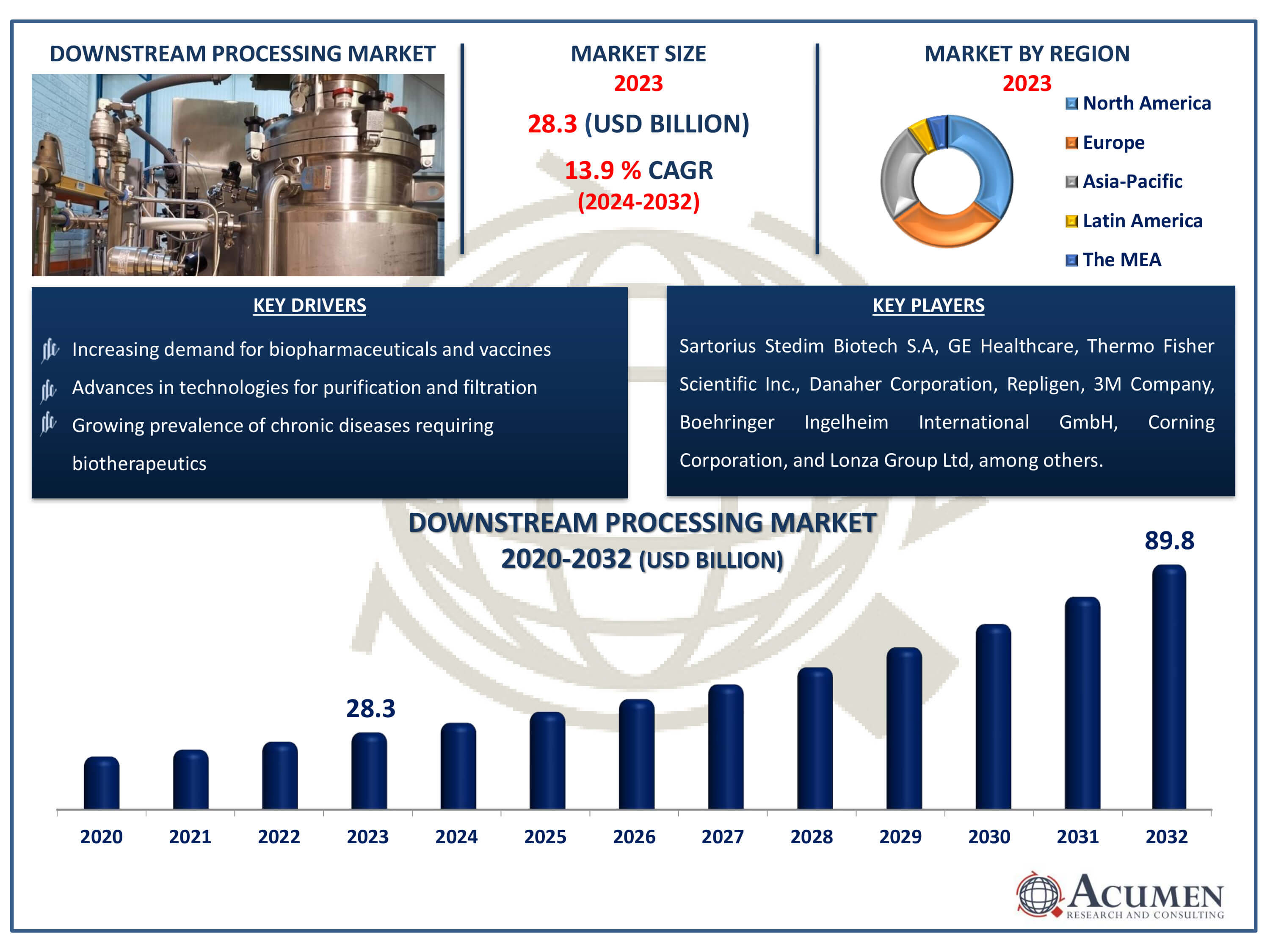

The Downstream Processing Market Size accounted for USD 28.3 Billion in 2023 and is estimated to achieve a market size of USD 89.8 Billion by 2032 growing at a CAGR of 13.9% from 2024 to 2032.

Downstream Processing Market Highlights

- Global downstream processing market revenue is poised to garner USD 89.8 billion by 2032 with a CAGR of 13.9% from 2024 to 2032

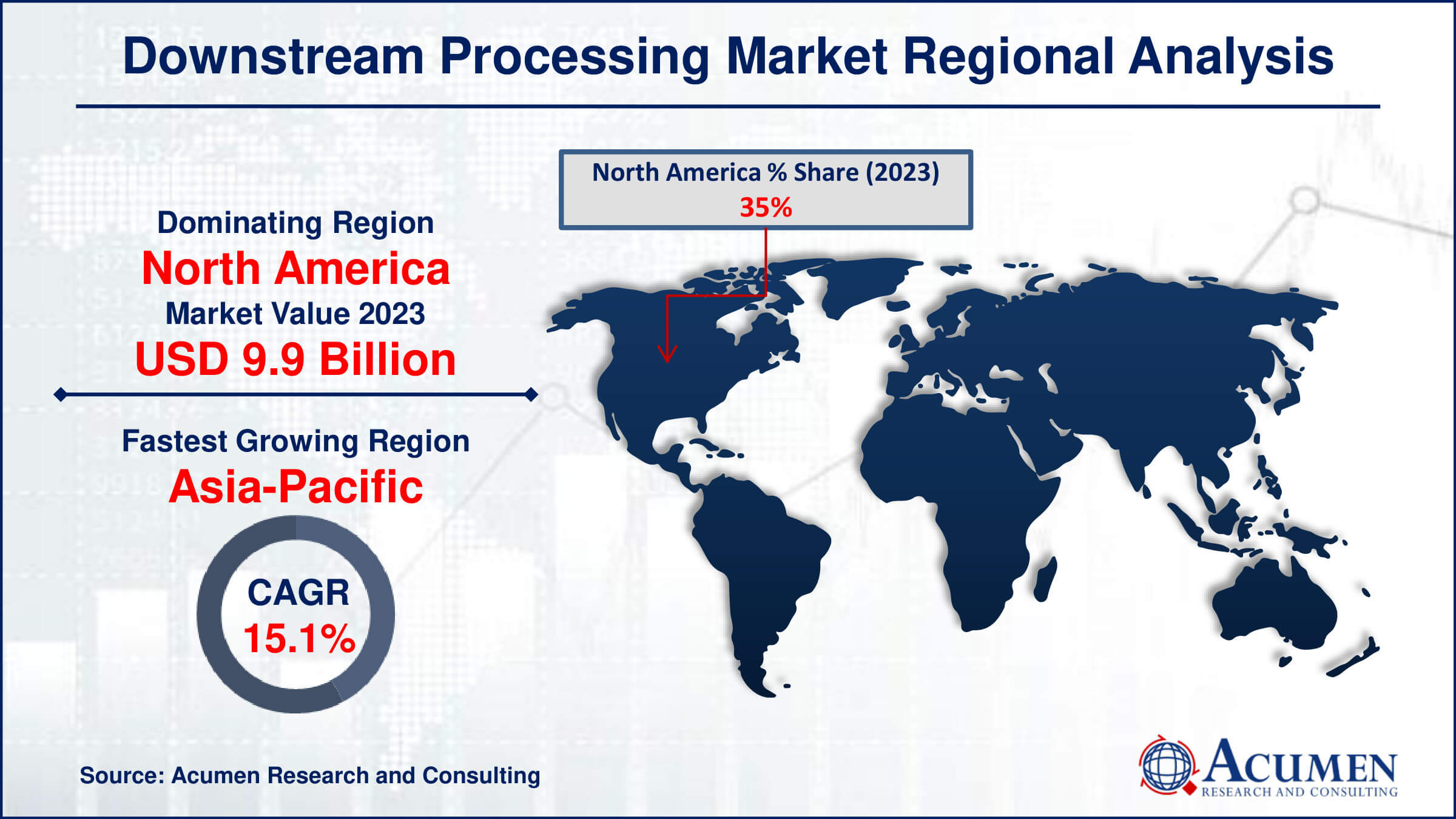

- North America downstream processing market value occupied around USD 9.9 billion in 2023

- Asia-Pacific downstream processing market growth will record a CAGR of more than 15.1% from 2024 to 2032

- Among technique, the purification by chromatography sub-segment generated more than USD 11.3 billion revenue in 2023

- Based on application, the antibiotic production sub-segment generated around 34% market share in 2023

- Collaborations and partnerships for technological advancements is a popular downstream processing market trend that fuels the industry demand

Downstream processing refers to the series of operations used to purify and isolate a desired product from a complex mixture, typically in biotechnological and pharmaceutical manufacturing. This process follows the initial stages of production, where the desired biological product, such as a protein, enzyme, or antibody, is produced. The key steps in downstream processing include cell disruption (if the product is intracellular), separation of solids (cell debris) from liquids, concentration of the product, and purification. Techniques such as centrifugation, filtration, chromatography, and crystallization are commonly employed. The final steps often involve polishing to achieve the required product quality and formulation to ensure stability for storage and use. Downstream processing is crucial for achieving the purity and quality needed for the product's intended application, whether in medicine, agriculture, or industry.

Global Downstream Processing Market Dynamics

Market Drivers

- Increasing demand for biopharmaceuticals and vaccines

- Advances in technologies for purification and filtration

- Rising investments in biotechnology and pharmaceutical R&D

- Growing prevalence of chronic diseases requiring biotherapeutics

Market Restraints

- High costs associated with downstream processing equipment

- Regulatory complexities and stringent approval processes

- Shortage of skilled professionals in the field

Market Opportunities

- Development of single-use technologies for downstream processing

- Expansion into emerging markets with growing biotech sectors

- Innovations in continuous manufacturing processes

Downstream Processing Market Report Coverage

| Market | Downstream Processing Market |

| Downstream Processing Market Size 2022 | USD 28.3 Billion |

| Downstream Processing Market Forecast 2032 | USD 89.8 Billion |

| Downstream Processing Market CAGR During 2023 - 2032 | 13.9% |

| Downstream Processing Market Analysis Period | 2020 - 2032 |

| Downstream Processing Market Base Year |

2022 |

| Downstream Processing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technique, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sartorius Stedim Biotech S.A, GE Healthcare, Thermo Fisher Scientific Inc., Danaher Corporation, Repligen, 3M Company, Boehringer Ingelheim International GmbH, Corning Corporation, Lonza Group Ltd, Dover Corporation, and Merck KGaA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Downstream Processing Market Insights

The flourishing biopharmaceutical sector across the globe and the wide applicability of downstream processing in drug discovery, development of new vaccines, antibiotics, and antibodies is a major factor expected to drive the global market. The biopharmaceutical sector is gaining traction due to promising results without significant side effects. Pharmaceutical manufacturers are investing heavily in biotechnology and the bio-service industry. Moreover, continuous development in gene therapy and genetic engineering approaches towards the development of new monoclonal antibodies is expected to further boost market growth. A gradual increase in the number of inpatients in hospitals related to cancer worldwide, high mortality due to the unavailability of drugs for specific diseases, along with government investment in biotech research and development activities, are other factors positively impacting market growth.

However, stringent government regulations related to product approval and high costs associated with new products are major factors restraining the global downstream processing market growth. Additionally, the lack of advanced infrastructure in developing countries and the shortage of skilled labor will challenge market growth. High investment in R&D activities and the development of new downstream processing techniques are factors creating new revenue opportunities for market players. Furthermore, the introduction of new facilities overseas to increase business presence and expand the customer base is an important factor supporting the growing traction. The antibiotic production segment of the global market is expected to account for a major revenue share due to the rising demand for antibodies worldwide. Increasing R&D activities in developing countries and the establishment of robust new manufacturing facilities capable of producing high amounts of monoclonal antibodies will further support segment growth.

Downstream Processing Market Segmentation

The worldwide downstream processing market is split based on product, technique application, and geography.

Downstream Processing Products

- Chromatography Systems

- Filters

- Evaporators

- Centrifuges

- Dryers

- Others

According to downstream processing industry analysis, the chromatography systems segment holds the maximum share in the market due to its critical role in the separation and purification of biomolecules. Chromatography systems are essential for achieving high purity and yield in biopharmaceutical production, making them indispensable for the development of drugs, vaccines, and biologics. Their versatility and efficiency in handling complex mixtures and large-scale production processes drive their widespread adoption. Additionally, advancements in chromatography techniques, such as affinity chromatography and ion exchange chromatography, enhance their effectiveness and application range. The increasing focus on quality and regulatory compliance in the biopharmaceutical industry further boosts the demand for chromatography systems. Consequently, these systems are integral to downstream processing, contributing significantly to market growth.

Downstream Processing Techniques

- Cell Disruption

- Solid-liquid separation

- Filtration

- Centrifugation

- Concentration

- Evaporation

- Membrane filtration

- Purification by Chromatography

- Formulation

Purification by chromatography stands out as the leading segment throughout the downstream processing industry forecast period, due to its unparalleled precision and efficiency in isolating specific biomolecules. This technique is integral to the biopharmaceutical industry, ensuring the removal of impurities and achieving high purity levels necessary for therapeutic applications. The versatility of chromatography allows it to handle diverse biological samples, making it essential for purifying proteins, nucleic acids, and other biomolecules.

Innovations in chromatography technologies, such as high-performance liquid chromatography (HPLC) and affinity chromatography, enhance its capabilities, making it more effective and scalable for industrial processes. Its ability to deliver consistent and reproducible results meets the stringent regulatory standards of the pharmaceutical industry. As a result, chromatography-based purification is favored for its reliability and effectiveness, driving its dominance in the downstream processing market. This technique's critical role in ensuring product quality and safety underscores its significance and widespread adoption in the industry.

Downstream Processing Applications

- Antibiotic Production

- Hormone Production

- Antibodies Production

- Enzyme Production

- Vaccine Production

Antibiotic production segment is the largest segment in the downstream processing market, driven by its essential role in combating infectious diseases worldwide. Antibiotics are crucial for treating bacterial infections, playing a pivotal role in healthcare by saving numerous lives globally. Downstream processing techniques are employed to purify and isolate antibiotics from fermentation broths or synthetic sources, ensuring high potency and safety.

The increasing prevalence of antibiotic-resistant bacteria continues to elevate the demand for effective antibiotics, prompting advancements in downstream processing technologies. Biotechnological and molecular innovations further enhance production efficiency, facilitating the development of new antibiotic formulations and variants. Moreover, sustained investment in research and development by the pharmaceutical industry supports ongoing improvements in production processes, aiming to meet global healthcare demands effectively.

Antibiotic production's prominence in downstream processing underscores its vital contribution to public health and its integral role in pharmaceutical manufacturing. As regulatory standards evolve and healthcare challenges persist, the segment is poised for growth, driving innovation in biopharmaceutical production technologies.

Downstream Processing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Downstream Processing Market Regional Analysis

In terms of the downstream processing market analysis, North America holds the largest share due to its advanced healthcare infrastructure, robust pharmaceutical industry, and substantial investment in biotechnology. The region benefits from established regulatory frameworks that support the development and commercialization of biopharmaceutical products, including stringent quality standards and efficient approval processes. Moreover, North America is a hub for research and development, fostering continuous innovation in downstream processing technologies.

Meanwhile, the Asia-Pacific region is experiencing rapid growth in the downstream processing market forecast period. This growth is driven by expanding pharmaceutical and biotechnology sectors, increasing healthcare expenditures, and a growing population with rising healthcare needs. APAC countries are increasingly investing in biopharmaceutical manufacturing capabilities, supported by favorable government initiatives and investments in healthcare infrastructure. Additionally, outsourcing of manufacturing processes to countries like India and China for cost-effectiveness further boosts market growth in the region.

Downstream Processing Market Players

Some of the top downstream processing companies offered in our report include Sartorius Stedim Biotech S.A, GE Healthcare, Thermo Fisher Scientific Inc., Danaher Corporation, Repligen, 3M Company, Boehringer Ingelheim International GmbH, Corning Corporation, Lonza Group Ltd, Dover Corporation, and Merck KGaA.

Frequently Asked Questions

How big is the downstream processing market?

The downstream processing market size was valued at USD 28.3 billion in 2023.

What is the CAGR of the global downstream processing market from 2024 to 2032?

The CAGR of downstream processing is 13.9% during the analysis period of 2024 to 2032.

Which are the key players in the downstream processing market?

The key players operating in the global market are including Sartorius Stedim Biotech S.A, GE Healthcare, Thermo Fisher Scientific Inc., Danaher Corporation, Repligen, 3M Company, Boehringer Ingelheim International GmbH, Corning Corporation, Lonza Group Ltd, Dover Corporation, and Merck KGaA.

Which region dominated the global downstream processing market share?

North America held the dominating position in downstream processing industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of downstream processing during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global downstream processing industry?

The current trends and dynamics in the downstream processing industry include increasing demand for biopharmaceuticals and vaccines, advances in technologies for purification and filtration, rising investments in biotechnology and pharmaceutical R&D, and growing prevalence of chronic diseases requiring biotherapeutics.

Which technique held the maximum share in 2023?

The purification by chromatography technique held the maximum share of the downstream processing industry.